APRA 2020 Year in Review

An introduction from APRA Chair Wayne Byres

Welcome to APRA's Year in Review for 2020.

By any measure, 2020 has been an extraordinary year as the world confronted a pandemic, the likes of which had not been seen for more than 100 years.

The impact of COVID-19 on our way of living, socialising and working was profound in its scale. The impact seemed even more dramatic as it followed devastating bushfires and storms in Australia early in the year.

COVID-19 swiftly and fundamentally changed the operating environment for the Australian financial system and APRA, as the financial safety regulator.

The health crisis brought with it an economic crisis and subsequent economic contraction that was, at one point, more severe than anything seen since the Great Depression. This had a material and ongoing impact on all of the industries that APRA supervises.

Thankfully, Australia went into this crisis with a financial system in a strong, stable position, which has been a critical factor in allowing the financial sector to perform its role in absorbing risk and acting as a shock absorber for the rest of the economy.

The strength of the financial system reflected a long period of investment in financial and operational resilience, in which APRA’s strong prudential framework and ongoing supervision has played an important role.

As a result, APRA-regulated financial institutions - authorised deposit- taking institutions (ADIs), insurers and superannuation funds - stood up to the challenge, both financially and operationally, and continued to fulfil their critical roles in society and the economy.

Crucially, each industry was able to withstand the challenges of the past year, including significant disruption to operations and workforces, while still playing its part in assisting Australians who were hit hardest by the crisis.

This support and assistance was provided in a number of ways, most notably by deferring loan repayments, suspending insurance premium increases, and facilitating prompt access to superannuation funds. All were important steps in helping the community navigate an extremely difficult period.

Resetting priorities

Not surprisingly, and like many other organisations, the onset of the pandemic required APRA to reset and reshape its priorities and activities.

At the start of 2020, APRA had set out a wide-ranging and ambitious agenda across banking, insurance and superannuation. The pandemic, however, required a rapid reassessment of those priorities and a redeployment of resources to focus on the core financial and operational resilience of the sector.

Chapter 1 of this publication details the measures APRA undertook in 2020 – often in close coordination with government and peer regulators – to ensure the financial system remained safe and stable and to give institutions the best opportunity to support their customers amid extraordinary social and economic disruption.

In particular, APRA provided a range of regulatory concessions and took steps to reduce regulatory burden; supported broader Government stimulus measures and policy responses; and collected and published additional data to enable a transparent and objective view of the impact and success of various measures. It also provided guidance to institutions on capital management, particularly in relation to limiting the payment of dividends at a time of heightened uncertainty.

In providing regulatory relief and reducing burden, APRA sought to do so in a way that did not materially weaken the fundamental strength of the financial system.

That is because a stable and resilient financial system remains a critical foundation for Australia’s economic recovery, and APRA was always focused on ensuring that any temporary measures did not undermine this important long-term goal.

In that regard, APRA updated its Corporate Plan for 2020-2024 to account for the substantial impact, now and into the future, of COVID-19. The updated Corporate Plan set out APRA’s strategic objectives over the next four years, but paid particular attention to clearly articulating the immediate priorities over the next 12-18 months.

In November, APRA recommenced some of its agenda originally planned for 2020, re-engaging on important prudential policy issues that were incomplete. These important reforms will not directly play a role in helping manage this crisis, but they will certainly be part of the foundation for dealing with the next one – whenever that may be.

Looking ahead, APRA’s strategic priorities will continue to be reviewed to ensure the organisation remains responsive to risks and vulnerabilities in the financial system that could impact financial institutions and the broader Australian community.

Chapter 2 looks at how each sector APRA supervises responded to the unfolding crisis and APRA’s activities in banking, insurance and superannuation. Key metrics for each of those industries give a snapshot of their overall health.

Chapter 3 provides insight into APRA’s own operational response to the unfolding pandemic and its ongoing efforts to lift the employee experience.

Changes in leadership

Two major changes to APRA’s Executive Committee occurred in 2020.

In March, APRA completed a refresh of its executive leadership team with the appointment of Renée Roberts as Executive Director, Policy and Advice Division. Renée brought to APRA skills and experiences from a diverse range of financial sector roles in Australia and overseas, including in risk management, strategy and governance.

At the end of December 2020, APRA Member Geoff Summerhayes concluded his five-year term at APRA.

In his time at APRA, Geoff strengthened and broadened APRA’s insurance supervision capabilities. Geoff also brought a strong emphasis on the importance of strategic leadership and alignment and on maintaining high governance standards.

Geoff was also critical in ensuring APRA maintained a broad and long-term perspective of its role and delivering on its mandate as the prudential supervisor of the Australian financial services industry. He leaves a strong legacy.

Conclusion

The Australian financial system remains fundamentally sound after one of the most challenging and testing years many institutions have ever faced.

However, heading into 2021, the environment ahead remains highly uncertain. The full financial impacts of the events of 2020 are still to be felt, and in some ways, 2021 could be just as difficult as 2020.

Against that backdrop, I would like to conclude by thanking, on behalf of the APRA Members, all of APRA’s employees for their unwavering commitment and diligence throughout the very challenging year. The year has been testing on many fronts, but APRA’s people have worked together collaboratively and constructively to ensure APRA’s mission – to deliver a safe and stable financial system for the Australian community – was achieved.

Supervision in action |

APRA became concerned about the heightened contagion risk exposure of a foreign ADI following significant deterioration in international economic and social conditions. As a result, APRA increased its supervisory intensity and took a number of actions to reduce the risk to the Australian domestic business. This included limiting exposures to the conglomerate group, increasing the liquidity holding requirements and requiring the ADI to increase funding sources. Reporting to APRA by the ADI, both in terms of content and timeliness, was stepped up over this period. APRA was also engaging with the home regulator to ensure an understanding of any emerging issues for the ADI. APRA’s actions ensured that, to the extent possible, the Australian domestic ADI was insulated from any shocks to the broader group. |

Chapter 1 - Financial sector resilience

From catastrophic bushfires and devastating storms, through to a global pandemic, volatile financial markets and the most severe economic downturn in nearly a century, Australia’s financial system battled a real-life, system-wide stress test in 2020.

Operating environment

The rapid spread of a new and deadly coronavirus required a public health response that had dire consequences for the economy and the livelihoods of many Australians. The financial sector’s role in such a year was to cushion those effects, by continuing to provide core services and support the economy.

Years spent building strong capital positions and investing in risk management, business continuity planning and management of service providers gave the financial system the necessary operational and financial resilience to function without major incident throughout 2020. Indeed, as the scale and seriousness of the health crisis increased, the financial sector had the wherewithal to facilitate and complement initiatives designed to buttress the economy and channel support to Australians experiencing hardship.

At year-end, structural changes from COVID-19 were still unfolding, and although substantial fiscal and monetary policy levers appeared to be working, they were not without their limitations. One of the few certainties with respect to 2021 is that the operating environment will be different again.

The year 2020 began with devastating bushfires, which claimed 33 lives, destroyed more than 3,000 homes, blanketed must of eastern Australia in thick smoke and burned more than 24 million hectares of land. The economic impact, estimated at more than $10 billion1, was compounded by a series of other natural catastrophes that followed, including storms, severe hail events and floods.

As the country tallied the loss to life, property and the environment, the Australia financial system remained stable and in a sound position to support the community. Crucially, the general insurance industry, on the financial frontline of the 2019-2020 summertime disasters, was well-equipped to cover claims costs that would ultimately exceed $5 billion.

In the shadow of these natural disasters, a global pandemic struck. For Australia’s financial regulators, COVID-19 warranted fast action, including the implementation of internal crisis management plans, preparation of an economic support strategy and checks on the readiness of financial institutions to cope with potentially severe operational and financial challenges.

Within weeks, Australia switched from a precautionary mode to an emergency footing, declaring COVID-19 to be a national pandemic at the end of February. Two weeks later, the World Health Organization declared a global pandemic.

Managing the crisis

In March, the financial ramifications of an easily transmitted and dangerous virus were becoming clearer. The combination of business shutdowns and job losses, lockdowns, and border closures dented public confidence and pushed the economy toward recession.

