Your Future, Your Super Frequently Asked Questions

The frequently asked questions on this page provide guidance to registrable superannuation entity (RSE) licensees on the measures included in the Government’s Your Future, Your Super (YFYS) reform package, announced in the 2020-21 Budget. The Treasury Laws Amendment (Your Future, Your Super) Act 2021 (the YFYS Act) came into effect on 1 July 2021.

Updated: 29 August 2025

Changes to FAQs:

- Updated FAQs:

- FAQ 13 under General

- FAQ 3 under Technical

- FAQ 5 under Technical

- FAQ 6 under Technical

- Deleted FAQs:

- FAQ 11 under General

- FAQ 15 under General

Performance Test

The performance test applies from 1 July 2021 to MySuper products, and from 1 July 2023 to trustee-directed products. The assessment under the performance test, in conjunction with the ATO’s YourSuper comparison tool, is intended to hold RSE licensees to account for underperformance through greater transparency and increased consequences. Where a product fails the performance test in two consecutive years, the RSE licensee will be prohibited from accepting new beneficiaries into that product.

These frequently asked questions provide general and technical guidance to RSE licensees on the annual performance test.

Trustee directed products

1. How do trustees determine which investment options offered to members are Trustee Directed Products (TDPs) for the Performance Test?

In determining which investment options must be reported as TDPs, the most straightforward approach is to consider that all investment options are TDPs unless the option is otherwise carved out by regulation 9AB.2 of the SIS Regulations.

2. Are investment options held through platform structures classified as trustee directed products (TDPs)?

Yes, the performance test applies at the investment option level. As such, any investment option offered either directly or through another mechanism (e.g. platform or master trust) that satisfies the requirements set out in regulation 9AB.2(2) of the SIS Regulations, and does not fall within an exception specified in regulations 9AB.2(5) to (7), will be classified as a TDP.

3. If an investment option is a TDP under one RSE licensee, will it be deemed to be a TDP if offered by other RSE licensees?

No, the definition of a TDP requires certain requirements to be satisfied as set out in regulation 9AB.2 of the SIS Regulations. As such, the determination of whether an investment option is a TDP will depend on the particular circumstances of each individual RSE licensee. For example, the “control exception” in regulation 9AB.2(7) may be satisfied in relation to one RSE licensee but not another.

4. If a TDP fails the performance test under one RSE licensee, will it be deemed to have failed the performance test when offered by other RSE licensee?

No, the performance test is calculated using RSE licensee-specific data relating to the TDP. As such, the performance test outcome is specific to the RSE licensee.

However, if an investment option fails the performance test, APRA expects all RSE licensees offering the option (regardless of whether it is classified as a TDP as part of their offering or not) to consider whether the performance of the investment option allows the RSE licensee to hold the view that it is in the best financial interests of members for the option to be continued to be offered.

5. Is a managed investment scheme on an investment menu subject to the performance test?

Yes, unless one of the exceptions are applicable. As a starting point, all investment options should be assumed to be subject to the test.

6. Does the legal characterisation of an interest in a managed investment scheme (MIS) affect the determination of whether it is a TDP?

No. APRA considers that the legal characterisation of the interest in the MIS is not relevant when assessing if the option is a TDP and, as such, subject to the performance test. For example, APRA considers that the TDP definition applies in the same way regardless of whether the investment option is a MIS unit trust structure or a MIS absolute entitlement trust structure.

7. Can investment options that have no strategic asset allocation benchmarks be classified as TDPs?

Yes, the performance test will be calculated using data reported on Reporting Form SRS 550.0 Asset Allocation (SRS 550). Benchmark allocations reported on SRS 550.0 are the allocation targets RSE licensees have adopted to meet the investment objectives of their investment strategy under Prudential Standard SPS 530 Investment Governance (SPS 530). Paragraph 20(a) of SPS 530 states:

An RSE licensee must, at a minimum, determine for each investment strategy for an investment option that includes multiple assets and/or asset classes:

(a) asset allocation targets and ranges that are appropriate to the investment objectives of the investment option;

As such, APRA expects strategic asset allocation targets to be reported for each investment option that invests in multiple asset classes in SRS 550.

