Strictly business: an update on commercial real estate lending

Insight Issue 4 2018

Poorly underwritten, monitored and controlled credit exposures to commercial real estate (CRE) borrowers have historically proven to be a key source of credit loss for banks. At the extreme, and usually linked with an economic downturn, these exposures have frequently been identified as the cause of bank failure. Often preceding more extreme CRE-related credit losses is a period of exuberance where CRE credit growth is rapid, credit underwriting conditions deteriorate and CRE credit exposures increase as a proportion of the loan portfolio.

Recognising the precursor risk factors for a concerning CRE underwriting cycle were building, APRA undertook a thematic review of bank CRE lending in 2016. Whilst the thematic review covered both development and investment lending, it focused particularly on residential property development, an area experiencing rapid growth and where APRA was concerned there may have been inadequate controls and weakening underwriting standards. Observations from this CRE thematic review were communicated in a letter to all ADIs in March 2017.

Since that time, APRA has continued to monitor CRE underwriting standards through both formal and ad-hoc data collections, the latter initiated as part of the thematic review. APRA has also been monitoring bank remediation of APRA-identified weaknesses.

The lenders

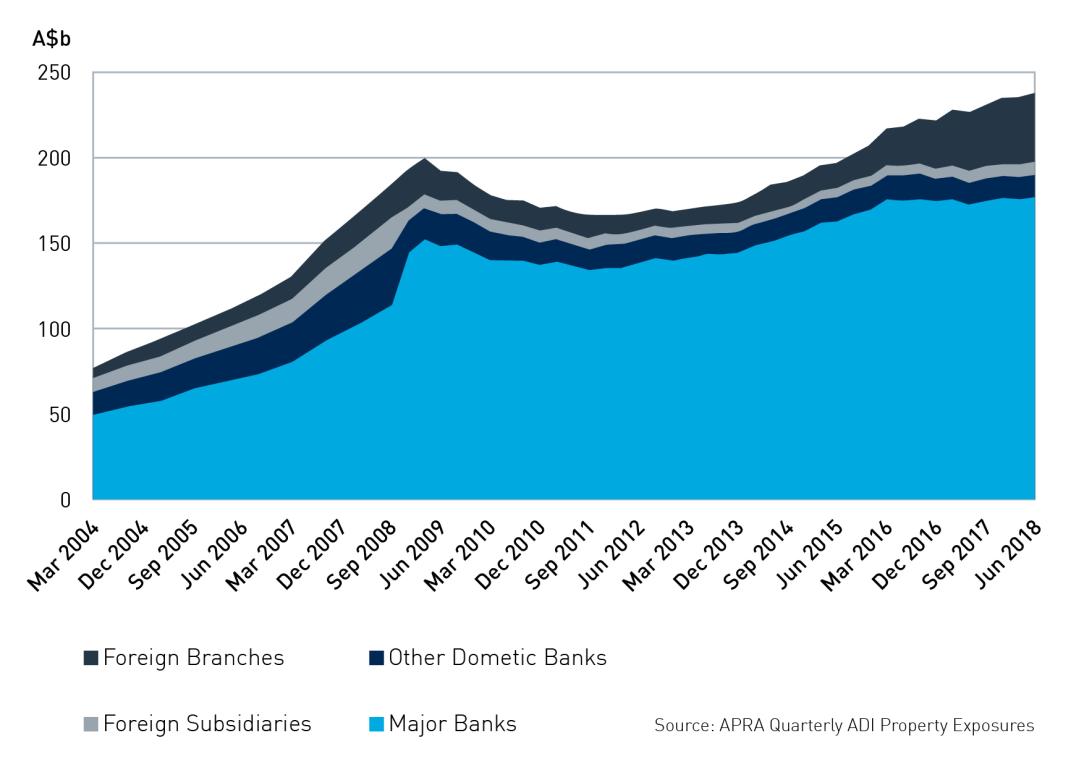

The major banks continue to be the main lenders to the Australian CRE industry. The foreign bank branch sector, the second largest CRE credit provider, has been growing rapidly and has exposure levels greater than other domestically owned banks and foreign bank subsidiaries combined.