For financial institutions, the challenge was to quickly implement remote working arrangements, which required them to navigate considerable technological and logistical issues in a matter of weeks, while continuing to perform core functions. Staff and customers – households and businesses – were likewise contending with rapidly changing financial positions and prospects. Against a backdrop of volatile financial markets and an Australian dollar that fell to its lowest level in many years, the Reserve Bank of Australia (RBA) cut the cash rate to 0.50 per cent. Though COVID-19 was mostly affecting the education and travel sectors in early March, the central bank was concerned that uncertainty would undermine domestic spending and lead to noticeably weaker GDP growth in the March quarter than previously expected.2

As a newly formed National Cabinet, comprising federal, state and territory governments, considered urgent responses to the unfolding health crisis, Australia’s financial regulators focused on the flow of credit in the economy, the continuity and stability of financial services, the orderly operation of markets and public confidence in the financial system. The Council of Financial Regulators (CFR), comprising APRA, the RBA, Treasury and the Australian Securities and Investments Commission (ASIC), was central to this work. As the key coordinating body, it met frequently to consider the design and delivery of complementary and mutually reinforcing public and private sector responses.

APRA’s actions, covered in detail later in this chapter, helped facilitate Government stimulus measures and reduce the regulatory burden on financial institutions. APRA also gathered important data on COVID-19 support initiatives, including the Government’s Coronavirus Small and Medium Enterprises (SME) Guarantee Scheme, early withdrawals of superannuation and the uptake of loan repayment deferrals offered by banks to customers facing financial hardship.

Financial institutions supported the economy and customers in many ways. In addition to the loan repayment deferrals, more than three million superannuation members applied to access in excess of $35 billion from their retirement savings under the Government’s temporary early release scheme. Superannuation entities, more used to steady inflows, had to process those payments promptly.

Insurers introduced special hardship measures and postponed premium increases, while navigating volatile investment markets and preparing for less certain economic conditions ahead.

Key economic data revealed the significance of the stimulus packages, business closures and job losses. Restrictions on public movement, including closure of businesses and venues to prevent the spread of the infection, saw gross domestic product fall 7 per cent in the June quarter. This was Australia’s largest economic contraction since the 1930s and followed a 0.3 per cent contraction in the March quarter. The household savings ratio shot up to 22.1 per cent in the three months to June, from 7.6 per cent in the prior quarter. Unemployment, which had been 5.2 per cent in March before the full impact of COVID-19 had hit, reached 7.4 per cent in June, its highest level since 1998.

In the second half of the year, Australia transitioned out of the acute crisis phase, as success in bringing infection rates down allowed parts of the economy and the country to re-open, notwithstanding subsequent setbacks in Victoria.

Still, unprecedented fiscal and monetary stimulus was added in the second half of the year, designed to reinforce the economic recovery and deal with unemployment. As Treasurer Josh Frydenberg stated in his 2020-21 budget speech in October, there remained a “monumental task ahead” to rebuild Australia’s economy.3

Adding to the stimulus packages from earlier in the year, the Treasurer detailed accelerated tax cuts, new infrastructure spending, wage subsidies and business incentives to drive a jobs recovery.

In November, the RBA took the country further into new territory to protect the economy and support job creation. Among other things, the RBA’s measures to lower borrowing rates and encourage spending included a reduction in the cash rate to a historic low of 0.1 per cent and a plan to buy up to $100 billion of government bonds.

Still, with many other countries implementing new lockdowns in November, Australia was in a more stable position at year-end. COVID-19 case numbers were low, often zero in different states and territories, domestic borders were opening up and Victoria had conquered its devastating second wave of infections. Although spot virus outbreaks continued around the country into December, clusters were being largely contained, although several state borders closed again towards Christmas.

In early December, the Australian Bureau of Statistics confirmed that the country was rebounding, recording a 3.3 per cent jump in September quarter GDP and an easing of unemployment from a July peak of 7.5 per cent. Elsewhere, most bank customers had resumed making payments on loans and applications for early release of superannuation had slowed dramatically. Banks at year-end had ample funding due to increased consumer deposits and access to the RBA’s Term Funding Facility.

The financial sector had met the immediate challenges to operational and financial resilience in 2020 and was maintaining services to the community and supporting the Australian economy. As a real-life stress test, 2020 had also revealed opportunities to improve on that resilience and better equip the financial system for future shocks.

APRA's response

APRA’s actions in response to COVID-19 were designed to mitigate the speed and depth of the economic downturn and support the operational and financial resilience of the banking, insurance and superannuation sectors. Fortunately the financial system began 2020 from a position of strength, with banks well capitalised and highly liquid, which proved critical to the industry’s capacity to support customers and act as a ‘shock absorber’ for the nation’s economy.

APRA began responding to the pandemic in earnest in early February. Shortly after the first confirmed COVID-19 case reached Australian shores, APRA mobilised to understand how a possible pandemic might impact financial institutions and their readiness to meet what lay ahead.

Under cross-industry Prudential Practice Guide CPG 233 Pandemic Planning (CPG 233) which supports compliance with Prudential Standard CPS 232 Business Continuity Management, all APRA- regulated entities should have tailored business continuity plans to identify and protect critical functions and consider alternative work arrangements in the event of a pandemic or similar widespread contagion. CPG 233 assists industry to plan and be ready for scenarios such as COVID-19, where events can unfold rapidly.

Supervision in action |

| Prior to COVID-19, APRA had scheduled a Prudential Review with an entity. As the pandemic developed, all face to face meetings were cancelled and reviews deferred. Following discussions between the frontline and specialist risk teams, it was agreed that, given the need to develop a better understanding of the relevant risks for the entity, the review should go ahead. With the co-operation of the entity, the first fully remote detailed risk review was conducted. While this came with a number of challenges, it was shown that specialist risk reviews can be conducted remotely. |

Like the banks, insurers and superannuation entities it regulates, as well as other organisations across Australia, APRA quickly activated its own crisis management arrangements to protect its people and operations. The Business Continuity Pandemic Plan was enacted and a new coordination structure was put in place led by an Executive Crisis Committee (See Chapter 3). Amid highly volatile global financial markets, APRA also began assessments of the potential economic impacts on the Australian financial system.

By March, it was evident that a swift reset and reshape of APRA’s priorities was required to mitigate the impact of COVID-19. APRA developed a package of measures to enhance and complement actions by Government, regulatory peers and industry. In summary, these measures:

- eased the operational burden on regulated firms to allow them to direct more resources towards their pandemic response and meeting the needs of customers;

- provided temporary regulatory concessions to support economic measures introduced by the Government, the RBA and industry;

- supported stimulus measures and implementation of policy responses, such as the early release of superannuation;

- captured data to track the uptake and impact of support measures; and

- promoted the importance of the continued flow of credit and APRA’s view that the banking sector had the necessary resilience to cushion the economy from the worst of the impact.

One of APRA’s first priorities was to keep credit flowing through the economy. It temporarily relaxed expectations regarding bank capital ratios – the amount of capital banks must maintain relative to their total risk-weighted assets. At the start of 2020, Australian bank capital ratios were very high by international standards and about double what they had been going into the 2008/09 financial crisis. Under APRA’s requirements, capital ratios had been built up over many years precisely so that banks could absorb losses and sustain the flow of credit to the broader economy in times of stress. In 2020, these capital buffers helped maintain confidence in the stability of the system.

As Chair Wayne Byres observed in May, the adage of saving for a rainy day was never more apt. “We’re glad we did it, even though it wasn’t always easy or popular at the time,” he said during a Financial Services Institution of Australasia webinar.

APRA also granted temporary capital concessions to authorised deposit-taking institutions (ADIs) offering loan deferrals to small businesses and home loan customers struggling due to COVID-19. In allowing ADIs to temporarily treat loans with deferred repayments due to COVID-19 as if they continued to be performing loans, lenders avoided the imposition of higher capital requirements.

In March, APRA temporarily suspended the bulk of the ambitious policy and supervisory agenda it had announced only eight weeks earlier. This decision allowed financial institutions to redeploy resources to managing the impact of COVID-19. It also allowed APRA to concentrate on financial system resilience, with supervisory attention redirected to the financial and operational robustness of financial institutions as they responded to unprecedented challenges.

With access to credit so critical to keeping the wheels of the economy turning, APRA took the unusual step of urging banks and insurers to make use of their capital buffers if needed while preserving capital by limiting discretionary capital distributions, including dividends. While dividends represent an important income source for many Australians, APRA wanted these institutions’ capital buffers to support further lending and underwriting ahead of dividends, and also to ensure the safety of bank deposits and the capacity of insurers to pay claims.

The uncertain environment also brought a temporary halt to the issuing of new banking, insurance and superannuation licenses. New entrants can battle to succeed in normal circumstances, and in keeping with its role to promote financial system stability and safety, APRA deemed it imprudent to license new APRA-regulated entities in such a challenging environment.

