Recovery and resolution planning

To: All APRA-regulated entities

APRA is releasing final prudential requirements and guidance for recovery and resolution planning. This includes:

- Prudential Practice Guide CPG 190 Recovery and Exit Planning (CPG 190);1

- Prudential Standard CPS 900 Resolution Planning (CPS 900); and

- Prudential Practice Guide CPG 900 Resolution Planning (CPG 900).

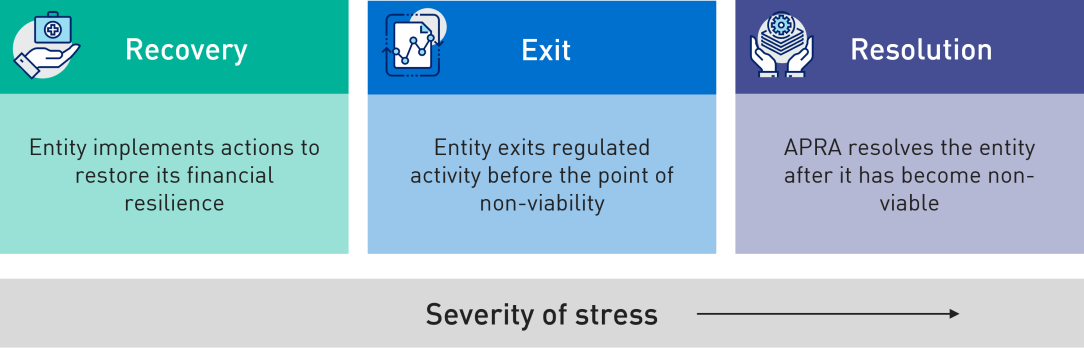

As demonstrated by recent events at overseas banks, the importance of crisis preparedness to a safe and stable financial system cannot be understated. In the last few years APRA has taken significant steps to strengthen crisis preparedness across the banking, insurance and superannuation sectors. The finalisation of this package is an important milestone in APRA’s efforts to ensure that the financial system is better prepared to manage periods of stress. There are several key components of crisis management, as summarised in the graphic below.

Purpose of recovery and resolution planning

APRA’s recovery and exit planning requirements aim to ensure that, in times of stress, entities can rebuild their financial resilience or exit regulated activity before they become non-viable. In the event an entity becomes non-viable, APRA would resolve the entity to protect beneficiaries, minimise disruption to the financial system, and provide continuity of critical functions.

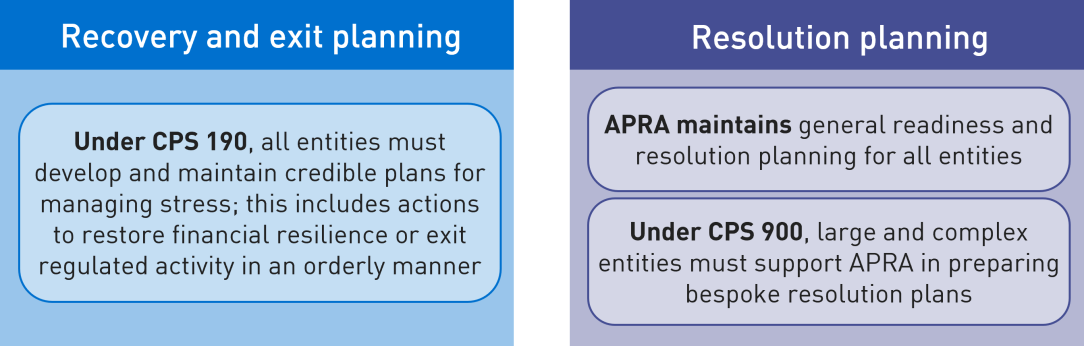

In recent years, APRA has enhanced its resolution planning and readiness. CPS 900 is an important part of this. It will require significant financial institutions (SFIs) and non-SFIs that provide critical functions to support APRA in developing bespoke resolution plans, where specific pre-positioning is needed ahead of time to ensure an orderly resolution. The graphic below summarises recovery and resolution planning, and the distinction between them.

This letter sets out APRA’s response to specific issues raised by stakeholders in the 2022 consultation on new requirements and guidance. Feedback on recovery and exit planning is summarised in Annex A (CPG 190); issues raised in relation to resolution planning are summarised in Annex B (CPS 900 and CPG 900).

