APRA’s role in private health insurance premium round

Every year, private health insurers apply for approval to change the premiums they charge policyholders. By law, private health insurers are unable to change their premiums without approval from the Minister for Health, Disability and Ageing (the Minister).

The approval process, known as the private health insurance (PHI) premium round, attracts significant attention due to the impact on policyholders and debate over whether the premium changes are appropriate.

While premium increases are rarely welcomed by policyholders, it's essential for private health insurers to maintain their ability to pay claims and meet other commitments. When expenses for insurers rise – for example through higher claim payments due to inflation or insurers needing to be more vigilant on information security threats, premiums should take into account these higher costs.

That's where APRA comes in.

A trusted advisor

As Australia's prudential regulator for PHI, APRA is responsible for making sure that insurers have the ability to meet obligations to policyholders, including payment of claims. APRA’s overarching responsibility is to ensure that regulated entities can meet their commitments to policyholders under all reasonable circumstances.

As a result, the Department of Health, Disability and Ageing (the Department) requests APRA’s view on the implications of each private health insurer’s application to change premiums.

Specifically, APRA’s role is to advise the Department on whether premium increase requests would result in an "adverse prudential outcome", which includes:

- an insurer being unable to pay claims or deliver other member services; and

- an insurer being unable to sustain its business.

APRA does not approve premium increases. Rather, APRA – as an important stakeholder in the PHI industry – is an advisor to the Department.

Approval process

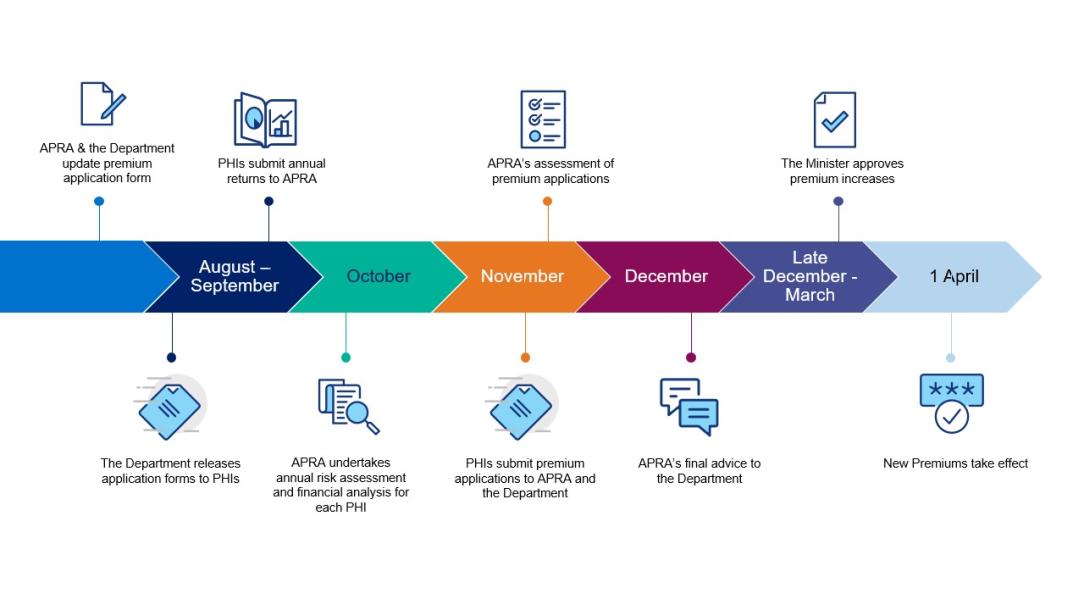

The PHI premium round usually occurs once a year and involves all insurers applying for premium changes at the same time. Typically, insurers’ applications are submitted to the Department in November for changes to apply from 1 April the following year.

The process is conducted by the Department and any changes to PHI premiums must be approved by the Minister. This is a requirement under section 66(10) of the Private Health Insurance Act 2007, where the Minister must approve the proposed change unless it is contrary to the public interest.

The Department publishes the application form in September. APRA collaborates with the Department to design the form and to decide what specific information should be gathered in relation to challenges facing the broader private health insurance industry. The Department consults with insurers on the draft form prior to publication of the final version.

APRA’s preparation and analysis

APRA’s role is to provide a comprehensive understanding of the current macroprudential environment within the PHI industry as well as assessing the financial health of individual insurers. Through its close supervision, APRA is well positioned to identify the challenges and issues faced by individual insurers. Our insights are informed by analysis of the data that insurers submit to APRA and direct engagements with each insurer.

In early October, around six weeks before applications are submitted to the Minister, APRA carries out a full financial analysis of each insurer. This includes analysis of the annual returns submitted to APRA, the Appointed Actuary’s assessment of the insurer in the annual "Financial Condition Report", among other things. The Appointed Actuary is the actuary required by law and selected by each APRA-regulated insurer to undertake certain functions.

The premium round applications submitted by insurers help APRA to understand each insurer's approach to managing the key risks it is facing.

Once APRA receives the insurers’ applications, its focus is on understanding each insurer’s approach to managing these risks via premium changes and assessing the effectiveness of that approach. This includes an assessment of:

- the insurer’s ability to maintain capital levels,

- the insurer’s ability to cover the costs of claims,

- the level of uncertainty around issues including membership, claim costs, premium revenue, capital and adequacy of pricing, and

- risks to sustainability.

Decision time

These assessments inform APRA’s final advice to the Department, which is then incorporated into the Department's advice to the Minister. After considering each insurer’s application, the Minister notifies each insurer of whether its application to change premiums has been approved.

If the Minister asks an insurer to reconsider or provide further information to support its request, APRA updates its advice to the Department based on the revised information.

APRA's role in the PHI premium round

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9.8 trillion in assets for Australian depositors, policyholders and superannuation fund members.