Data gathering is one of APRA’s core functions, and as the Government, RBA and industry rolled out major initiatives to support the economy, APRA moved rapidly to provide key metrics regarding their uptake.

In April, APRA fast-tracked a new reporting standard to collect data from financial institutions taking part in the Federal Government’s Coronavirus Small and Medium Enterprise (SME) Guarantee Scheme. Under the scheme, the Government acted as 50 per cent guarantor on new unsecured loans to be used for working capital by SMEs.

Other new data collections tracked applications under the temporary Early Release of Superannuation Scheme and loan deferrals mentioned above.

Early in the second half of 2020, APRA recalibrated its response to the pandemic and gradually moved from a short-term emergency agenda to a recovery agenda. This included the restoration of the policy and supervisory work it had put on hold in March.

The repositioning was supported by a view that the banking sector was well-placed to face the economic headwinds ahead, the fact that insurers were being flexible with customers in a time of need, and the success of the superannuation sector in swiftly processing tens of billions of dollars in early release applications while also supporting extensive capital raisings from the corporate sector.

Supervision in action |

| Prior to the release of APRA’s first MySuper Product Heatmap, APRA undertook activities to identify MySuper products with relatively high fees and indicators of underperformance. APRA engaged with the entities responsible for those products to develop an action plan to address any concerns. In one example, the entity implemented a fee reduction following this engagement, then as part of their action plan undertook a strategic review of their MySuper product. The strategic review determined that the MySuper product was not core to the entity’s product offering and strategic direction. The entity undertook a market scan to identify a fund that could offer its members a better outcome over the longer term and has completed a transfer of its MySuper product to that fund. |

In July, APRA eased its guidance on dividends, telling banks and insurers there was room for moderate dividend payments given diminishing uncertainty about the economic outlook and a review of banks’ and insurers’ financial projections and stress testing results. In advising boards to maintain caution in planning capital distributions, APRA specifically told banks they should retain at least half of their earnings for the remainder of the calendar year.

A few weeks later, in August, APRA recommenced work on its highest priority prudential policy reforms, including the cross-industry prudential standard for remuneration, ADI capital reforms and insurance capital framework reforms.

APRA also announced the staged resumption of work on assessing and issuing new banking, insurance and superannuation licences.

Recommencing policy consultations with industry did not mean the crisis had ended. APRA’s 2020-2024 Corporate Plan, published in August, re-framed priorities in light of COVID-19 and highlighted continuing uncertainties in the external environment. The Corporate Plan emphasised the need to continue to actively respond to the pandemic and its near-term impacts on financial institutions. To address an increasing risk of failure of one or more APRA-regulated institutions, APRA also set maintenance of financial system resilience and resolution planning as priorities for the first 12-18 months.

As Wayne Byres told the House of Representatives Standing Committee on Economics in October: “The full financial impacts of the events of 2020 will flow through over time, and we expect 2021 will in many ways, be just as difficult as 2020. We therefore need to stay vigilant.”

Nevertheless, by December APRA adjusted its dividend guidance again to reflect the improved economic outlook and stability in financial markets. Acknowledging the importance of bank and insurer distributions to households and businesses, APRA said that from 2021 banks would no longer be held to the minimum level of earnings retention set in July 2020. Given the high degree of uncertainty in the outlook for the operating environment, however, all entities will still need to maintain vigilance and careful planning in capital management.

Despite the disruptions to APRA’s planned agenda in 2020, in some areas work plans progressed further and achieved faster results. These included stress testing, resolution planning and cross-agency collaboration. The unscheduled testing of APRA’s and the financial system’s capacity to cope with a dramatic rise in risk and change ultimately presented an invaluable learning opportunity.

Supervision in action |

| Following a whistleblower notification to the Board of an entity and subsequently to APRA, APRA engaged with the entity over its response to the significant issues raised. APRA was not satisfied with the timeliness or urgency of the response and acted to ensure the issues would be appropriately considered. The resultant investigation identified deficiencies and led to control improvements in the finance function and expense management, and the commissioning of an independent review into the risk management practices of the entity. APRA is monitoring progress against the findings of the review, which will enhance Board oversight and management control of the entity. |

APRA's Corporate Plan

In August, APRA published a new Corporate Plan, prioritising activities that are intended to protect the community and support the economy from COVID-19’s continuing impact.

For the first 12-18 months of the four-year plan, APRA’s objective is to prioritise the maintenance of financial system resilience. In protecting the stability and soundness of banks, insurers and superannuation trustees, fostering operational resilience during periods of significant disruption, and further enhancing contingency planning. In doing so, APRA will help maintain public confidence in the financial system and aid the economic recovery.

Four longer-term objectives, common to the 2019-2023 Corporate Plan, remain in place, despite the rescheduling of planned activities. These are:

- maintaining financial sector resilience;

- improving outcomes for superannuation members;

- transforming governance, culture, remuneration and accountability across all regulated industries; and

- improving cyber resilience across the financial system.

The Corporate Plan also restates five areas where APRA needs to enhance its internal capabilities in order to deliver on its mandate and the community outcomes above. These include:

- improving and broadening risk-based supervision;

- improving resolution capacity;

- improving external engagement and collaboration;

- transforming data-enabled decision making; and

- transforming leadership, culture and ways of working.

APRA’s commitment to addressing recommendations arising from many reviews and inquiries that took place in 2018 and 2019, including the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, remains unchanged under the 2020-2024 plan.

The full financial impact of the events of 2020 will flow through over time, and we expect 2021 will un many ways, be just as difficult as 2020. We therefore need to stay vigilant."

- Wayne Byres

Continuing to build resilience: Cross-industry initiatives

Chapter two of this publication details the activities and initiatives undertaken by APRA in 2020 on an industry-by-industry basis. However, that tells only part of the story, as significantly more of APRA’s supervisory and policy activities are cross- industry in nature, reflecting a wider range of risks that have relevance across the entire financial sector.

Some of the key cross-industry issues that APRA tackled in 2020 are set out in the remainder of this chapter.

“In an environment where an attack on one of us could be an attack on any of us, our financial system is only as resilient to cyber attacks as the weakest link in the chain. By working together, we can actually capitalise on our increased connectivity to strengthen the chain, and protect ourselves by protecting each other.”

- Geoff Summerhayes

Cyber risk

The financial system provides essential services to all Australians and is a form of critical infrastructure for the nation. It achieves this through a myriad of interconnections and digital channels within a complex financial ecosystem. This same ecosystem that delivers faster and more innovative products, services and markets also represents a large attack surface for cyber criminals. Today, a cyber attack on a single component of the financial system can have a far-reaching impact. Consequently, cyber threats are a material prudential risk from a regulatory and national security perspective.

The frequency and sophistication of cyber attacks is increasing, and so is the degree of potential harm. According to Australia’s Digital Trust Report, a digital disruption spanning four weeks would cost the economy an estimated $30 billion (1.5 per cent of GDP), representing the loss of around 163,000 jobs. More significantly, it would undermine the public’s trust and confidence in digital activities.4 For this reason, improving cyber resilience across the financial system is one of APRA’s four key long-term objectives.

A key challenge for APRA in relation to cyber risks is ensuring it has the necessary skills, knowledge and resources to monitor a fast growing and rapidly evolving risk. In 2020, APRA responded by recruiting additional specialist information security skills, and rolling out training programs to help frontline supervisors better understand how their entities are managing potential cyber threats.

Armed with these new skills, APRA’s supervisors engaged with their entities on their implementation of APRA’s Cross-industry Prudential Standard CPS 234 Information Security. APRA also needed to grant more than 100 requests for regulatory relief to entities struggling, primarily due to COVID-19, to meet the 1 January 2021 deadline to comply with CPS 234 standards in relation to third-party arrangements.

The onset of COVID-19 further increased cyber risks through the rapid transition to online working, as well as other changes to business processes that brought about some unavoidable compromises to normal information security protocols. Although APRA saw no obvious sign of an increase in cyber adversaries targeting banks, insurers or super funds during 2020 – and no APRA-regulated entity suffered a material breach – APRA engaged closely with entities regarding how their cyber controls may have been impacted by the pandemic. In particular, APRA stressed that entities that may have made changes to their normal information security protocols in response to the pandemic needed to shore up their systems and processes as quickly as possible.

APRA’s most significant step in addressing the cyber challenge in 2020 was the unveiling of its new 2020-2024 Cyber Security Strategy, which is designed to pursue a step change in the financial sector’s cyber resilience. Importantly, the strategy’s vision extends beyond the 680-or-so entities that APRA directly regulates to influence the broader financial ecosystem, comprising many thousands of interconnected entities, markets and financial markets infrastructures.

