Fortis Fortuna Adiuvat: Fortune Favours The Strong

Wayne Byres, Chairman - Keynote address at the AFR Banking & Wealth Summit, Sydney

Thank you for the opportunity to be part of the third AFR Banking & Wealth Summit. This is the third time I have been asked to speak at this event, and I am going to return to my usual theme: the strength in the Australian banking system. I’ve titled my remarks today with the Latin phrase, fortis fortunaadiuvat.[1] Over the years, this has been interpreted in a number of ways – often as fortune favours the brave or fortune favours the bold. However, as a prudential regulator, I am attracted to an earlier interpretation: fortune favours the strong. As a proverb from Roman times, it remains highly relevant today.

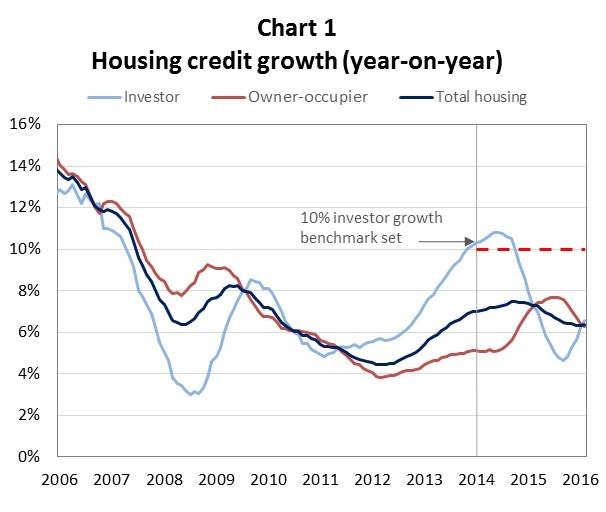

In the past few days, there has been a great deal of attention given to our recent announcement on additional measures to strengthen one particular part of the financial system: the residential mortgage lending market. These measures build on the steps we have taken over the past two years to bolster loan underwriting practices and moderate investor lending, in an environment that we considered to be one of heightened risk. Those measures had a positive impact (Chart 1), but at the same time the risk environment certainly hasn’t moderated:

- house prices remain high;

- household income growth remains subdued;

- the already high ratio of household debt to income has got higher;

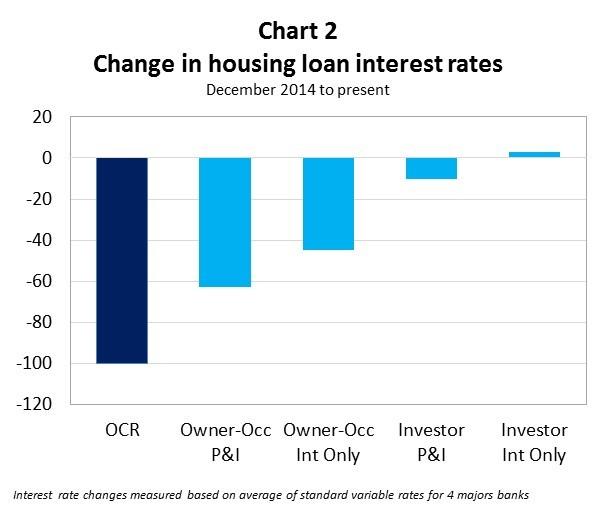

- the already low official cash rate has got lower (although not all of this reduction has flowed to borrowers, particularly investors - Chart 2); and

- competitive pressures haven’t diminished.

