Quarterly authorised deposit-taking institution property exposure statistics - highlights

Key messages

- Mortgage borrowers remained resilient as interest rates increased. However, increases in the amount of arrears and non-performing loans suggest that there is a small, but growing, cohort of stressed borrowers.

- New residential lending, excluding refinancing, accelerated despite interest rate increases. External refinancing has reduced from record highs as ADIs withdrew incentives such as cash backs.

- Strong demand within the industrial sector supported growth in commercial property lending. Non-performing exposures marginally increased as a small subset of overseas property portfolios came under pressure.

Residential mortgages: credit outstanding

Mortgage credit continued to grow but at below pandemic era levels.

- Overall mortgage credit outstanding grew 4.3 per cent over the year to December 2023. While the rate of growth has slowed, it remained above pre-COVID levels. Overall credit outstanding for owner-occupiers grew faster than for investors, at 5.1 and 3.8 per cent respectively.

Borrowers continued to meet higher loan repayments…

- Borrowers continued to meet their required mortgage repayments, despite continued cost of living pressures and increases in interest rates.

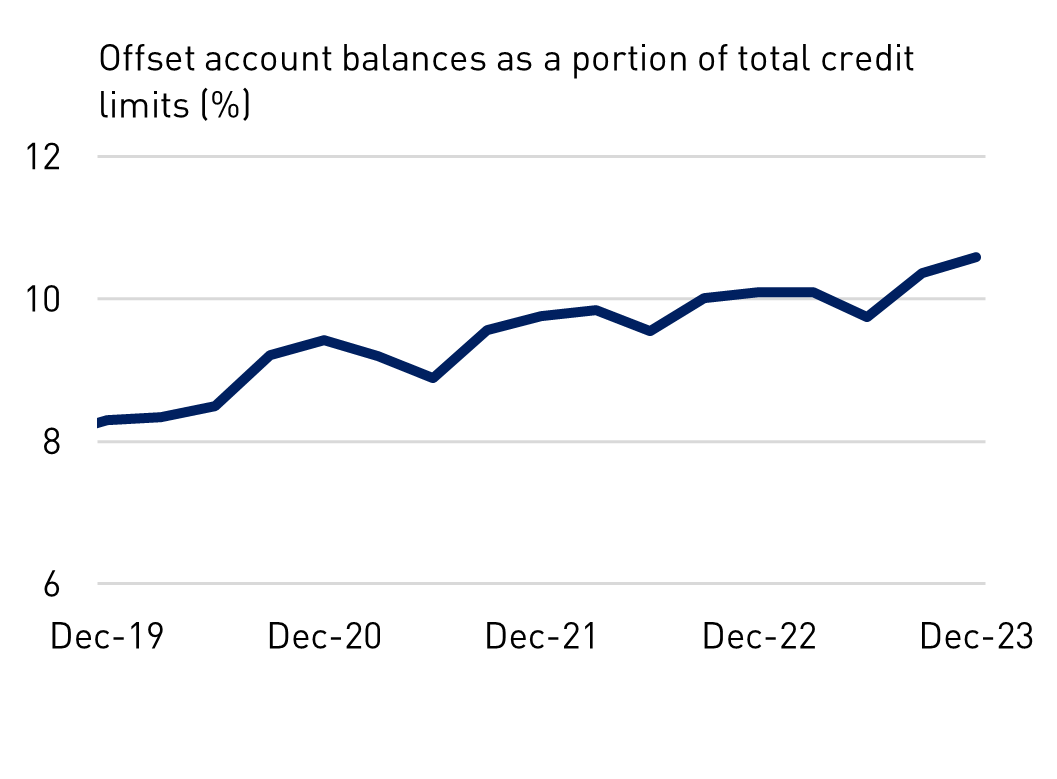

- Prepayment balances continue to increase, but this is not consistently observed across all borrowers. Balances in offset accounts increased to 11 per cent of credit limits, the highest share since the data series began in March 2019. Higher interest rates, however, have resulted in higher scheduled loan repayment amounts, thereby reducing the number of future repayments covered by these buffers.

.…however, there is a small, but growing, cohort of stressed borrowers.