The new Cyber Security Strategy will see APRA apply a broader set of regulatory tools and techniques, working in concert with peer regulators and other government agencies, and imposing greater accountability on entities that fall short of prudential obligations.

As APRA Executive Board Member Geoff Summerhayes explained at a Financial Services Assurance Forum in November: “In an environment where an attack on one of us could be an attack on any of us, our financial system is only as resilient to cyber attacks as the weakest link in the chain. By working together, we can actually capitalise on our increased connectivity to strengthen the chain, and protect ourselves by protecting each other.”

APRA’s Cyber Security Strategy complements Australia’s national Cyber Security Strategy 2020, and was drafted following extensive consultation with the Department of Home Affairs, Treasury, ASIC and the RBA. It also builds on previous strategic initiatives, including the implementation of CPS 234. The standard came into effect in July 2019, making Australia one of the few jurisdictions worldwide at the time with enforceable regulation in this area.

The strategy comprises three key focus areas:

- establish a baseline of cyber controls to prevent, detect and respond to cyber attacks;

- enable boards and executives to oversee and direct correction of cyber exposures; and

- rectify identified weak links within the broader financial eco-system and supply chain.

With these goals in mind, APRA will shortly require all APRA-regulated entities to undergo independent cyber security reviews. This will commence with a small number of pilot entities across industries, with the pilot expected to run until mid-2021. APRA expects that these independent assessments will reveal how effectively organisations have embedded the requirements of CPS 234 into their practices.

To help decision-makers ensure their information security capabilities are sufficiently robust, and that they act where needed, APRA plans to draw on expertise from various professional bodies, including the Australian Institute of Company Directors, the Risk Management Institute of Australasia, and the Institute of Internal Auditors to improve guidance for board members, internal auditors and risk management professionals in the area of cyber.

APRA also will be drawing on industry expertise to develop stronger third-party provider assessment and assurance practices for use by APRA-regulated entities. This will involve working with a selection of suppliers, auditing associations and financial entities.

To enable APRA to better influence cyber security practices beyond its own regulated entities, APRA’s Cyber Security Strategy incorporates several joint initiatives with the other Council of Financial Regulator agencies, including better harmonisation of regulation and supervision with respect to cyber. To ensure ongoing alignment with the national strategy, APRA will also continue to work closely with the Department of Home Affairs and the Australian Cyber Security Centre.

Finally, APRA will use additional resources allocated in the Federal Budget to help execute its cyber strategy with the goal of improving cyber resilience across the financial system.

Remuneration

One of the most important items on APRA’s agenda in 2020 was a revised standard on executive remuneration.

As highlighted by the financial services Royal Commission, existing frameworks have not always worked well for consumers or financial entities. Examples of executives being inadequately held to account, and sometimes even handsomely rewarded when things have gone badly, and a lack of clarity on where accountability rests, have contributed to the many well-documented incidences of unethical or illegal conduct and undermined public trust in the financial sector.

For APRA, the challenge has been to craft a remuneration standard that is sufficiently prescriptive to deliver against the Royal Commission’s findings and recommendations, while being fit for purpose across financial entities of varied size, nature and complexity. Within these boundaries, there needs to be:

- stronger incentives for companies and individuals to manage non-financial risks;

- appropriate financial consequences when material risks events occur; and

- increased transparency to drive board accountability for remuneration outcomes.

APRA first released a draft of CPS 511 Remuneration consultation in July 2019. Following initial industry consultation which provided extensive and robust feedback and delay due to COVID-19, APRA issued a revised draft of the prudential standard and opened a second consultation round in November 2020.

Key revisions include more extensive requirements for larger and more complex regulated entities classified as Significant Financial Institutions (SFIs). In particular, the updated standard requires SFIs to assign material weight to non-financial outcomes as they consider executive bonuses, and also introduces a “risk and conduct modifier “ – a risk adjustment feature that allows executive bonuses to be cut to zero in certain circumstances.

Further, SFIs will be required to withhold a portion of executive bonuses in case poor outcomes take years to surface. APRA is proposing that CEOs be made to wait six years before receiving the last component of their bonus, senior managers five years and highly-paid material risk takers four years.

Chair Wayne Byres told the Australian Financial Review Banking and Wealth Summit in November that this refinement “strikes an appropriate balance between ensuring Australian regulations are not out of line with international and regional peers, but still robust and delivering significant skin in the game for a sufficient period of time to allow performance outcomes to be genuinely assessed, and action taken if need be.”

For smaller entities, APRA streamlined remuneration requirements to avoid undue regulatory burden. Unlike SFIs, these entities won’t need to apply a material weight to non-financial measures or have a risk and conduct modifier. They also won’t be subject to minimum deferral periods and clawback provisions, or need to conduct annual compliance checks or tri-annual effectiveness reviews of their remuneration frameworks.

Another consideration for APRA has been how its proposed remuneration prudential standard will interact with Government plans to extend the Banking Executive Accountability Regime (BEAR) to the insurance and superannuation sectors. This has been discussed with Government as part of consultations about the Financial Accountability Regime (FAR).

Consultations over revisions to CPS 511 will close February 2021. APRA expects to have a finalised standard by mid-2021 that will come into effect for SFIs that are authorised deposit-taking institutions (ADIs) on 1 January 2023, followed by insurance and superannuation SFIs on 1 July 2023 and non-SFIs on 1 January 2024.

Supervision in action |

| As part of APRA’s ongoing supervision, weaknesses were identified in the capital management of an entity, particularly around stress testing. Small deviations in claims experiences and investment results were causing the entity to frequently go below its preferred capital operating range, requiring capital injections from the parent. The supervision team met with the entity to discuss APRA’s concerns and the recommended actions needed to address the issues. As a result, the entity has undertaken additional work to improve the capital management framework and therefore become more resilient by remaining in their preferred capital operating range. The supervision team has reverted to business as usual supervision for the entity. |

Climate-related financial risks

The effects of climate change have the potential to pose a material prudential risk to the functioning of a stable, efficient and competitive financial sector.

In February, APRA detailed two initiatives designed to quantify the financial risks of a changing climate for banks, insurers and superannuation trustees, and better communicate APRA’s expectations of financial institutions in managing their exposure.

Under the first of these initiatives, which was delayed by the pandemic, APRA put regulated entities on notice that they will need to provide APRA with an assessment of the financial impact of a changing climate on their businesses in the near future. APRA recognises that undertaking this assessment will be challenging, which is why the first call for climate vulnerability assessments will only involve the country’s largest banks.

In completing the climate vulnerability assessments, these banks will be required to estimate the impact of a changing climate on their balance sheets, including the impact of natural disasters, as well as the risks that may arise from a global transition to a low-carbon economy.

In coordinating these assessments, APRA is acting in conjunction with the Council of Financial Regulators (CFR), and working with fellow CFR members on the application of scenario analysis, disclosure recommendations and the analysis of macroeconomic impacts from climate change. The assessments are also being built on learnings from peer regulators elsewhere in the world, who are also undertaking similar assessments. The vulnerability assessments are seen by APRA as a tool to help tackle an information gap related to quantifying and pricing climate risk, as highlighted by a 2018 APRA survey of 38 banks, insurers and superannuation trustees.

That same survey also informed the second initiative announced by APRA in February. In response to requests from industry for more information about better industry practice and climate- related financial risks, APRA has begun work on a cross-industry prudential practice guide (PPG). The PPG will help financial institutions better prepare for climate-related risks and clarify the expectations set out in Prudential Standard CPS 220 Risk Management (CPS 220), SPS 220 Risk Management (SPS 220), CPS 510 Governance (CPS 510) and SPS 510 Governance (SPS 510). As with the vulnerability assessments, consultations on the PPG will be held in 2021.

Beyond these initiatives, APRA engaged with international and domestic regulators on the issue of climate- related financial risk, including as chair of the CFR’s Working Group on Financial Implications of Climate Change in 2020. Internationally, APRA has contributed to ongoing work on climate risk for the Sustainable Insurance Forum, International Association of Insurance Supervisors and the Network for Greening the Financial Sector. APRA also is a member of the Basel Committee’s Task Force on Climate-related Financial Risks.

Enforcement

APRA uses a range of powers to hold financial institutions accountable for prudential shortcomings, enforce remedial actions and incentivise the wider financial sector to do the right thing. Having adopted a new ‘constructively tough’ enforcement strategy in 2019, APRA in 2020 took a range of actions against institutions which fell short of expectations.

