APRA Deputy Chair John Lonsdale - Speech to the COBA CEO and Director Forum

Banking on a successful future for the mutual sector

Good morning. It’s a great to be here in person at this year’s event.

175 years ago, on an early February evening, a large crowd gathered at Mr Smith’s White Horse Inn in Adelaide.

They’d been drawn by an ad in the local newspaper, which exhorted that: “No industrious working man who desires to insure the permanent comfort of his family ought to absent himself…”

It was a meeting to discuss the formation of Adelaide’s – and very likely Australia’s – first building society. Based on the mutual model that had taken hold across England, the Adelaide and Suburban Building Society offered an opportunity for its working-class members to pool funds to help each other buy their own homes. Within a matter of years, dozens of similar societies had sprung up across the colonies.

Since those pioneering days, Australia’s mutual sector has carved out a proud and unique place in Australia’s banking sector:

- A proud history of providing differentiated service to its customer members and supporting local communities.

- A proud history as an early adopter of innovation, from ATMs to the New Payments Platform. (You might even argue that the early building societies like the Adelaide and Suburban Building Society were one of Australia’s earliest forms of crowdfunding!)

- And a proud history of resilience. The customer-owned banking model has withstood a raft of challenges since that first meeting in the White Horse: from Australia’s banking crisis of the 1890s through to the global financial crisis a century later… and more recently the COVID pandemic.

However, as history reminds us, a proud past is no guarantee of a successful future.

The rate of change in the financial sector has never been faster. Australia’s credit unions, mutual banks and building societies must keep evolving to keep pace.

What’s apparent, however, is that not all mutuals are equally equipped to the task.

Key to extending the proud history into a successful future is strong governance. By working to improve their governance, boards will put themselves in a stronger position to make good decisions, address industry changes and plan for a sustainable future.

APRA is taking steps, too, to support the strength and resilience of the sector. This year we have increased our regulatory focus on cyber risk, risk culture and upgrading continuity and contingency planning. The new bank capital framework announced late last year will further ensure Australian banks of all sizes remain financially strong. But more on that later.

Learning from the past

The customer-owned model has survived in Australia since 1847, but literally hundreds of individual entities have disappeared along the way… some deliberately, such as the original ‘terminating’ building societies, others as a result of poor governance or financial stress, and then there are those that have sought survival or growth through mergers.

In just the past 16 years, more than 100 mutuals have merged or exited the industry in Australia.

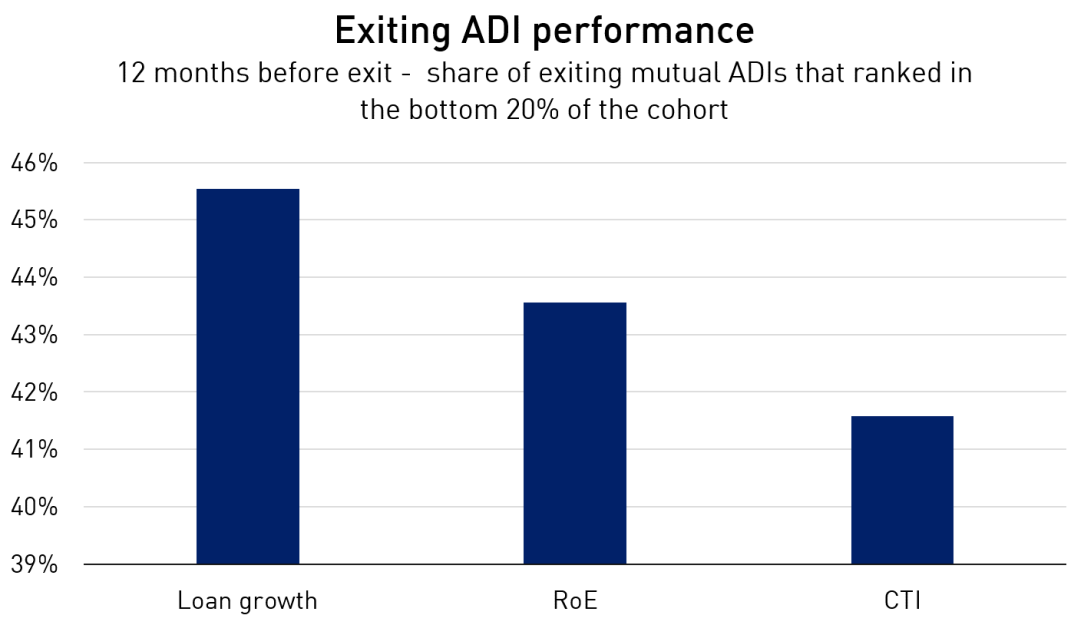

APRA recently reviewed the performance metrics of each of these mutuals one year out from their industry exit. As a result, we identified several strong indicators of a potential future exit from the industry.

