APRA Deputy Chair Helen Rowell - Speech to the 2019 ASFA Conference

Turning up the heat on underperformance

Good morning. It is a pleasure to be here and address this significant superannuation industry event again this year.

APRA’s Corporate Plan, released in August 2019, sets out the key elements that form part of our superannuation agenda for 2019 to 2023: namely strengthened prudential standards, an intensified supervision approach, a significantly enhanced data collection, and improved industry transparency. The Corporate Plan also makes clear that one of APRA’s core strategic priorities is improving member outcomes in superannuation – and today provides an ideal opportunity for me to tell you about one of the key initiatives that we are implementing to support that. We are also continuing to progress our broader agenda to lift standards of practice in key areas across the superannuation industry and my colleague, Suzanne Smith, provided an update on our progress in some of those areas in a session yesterday afternoon. Her speech is available on APRA’s website for those who may have missed it.

I often use events like this to emphasise where the industry needs to do better, and I will do that again today. But it is also important to acknowledge the good outcomes being delivered for many members. In the coming days, APRA will publish the second edition of its new-look Insight newsletter, which will have a special focus on superannuation. It includes an interactive timeline depicting the changes and advancements in superannuation over recent decades; not only the legal and regulatory reforms, but also the increasing financial benefits the system is delivering for members.

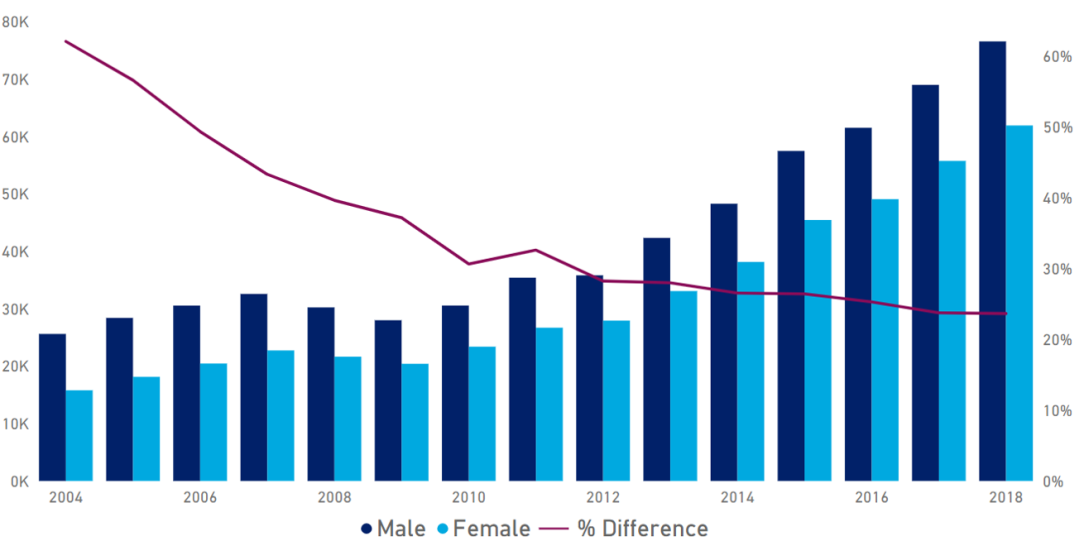

As just one example of improved outcomes, this chart shows how average superannuation fund balances have increased over the past 15 years. (Figure 1). As you can see, aside from a dip during the global financial crisis, average industry balances have grown strongly year-on-year, and the average super account balance is around 3.5 times that in 2004. Importantly, the gap between male and female account balances is also shrinking, which is good news but of course more needs to be done to fully close the gap. Average fund returns for the industry as a whole have also been strong over the last 15 years, at 6.5 per cent per annum, and the proportion of the population with superannuation coverage is now 78 per cent – one of the highest levels in the world.