Notably, APRA took action in response to a number of referrals from the financial services Royal Commission. This included imposing licence conditions on superannuation trustees owned by Commonwealth Bank of Australia (CBA) and Suncorp Group in July. APRA found no legal breach by either Colonial First State Investments Limited (CFSIL) or Suncorp Portfolio Services Limited (SPSL), but in both instances was concerned by their internal practices when it came to demonstrating how members’ best interests were being considered and prioritised. Under the new licence conditions, CFSIL and SPSL must record how they consider and prioritise members’ best interests when making decisions that will materially affect them. SPSL was further required to have an independent expert verify its remediation program, and notify affected members and the public of its remediation plan.

In August, APRA imposed directions and licence conditions on NULIS Nominees (Australia) Ltd. to ensure members’ best interests are prioritised in decision making and to address prudential concerns. NULIS is a superannuation trustee of pension fund products and is part of the National Australia Bank (NAB) group. The Royal Commission had referred the NULIS case to APRA, having formed the view that NULIS may not have made decisions in the best interests of members when transferring certain cohorts into MySuper products, grandfathering certain fee arrangements, and by charging for services that were not provided. While APRA did not find that NULIS had breached the law, it was sufficiently concerned to require improvements to transparency in decision-making and enhancements to NULIS’s governance and control environment.

Other enforcement actions in 2020 included action against Bendigo and Adelaide Bank in October for multiple breaches of a prudential standard on liquidity. The breaches were historical in nature, but raised questions about past risk management practices and the bank’s ability to accurately calculate and report on its liquidity position. In response to Bendigo and Adelaide Bank’s breaches, APRA ordered the bank to submit to a review of its compliance with liquidity requirements by an independent third party. APRA also imposed a 10 per cent add-on to one component of the bank’s liquidity coverage ratio (LCR) calculation. This will stay in place until APRA is satisfied with progress against the independent review’s findings. APRA further ordered the bank to restate relevant public disclosures it had made over the preceding 24 months.

APRA’s most significant enforcement action in 2020 involved Westpac Banking Corporation. In early December, APRA acted against Westpac for material breaches of prudential standards on liquidity, and secured a court enforceable undertaking (CEU) that committed the bank to remedying serious and long- standing risk failures. APRA also imposed a tougher formula for the calculation of Westpac’s LCR, until such time that the bank addressed the findings of thorough and independent reviews into its compliance with APRA requirements and remediation of liquidity risk management procedures. Westpac must also apply a 10 per cent add-on to a net cashflow component of its LCR calculation.

The CEU reflects APRA’s dissatisfaction with Westpac’s progress in fixing risk governance weaknesses, including “an immature and reactive risk culture, unclear accountabilities, capability shortfalls, and inadequate oversight.” These concerns were based on a risk governance review into Westpac that APRA commenced following AUSTRAC’s allegations of anti-money laundering breaches in December 2019. The CEU provides greater assurance that Westpac will address APRA’s concerns.

Deputy Chair John Lonsdale stated at the time of the CEU: “As one of the country’s largest and most important financial institutions, Westpac should be a leader in risk management. Although the bank has made progress in some areas over the past year, it is not good enough. We continue to observe new prudential issues arising while long-standing weaknesses persist, and we believe Westpac’s governance, culture and accountability frameworks and practices are still in need of a substantial uplift.”

Once APRA imposes a capital penalty on a regulated entity to drive better practices, a process of continual assessment begins. Improving outcomes at CBA and Allianz Australia Ltd. (Allianz) during 2020 gave APRA cause to wind back capital add-ons it had applied in 2019.

In November, APRA halved a $1 billion capital add-on that had been imposed on CBA in May 2018. The capital add- on had been applied after APRA’s prudential inquiry into CBA found shortcomings in the bank’s governance, culture and accountability frameworks. Under the terms of an enforceable undertaking in 2018, CBA committed to a Remedial Action Plan (RAP) and appointed an independent reviewer to report quarterly on its progress. The reduction in the capital add-on recognised the improvements made by CBA to date against the RAP. The remaining $500 million capital add-on will remain until CBA satisfactorily addresses all of the matters covered by the RAP, addresses all recommendations arising from APRA’s prudential inquiry, and APRA assesses the sustainability of CBA’s improvements.

In December, APRA reduced a $250 million additional capital requirement it had imposed on Allianz in August 2019 by $100 million. The reduction reflected Allianz’s progress in addressing shortcomings in its risk management and governance practices. The remaining $150 million capital add-on will remain in place until Allianz embeds the required improvements across its business.

Recovery and resolution

One of APRA’s core functions is to regulate and supervise its entities in order to protect Australian depositors, policyholders and superannuation members, and to minimise financial loss and disruption. It does this, in part, by planning for and implementing quick and effective responses to a crisis in the financial system. In light of the challenging external environment for all APRA-regulated industries during 2020, APRA drew on its accumulated expertise and experience with recovery and resolution planning to ensure contingency plans were in place to deal with extreme financial stress.

As recovery plans are critical to ensuring APRA-regulated entities are prepared for and can recover from losses without the need for public sector assistance, there was a substantial focus on the credibility of recovery plans within the banking and insurance industries in 2020.

It is important to note that APRA does not operate a zero-failure regime. Rather, where an entity faces financial stress and private sector recovery is not possible, the entity and APRA must be prepared to facilitate an orderly exit or resolution that minimises any impact on beneficiaries (depositors, policyholders or members), public funds and financial stability. This process is referred to as resolution planning.

As the potential impacts of COVID-19 emerged, APRA focused its resolution planning work on simple, credible resolution strategies that could be readily implemented – especially for the more vulnerable institutions within APRA’s regulated population.

In addition, APRA identified the need to further develop recovery and resolution planning in the superannuation industry in light of sector developments earlier in 2020, and a focus on entity sustainability and under-performance.

APRA also continued to enhance its own preparedness for a resolution or crisis throughout 2020. This included improvements to APRA’s resolution and crisis governance infrastructure.

In December, APRA adopted a monitoring role as Xinja Bank Limited announced it would return all funds to depositors and ultimately relinquish its licence to operate as an authorised deposit-taking institution. As Australia’s financial safety regulator, APRA’s role was closely monitor the return of deposits to ensure all funds were returned in an orderly and timely manner. This was completed in January 2021.

Supervision in action |

Following the discovery of errors in quarterly financial data submitted by an entity, APRA identified a potential systemic issue regarding the accuracy of data submitted. Further investigation led to the discovery of additional concerns regarding the appropriateness of methods used to determine critical actuarial calculations. In order to confirm the root cause of the issues, APRA initiated discussions with the entity’s Appointed Actuary, as well as requiring the entity to commission an independent review of previous data submissions to determine their accuracy. Findings to date from the independent review have highlighted a number of shortcomings in the entity’s data compilation and reporting processes, which are currently being rectified. This rectification will contribute to better data management and reporting by the entity. |

Supervision and risk intensity model

In October, APRA began using a new risk assessment tool, aimed at providing an enhanced view of emerging vulnerabilities within banks, insurers, superannuation entities, and by extension the broader financial system.

Purpose-built for an environment where the type and nature of prudential risks are evolving, and seemingly non-financial risks have been shown to have potentially serious financial consequences, APRA’s new Supervision Risk and Intensity (SRI) Model allows it to better direct supervisory attention and resources to areas of greatest risk. This includes consideration of risks pertaining to governance, culture, remuneration and accountability (GCRA), operational resilience, cyber security, and (in superannuation) member outcomes.

The new model replaces the dual risk assessment framework used by APRA since 2002. Although the Probability and Impact Rating System (PAIRS) and the Supervisory Oversight and Response System (SOARS) served APRA well for nearly two decades, recent years have identified new risks and vulnerabilities for which they were not well suited.

The SRI Model has three main components: tiering, risk assessment and staging.

Each APRA-regulated entity is first allocated a tier. If an entity’s failure, bad behaviour or operational disruption could hurt financial stability, the economy and the broader Australian community, it will be rated Tier One and subjected to routine risk assessments that are more detailed than those for institutions rated as Tiers Two, Three or Four.

A risk scoring process, which can be dialled up or down depending on current and prospective operating conditions, is then applied to set the level of supervisory intensity. The SRI Model includes five risk assessment stages, ranging from ‘routine supervision’ activities (Stage One) through to ‘resolution action’ (Stage Five), where an entity’s position is not viable and compulsory solutions are imposed.

