Quarterly authorised deposit-taking institution performance statistics - highlights

Key messages

- ADIs’ profits fell in the December quarter following five quarters of growth. This quarter’s result reflected compressed margins and a reduction in net interest income. To mitigate this, ADIs reduced growth in operating expenses. Despite this, overall profit levels remained high by historical standards.

- Credit growth has continued, though at a slower rate. The high levels of growth experienced by ADIs during the pandemic look to have subsided as higher interest rates dampen borrower demand. Any further slowing in credit growth could weigh on ADIs’ profitability over the coming months.

- Non-performing loans increased marginally, but do not represent a significant risk to industry. Most borrowers continued to meet their repayment obligations despite ongoing cost of living and interest rate pressures. While some signs of stress have appeared in mortgage portfolios, high collateral values, supported by rising house prices, limit potential losses for borrowers and banks.

Capital adequacy

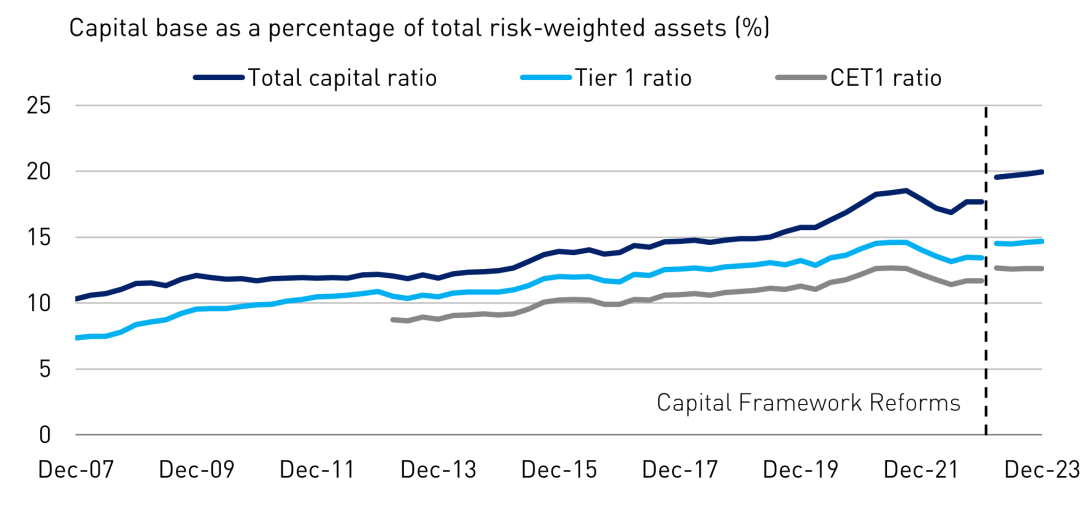

Capital ratios continued to strengthen…

- Australia’s banking industry remained well capitalised. ADIs recorded an aggregate total capital ratio of 20.0 per cent at the end of the quarter, a 16-basis point increase.

- The industry’s Common Equity Tier 1 (CET1) ratio remained stable at 12.6 per cent. Strong profits over 2023 have allowed banks to return capital to shareholders whilst maintaining or building their total capital levels.

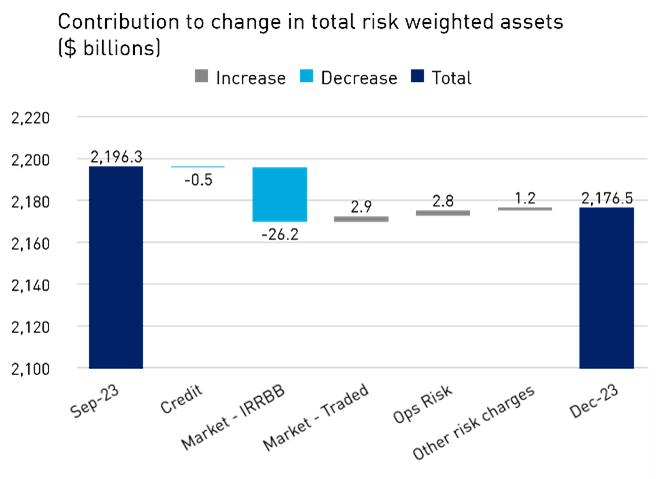

…driven by a substantial decline in banks’ market-risk weighted assets.

- The increases in capital ratios were predominantly driven by a 16.8 per cent decline in Interest Rate Risk in the Banking Book (IRRBB) RWAs.

- There have been significant movements in IRRBB RWAs since 2021. The movements over the December quarter were a result of movements in the yield curve, resulting in a decrease in embedded losses.