Recovery and exit planning

In 2022, APRA consulted on a new prudential standard and associated guidance for recovery and exit planning. CPS 190 was finalised in December 2022.2 APRA is now finalising the accompanying guidance, without material revision to the draft proposals.

APRA’s recovery and exit planning requirements and guidance aim to reduce the likelihood of an entity becoming non-viable, by ensuring that regulated entities are better prepared for managing stress. It requires entities to develop and maintain credible plans that set out how they would restore their financial resilience (‘recovery’) or exit regulated activity in an orderly manner (‘exit’) before becoming non-viable.

Most banks and insurers have been familiar with recovery planning for some time. Over recent years, APRA supervisors have worked with these entities to strengthen their planning capabilities, including through several thematic reviews. The finalisation of guidance will assist banks and insurers in closing gaps to the new requirements under CPS 190, such as determining recovery capacity.

For RSE licensees, APRA is progressing several related reforms, which aim to reinforce the objectives of CPS 190. This includes proposed requirements for transfer planning and financial resources for risk events.3 APRA has provided RSE licensees with a transition timeline for implementing CPS 190 to assist the industry in implementing reforms holistically. APRA will consider whether further guidance is needed as related reforms for superannuation are finalised, and will be engaging closely with RSE licensees through supervision.

Resolution planning

CPS 900 supports APRA in executing its resolution function. It introduces new requirements for entities to support APRA in the development and maintenance of bespoke resolution plans. Under CPS 900, entities would be required to implement specific pre-positioning actions and maintain capabilities to support their orderly resolution, where appropriate. CPS 900 is a unique standard, in that it would only apply to an entity where an orderly resolution may be challenging without bespoke planning.

The finalisation of the new requirements for resolution planning follows consultation in 2022. APRA initially received substantive feedback on CPS 900, with entities generally unfamiliar with how resolution planning would occur in practice. Since then, APRA has issued guidance to assist entities in better understanding bespoke resolution planning and the intent of CPS 900. As this prudential standard will apply on an entity-by-entity basis, APRA will also engage closely with entities during implementation. APRA intends to provide periodic public updates on its resolution planning priorities, to build broader awareness.

The finalised CPS 900 and CPG 900 have not been materially revised from the draft proposals. Stakeholders were generally supportive of APRA’s guidance, which explains the outcomes that APRA is seeking to achieve through the standard, and the factors that APRA will have regard to in developing bespoke resolution plans, such as implementation costs. Some clarifications have been made to address industry feedback.

Modernising the prudential architecture

As part of the consultation on draft CPG 190 and CPG 900, APRA trialled a new way of presenting its guidance material. APRA mapped, at a paragraph level, specific requirements in the prudential standards to the relevant accompanying guidance in prudential practice guides. APRA’s objective was to improve the experience for users in navigating the prudential framework. Stakeholders were supportive of this new approach to presenting guidance.

Next steps

With the finalisation of the prudential standards and guidance for recovery and resolution planning, next steps will be centred on implementation:

- Recovery and exit planning: CPS 190 will come into effect from 1 January 2024 for banks and insurers, and from 1 January 2025 for RSE licensees. APRA will be engaging with entities on their approach to implementation ahead of the effective dates.

- Resolution planning: CPS 900 will formally come into effect from 1 January 2024, and will be implemented on an entity-by-entity basis, as applicable. Further information on APRA’s approach to implementing the standard is provided at Annex B.

Yours sincerely,

John Lonsdale

Chair

ANNEX A: RECOVERY AND EXIT PLANNING

Set out below is APRA’s response to specific issues raised in consultation on draft CPG 190.

Integration of plans

Respondents sought further clarity on how CPS 190 interacts with other parts of the prudential framework, including the Internal Capital Adequacy Assessment Process (ICAAP) for banks and insurers. There was a particular focus on understanding how granular the modelling of CPS 190 scenario analysis should be. Some entities sought clarity on how recovery planning should be used in the setting of capital targets.

APRA’s guidance provides examples of linkages between CPS 190 and other parts of the prudential framework. For example, APRA would expect entities to use their assessment of recovery capacity to inform the setting of ICAAP capital targets and their risk appetite. Good practice would also seek to leverage existing stress tests for the purposes of scenario analysis.