In addition to changing the way ratings are done, APRA has updated its supervision philosophy. Like the SRI Model, the philosophy ensures that APRA’s supervisory approach and activities align with its mandate and vision for financial resilience and supervisory excellence. It provides for proactive and accurate risk identification and assessment in terms of impact on an entity’s financial health, and prompt action to resolve issues and intensify supervision when needed. Where steps to rectify problems aren’t working and more coercive tools are needed, the SRI Model provides for an escalation in APRA’s response and enforcement action.

APRA held a series of webinars with industry in November and December to help entities understand how the SRI Model works and the impact it might have on the level and intensity of supervision applied to them.

To ensure the SRI Model is applied as intended across all APRA-regulated entities, APRA’s Supervision Training Academy has run in-depth training for all supervisors. A series of quality assurance activities, including benchmarking exercises, will provide further confidence that the new model is being applied consistently in respect of the rating and staging outcomes.

Supervisors will complete their first SRI assessments in a staged manner. All APRA-regulated entities will be assessed under the new SRI Model by 30 June 2021. APRA will advise each entity their tier and stage once approved. For those entities in Stages Two or above, APRA’s communication will make clear its risk concerns and what is expected of the entity for it to return to Stage One routine supervision.

Footnotes:

1 Royal Commission into National Natural Disaster Arrangements Report, 28 October 2020

2 RBA – Statement by Philip Lowe, Governor: Monetary Policy Decision, Media Release, March 3, 2020 https://www.rba.gov.au/media-releases/2020/mr-20-06.html

3 Treasurer Josh Frydenberg, 2020-2021 Budget Speech, 6 October 2020 https://joshfrydenberg.com.au/wp-content/uploads/2020/10/Treasurer-Speech-Budget-2020-21-Parliament-House-Canberra-6-October-2020-1.pdf

4 AustCyber (2020), Australia’s Digital Trust Report 2020, available at https://austcyber.com/resource/digitaltrustreport2020

Chapter 2 - Sector developments

Authorised Deposit-taking Institutions

The ADI industry demonstrated resilience during 2020. Despite being tested by the impacts of COVID-19, ADIs remained well capitalised with sound liquidity and funding positions. With the aid of policy support measures, the ADI industry successfully managed increased risks to its financial health, while short-term support measures, such as loan repayment deferrals, provided many borrowers additional time to improve their financial situation.

Introduction

Nevertheless, ADIs remain exposed to significant headwinds and vulnerabilities. Although signs of deterioration in key asset quality measures were muted, banks increased provisions in anticipation of higher expected credit losses as support measures ease off in 2021. If maintained, low credit growth and the very low interest rate environment will likely restrain industry profitability over the year ahead.

In response to these heightened risks, APRA sharpened its focus in 2020 on maintaining the banking industry’s resilience, enhancing its crisis readiness, and ensuring ADIs were well positioned to work through the pandemic to recovery.

The industry landscape

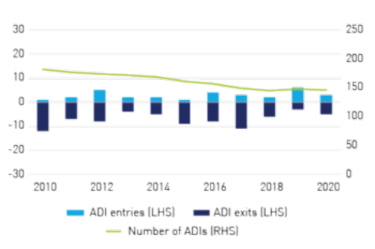

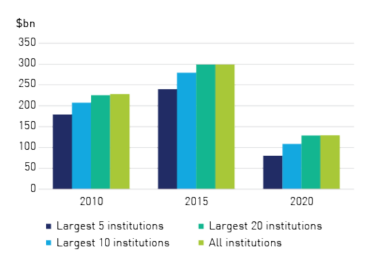

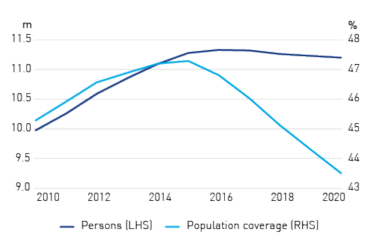

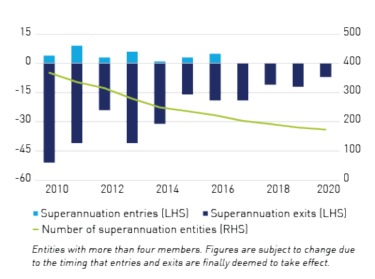

There were 146 ADIs operating in Australia as at 30 June 2020, down from 148 a year earlier (Figure 1a). This comprised 98 banks, 40 credit unions and building societies, seven other ADIs, and one Restricted ADI.

The year saw the entry of one domestic bank, one foreign bank and the restricted licensing of one locally-incorporated new entrant, alongside the exit of five ADIs. In late 2020, Xinja Bank also announced its intention to exit; a process that will be finalised in early 2021. APRA’s temporary suspension of new ADI licences in April 2020 meant a number of potential new entrants were deferred until the economic and financial outlook became more settled. APRA announced in August that it would recommence licensing in a two- stage process.

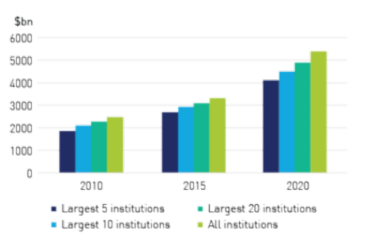

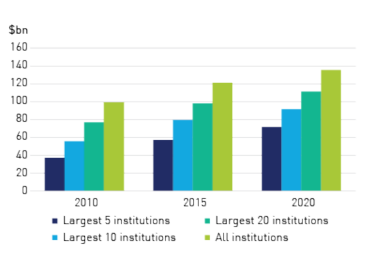

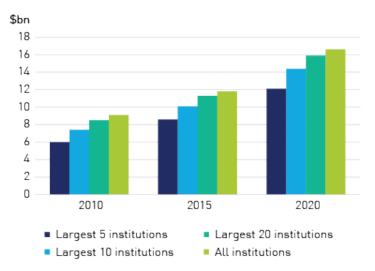

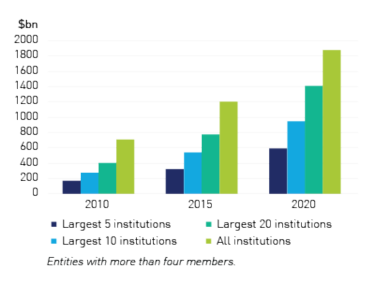

As at 30 June 2020, total ADI industry assets stood at $5.4 trillion, up from $4.7 trillion the year prior. The industry remained concentrated, with the four major banks holding around 73 per cent of industry assets, a marginal reduction in concentration compared to prior years (Figure 1b). Industry profitability was dampened by a number of factors, including:

- impacts of COVID-19 on borrowers’ ability to make repayments;

- subdued credit growth; and

- narrowing net interest margins, reflecting historically low and declining interest rates.

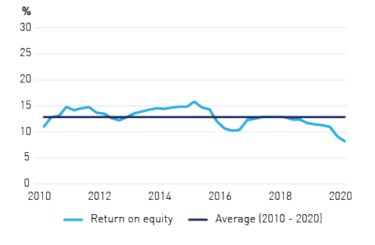

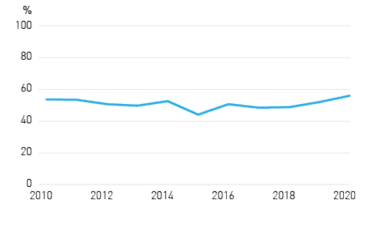

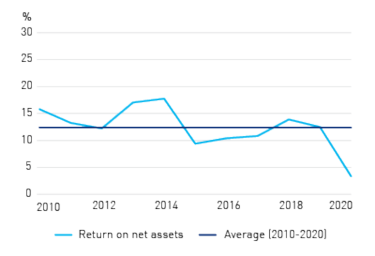

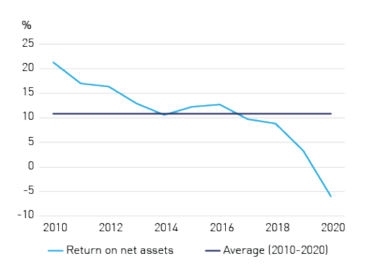

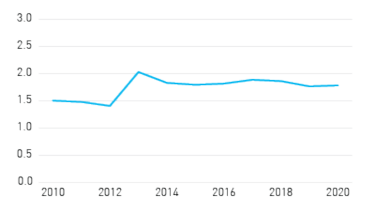

As a result, industry return-on-equity (RoE) fell to 8.2 per cent (Figure 1c), a fall of 3.3 percentage points from 2019 and well below the longer-term average RoE of 12.9 per cent since 2010. The industry cost-to-income ratio was largely unchanged from the previous year (Figure 1d).