Prudential Practice Guide SPG 530 Investment Governance (paragraphs 40 and 41) provides further guidance that irrespective of asset allocation approach (e.g. dynamic asset allocation), APRA expects RSE licensees to establish formal approaches to determining asset allocations including establishing initial target asset allocations and ranges as required under SPS 530.

8. Is a product a trustee-directed product (TDP) – and therefore subject to the performance test assessment - if a beneficiary’s interest in the product supports a superannuation income stream that is in the retirement phase?

A product will be a TDP if it is held by at least one beneficiary in the accumulation phase (provided all the other requirements of the definition of TDP in regulation 9AB.2 of the SIS Regulations are satisfied). For example, an investment option offered on a platform is subject to the performance test if any of the beneficiaries that have invested in that option are in the accumulation phase. In contrast, a product will not be a TDP if it is only providing a superannuation income stream in the retirement phase.

9. How do trustees determine if their investment option is a TDP for the performance test?

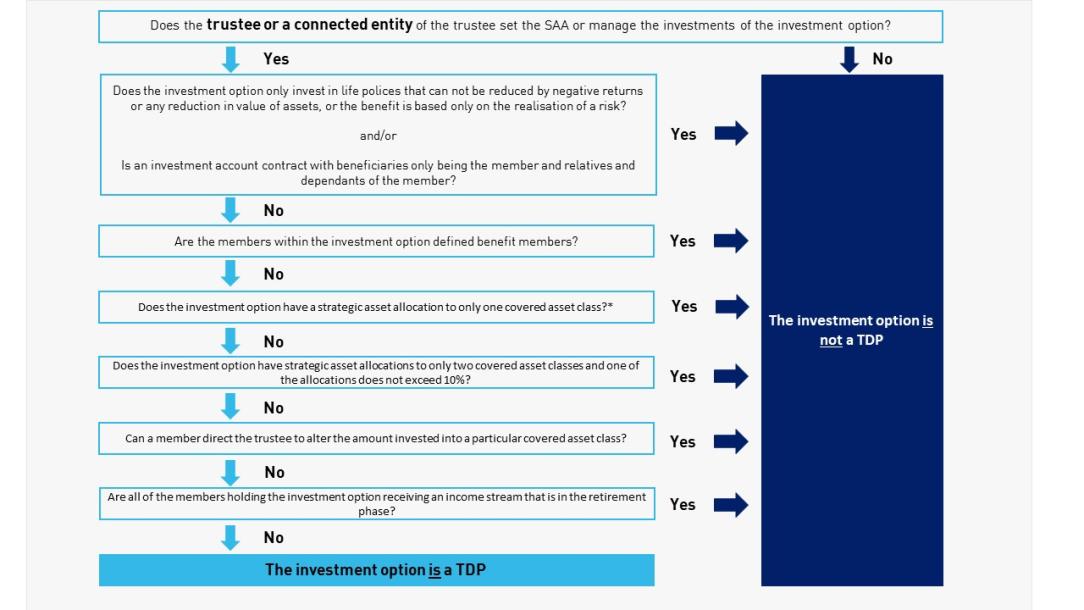

The diagram below may assist trustees in determining if their investment option is a TDP for the performance test. Exclusions to TDP status are found in regulations 9AB.2(2) - 9AB.2(7) of the SIS Regulations.

Accessible version - Diagram in question 9 under trustee directed products.

10. Can Separately Managed Accounts (SMAs) be Trustee Directed Products (TDPs)?

Yes, SMAs and other managed accounts can be TDPs depending on how the product features operate and interact with the requirements of the definition in Regulation 9AB.2 of the SIS Regulations. In practice, this is determined by the ability of the beneficiary to alter the strategic asset allocation of a particular covered asset class. Per SIS Regulation 9AB.2(2)(c) of the SIS Regulations, if a beneficiary of the fund cannot require the trustee of the fund to alter an amount attributable to the beneficiary to be invested in a particular covered asset class in an investment option then that product satisfies the TDP definition. Conversely if a beneficiary can require the trustee of the fund to alter the covered class amount of the investment option then it cannot be a TDP.

