Premium increases in life insurance

To: All life insurers and friendly societies (life companies)

This letter outlines findings from the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission’s (ASIC) joint review of life companies’ practices in relation to premium increases, including subsequent corrective action taken by some life companies. It also makes clear our regulatory expectations of life companies going forward, namely to:

- have sound risk management and compliance assurance around re-rating practices and ensure any contract terms allowing for premium increases are transparent and not unfair;

- clearly explain how premiums are calculated and may change over the life of the policy; and

- design and price life insurance products factoring in consumers’ need for premium stability.

APRA and ASIC will monitor the progress of life companies in meeting regulatory, consumer and community expectations of pricing decisions, marketing and disclosure, as well as product design, to deliver better consumer outcomes. We will consider appropriate regulatory action if our expectations are not met.

Life insurance has an important role in safeguarding the financial wellbeing of Australians. It exists to help consumers manage risks such as paying their debts and supporting their dependents in the case of death or disability. A well-functioning market would have products that are designed to meet consumer needs and priced sustainably and affordably. Unfortunately, this has not always been the case in the Australian life insurance industry.

Failures by the life insurance industry to design, price and manage individual disability income insurance, as outlined in the letter dated 2 December 2019 from APRA, have emphasised the need for APRA and ASIC to closely monitor how life companies are designing and pricing life insurance products more generally while factoring in consumer expectations.

APRA and ASIC have seen increasing complaints from consumers and other stakeholders, and ASIC has received reportable situations from life companies about premium increases in retail life insurance policies. This prompted APRA and ASIC’s letter dated 8 December 2022 addressed to CEOs of life companies, asking them to review past:

- premium increases to ascertain whether they have been applied in accordance with the applicable policy terms; and

- disclosure and marketing material to determine whether policyholders have been provided sufficient clarity about premiums, including the way in which premiums may change over the life of the policy.

APRA and ASIC also asked life companies to consider the design of future products and the expectations their selling practices create for consumers. This included how they could:

- design sustainable products with reasonable premium stability;

- be clear about premiums and product offerings in marketing and disclosures;

- use appropriate premium labels; and

- manage the reasonable expectations of policyholders around premium increases in an ongoing manner.

APRA and ASIC wrote separately to the Council of Australian Life Insurers (CALI) asking what steps could be taken at an industry level to improve disclosure, including accurate premium labels, and to manage consumer expectations around premium increases.

APRA and ASIC reviewed the responses from life companies and jointly met to discuss those responses with them. The agencies are still considering whether further regulatory action is appropriate.

Life companies have started taking action to address APRA and ASIC’s concerns raised in the letter dated 8 December 2022:

- Three life companies found instances where premium increases were applied to consumers without a clear right to increase premium rates in the underlying policy. The life companies have all indicated that they have started or will start remediating consumers.

- Three life companies found possible problems with disclosure and marketing materials. Seven identified areas for improvement in Product Disclosure Statements (PDSs), quotations, insurance schedules, annual renewal notices, consumer flyers, educational content on their websites, as well as adviser communication and guidance. Some improvements have already been made, while others are in progress.

But more needs to be done by life companies. APRA and ASIC have made the following observations that provide context for the actions life companies need to take in relation to premium increases, marketing and disclosures and future product design.

Observations

Premium increases (re-rating base premiums)

Life companies conduct an annual experience investigation and then decide whether premiums are set at the right level to cover estimated future claims costs. This frequently leads to increases in base premium rates that are charged to consumers. This process is known as re-rating premiums.