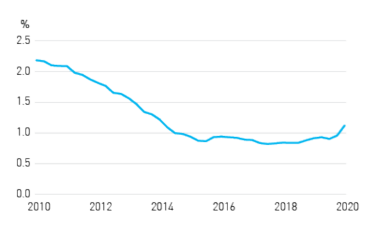

Unsurprisingly, industry asset quality deteriorated, but in the circumstances there was only a relative modest increase in non-performing loans, up 0.2 percentage points to 1.1 per cent of gross loans and advances at 30 June 2020 (Figure 1e). Temporary loan repayment deferrals served to dampened the levels of impaired and past due assets and credit losses.

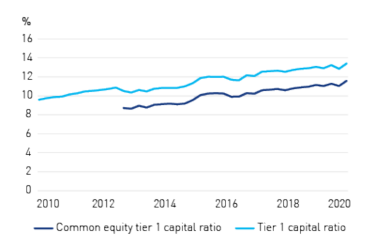

The ADI industry was well capitalised at 30 June 2020, with the weighted average CET1 ratio for the industry at 11.6 per cent — an increase of 0.5 percentage points over the prior year. The weighted average industry Tier 1 capital ratio rose 0.4 percentage points over the year to 13.4 per cent (Figure 1f).

Key issues and activities of 2020

Loan deferrals

As Australians lost jobs and businesses came to a near or total standstill due to COVID-19 impacts and related health and safety restrictions, the banking industry offered repayment deferrals to households and businesses, giving a temporary reprieve from mortgage and business loan obligations. To avoid a situation where strict adherence to regulations might do more harm than good to the community and the economy, APRA granted a regulatory concession, allowing banks to not treat loans subject to deferral programs as impaired. This avoided the imposition of the higher capital requirements that apply in normal circumstances for a loan that falls into arrears.

Relief also was given for loan restructurings, subject to banks meeting certain disclosure requirements and undertaking customer needs assessments. Under this concession, a loan restructure before 31 March 2021 intended to put a borrower on a sustainable financial footing could be regarded as a performing loan for capital and regulatory reporting purposes.

While the financial system remained strong, the concessionary treatment of a substantial volume of loan deferrals resulted in credit risk essentially being understated. To aid transparency, APRA required banks to publicly report on the nature and terms of any repayment deferrals and the volume of loans involved. APRA began gathering, collating and publishing aggregated data gathered from banks, providing APRA and the market a clear view of the nature and size of deferred loans in Australia.

As Chair Wayne Byres told the Board of the International Banking Federation in May, in exercising a degree of flexibility with its response to COVID-19 measures, APRA had no appetite for proposals that would keep facts hidden: “Denial is not going to be a successful strategy for anyone. Moreover, just ‘kicking the can down the road’ risks making the adjustment process even more onerous than it already is by undermining confidence in the health of the system,” Mr Byres said.

At the peak in June, customers with $274 billion in loans, or approximately 10 per cent of bank loans at that time, were taking advantage of deferral arrangements.

APRA’s focus shifted in mid-2020 from the initial policy response to the financial system’s role in supporting an economic recovery. Key elements of a successful transition would be the continued supply of credit by banks and careful management of the end of the loan repayment deferrals. Mindful that many other COVID-19 support measures were, at that time, due to end in September, APRA extended the regulatory concessions to banks on deferred and restructured loans to March 2021. The extension meant banks had more time to tailor debt management solutions for each borrower, avoiding unnecessary hardship and foreclosures.

To facilitate an orderly end to the deferrals program, APRA asked banks to develop comprehensive plans for assessing and managing the winding down of the support package. Though loans under deferral arrangements declined through the second half of the year, there remained loans totalling $51.2 billion (or 1.9 per cent of total bank loans) subject to deferral at the end of December. Housing loans accounted for most of the loan deferrals by value ($42.9 billion), representing 2.4 per cent of all housing loans. Loans to small and medium-sized enterprises (SME) totalled $6.0 billion, representing 1.9 per cent of all SME loans.

In December, APRA published further analysis of trends emerging from the loan deferral data. This can be found in the APRA Insight article: “APRA’s loan repayment deferral data: Shining a light on credit risk.”

Capital management

The Australian banking system entered 2020 in more robust health than before previous downturns, reflecting the conservative stance on balance sheet strength and liquidity that APRA adopted following the 2008 global financial crisis (GFC).

A lesson from the GFC was the importance of resilience, and this influenced APRA’s decision to require banks to implement capital buffers to meet internationally agreed Basel III standards earlier than many other countries. It also informed the subsequent increase in the amount of capital APRA expected ADIs to hold to deliver on the Financial System Inquiry’s recommendation that Australia’s banks maintain ‘unquestionably strong’ capital positions.

At the end of 2019, Common Equity Tier 1 (CET1) capital, the highest grade of capital held by banks, had reached $235 billion – well above minimum regulatory requirements. The CET1 ratio across the nation’s four largest banks stood at 11.3 per cent, comfortably above the ‘unquestionably strong’ benchmark on of 10.5 per cent.

One of APRA’s key actions was to respond to the changing environment by permitting banks to tap their large capital reservoirs.

“Just as we try to dampen excessive swings on the upside, prudential supervisors also have an important role to play in limiting the downside,” Mr Byres told a Trans-Tasman Business Circle webinar in July. “We cannot avoid or hide from the long-run impact of a shock, but macro- and micro-prudential measures can assist in making the adjustment process more orderly and limit unnecessary costs,” he said.

While providing room to use their capital buffers, APRA wanted banks and insurers to recognise the need for prudence with regard to their discretionary capital distributions given the environment and uncertain outlook, as well as the substantial regulatory concessions being provided. In April, APRA requested banks and insurers to defer dividends and moderate executive bonuses, saving capacity to support the economy. Where a board felt confident enough to pay a dividend before the outlook was clearer, it should only do so after a robust stress testing of the results and discussions with APRA. APRA also requested that any dividend should, where possible, be offset through the use of dividend reinvestment plans and other capital management initiatives.

In late July, with the economic outlook somewhat less cloudy, APRA relaxed its guidance on dividends. In advising boards that they should maintain caution in planning capital distributions, APRA said ADI boards should seek to retain at least half of their earnings when making decisions on capital distributions, including dividends. This updated guidance sought to strike a balance between recognising the strength of the financial system and the difficulty of the path ahead.

In December, APRA further relaxed the guidance for 2021, citing an improving economic outlook and stability in financial markets. In doing so, APRA noted a strengthening in capital positions and provisioning levels by banks, and that the majority of loans subject to repayment holidays had recommenced repayments. A range of stress testing exercises had “provided assurance that the banking industry is well placed to withstand a range of downturn scenarios,” Mr Byres said in a letter to all ADIs and insurers.

While no longer expecting retention of at least half of earnings in the new calendar year, APRA strongly advised boards to carefully consider a sustainable rate for dividends, taking into account the outlook for profitability, capital and the economic environment. APRA also said it expected boards to moderate dividend payout ratios and consider the use of dividend reinvestment plans and/or other capital management measures to offset the impact on capital from distributions.

Also in December, APRA recommenced consultation on proposed changes to the ADI capital framework. The consultation is a continuation of a process that responds to the Financial System Inquiry recommendations and ensures Australian banks meet the internationally agreed Basel III requirements. The proposed changes are designed to make the capital framework more flexible, transparent and resilient, and are not expected to require the ADI industry to need to raise extra capital. “These proposed changes will embed the ‘unquestionably strong’ capital position that has been achieved by the banking sector into a regulatory capital framework that is more flexible and responsive at times of crisis,” Mr Byres said. APRA proposes to implement the new framework from 1 January 2023.

Operational resilience

Banks play a vital role in the financial system. In lending money to households and businesses through upturns and downturns, processing payments for goods and services and safeguarding trillions of dollars on behalf of depositors, banks are a critical conduit for economic activity.

While financial resilience is a recurring theme in this Year in Review, COVID-19 was also a test of operational resilience, and the ability to deliver core services while drastic public health measures upended everyday life and reduced public confidence. As Mr Byres noted in remarks to a Basel Committee Banking Supervision (BCBS) meeting on operational resilience in October: “The ability of participants to continue to perform their core functions seamlessly and without disruption is obviously important to community confidence – and especially critical at a time when confidence might be a bit fragile. It will also play an important role in facilitating the economic recovery we’re all hoping for.”