We chose not to lower the investor lending growth benchmark at this point in time, given the need to accommodate the increasing supply of housing in the construction pipeline. However, limitations on the volume of new interest-only lending will impact investors more acutely than owner-occupiers, given that around two-thirds of lending to investors is on an interest-only basis. Furthermore, although the 12-month annual growth rate for investor lending is currently below the 10 per cent benchmark, the run rate in more recent months has been closer to (if not a little above) 10 per cent on an annualised basis. Therefore, even with the benchmark unchanged, lenders are still likely to have to tighten their lending practices and slow lending from that in recent months to ensure they remain comfortably below the desired level.It’s important to be clear that our goal in implementing the additional measures we announced on Friday is not to determine house prices. Housing prices are not within the control, nor the mandate, of the prudential regulator. Nor, as the Reserve Bank Governor said last night, can prudential measures address underlying supply-demand issues within the housing market. Rather, our role in the current environment is to promote a higher-than-normal degree of prudence – definitely by lenders and, ideally, also borrowers – in both credit decisions and balance sheet strength. On this occasion, we have focussed on interest-only lending to complement our earlier measures. Although there are perfectly legitimate reasons why individual borrowers might prefer an interest-only loan, in aggregate the level of interest-only lending creates additional vulnerabilities and we came to the view some additional moderation in this area was warranted.

This latest step is a tactical response to current market conditions – we can and will do more (or less) as conditions evolve. We also developing a more strategic response that recognises that, in the Australian banking system, housing lending risks and capital adequacy are far from independent issues. I’ll come back to that point a bit later.

Building strength

First, a recap. Building strength in the financial system has been at the core of the post-crisis financial reform agenda. Amongst other things, substantial reforms were enacted by the Basel Committee on Banking Supervision to lift both the quality and quantity of capital. As part of the G20, Australia implemented those reforms. Having a banking system that was less impacted by the financial crisis than others reflected good management, no doubt, but also a healthy dose of good fortune (remember, fortune favours the strong!). As a result, we were also able to claim to be one of the first countries that could say its banking system met the new global minimums. In the periodic bouts of financial fragility that have occurred in recent years, there is no doubt that strength has been a virtue.

The conclusion that Australia benefits from a strong banking system was endorsed by the Financial System Inquiry (FSI) in 2014. The first – and probably most prominent – recommendation of the FSI was that APRA should set capital standards such that the capital ratios of Australian deposit-takers are ‘unquestionably strong.’[2] In making this recommendation, the FSI did not dispute that the Australian banking system was in good shape, but simply that some further strengthening was a worthwhile investment for the Australian community.

In thinking how to put the recommendation into practice, we have been mindful that the international bank capital regime is still undergoing further fine-tuning. We therefore chose to hold off implementing the ‘unquestionably strong’ recommendation until the work in Basel was completed. We thought it made sense to tackle both issues together, on the basis that implementing one set of changes rather than two was likely to be more efficient and provide greater certainty for everyone.

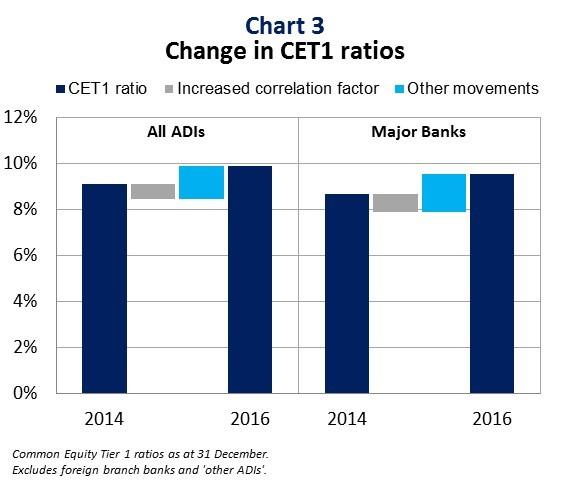

I still think that decision was the right one, even though the final Basel agreement has now been delayed. And it is important to remember that neither we nor the banking industry has stood still in the meantime. Notably, we have already taken steps to strengthen capital requirements for residential mortgages for those banks using internal models to determine their risk weights,[3] which added in the order of $10 billion to system capital requirements. This policy change had the effect of reducing the major banks’ Common Equity Tier 1 (CET1) capital ratio by just under 80 basis points, and the benefit of tackling two issues in one: strengthening the capital position of the largest Australian banks relative to their international peers, and bolstering the capital backing for mortgage exposures in the current environment. Despite that change, the banking system has continued to lift its capital ratios.