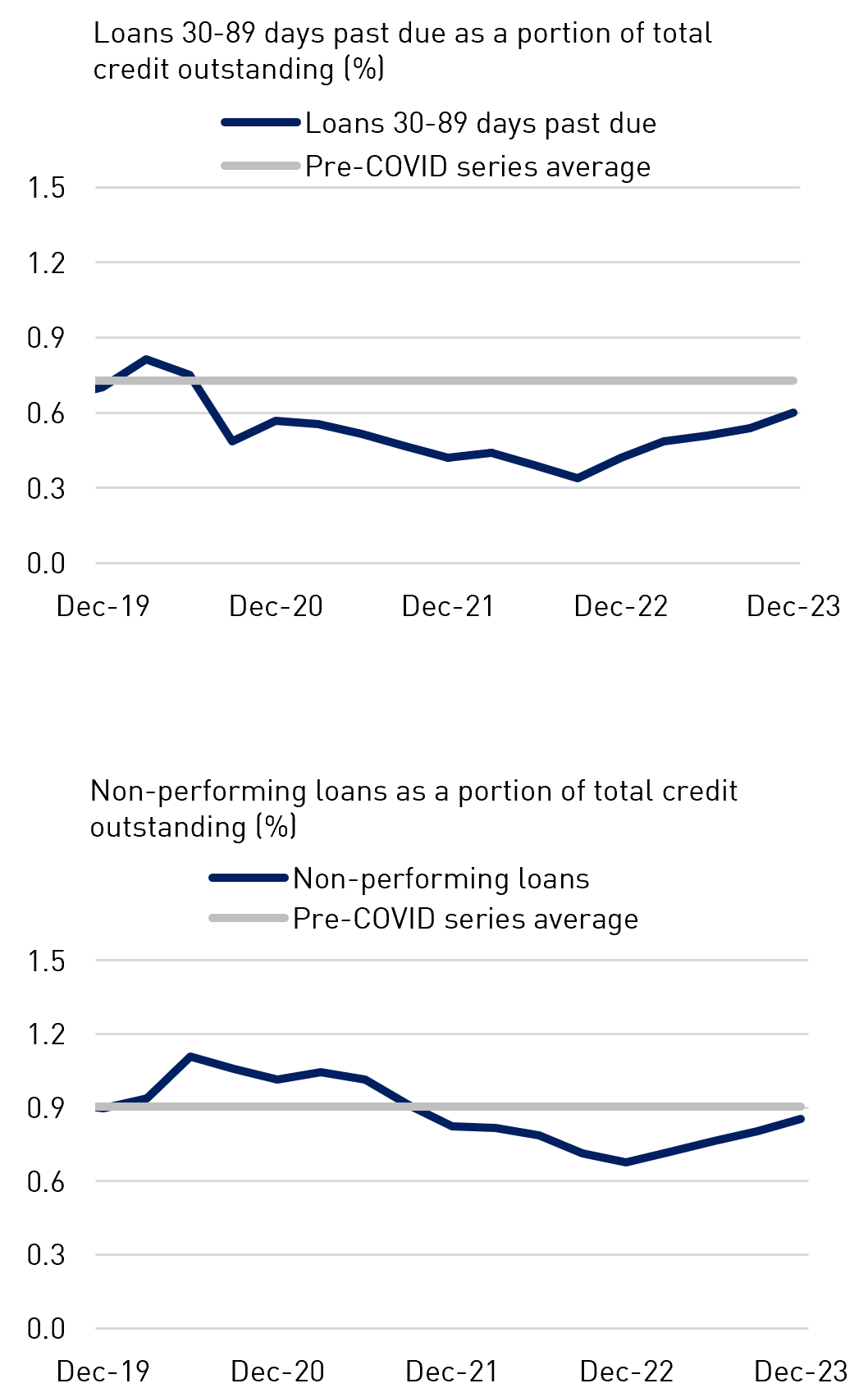

- A small, but growing, portion of borrowers are entering stress. Loans 30-89 days past due increased to 0.60 per cent of total loans over the quarter. This is the fifth consecutive quarter of increase in these arrears; however, it is still below historical levels.

- The ratio of non-performing loans to total credit outstanding continued to increase towards pre-COVID levels. The non-performing loan ratio increased to 0.85 per cent over the December 2023 quarter, having grown at a consistent pace since December 2022.