General

1. Will APRA use data submitted after 15 August for the performance test?

The Your Future Your Super regulations specify the use of data available to APRA as at 15 August each year. For the relevant assessment year, APRA will not include any updated data received after 15 August other than in exceptional circumstances.

2. When will RSE licensees be notified of their annual performance test results?

APRA will provide notification to each RSE licensee of their product’s performance test result prior to publication. Publication of the outcomes of the performance test for all products that have been assessed will occur end of August each year.

Recognising that the timing between the running of the performance test and notification is short, APRA’s ability to provide any results in advance of publication is limited. However, provisional results will be provided to RSE licensees ahead of publication where a product appears likely to fail the test.

3. Can an RSE licensee request that its result is not published by APRA?

No. There is no discretion for APRA to exempt a product from having its results published by APRA.

4. Are RSE licensees required to notify beneficiaries of their performance test result?

An RSE licensee must give notice to its beneficiaries who hold a product that has failed the performance test. The notice must be provided in the prescribed form, within 28 days of an RSE licensee being advised of its determination by APRA.

5. Can an RSE licensee be exempted from providing notice to beneficiaries if it is in the process of transferring its beneficiaries to another product or fund?

No. There is no ability under the legislation to exempt an RSE licensee from giving notice to its beneficiaries.

6. Can an RSE licensee apply for an extension to the 28 day timeframe for providing notice to beneficiaries?

In exceptional circumstances such as a merger, consideration may be given to deferring the RSE licensee’s obligation to give notice to beneficiaries.

RSE licensees can apply by submitting their request in writing, providing clear reasons for the request before the expiration of the 28 days. Their request must be sent to BOTH their responsible supervisor at APRA and to ASIC through the ASIC Regulatory Portal. ASIC will be the lead agency in considering requests and will consult with APRA prior to making a decision.

RSE licensees should make their request early in the period leading to expiration of 28 days when submitting their request as they will need to provide notice within the 28 day timeframe if no extension is provided.

7. Do RSE licensees need to send the notice to beneficiaries who are in the product at the date of the notice or at the date the performance test was conducted?

The notice is to be sent to beneficiaries who (i) hold an interest in the product at the date APRA provides its determination to the RSE licensee and (ii) continue to hold the product at the date the notice is sent.

8. Can new beneficiaries hold a product that fails the performance test for a second consecutive year?

Products that fail the performance test in two consecutive years cannot accept any new beneficiaries into the product until they pass a future performance test.

RSE licensees are expected to have administrative processes in place to ensure they comply with their legislative obligation to prevent new beneficiaries from holding the product from the beginning of the day after the second fail notification is received. Any contributions received from or on behalf of persons who were not holding the product on the day the second notification is received will need to be returned.

APRA expects RSE licensees of MySuper products that failed last year’s performance test to be engaging closely with their employer-sponsors, promotors and other key stakeholders to ensure they are aware that the product may be closed to new beneficiaries if the product fails this year’s performance test.

9. Are RSE licensees required to consider their performance test result in their annual outcomes assessment(s) under section 52(9) of the SIS Act?

Yes. In undertaking the annual outcomes assessment, an RSE licensee must have regard to their performance test result.

10. Will APRA publish the performance test values?

Yes, this will be released as part of APRA’s comprehensive product performance package.

11. Can trustees resubmit SRS 550.0 reporting having regard to the changes to covered asset classes in the Regulations?

The applicable reporting standards have not changed. The resubmission of data should not be required unless an error has been made.

12. How will APRA determine Strategic Asset Allocations (SAA) where disaggregated asset classes are reported as sub-sector or sector SAAs in SRS 550.0 (Table 1)?

APRA will use sub-sector SAA where it has been provided by the trustee, otherwise sector SAA will be used. If entities have further questions, they can contact their supervisors or email superdatatransformation@apra.gov.au.

13. What were the benchmark representative administration fees and expenses (‘BRAFE’) for the 12 months to June 2025?

The BRAFE for the 12 months to June 2025 were:

- MySuper products – 0.2482%

- Non-Platform Trustee Directed Products – 0.24444%

- Platform Trustee Directed Products – 0.467529352%

The APRA BRAFEs used for the performance test are available in the comprehensive product performance package.

