APRA 2021 Year in Review

An introduction from APRA Chair Wayne Byres

Welcome to APRA’s Year in Review for 2021.

The past year has been an active one for APRA. After an urgent and intense shift in 2020 to focus on the immediate and significant impacts from the sudden onset of the COVID-19 pandemic, 2021 saw APRA able to begin to refocus on its longer-term prudential agenda.

Responding to the impact of the pandemic on the financial system, and the financial institutions that operate within it, continued to require considerable time and attention. At the same time, however, APRA was able to recommence work on a number of other key supervision priorities, as well as pushing ahead with a suite of important reforms across banking, superannuation and insurance that had previously been put on hold.

In doing so, APRA has sought to ensure the Australian community can be confident it is being served by a financial system that possesses the necessary strength and resilience to successfully deal with a highly uncertain operating environment.

Protected today, prepared for tomorrow

APRA released its updated Corporate Plan in August 2021. The Plan is founded on the strategic theme of ‘protected today, prepared for tomorrow’.

This theme is at the heart of good prudential supervision. Prudential supervision is, by its very nature, forward-looking. The ‘protected today, prepared for tomorrow’ theme acknowledges that a resilient financial system is not just one that is safe and sound today, but one that also has the ability to withstand, respond and adapt to the challenges of tomorrow – whatever they may be.

This publication outlines how APRA has delivered on its objectives in 2021.

Chapter 1 discusses the operating environment in 2021, emphasising the rapidly shifting outlook at various points in the year. The chapter sets out the industry-wide measures APRA pursued to ensure the financial system remained safe, stable and resilient. This includes work on stress testing, cyber risk, governance, culture, remuneration and accountability (GCRA), recovery and resolution planning, and climate-related financial risks. The chapter also highlights APRA’s significantly improved data collection capabilities, outlines some of APRA’s major enforcement actions, and discusses the ongoing co-operation between APRA and other Council of Financial Regulator (CFR) agencies.

Chapter 2 details APRA’s key initiatives and activities in the banking, superannuation and insurance industries.

Of particular note is APRA’s completion of the Basel III bank capital reforms and use of macro-prudential policy measures to build financial resilience in the banking sector; its work to identify and weed out underperforming superannuation funds in order to improve member outcomes; the launch of APRA’s review of insurance risk management frameworks; and updates to the capital and reporting frameworks for insurance in response to the introduction of Australian Accounting Standards Board 17 Insurance Contracts (AASB 17).

Chapter 3 provides insight into APRA as a workplace, including the transformation of its ways of working since the onset of the pandemic, its investment in technology to support flexible work arrangements, and its ongoing efforts to promote a diverse and inclusive culture.

Changes in leadership

2021 saw some important changes to APRA’s senior leadership.

Following an announcement in March by the Treasurer, the Hon Josh Frydenberg MP, APRA welcomed Margaret Cole as a new APRA Member on 1 July 2021. Margaret was appointed for a five-year term and filled the vacancy created by Geoff Summerhayes, whose term of office expired on 31 December 2020.

With her strong experience in governance and conduct-related matters, Margaret took on primary responsibility for overseeing APRA’s activities in superannuation. APRA Deputy Chair, Helen Rowell, who had led a period of extensive change in the supervision of superannuation over eight years, assumed primary responsibility for overseeing APRA’s activities in general, life and private health insurance.

More broadly, APRA continued to develop and strengthen its executive talent. Katrina Squires, Robert Armstrong, Mike Cornwell and Peter Diamond were all promoted to General Manager roles during the year. In addition, Joanna Bakker was recruited as General Manager, People and Culture.

A note of thanks

One of the findings of APRA’s 2021 Stakeholder Survey was the very high percentage of respondents (>95 per cent) who endorsed the statement that APRA’s supervision helps to protect both their industry and the financial wellbeing of the Australian community. Such a result would not be possible without the expertise and dedication of APRA’s people.

I therefore want to conclude this introduction to the Year in Review by acknowledging those who have contributed to the achievements outlined in the following chapters. All of APRA’s employees deserve thanks for their diligence, commitment and resilience throughout a tough and tumultuous year. APRA’s achievements in 2021 are a testament to its people, who worked tirelessly through the isolation of long lockdowns, while many were also ‘home-schooling’ children or managing other family responsibilities, to ensure the safety and stability of the financial system for the Australian community – now and into the future.

Wayne Byres

Supervision in action |

|---|

| Australia’s largest banks have operations in a number of different countries, including New Zealand, where they have a significant market presence. APRA, together with five other supervisory agencies in Australia and New Zealand, held a virtual multi-day supervisory college focused on one large banking group with trans-Tasman operations. The overarching objective of the supervisory college was to promote effective information sharing, coordination and collaboration, to assist supervisors to develop a better understanding of the risk profile and vulnerabilities of the cross-border banking group and to provide a framework for addressing key topics relevant to the supervision of the group. |

Chapter 1 - Financial sector resilience

Operating environment

The strength and resilience of the Australian financial system – and the community – were further tested in 2021 as the one-in-100-year pandemic that began in late 2019 moved into a second year.

At the beginning of 2021, the Australian economy looked to be recovering well from the economic and financial impacts of widespread lockdowns of 2020. Against this backdrop, APRA set out its policy and supervisory agenda for the year ahead, focused on further strengthening the resilience and crisis readiness of Australia’s financial system. In particular, APRA’s 2021 agenda contained a range of measures to ensure the financial system and individual entities were managing current challenges, while also helping APRA and regulated entities prepare for the future.

The economy’s broadly positive outlook experienced a setback mid-year, however, as the emergence of the Delta variant saw the reintroduction of strict lockdown measures in many parts of the country. The outbreak and associated lockdowns affected many parts of the economy, although the impact was uneven. The housing market remained buoyant despite the economic setbacks. Some industry sectors experienced strong economic growth, while others – such as hospitality, tourism, the arts, education and construction – were placed under considerable pressure. Coinciding with the most severe time of restrictions, national sales volumes fell sharply in the September quarter, and total employment fell by more than 2 per cent – negatively impacting consumer confidence. To cushion the blow, federal and state governments provided around $20 billion in direct economic assistance to businesses and households in the September quarter of 2021.

While the lockdowns and state and territory border closures had a severe adverse impact on many businesses, overall the Australian financial system remained financially and operationally resilient. Banks and insurers remained soundly capitalised, while APRA-regulated superannuation funds were able to delivered higher-than-average returns to their members. Importantly, these institutions continued to deliver their essential services to the community despite staffing and other operational challenges.

In the last quarter of 2021, a rapid increase in vaccination rates helped individual states reach their target vaccination levels, enabling the easing of COVID restrictions. The unemployment rate began to fall again and business confidence rose, laying the groundwork for a sustained economic recovery. However, as the end of 2021 drew near, the emergence of another new variant – Omicron – provided a sharp reminder that the pandemic, and its associated disruption and uncertainty, was far from over.

Industry-wide initiatives

During the course of 2021, APRA was able to complete a number of significant longer-term projects, as well as key policy priorities and supervision activities. Chapter 2 of this publication details the activities and initiatives undertaken by APRA in 2021 on a sector-by-sector basis. However, that only tells part of the story, as a significant proportion of APRA’s supervisory and policy activities are industry-wide in nature.

The key industry-wide activities APRA undertook in 2021 are set out in the remainder of this chapter.

Enhancing stress testing

To ensure the ongoing financial and operational health of the financial sector was maintained during 2021, APRA needed to continually adapt and update its supervisory priorities in response to the rapidly evolving environment – both domestically and internationally. To understand and mitigate the impacts of these risks, APRA made use of one its core tools, regular stress testing, across its key industries.

Updated macroeconomic scenarios were developed in collaboration with the RBA to reflect a range of future outcomes, including severe downside scenarios that reflect potential tail events emanating from the prevailing economic environment. Pleasingly, the stress test results provided further assurance that the banking and insurance industries remained well-placed to withstand a range of adverse events, as well as being able to support the economic recovery under more benign scenarios, notwithstanding lingering effects of the pandemic.

Supervision in action |

|---|

| APRA commenced a comprehensive stress test specifically for the friendly society industry. This was the first such stress test conducted by APRA for this industry, with the aim of assessing the level of financial resilience of each friendly society under a both mild and a severe financial and economic event over a three year period. Participants have been provided with detailed reporting templates and instructions for completing the stress test, with APRA aiming to also use this exercise to enhance the entities’ stress testing capabilities more broadly. |

Improving cyber resilience

The frequency and sophistication of cyber-attacks continues to increase, as does the degree of potential harm. Notably, the Australian Cyber Security Centre (ACSC) received more than 67,500 cyber-crime reports during 2020-21 – one every eight minutes – which was a 13 per cent increase from the previous financial year. Self-reported losses from cyber-crime topped AU$33 billion1. Driven by more complex and sophisticated cyber-attacks, the ACSC also classified a higher proportion of cyber security incidents as ‘substantial’ in impact. As APRA’s Chair, Wayne Byres, stated at the Committee for Economic Development of Australia in April:

“Cyber risk presents arguably the most difficult prudential threat as it’s driven by malicious and adaptive adversaries who are intent on causing damage.”

The financial system is part of the country’s critical infrastructure. Consequently, its ability to stand firm against cyber-attacks is of utmost importance. The financial system is a complex ecosystem comprising many thousands of interconnected financial entities and financial market infrastructures – and a myriad of supporting service providers. Notably, APRA only directly supervises approximately 680 of these entities, yet a cyber-attack targeting any point of weakness in the financial system could have far-reaching impacts.