In particular, poor performance on cost management, lending growth and profitability should be cause for concern for mutual boards.

On this chart, we show that 12 months before exit:

- 46 per cent were in the bottom 20 per cent of the cohort on loan growth;

- 44 per cent were in the bottom 20 per cent of the cohort for return on equity; and

- 42 per cent of the exiting mutuals were ranked in the bottom 20 per cent of the mutual cohort on cost to income.

Being in the bottom 20 per cent on any of these metrics does not, of itself, foreshadow pending demise however it should signal a strong warning. Strong, effective boards should be attuned to these warning signs and make appropriate decisions if the circumstances warrant it.

Which brings me back to the subject of good governance.

On board with good governance

As Australia’s first building societies began to emerge, newspapers in the colonies were rife opinions on how such societies should be structured and governed. Mutuals established constitutions which aligned governance with their core purpose of supporting members. Constitutions remain central to how mutuals are run to this day. However, some of the constitutional rules and traditional practices used by mutuals today are out of touch with evolving public expectations of good governance, particularly as they relate to board tenure, composition and a mutual ADI’s bond.

Regardless of industry sector, APRA considers good governance to be a precondition to sustainable success.

Tenure

Board tenure, composition, capabilities and performance are important aspects of good governance, and the areas where we see the most scope for improvement within the mutual sector.

APRA has articulated its concern about excessive tenure within the prudential framework. Our cross-industry prudential standard on governance (CPS 510) requires authorised deposit-taking institutions (ADIs) to have a board renewal policy that considers whether directors have served for a period that could materially interfere, or could be perceived to materially interfere, with their ability to act in the best interests of the institution.

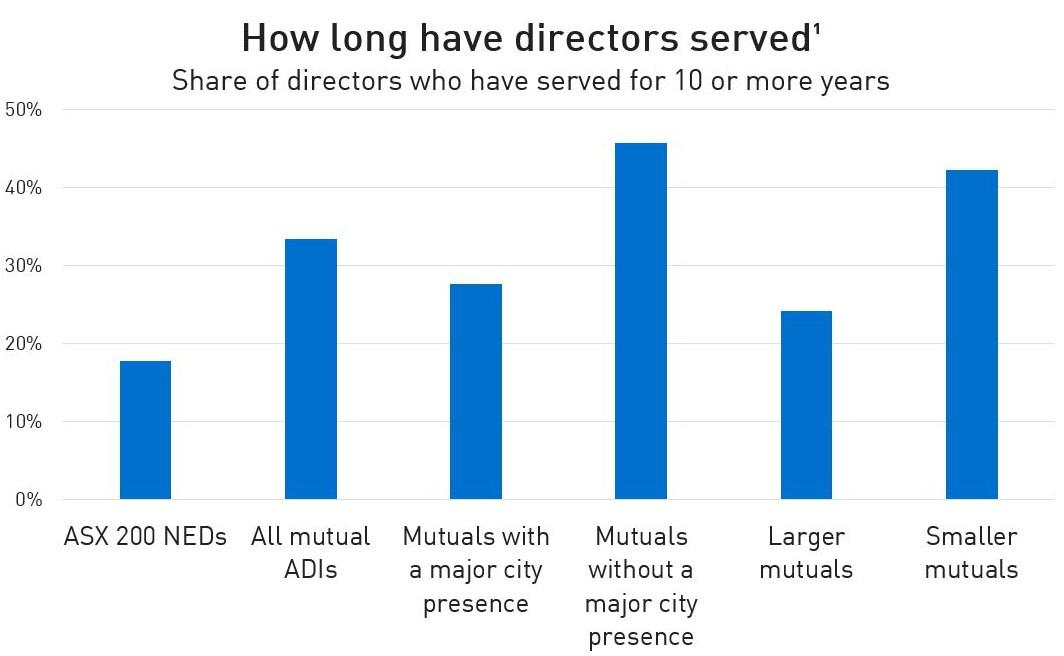

And yet, directors are remaining on mutual boards far longer than their ASX 200 counterparts. The boards of 19 out of the 60 mutuals regulated by APRA have an average director tenure of at least 10 years.