Liquidity

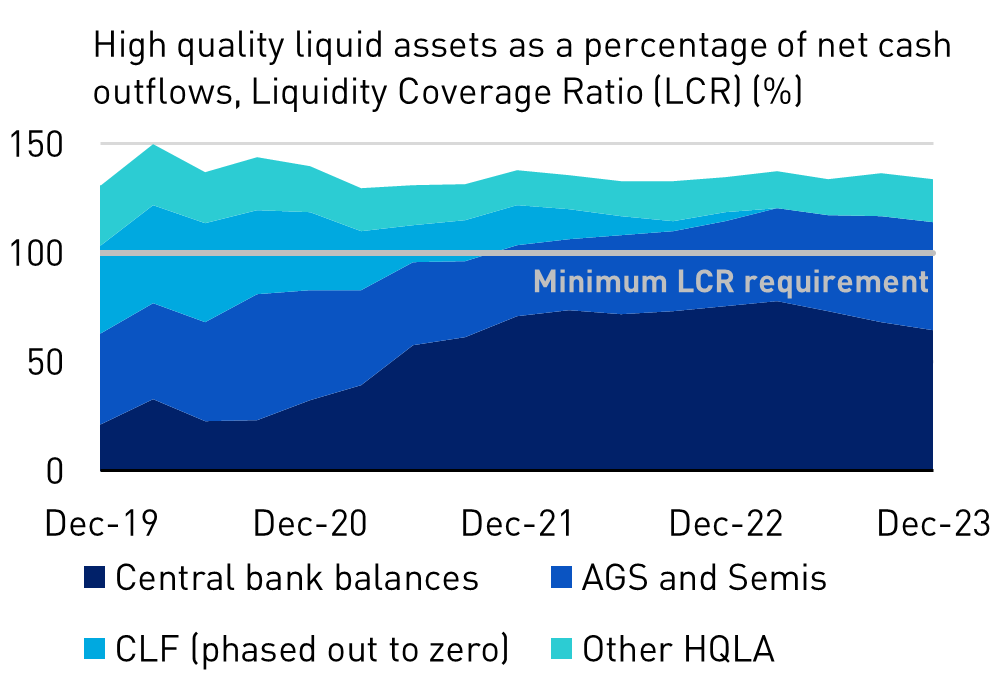

Larger ADIs maintained strong liquidity positions…

- ADIs maintained a strong liquidity position, ending the quarter with a LCR of 133.7 per cent. This is well above the minimum APRA requirement of 100 per cent.

- The first tranche of funds due under the Term-Funding Facility (TFF) were repaid in the September 2023 quarter. With expected peak maturities not due until 30 June 2024, central bank balances were broadly steady.

- ADIs are expected to continue to purchase additional Government Securities and Semis in anticipation of the final TFF repayments due.

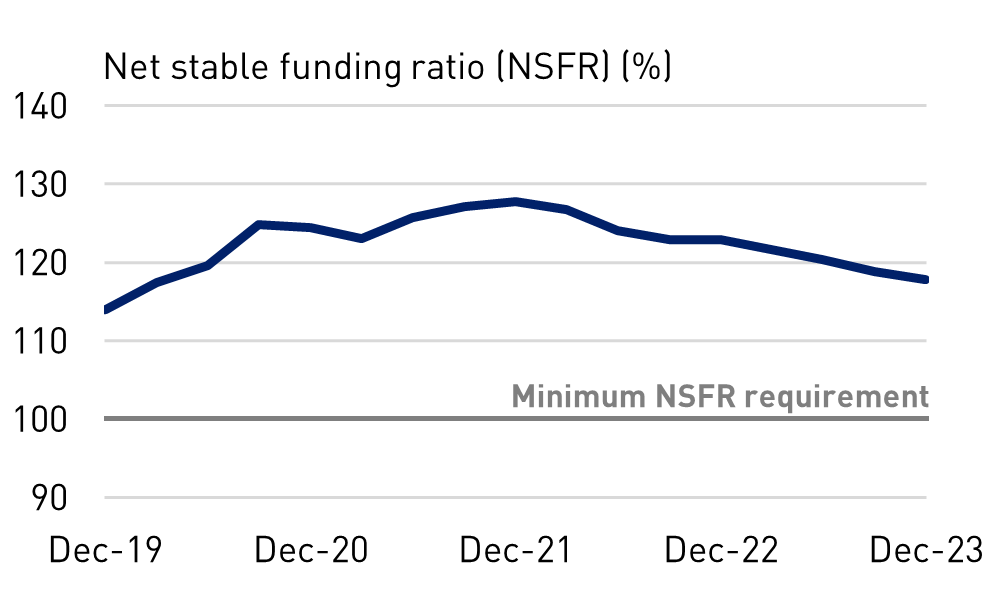

…and a stable funding base.

- The Net Stable Funding Ratio (NSFR) decreased by 1.0 per cent over the quarter to 117.8 per cent. This remained well above the 100 per cent regulatory minimum.

- The declining trend in the NSFR since December 2021 reflects the unwinding of funding measures by ADIs during the pandemic.