Assessing recovery capacity

Some respondents sought further guidance on APRA’s expectations of Boards in assessing recovery capacity. Recovery capacity is an important indicator of the aggregate effectiveness of recovery actions; it demonstrates the total amount of losses that could be offset from implementing plausible recovery actions in stress.

CPS 190 requires the Board of an SFI, in reviewing the recovery and exit plan, to form a view on the sufficiency of its recovery capacity. APRA’s guidance in CPG 190 explains that a prudent Board would consider a range of factors in making this assessment, challenging underpinning assumptions to ensure that estimates are credible. It is good practice for recovery capacity estimates to be benchmarked against historical and international peer comparisons.

Testing and review

Respondents sought further clarity on APRA’s expectations of entities in reviewing and updating their recovery and exit plans. CPS 190 sets minimum timeframes for reviewing plans: for SFIs, this is annually; and for non-SFIs, every three years.

In requiring entities to review and update their plans, APRA’s expectation is that plans remain current and effective. A prudent entity would consider, for example, whether there are new scenarios that the plan should be tested under. While CPS 190 does not set a minimum frequency for developing new scenarios, it is important that the recovery and exit plan is regularly tested under a range of relevant scenarios that are updated as risks evolve.

Prudent entities would also consider whether existing recovery and exit actions remain appropriate or whether new actions should be added to the plan. Changes in the legal or economic environment can have implications for recovery capacity. Failure to take account of these changes can undermine the effectiveness of the recovery and exit plan.

In addition to annual reviews and updates, CPS 190 also requires SFIs to undertake a comprehensive review, including operational testing, of the recovery and exit plan at least every three years. In finalising CPG 190, APRA has clarified that comprehensive reviews can be conducted by internal staff or external parties. Where internal staff conduct the review, APRA expects that these persons would not be involved in the development and maintenance of the recovery and exit plan.

ANNEX B: RESOLUTION PLANNING

Set out below is APRA’s response to specific issues raised in consultation on draft CPS 900 and accompanying guidance.

Application by industry

Respondents to the consultation were generally supportive of APRA’s objectives to strengthen requirements for bespoke resolution planning. The main area of feedback related to a request for industry-specific requirements. Some respondents suggested that cross-industry requirements may not adequately capture the differences in risks faced by APRA-regulated entities.

In APRA’s view, it is important that CPS 900 establishes a common set of principles for resolution planning that apply to all industries. CPS 900 sets out a framework for how APRA expects to engage with individual entities in developing and implementing a bespoke resolution plan. This framework allows APRA to implement CPS 900 in a way that ensures resolution plans are appropriate for the particular circumstances of individual entities.

APRA plans to work closely with each entity in implementing the new CPS 900. The accompanying guidance explains APRA’s approach to decision-making and demonstrates how entity feedback would be considered in implementing various CPS 900 requirements, including for implementation costs.

Application by ownership structure

Submissions sought further clarity on how resolution planning under CPS 900 would apply to group structures. In developing resolution plans, APRA will work with regulated entities on a case-by-case basis to assess all potential risks to an orderly resolution. This includes those that may stem from non-regulated entities within a group. APRA is planning to release a discussion paper later this year, setting out its broader approach to regulating groups.4

Approach to implementation

Respondents sought further clarity on APRA’s approach to implementing CPS 900, and what they would be expected to do in preparation.

While CPS 900 will formally come into effect from 1 January 2024, individual entities would only be subject to the requirements of CPS 900 when notified by APRA that it is commencing bespoke resolution planning for that entity. Prior to this, there are no formal requirements under CPS 900 that the entity would need to meet.

APRA has recently commenced bespoke resolution planning with a small number of entities through a pilot program. The pilot program covers entities from all industries, of differing sizes, business models and international exposures.

To provide greater transparency on APRA’s resolution planning program going forward, APRA plans to release periodic updates. These public updates will outline the progress of APRA’s resolution planning with particular entities; it will also foreshadow APRA’s future plans for extending bespoke resolution planning to other entities. APRA expects to release its first update within the next 12 months.

Alignment to recovery and exit planning

Several submissions sought further clarity on how an entity’s recovery and exit plan would influence APRA’s approach to resolution planning. Some respondents suggested that a credible exit plan would remove the need for APRA to do resolution planning.

The resolution plan is an important complement to an entity’s recovery and exit plan; these plans are not mutually exclusive. The resolution plan is executed by APRA in the final stage of a stress event, and likely after an entity has attempted to execute its recovery and exit actions.