One in three of all directors in the mutual sector have been on the same board for a decade or more, with one in six having tenures of 15-plus years.

On this chart, we compare the length of tenure of ASX 200 non-executive directors to directors on mutual boards. The proportion of directors serving 10 years or more on mutual boards is almost double that of directors on the boards of ASX 200 companies.

The chart also shows that regional mutuals and smaller mutuals tend to have the highest proportion of long-tenured directors on their boards. This is not surprising, and reflects the challenges regional and small mutuals face in attracting new directors. However, that does not mean the issue should be ignored.

While there are no current limits on board tenures within the ADI prudential framework, the Australian Institute of Company Directors’ not-for-profit governing principles state that:

“Boards should consider how a director’s tenure may impact their performance, particularly if serving for ten years or longer.”

In superannuation, where APRA does expect boards to set maximum tenures for directors, the current guidance is that the maximum would exceed 12 years in limited circumstances, although my colleague Margaret Cole, has signalled a preference for 10 years maximum. Likewise, the Australian Shareholders Association no longer classifies long-serving directors as ‘independent’ after 12 years of service.

One of APRA’s main concerns about long tenures is the erosion of a person’s capacity to exercise independent judgement. Long-term directors can become entrenched, too closely aligned to management or past decisions, and less likely to challenge decisions. Under CPS 510, boards of APRA-regulated institutions are required to have a majority of independent directors at all times. If the 12-year rule for independence were applied, more than a quarter of mutuals would be non-compliant.

Board composition and capability

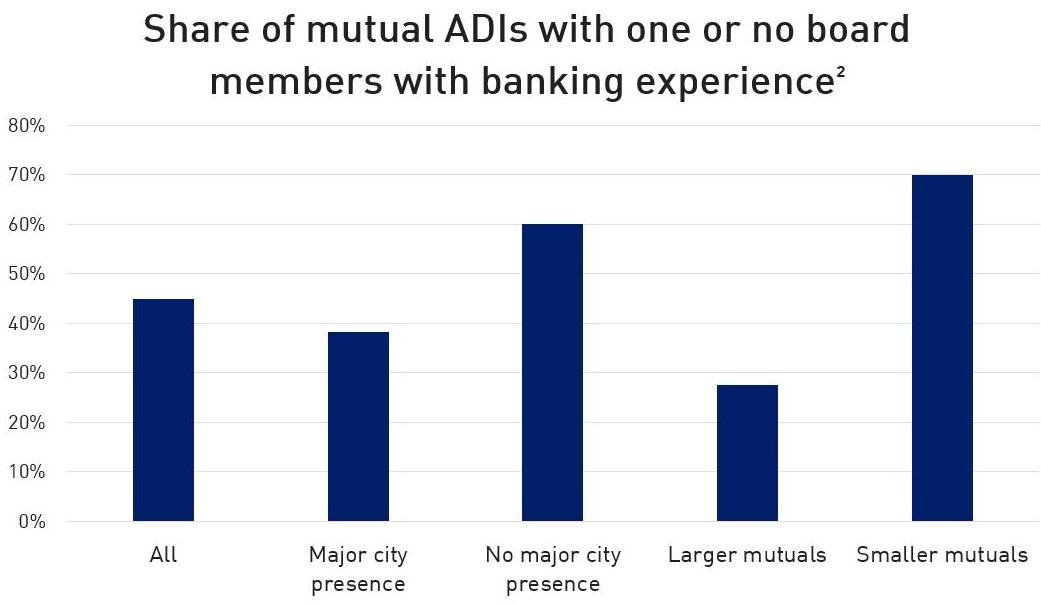

Regulated entities need sound stewardship and vigilant oversight – but mutual boards often lack the full breadth of capability and skills required.