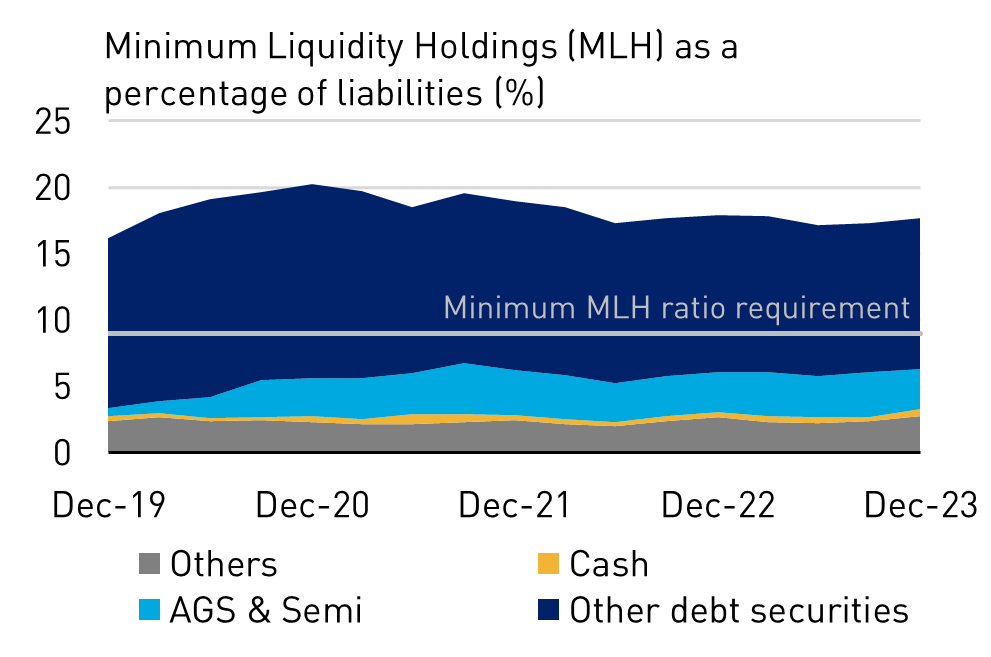

Liquidity buffers for smaller ADIs were largely unchanged.

- The Minimum Liquidity Holdings (MLH) ratio, which is applicable to smaller and less complex ADIs, increased by 0.4 percentage points over the quarter, to 17.7 per cent. This remained well above the regulatory minimum of 9 per cent. The increase reflects higher levels of certificates of deposits and at-call deposits held by the ADIs.

Asset quality

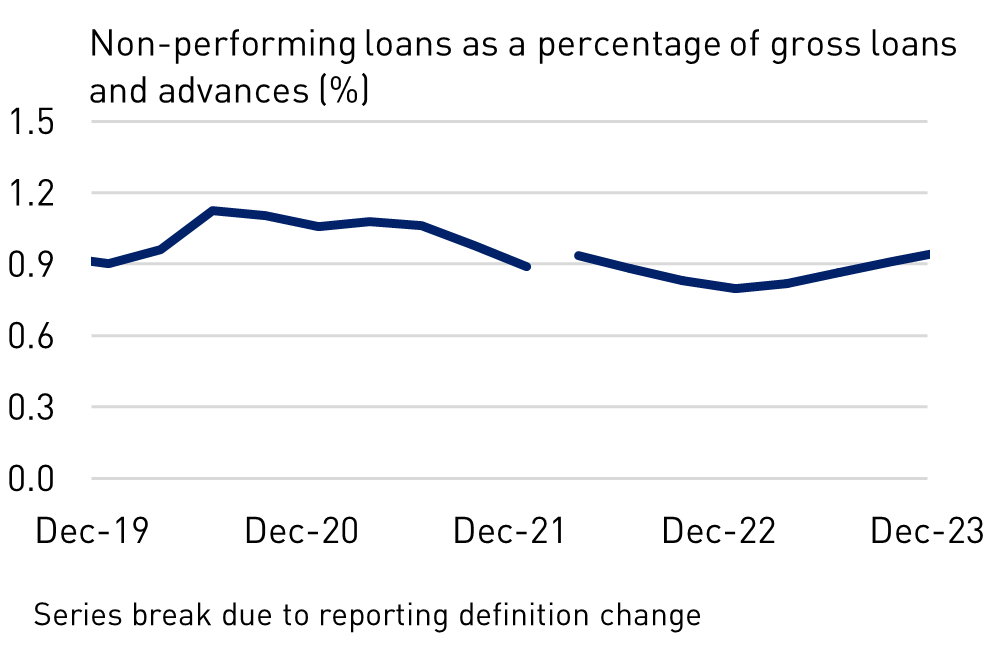

Non-performing loans continued to increase from a low base.