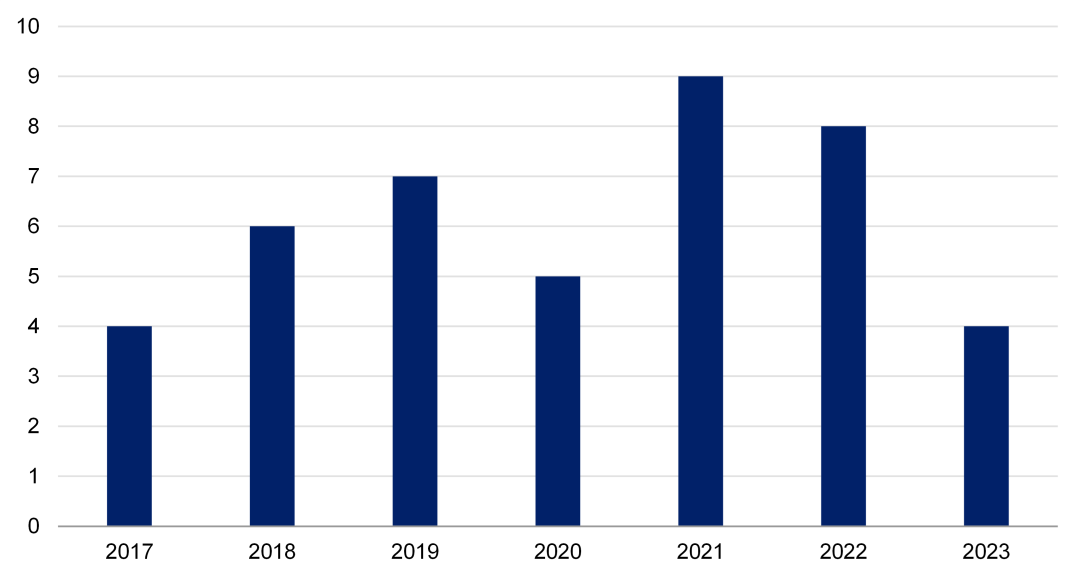

- Frequent re-ratings: Of the 16 life companies that have provided retail life policies, 13 have re-rated at least once and 7 have re-rated at least 4 times since 2017.

Figure 1: Number of life companies that have re-rated

- Re-rating rationales: Most life companies said re-rating decisions were triggered by worsening claims experience and were made to restore target profitability levels following changes in assumptions on lapses, claims and economic conditions and/or reinsurance arrangements.

- Smoothing and capping re-rates for acceptable consumer impact: Some life companies greatly increased premiums in a single year, hoping to restore profitability and prevent increases in future years. They reported that this resulted in a spike in lapses and had a negative impact on consumers. Other life companies were more mindful of how such increases could affect consumers and affordability. They made smaller but more frequent increases or capped the maximum annual increase at a set level to avoid selective lapses.

- Re-rating level premiums more than stepped premiums: Increases of base premium rates for consumers on level premiums were generally larger than those for consumers on stepped premiums. Despite consumer expectations that level premiums are more stable than stepped, only one life company made the conscious decision to keep increases for level premiums at a lower rate than for stepped premiums.

Marketing and disclosures

- Potentially misleading graphs about level premiums: Some graphs used in recent marketing materials showed level premiums as a flat line compared to stepped premiums increasing each year. These have been removed after ASIC expressed concerns that they were potentially misleading.

- Lack of details on why and how premiums would change: Most life companies clearly stated in their PDSs that they may vary premiums for both level and stepped premiums. However, there was generally a lack of detail on what factors may give rise to such increases and how premiums were likely to change . One life company directed consumers to historical premium rate changes to show how premiums changed in the past.

- Lack of transparency on duration-based pricing: Most life companies adopted a duration-based pricing model that reflected the assumption of increased claims as policyholders progress into later policy years. This resulted in reductions in premiums in the first year of a policy followed by premium increases year-on-year. Some life companies were concerned that the pricing model may encourage churning and undermine long-term product sustainability, but eventually adopted the pricing model to stay competitive in the market. Although some life companies provide premium projections in quotations, most have not explicitly set out in disclosure or marketing materials the impact of the pricing model on current and future premiums.

Product design

- Challenges in product design that offers premium stability: Some life companies are considering the design of alternative products or features that offer better premium stability. However, life companies told APRA and ASIC about the difficulty in getting new products to market, particularly if they are more expensive than current products. For example, they pointed to products with guaranteed premiums which had low take-up. This was reportedly due to the higher premiums charged to reflect the cost of the guarantee.

- Broad target markets with insufficient consideration of consumers’ need for premium stability: ASIC’s review of target market determinations (TMDs) of retail life insurance policies showed that some life companies used broad statements to describe the target market of the product. Some life companies told APRA and ASIC that consumers who opt for level premiums tend to have a greater need for premium stability. However, ASIC did not see this reflected in TMDs. Life companies have generally not considered the need for premium stability as an element of a consumer’s financial situation or premium structure as a key attribute of their products.

What this means for life companies

Right to re-rate

Life companies need to strengthen their risk management frameworks and compliance assurance around re-rating practices. Life companies should examine their contracts to ensure that the terms about how and when premiums may change are transparent and not unfair.

Prudential Standard CPS 220 Risk Management requires that an APRA-regulated institution maintains a risk management framework that enables it to appropriately develop and implement strategies, policies, procedures and controls to manage different types of material risks.

The legal uncertainty as to whether life companies have the right to re-rate, the potential for significant financial exposure for life companies and the impact on consumers raises fundamental concerns about the strength of life companies’ risk management frameworks.

Life companies tend to rely on unilateral variation clauses that allow them to re-rate premiums.

Unilateral variation clauses carry a heightened risk of being unfair. They may be considered more acceptable if the variation power:

- is clearly expressed;

- only goes as far as is necessary to allow the business to achieve its legitimate business interest; and

- provides a balancing right for the consumer where the change could be materially detrimental.