To support banks to keep delivering core functions, APRA temporarily eased some of the regulatory requirements on ADIs and worked with the industry to ensure business continuity plans were enacted and frontline impacts accommodated. In many respects, past investment in risk management, business continuity, and management of service providers allowed banks to function relatively well through this period. Critical services were maintained, though systems and processes needed to be changed in some areas to support customers and mitigate service provider failures, including those provided by overseas parties also in lockdown.

Even so, the crisis highlighted areas where improvements can be made ahead of the next shock. APRA outlined some industry- wide lessons in August in an APRA Insight article titled: “COVID-19: A real-world test of operational resilience”. Mr Byres also outlined some observations in that regard in his BCBS comments, including:

- There is scope to improve business continuity plans, including the potential need for repatriation of services conducted by offshore providers, and examining the impact of lockdowns on offshore providers and extended periods of working from home.

- Having employees working entirely from home creates new cyber-attack vulnerabilities.

- Decisions to pause or postpone technology upgrades, such as less critical security patches, create a backlog of work and can cause security vulnerabilities to build up.

- COVID-19 delayed testing of some aspects of contingency planning, including wholesale data centre loss, major cyber attack and data corruption.

- Contingency planning in the future will need to pay more attention to sustaining staff wellbeing.

General insurance

The general insurance industry’s capital position remained robust throughout 2020. This was despite a large fall in industry profits due to high claims costs from catastrophic bushfire and storm events early in the year, and lower investment income from financial market volatility in the early period of the COVID-19 pandemic.

Introduction

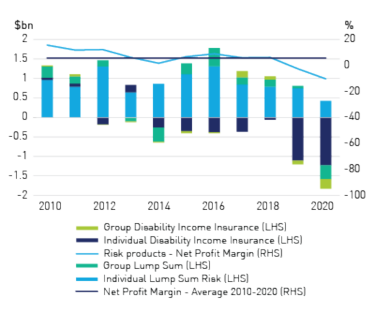

Following the initial impact on insurers’ investments, the economic and social disruption from COVID-19 led to heightened uncertainty around potential claims impacts. This was most pronounced in business interruption (BI) insurance. Post SARS in 2003, insurers sought to eliminate their exposure to pandemics by adjusting exclusions in their policies. However, imprecision in terms and conditions meant that insurers now face legal challenges to their policy wordings, and at the time of writing, judicial interpretation may result in BI insurers needing to pay substantial unanticipated BI claims. Insurers have been strengthening their claim provisions as a result.

The negative impact of COVID-19 on household and business incomes, particularly as Government fiscal support is unwound, is likely to exacerbate concerns relating to the affordability and availability of insurance. Further, the increased frequency and intensity of natural disasters associated with climate change will require greater attention to mitigation and disaster preparedness to ensure that general insurance remains accessible and affordable to all Australians.

The industry landscape

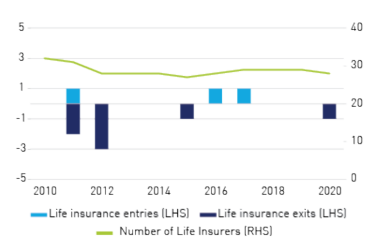

At 30 June 2020, 95 APRA-authorised general insurers operated in Australia, comprising 85 direct insurers and 10 reinsurers. The number and composition of general insurers remained broadly stable over the period (Figure 2a).

The industry continued to be concentrated, with the top five general insurers accounting for 53 per cent of total industry assets (Figure 2b). The degree of concentration has increased over time, which in part reflects the rationalisation by some of the larger insurers of APRA insurance licences, resulting from past acquisitions.

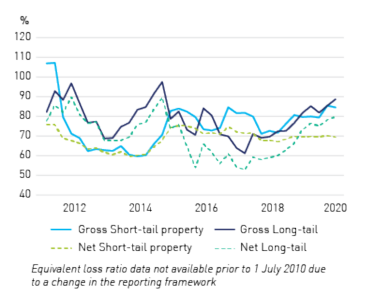

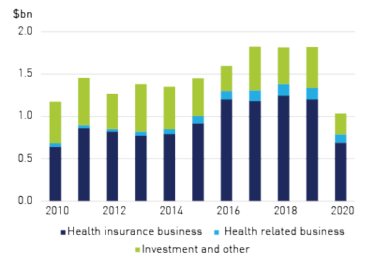

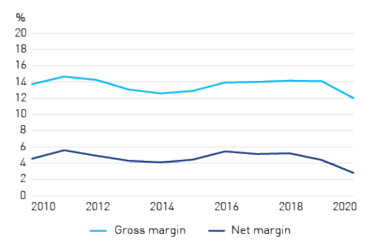

The industry generated a 3.2 per cent return on net assets in the year to June 2020, which was significantly below the 10-year average of 12.4 per cent (Figure 2c). The lower return on net assets was due to weaker underwriting results as a consequence of the bushfires and storm events in late 2019 and early 2020, and large falls in investment income. The natural catastrophe events resulted in higher gross loss ratios in short-tail property classes of business, particularly for the Householders and Fire and Industrial Special Risks classes of business (Figure 2d). However, the net loss ratios in these classes were largely unchanged compared with 2019 because of a large increase in recoveries from reinsurers for these catastrophe events, along with premium rate increases during the year to June 2020.

The net loss ratio for long-tail classes of business increased over the fiscal year. This was due, in part, to an increase in the valuation of long-tail claims reserves, driven by falling bond yields. These were particularly pronounced in the March quarter, when the negative impact of COVID-19 on financial markets was most pronounced. On the other hand, releases of claims reserves continued to positively impact underwriting profits in the compulsory third party (CTP) motor vehicle class of business. However, these have been declining in recent years due to the impact of the 2017 reforms to the New South Wales CTP scheme.

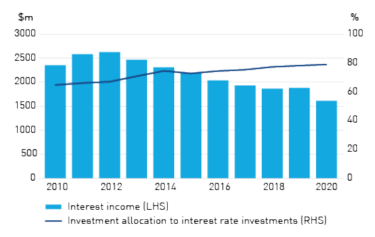

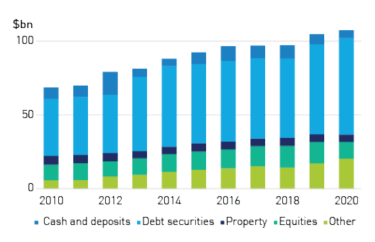

General insurers’ investment portfolios continue to be heavily weighted to interest bearing investments (Figure 2e). In response to the COVID-19 pandemic and associated volatility in financial markets, insurers reduced their exposure to equity investments and further increased their holdings of interest-bearing investments. Low interest rates continue to reduce insurers’ interest income on these investments.

Key issues and activities of 2020

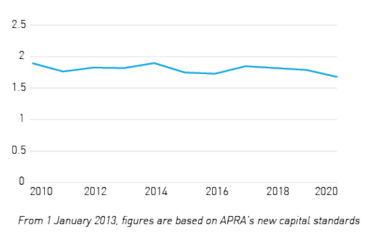

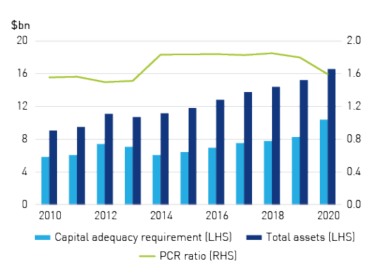

The industry’s capital position remained relatively stable, with a coverage ratio of 1.7 times the minimum requirement at 30 June 2020 (Figure 2f). The quality of insurers’ capital continued to be high, with CET1 capital making up 92 per cent of non-branch insurer eligible capital.

Business interruption insurance

Over 2020, APRA’s work in the general insurance industry centred on responding to the prudential impacts of the pandemic. In particular, the rapid onset of COVID-19 and subsequent closure of many businesses has drawn global attention to whether, and how, business interruption (BI) insurance policies will respond.

As Australian courts consider the effectiveness of pandemic exclusions found in many BI insurance policies, APRA has been closely monitoring the potential prudential implications of this issue. APRA continues to engage with insurers and other regulatory bodies including the Treasury, ASIC, Australian Financial Claims Authority (AFCA), the Insurance Council of Australia (ICA) and international peer regulators to maintain an accurate understanding of any potential prudential impact.

Access, affordability & resilience

The summer of 2019/2020 has come to be known as Black Summer following one of the most devastating bushfire seasons in modern Australian history, which claimed 33 lives, destroyed 3000 homes and burnt out an estimated 24,000 of hectares of bush and grassland1. As the scale of the disaster became apparent, APRA established an internal Bushfire Impact Monitoring Group to keep a close eye on how insurers were responding to a rapidly rising volume of claims stretching simultaneously across multiple states.