- Most borrowers have adapted to higher interest rates and managed their repayments well. However, a small but growing segment are facing financial stress, resulting in another quarterly increase in non-performing loans (NPLs).

- Pockets of stress continued to appear, mainly in residential mortgages. These continued to be manageable for ADIs as NPLs remained near pre-pandemic levels. Over half of the housing loans fixed at very low interest rates have now rolled-off onto higher variable or fixed rates. These borrowers have largely been able to absorb these increased repayments.

- Business and personal loan NPLs saw a slight uptick. Commercial real estate NPLs remained stable.1

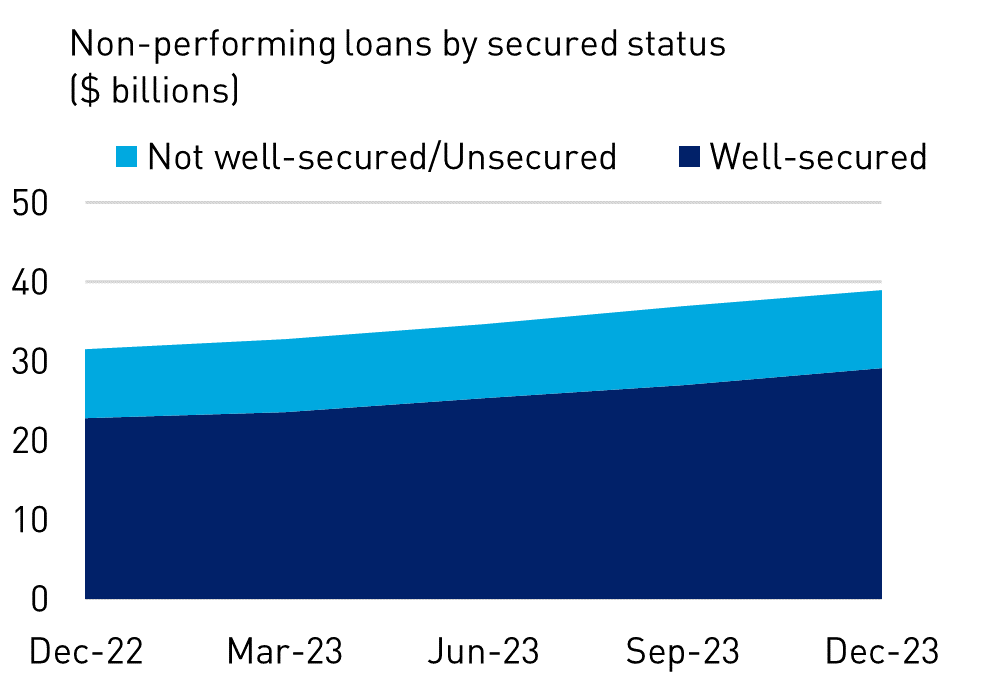

However, ADIs and borrowers are largely well-secured.

- High collateral coverage provides assurance for both borrowers and banks. Australia has a healthy loan-to-valuation profile for housing, with 82 per cent of mortgages having LVRs below 80 per cent.

- A loan is defined as well-secured when a bank considers the value of the loan’s collateral to be sufficient to cover the outstanding loan amount. In Australia, around 75 per cent of loans are considered well-secured.

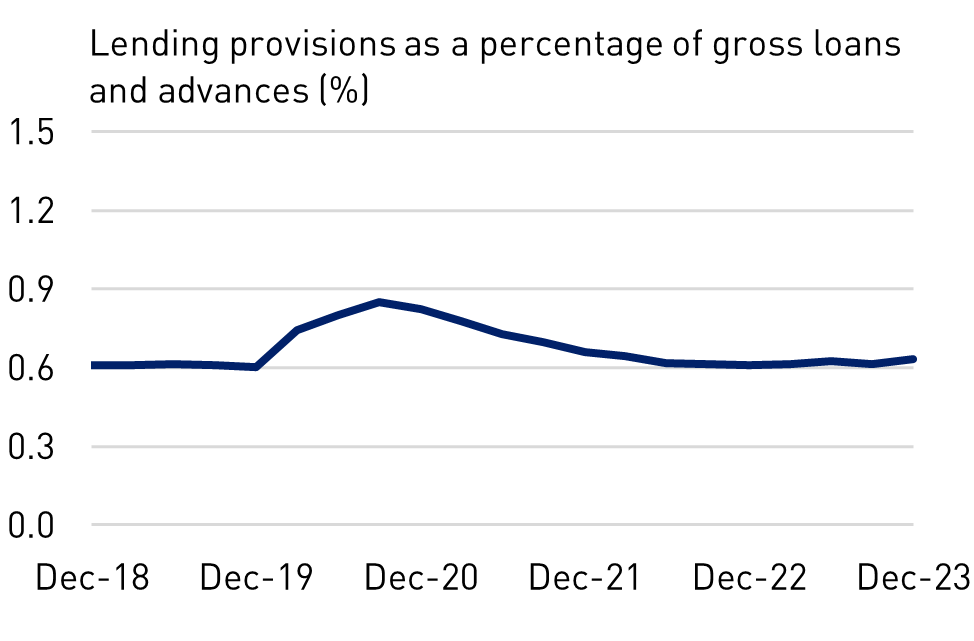

Credit losses are expected to remain low, given better-than-expected economic performance.

