Choice Heatmap

APRA’s Choice Heatmap presents data in a more flexible format and enables users to interact with the information. The heatmap uses a graduating colour scheme to provide credible, clear and comparable insights into multi-sector choice investment pathways across three areas: investment returns, fees and costs, and sustainability of member outcomes.

Metric definitions

- RSE licensee

- RSE name

- Superannuation product name

- Investment menu name

- Investment option name

- Member assets ($'000)

At the pathway level, as at 30 June 2022.

- Member accounts

At the pathway level, as at 30 June 2022.

- Open/Closed to New Members

- Strategic growth asset allocation

The allocation to growth assets as at 30 June 2022, based on strategic asset allocation data provided to APRA and a consistent definition of growth and defensive assets used for this analysis only.

- Strategic growth asset allocation category

The allocation to growth assets as at 30 June 2022, sorted into six categories.

- 8 year Net Investment Return (NIR) p.a.

As at 30 June 2022. Colours are applied based on the level of relative performance to the appropriate reference point in the NIR / growth asset allocation trend line and in line with the colour scale below:

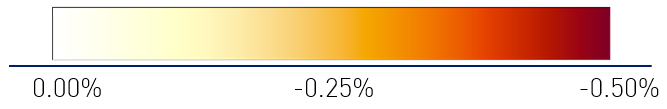

- 8 year NIR relative to SAA Benchmark Portfolio p.a.

As at 30 June 2022. Colours are applied based on the level of relative performance to the SAA benchmark portfolio and in line with the colour scale below:

- 8 year NIR relative to Simple Reference Portfolio p.a.

As at 30 June 2022. Colours are applied based on the level of relative performance to the Simple Reference Portfolio and in line with the colour scale below:

- 5 year Net Investment Return (NIR) p.a.

As at 30 June 2022. Colours are applied based on the level of relative performance to the appropriate reference point in the NIR / growth asset allocation trend line and in line with the colour scale below:

- 5 year NIR relative to SAA Benchmark Portfolio p.a.

As at 30 June 2022. Colours are applied based on the level of relative performance to the SAA benchmark portfolio and in line with the colour scale below:

- 5 year NIR relative to Simple Reference Portfolio p.a.

As at 30 June 2022. Colours are applied based on the level of relative performance to the Simple Reference Portfolio and in line with the colour scale below:

- 3 year Net Investment Return (NIR) p.a.

As at 30 June 2022. Colours are applied based on the level of relative performance to the appropriate reference point in the NIR / growth asset allocation trend line and in line with the colour scale below:

- 3 year NIR relative to SAA Benchmark Portfolio p.a.

As at 30 June 2022. Colours are applied based on the level of relative performance to the SAA benchmark portfolio and in line with the colour scale below:

- 3 year NIR relative to Simple Reference Portfolio p.a.

As at 30 June 2022. Colours are applied based on the level of relative performance to the Simple Reference Portfolio and in line with the colour scale below:

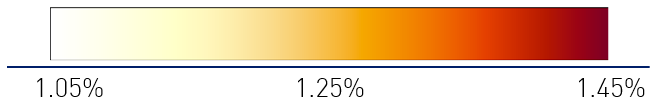

- Administration fees disclosed ($10,000 account balance)

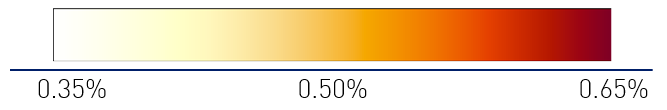

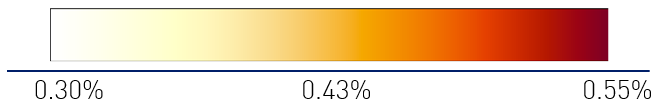

As at 1 October 2022. Colours are applied based on the administration fees for the representative account balance in line with the colour scale below:

- Administration fees disclosed ($25,000 account balance)

As at 1 October 2022. Colours are applied based on the administration fees for the representative account balance in line with the colour scale below:

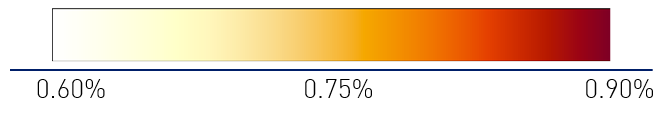

- Administration fees disclosed ($50,000 account balance)

As at 1 October 2022. Colours are applied based on the administration fees for the representative account balance in line with the colour scale below:

- Administration fees disclosed ($100,000 account balance)

As at 1 October 2022. Colours are applied based on the administration fees for the representative account balance in line with the colour scale below:

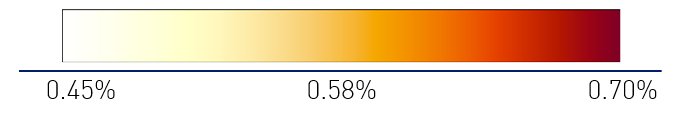

- Administration fees disclosed ($250,000 account balance)

As at 1 October 2022. Colours are applied based on the administration fees for the representative account balance in line with the colour scale below:

- Total fees disclosed ($10,000 account balance)

As at 1 October 2022.

