Quarterly authorised deposit-taking institution performance statistics - highlights

Key statistics 1

| March 2024 | March 2025 | Year-on-year change |

|---|---|---|---|

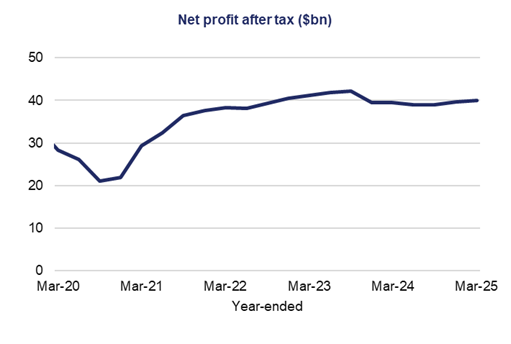

| Net profit after tax (year-end) ($bn) | 39.4 | 40.0 | 1.3% |

| Total assets ($bn) | 6,205.8 | 6,545.9 | 5.5% |

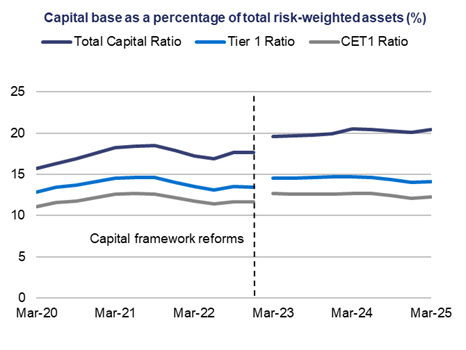

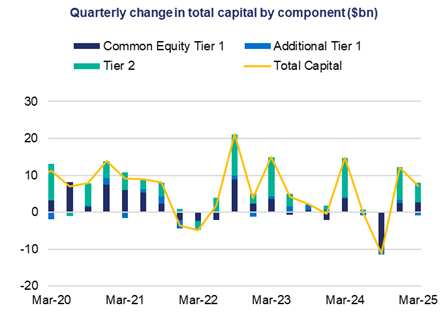

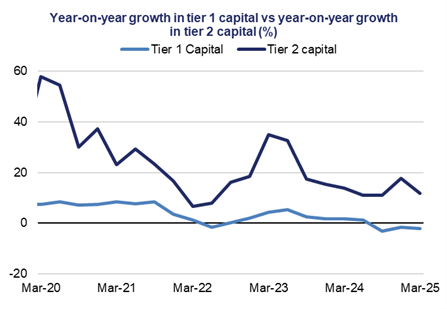

| Total capital base ($bn) | 449.0 | 456.7 | 1.7% |

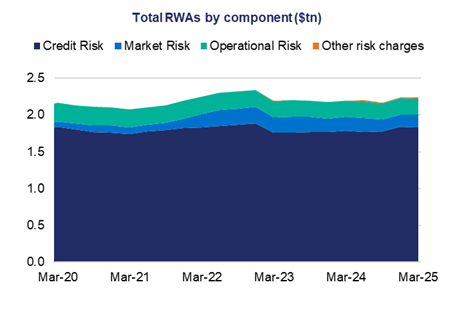

| Total risk-weighted assets ($bn) | 2,192.9 | 2,236.3 | 2.0% |

| Total capital ratio | 20.5% | 20.4% | -0.05 points |

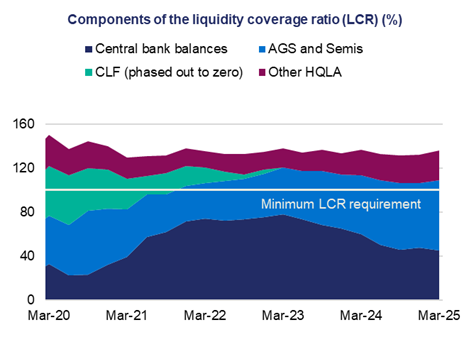

| Liquidity coverage ratio | 136.6% | 136.0% | -0.6 points |

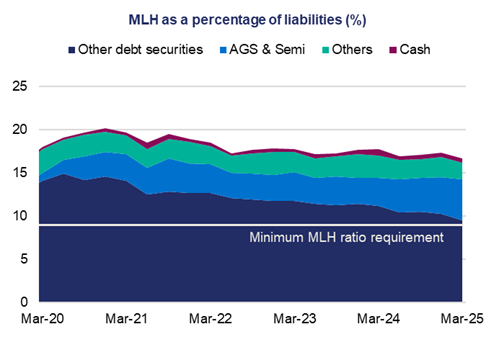

| Minimum liquidity holdings ratio | 17.7% | 16.7% | -1.0 points |

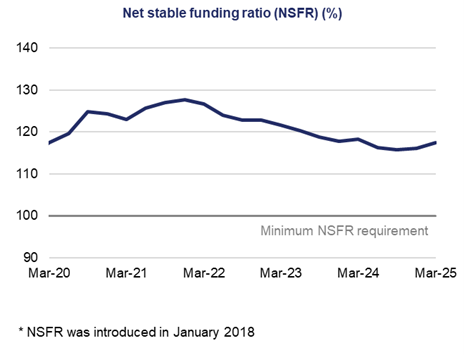

| Net stable funding ratio | 118.2% | 117.4% | -0.8 points |

Financial performance

Asset quality

Capital adequacy

Liquidity

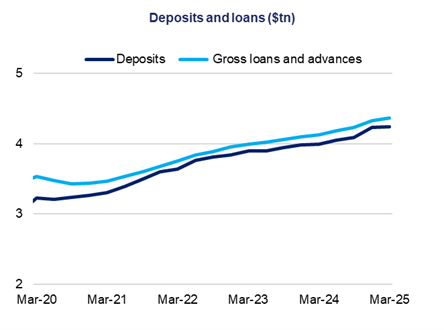

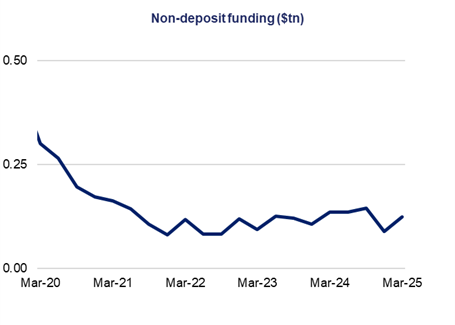

Financial position

Footnote

1Excludes ADIs that are not banks, building societies or credit unions, such as payment providers.