- The provisioning ratio remained unchanged. When viewed in combination with strong capital ratios, the industry is well-positioned to manage any future credit losses.

Financial performance

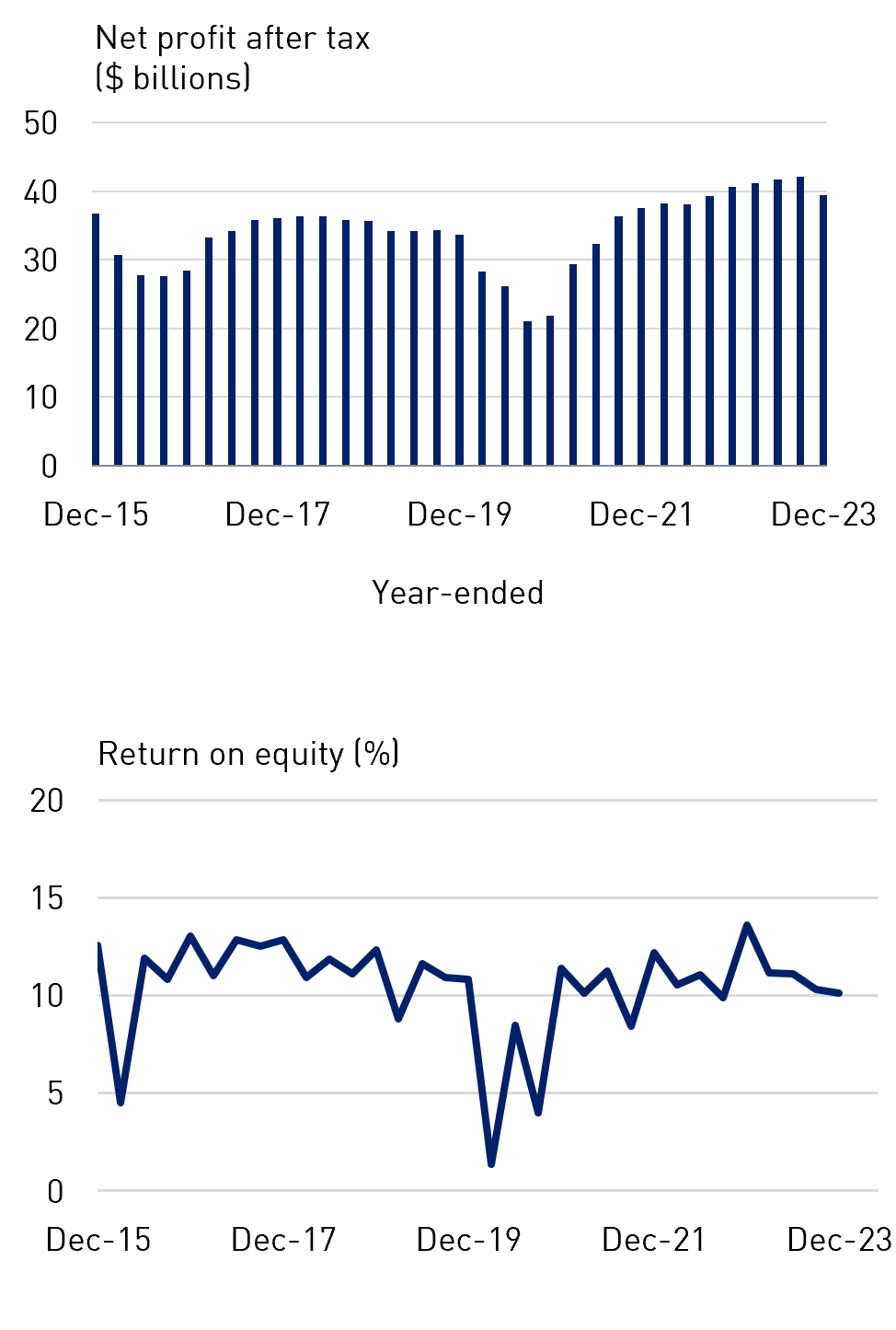

Bank profitability has, as expected, weakened…

- The banking industry reported $39.4 billion in Net Profit After Tax (NPAT) for the year to December 2023. While this figure remained near all-time highs, it represented a 6.4 per cent decrease compared to the equivalent September period.

- This decline in NPAT led to a slight drop in Return on Equity (RoE), which fell 17 basis points to 10.1 percent. Nevertheless, the RoE remained broadly in line with levels seen over the past decade (with the exclusion of the pandemic period).

