APRA’s response to climate-related financial risks

As COVID-19 cut a path of illness and social and economic dislocation through 2020, a rare, and perhaps unexpected, beneficiary was the environment. Greenhouse gas (GHG) emissions – the driving force behind climate change – dropped by seven per cent globally in response to a sharp economic contraction that saw industries shut down, fewer vehicles on the roads and international travel curtailed. Yet despite this being the largest annual fall in emissions in recorded history, 2020 was still the equal warmest year on record (tied with 2016), underlining the long-term challenges of addressing climate change.

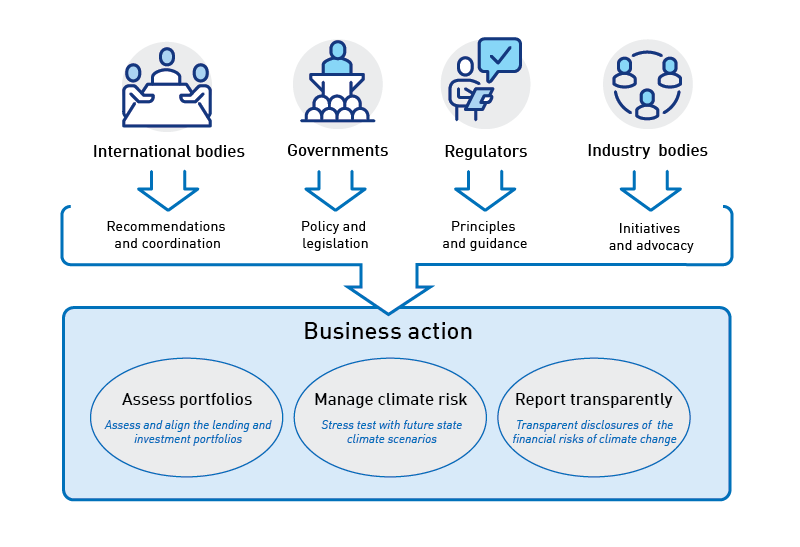

A global challenge needs a global response, and 2020 also saw continued international action to combat climate change, with governments, businesses and investors advancing a range of initiatives to measure, manage and reduce emissions. At the same time, regulators and international bodies were also working towards improved approaches, principles and guidelines to improve the understanding of, and the management of risks posed by, climate change.

The impact of these international developments will present both financial risks and opportunities for Australia’s financial institutions. Mindful that these implications will become more acute as the transition to the low carbon economy gathers pace around the world, APRA is undertaking two key initiatives: a prudential practice guide setting out APRA’s expectations of entities in response to climate-related financial risk; and the commencement of a pilot program of Climate Vulnerability Assessments. By pushing regulated entities to move more swiftly from awareness to action, APRA aims to ensure these institutions are equipped to adapt and respond to the substantial changes in the international economic and regulatory environment that are in train.

A global response

Last month marked four years since former APRA Member Geoff Summerhayes gave APRA’s first speech on climate risk, declaring that climate-related risks were distinctly financial in nature, and that these risks were “foreseeable, material and actionable now”. That view has since been reinforced by Australia’s other financial regulators, including the Reserve Bank of Australia and the Australian Securities and Investments Commission. More broadly, the business community continues to take steps to adjust to the shift to lower emission technologies, adjustments in asset values and changing demands from customers and investors. As important as these developments are, however, it is decisions being made internationally that may be the most consequential in determining the speed and magnitude of this transition.

Chief among these is the 2015 Paris Agreement, the main global driver of international climate policy. Ratified by over 190 countries, including Australia, it established a framework to drive emissions reductions, including through the establishment of national emissions targets.

A growing ecosystem of global alliances and initiatives has also emerged to guide, support, and – to some extent – standardise the finance sector’s approach to addressing climate-related financial risks. This ecosystem is evolving rapidly, through multi-lateral and NGO actions, industry collaboration and business actions, as well as through regulator initiatives. One core driver of action is the Task Force on Climate-related Financial Disclosures (TCFD), an industry-led task force established by the Financial Stability Board in 2015. The TCFD has published a globally influential framework for the effective disclosure of climate-related financial risks. Acceptance of this framework has grown rapidly since its launch, with more than 1500 organisations already expressing their support: in Australia, almost 60 per cent of ASX100 businesses disclose climate risks following the TCFD framework. Some jurisdictions (such as the United Kingdom and New Zealand) are moving to make TCFD disclosures mandatory.