Before the global financial crisis, foreign banks (subsidiaries and branches combined) lent approximately 20 per cent of all Australian CRE credit. The global financial crisis saw the exit of many European bank branch operations from Australia and an associated reduction in their CRE lending. Over the past four years there has been a resurgence in foreign branch bank CRE lending activity. Asian-based banks have driven the foreign bank sector’s lending to CRE back to – and above – pre-global financial crisis levels.

A history of losses

There are characteristics of CRE lending that make it an immediately profitable, relatively fast growing source of credit growth for banks entering new markets (both foreign banks and local banks seeking to expand interstate). CRE exposures generate prima facie strong returns for exposures that are typically secured. Banks undertaking CRE lending are able to undertake relatively large transactions with limited overheads or need for a substantial sales force, allowing rapid credit growth and providing frequently illusory confirmation to growth strategies. Often these same “out-of-territory lenders” are willing to accept weaker underwriting standards to gain market entry. The acceptance of lower standards by one segment can instigate a downward spiral when incumbents seek to fend off new entrants and retain market share. For market incumbents, pressure to maintain or grow revenue can outweigh the memory that there is a high price to be paid for ill-disciplined CRE lending.

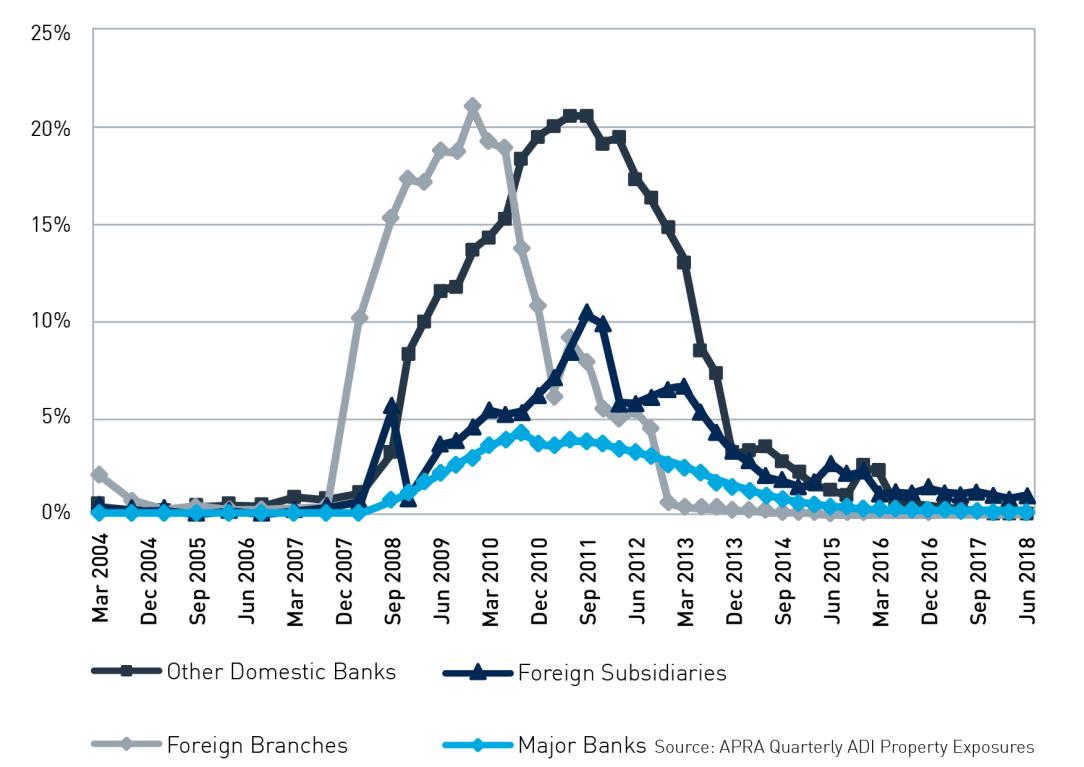

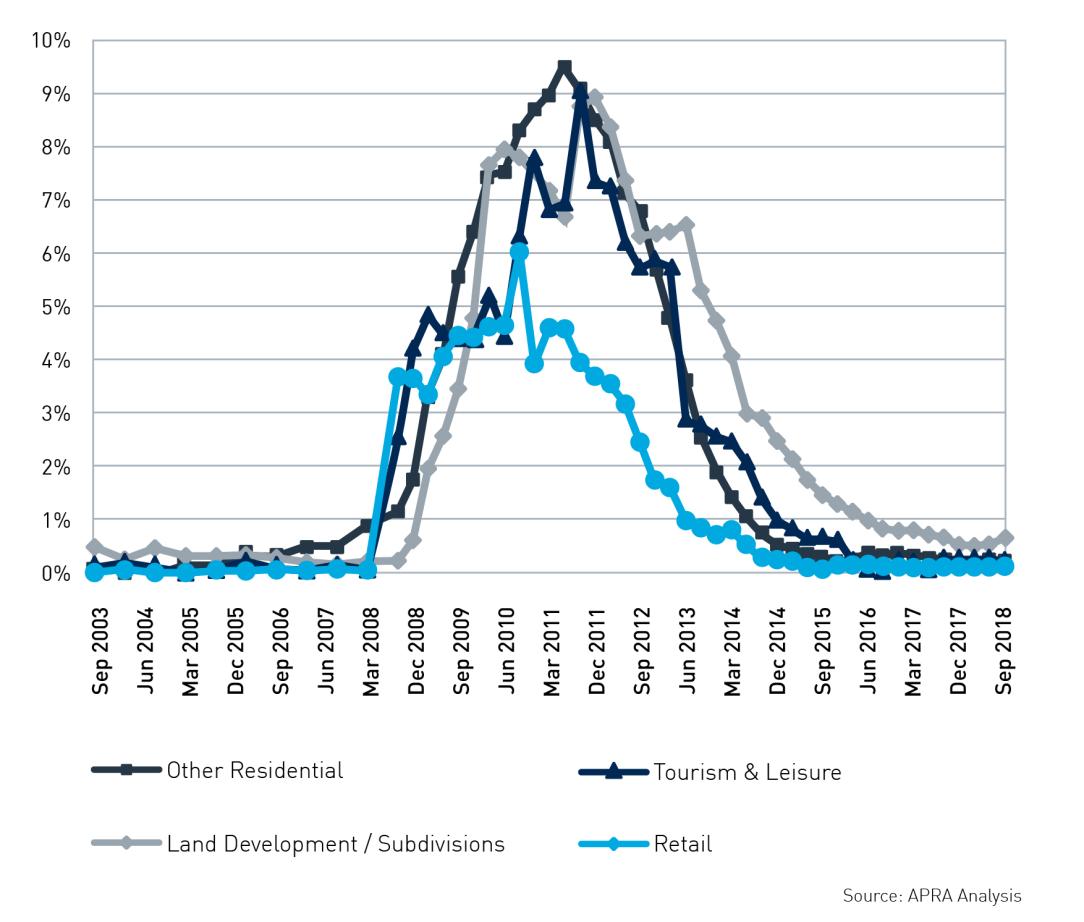

This pattern of outcomes, with out-of-territory lenders experiencing greater loss, is evidenced in APRA’s formal CRE data collections. Impairment rates experienced on CRE exposures differed substantially across ADI sectors through the downturn experienced in the global financial crisis.