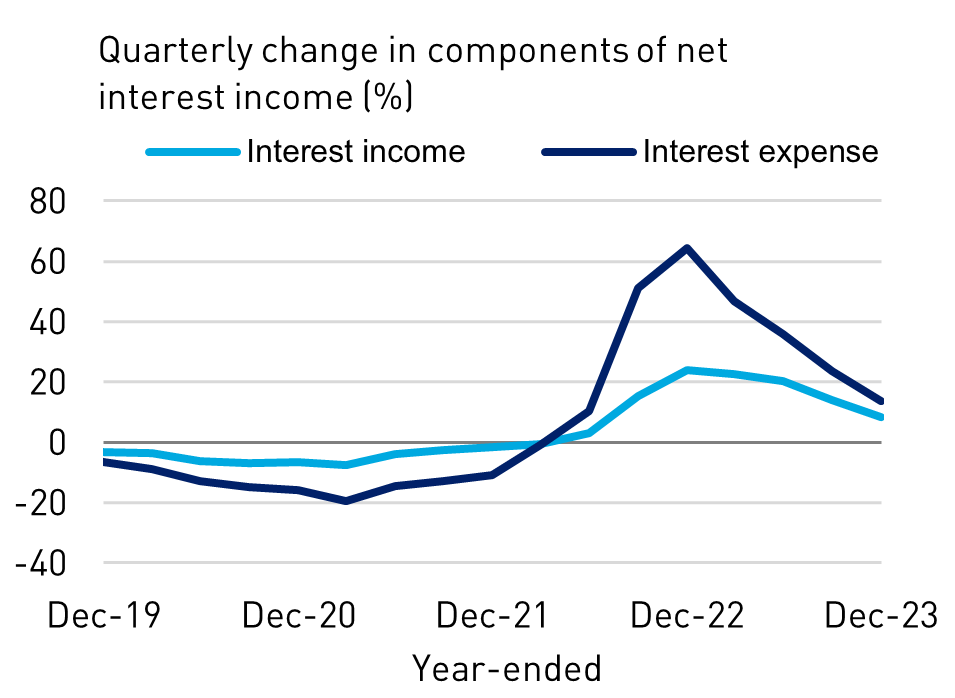

…due to compressing margins…

- Interest expense increased more than interest income. This trend has been evident since June 2022, when the cash rate target started increasing.

- Competition for both deposits and loans, along with the need for ADIs to find alternative funding sources to repay the TFF, have been key drivers.

- This resulted in a 1.3 per cent decrease in net interest income for the quarter.

