APRA’s place in the wider regulatory environment

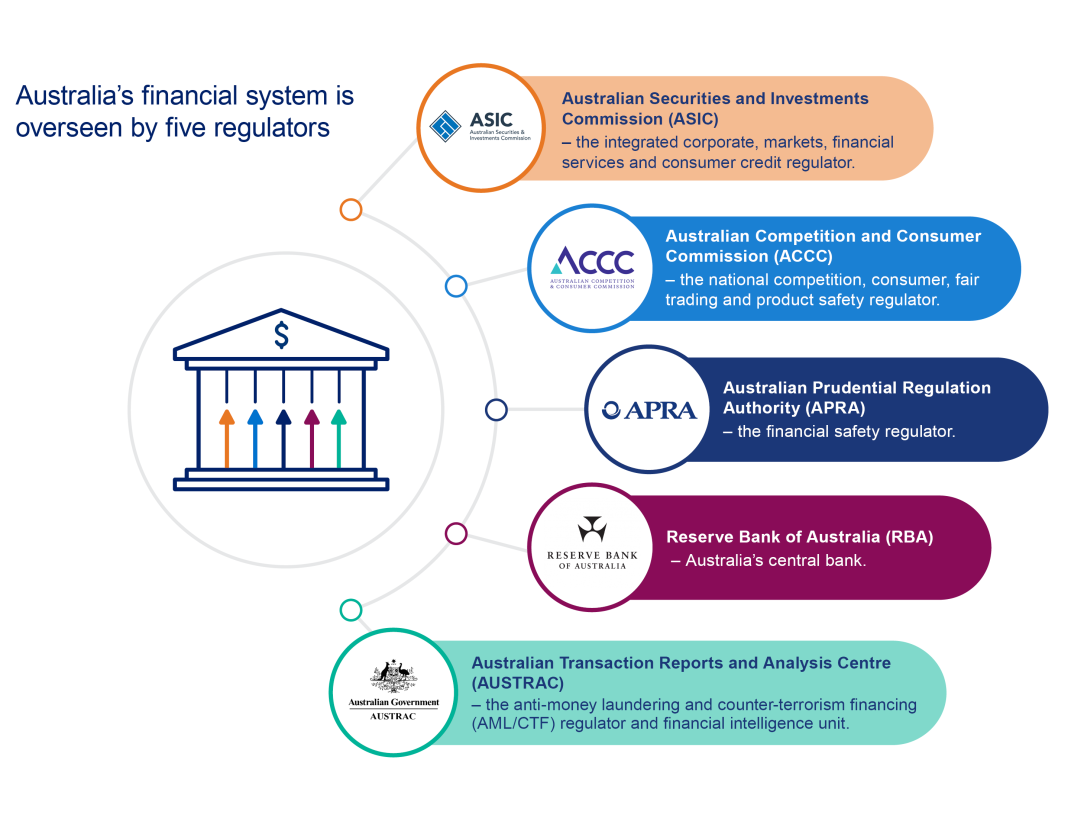

Australia’s financial system is overseen by five regulators:

- The Australian Prudential Regulation Authority (APRA) – the financial safety regulator.

- The Australian Securities and Investments Commission (ASIC) – the integrated corporate, markets, financial services and consumer credit regulator.

- The Australian Competition and Consumer Commission (ACCC) – the national competition, consumer, fair trading and product safety regulator.

- The Reserve Bank of Australia (RBA) – Australia’s central bank.

- The Australian Transaction Reports and Analysis Centre (AUSTRAC) – the anti-money laundering and counter-terrorism financing (AML/CTF) regulator and financial intelligence unit.

The regulators work together, sharing information and insights to protect the financial wellbeing of our financial system. A key enabler of success is the strength of the regulator relationships and coordination across the cohort.

These agencies also contribute to the Regulatory Initiatives Grid which is now in its second edition.

Council of Financial Regulators

The Council of Financial Regulators (CFR) is Australia’s primary coordinating body for financial regulation, comprising APRA, ASIC, the RBA, and the Treasury.

The CFR facilitates cooperation and collaboration across member agencies, with the ultimate aim of promoting the stability of the Australian financial system and supporting effective and efficient regulation. In pursuing this aim, the CFR also seeks to support competition in the financial system.

Learn more about the CFR here.

The five Australian financial system regulators

Australian Securities and Investments Commission

APRA and ASIC are often referred to as the “twin peaks” of Australia’s system of financial regulation. Like APRA, ASIC regulates aspects of the Australian financial system.

But whereas APRA is Australia’s financial safety regulator, focused on the soundness of individual financial institutions, ASIC is the conduct regulator, responsible for detecting and punishing misconduct in the industry, and for achieving good outcomes for consumers and investors.

ASIC regulates the conduct of Australian companies, financial markets, financial services organisations (including banks, life and general insurers and superannuation funds) and professionals who operate in those sectors. ASIC is also responsible for regulating consumer credit.

The Reserve Bank of Australia

The RBA is Australia’s central bank. Its duty is to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people. It does this by conducting monetary policy to meet an agreed inflation and full employment objectives, working to maintain a strong financial system and efficient payments system, and issuing the nation's banknotes.

The Australian Competition and Consumer Commission

The role of the ACCC is to administer and enforce the Competition and Consumer Act 2010 and other legislation, promoting competition, fair trading and regulating national infrastructure for the benefit of all Australians.

Australian Transaction Reports and Analysis Centre (AUSTRAC)

AUSTRAC performs a dual role as Australia’s anti-money laundering and counter-terrorism financing (AML/CTF) regulator and financial intelligence unit. This dual role helps to build resilience in the financial system and enables AUSTRAC to use financial intelligence and regulation to disrupt money laundering, terrorism financing and other serious crime.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9.8 trillion in assets for Australian depositors, policyholders and superannuation fund members.