Technical

1. How will a product be assessed when there has been a significant change in the structure of the product over time, for example changing from a single strategy to a lifecycle strategy?

The performance of a product must be assessed over the lookback period of the performance test or since the product first began reporting investment performance data to APRA, if later. Therefore, if a product has changed from a single strategy to a lifecycle strategy, the performance under both structures is required to be assessed under the performance test. For further information, refer to APRA’s Information Paper published on 16 August 2021, outlining how the performance test will be applied for products that have had a change in their structure over the lookback period.

2. Will APRA combine (or “stitch”) history in the performance test where APRA has granted a new MySuper product authorisation on the basis of material goodwill?

Where APRA grants a new MySuper product authorisation under the material goodwill provision, APRA is satisfied that the previously authorised MySuper product is similar to the new MySuper product under s 29TA of the SIS Act. Accordingly, APRA will in such circumstances combine the performance history of both products for the purpose of the performance test. For further information, refer to APRA’s Information Paper on combining performance histories for the purposes of the performance test.

3. What performance history is assessed under the test? If a product does not have a performance history for the full lookback period, will it be assessed?

The performance test assesses the investment performance of a product over a ten year time horizon. If a product has a performance history of less than seven years, the product has met the requirements of the performance test, unless APRA issues a determination under regulation 9AB.10(4) to calculate a performance measure for the product.

4. Will the Performance Test use the data collected as part of the Superannuation Data Transformation (SDT) Project?

Both the MySuper and Choice Performance Test will use the data collected as part of the SDT project, with the exception of SRF 533.0 Item 2.1 (see question 5 below for the reporting forms used).

5. Which data items from APRA’s reporting forms are used to calculate a product’s performance test result?

The data used in the performance assessment is reported to APRA under the Financial Sector (Collection of Data) Act 2001 through the following forms and available in APRA publications:

| Data Item | Data Source |

|---|---|

| Net Investment Return | Reporting Form SRF 705.1 Investment Performance and Objectives – Table 2 – Items 5 & 6 |

| Gross Investment Return net of fees | Reporting Form SRF 705.1 Investment Performance and Objectives – Table 2 – Items 5 & 6 |

| Strategic Asset Allocation | Reporting Form SRF 550.0 Asset Allocation – Table 1 – Items 2 – 10 and item 13 |

| Administration fees and costs | Reporting Form SRF 705.0 Components of Net Return – Table 1 – Items 5-6, 9-17 & 19-20 |

| Administration-related tax expense / benefit | Reporting Form SRF 705.0 Components of Net Return – Table 1 – Items 5-6, 9-17 & 19-20 |

| Advice fees and costs | Reporting Form SRF 705.0 Components of Net Return – Table 1 – Items 5-6, 9-17 & 19-20 |

| Administration-related tax expense / benefit | Reporting Form SRF 705.0 Components of Net Return – Table 1 – Items 5-6, 9-17 & 19-20 |

| Trustee Directed Product Indicator | Reporting Form SRF 605.0 RSE Structure – Table 3 – Item 5 |

| Member assets | Reporting Form SRF 606.0 RSE Profile – Table 4 – Item 5 |

| Total investments (MySuper) | Reporting Form SRF 533.0 Asset Allocation – Item 2.1 |

6. APRA has flexibility under the SIS Regulations to combine the performance histories of two or more products for the purpose of the performance test. How does APRA intend to use that flexibility?

APRA has outlined the principles and approach to combining performance histories for the purposes of the performance test through its:

- Information Paper published in August 2023, which is applicable for combining multiple MySuper Products, and

- Information Paper published in April 2023, which is applicable for combining two or more Trustee Directed Products (TDPs).

RSE Licensees are expected to notify APRA where the RSE Licensee has consider it is appropriate to combine the performance history of two or more TDPs given the products’ circumstances. APRA considers the RSE licensee’s submission and will advise the RSE licensee of APRA’s decision.

7. How will APRA calculate the representative administration and advice fees, costs and taxes (RAFE) for an investment pathway in the performance test if there is more than one standard fee and cost arrangement reported in SRF 705.0 Table 1?