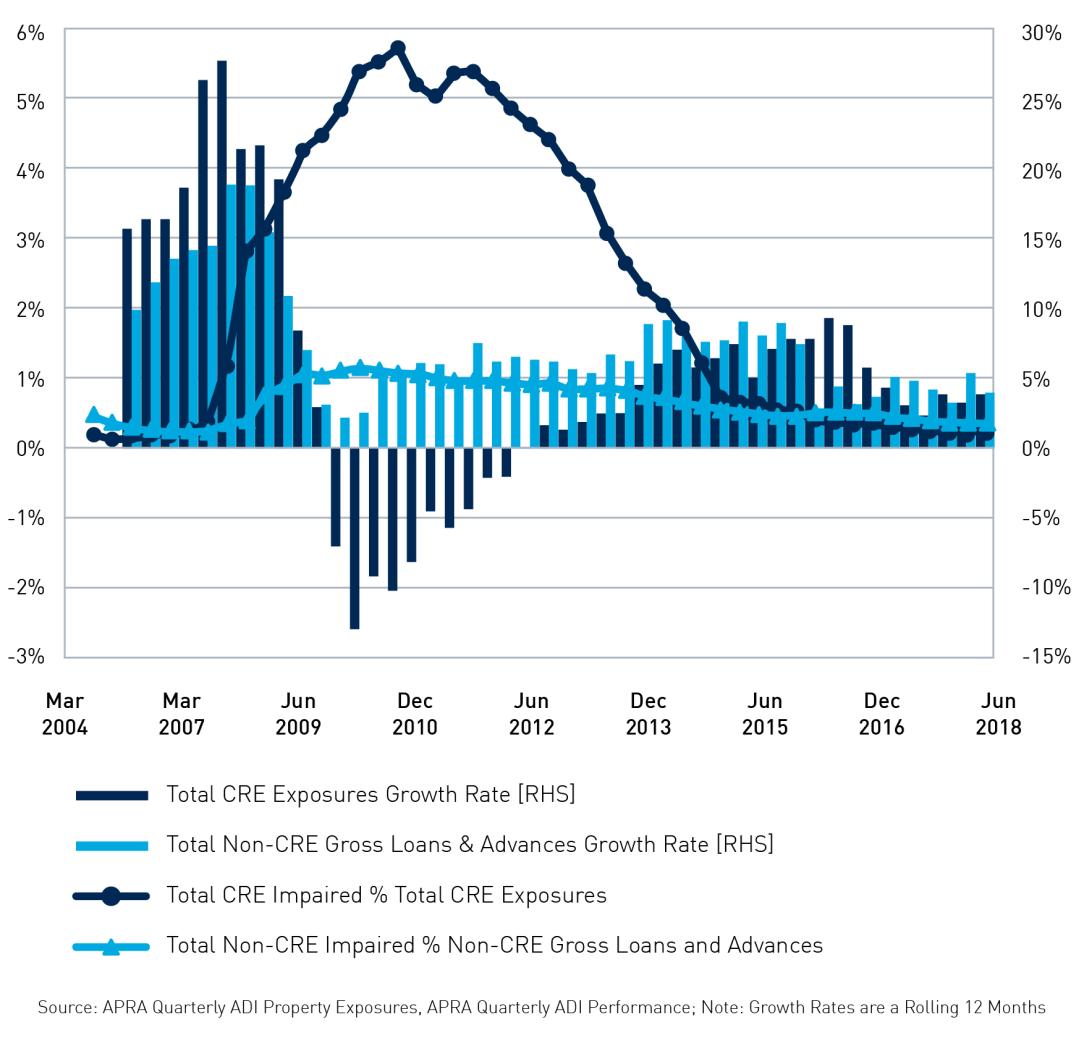

Credit risk is typically cyclical, with impairment rates and credit losses greater in and after an economic downturn. CRE lending is highly cyclical. While CRE credit exposures are typically secured like residential mortgages, their impairment rates and loss experience is often consistent with the more risky corporate exposures. The difference in impairment rates between bank CRE lending exposures and the remainder of the credit portfolio (predominantly composed of residential mortgages) was evident during the most recent downturn. This difference in observed riskiness supports the higher regulatory capital requirement for CRE credit exposures.

Rapid growth in CRE credit (and other credit generally) can indicate loose underwriting practices and future problems to come – the more rapid the growth, the greater the potential concern. This behaviour was observed in the lead-up to the global financial crisis and similar signs of building risk were present moving into 2016.

At inception, APRA had two goals from its 2016 CRE thematic reviews: firstly, to assess and, if necessary, initiate rectification of any imprudent CRE lending practices and secondly, reflecting the repetitive nature of CRE losses, to put in place monitoring to readily identify future deterioration in CRE lending underwriting standards.