Building on APRA’s Prudential Standard CPS 234 Information Security (CPS 234)that came into effect in July 2019, APRA unveiled its new Cyber Security Strategy in November 2020. A key focus area of this strategy is enabling boards and executives to oversee and direct correction of cyber exposures. In an APRA Insight article, “Improving cyber resilience: the role boards have to play” published in late 2021, APRA discussed two of its recently completed initiatives for these priority projects: a pilot technology resilience data collection, and an independent assessment of a pilot set of entities’ compliance with CPS 234. The learnings gained from the two pilots, and from APRA’s other supervisory activities, reinforced APRA’s view that boards need to strengthen their ability to oversee cyber resilience.

Results from the CPS 234 assessment and APRA’s other supervisory activities show that entities need to apply greater rigour in testing the design and operating effectiveness of their service providers’ information security controls. Testing coverage may also be an issue, as the data collection found that over the past 12 months, 60 percent of entities had not managed to assess the information security control testing for their service providers, as required by CPS 234. APRA also observed that some entities relied heavily on control self-assessments or surveys completed by their service providers, and had not taken sufficient steps to verify the information security controls were effective.

Given cyber-attacks are increasingly targeting suppliers in order to find that ‘weak link’, the need for improvement in this area is crucial. APRA specifically encouraged boards to play a more active role in challenging management’s assumptions regarding the effectiveness of service provider information security controls.

Collaboration is key when it comes to combatting the cyber problem, where the establishment of a community of defenders is imperative. Consequently, APRA worked closely throughout the year with industry bodies and other arms of government, including its CFR peers, the ACSC and the Department of Home Affairs. Through this work, APRA sought to ensure its cyber security strategy was aligned with the national cyber security strategy. Further, by working collectively to share intelligence, pool resources and respond quickly to identify and fix weak links, financial system participants, including entities, regulators and government agencies, can more effectively keep adversaries at bay.

Supervision in action |

|---|

| APRA is concerned about the heightened risk of cyber-attacks for all regulated financial services entities. As part of its overall approach to strengthening the resilience of the sector, APRA requires a structured independent review of the strength of controls to meet the expectations set out in Prudential Standard CPS234 Information Security. Acknowledging that mutual banks often use common suppliers, APRA worked with the Customer Owned Banking Association, an industry body, and the mutual ADIs as a cohort, to establish a common understanding of the issues and to find opportunities in conducting the external reviews for a common benefit, including different mechanisms to share the learnings. |

Transforming governance, risk culture, remuneration and accountability

One of the longer-term strategic objectives in APRA’s Corporate Plan since 2019 has been to lift standards of governance, risk culture, remuneration and accountability (GCRA) across the financial system.

After deferring some of this work program in 2020 to allow entities (and APRA) to concentrate on urgent COVID-19 response activities, APRA’s work across a range of GCRA components recommenced in 2021. However, as Deputy Chair Helen Rowell said to the Financial Services Assurance Forum in November:

“This is not a transformation APRA can or should undertake on its own… Ultimately, boards and management are responsible for how they assess and improve GCRA in their entities. On this front, there is more to do. The financial industry has come some way on GCRA since the damaging headlines of the Royal Commission. However, industry’s own analysis, through the risk governance self-assessments undertaken since that time, has identified a number of key areas where improvements still need to be made.”

One of the significant milestones for APRA during the year was releasing a final version of its cross-industry prudential standard on remunerationCPS 511 Remuneration (CPS 511). CPS 511 addresses several Royal Commission recommendations, and is designed to support stronger incentives for individuals to manage the risks they are responsible for; assign appropriate consequences for poor risk outcomes; and increase oversight, transparency and accountability for remuneration.

Deputy Chair John Lonsdale described the finalised standard as a key milestone in APRA’s drive to transform industry practices in governance, risk culture, remuneration and accountability:

“As the Royal Commission made clear, poorly designed or implemented remuneration practices can incentivise behaviour that is harmful to consumers, and detrimental to long-term financial soundness. CPS 511 will impose genuine financial consequences on senior banking, insurance and superannuation executives when their decisions lead to poor risk management or conduct that is contrary to community expectations. It ensures financial performance alone is no longer enough when companies reward employees; companies must also consider their impact on customers and risk management outcomes. Where executives fall short, they now stand at risk of losing their bonus.

"We have been sensitive to minimising the regulatory burden on smaller institutions that typically make limited use of variable remuneration. The sharp end of CPS 511 is deliberately aimed at significant financial institutions (SFIs), where there is a heavier reliance on bonuses. In keeping with APRA’s focus on transparency, the standard will be supported by new disclosure requirements that will allow scrutiny of how effectively boards are adhering to the requirements and holding their executives accountable,”

Mr Lonsdale said.

Beyond remuneration, APRA has continued to pursue an agenda that seeks to strengthen governance, risk culture and accountability within financial institutions more broadly.

In 2018, APRA requested 36 regulated entities to conduct a risk governance self-assessment against the findings in the final report from the CBA Inquiry in 2018 and provide that self-assessment to APRA. In 2021, APRA followed up with those entities to review the extent to which necessary changes had been effectively implemented. This follow-up review identified:

- that the profile of non-financial risk management practices has been raised in many entities through the establishment of dedicated non-financial risk committees at the executive level, or inclusion of non-financial risk as a standing agenda item at Board Risk Committee meetings. Entities had also revised their risk appetite statements to incorporate non-financial risk metrics, and are capturing non-financial material risks on their risk registers.

- increased ownership and accountability for both risk and compliance was evident, with frontline business units now identifying more risk issues than they had previously. More progress has also been made clarifying accountabilities in the banking industry, reflecting the implementation of the BEAR.

- there was increased awareness and focus by entities on risk culture, although the approach of many entities towards risk culture would still benefit from further maturity through the use of more consistent methodologies, frameworks and a range of data sources.

Overall, the story of recent years has been one of progress. Regulated entities have implemented a number of design elements, including policies and frameworks, to better identify and manage non-financial risks. In the coming year, APRA will be looking for evidence that work on non-financial risks has shifted beyond design effectiveness to also ensure operating effectiveness, and that boards and senior management are being vigilant to ensure weaknesses do not re-emerge.

APRA will also continue to look at how entities are working to understand the behaviours and cultural drivers that may underpin GCRA issues. To reinforce this, APRA elevated the profile of GCRA in its Supervision Risk and Intensity model, with APRA supervisors explicitly assessing GCRA-related risks when they determine the level of supervisory intensity applied to each regulated entity. To assist supervisors with this assessment, APRA developed a new supervisory approach for assessing risk culture, ‘the Risk Culture 10 Dimensions’.

Building on this new framework, in October and November, APRA sent a risk culture survey to the employees of 18 banks, following the successful completion in July of a pilot survey involving 10 general insurers. By giving a voice to employees from all levels of an organisation rather than only hearing from a small number of senior executives or board members, APRA’s survey is able to get a much better picture of how GCRA practices are, or are not, working at an entity. This will be an important source of information for APRA, which is one of only a few regulatory bodies worldwide that directly collects survey data at an industry level.

APRA plans to roll out the survey to a further 40 regulated entities across the insurance and superannuation sectors in 2022.

Supervision in action |

|---|

| A life insurer operating a unique business model grew in recent years, and raised some concern for APRA in relation to the effectiveness of governance and controls to support this model and its growth on an ongoing basis. APRA started engaging with the entity to seek further insight into the business model, and the adequacy of controls and governance in place for the key functions. With some issues unresolved, APRA subsequently decided to conduct a deeper dive prudential review, and is currently forming its opinion in regard to the adequacy of current practices. |

Strengthening recovery and resolution capability

In its role as Australia’s resolution authority, APRA aims to ensure that where an entity faces financial stress and private sector recovery is not possible, the entity and APRA are prepared for an orderly exit or resolution that minimises any impact on depositors, policyholders, superannuation members and financial stability.

The preparatory work for such an eventuality was put to the test in January 2021, when Xinja Bank completed a return of its deposits, the first time an Australian authorised deposit-taking institution (ADI) had undertaken such a process. When the return of deposits was initiated, Xinja had 37,884 customers with 54,357 individual deposit accounts worth more than $252 million. APRA closely monitored the process, which was completed without loss of any customer funds or contagion to other institutions. The return of deposits is an example of an entity-led orderly exit, overseen by APRA. As APRA Chair, Wayne Byres noted in his speech at the 2021 Australian Financial Review Banking Summit,

“It was a successful failure.”

Throughout 2021, APRA worked on the development of a prudential framework for entity-led recovery and exit plans (collectively, financial contingency planning) and for APRA-led resolution planning, that will drive greater entity crisis preparedness. In December 2021, APRA released a draft set of cross-industry prudential standards for consultation: CPS 190Financial ContingencyPlanning (CPS 190) and CPS 900Resolution Planning (CPS 900).

This new framework will formalise APRA’s requirements on contingency planning and set obligations on entities to cooperate with APRA in the development and implementation of resolution plans. For ADIs and insurers, APRA will focus on further improvements to ensure contingency plans are feasible and credible, with a view to achieving full industry compliance with the new prudential framework by the planned commencement date of 1 January 2024. Given contingency planning in superannuation is less advanced, CPS 190 will have a later implementation date of January 2025 for this industry.

