APRA Explains: Successor fund transfers in superannuation

Over the last 40 years, there have been many changes to the size and shape of Australia’s superannuation industry, such as the number of funds and trustees, the ownership of funds, and the names of funds and trustees. These changes are often due to consolidation within the superannuation industry and law reform, including changes to allow employee choice of fund and the introduction of MySuper products. One of the most common ways consolidation occurs is via a successor fund transfer.

What is a successor fund transfer?

A successor fund transfer is effectively a bulk transfer of members and their benefits from one superannuation fund to another.

Before a successor fund transfer can take place, the outgoing and incoming trustee must agree that the receiving (successor) fund will provide members with ‘equivalent rights’ to those the members in the outgoing fund had prior to the transfer. This step is critical in allowing the transfer to occur without member consent.

The trustees then enter into a ’Successor Fund Transfer Deed’ (or equivalent) to implement the change. The members’ benefits and the fund’s assets are transferred to the receiving fund, and members are notified of the outcome in writing via a disclosure notice/member communication. APRA’s approval is not required for a successor fund transfer.

A successor fund transfer does not occur if your fund simply moves to another trustee (as a change of trustee) but remains a standalone fund (that is, its assets and members are not merged with another fund).

What happens when the fund is successor fund transferred?

Where a successor fund transfer occurs, it changes the fund your superannuation is held in. For example:

- Your previous fund will be wound up once the successor fund transfer has been completed, so you can no longer refer to this fund’s ABN.

- Your superannuation monies are now in the new superannuation fund, with a new ABN, where it is held either:

- as a sub-fund/plan within the new superannuation fund, using the old superannuation fund name (or similar); or

- absorbed wholly into the new superannuation fund.

- Depending on who operates the new superannuation fund, it may be the same trustee as your previous fund, or it can be a new trustee.

How do I find my super after a successor fund transfer?

Trustees must always send out a written disclosure notice (sometimes referred to as a ‘significant event notice’ or SEN) to notify members of a successor fund transfer.

In addition, each year members receive a member statement, which details the name of their superannuation fund and the sub-fund/plan name (if applicable). This disclosure documentation will also advise the name of the trustee and their ABN, the fund’s ABN and how to contact the trustee if you have any queries or complaints.

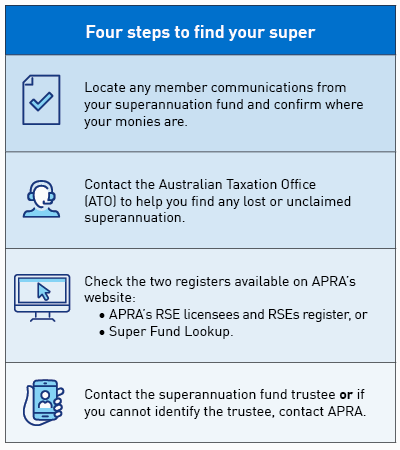

If you’ve lost track of where your superannuation monies are being held (or a family member’s benefit if you’re a beneficiary trying to find super as part of an estate), there are a number of steps you can follow to find your super:

- Locate and review any member communications you have received about your superannuation fund/sub-fund/plan to see who you can contact to confirm where your monies are.

- The Australian Taxation Office (ATO) may be able to help you find your lost or unclaimed superannuation. If your superannuation monies are lost or unclaimed, guidance on what trustees need to do in these circumstances and what this means is also available on APRA’s website.

- If you know the name of your fund, you can check the registers available on APRA’s website. The main two registers to use are:

- APRA’s Registrable Superannuation Entity (RSE) licensees and RSEs register, which lists names of trustees, funds and contact details for all current APRA-regulated funds, and

- ATO’s Super Fund Lookup, which includes historical names of trustees and funds under the “All fund” search, plus the names of ‘fund products’ (i.e. sub-funds/plans). This register is also linked to the APRA register above.

- Contact the trustee of the superannuation fund you have identified for assistance.

What other searches can I do to find my super?

When trying to find your superannuation, changes can also occur through other mechanisms that don’t involve a successor fund transfer. Here are a few practical tips to consider as part of your search:

- If you left your employer before 1999, i.e. prior to the full compulsory preservation requirements being phased into superannuation law, you may have already been paid your benefit.

- A benefit payment may otherwise already have been made to the member or their beneficiaries.

- If your superannuation monies were transferred to a self-managed superannuation fund (‘SMSF’), you will need to contact the ATO for assistance in locating this type of fund.

APRA’s website also provides guidance on common questions about superannuation. Please note, however, that APRA only holds data about the fund as a whole. APRA does not hold any data about individual superannuation fund members. Only trustees of superannuation funds keep member details, so if you are looking for individual member details, please contact the relevant trustee.

Media enquiries

Contact APRA Media Unit, on +61 2 9210 3636

All other enquiries

For more information contact APRA on 1300 558 849.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding $9.8 trillion in assets for Australian depositors, policyholders and superannuation fund members.