However, without clarity as to a deadline for an agreement in Basel, we have decided it does not make sense to wait any longer to deal with the question of ‘unquestionably strong’.

Before talking a little about how we propose to do that, I want to respond to three questions that I’ve been asked recently.However, without clarity as to a deadline for an agreement in Basel, we have decided it does not make sense to wait any longer to deal with the question of ‘unquestionably strong’.

Is it still necessary?

The first question is: is it still necessary? The ‘unquestionably strong’ concept was proposed a few years ago now – maybe it is no longer valid or worth the effort?

In response, I’d like to make three points:

- First, the underlying rationale for the FSI’s recommendation continues to hold. Australia remains dependent on the willingness of foreigners to lend us their savings. And the banking system does a large part of that borrowing. We learnt from the financial crisis that threats to our on-going access to international financial markets can quickly and severely impede the flow of credit to the community. We also learnt that, as a relatively small part of the global economy, few international investors need to lend to Australia. Particularly in times of stress, they can be inclined to run first, and ask questions later.

The good news is that the system is less exposed to that particular risk than previously, given the increasing proportion of the banking system’s balance sheet that is funded by domestic deposits and longer-term wholesale borrowing. But it is not a risk that has disappeared. Keeping the confidence of international investors remains an important goal. - Second, our relative positioning is under threat as the rest of the world recovers from the financial crisis. As I noted earlier, Australia could lay claim to being one of the first jurisdictions to meet the new global minimum standards. That is no longer a particularly notable badge of honour. Banking systems in North America, Asia and – slowly but surely – Europe have been strengthened, and continue to do so. Australia’s relative strength will not be sustained without further action.

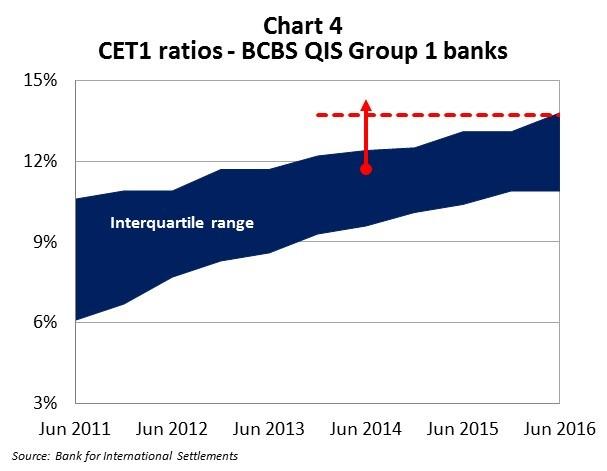

Chart 4 shows the interquartile range of CET1 capital ratios for large internationally-active banks. The range has risen pretty steadily, with no sign of levelling off just yet. This accumulation of capital must surely slow soon, but given many banks are still building capital we expect the trend to go on a bit further before it does so. The dot shows where the major banks collectively sat in June 2014, and the arrow represents what we estimated, at that time, would be required to be comfortably in the top quartile over the longer term. We estimated at least 200 basis points: many thought that estimate was quite high, but it has proven to be a pretty useful forecast. - And third, the risk environment has not markedly improved since the FSI’s recommendation, so there is little room for complacency. Internationally, there appears to be a slightly more optimistic economic outlook in the short term, with the US and most Asian economies strengthening, and Europe continuing to grow. But the skies are not entirely blue: the Reserve Bank has noted, for example, there continues to be significant uncertainty about policy in China and the United States and the implications for global growth and trade after 2017. Domestically, the outlook is again cautiously optimistic, but reliant on ongoing support from very low interest rates. Commodity prices are higher than a year or so ago, but have fallen a bit from their most recent peaks, and there continues to be on-going slack in the labour market. And I’ve already spoken about housing.