Figure 1: Average Account Balance by Gender

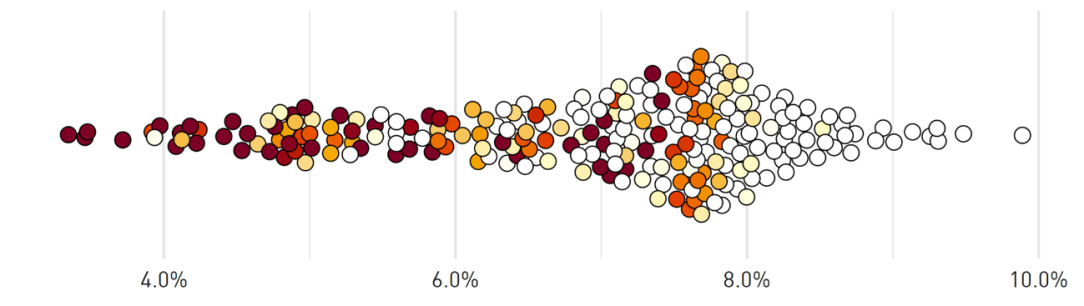

So at an overall level, the story of the Australian superannuation system is generally a positive one, as emphasised by the Melbourne Mercer Global Pension System Index recently ranking it the world’s third best.1 However it’s not universally positive, particularly as we start to look deeper and differently at the data being reported and the impact on member outcomes. There is a potentially vast gap between the net returns achieved by members of the top performing MySuper products versus those at the bottom, and also in the fees that are paid by members in different MySuper products (Figure 2). And as the Productivity Commission noted2, over time this variation can have a significant impact on retirement outcomes for members of the products that are delivering poorer outcomes. It also has a wider impact through increasing reliance on the age pension and hence the level of taxpayer support required.

Figure 2: Significant Variation in Outcomes

5 year net return ($50,000 rep member)

Total fees disclosed ($50,000 rep member)

That is why improving outcomes for superannuation members is a key strategic priority in APRA’s Corporate Plan for 2019 to 2023. Achieving this objective requires lifting standards of practice across the industry – requiring trustees to assess the outcomes they are delivering for members, and fix any identified weaknesses. And APRA’s Prudential Standard SPS 515 Strategic Planning and Member Outcomes (SPS 515), which takes effect from 1 January 2020, requires just that.

It also means APRA intensifying its supervision efforts to ensure that SPS 515 is implemented effectively by the industry and that we weed out the industry’s underperforming tail. Supported by stronger powers, better quality data and a new willingness to publicly call out underperformers, APRA intends to turn up the heat on trustees that aren’t serving their members’ best interests – either by forcing them to lift the outcomes they deliver or forcing them out.

Know your place

Comparing funds with different investment strategies, corporate structures and member demographics is inherently difficult. As APRA has argued repeatedly, superannuation performance can’t be assessed using a single metric or by peer rankings alone. Investment returns are important, but a singular focus on that one factor risks obscuring the bigger picture. Further, many funds have different risk/return profiles, especially those with an older demographic profile and hence (appropriately) a more conservative investment strategy. Assessing investment performance on a risk adjusted basis is therefore important to ensure that those differences in strategy are appropriately taken into account. But other factors contribute to the outcomes members receive, such as fees, expenses, insurance, sustainability, and quality of services provided, and also need to be considered.

APRA has traditionally incorporated these wider factors, using both the data we collect and the insights gained from our supervision activities, in our assessment of trustees. Based on this assessment, APRA has been gradually increasing its supervision intensity in recent years on those trustees identified as not delivering quality outcomes for their members. The strengthening of the regulatory framework and APRA’s supervision focus have been significant factors in the number of APRA-regulated superannuation funds more than halving over the past decade3, as many trustees accepted they couldn’t meet the higher regulatory and supervisory expectations they were being held to. Most notably, in late 2017 we identified for intensified supervision a list of what we referred to at that time as ‘outliers’; all of these have taken (or are well progressed in taking) action to either address the areas of concern APRA had identified, or have exited the industry – although in a few cases further action may still be required.

Historically, it’s been harder for trustees to gain a reliable sense of how the outcomes they deliver compare relative to their peers and objective benchmarks across the full spectrum of their operations. But that should begin to change with SPS 515 Strategic Planning and Member Outcomes commencing on 1 January next year. The Business Performance Review, together with legislated member outcomes assessment, are aimed squarely at enabling trustees to have a clear sense of where they sit in comparison to the rest of the industry and relevant benchmarks. The self-reflection that this is intended to encourage – and the fixing of any identified weaknesses that is required in response – are key planks in APRA’s strategy to lift member outcomes across the industry.

Although an important step forward, in isolation SPS 515 is not sufficient to address areas of underperformance. For this reason, APRA is also committed to collecting and publishing more granular, reliable and accessible superannuation data – a multi-year programme of work. A major step in that initiative was taken last week when we commenced consultation on transforming our superannuation data collection. The uplift in breadth, depth and quality of the data we collect will significantly strengthen our – and other stakeholders’ - visibility and understanding of outcomes being delivered across the industry. It will inform the setting of our supervision priorities, including which trustees are targeted for intensified supervision. However, even with stronger powers introduced by the member outcomes legislation earlier this year, we are mindful that APRA is still likely to meet resistance in persuading the trustees of some chronically underperforming funds to merge or exit the industry.

