Removing Additional Tier 1 capital from the prudential framework

Executive summary

In December 2024, APRA announced its decision to remove Additional Tier 1 (AT1) capital from the bank prudential framework from 1 January 2027, replacing it with more reliable and effective forms of capital. This followed two rounds of public consultation and extensive industry engagement over a 12-month period. The decision to remove AT1 was in response to lessons learned from the overseas banking turmoil in 2023 where AT1 failed to fulfil its intended role as going concern capital when several US and European banks either failed or required rescue.

The key objectives of APRA’s reforms are to:

- Improve capital effectiveness in crises, with fewer uncertainties and complexities that can hinder recovery or resolution.

- Reduce compliance costs for banks, by simplifying the framework and replacing a type of capital instrument that is subject to additional burden relating to design, marketing and issuance.

- Enhance proportionality by lowering the cost of capital for smaller banks relative to larger banks.

Embedding the removal of AT1 capital

APRA is now consulting on technical amendments to its bank prudential framework to both effect, and address impacts stemming from, the removal of AT1. This requires amending seven prudential standards, three reporting standards, and three prudential practice guides. Draft revised standards and guides have been released alongside this Consultation Paper.

These amendments embed the key decisions in APRA’s December 2024 letter:

- Removal of AT1 from the minimum capital requirements for banks, including eliminating the concept of Tier 1 capital and recalibrating Common Equity Tier 1 (CET1) capital and Total capital requirements.

- Transitional arrangements for existing AT1 instruments to be treated as Tier 2 capital until the first call date (2032 at the latest).

- Other amendments to the framework to remove references to AT1 and Tier 1 requirements.

In line with the December 2024 letter, this consultation does not increase overall capital requirements for banks.

This consultation clarifies APRA’s proposed approach for a range of less material issues arising from the changes. While APRA has sought to minimise unintended impacts on industry, it has also aimed to maximise simplicity and to maintain the framework’s underlying strength, including that internationally active banks remain compliant with the minimum requirements set out by the Basel Committee on Banking Supervision (Basel Committee).

The more substantive of these other proposals are:

- The leverage ratio, and large and related entities exposure limits would remain unchanged, but would be calculated on a CET1 basis, rather than on the basis of Tier 1.

- To not allow an additional subordinated tranche of Tier 2, an idea suggested by some industry participants during the previous consultation in 2024. Dividing Tier 2 into two tranches would introduce new complexities and would be contrary to the rationale for eliminating AT1.

- To no longer recognise AT1 or AT1-like hybrid capital at a group level for Level 3 banking non-operating holding companies (NOHCs). This will be implemented via amendments to the conditions on relevant NOHC authorities.

APRA has carefully considered the impact of these proposals on competition and proportionality. APRA remains of the view that removing AT1 from the bank prudential framework will lead to a relatively small increase in the overall cost of regulatory capital for Advanced banks and have either no effect or reduce the cost of regulatory capital for Standardised banks. APRA recognises there will be some additional impact on Level 3 Banking NOHCs from phasing-out AT1 or AT1-like hybrid capital.

Next steps

This Consultation Paper seeks feedback on the specific technical amendments required to embed the removal of AT1 from the bank prudential framework (rather than the removal decision itself). In considering feedback on its proposals, APRA will aim to ensure the reforms are implemented consistently with their overarching objectives.

Written submissions should be provided to APRA by 5 September 2025. Following consideration of feedback, APRA intends to finalise amendments to its framework before the end of 2025, ahead of the new framework coming into effect on 1 January 2027. APRA expects all AT1 issued by banks to be phased out by 2032.

Chapter 1 - Overview

On 10 September 2024, APRA issued a Discussion Paper that proposed replacing AT1 for banks with more reliable forms of capital (Tier 2 and CET1) to create a simpler and more effective capital stack.1

On 9 December 2024, APRA released a letter to industry confirming that it would phase-out AT1 from the bank prudential framework.2 The letter included a timeline for transitioning to the updated framework over the next eight years, and responded to submissions to the September 2024 consultation.

This chapter provides an overview of APRA’s proposed approach to phasing out AT1.

Minimum capital requirements

APRA’s approach to replacing AT1 with other forms of capital, as confirmed in the December 2024 letter to industry, includes:

- Large, internationally active banks will be able to replace 1.5 per cent AT1 with 1.25 per cent Tier 2 and 0.25 per cent CET1.