The unfair contract terms law applies to insurance contracts entered into or renewed on or after 5 April 2021, or where a term in an existing contract was varied on or after 5 April 2021. From 9 November 2023, multi-million-dollar penalties may be imposed if a life company proposes, applies, relies on or purports to rely on an unfair contract term: see s12GBCA(2) of the Australian Securities and Investments Commission Act 2001.

ASIC’s Information Sheet 210 Unfair contract term protections for consumers (INFO 210) explains how the law protects consumers from unfair terms in contracts for financial products and services. The Australian Competition and Consumer Commission has also produced a guide to unfair contract terms and a review of unfair terms in small business contracts.

Marketing and disclosures

Life companies should do better at explaining how premiums are calculated and how they might change over the life of the policy. This includes both point of sale and ongoing communications.

Marketing materials and disclosures must not mislead or deceive. This means they should be designed to provide clear and accurate information.

APRA and ASIC welcome the changes made by life companies in response to the letter dated 8 December 2022. We look forward to seeing further improvements to ensure that consumers are not misled or deceived about how their premiums may change.

CALI has informed us that they are developing a new set of premium labels. The intention is for these to be adopted by industry for retail advised policies by 1 July 2024. They are also developing guidance for life companies and financial advisers on disclosure and marketing materials that articulate the different premium types and when these might increase. The Life Insurance Code of Practice also requires life companies to explain how premiums may change at point of sale and each policy anniversary.

This is welcome, but only forms part of the solution to managing consumer expectations of how premiums work.

Life insurance premiums have been volatile for many consumers in recent years. With this greater volatility, comes a greater responsibility for life companies to ensure consumers understand how premiums are likely to change.

To achieve this, life companies themselves need to better understand the rate and drivers of future premium increases.

This is consistent with APRA’s expectation that premiums are set with the objective of providing policyholders with a reasonable degree of stability over the lifetime of their products.

Product design

Life companies should improve their product governance. They should start by considering consumer needs, including premium stability. Premiums should be aligned to the risks borne by the life companies, noting that these are products designed to be held long-term.

ASIC has previously written to the life insurance industry about compliance with design and distribution obligations. The design and distribution obligations require life companies and their representatives to:

- have a consumer-centric approach to the design of insurance products;

- distribute those products in a targeted manner; and

- monitor consumer outcomes to ensure products continue to meet consumer needs.

ASIC encourages life companies to consider the findings outlined in the letter and move beyond thinking of TMDs as a disclosure obligation. Instead, TMDs should be seen as part of good product governance. Life companies should focus on consumers in the identified target market receiving products that are likely to be consistent with their objectives, financial situation and needs. This can be achieved through product design, distribution, monitoring and review.

ASIC draws the attention of life companies to two points that are particularly relevant to the observations made about TMDs as part of this review:

- When catering for a broad target market, the issuer has a greater responsibility to justify how the product is likely to be suitable for a wide range of consumers.

- Consumers’ need for premium stability or certainty should be considered when defining the target market for the product, especially where different premium structures are available.

APRA’s intervention in individual disability income insurance identified product design as a key contributor of unsustainable market practices. The failure of life companies to appropriately price for the risks borne in a quest to gain market share led to the need for material price increases, poor consumer outcomes and, by extension, reputational damage to the industry.

Much of this could have been mitigated by life companies investing time to clearly understand the needs of different consumers, designing products best suited to the needs of particular target markets and ensuring that the prices being set were aligned to the risks being borne by the life companies noting that these products are designed to be held long-term.

Next steps

Life companies should examine their contracts to ensure that the terms about how and when premiums may change are transparent and not unfair. When making re-rate decisions, due consideration should be given to the consumer impact as part of the risk management framework. Life companies should ensure their disclosure and marketing materials and any other relevant communications are fit for purpose and help consumers to properly understand how their premiums may change.

To do this effectively, life companies themselves need to better understand the rate and drivers of future premium increases. More rigorous product governance practices, which will be aided by deeper engagement with the design and distribution obligations, will help life companies to better meet consumer needs and deliver responsible market practices.

During the coming 12 months, APRA and ASIC will monitor the progress of life companies in meeting regulatory, consumer and community expectations of pricing decisions, marketing and disclosure, as well as product design, to deliver better consumer outcomes. In monitoring progress, we will consider whether any regulatory action is needed if our expectations are not met.

Signed

| Suzanne Smith Executive Board Member Australian Prudential Regulation Authority www.apra.gov.au | Karen Chester Deputy Chair Australian Securities and Investments Commission www.asic.gov.au |