- The vast majority of these non-performing loans have adequate security to cover the outstanding debt. Only 7.6 per cent had a loan-to-valuation ratio greater than 95 per cent.

Residential mortgages: new lending

New lending returned to growth.

- New lending accelerated over the quarter, after a period of deceleration. New lending in the December 2023 quarter was 1.6 per cent higher than December 2022. Excluding refinancing, new lending was 18 per cent higher. Forward indicators, such as lending commitments, suggests this growth will continue next quarter.

- New investor lending returned to modest growth, ahead of owner-occupier lending, which is recovering. Just under one third of new term loans were for investment purposes, including refinancing, well below the peak observed in 2015.1

- External refinancing came off record highs as lenders withdrew cashback offers, and with new expectations for future cash rate decreases. Strong competition for new mortgages has resulted in narrowing margins.

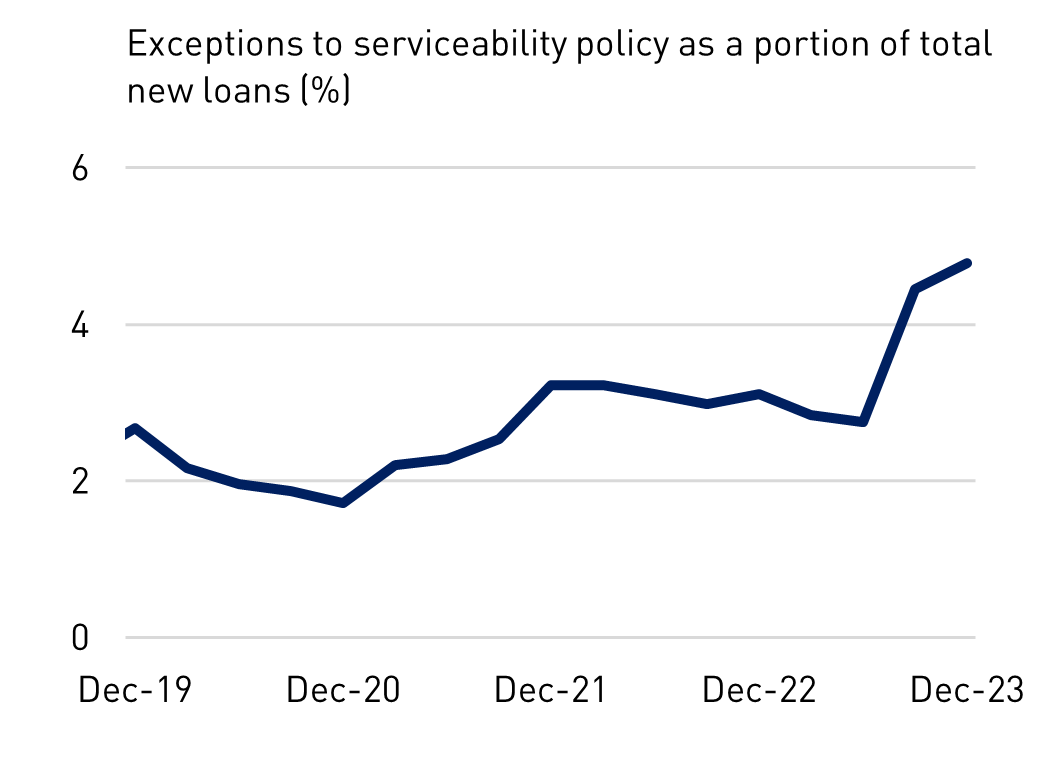

Refinancing continued to drive an increase in policy exceptions.

- Under APRA’s prudential framework, banks can use exceptions to their serviceability policies in a prudent and limited manner. APRA monitors these exceptions closely.

- Higher interest rates can make it difficult for some borrowers to refinance with another lender because they may no longer meet standard loan criteria. Some ADIs are applying exceptions to these criteria for refinancing, by considering other indicators of repayment capacity.2

- These specific refinancing exceptions continue to drive an increase in overall exceptions to serviceability policy, despite the decline in external refinancing volumes. This increase is expected to stabilise over the coming quarters. Other types of exceptions to serviceability policy were stable.