- Smaller banks will be able to fully replace AT1 they currently issue with Tier 2, with a reduction in minimum Tier 1 requirements.

There will be no overall increase in capital requirements for banks. The difference in the proposed treatment between banks is to ensure that large, internationally active banks continue meeting the minimum capital adequacy requirements set by the Basel Committee.

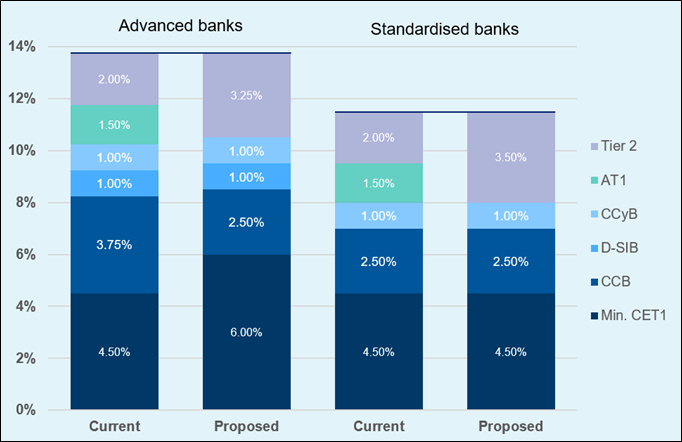

To implement these proposals, APRA intends to update Prudential Standard APS 110 Capital Adequacy (APS 110) so that minimum Prudential Capital Requirements (PCRs) are set in reference to CET1 and Total capital rather than Tier 1 capital. The tables and chart below set out how minimum PCRs will change from 2027 under both the Advanced and Standardised approaches.

Table 1. Minimum risk-based capital adequacy requirements

| Minimum requirements | Advanced | Standardised | ||

|---|---|---|---|---|

Current | 2027 | Current | 2027 | |

| CET1 requirement | 4.50% | 6.00% | 4.50% | 4.50% |

| Tier 1 requirement | 6.00% | - | 6.00% | - |

| Total capital requirement | 8.00% | 9.25% | 8.00% | 8.00% |

Table 2. Minimum CET1 buffers

| Minimum requirements | Advanced | Standardised | ||

|---|---|---|---|---|

Current | 2027 | Current | 2027 | |

| Countercyclical Buffer | 1.00% | 1.00% | 1.00% | 1.00% |

| Domestic Systemically Important Bank (D-SIB) Buffer (where applicable) | 1.00% | 1.00% | - | - |

| Capital Conservation Buffer | 3.75% | 2.50% | 2.50% | 2.50% |

| Total CET1 buffer | 5.75% | 4.50% | 3.50% | 3.50% |

Figure 1. Current vs proposed capital stacks

Transitional arrangements for AT1 instruments

APRA’s intention is for the phase-out of AT1 instruments to follow an orderly transition path.

AT1 will be replaced gradually with Tier 2 (and CET1 where relevant), seeking to minimise market disruption. In line with the approach set out in APRA’s December 2024 letter, APRA proposes to update Prudential Standard APS 111 Capital Adequacy: Measurement of Capital (APS 111) with a new attachment setting out detailed transitional arrangements. At a high level:

- AT1 issued prior to 1 January 2027 would be eligible to be included as Tier 2 until their first call option dates. All existing AT1 would reach their first call option dates by 2032 at the latest.

- During the transition period, the legal terms for AT1 would remain in effect, with AT1 absorbing losses ahead of Tier 2 in a resolution event.

Chapter 2 - Other amendments

This chapter sets out further detail on APRA’s proposed approach to embed the removal of AT1, alongside other minor amendments to the prudential framework to simplify the operation of capital instruments.

Leverage ratio

APRA sets minimum leverage ratio requirements for Advanced banks to limit the amount of leverage in the banking system. This requirement does not apply to Standardised banks.

The current leverage ratio requirement of 3.5 per cent of exposures reflects APRA’s approach to calibrating capital requirements based on the principle of ‘unquestionably strong’. The leverage ratio is calibrated based on Tier 1. With the removal of Tier 1 from the bank prudential framework, APRA proposes to instead base the leverage ratio on CET1 and maintain the minimum 3.5 per cent ratio.

This proposal is based on two considerations.