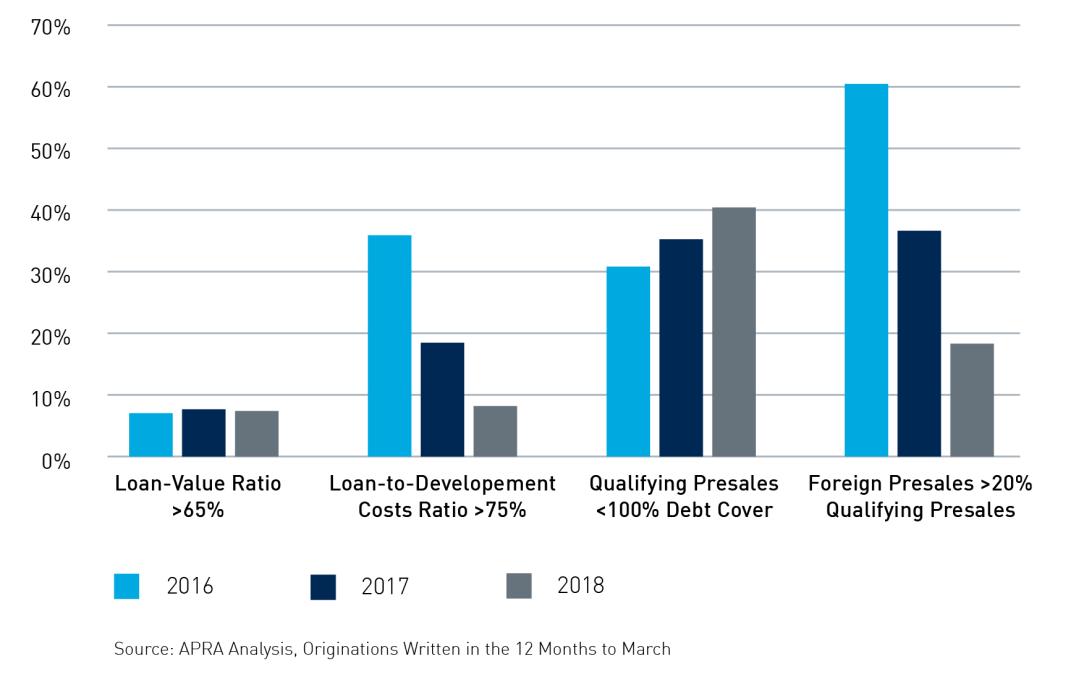

The thematic review indicated that, while underwriting standards were broadly adequate, there had been a weakening in underwriting standards by some banks and there was room for improvement in the general operating environment and controls around CRE lending. APRA noted that there was an increasing proportion of loans being written at higher Loan-to-Value Ratios (LVRs), Loan-to-Development-Cost Ratios (LDCRs), Interest Cover Ratios (ICRs) and Qualifying Pre-sales to Debt Cover (QPS Cover) levels, while the levels of foreign pre-sales (considered to have higher uncertainty) used to support qualifying pre-sales in developments were increasingly high.

CRE loan underwriting since APRA’s Thematic Review

Since the commencement of the CRE Thematic Review and the subsequent feedback from APRA, ADIs have generally tightened CRE underwriting parameters in their credit policies.