The latest step in our efforts to weed out underperformers harnesses another powerful tool: public exposure.

Galvanised into action

In a few weeks APRA will publish a heatmap that provides insights into the outcomes being delivered by every MySuper product across three key areas: investment performance, fees and costs, and sustainability. Shortly after I finish speaking here, APRA will release an information paper outlining how we selected the metrics and benchmarks used, the methodology we have used to, for example, determine the thresholds that underpin the outcome assessments in the heatmap, and how we intend to present the heatmap. We will also release today a sample heatmap for illustrative purposes. I know there is a degree of both anticipation and trepidation by industry about this piece of work, so I’d like to use this opportunity to give you a preview of what we will be releasing, including what the new heatmap will look like.

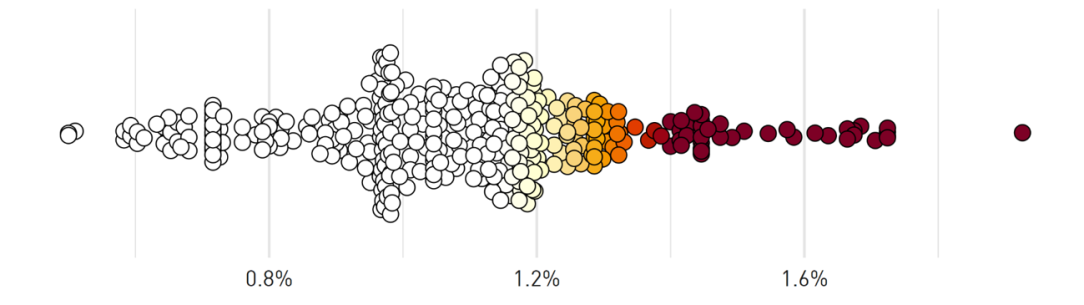

Its primary purpose is to provide credible, clear and simple insights into the outcomes provided by MySuper products across the superannuation industry. Almost all of the data used for the heatmap is already available, but it is spread across multiple publications and time periods. And it’s typically presented something like this (Figure 3):

Figure 3: MySuper statistical publications

APRA’s statistical publications are designed with clarity in mind, but they are aimed at industry. They can be challenging for non-experts to interpret, and they leave users to do the heavy lifting of assessing and comparing performance. This can unintentionally obscure poor performance, making it much easier for underperforming funds to blend into the background. That’s about to dramatically change.

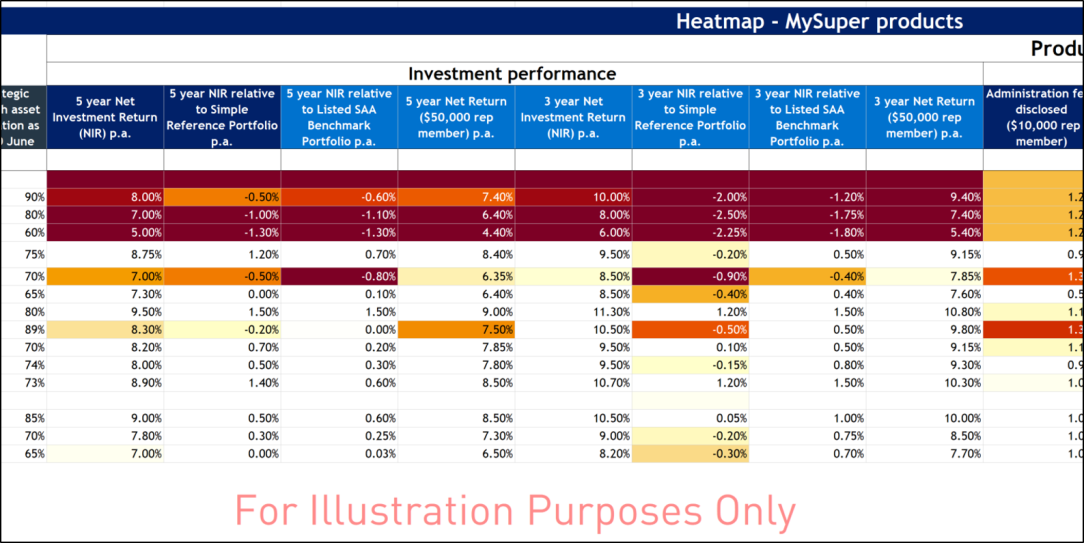

The proposed MySuper heatmap APRA is about to release looks like this (Figure 4):

Figure 4: MySuper heatmap – expanded version

The first thing you might notice is there is no green. This is not a traditional “traffic light” system with three distinct and simple categories. This is intentional. The heatmap is designed to emphasise underperformance; it’s not meant to give a pat on the back to better performing MySuper products, or be seen as a peer ranking mechanism. Any product that is performing above a determined benchmark for each investment performance or fee metric is coloured white. Products that are performing below that benchmark are presented on a continuous coloured gradient from pale yellow to dark red. (The approach for the sustainability indicators is a little different, and is explained in the Information Paper.)

