APRA General Manager, Advice and Approvals, Peter Kohlhagen - Speech to 19th Annual Health Insurance Summit

Health check: APRA's view of the impact of COVID-19 on private health insurers

Good morning everyone,

It’s great to be back at the Health Insurance Summit, albeit this year as a virtual event.

This is my fourth consecutive appearance at the Summit. In previous years, I have generally spoken to you about major pieces of policy or supervision activity. This time I’ll take a different approach – you can all relax as I’m not going to make an announcement or deliver a major new message. Instead I think it’s timely to look back on the trajectory of the industry over time and how that has evolved as a result of COVID-19. The private health insurance system is heavily influenced by matters of health policy, and those are matters for Government. My remarks today are focused around prudent management of insurers in a challenging environment.

For people around the world, the emergence of COVID-19 has been a defining event and has divided our thinking into three periods: pre-COVID, the current crisis, and what might happen once the pandemic has passed or is well under control. APRA’s engagement with the private health insurance sector is no different in that regard. Today I will discuss how APRA’s views on the sector have evolved in three parts:

- pre-COVID, from APRA’s assumption of responsibility for supervising private health insurance through to February this year;

- the COVID period, from March this year until today; with a particular focus on the acute first phase of the pandemic in Australia; and

- finally, looking forward to consider some potential impacts of COVID on the longer-term trajectory of the industry.

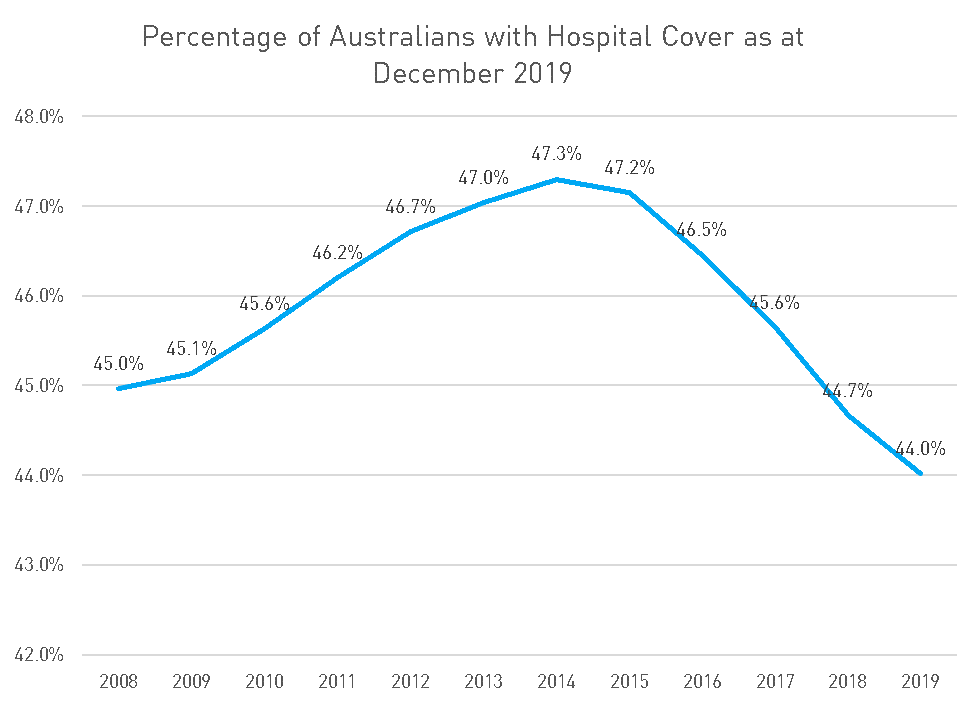

It’s no secret that APRA believes the past several years have seen the industry under significant and increasing pressure. Premiums are being driven up due to rising utilisation and the increasing cost of health services, and, as a result, affordability concerns are driving down participation, particularly amongst lower risk policyholders. This adverse selection creates a feedback loop that drives further increases in costs and premiums. A significant improvement in insurer capability was required across a range of dimensions, including risk management, governance, capital management, strategy and business planning, and recovery planning to allow the industry to respond effectively. In particular, insurers need to develop robust strategies for managing affordability and adverse selection. And because no strategy is guaranteed to be successful, insurers need a robust recovery plan; colloquially, a Plan B.