Banks maintained prudent lending standards.

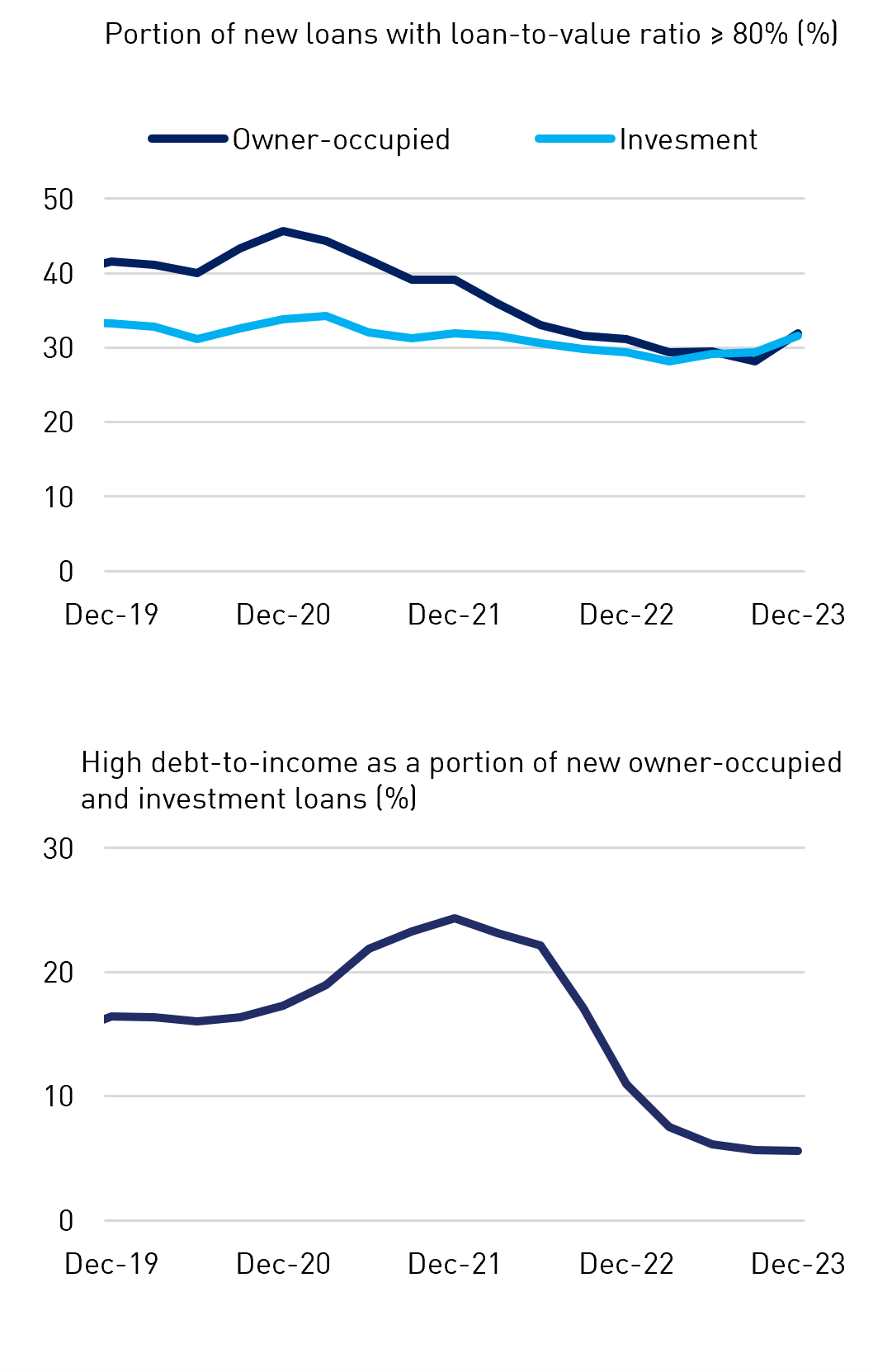

- Lending standards remained prudent. The share of new loans with a loan-to-value (LVR) ratio greater than or equal to 80 per cent remains low, although there was a marginal increase during the quarter to 31.4 per cent. In aggregate, high-LVR lending remains below pre-COVID levels.