Alongside the release of the draft framework, APRA wrote to the domestic systemically important banks (the four major banks) finalising its requirement to maintain additional loss-absorbing capacity to support resolution. This is a key component in ensuring private financial resources are used in resolution, thereby limiting the need for taxpayer funds to be put at risk.

Earlier in 2021, APRA completed an assessment of tests of recovery plans by large and medium ADIs, as well as stepping up its focus on the exit readiness of small ADIs. As APRA Deputy Chair John Lonsdale said in a speech to the Customer Owned Banking Association in December 2020.

“APRA recognises that for smaller ADIs with simple businesses, the range of recovery options may be more limited… It is prudent that such ADIs consider the preparatory steps required for a merger or transfer of business.”

Every private health insurer has a recovery plan in place that APRA has reviewed and provided feedback on. In the case of life and general insurers, APRA prioritised the review and feedback of contingency plans for insurers that have greater systemic importance and/or face higher risks. As APRA General Manager, Insurance Division, John Huijsen told the Health Insurance Summit in June 2021:

“APRA wants to be assured that recovery plans are embedded and credible, especially where there is a greater chance an entity will need to enact the plan.”

In superannuation, contingency planning is at an earlier stage of development. APRA started recovery plan pilots for trustees that are part of larger groups, and requested contingency plans from entities failing the Performance Test under the Government’s Your Future, Your Super (YFYS) reforms. At the Australian Institute of Superannuation Trustees Conference of Major Superannuation Funds in May, APRA Deputy Chair Helen Rowell said:

“Trustees should have a plan in place to ensure their obligations to members can continue to be met – whether that plan is to ‘recover’ themselves to financial soundness or to exit the industry in an orderly fashion”.

With respect to APRA-led resolution planning, APRA continued to pilot planning exercises for significant financial institutions ahead of the finalisation of the associated prudential framework. In November 2021, APRA hosted the first trans-Tasman Crisis Management Group meeting, comprising members of the CFR and relevant NZ authorities, aimed at enhancing entity-specific preparedness for – and facilitating the management and resolution of – a cross-border bank. In addition, APRA continued to work closely with the CFR and the Trans-Tasman Council on Banking Supervision on overarching frameworks to execute resolution strategies and enhance agencies’ ability to deal with a systemic crisis.

Supervision in action |

|---|

| An insurer continued to struggle with financial performance, further exacerbated by COVID-19. In the course of reviewing the regulatory returns of this entity, APRA identified an inappropriate approach to calculating the entity’s regulatory capital requirement, resulting in inadequate capital coverage. APRA engaged with the entity to resolve the situation, which led to corrections to reporting and a capital injection to ensure risks faced by the entity were adequately covered. |

Managing financial risks from climate change

Climate change poses significant challenges, and opportunities, for the global and Australian economies. Financial institutions need to understand where, how, and to what extent the financial risks associated with climate change will impact their business. They will also need to consider how to respond to those impacts.

Since the Australian Government became a party to the Paris Agreement in 2016, APRA has been raising awareness of climate-related risks to the financial sector. More recently, APRA has been encouraging the financial sector to strengthen its capability to identify and quantify the financial risks associated with climate change, and to develop ways to build resilience to those risks.

As APRA Chair Wayne Byres observed in April:

“One of the biggest challenges is to shift from subjective judgements to data-driven analysis. The scientific link between rising greenhouse gas emissions and warming temperatures is clear, but the tools and methods for risk analysis are still in their relative infancy. Not only are the direct impacts difficult to assess, but so are the potential technology and policy responses. But that’s no excuse for not trying.”

On behalf of the CFR, APRA is leading the Climate Vulnerability Assessment (CVA) initiative (PDF). The CVA is a bottom-up supervisory exercise with the five largest Australian banks, designed to assess the impact on both individual banks and the financial system of two plausible future scenarios for how climate change, and the global response to it, may unfold.The CFR agencies are supporting the CVA initiative by participating in a dedicated steering committee and a modelling working group.

APRA published further details in September on the CVA initiative. The participating banks commenced their CVAs in June, and are due to submit their first CVA analysis early in 2022, with publication of aggregated results and findings expected by the middle of the year.

In April, APRA finalised and published its practice guide on climate change financial risks, Prudential Practice Guide CPG 229 Climate Change Financial Risks (CPG 229). To assess the value of this guidance, APRA will undertake a survey in 2022 to help gauge the alignment between institutions’ management of climate change financial risks, the guidance set out in CPG 229, and the Financial Stability Board’s Taskforce for Climate-related Financial Disclosures.

In the lead up to the COP26 climate conference in Glasgow, APRA and the Reserve Bank of Australia (RBA) published a joint statement on their climate-related actions. In doing so, APRA and the RBA joined other regulatory agencies, including the European Central Bank, Banque de France, Bank of Canada and the US Federal Reserve Board, in making public statements on the important role of central banks and financial regulators in mitigating the physical, transition and liability risks of climate change in the finance sector.

In addition, APRA contributed to sharing knowledge on climate-related financial risks through participation in forums including the Network for Greening the Financial System, the Financial Stability Board, the Bank for International Settlements and the Executives’ Meeting of East Asia Pacific Central Banks. APRA also is a member of the Basel Committee’s Task Force on Climate-related Financial Risks, and participated in climate-related working group activities with organisations such as the International Organisation of Pension Supervisors, the International Association of Insurance Supervisors and the Sustainable Insurance Forum.

APRA Connect

In September 2021, APRA reached a major milestone in its plan to transform how it collects data as APRA Connect went live.

APRA Connect is the culmination of a multi-year program of work designed to create a modern, efficient and flexible technology platform that will serve both APRA and industry in relation to data collection, storage, analysis and insights.

APRA Connect was designed and implemented with a strong focus on industry and entity engagement. In addition to creating a Strategic Industry Reference Group consisting of 15 entity and industry body representatives to provide input on the approach and key decisions, APRA also provided significant testing opportunities for entities and RegTech firms.

As a result, APRA Connect reduces reporting burden on entities by:

- allowing greater automation of data submissions;

- facilitating the development of more granular data collections, reducing the need for supplementary and ad hoc data collections; and

- creating the potential to collect data once, and share it across multiple public sector agencies.

At the same time, APRA Connect gives APRA:

- the capability to collect more granular and diverse data, supported by workflow capabilities for more automated processing;

- more self-service capabilities for entities to maintain their information;

- a single platform allowing more centralised information exchange with entities; and

- enhanced ability to enable access to, and share data with other agencies and industry to increase transparency.

APRA plans to progressively implement a substantial pipeline of new and revised data collections within APRA Connect, enabling APRA to be more targeted and forward-looking in its policy development and supervisory actions.

The first Super Data Transformation collection, detailed below, became the first new data collection on the new platform. APRA Connect will also be used to collect data required by APRA and Australian Securities and Investments Commission (ASIC) in the implementation and ongoing operation of the proposed Financial Accountability Regime.

Supervision in action |

|---|

Following the publication of APRA’s heatmaps in December 2020, APRA received information regarding governance, conduct and expenditure concerns in relation to one of the RSEs identified in the heatmaps. In the first half of 2021, APRA began investigating expenditure and governance concerns at the trustee, and also queried the decision taken by that entity to merge with another fund that was not objectively justifiable. APRA’s supervision team:

|

APRA's Super Data Transformation project

APRA’s Superannuation Data Transformation (SDT) project was launched in November 2019. The project aimed to facilitate the collection of more granular data across all superannuation products and fill gaps in data (particularly for choice products), enhancing APRA’s ability to identify and address underperforming products.

In March 2021, APRA completed Phase 1 of the SDT project, which addressed the most urgent gaps in the data reported to APRA by superannuation trustees. This included expanding the data collection to include all products and investment options, and collecting improved data on insurance arrangements, expenses, member demographics and asset allocation classifications. Phase 1 data will also enable APRA to administer the YFYS performance test for trustee-directed products in mid-2022; expand analysis and insights, such as APRA’s heatmaps and performance benchmarking, into the choice sector; and provide greater transparency on how trustees spend members’ money.

APRA supported industry through close consultation and posting answers to frequently asked questions, and releasing a response paper and 10 finalised new reporting standards for Phase 1. The new reporting standards cover fund structure and profile, member demographics, expense management, asset allocation, investment performance fees and costs and insurance arrangements.

APRA Deputy Chair Helen Rowell said the completion of Phase 1 was a major step in APRA’s efforts to lift industry standards and weed out underperformers:

“Armed with new and deeper insights into aspects of the industry that have long been difficult to scrutinise, APRA supervisors will be in a stronger position to hold trustees to account for their decisions and the outcomes they deliver to all their members. Not only will we collect more and better-quality data through the SDT, we will also substantially lift the quantity of data we make public, enabling government, peer regulators, analysts and members to make better informed superannuation decisions.”

Phase 2 of the project will further increase the granularity of the superannuation data collections (as well as identifying data collections that could be discontinued), is due to commence in early 2022. Once Phase 2 is complete, the final phase of the project will assess the quality and consistency of the outcomes from Phases 1 and 2 and address any implementation issues.

APRA has worked closely with ASIC to ensure changes to superannuation data collection also support ASIC’s data needs in relation to superannuation, and to put in place data sharing arrangements to reduce the burden on industry under the principle of ‘collect once and share’.