- Previous consultations raised investor concerns that phasing out AT1 could increase leverage in the banking system. Maintaining the leverage ratio requirement at 3.5 per cent of exposures, rather than offsetting the change in basis to CET1, minimises this risk of excessive leverage. This approach is consistent with APRA’s ‘unquestionably strong’ approach to the capital framework and maintaining the strong access of Australian banks to international funding markets.

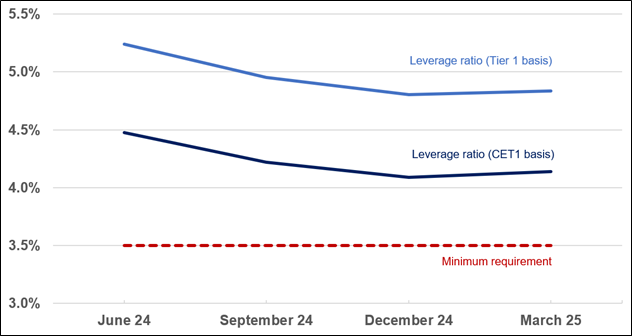

- APRA’s analysis indicates that a 3.5 per cent leverage ratio based on CET1 would not be binding on relevant banks, even in a stress situation. As indicated in Box 1, the leverage ratios of the four major Australian banks were around 5.0 per cent of Tier 1 and over 4.0 per cent of CET1 over the past 12 months. APRA does not anticipate that calibrating the existing leverage ratio on the basis of CET1 rather than Tier 1 will make it binding on any bank subject to the leverage ratio requirement (noting that it is intended to supplement rather than replace risk weighted asset-based capital requirements).

APRA is aware that US regulators have recently announced a rulemaking proposal to reduce the enhanced supplementary leverage ratio (eSLR) requirement for large banks. The eSLR is a buffer above the minimum 3 per cent leverage ratio requirement that applies to US banks that are categorised as Global Systemically Important Banks (GSIBs). APRA does not consider that the US proposal is relevant to Australia.

- Current US leverage restrictions are much tougher than in Australia. The minimum leverage ratio for US GSIBs is 5 per cent. Depository institutions owned by US GSIBs must satisfy a separate 6 per cent threshold to be considered ‘well capitalised’. This is well above APRA’s 3.5 per cent minimum leverage ratio requirement.

- The purpose of the US’s proposed rulemaking is to ‘help ensure that the enhanced supplementary leverage ratio standards will serve as a backstop to risk-based capital requirements rather than a constraint that is frequently binding over time and through most points in the economic and credit cycle.’3

- In contrast, Australia’s leverage ratio requirement already operates as a backstop to risk-weighted assets. APRA intends to retain this approach while recalibrating the leverage ratio on a CET1 basis rather than a Tier 1 basis.

Box 1: Leverage ratio buffers

The below chart shows the average leverage ratios for the four major Australian banks measured on a Tier 1 and a CET1 basis over the past 12 months. It shows that when measuring on a CET1 basis, the major banks typically operate with large capital buffers above the minimum leverage ratio requirement of 3.5 per cent of total exposures.

Figure 2. Average major bank leverage ratios (CET1 vs Tier 1 basis)

Source: APRA. Data is on a Level 2 basis.

Large and related entities exposure limits

A bank can incur disproportionately large losses as a result of the failure of an individual counterparty or a group of connected counterparties. To limit concentration risk, Prudential Standard APS 221 Large Exposures (APS 221) imposes large exposure limits on banks. Similarly, to limit contagion risk, APRA also sets related entities exposure limits under Prudential Standard APS 222 Associations with Related Entities (APS 222).

In common with the leverage ratio, the large and related entities exposure limits are currently based on Tier 1. APRA proposes that these should be calculated based on CET1 given Tier 1 will no longer be recognised by the bank prudential framework. This approach maintains the linkage between these limits and a bank’s ‘going concern’ capital.

APRA does not propose to increase the current large and related entities exposure limits to offset the effect of basing them on CET1 rather than Tier 1. This proposal would have no effect on banks that do not currently issue AT1 (given their CET1 capital equals their Tier 1 capital). It would result in a small tightening of the limits for AT1 issuing banks, however, it would be unlikely to be binding for most banks.

This proposal is based on three considerations.

- Retaining the current limits avoids weakening the framework for banks that do not currently issue AT1, given these banks already effectively measure exposures on an CET1 basis.