- The fall in refinancing levels contributed to a small increase in the share of new loans with a LVR greater than or equal to 80 per cent. Refinanced loans tend to have lower LVRs as they tend to take place after borrowers have built up equity.

- Borrowers are taking on less debt relative to their incomes, as higher interest rates have reduced borrowing capacity. The share of borrowers with total debt over six times their income has stabilised at 5.6 per cent. This is the lowest level reported since the series began in March 2019.

Commercial real estate

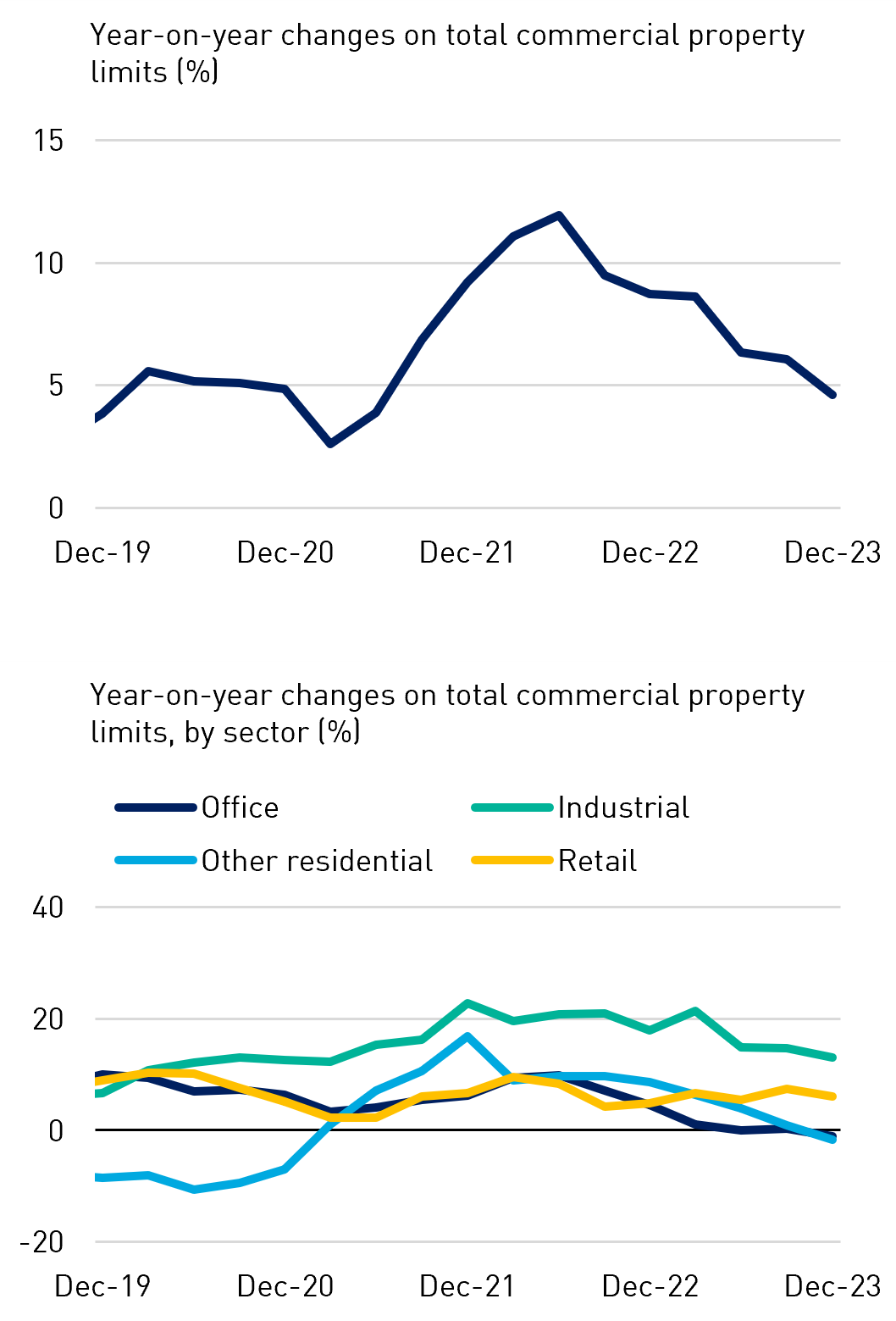

Growth in commercial real estate lending continued to slow

- Although commercial real estate lending continued to increase, its rate of growth has softened significantly from the peak observed in June 2022. Overall commercial real estate exposure limits grew by 4.6 per cent in the year to December 2023.