As noted in APRA’s guidance for recovery and exit planning, a prudent entity would also update its recovery and exit plan to align with its bespoke resolution plan. For example, executing certain recovery actions, such as divestments, could impact resolution pre-positioning measures. It is important that these interconnections are assessed.

Role of the Board

APRA’s expectations of Boards in resolution planning was another area of feedback. Several submissions questioned whether Boards could really be fully responsible for ensuring that entities are resolvable, given key elements of the resolution plan will rely on APRA to implement.

In finalising CPS 900, APRA has clarified its expectation of Boards: the Board of an entity must support APRA in bespoke resolution planning and is ultimately responsible for ensuring that the entity meets the requirements of the Prudential Standard, rather than guaranteeing that APRA will effectively execute a resolution plan. In practice, this would involve the Board overseeing the steps involved in preparing for resolution: in particular, the implementation of pre-positioning actions and the maintenance of capabilities needed for resolution.

Determination of critical functions

Several respondents sought further information on the approach to determining critical functions. Under CPS 900, entities may be required to support APRA in determining whether they provide functions that are important to financial system stability or the availability of essential financial services to a particular industry or community. A high-level framework for assessing critical functions has been provided in CPG 900.

In finalising CPS 900, APRA has also clarified that, where critical functions exist, an entity may also be required to identify shared services, including those provided by third parties, that are vital to the provision of those functions. This could include, for example, IT systems, legal services or administrative services. Guidance to assist entities in making this assessment has been provided in the finalised CPG 900.

Expectations for disclosure

Several submissions questioned APRA’s draft requirement that entities must seek APRA’s approval before publicly disclosing any information on resolution planning. Entities raised challenges associated with meeting this approval requirement and their other disclosure obligations.

In finalising CPS 900, APRA has removed the requirement of entities to seek APRA’s approval before making any public disclosures on resolution planning. APRA expects that entities would take a prudent approach to disclosing information on resolution planning. In determining a bespoke resolution plan for an APRA-regulated entity, APRA may outline its expectations regarding the public disclosure of certain elements of the plan.

Expectations for pre-positioning

Several respondents sought further clarity on APRA’s expectations for renegotiating contracts with third-party service providers, where these have been identified as a barrier to an orderly resolution.5 APRA will engage directly with entities to assess potential options for addressing barriers introduced by contracts, taking into account entity feedback on a case-by-case basis. APRA expects that entities will be open and constructive in these engagements.

Loss-absorbing capacity

Several respondents sought further clarity on APRA’s expected approach to requiring entities to hold additional loss-absorbing capacity, including timeframes and composition of capital. As noted in APRA’s guidance, where entities are required to build additional loss-absorbing capacity, APRA will determine an appropriate timeframe for implementation, taking into account circumstances at the time.6 Additional loss-absorbing capacity requirements can be met with any form of regulatory capital.

Use of external experts

Some submissions sought greater clarity regarding APRA’s expectations for the use of external advisors in resolution planning. APRA has clarified that, where APRA requires an entity to engage an expert external advisor, an APRA-regulated entity must consult with APRA before finalising the terms of engagement, and ensure that external advisors are available to meet with APRA on request. CPG 900 provides further explanation of APRA’s expectations regarding these engagements.

Under CPS 900, APRA-regulated entities must also support external advisors engaged by APRA. APRA has removed the requirement for entities to pay for the costs of external advisors that have been engaged by APRA.

Footnotes

1 CPG 190 supports Prudential Standard CPS 190 Recovery and Exit Planning (CPS 190), which was finalised on 1 December 2022. The history of consultation on these reforms is at Strengthening crisis preparedness.

2 APRA’s response to consultation feedback received on the draft standard is available at Letter to all APRA-regulated entities - Recovery and exit planning.

3 See APRA moves to strengthen transfer planning in superannuation and APRA releases discussion paper on financial resources for risk events in superannuation.

4 This discussion paper forms part of a broader review into the prudential framework for groups. See Group regulation: roadmap for review.

5 Under CPS 900, entities will be expected to implement pre-positioning measures, where necessary, to ensure that barriers to the execution of resolution options are removed. This could include renegotiating contracts where, for example, third parties could restrict services in a resolution event.

6 See, for example, Letter - Finalising loss-absorbing capacity requirements for domestic systemically important banks.