When the pandemic hit, insurers responded admirably to the needs of their policyholders and engaged with APRA on the emerging prudential issues. And while many future paths are possible, APRA’s central case is that the underlying structural issues have not gone away and the impacts of the pandemic may have accelerated the existing deteriorating trend in sustainability.

Pre-COVID

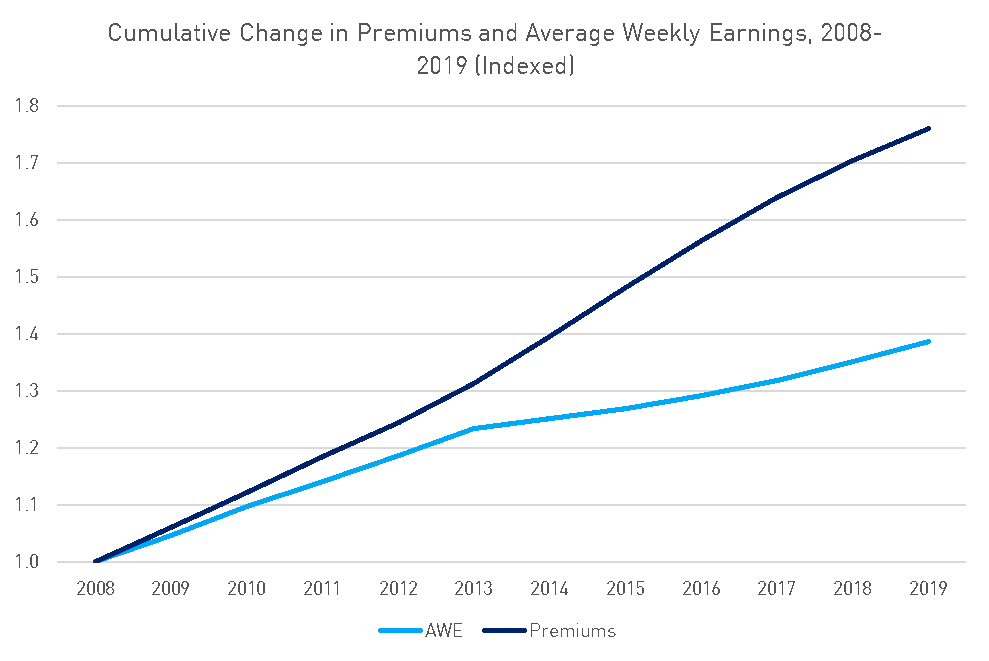

I should pause at this point and emphasise some terminology. APRA has talked a lot over the past few years about sustainability of the industry – but what do we mean by that? In simple terms, we mean that the industry was on a trajectory that could not continue indefinitely. Clearly premiums can’t increase more rapidly than incomes forever, and participation cannot decrease forever. Health care costs cannot increase more rapidly than health insurance premiums forever. The following charts illustrate the current direction of travel.1

Concerns over sustainability do not necessarily mean that there are concerns over the viability of individual insurers at a particular point in time. The private health insurance industry remains profitable and well-capitalised, and policyholders can be confident that insurers have the financial means to pay all legitimate claims they receive. However the longer the industry continues on an unsustainable trajectory, the greater the likelihood that individual insurers would experience pressure on their business models and viability concerns would emerge.

This is the point that APRA Member Geoff Summerhayes was making when he delivered a speech to the industry in February on the theme of sustainability. His address contained some very challenging messages that fed into a debate already underway involving a wide range of stakeholders and observers of the health insurance system.

Fundamentally, if the cost of running a business (in this case, paying claims) is growing more rapidly than its revenue (premiums), eventually something has to give. That is as true for private health insurers as it is for any other business.

In short, the key messages in the speech were that:

- the private health insurance industry was at that point profitable and well-capitalised;

- notwithstanding ongoing efforts by industry and substantial ongoing support and action by the Government, the outlook for the industry was increasingly challenging;

- many of the most significant factors driving the sustainability challenge are not within the control of insurers, such as the ageing population and rising cost of medical services;

- so insurers should absolutely not be waiting for someone else to solve the problems, they needed to focus on the steps they can take that are within their control. APRA’s letter of June 2019 discussed some practical steps that insurers could take to position themselves;2

- there was a need for a whole of system response – for stakeholders across the healthcare system to work on collective solutions given they all have a stake in a sustainable industry. A wide range of stakeholders – insurers, private hospitals, medical device companies and others – need to continue to search for innovation and win-win solutions that enable better overall outcomes and value for customers within the private system.