Supervision in action |

|---|

During the course of ongoing supervision, APRA identified issues relating to the reserving adequacy for certain longtail claims of an insurer. In particular, an escalation in claims numbers and court awards had the potential to put pressure on the insurer’s capital position. APRA supervisors worked with the insurer during the year to ensure additional capital support from shareholders was forthcoming. The additional capital provided a buffer against the increasing reserves, ensuring ongoing protection was achieved for policyholders. |

Regulatory collaboration and engagement

Strong collaboration between regulators and government agencies remained crucial in successfully navigating the challenges of the economic environment over the past year. In 2021, APRA worked actively with other domestic and Trans-Tasman regulators to support collective goals, minimise duplication of activities and reduce regulatory burden.

Key forums for collaboration included the Council of Financial Regulators (CFR) (comprising Treasury, ASIC, RBA and APRA), the Trans-Tasman Council on Banking Supervision, the APRA-ASIC Committee (AAC), and a range of international bodies. APRA also continued to develop stronger working relationships with other agencies, including the Australian Competition and Consumer Commission (ACCC), the Australian Taxation Office, the Australian Transaction Reports and Analysis Centre (AUSTRAC), and the Australian Financial Complaints Authority (AFCA).

As the “twin peak” regulators, proactive cooperation between ASIC and APRA is especially important to efficiently achieve good regulatory outcomes across the Australian financial sector. To ensure this, ASIC and APRA maintained a constant dialogue throughout the year, facilitated through a formal-engagement structure led by the AAC, and supported by several Standing Committees, to enhance information-sharing and collaboration on both strategic and operational matters. Some specific examples include:

- cooperative industry-wide work on the implementation of the member outcomes obligations and design and distribution obligations, administered by APRA and ASIC respectively, to ensure superannuation trustees understood the interaction between the two sets of obligations.

- strengthened cooperation on entity-specific enforcement matters – for example, the two agencies collaborated through their respective investigations into AMP Super, and the Enforceable Undertaking provided to APRA by AMP Super was designed to also address the regulatory concerns of ASIC (see enforcement section below for further details).

ASIC and APRA have also created joint working groups in anticipation of their joint administration of the Financial Accountability Regime, the legislation for which is currently before Parliament.

Some other key examples of regulator and government agency collaboration and engagement in 2021 included the following:

- The CFR agencies, with supporting engagement by the ACCC, worked collaboratively to assess housing market risks and potential responses in the lead up to action taken by APRA in October 2021 to strengthen residential mortgage serviceability assessments;

- APRA worked together with other CFR agencies to develop a protocol to deal with the coordination of a response to a cyber incident being experienced at a financial service provider; and

- APRA, ASIC, AFCA and Treasury formed a cross-agency working group to engage with industry on the business interruption insurance test cases being heard in the Federal Court.

Supervision in action |

|---|

During the course of ongoing supervision, APRA identified issues relating to the reserving adequacy for certain longtail claims of an insurer. In particular, an escalation in claims numbers and court awards had the potential to put pressure on the insurer’s capital position. APRA supervisors worked with the insurer during the year to ensure additional capital support from shareholders was forthcoming. The additional capital provided a buffer against the increasing reserves, ensuring ongoing protection was achieved for policyholders. |

Enforcement activities

Enforcement action is an integral part of APRA’s supervisory toolkit. Enforcement is considered when regulated entities either cannot or will not properly address identified prudential risks. During 2021, APRA continued to implement its “constructively tough” enforcement philosophy, using its suite of regulatory powers forcefully where necessary.

In taking enforcement action, APRA not only seeks to prevent and address serious prudential risks but also to hold individuals and entities to account. To that end, public enforcement action was taken against a range of institutions during the year, including:

In March 2021, APRA agreed to a Court Enforceable Undertaking (CEU) from Allianz Australia Insurance Limited (Allianz). Allianz acknowledged past risk and compliance weaknesses and committed to rectify them. The CEU also committed Allianz to completing a series of transformation programs related to risk maturity, compliance, conduct and culture in a timeframe agreed with APRA, and to provide APRA with assurance that these programs were complete and operationally effective.

APRA Deputy Chair John Lonsdale said:

“While Allianz has already made some positive changes, their commitment to the agreed actions are a significant step forward in fixing the serious deficiencies in their risk management frameworks. We do not expect, nor would we tolerate, a repeat of Allianz’s past shortcomings.”

In the case of Macquarie Bank Limited (Macquarie Bank), APRA took enforcement action over Macquarie Bank’s historic incorrect capital and related-party exposure reporting, and multiple breaches of liquidity reporting requirements between 2018 and 2020. APRA required Macquarie Bank to hold an operational capital overlay of $500 million, a 15 per cent add-on to the net cash outflow component of its Liquidity Coverage Ratio (LCR) calculation and a 1 per cent adjustment to the available stable funding component of its Net Stable Funding Ratio (NSFR) calculation.

While the historical breaches had no impact on the overall soundness of Macquarie Bank’s capital or liquidity, APRA Deputy Chair John Lonsdale said:

“APRA’s legally-binding prudential and reporting standards play an essential role in enabling APRA to adequately monitor risks to financial safety and stability. For one of the country’s largest financial institutions to have committed breaches of this nature is disappointing and unacceptable. Alongside the enforcement actions, APRA will subject Macquarie Bank to intensified supervision to address the bank’s persistent difficulties in complying with its prudential obligations. We cannot rule out further action as more information comes to light about the root causes of these breaches.”

In the case of the CEU agreed in November with AMP Superannuation Limited and N.M. Superannuation Proprietary Limited (collectively AMP Super), APRA’s decision to accept the CEU followed a lengthy investigation into past conduct that APRA believes led to a number of potential breaches of the Superannuation Industry (Supervision) Act 1993. AMP Super acknowledged APRA’s concerns and accepted the need for rectification and remediation of members. Under the terms of the CEU, AMP Super committed to identify and address the root causes of the potential breaches and issues, rectify areas of concern, remediate affected members who have yet to receive remediation, and continue to enhance its governance controls, risk management and processes for acting in members’ best interests.

APRA Member Margaret Cole said APRA accepted the CEU as the most effective and efficient way to protect AMP Super members by ensuring there is minimal risk of such issues recurring, stating:

“AMP is one of the wealth industry’s largest and best resourced companies, and APRA expects a commensurately high standard of governance and risk management. While we acknowledge the efforts AMP Super has made towards improving its internal systems, the issues addressed by the CEU show there is further work to do. By offering this CEU, AMP Super has committed to fix promptly remaining legacy issues that have existed within its superannuation business and ensure affected members are appropriately remediated.”

Licence conditions were imposed on two superannuation trustees: the trustees for the EISS and Christian Super superannuation funds were each required to implement a strategy to merge with better performing funds given the poor outcomes their MySuper members have been experiencing, as demonstrated by their position on APRA’s MySuper heatmap and their failure of the YFYS Performance Test.

Supervision in action |

|---|

APRA’s supervision team, over the course of the year, has been engaging with an insurer to actively monitoring the implementation of its ongoing transformation programs. These programs are intended to address weaknesses that had been identified in a prior period relating to risk governance, and risk management and compliance practices. The supervision team provided close oversight of the execution of these programs, which, to date, have yielded observable improvements in these areas within the insurer. |

Protecting today, preparing for tomorrow

Despite the volatile and unpredictable environment that was experienced during 2021, the Australian financial system remained in a sound and stable position throughout. Further detail on individual industry sectors is contained in Chapter 2.

While the impact of the pandemic continues to play out, the past 12 months have demonstrated that the financial services industry possesses considerable underlying strength, and has the ability to adapt when the unexpected happens. As APRA Chair Wayne Byres noted in his speech to the Committee for the Economic Development of Australia (CEDA) in April:

“The Australian financial system has been resilient through the COVID period because of its underlying financial strength, and evidence from around the world is that strong financial systems have had a major advantage in responding to the crisis. For those reasons, APRA remained focused on the system’s core financial health. It needs to be there when we need it most. But the threats to that health are always evolving. So, APRA cannot stand still; we need to evolve our tools and methodologies in response. We are adapting our supervision in response to risks that have very much come to the fore in recent years, launching a number of pilot projects to trial new ways of doing things.”

In August, APRA published an updated Corporate Plan for 2021-2025 (PDF). It set out APRA’s strategic priorities for preserving the stability of the financial system, and protecting bank depositors, insurance policyholders and superannuation members, during the current period of disruption and uncertainty, while also preparing for future challenges.

“After narrowing our focus last year to help support the industry through the early stages of the pandemic, our latest Corporate Plan once again widens APRA’s regulatory gaze and activities,”

said Mr Byres.

The updated Corporate Plan was founded on two strategic themes: ‘protected today’ and ‘prepared for tomorrow’.

As part of its goal to ensure the Australian community remains protected today, APRA’s primary focus will be on:

- preserving the resilience of banks, insurers and superannuation funds, with a continuing emphasis on financial strength; cyber risks; governance, risk-culture, remuneration and accountability; and in superannuation in particular, implementing the Government’s Your Future, Your Super reforms;

- modernising the prudential architecture to ensure it is effective and accessible, less burdensome for entities, and more adaptable to the rapidly evolving financial sector; and

- better enabling data-driven decision-making by continuing to invest in and embed data as a core enabler for achieving APRA’s purpose and strategy.