The composition of mutual boards is often a product of history. In a number of cases, mutuals are bound by longstanding constitutional rules that require a majority of directors to be from the “bond” – the customer cohort – or from a particular geographic area. In the interests of their customers and good governance, boards should consider consigning to history outdated provisions in their constitutions that undermine their ability to operate effectively.

Despite being in the banking business, almost half of boards in the sample have either only one director or no directors with contemporary banking experience. The lack of banking experience is more pronounced on the boards of regional and smaller mutuals. Other boards are dominated by members of a single industry group or from a specific regional area, narrowing the breadth of the directors’ capabilities and experience. While experience in the industry of its customer base is useful, it is arguably less useful than experience in running a bank.

It is unrealistic to expect every director to be competent in all the skills required. Effective boards should form a strong cell of collective knowledge, skills and experience and record this breadth of experience on a skills matrix. This matrix itself needs to be a living document: dynamic and used, reviewed and adapted to ensure the skills and experience needed by the board is considered, directors are assessed against that matrix, and any gaps identified and addressed.

APRA recognises that it can be challenging for mutuals, especially smaller ADIs operating in regional areas, to attract directors with the right skill mix. The relatively low remuneration paid to directors in the sector adds to the difficulty. Some approaches that could help offset these challenges include the increased use of virtual board meetings and allocating more time to the board renewal process. Where a skills gap exists, mutual boards also have the option to engage external consultants. This is specifically permitted under CPS 510. Yet, we often see boards relying on management to fill knowledge gaps instead.

Assessing board performance

The assessment of board performance is another area of governance that needs improvement.

CPS 510 requires annual assessment of board performance. APRA reviews these assessments and too often we see boards solely relying on self-assessment and peer review, which often does not result in the right outcomes. Even more concerning are the instances we see where boards engage independent experts to assess performance then fail to implement the recommendations arising from the review.

Fortunately, there are many mutual boards thinking carefully about the best way to achieve an objective and independent assessment, including the use of qualified independent experts. While there is a cost element involved in using external experts, mutuals need to weigh this against the value of recommendations that lead to a properly functioning, appropriately-skilled board.

So what does good practice look like? Consistent with the prudential framework:

- Fixed term tenure for directors and robust board renewal planning;

- Clearly articulated policies on optimal board composition, to ensure appropriate levels of experience, skills and diversity; and

- External review of board performance, committees and individual directors by appropriately qualified independent experts.

In the next 12 months, APRA supervisors will be engaging with mutual ADIs to push for the good practice I have outlined, this may include asking for independent third-party assessment of board composition, capability and renewal.

APRA’s support for a strong, stable mutual sector

APRA’s supervision priorities for 2022 will further support the strength and stability of the mutual sector.

In addition to APRA’s core activities in system resilience, we have three key priorities.

The first is cyber risk preparedness and responsiveness, across all industries that APRA regulates. The risk of cyber-attacks is relentless and ever-increasing across the financial system. Two recent pilot initiatives by APRA highlighted the need for boards to strengthen their oversight of cyber risks. A technology resilience data collection and a pilot independent assessment of compliance with APRA’s information security prudential standard (CPS 234) pinpointed weaknesses in a number of areas.

Boards need to play a more active role in:

- reviewing and challenging information reported by management on cyber resilience;

- ensuring their entities can recover from high-impact cyber-attacks; and

- ensuring information security controls are effective across the supply chain.

The CPS 234 independent reviews are now being rolled out to all regulated entities. The first tranche, which includes COBA members, is expected to be completed in late 2022.

The second priority is APRA’s continuing focus on risk culture.

A risk culture survey was sent at the end of last year to 18 banks – including a number of mutuals – with the purpose of benchmarking perceived risk behaviours and the effectiveness of risk structures within entities. Although mutuals are doing well on the alignment between employees and the ADI on their purpose and values, there were two key areas where the surveyed mutuals lagged behind other banks in their cohort. The first was in the effectiveness of risk management oversight and the appropriateness of frameworks and controls. The other area was in decision-making and challenge, which relates closely to standards of governance.

The results will help surveyed entities identify priority areas that may warrant additional attention. APRA wants to understand better what action mutual boards and management are taking to build and maintain an effective risk culture. Expect to hear more from your supervisors on this.