The speech highlighted a potential future where, without action, many insurers wouldn’t have sustainable business models. That is a future that no one wants to see. APRA’s view remains that the community is well-served by having a wide range of health insurers in a competitive market looking to meet the needs of their members and that is reflected in the APRA mandate that requires us to have regard to efficiency, competition, contestability and competitive neutrality. We have no desire to see insurers exit the industry, and are keen to see action by insurers to avoid exactly that outcome. Indeed, much of APRA’s work is aimed at giving insurers the longest possible runway to do so. However, it is the role of APRA to act to protect policyholders should it become clear that an insurer is going to be unviable.

COVID period

Turning now to more recent events, and as the impacts of COVID-19 emerged in March, both APRA and industry had two key initial areas of focus – operational resilience in adapting to a work from home environment and supporting the needs of policyholders. On both these fronts, the efforts of insurers were significant. As with many organisations around the world, private health insurers compressed years of operational and technology change into a matter of weeks. No material operational issues emerged through the process, which was a credit to the industry. Insurers also took steps to support the needs of their policyholders, supporting appropriate models of care, deferring premium increases and responding to hardship cases.

From APRA’s perspective, we have needed to rethink our priorities and create space for insurers and ourselves to respond to the emerging challenges. We issued early guidance to all the industries we regulate that we were pausing the majority of our policy and supervision initiatives at least through to the end of September. This had material benefits for health insurers, as we extended the consultation period for the important capital reforms and delayed the finalisation of new requirements on remuneration. On supervision, we slowed our work on affordability and pivoted our focus towards the recovery planning work that is even more important in times of stress.

Across all industries, APRA recognised the extreme uncertainty that characterised the period and issued clear expectations around capital management and dividend decisions. This guidance was designed to preserve capital given market volatility and economic impacts.

Attention quickly turned to the impact of elective surgery deferrals and constraints impacting access to general medical treatment. The need to make sure that policyholders are getting value from their policies during a period where access to services was restricted emerged as an issue. In response, insurers made firm commitments not to profit from the pandemic. Insurers worked with Government to expand telehealth services for a number of specialties – and policyholders will gain future benefit from continuation of such services announced in the recent Budget.