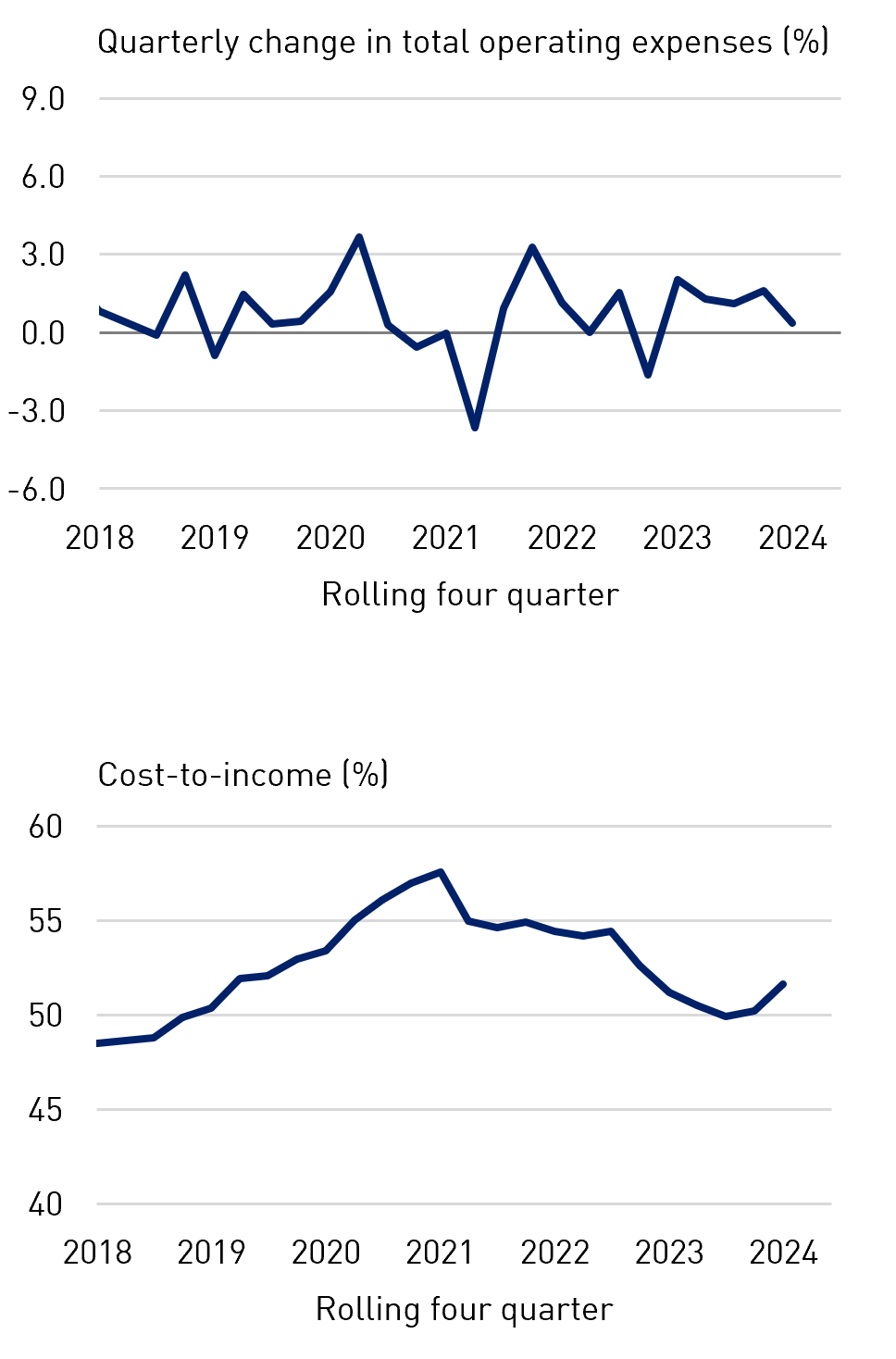

…which led to a focus on expenses.

- Total operating expenses still increased, but at a slower rate of 0.4 per cent - the smallest increase since September 2022.

- This is despite a very high wage price index (WPI) of 4.2 per cent over the year to December placing pressure on staffing costs. Some larger banks announced redundancies over the quarter in attempts to increase efficiency and reduce costs.

- The industry’s cost-to-income ratio increased 1.4 percentage points to 51.6 per cent.