- Total fees disclosed ($25,000 account balance)

As at 1 October 2022.

- Total fees disclosed ($50,000 account balance)

As at 1 October 2022.

- Total fees disclosed ($100,000 account balance)

As at 1 October 2022.

- Total fees disclosed ($250,000 account balance)

As at 1 October 2022.

- RSE Adjusted Total Accounts Growth Rate (3 year average)

The annual percentage change in member accounts, averaged over a three year period to 30 June 2022. Where a sustainability threshold condition is met, the metric has a colour overlay applied. Refer to Methodology Paper – Choice Heatmap for flagging thresholds.

- RSE Net Cash Flow Ratio (3 year average)

Net member benefit flows as a percentage of cash flow adjusted net assets, averaged over a three year period to 30 June 2022. Where a sustainability threshold condition is met, the metric has a colour overlay applied. Refer to Methodology Paper – Choice Heatmap for flagging thresholds.

- RSE Net Rollover Ratio (3 year average)

RSE net rollovers as a percentage of cash flow adjusted net assets, averaged over a three year period to 30 June 2022. Where a sustainability threshold condition is met, the metric has a colour overlay applied. Refer to Methodology Paper – Choice Heatmap for flagging thresholds.

^ Represents investment pathway that has reported compliance with the 2017 version of ASIC Regulatory Guide 97 (or N/A) rather than the 2020 version.

Useful information from consumers seeking to better understand superannuation can be found on the Australian Securities and Investments Commission’s MoneySmart website.

APRA Choice Heatmap Disclaimer and Terms and Conditions of Use

The Australian Prudential Regulation Authority (APRA) is an Australian Government statutory authority that supervises institutions across banking, insurance and superannuation and promotes financial system stability in Australia. As part of APRA’s role, APRA makes publications including on statistics for the financial sector.

- The Choice Heatmap (“the Heatmap”) utilises asset allocation, investment return and fee data provided to APRA by regulated RSE licensees. Superannuation RSE licensees are responsible for ensuring they report accurate data to APRA. APRA has taken reasonable steps to ensure the accuracy of metrics in the heatmap publication, and will endeavour to liaise with an entity directly if it identifies potential concerns regarding data quality. APRA believes that the Choice Heatmap is a useful tool supporting transparency in superannuation and provides valuable insights for Australian superannuation members and the industry. Data collection for superannuation choice products is still relatively new and will continue to improve as reporting requirements are embedded across the industry.

- The listing of a Choice investment option in the Heatmap, regardless of the set of ‘heat’ colours attributed to that Choice investment option, in no way implies any form of APRA endorsement or advice. It should not be taken as such. You will need to exercise your own skill and care with respect to your use of the Heatmap. The Heatmap is not a substitute for independent professional advice and you should always obtain any appropriate professional advice relevant to your particular circumstances.

- APRA will take reasonable actions to ensure the Heatmap is not compromised with bugs, trojan horses, spyware or adware. APRA accepts no liability or responsibility for any interference with or damage to your computer, software or data occurring as a result of access to, or use of, the Heatmap.

- By accessing the Heatmap you agree to the APRA’s terms and conditions of use.

© Australian Prudential Regulation Authority 2023. This publication may also contain third party supplied material that is subject to copyright. Any such material is the intellectual property of that third party or its content providers.

Key documents

Insights paper - Choice Heatmap

Published 26 April 2023

Methodology paper - Choice Heatmap

Published 26 April 2023

Heatmap archived documents and information - the central location for all documents related to previous iterations of the heatmap.

Related links

- Superannuation Heatmap FAQs – includes both general information and answers to a number of technical questions on the MySuper and Choice Heatmaps.

- Choice Heatmap metric definitions – provides the details of the metrics in the Choice Heatmap, including definitions, the data sources used to calculate the metrics, and more.

- Heatmap investment indices - outlines the indices used for each asset class to construct the reference and benchmark portfolios.