As per FAQ 605.0 t, the standard fee arrangement should reflect the absence of any custom fee arrangement. In most cases, it is sufficient to report one standard fee arrangement which applies to all products.

However, if there is more than one standard fee arrangement reported for an investment pathway, APRA will use the highest reported administration fees, costs and taxes.

8. How will APRA calculate a product’s net investment return / gross investment return net of fees for an investment pathway in the performance test if there is more than one standard fee and cost arrangement reported in SRF705.1 Table 2?

As per FAQ 605.0 t, the standard fee arrangement should reflect the absence of any custom fee arrangement. In most cases, it is sufficient to report one standard fee arrangement which applies to all products.

However, if there is more than one standard fee arrangement reported for an investment pathway, APRA will use the lowest reported investment return.

9. When an investment option has existed throughout the entire reporting quarter but the superannuation product and/or investment menu (i.e. investment pathway) have changed over the reporting quarter, how should this be reported?

APRA expects the following for Choice investment pathways (excluding MySuper partial interests) in SRF705.0 and SRF705.1:

| Option existed throughout the entire quarter but the… | SRF705.0 | SRF705.1 | ||

| Gross Investment Return | Investment fees, costs and taxes | Administration fee | Investment Return | |

| Product inception date part way through the quarter | Full quarter | Full quarter | Full quarter^ | Full quarter |

| Product ended part way through the quarter | Full quarter | Full quarter | Full quarter^ | Full quarter |

| Menu inception date part way through the quarter | Full quarter | Full quarter | Full quarter^ | Full quarter |

| Menu ended part way through the quarter | Full quarter | Full quarter | Full quarter^ | Full quarter |

^The value is to be reported as if the superannuation product and investment menu have existed for the full quarter.

10. What needs to be reported where an investment option with multiple asset classes does not have any strategic asset allocation benchmarks?

See the response to 550.0 n in FAQs on the Superannuation Data Transformation Project.

11. How are standard fee and cost arrangements reported at each level of product, menu and option?

As per Superannuation Data Transformation FAQ 605.0t, the standard fee arrangement should reflect the absence of any custom fee arrangement. In most cases, it is sufficient to report one standard fee arrangement that applies to all products.

Where more than one standard fee and cost arrangement has been reported in SRS 605.0 RSE Structure Table 4, RSE licensees cannot report ALL under ‘Fees And Costs Arrangement Identifier’ in SRS 705.0 Components of net return, SRS 705.1 Investment Performance and Objectives or SRS 706.0 Fees and Costs. Instead, RSE licensees must report a separate row for each fee arrangement.

Importantly, under SRS 705.0, SRS 705.1 and SRS 706.0, APRA expects entities to report one standard ‘Fees And Costs Arrangement Identifier’ for each investment pathway (combination of Superannuation Product, Investment Menu and Investment Option). Where applicable, the relevant custom ‘Fees And Costs Arrangement Identifier’ should also be reported for the investment pathway.

Technical FAQ 7 and 8 in Your Future, Your Super Frequently Asked Questions state how multiple standard fees are treated in the performance test.

12. How is “Not Specified” and “Not Applicable” domicile type and listing type reporting in Table 1 of SRS 550.0 Asset allocation treated for the purposes of the definition of a “trustee-directed product”(TDP)?

The strategic asset allocation reported on table 1 in SRF 550.0 is converted into covered asset classes defined in reg 9AB.17 of the SIS Regulations. For some asset classes, the domicile and/or listing type must be known to complete this conversion. If the domicile and/or listing type columns are reported as “Not Specified” and /or “Not Applicable”, the allocations are split equally into Australian and International domicile and Listed and Unlisted respectively in accordance with 9AB.5 of the SIS Regulations. Once the covered asset classes have been identified the investment option will be assessed on whether it’s a TDP having regard to reg 9AB.2 of the SIS Regulations.

For more information

Email PerformanceAssessment@apra.gov.au or mail to

Senior Manager, Superannuation Strategic Insights - Life & Private Health Insurance & Superannuation

Australian Prudential Regulation Authority

GPO Box 9836, Sydney NSW 2001