In ‘preparing for tomorrow’, the Corporate Plan outlines APRA’s aim of:

- increasing its understanding of, and ability to respond to, the impact of new financial activities and participants, such as technological innovations and new business models that do not fit traditional regulatory approaches;

- helping to find solutions to important challenges, such as superannuation retirement income products, insurance accessibility and affordability, and the financial risks of climate change; and

- adopting the latest regulatory tools, techniques and practices in areas such as specialist regulatory services, enforcement actions, transparency and resolution.

Mr Byres emphasised:

“While our strategic priorities may change over time, our core purpose remains constant: to ensure the financial system remains stable, efficient and competitive, and the financial interests of Australians are protected.”

Footnotes:

Chapter 2 - Sector developments

Authorised deposit-taking institutions (ADIs)

The ADI sector demonstrated its resilience during 2021, despite the COVID-induced disruptions. The sector remained well capitalised and profitable, with sound liquidity and funding positions. This financial health was fundamental to its capacity to navigate through recent challenges and continue to support the Australian economy.

Nevertheless, ADIs remain exposed to significant headwinds and an uncertain outlook. Although signs of deterioration in key asset quality measures were muted, the sector may face higher credit losses as the full impact of COVID on borrower creditworthiness becomes clearer. Risks in housing markets are also heightened, with rising house prices and a very low interest rate environment placing a premium on the maintenance of sound lending standards. Technology and digitisation are creating new ways to provide banking and payment services, and challenging the sustainability of many current business models.

The industry landscape

There were 143 ADIs operating in Australia as at end-June 2021, down slightly from 146 a year earlier (Figure 1a). This comprised 97 banks, 37 credit unions and building societies, eight other ADIs, and one restricted ADI.

Following the lifting of the temporary suspension of licensing activity that had been implemented in an early response to COVID-19, 2021 saw the entry of one foreign bank and one other ADI. However, this was offset by the exit of three credit unions through market consolidation in the mutual ADI sector, and the exit of one foreign bank and one restricted ADI, Xinja Bank.

As at 30 June 2021, total ADI industry assets stood at $5.4 trillion, up slightly from $5.3 trillion the year prior. The four major banks hold around 73 per cent of industry assets, largely unchanged compared to prior years (Figure 1b).

Industry profitability improved over the year to 30 June 2021 due to a number of factors, including:

- lower than expected losses arising from the impacts of the COVID-19 pandemic;

- a reduction in provisions held against future loan losses; and

- improvements to operating income outpacing the growth in operating expenses.

As a result, industry return-on-equity (RoE) rose to 9.5 per cent (Figure 1c), an increase of 1.3 percentage points from 2020. However, this remains well below the 10-year average RoE of 12.3 per cent since 2011. The aggregate cost-to-income ratio decreased to 54.6 per cent over the year to June 2021 from 56.1 per cent over the year to June 2020 (Figure 1d).

Asset quality in the ADI sector has been supported by loan repayment deferrals programs, government income support measures and the better than previously forecasted economic recovery. As a result, overall asset quality remained broadly stable, with a slight improvement in non-performing loans, down 6 basis points to 1.06 per cent of gross loans and advances as at 30 June 2021 (Figure 1e).

The ADI industry is well capitalised, and at 30 June 2021 its weighted average CET1 capital ratio stood at 12.7 per cent – an increase of 0.9 percentage points over the year. The weighted average industry Tier 1 capital ratio rose 1.0 percentage points over the year to 14.6 per cent (Figure 1f). Both remain at historically high levels.

Key issues and initiatives

Loan repayment deferrals

In July 2021, as the Delta variant of COVID-19 took hold, a number of ADIs announced support packages in the form of loan repayment deferrals to support their customers through temporary disruptions caused by renewed lockdowns. In tandem, APRA provided regulatory relief to ADIs offering deferrals.

This relief mirrored the approach taken in 2020. For eligible borrowers granted a repayment deferral of up to three months before the end of September 2021, ADIs did not need to treat a period of repayment deferral as a period of arrears or a loan restructuring. However, for transparency, ADIs were required to publicly disclose and report the nature and terms of any repayment deferrals and the volume of loans to which they were applied.

ADIs responded quickly in reintroducing repayment deferrals programs for impacted borrowers, but the take up of these programs was significantly lower than during the first phase in 2020. At their peak during the second phase, loans subject to repayment deferral totalled $13.1 billion (or 0.6 per cent of total lending), compared to a peak of $266.1 billion (10.1 per cent of total lending) during the first phase in 2020.

Macroprudential policy actions

In October 2021, APRA announced it expected ADIs to increase the minimum interest rate buffer they use when assessing a borrower’s ability to service a loan. In particular, APRA indicated that lenders should assess new borrowers’ ability to meet their loan repayments at an interest rate that is at least 3.0 percentage points above the loan product rate. This compared to a buffer of 2.5 percentage points that had been commonly used previously.

APRA’s decision reflected growing financial stability risks from ADIs’ residential mortgage lending, with more than one in five new loans approved in the June quarter being at more than six times the borrowers’ income. APRA’s decision was supported by other members of the CFR.

APRA Chair Wayne Byres said increasing the buffer was a targeted and judicious action designed to reinforce the stability of the financial system. He noted:

“In taking action, APRA is focused on ensuring the financial system remains safe, and that banks are lending to borrowers who can service the level of debt they are taking on – both today and into the future.”

To support future macroprudential responses, APRA also published a framework for the use of macroprudential policy measures. This framework gives financial industry stakeholders a better understanding of the factors APRA considers in making decisions to use these tools, the types of macroprudential measures APRA could deploy in the future, and how they might be implemented.As the same time, to support the implementation of the framework, APRA commenced a consultation on steps to formalise and embed credit-based macroprudential policy measures within its prudential standards.

Capital management

In November 2021, APRA finalised a new bank capital adequacy framework. The new framework is designed to ensure the unquestionably strong levels of capital held by the banking sector are preserved, and that Australian standards align with the internationally agreed Basel III framework. In addition, APRA sought to achieve a number of key improvements to the capital adequacy regime to enhance flexibility, risk sensitivity, competition, transparency and proportionality.

At its heart, the new capital framework is aimed at ensuring that Australian banks continue to have the financial strength to withstand future adverse economic conditions, protect depositors in times of stress and retain an ability to support lending to households and businesses.

APRA Chair Wayne Byres noted that the internationally agreed Basel III framework is due to come into force around the world in 2023. Due to the strength of the Australian financial system, Australia will be compliant with the Basel III framework without the need for lengthy transitional periods and phase-in arrangements that will be needed in many other countries.

As noted in Chapter 1, APRA also announced in late 2021 that it had finalised requirements for domestic systemically important banks (the four major banks) to maintain additional loss-absorbing capacity to ensure they could be recapitalised using private, rather than taxpayer, funds in the unlikely event of a failure. APRA wrote to the major banks confirming that the final setting for loss-absorbing capacity would be an increase in minimum total capital requirements of 4.5 percentage points of risk-weighted assets, to be met from 1 January 2026.

Phasing out the Committed Liquidity Facility (CLF)

In September 2021, APRA announced that it expected locally incorporated ADIs subject to the Liquidity Coverage Ratio (LCR) to reduce their reliance on the CLF to zero by the end of 2022, subject to financial market conditions. This reflected the expectation of APRA and the RBA that there would be sufficient high-quality liquid assets (HQLA) available for ADIs to meet their LCR requirements without the need to utilise the CLF.

APRA advised that it would continue to review financial market conditions and would adjust its expectations if circumstances were to materially change. APRA also noted that the CLF will remain available should it be needed due to future shortfalls of HQLA, or other liquidity pressures.

New approach to licensing

In support of a sustainable, forward-looking competitive banking sector, APRA updated its approach to licensing and supervising new ADIs in August 2021. This followed a period of consultation on a draft framework, which had been published earlier in the year.

APRA’s updated approach entails stronger requirements for being granted a banking licence and closer supervision of new entrants as they seek to establish themselves. The approach is designed to encourage sustainable competition in the banking sector by ensuring new ADIs are better equipped to succeed.

The new approach came into effect immediately, although much of the information package published was a formalisation of existing practice. The final information paper and the two guidelines released are available on the APRA website at: Licensing for authorised deposit-taking institutions.

Superannuation

Overall, the superannuation industry continued to provide strong returns to members over the year despite the ongoing economic uncertainty associated with the pandemic. The primary driver of this performance was the continued buoyancy of the financial markets, resulting in double-digit investment returns. Registrable superannuation entity (RSE) licensees have, however, continued to grapple with a number of operational challenges due to the ongoing lockdowns and challenging business environment. These have generally been managed relatively well, with minimal disruption to member services.

Across the superannuation industry, member accounts continue to be consolidated as a result of recent legislative reforms. The reduction in the number of member accounts has resulted in better outcomes for members overall, but has also resulted in cost pressures for RSE licensees. These pressures are likely to continue into 2022 and beyond.

APRA’s focus in 2021 was directed at improving member outcomes and eradicating underperformance, supported by the Government’s Performance Test and the MySuper heatmap. Over the year, this work, coupled with effective supervisory actions, has led to an increase in merger activity across the industry, with 12 mergers completed and a further 12 RSE licensees in initial or advanced execution phases.

The industry landscape

As at 30 June 2021, superannuation industry assets totalled $3.3 trillion, an increase of 15 per cent over the year from $2.9 trillion. This double-digit growth was driven primarily by APRA-regulated funds which grew over 17 per cent from $1.9 trillion to nearly $2.3 trillion, with these funds managing close to 69 per cent of assets within Australia’s superannuation system.