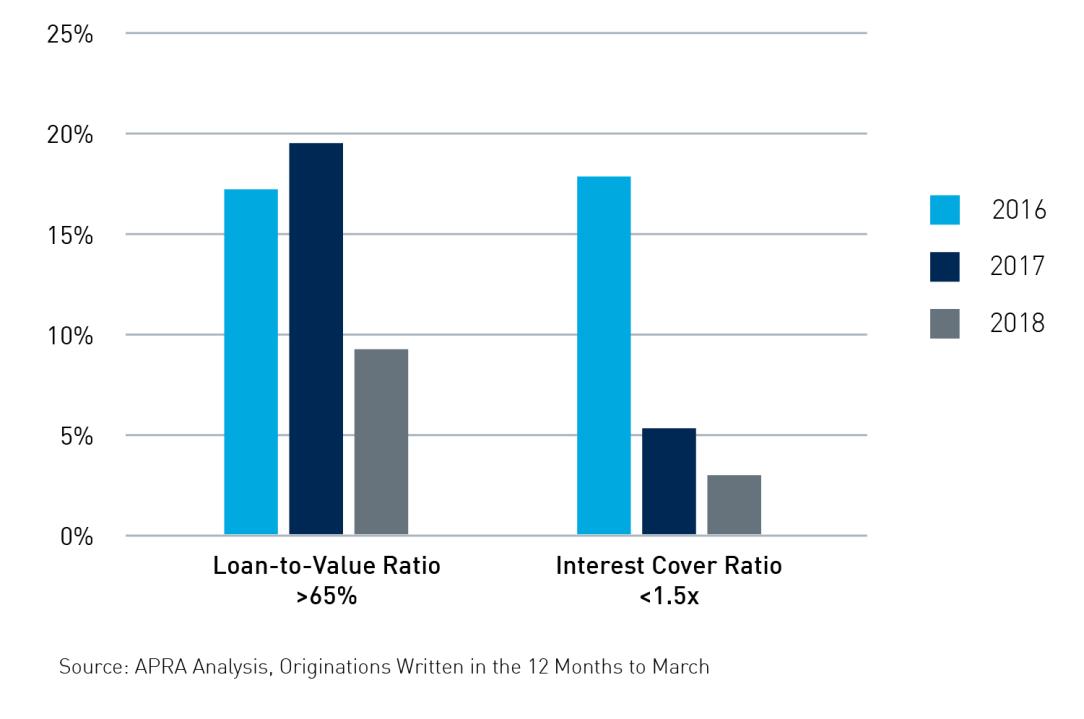

For both residential property development and property investment segments, the maximum LVR has reduced and now sits at around 65 per cent. Banks have increasingly moved to implement a minimum 100 per cent qualifying pre-sales requirement for residential property development and have reduced the level of acceptable presales from foreign purchasers. Loans to finance land banks and pre-development sites continue to be characterised by relatively short loan tenors (typically ≤2 years) and lower maximum LVRs (ranging between 50 to 65 per cent), reflecting their higher risk.

Policy changes rarely provide the full perspective on actual loan underwriting, with banks often deviating in one dimension or another. Reflecting this, APRA has been collecting transaction-level information to understand the delivered underwriting outcomes.

The greatest improvement has been in originations at lower LDCRs and lower levels of qualifying pre-sales from foreign purchasers. However, ADIs have adopted different definitions for development costs, such as using only ‘Hard Costs’ or both ‘Hard Costs' and ‘Soft Costs’ [3]. The rise in CRE loan originations where QPS Cover is less than 100 per cent is potentially a reflection of smaller developments finding it difficult to obtain sufficient levels of qualifying pre-sales or the developer’s strategy to hold some stock post completion.

More recently, APRA has observed an emergence of 'construct to hold' residential development loans which do not require, or require reduced levels of, qualifying pre-sales. All else being equal, these loans imply higher credit risk and are likely to reflect difficulties in obtaining qualifying pre-sales in an environment of softening demand from end purchasers, both foreign and local, in the presence of already boosted supply and softening house and apartment prices.

For land banks and pre-development sites, banks typically lend to lower LVR levels reflecting the higher risk that this form of CRE lending presents. For the 12 months up to 31 March 2018 there had been an increase in originations above an LVR of 50 per cent. While land bank and pre-development site loans are typically for a shorter tenor, this late cycle behaviour can increase ADI losses. Historically loans to finance land banks and pre-development sites, and residential property development, have incurred greater losses, reflecting higher property value volatility and the capitalisation of interest over the period of the debt reflecting the absence of cash flows from the property.

Property investment LVRs are influenced by a number of factors including different maximum LVRs for various property types and property locations. APRA has observed that ADIs have generally adopted more conservative maximum LVRs for riskier commercial property classes such as hotels and for properties located in regional or remote locations. There has been significant improvement in the serviceability assessment of property investment loans with a much lower level of originations being written with an ICR <1.5x. APRA also recognises that some ADIs factor in stressed interest rates within their ICR calculations which may make comparisons between ADIs difficult. For property investment loans, the majority of banks have implemented a maximum loan tenor that is at least one year shorter than the weighted average lease expiry of the relevant property’s tenancies.

Looking ahead

APRA has continued its interaction with ADIs involved in the CRE thematic review to monitor their progress in rectifying the deficiencies identified by the review. For foreign bank branches, this process has also included contact with the relevant home supervisory agencies. Progress has been made on a number fronts with banks generally tightening underwriting standards, putting in place tactical solutions to data and management information system gaps while preparing longer term correction, monitoring of underwriting exceptions has improved and portfolio limit frameworks have generally strengthened. APRA also intends to modernise its formal data collections for CRE lending in order to allow better prudential monitoring in this area.

Footnotes

[1] For "Other Domestic Banks" and "Foreign Subsidiary Banks" from June 2013 onwards we used Total CRE Impaired and Total CRE Exposures as there was no data for Australian exposures. In December 2008, Bankwest was sold by HBOS (foreign subsidiary bank) to CBA (other domestic banks) explaining the shift in CRE exposure at this time.

[2] For 2016, the minimum benchmark for Foreign Presales was >10% of Qualifying Presales.

[3] "Hard Costs" usually include land purchases, demolition and site clearing, construction and refurbishment, whereas "Soft Costs" may include professional fees, marketing, rates and taxes.