Importantly, there is no overall assessment. Each MySuper product is assessed against each metric. So it is entirely possible for a product to be white for some investment performance metrics, yellow for others and red for fees and costs. Going further, each metric is divided into sub-categories. For example, the heatmap covers four different measures of investment performance (Figure 5).

Figure 5: MySuper heatmap - close-up

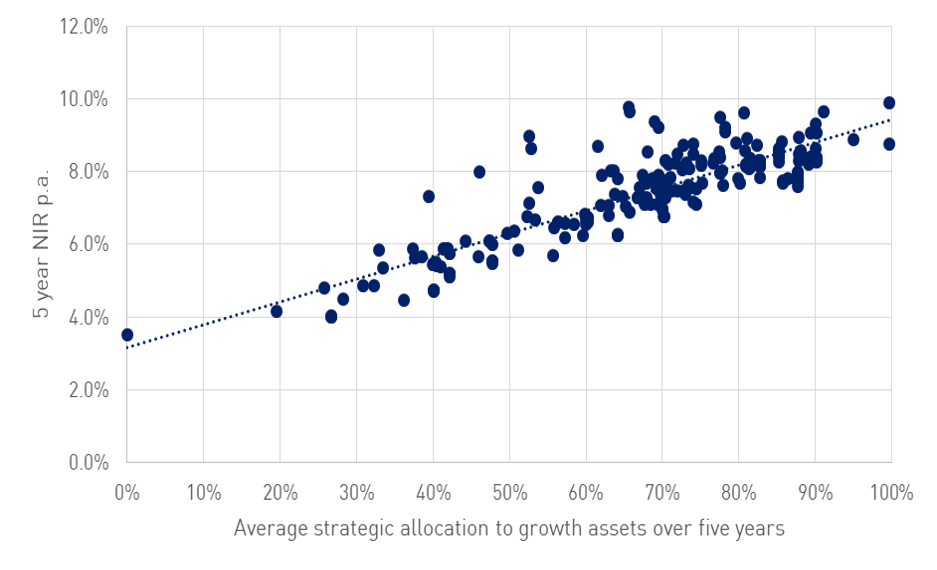

In addition to net returns and net investment returns, the heatmap includes two measures of risk-adjusted investment performance: net investment returns relative to simple reference portfolio, and net investment return relative to a strategic asset allocation benchmark portfolio. Further, in determining the benchmarks used to assess net return and net investment return underperformance we have also sought to ensure like-for-like comparisons based on the average allocation to growth assets over the appropriate timeframe (Figure 6).

Figure 6: Net investment return peer comparison on a risk-adjusted basis

The relative performance of each product is measured based on the difference between their performance and the appropriate reference point on the trend line. That takes away any concerns that trustees may have that they are being unfairly compared to products with a higher risk profile.

Breaking each broad assessment area down into multiple metrics makes the heatmap more complex, but it is necessary to deal with industry’s “apples and oranges” dilemma. It also shows that performance on one metric of performance may be strongly correlated with another, though not perfectly. Therefore, assessment across a range of metrics enables the user to draw deeper insights.

The heatmap is a significant step for APRA in our work to improve member outcomes. It is the culmination of more than a year’s worth of research and development, and has been subject to considerable external review. The end result is a publication that we firmly believe shows which MySuper products are underperforming in key areas and where they need to improve, even taking into account differences in investment strategy and asset allocation. Unlike a sea of numbers on a spreadsheet, a row of red across the heatmap sends a message so clear and strong it nearly jumps off the screen. That message is hard to ignore, and exactly what we’re counting on. As much as transparency is important, the ultimate purpose of the heatmap is – to be blunt – to galvanise the trustees of underperforming products into action.

The heatmap to be published in early December is now locked down, based on data submitted to APRA up until 15 November 2019. Our reporting standards are legally binding in the same way as prudential standards, and we expect trustees to have appropriate reporting processes in place that are subject to audit requirements under the Financial Sector (Collection of Data) Act 2001. Through the development of the heatmap, where data appears inconsistent with other publically available data, APRA has taken steps to investigate and follow up with entities, to the extent possible. However the onus remains on trustees to ensure data reported to APRA is accurate. Whilst there may be further refinements possible in the underlying data, we are confident that the heatmap accurately represents the outcomes that MySuper products are delivering for their members.