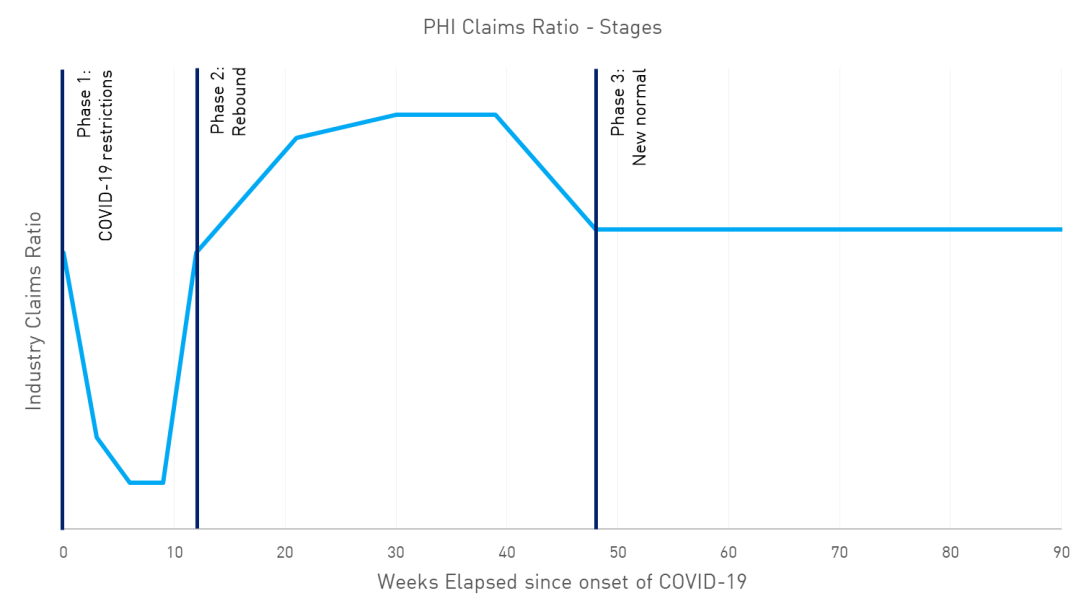

From an APRA perspective, our core role is to make sure that insurers remain prudentially sound. To the extent these claims are just delayed rather than eliminated, insurers needed to make the right provisions and hold capital to make sure they can pay when the time comes. Prematurely recognising these potentially temporary gains as profit puts future prudential soundness at risk. This chart shows a conceptual model of the lockdown in three phases. First is the lockdown period itself, when claims are significantly depressed, in the second phase claims rebound and there is a catch-up of claims that were deferred during phase 1, third is the ‘new normal’ after the catch-up has flowed through the system (shown as a flat line here for simplicity, although we know that in reality claims have been on an increasing trend over time).

APRA worked very closely within Government with our peer agencies ASIC, the ACCC and the Department of Health to drive a coordinated approach. These are complex and challenging issues that go to the heart of both prudential soundness and the fair treatment of policyholders. Getting a shared understanding of the issues was therefore critical to support an informed public debate. We also engaged extensively with insurers, industry associations, the Actuaries Institute and other informed stakeholders to understand the issues and provide timely guidance to support a consistent approach around how insurers should reserve against these deferred claims and how to treat them for capital purposes. One key consideration was around the capacity of the health system to ‘catch up’ the deferred claims – APRA benefited greatly from insights of stakeholders on that and other challenging issues.

APRA’s view is that a sensible starting point was that there would be something approaching a full catch-up. Or to put that another way, over the medium term, our best judgment is that the total volume of claims will be broadly the same as it would have been without COVID – what has changed is the timing of those claims. We have been intentionally somewhat prudent, particularly for capital purposes where we are trying to protect against very adverse scenarios.

It’s too early to tell whether all of these deferred claims will ultimately materialise. People have different views on that and there are many confounding factors, but they look to be tracking broadly in line with APRA’s guidance at this stage. While there is significant noise in the data, there is evidence that claims have rebounded and that a catch-up is underway. There is some evidence of a state-by-state story emerging, with those states less impacted by COVID experiencing a faster and higher rebound in claims.

Ultimately, we will reach a new steady state some time over the medium term. The total amount of profit or loss achieved will be driven by the total amount of claims received and the premiums charged, and will only be known with certainty in hindsight. The impact of APRA’s guidance will only be on the timing of the release of those profits, not the overall amount.

The further lockdown in Victoria subsequent to the initial guidance has added some complexity with a fresh round of claims deferred. To that end, we have released updated guidance in the form of frequently asked questions to make sure APRA’s expectations are clear. The message is simple – we expect insurers to continue to prudently reserve for deferred claims, treating the latest deferred claims using the same approach as those emerging from the initial shutdown.

It’s far too early to draw definitive conclusions however I will venture some observations from our perspective:

- Across all APRA-regulated industries, entering the crisis with strong capital positions has stood Australia in good stead. The peacetime defences we have built up give us time and space to move without entities coming under immediate viability concerns.

- The operation of the capital framework in this period has provided relevant lessons for our review of the current framework – in particular, the need for more consistency in capital outcomes between like insurers, which was recognised in APRA’s capital consultation issued last year.3 COVID-19 has also demonstrated that private health insurance is not immune from the impact of a pandemic, albeit the final landing is yet to be settled. APRA will consider how to reflect that in the future capital framework as part of our ongoing review.

- The LAGIC framework for life insurers and general insurers, which APRA proposes will form the basis of the future-state capital framework for health insurers, has so far proven robust through this period.

- When we examined the scenarios insurers were using to drive reserving and capital decisions, they looked quite optimistic. This re-confirms earlier APRA commentary that insurers should continue to invest in their stress testing capability and challenge themselves to consider a wide range of scenarios – including highly stressful ones.