- Basing the limits on CET1 should not adversely affect most banks that currently issue AT1. Analysis suggests that only a few small entities are close to these limits. Any entity that believes it may be impacted by these changes should contact their supervisor to discuss potential adjustments.

- Retaining the current limits will ensure that Australia’s bank prudential framework continues to meet the minimum requirements set out by the Basel Committee.

‘Subordinated’ Tier 2

During consultation on whether to remove AT1 from the bank prudential framework, APRA received a suggestion from parts of industry that it should allow some form of ‘subordinated’ Tier 2 in place of AT1. Under this proposal, banks would be able to issue two tranches of Tier 2. One of these tranches would convert or be written off in resolution ahead of the other tranche.

While some banks suggested this might lower funding costs at the margin, APRA is concerned that it would increase complexity in resolution. This would be contrary to APRA’s main objective for phasing out AT1, which was to simplify the capital stack. There have also been varying views on the proposal across industry, as, for example, it could disadvantage smaller banks that may have difficulty issuing such an instrument.

APRA has decided not to allow multiple tranches of Tier 2. APRA proposes to clarify the wording of APS 111 to preclude the issuing of ‘subordinated’ Tier 2.

Some banks also suggested loosening loss-absorbing capacity (LAC) requirements to maintain investor demand in the absence of the AT1 layer, including allowing the use of applicable senior debt instruments in addition to Tier 2. APRA considers that the current LAC requirements do not need any changes in response to the removal of AT1.

Level 3 banking NOHCs

During consultation, industry sought clarity on the treatment of AT1 or AT1-like hybrids that are currently issued by some Level 3 banking NOHCs. APRA’s bank prudential framework does not set capital requirements for Level 3 NOHCs. Instead, requirements for authorised NOHCs are set out in individual NOHC authorities. APRA proposes to align individual Level 3 banking NOHC authorities with the broader bank prudential framework. This means that APRA would no longer recognise AT1 or AT1-like hybrid capital at Level 3.

Phasing out AT1 or AT1 like hybrids for banking NOHCs will level the playing field, by ensuring a consistent treatment of capital across different banking groups. While stress events may impact a NOHC differently from a subsidiary bank, the capital strength of a group is important in mitigating contagion risks to a bank from the unregulated parts of the group.

APRA will engage with relevant Level 3 Banking NOHCs to ensure a smooth phase-out of AT1 and AT1-like hybrids, similar to other transition arrangements. Consistent with APRA’s approach to the insurance prudential framework, APRA will continue to recognise AT1 issued by Level 3 NOHCs where the AT1 is used to meet the capital requirements of an insurance subsidiary.

Other proposed amendments

Other amendments proposed by APRA in this consultation package include:

- Conversion and write-off. While APS 111 currently provides optionality for banks in how Tier 2 is designed to absorb losses, the common industry practice in Australia is for Tier 2 to be converted first, with write-off available as a backstop only if conversion is not viable. APRA proposes minor amendments to APS 111 to simplify the instrument for investors by embedding this practice as a requirement for new issuances. Mutually owned banks would be exempted from this requirement, given they cannot issue common shares. APRA will also retain the discretion to approve write-off instruments in exceptional circumstances.

- Mandatory or investor conversion after first call option date. APS 111 includes a provision that a call option combined with a provision to convert into ordinary shares does not constitute an incentive to redeem, provided conversion is at least two years after the first call option date. In practice, this provision has created an incentive to redeem, given the potential for dilution of existing shareholders as a result of mandatory conversion to ordinary shares two years after the call option date. APRA proposes to remove this provision to ensure new issuances of Tier 2 do not include mandatory or investor conversion features (except for at the point of non-viability).

- Regulatory adjustment for holdings of AT1. APS 111 currently requires banks to deduct from AT1 their holdings of AT1 in other deposit-taking institutions and their subsidiaries, insurance companies and other financial institutions. With the removal of AT1, APRA proposes to now require banks to deduct all holdings of AT1 from other entities from CET1. Deducting from Tier 2 would be sub-equivalent to the Basel framework and compared to entities from other jurisdictions that would continue to deduct from Tier 1.

- Trans-Tasman funding arrangements. In submissions to the previous consultation, banks noted potential impacts on APRA’s supervision of Trans-Tasman funding arrangements, which currently focus on Tier 1. APRA recognises these concerns and does not intend to additionally restrict these funding arrangements. APRA will discuss the specific arrangements bilaterally with impacted entities.