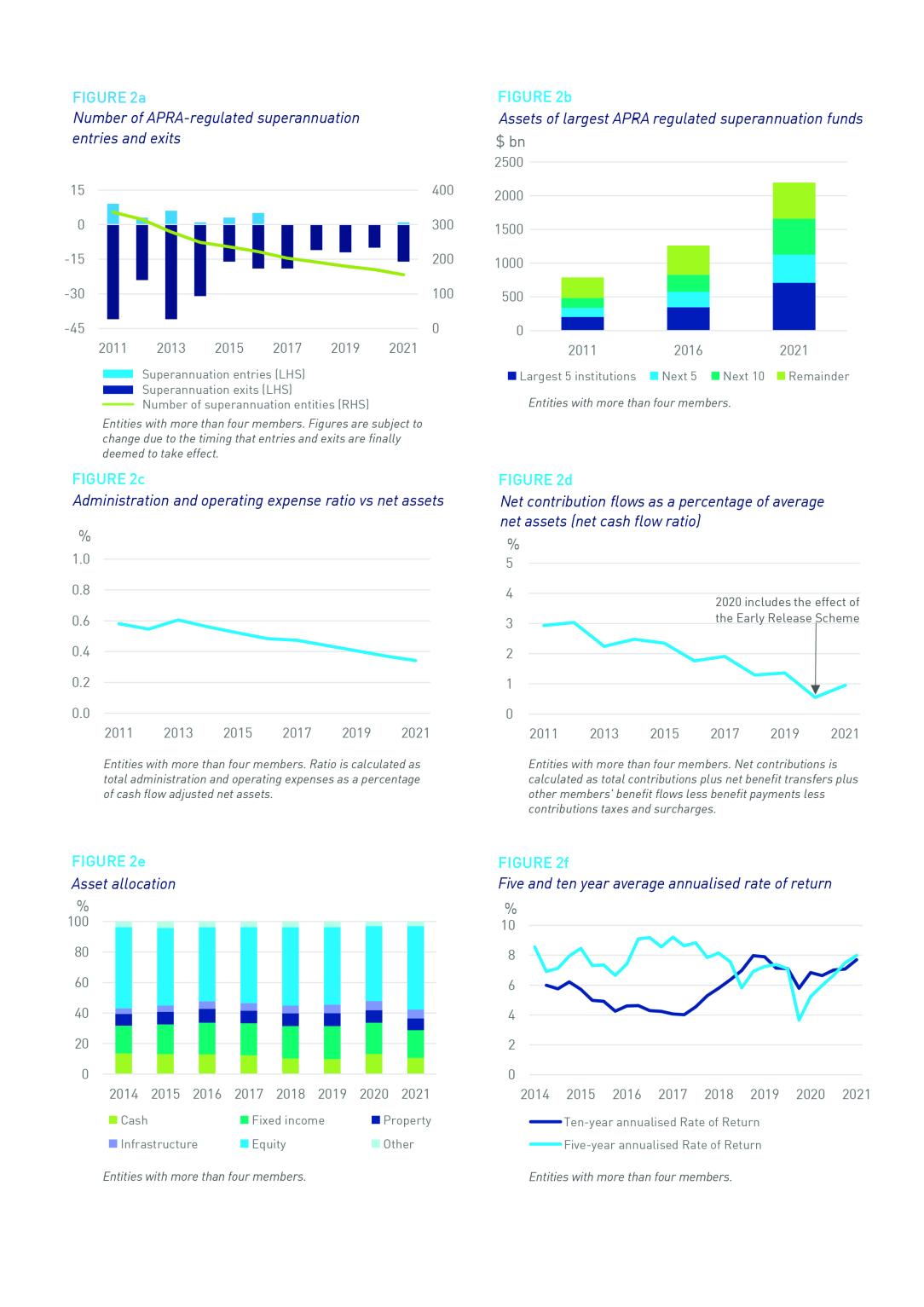

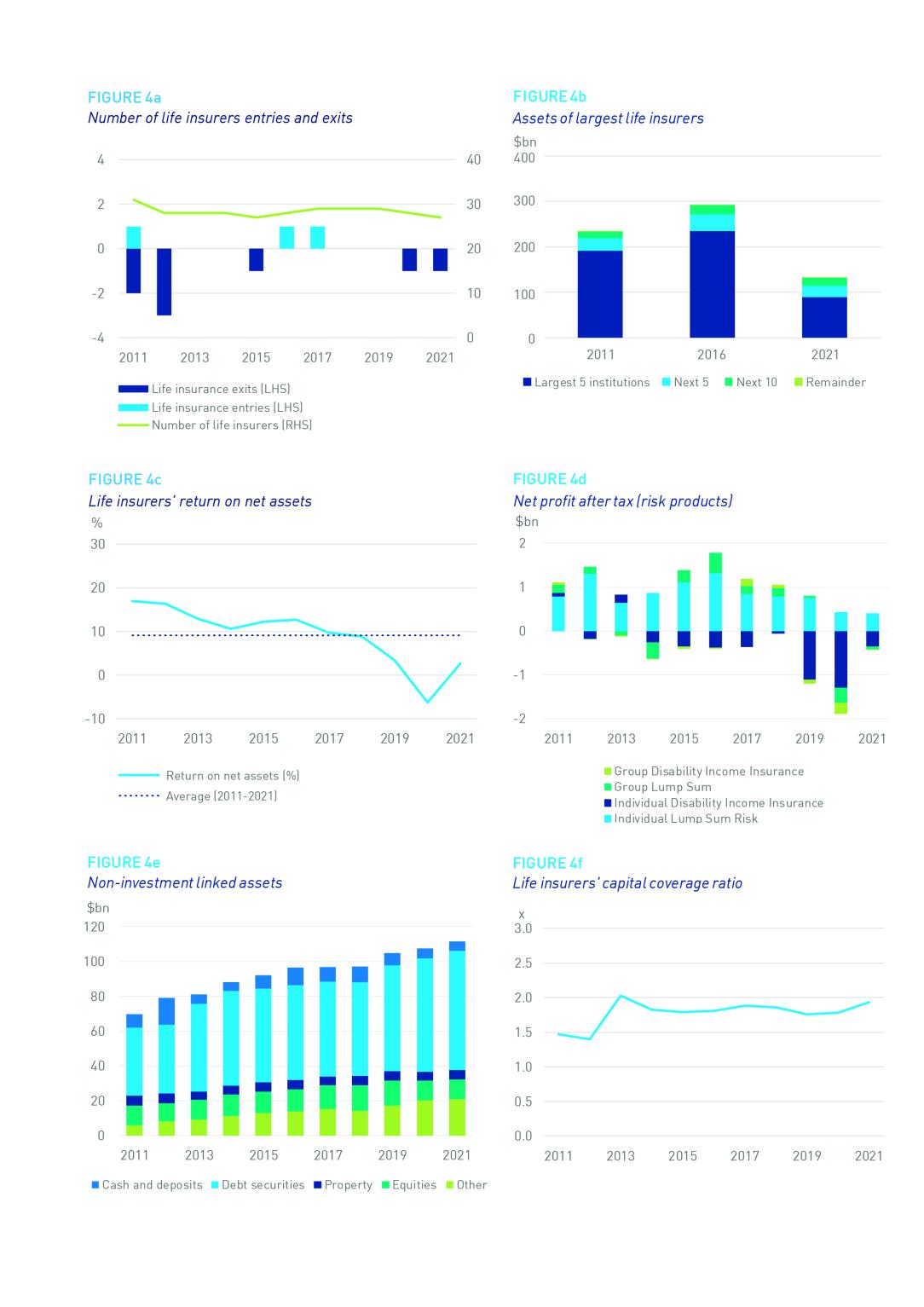

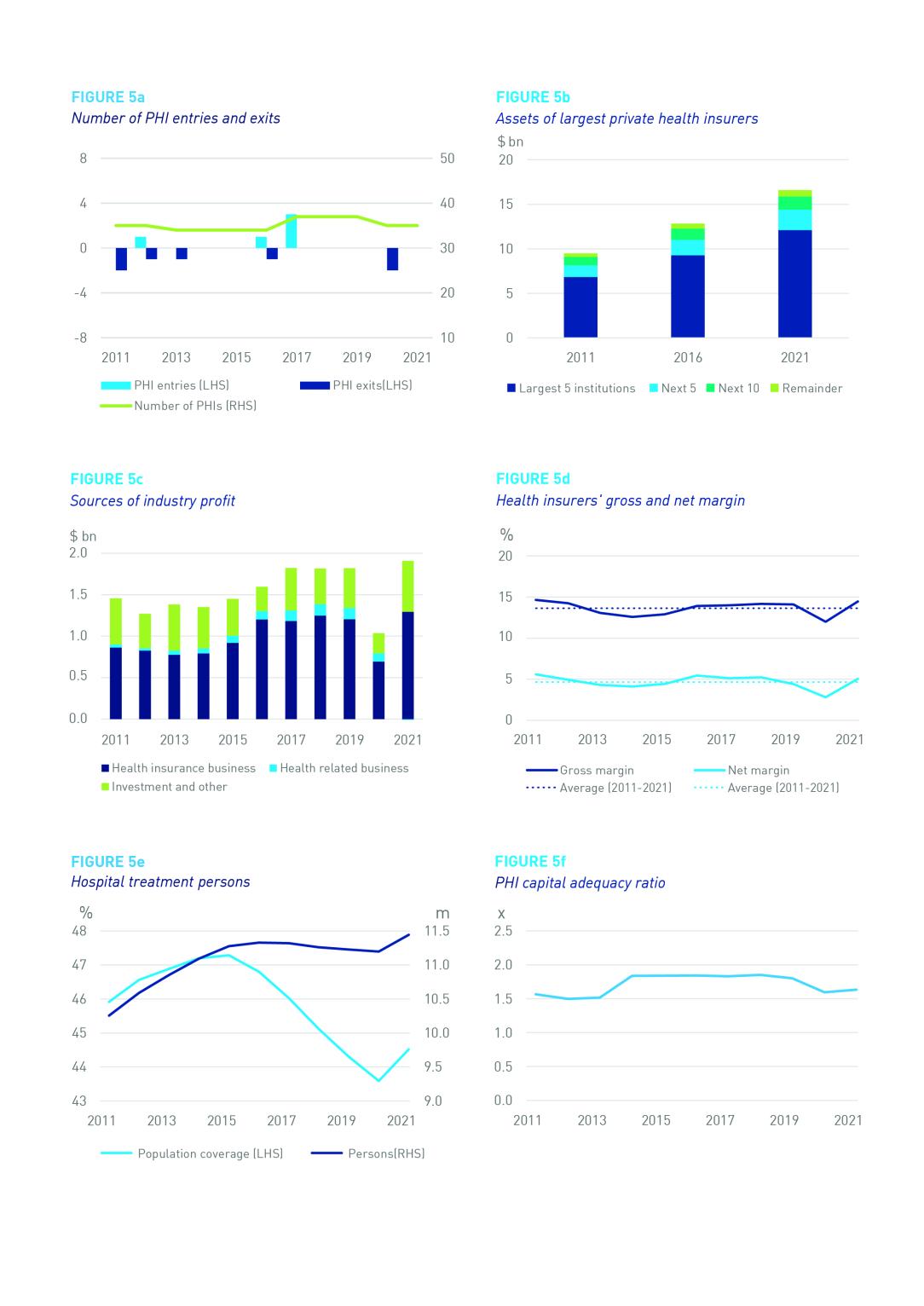

The number of APRA-regulated funds with more than four members decreased from 170 to 155 by the end of the year with 16 funds exiting the system and only one new entrant (Figure 2a). The decline in the number of super funds gave rise to a fall in the number of RSE licensees from 107 to 95 over the year. Reflecting this consolidation, concentration within the superannuation industry also increased over the year, with the five largest super funds holding 32 per cent of total APRA-regulated super assets as at 30 June 2021, up from 27 per cent five years ago (Figure 2b).

The combined effect of continuing asset growth and consolidation within the superannuation industry over the year resulted in the average fund size increasing from $12.3 billion to $15.4 billion over the year, a 25 per cent increase. The normal operating efficiencies associated with increasing fund size, observed over the longer-term (Figure 2c), continued over the year with total administration and operating expenses as a percentage of net assets decreasing from 0.37 percent to 0.34 per cent.

Contrary to the longer-term trend, net contribution flows (which represent the amount of member monies paid into the system less the monies paid out of the system), as a percentage of average net assets, increased from 0.5 per cent to 0.95 per cent between the June 2020 and 2021 financial years (Figure 2d). This rebound reflected the end of the 2020 Early Release Scheme, however the overall net contribution flow remains notably below earlier years.

Fund asset allocations shifted towards growth assets over the year, as the initial concerns brought on by COVID-19 subsided and entities took advantage of the strong performance of global markets. As at 30 June 2021, the allocation to equity was 54.8 per cent of total assets (Figure 2e) with allocations to fixed income, cash, property and infrastructure accounting for 18.2 per cent, 10.6 per cent, 7.7 per cent and 5.7 per cent of total assets respectively. Other assets, including hedge funds and commodities, accounted for the remaining 3.0 per cent of total assets.

Strong investment performance yielded an annual return of 17.0 per cent over the year to 30 June 2021, as global markets recovered from COVID-19-induced losses during the second half of the previous year. This was well above the 10-year annualised rate of return of 7.7 per cent per annum for the 10-year period ending 30 June 2021 (Figure 2f).

Key issues and activities

Eradicating underperformance

APRA’s strategic focus to improve member outcomes and eradicate underperformance continues to be supported by the annual release of its heatmaps. APRA’s MySuper product heatmap, first published in 2019, provides a major enhancement to industry transparency. In December, alongside its annual MySuper heatmap, APRA published its first choice heatmap covering an important segment of the choice sector.

The APRA heatmaps supplement the Government’s YFYS reforms, which came into effect on 1 July 2021, and included an annual performance test. The performance test enhances accountability for RSE licensee performance through greater transparency and increased consequences for underperformance.

Performance test

As part of the Government’s YFYS reforms, an annual performance test was introduced. A RSE licensee of a product that fails the performance test must write to its members informing them of the failure. Where a product fails the performance test in two consecutive years, the RSE licensee will be prohibited from accepting new beneficiaries into that product.

The inaugural MySuper Product Performance Test outcomes were released on 31 August 2021. On the release of the performance test outcomes, APRA Executive Board Member, Margaret Cole commented:

“It is welcome news that more than 84 per cent of products passed the performance test, however APRA remains concerned about those members in products that failed. Trustees of the 13 products that failed the test now face an important choice: they can urgently make the improvements needed to ensure they pass next year’s test or start planning to transfer their members to a fund that can deliver better outcomes for them.”

APRA also intensified its supervision of the RSE licensees with products that failed the test and requested they provide a report identifying the causes of their underperformance and how they plan to address them. RSE licensees are required to monitor their products closely and report important information to APRA – including relating to the movement of members and outflow of funds.