Over the next few weeks, APRA will be holding industry webinars to further explain how the heatmap has been developed, our methodology and how we intend to both use and update it. Over this same period, our supervision teams will undertake targeted engagement with the trustees of MySuper products that the heat map will clearly identify as the poorest performers, to make sure they will deliver on action plans to address this. The more crimson the heatmap, the more trustees can expect to see a similarly calibrated increase in supervision intensity.

We expect trustees to analyse why the outcomes in identified areas are relatively poor and whether the problems can be fixed in a reasonable period of time. If trustees don’t fix these issues within a timeframe that is acceptable to APRA, we will be requiring them to consider other options, including a merger or exit from the industry in some cases. Over the next year, you can expect to see APRA increasingly prepared to judiciously apply all of its powers, including its new directions power and imposition of additional licence conditions, to achieve change where needed.

Caveat member

Given the industry and media’s obsession with league tables, and the competitive tensions across the industry, we fully expect to see the heatmap quickly dissected and attempts made to rank MySuper products. It’s essential to therefore sound a note of caution, and emphasise not only what the heatmap does, but what it is not intended to do.

Crucially, the heatmap doesn’t provide a complete picture of trustee performance. It provides great insights into the outcomes being delivered by MySuper products in the areas it covers – but that is all. It is not designed to be used by members as their only source of information to make decisions about where to invest their retirement savings. And even though the metrics take into account some product differences, the outcomes individual members experience can vary markedly based on many factors, such as account balance or age.

So the heatmap tells an important story but not the full story. It provides a starting point for trustees to give further consideration to their MySuper product performance and how to improve it. For APRA, it will signal areas for further analysis and help determine where and when heightened supervision intensity or possible enforcement action is necessary. And it’s also a starting point for other industry stakeholders, including employers and members, to develop a greater understanding of superannuation performance and how their choices and personal circumstances can influence retirement outcomes.

All white is not all right

Before I conclude, let me also counsel against any sense of complacency among the trustees of funds who appear on the heatmap more as Snow White than Simply Red. The colour white indicates a MySuper product is performing around or above benchmarks for investment performance and fees and costs. It doesn’t mean blemish-free, or that there is no room for improvement for the MySuper product.

By publishing the heatmap, transforming our data collection and introducing stronger prudential requirements, APRA aims to create a culture across all of the industry of continuous improvement in delivering quality outcomes to superannuation members. Trustees have a legal duty to promote their members’ financial interests. Those interests are not best served by trustees deciding that they’re already good enough and have no more work to do.

A question of purpose

In wrapping up, let me briefly comment on purpose and value add.

Despite the continuing trend of consolidation in the superannuation industry, Australians still have the option of choosing between around 190 funds and 40,000 investment options. This level of choice arguably works against competition, with members so overwhelmed by options that they struggle to separate the wheat from the chaff.

APRA remains focused on ensuring all funds improve the outcomes they deliver for their members. However, we also consider that the interests of all members are likely to be better served by an industry with fewer funds, all performing better, and also far fewer products and investment options to choose between.

So when trustees sit down a few weeks from now to digest their place on our new heatmap and consider where they must improve, and also when they undertake their Business Performance Review under SPS 515, I’d like them to honestly reflect on some important questions:

“What is our purpose?”

“Does our fund offer a compelling value proposition for our members?”

“Do we bring something different to the market, or are we just another middling superannuation fund offering much the same thing as dozens of other funds, although not as well?”

“Do we have the capacity and ability to do better?”

While addressing the weaknesses highlighted in APRA’s heatmap will help trustees improve the outcomes they deliver, their members’ best interests may ultimately be served by having their money managed elsewhere. And you can rest assured that if trustees are not able to reach that conclusion on their own, APRA will be helping some trustees to do so.

Footnotes:

1. Melbourne Mercer Global Pension Index 2019, p6.

2. Superannuation: Assessing Efficiency and Competitiveness, Productivity Commission Inquiry Report Overview, p2.

3. https://www.apra.gov.au/data-find-number-of-apra-regulated-superannuation-funds-from-2008-to-2018

Media enquiries

Contact APRA Media Unit, on +61 2 9210 3636

All other enquiries

For more information contact APRA on 1300 558 849.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding $9.8 trillion in assets for Australian depositors, policyholders and superannuation fund members.