"It's tough to make predictions - especially about the future"

It’s always risky to try to predict the future and certainly my training as a prudential regulator doesn’t equip me with any special ability in that regard. So to the extent anyone expected me to be able to talk with confidence about the future direction of the industry, I’m going to disappoint you.

However, there are tools we can use to help insurers navigate uncertainty about the future and plan for the resilience of their businesses and the value they provide to customers. A key one, and one that is growing in prominence in the extremely uncertain environment we find ourselves in, is scenario analysis.

Importantly, scenario analysis should test the resilience of the insurer’s strategy and business model against a range of scenarios – favourable and unfavourable, likely and more remote, mild and severe – so that it can support boards and management in making the important decisions they need to make about how to run their business.

Insurers might find it helpful to consider:

- economic scenarios: the path of the recession and recovery will have a material impact on private health insurance, particularly in terms of affordability and participation rates. What impact can unemployment and changes in household incomes be expected to have on participation?

- scenarios around premium levels, including the potential for very constrained premium growth over the medium term.

- scenarios around the cost and utilisation of health services.

- scenarios around the health impacts of the pandemic – both acute and over the longer term. What will be the impact of delays in elective surgery, will those surgeries be more complex or costly when they occur? What about where diagnostic and preventative treatments haven’t been able to be done? What about longer term mental health impacts? Or longer term health impacts on those who have had COVID? Implications for health costs of any acceleration in adoption of new technology or medicines?

Perhaps some of the impacts will put downward pressure on costs over the longer term. Will people become more conscious of the value of their health and therefore value insurance more? Will people invest more in preventative medicine and lifestyle measures to protect their health? Will there be lasting changes to behaviour that are beneficial?

The crisis has forced everyone to think creatively about how to deliver services to customers. In the health space this has included a focus on new modes of care. Are there opportunities to embed those changes into the future operation of the system? And what will all this mean for the financial position of insurers?

While we all hope this is not the case, there is a plausible scenario where the current pandemic amplifies and accelerates the underlying structural trends impacting private health insurance sustainability. Under one such scenario, the pandemic results in a sustained hit to household incomes due to depressed wage growth and higher unemployment. Household budgets become increasingly constrained and, as a result, downgrades and cancelations of health insurance accelerate. These reductions in participation are not even across cohorts of policyholders but are instead concentrated amongst lower claiming younger policyholders. This outcome accentuates existing anti-selective dynamics in the industry. Against this background, long-term trends around the cost and utilisation of health services continue to drive up the cost base of insurers, meaning that premiums need to continue to increase to maintain soundness of insurers.

Again, this is not a prediction. Different people will attach different probabilities to such a scenario eventuating. For APRA as a prudential regulator, we exist to worry about downside scenarios and work to ensure that the system is resilient to severe but plausible negative outcomes. Our message to insurers continues to be to consider a wide range of scenarios, challenge yourselves to make sure they include severe enough stresses to seriously challenge your business model and design strategies and plans that are resilient to those stresses.

Conclusion

So where does all of that leave us regarding our overall assessment of the industry? That is naturally subject to a much greater degree of uncertainty than usual given the external environment but APRA’s central case is that:

- The underlying structural challenges that existed pre-COVID have not gone away, and the work needed by both insurers and APRA to prepare for and respond to those challenges is still important. The Government has announced further supportive policy changes for private health insurance as part of the recent budget that are welcomed.

- To date, industry has navigated the challenges of COVID very well. Insurers’ operational resilience has stood up, and insurers were well placed to support their policyholders and prudently manage the financial risks. That said, deferred claims and the associated reserving and capital issues will need ongoing careful management. Stakeholders will look for insurers and the overall industry to demonstrate that they have met their commitments not to profit from the pandemic.

Looking forward, there is the risk that the economic and health consequences of COVID could amplify and accelerate the challenges of affordability and sustainability. The need for ongoing careful management of these issues, including a robust strategy and Plan B as outlined in APRA’s June 2019 letter to industry, remains front of mind for APRA and should also be front of mind for insurers.

Footnotes:

1 All charts in this speech are drawn from APRA data.

2Letter: Financial Sustainability Challenges in Private Health Insurance June 2019

3Review of the private health insurance capital framework

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9.8 trillion in assets for Australian depositors, policyholders and superannuation fund members.