- Strong demand for warehouses contributed to the increase in ADIs’ commercial real estate exposures. Industrial property exposure limits grew by 13.0 per cent in 2023. Retail property exposure limits increased by 6.1 per cent despite slowing consumer spending.

- ADIs’ lending for offices and other residential property was muted. Exposure limits for these categories decreased by 1.1 and 1.7 per cent respectively over 2023.

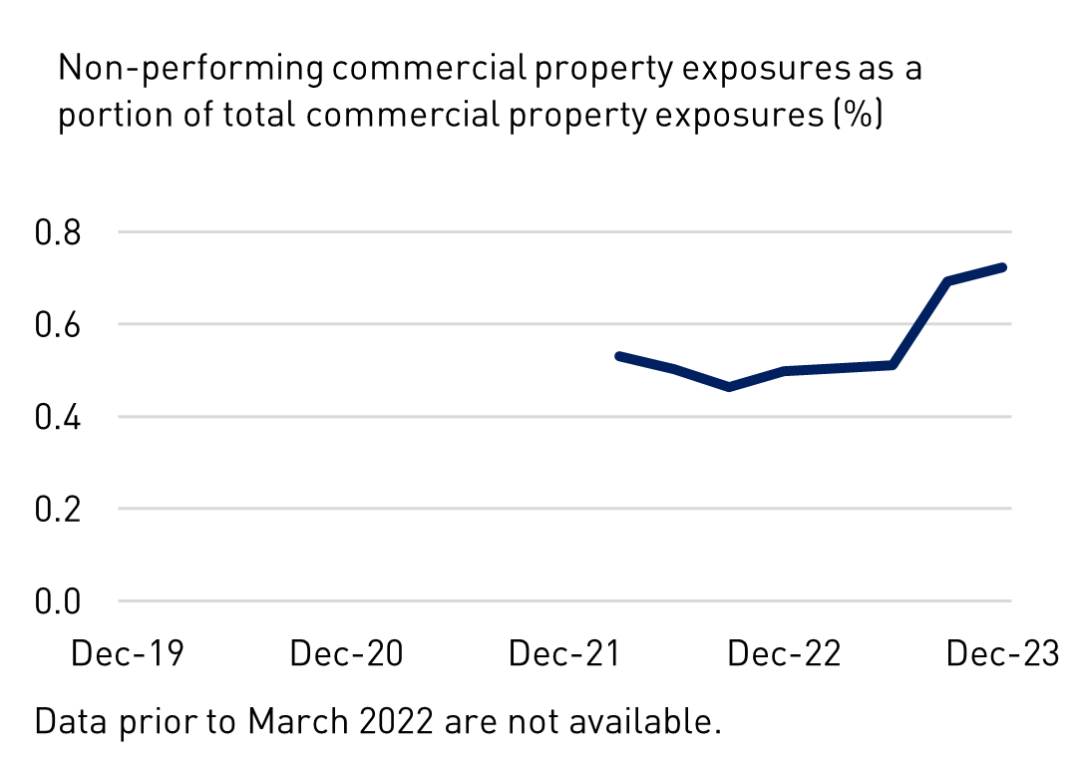

Non-performing exposures increased marginally.

- Non-performing commercial property exposures increased marginally over the December quarter to 0.72 per cent of total commercial property exposures.

- The small increase in non-performing commercial property exposures was primarily driven by overseas exposures, which remain a small part of ADIs’ book. It is lower than the non-performing rate of 0.95 per cent for ADIs’ overall lending.

- APRA is continuing to monitor this sector closely, in the context of developments overseas.

Footnote

1See Historical Data Quarterly authorised deposit-taking institution statistics

2Letter to all ADIs: Housing lending standards: Reinforcing guidance on exceptions