But regardless of the short term outlook, prudential policy should not be based on the here and now. Good prudential policy is set for the long-run benefit of the community, weighing up the costs and benefits associated with policy settings through the cycle, and preparing for adversity when times are good. As we have said many times, it is easiest to build resilience when the system is in good health than try to do so when times are tougher.

Isn’t the rest of the world changing direction?

The second question is: in pursuing ‘unquestionably strong’ now, could we find ourselves moving in the opposite direction to the rest of the world?

We always keep a close eye on trends in the rest of the world, but I don’t see anything at present that would cause us to change direction.

The delays in Basel are unfortunate. There are only a few issues that remain subject to negotiation, but the fact they remain unresolved means they are obviously important issues. I’m still hopeful, however, that we can get an agreement sooner rather than later, but if no agreement proves possible, the status quo remains and we will continue to measure ourselves against that.

I fully expect to see some deregulatory measures in the United States. However, the US starts with a regulatory system that is, on a number of dimensions, one of the strongest in existence. Many of the issues that seem to be the primary candidates for change – the Volcker Rule, the stress testing regime, the Department of Labour’s fiduciary rule, the roles and activities of the Financial Sector Oversight Council and the Consumer Financial Protection Bureau – are domestic initiatives that exist over and above internationally-agreed minimum standards. Changes in any of these areas would not necessitate a change in our approach one iota.[4]

Of course, the risk of a broader move away from international cooperation and coordination in the area of financial regulation can’t be dismissed lightly. That might even be superficially appealing for those who dislike the work of the international standard setters. But be careful what you wish for. Such a shift would likely see a raft of new regulations produced at a national or jurisdictional level, potentially quite different in objective and detail, and at least some with a strong element of domestic bias, that are not well suited to efficient cross-border banking or international financial markets. That is not in Australia’s interests. If it were to occur, it would only make it more important - not less - that our standards were as strong as they could be to guarantee continued market access.

Haven’t we done enough already?

The third question is: haven’t we done enough already?