As well as scrutinising the plans of the 13 funds that failed the test, APRA is engaging with RSE licensees at risk of failing the performance test next year, to ensure they take the steps necessary to improve performance and to understand their contingency plans. These contingency plans must include pre-positioning to be able to give effect to an orderly transfer of members to another fund, if required.

APRA's inaugural Choice heatmap

APRA’s heatmaps are designed to provide stakeholders with insights into the outcomes being delivered by RSE licensees, in particular for investment returns and fees and costs, by providing information that is credible, clear and comparable across products. However, to date, APRA’s heatmaps had only covered MySuper products.

Research undertaken by Chant West shows there are 568 choice products within APRA-regulated superannuation funds, offering approximately 9000 distinct investment options. Choice products are typically more complex and varied than default MySuper products, which makes comparisons between choice products more challenging.

In October, APRA published an information paper that provided some high level analysis of the choice sector, ahead of releasing its first Choice heatmap in December 2021.

The Choice heatmap focuses on multi-sector investment options in open, accumulation products (excluding platform products), representing 40 per cent of total member benefits in the APRA-regulated choice sector. This segment is also the most similar to MySuper products, enabling direct comparisons between the sectors.

APRA Executive Board Member Margaret Cole noted that the findings demonstrate the importance of exposing and addressing the varying levels of performance and the high fees within the choice sector. APRA will continue to closely monitor and take firm supervisory action on underperforming choice products ahead of the expanded performance test in 2022.

Driving improvements in industry practice

The performance test and heatmaps are necessarily backward-looking. APRA also devoted considerable resources to making sure RSE licensees have robust frameworks to make investment and expenditure decisions into the future. In 2021, APRA completed thematic reviews into three core areas of RSE licensee business operations critical to delivering outcomes to members.

The first was a benchmarking review of 24 RSE licensees with respect to their implementation of Prudential Standard SPS 515 Strategic Planning and Member Outcomes (SPS 515). This review focused particularly on business plans and business performance reviews (BPRs), to understand practice and assess how well RSE licensees have embraced and embedded the intent of SPS 515.

The review identified areas where RSE licensees needed strengthen their practices during the upcoming BPR and business planning cycle, including consideration of member outcomes, cohort analysis, understanding drivers of performance, and testing financial soundness.

The second thematic review was of 12 RSE licensees, undertaken between November 2020 and October 2021, examined expenditure on advertising, sponsorships and promotions.

The review identified that, given the new best financial interests duty introduced in the Government’s YFYS reforms, some instances of expenditure examined did not have sufficient evidence to demonstrate that the expenditure would be in the best financial interests of members. It also identified areas where industry practices need to be improved: specifically, RSE licensees should make a significant shift from broad reliance on qualitative judgements, to applying robust quantitative analysis as a basis for justifying expenditure.

The third review, which took place against the backdrop of the heightened market volatility in early 2020 as a result of COVID-19, highlighted the importance of a prudent approach to valuing unlisted assets. Increased member switching, together with the Government’s expansion of the early release of the superannuation program, led APRA to seek information on how member equity issues were being balanced by RSE licensees during the period.

Encouragingly, APRA’s review found that most RSE licensees demonstrated a proactive approach to revaluing unlisted assets in response to the market volatility in early 2020. Areas identified for improvement included addressing inadequate revaluation frameworks (with no predefined revaluation triggers and weak or no processes for monitoring and adjusting revaluations); limited board engagement (an area of particular concern across a number of RSE licensees); and an over-reliance on external parties, including fund managers and asset consultants.

Observations from these reviews were published in October 2021, in Information Paper: Findings from APRA’s superannuation thematic reviews (PDF).