Another influential forum has been the Network for Greening the Financial System (NGFS), a group of over 83 central banks, standard-setting bodies and financial regulators from countries that account for around 75 per cent of global emissions. The NGFS develops recommendations, tools, models and other supporting guidance for addressing climate-related financial risks. For example, the NGFS Climate Scenarios, published in 2020, have been valuable in supporting the banking industry’s understanding of how our climate may evolve in the future, and they will inform APRA’s own work on the Climate Vulnerability Assessments being carried out within, in the first instance, large banks.

At the same time, a number of other multi-lateral initiatives are seeking to integrate climate considerations into broader concepts of “responsible” business practices. Through the UN Environment Programme’s Finance Initiative (UNEP FI), the Principles for Responsible Banking (PRB), Principles for Sustainable Insurance (PSI) and Principles for Responsible Investment (PRI) all bring the consideration of climate change and climate-related risks within a broader category of responsible business practices.

Awareness to action

Although all parts of the economy will be impacted by climate-related risks and the global response to address it, the finance sector will have a central role to play in responding to this challenge, from financing physical infrastructure to adapt to climate change, to investing in long-term decarbonisation opportunities. Many leading institutions in the global finance industry – including banks, insurers and superannuation funds – are already setting climate strategies and seeking to better understand and manage climate-related risks and opportunities.

For example:

- more than one third of the global banking industry has now joined the pledge to implement the UNEP FI’s Principles for Responsible Banking;

- over 140 organisations, including insurers representing more than 25 per cent of world premium volume and USD 14 trillion in assets under management, have adopted the UNEP FI’s Principles for Sustainable Insurance (PSI); and

- six of the largest investor alliances, representing assets worth over USD103 trillion, have called on companies and auditors to fully reflect the effects of climate change in their declared results.

Australia’s financial services sector is closely attuned to these international developments, and advancements in climate science more generally. APRA’s first climate survey of 2019 indicated that most APRA-regulated entities were already taking steps to better understand these risks, especially in the banking, general insurance and superannuation sectors. A third of survey respondents considered climate change was a material financial risk to their businesses now and a further half thought it would be in future; a majority of banks considered climate-related financial risks as part of their risk management frameworks; while reputational damage, flooding, regulatory changes and cyclones were nominated as the top climate-related financial risks. Despite this awareness, APRA also received feedback from many regulated entities, especially smaller ones, as to the need for better guidance on how to respond to climate-related financial risks, especially as APRA started urging entities to move from awareness to action in mitigating these risks.

APRA has responded to this feedback by indicating it would develop its first cross-industry prudential practice guide (PPG) on the management of climate-related financial risks. A PPG is not a legally binding regulation, but rather, is designed to be helpful guidance as to how regulated entities can fulfil their prudential obligations in relation to risk management when it comes to climate-related risks. Drawing on aspects of the TCFD, as well as other international regulatory initiatives and precedents, the PPG will support the Australian finance sector as it seeks to effectively address climate-related risks. The PPG is expected to be released for consultation in the first half of this year, and finalised before the end of 2021.

APRA’s other major initiative in addressing climate risk this year is the commencement of a series of Climate Vulnerability Assessments (CVAs) of major Australian banks. First announced in February 2020, the CVAs will directly leverage work by the NGFS and other initiatives for this first-of-its-kind assessment of banking industry climate-related risks in Australia. In developing the CVAs, APRA is engaging with ASIC and the Reserve Bank to ensure a consistent approach is taken to recommendations based on the CVAs, and to disclosure of climate-related risk information.

Initially commencing with the five largest banks, the CVAs will eventually be rolled out across the rest of the banking sector, as well as the insurance and superannuation sectors, with the final timetable yet to be confirmed.

The CVAs are aimed at:

- Assessing the vulnerability of institutions, the financial system and the economy to both physical and transition risks arising from climate change; and

- Understanding how financial institutions may adjust their business models in response to the unique challenges proposed by different scenarios.

In addition, the CVAs will build enhanced capability for assessing the emerging macroeconomic and prudential risks of climate change for Australia more broadly. APRA expects to have its analysis of the CVA results relating to the major banks completed by the fourth quarter this year.

These regulatory initiatives will help the Australian financial sector to better understand climate-related financial risks, address some of the data and standardisation challenges in climate risk assessment and reporting, and support market participants as they respond to the policy, investment and insurance challenges of climate change.

Media enquiries

Contact APRA Media Unit, on +61 2 9210 3636

All other enquiries

For more information contact APRA on 1300 558 849.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding $9.8 trillion in assets for Australian depositors, policyholders and superannuation fund members.