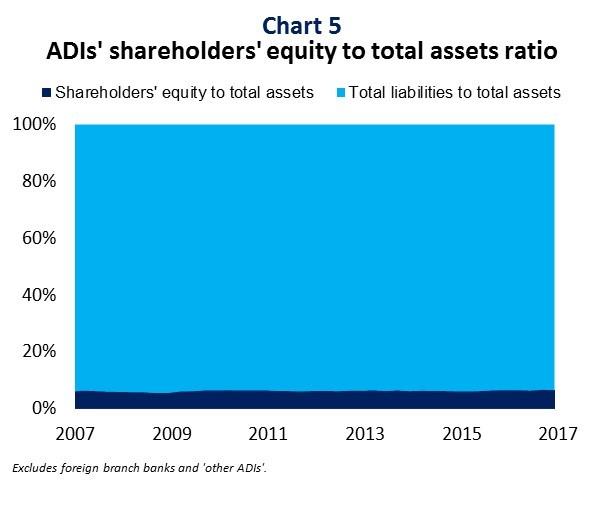

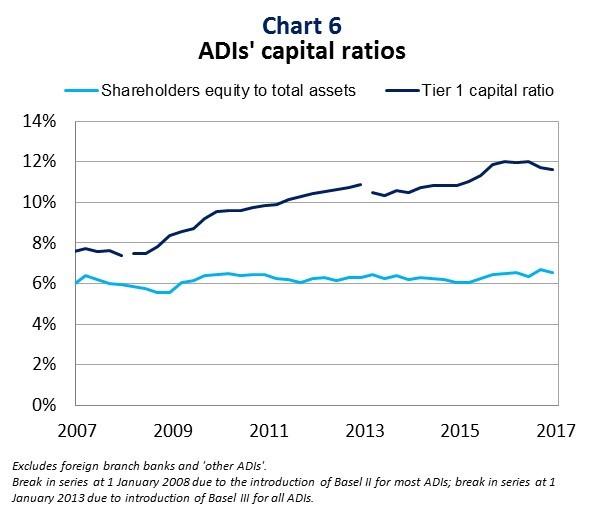

The banking system certainly has higher capital adequacy ratios than it used to. But overall leverage has not materially declined. The proportion of equity that is funding banking system assets has improved only modestly, from a touch under 6 per cent a decade ago to just on 6½ per cent at the end of 2016.[5] (By the way, Chart 5 is a nice reminder that, notwithstanding the extra capital that new regulation has required, banking remains a highly leveraged business).

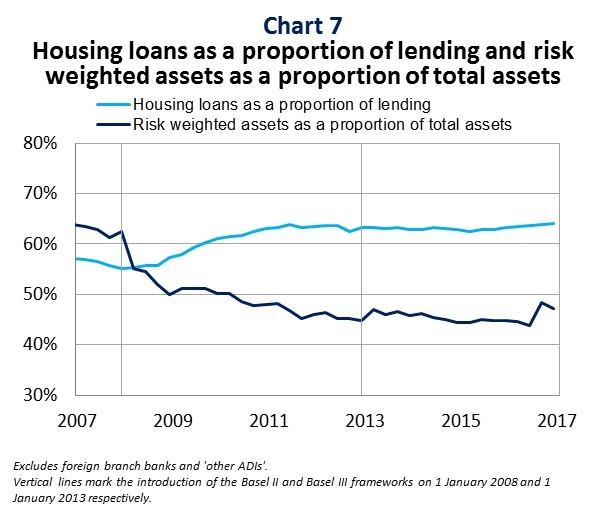

The difference between improved risk-based measures of capital adequacy, and the more limited improvement in non-risk based measures of leverage (Chart 6), is driven to a significant degree by changes in asset composition. In particular, it reflects the increasing concentration of the banking system in mortgage lending (which benefits from lower risk weights – Chart 7).[6] It implies the system has de risked more than deleveraged. But that assessment is itself premised on a critical assumption: that a high and increasing concentration in mortgages is generating a lower risk banking system. In the current environment, it is certainly an assumption that deserves a bit more scrutiny. While it might be a reasonable proposition most of the time, we need to be wary of the fallacy of composition when concentrations grow.

Unquestionably strong

One way to think about our objective in establishing ‘unquestionably strong’ capital requirements is that we should be able to assert, with credibility, that the banking system can withstand reasonably foreseeable adversity and continue to provide its core function of financial intermediation for the Australian community.

Unfortunately, there is no universal measure of financial strength that provides a clear cut answer to that test. So we need to be able to look at this question through multiple lenses. In thinking about the concept of ‘unquestionably strong’, there are three basic ways to do that:

- relative measures: the FSI adopted a relative approach in suggesting that unquestionably strong regulatory capital ratios would be positioned in the top quartile of international peers. We have said on a number of occasions that we do not intend to tie ourselves mechanically to some particular percentile, but top quartile positioning is a useful sense check which we can certainly use to guide our policy-making.

- alternative measures: regulators do not have exclusive domain over measures of financial strength. There are a range of alternative measures, such as those used by rating agencies, which can be used to benchmark Australian banks. Again, we do not intend to tie ourselves too closely to these measures, but it would be difficult to argue the banking system is unquestionably strong if alternative measures of capital strength, particularly those that are influential in investment decision-making, were to suggest something to the contrary.

- absolute measures: relative and alternative measures are useful guides, but the real test for a bank to claim it is unquestionably strong is whether it can comfortably survive extreme but plausible adversity. So stress testing, which doesn’t rely on relativities with other banks, or competing measures of strength, provides another useful guide for us.