Policy initiatives

APRA has undertaken a number of critical reforms to the prudential standards for superannuation, aimed at ensuring that RSE licensees are acting prudently to improve outcomes delivered to members. Highlights from 2021 include:

In November, APRA finalised revisions to requirements and guidance relating to insurance in superannuation, Prudential Standard SPS 250 Insurance in Superannuation (SPS 250) andPrudentialPractice Guide SPG 250 Insurance in Superannuation (SPG 250), following extensive industry consultation over two years. In particular, the standard has been strengthened to protect members from potential adverse outcomes caused by conflicted life insurance arrangements. This includes heightened obligations on the RSE licensee to assess whether there are any conflicted provisions or business practices with respect to insurance arrangements, and whether they are appropriate and in the best financial interests of beneficiaries.

The revisions also fulfilled recommendations 4.14 and 4.15 of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry.2

In September, APRA released for consultation its proposed revisions to Prudential Standard SPS 530Investment Governance (SPS 530). The proposed amendments to SPS 530 included a number of enhancements to valuation practices, stress testing and liquidity management practices. This is an important step in ensuring that RSE licensees continue to meet their obligations to prudently select, manage and monitor investments. The consultation closes in February 2022, and APRA will look to finalise the standard – and commence consultation on associated prudential guidance – next year.

In November 2021, APRA also released a discussion paper seeking information from RSE licensees on their plans to maintain the financial resilience needed to protect members’ best financial interests. This is an important step in ensuring that every RSE licensee is financially resilient to ensure the continued delivery of improved member outcomes and the ability to operate in the best financial interests of beneficiaries. In light of the continual changes to the superannuation landscape, APRA sought to better understand current approaches to the management of financial resources. In particular, this included the role and use of the operational risk financial requirement, reserving practices, and protections afforded to RSE licensees via insurance, and how these practices might need to adapt over time.

General insurance

Introduction

The general insurance industry faced a difficult 2021, with a large fall in industry profits due to higher claims costs from weather events, coupled with lower investment income reflecting ongoing financial market volatility.

In addition, the industry continued to grapple with the extent business interruption insurance (BI) claims triggered by lockdowns and other restrictions associated with COVID-19. Many insurers found themselves exposed through policy wordings that had not kept up with changing legislation. This created considerable uncertainty, which needed to be resolved through a series of test cases in the Courts.

The general insurance industry also continued to face a challenging operating environment. Rising premiums and reduced capacity in certain product lines is making some types of insurance less affordable (or in some cases unavailable) for many Australian households and businesses. Furthermore, the increased frequency and intensity of natural disasters associated with climate change will continue to add increasing challenges of accessibility and affordability of insurance for parts of the Australian community. It will require greater attention to mitigation and disaster preparedness to ensure that general insurance remains accessible and affordable to all Australians.

The industry landscape

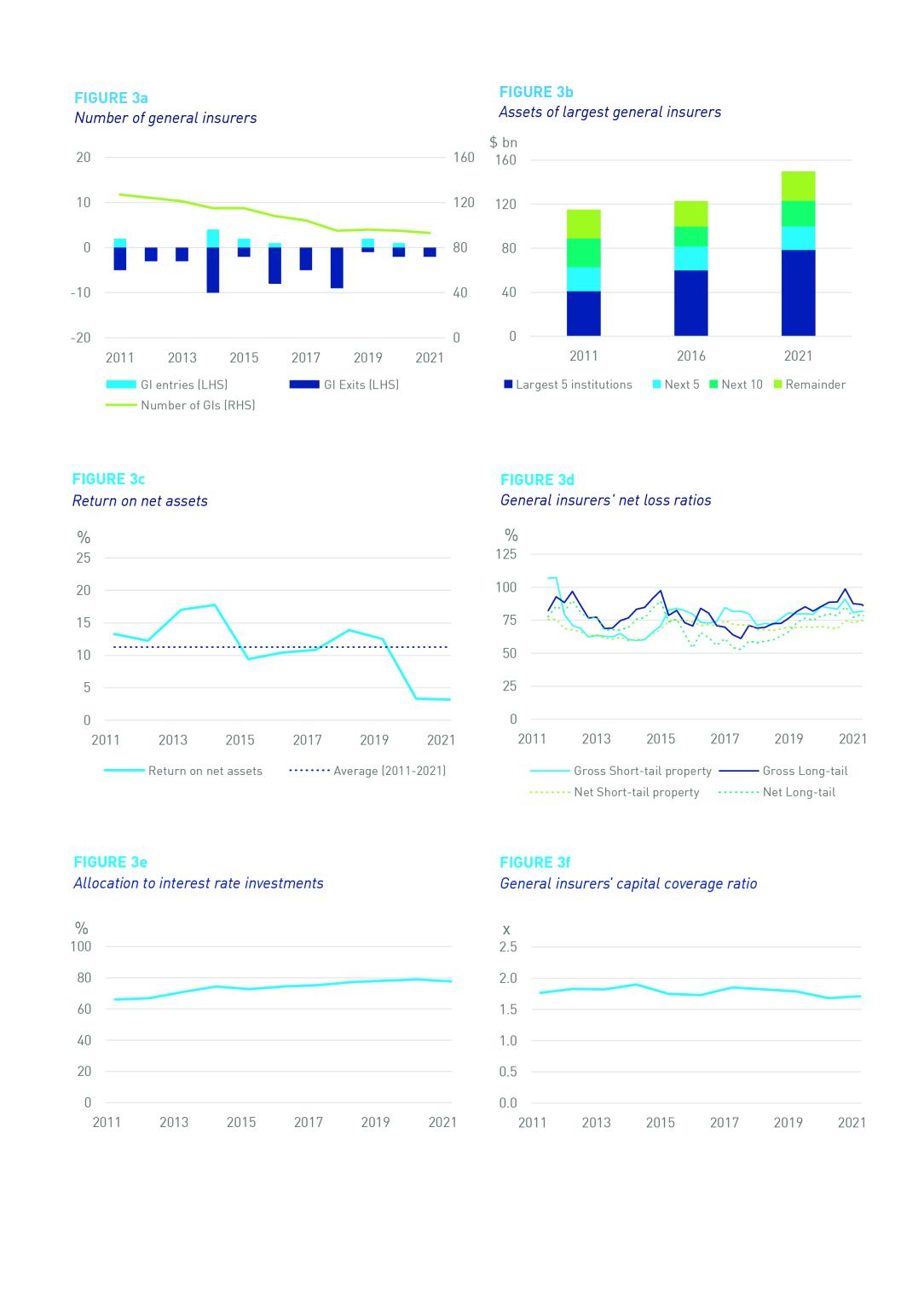

There were 93 APRA-authorised general insurers as at 30 June 2021, comprising 83 direct insurers and 10 reinsurers. The number and composition of general insurers has remained broadly stable in recent years (Figure 3a).

Industry concentration has increased over time with the top five general insurers now accounting for 52 per cent of total industry assets (Figure 3b). This compares with 36 per cent 10 years ago.

Industry profits remained suppressed for a second successive year, with a 3.2 per cent return on net assets tracking significantly below the 10-year average (Figure 3c). The primary driver of this result was significant provisioning for COVID-19 business interruption claims. Despite the lower incidence of very large catastrophe events in 2021, gross claims costs for the householders’ class of business also remained elevated. Domestic motor claims costs also increased in the year. Overall, this led to higher net loss ratios for the short-tail property classes of business, in particular the Fire and Industrial Special Risks class (Figure 3d).

The net loss ratio for long-tail classes of business was largely unchanged over the year. Releases of claims reserves continued to positively impact underwriting profits in the compulsory third party (CTP) motor vehicle class of business, albeit these have significantly declined in recent years. In contrast, strengthening of claims reserves was notable in the public and product liability class of business. Significant premium rate increases were observed during the year for some classes of business including professional indemnity and employers’ liability.

General insurers’ investment portfolios remained heavily weighted to interest-bearing investments (Figure 3e). Investment income during the year remained subdued, with increases in bond yields causing unrealised losses on these investments.

The quality of insurers’ capital continued to be high, with CET1 capital making up 93 per cent of eligible capital (figure 3f).

Key issues and activities

Business interuption insurance

Over 2021, a number of court cases considered the effectiveness of pandemic exclusions found in many business interruption (BI) insurance policies. APRA regularly reassessed the prudential impact of these court decisions and actively engaged with peer agencies as part of a Treasury-led BI working group on this matter (the working group also includes ASIC and AFCA), as well as with the Insurance Council of Australia and international peer regulators.

The financial and reputational impact on the general insurance industry and the uncertainty created over pandemic coverage under BI policies has been significant. The issues raised concerns for APRA about the level of robustness applied to the management of insurance risk by some insurers, and whether the weak practices that led to problems in the BI line of business could be replicated elsewhere.

To help strengthen risk management across the general insurance industry, APRA commenced a thematic review of 10 general insurers. This exercise aims to significantly reduce the likelihood of similar problems recurring in the future. It specifically focuses on cyber-risk, but APRA expects the learnings that will be drawn from it to be applicable across all product areas and potential exposures.

APRA Deputy Chair Helen Rowell told delegates at the Insurance Council of Australia’s Virtual Industry Forum in October 2021:

“Once we review the submissions we will provide broader industry feedback. If any red flags are raised as a result of the exercise, it may result in a supervisory response for an insurer, but the purpose of the review is not intended to be punitive. Rather, we want to work with the industry to help them identify and address any weaknesses before they manifest in a similar way to BI.”

Affordability and accessibility

Another key area of attention for APRA was the affordability and accessibility of insurance.