Financial position

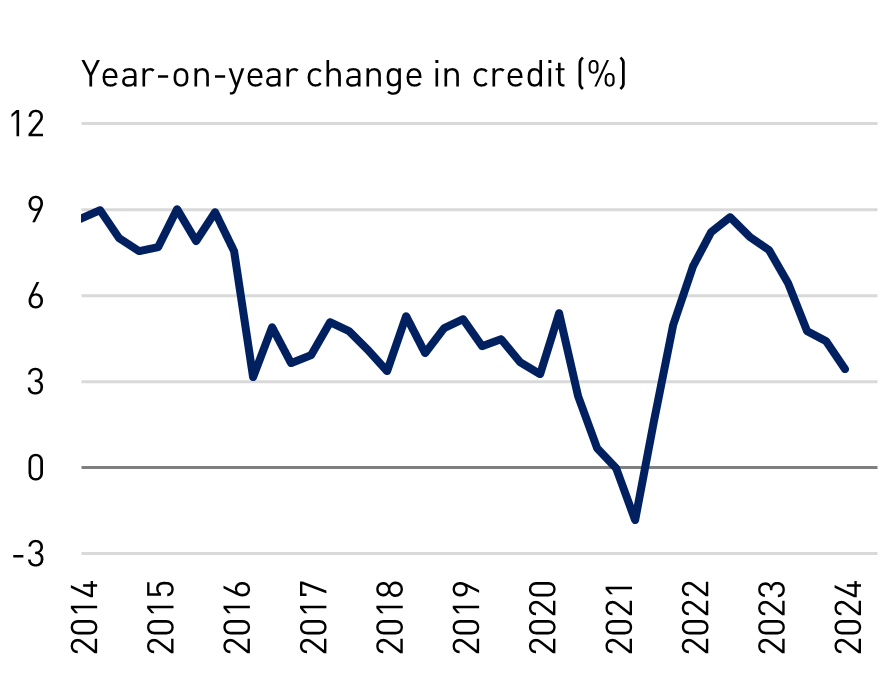

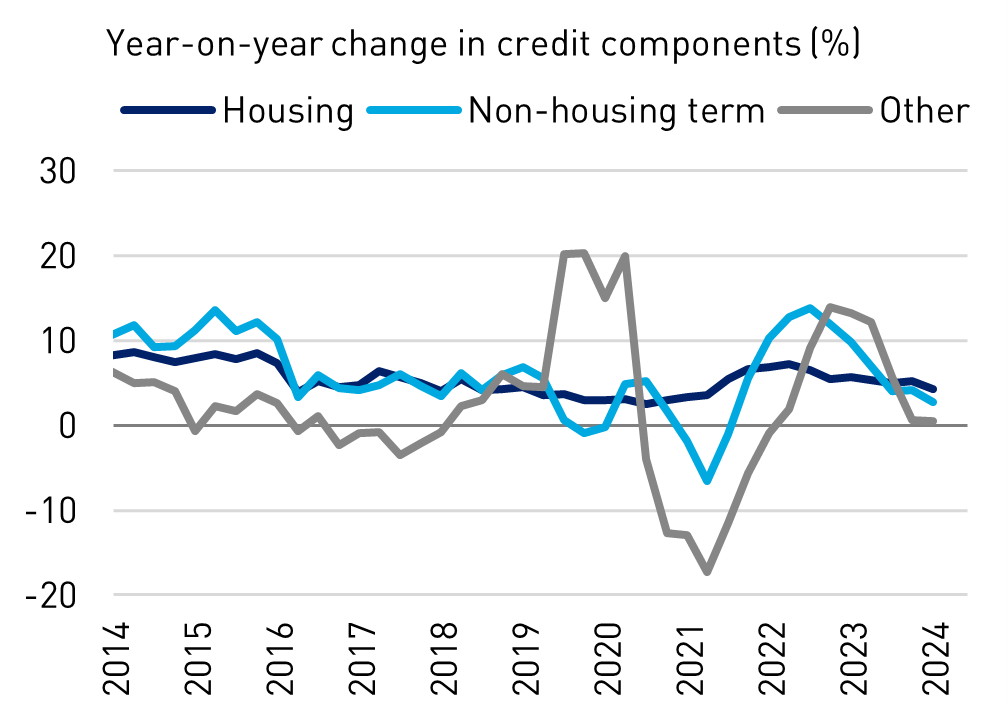

Credit growth continued, though at a slower rate…

- Credit growth increased, though the rate of growth has slowed. Gross loans and advances increased by 3.4 per cent on a year-on-year basis, down from the 4.4 per cent increase observed in the prior quarter.

- Slowing growth is expected to put increasing pressure on ADIs’ performance.

… with most of the increase being driven by housing.

- Housing loans, the largest component, reported an increase of 4.2 per cent year-on-year. Growth has been trending down following the most recent peak of 7.2 per cent in March 2022.

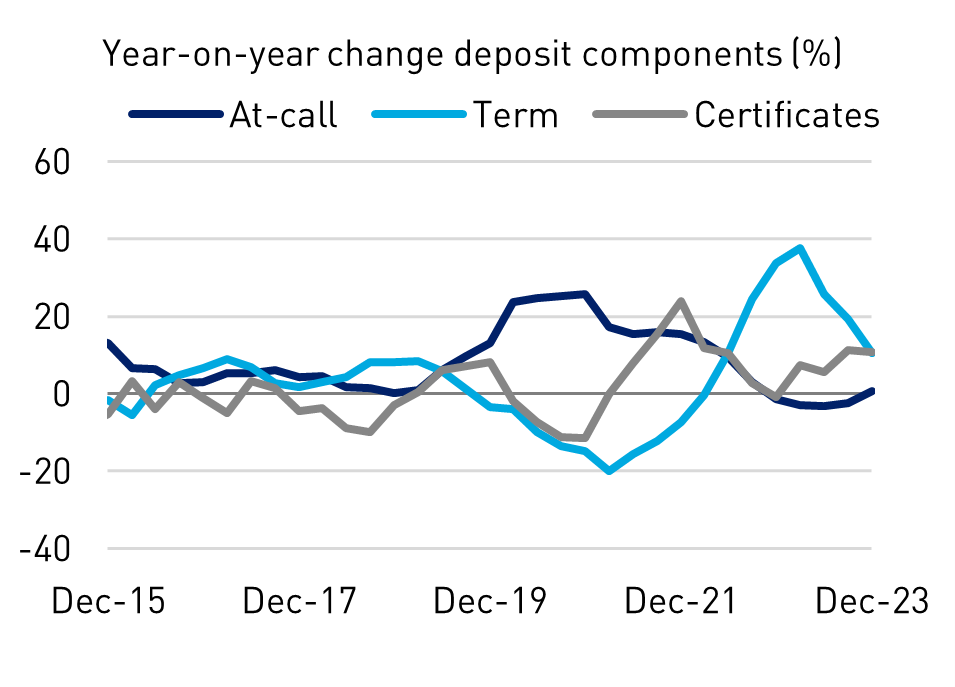

At-call deposits returned to growth.

- At-call deposits increased 0.6 per cent in the latest quarter, after falling for the past four quarters (on a year-on-year basis).

- This increase is likely due to changing interest rate expectations, as at-call deposits are being priced at more competitive rates to term deposits.

Population changes

The number of ADIs on a consolidated group basis operating in Australia remained unchanged from the September 2023 quarter at 140 ADIs as of 31 December 2023.

Footnote

1Further details on these exposures can be found in the accompanying Quarterly Property Exposures (QPEX) highlights.