Using multiple measures will provide useful insights on the banking system’s strength, but unfortunately will be unlikely to give us a single ‘right’ answer. At best it will provide a range for possible calibration which would reasonably meet our objective that, whichever lens you look through, we can credibly claim to have capital standards that produce an unquestionably strong banking system. We will still need to exercise judgement, taking account of other dimensions of risk within the system – both quantitative (such as liquidity and funding) and qualitative (such as risk management and risk culture within banks, and the strengths of the statutory framework and crisis management powers on which the stability of the system is built). Inevitably, some will argue the calibration should be higher, and others think it too high, but at the very least our logic and rationale should be transparent, and we can readily explain how our decisions are consistent with the FSI’s intent.

As things stand today, our plan is to issue an information paper around the middle of the year, which will set out how we view the banking system through the various lenses that I have just mentioned, the extent of further strengthening required, and the timeframe over which that can be achieved in an orderly manner.

Beyond establishing the aggregate level of capital, we will need to follow that up with consultation on how the regulatory framework should allocate that capital across the different types of risk exposure. Some of those changes will flow from the inevitable direction of the work in Basel that I referred to earlier: this will include, for example, greater limitations on the use of internal credit risk models, and the inevitable removal of operational risk models. These changes will primarily impact the larger banks.

But, coming back to my starting point, probably the biggest issue we will need to resolve in ensuring capital is appropriately allocated is whether and how we adjust the risk weights for housing-related exposures. Our announcement last week reflected a tactical response to current conditions in the housing market. We will continue to refine these sorts of measures as long as they are needed. But a longer term and more strategic response will involve a review, during the course of our work on ‘unquestionably strong’, of the relative and absolute capital requirements for housing exposures. That should not be taken to imply that there will be a dramatic increase in capital requirements for housing lending: APRA has always imposed capital requirements for housing exposures that are well above international minimum standards, so we do not start with glaring deficiencies. By anyone’s standard, however, we have a banking system that has a notable concentration in housing. It is therefore important we give that issue particular attention as we think about how to put the concept of ‘unquestionably strong’ into practice.

Concluding remarks

The case for the Australian banking system to be seen as unquestionably strong remains as valid today as it did when the FSI recommended it in 2014. And, as much as we would like international policy deliberations to be complete, we do not think it right to defer a decision on this issue any longer.

In moving ahead, we will be looking at many components of the capital adequacy framework, but given its position as the dominant asset on the balance sheet of the banking system, the adequacy of capital requirements for housing-related risks will be a critical part of that assessment. Beyond the recently-announced tactical responses to current conditions in the housing market, making sure the system is on a sound footing for the longer term is even more important. Put simply, the capital adequacy framework needs to address the concentration in housing lending that has built up in the banking system over time: if we are going to put an increasing number of eggs into a single basket, we’d better make sure that basket is a (unquestionably) strong one.

After all, fortune favours the strong.

Footnotes

- The phrase ‘fortis fortuna adiuvat’ is often attributed to the Roman playwright Terence, and can be found in his play, Phormio. A literal translation is ‘the strong ones, Fortune helps'.

- The Government subsequently endorsed that recommendation, along with most others from the Inquiry.

- These banks account for around 85 per cent of the stock of outstanding housing loans granted by all APRA-regulated ADIs.These banks account for around 85 per cent of the stock of outstanding housing loans granted by all APRA-regulated ADIs.

- It is also worth noting that the Executive Order on financial regulation signed by the new US President includes as a core principle that regulation should be designed to ‘prevent taxpayer funded bail-outs’. Minimising risk to the taxpayer was also an important consideration in the FSI’s recommendation to strengthen the financial position of the banking system.

- This net change slightly understates the improvement in the ratio of shareholders’ funds to assets: at its lowest, in late 2008, the ratio was 5.5 per cent.

- For a detailed explanation of the impact of shifts in asset composition, see Byres, W (2014), Seeking strength in adversity: Lessons from APRA's 2014 stress test on Australia's largest banks, Speech to AB+F Randstad Leaders Lecture Series, Sydney.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9.8 trillion in assets for Australian depositors, policyholders and superannuation fund members.