Other minor amendments are set out in Table 3.

Table 3. Summary of other amendments to prudential and reporting frameworks

| Standard and guide | Description |

|---|---|

| APS 111 |

|

| |

| |

| Prudential Standard APS 117 Capital Adequacy: Interest Rate Risk in the Banking Book (APS 117) |

|

| APS 222 |

|

| Prudential Standard APS 330 Public Disclosure (APS 330) |

|

| |

| |

| Prudential Standard CPS 001 Defined Terms (CPS 001) |

|

| Prudential Practice Guide APG 110 Capital Adequacy (APG 110) |

|

| Prudential Practice Guide APG 117 Capital Adequacy: Interest Rate Risk in the Banking Book (APG 117) |

|

| Prudential Practice Guide CPG 110 Internal Capital Adequacy Assessment Process and Supervisory Review (CPG 110) |

|

| |

| Reporting Standard ARS 110.0 Capital Adequacy (ARS 110.0) |

|

| |

| |

| Reporting Standard ARS 221.0 Large Exposures (ARS 221.0) |

|

| Reporting Standard ARS 222.0 Associations with Related Entities (ARS 220.0) |

|

Chapter 3 - Consultation

Following assessment of the feedback to the proposals in the Consultation Paper, APRA intends to finalise amendments to its prudential and reporting framework in 2025. Further detail on the expected timeline is provided in the below table.

| Timeline for reform | |

|---|---|

| Consultation Paper | July – September 2025 |

| Finalisation of amendments to prudential and reporting framework | Late 2025 |

| Effective date for new requirements | 1 January 2027 |

| Final AT1 Capital instruments phased out | 2032 |

Request for submissions and cost-benefit analysis information

APRA invites written submissions on the proposals set out in this Consultation Paper. Written submissions should be sent to policydevelopment@apra.gov.au by 5 September 2025 and addressed to:

General Manager

Policy

Policy and Advice Division

Australian Prudential Regulation Authority

Important disclosure notice – publication of submissions

All information in submissions will be made available to the public on the APRA website, unless a respondent expressly requests that all or part of their submission is to remain in confidence. Automatically generated confidentiality statements in emails do not suffice for this purpose. Respondents who would like part of their submission to remain in confidence should provide this information marked as confidential in a separate attachment.

Submissions may be the subject of a request for access made under the Freedom of Information Act 1982 (FOIA). APRA will determine such requests, if any, in accordance with the provisions of the FOIA. Information in the submissions about any APRA-regulated entity that is not in the public domain and that is identified as confidential will be protected by section 56 of the Australian Prudential Regulation Authority Act 1998 and will therefore be exempt from production under the FOIA.

Request for cost-benefit analysis information

APRA asks that all stakeholders use this consultation opportunity to provide information on the compliance impact of the proposals, and any other substantive costs including business costs. Compliance costs are defined as direct costs to businesses of performing activities associated with complying with government regulation. Specifically, information is sought on any changes to compliance costs incurred by businesses as a result of APRA’s proposals.

Consistent with the Government’s approach, APRA will use the methodology behind the Regulatory Burden Measurement Framework to assess compliance costs. It is available at https://oia.pmc.gov.au/resources/guidance-assessing-impacts/regulatory-burden-measurement-framework.

APRA requests that respondents use this methodology to estimate costs to ensure the data supplied to APRA can be aggregated and used in an industry-wide assessment. When submitting cost assessments to APRA, respondents should include any assumptions made and, where relevant, any limitations inherent in their assessment. Feedback should address the additional costs incurred as a result of complying with APRA’s requirements, not activities that institutions would undertake due to foreign regulatory requirements or in their ordinary course of business.

Footnotes

1 APRA, A more effective capital framework for a crisis (Discussion Paper, 10 September 2024).

2 APRA, ‘A more effective capital framework for a crisis: Update’ (Letter, 9 December 2024).

3Office of the Comptroller of the Currency, Notice of Proposed Rulemaking: Modifications to the Enhanced Supplementary Leverage Ratio Standards for U.S. Global Systemically Important Bank Holding Companies and Their Subsidiary Depository Institutions (27 June 2025) <https://www.occ.gov/news-issuances/bulletins/2025/bulletin-2025-14.html>.