The third priority is upgrading contingency and continuity frameworks in the banking sector.

Towards the end of 2021, APRA released a draft prudential framework with the objective of strengthening crisis preparedness across all APRA-regulated industries. APRA has intentionally taken a proportional approach in this policy development to recognise key differences across industry.

Under the new draft requirements, entities must have a plan for financial stress. For mutuals, in most cases this means developing feasible, entity-led transfer arrangements to other entities. As this is an entity’s last defence ahead of failure, waiting for APRA to step in is not a fall-back option. Recent APRA reviews of plans in this cohort identified that most had weak or insufficient trigger frameworks that did not meet APRA’s expectations. Additionally, at least half of the reviewed plans required either remediation of their crisis communication strategies or additional preparatory measures taken for contingency options to be credible. It is clear that there is work that needs to be done.

Whilst it is no-one’s wish that the deployment of a contingency plan becomes a necessity, it is important that they are dynamic, robust and credible. They should be considered an integral part of an ADI’s risk management framework. With that in mind, APRA supervisors will continue to engage with mutual ADIs on the adequacy of their plans with the next round of feedback to be provided in the coming months.

Basel III implementation

A few words on the upcoming implementation of APRA’s new bank capital framework.

Finalised in late 2021, the new bank capital framework has been developed over four years of consultation with ADIs, and it is fair to say that the mutuals have been heard. The framework is designed to embed ‘unquestionably strong’ levels of capital and align Australian standards with internationally agreed Basel III requirements – and APRA has sought to do this in a proportional way.

The key takeaways for the mutual sector are:

In developing the framework, APRA has minimised unnecessary regulatory burden on mutuals and other small ADIs. Included in the framework is a set of simplified capital requirements that can be applied to small, less complex ADIs, such as those with under $20 billion in assets and simple business models.

The gap in risk weights between Internally Ratings Based (IRB) and standardised banks has narrowed, and the unquestionably strong framework was calibrated to raise minimum requirements by 50 basis points for the average standardised bank versus 150 basis points for the average IRB bank.

Mutuals should anticipate a change to their capital conservation buffers, as outlined in the information paper we released in November last year… Revisions to the capital framework for authorised deposit-taking institutions.

We do not expect a need for additional capital across the sector. However, it’s important to be aware that this is an industry-wide perspective and that the impact on individual mutuals will vary, depending upon an ADI’s portfolio composition.

This audience will be well aware that the board of a regulated institution has primary responsibility for the capital management of that institution. This obligation goes beyond the need to ensure compliance with regulatory capital requirements and requires the board to ensure that each regulated institution holds capital resources commensurate with its risk profile.

Mutuals should have fully considered the impacts of the revised capital standard changes by now. APRA expects that mutual boards will satisfy themselves that revised capital targets are in line with risk appetite, which will include consideration of the board’s appetite for potential breaches of regulatory capital requirements.

The bank capital framework is a keen area of focus for your APRA supervision teams and you can expect to hear more about this soon. The new framework will protect depositors, support lending and ensure Australia’s already strong banking system is preserved and ready to withstand adverse economic conditions into the future.

Concluding remarks

175 years on from the meeting in Mr Smith’s White Horse Inn, Australia’s mutuals continue to support customers and communities, and provide a popular alternative to big banks and other financial institutions.

It’s a sector with a proud past and a future filled with challenges… and opportunities, too. By continuing to evolve, and staying vigilant on good governance, mutual ADIs will remain an important, unique feature of Australian banking well into the future.

At APRA, we want to see Australia’s mutual sector continue to make history, not become history. I’m sure the feeling’s mutual.

Footnotes

1 Mutual ADI board data sourced from 2021 annual reports. ASX 200 NED data sourced from the 2021 Ashurst board succession review: https://www.ashurst.com/-/media/ashurst/documents/news-and-insights/insights/2021/nov/ashurst-board-succession-review.pdf

2 Includes mutual ADIs that list relevant experience of board members in their annual reports.

Media enquiries

Contact APRA Media Unit, on +61 2 9210 3636

All other enquiries

For more information contact APRA on 1300 558 849.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding $9.8 trillion in assets for Australian depositors, policyholders and superannuation fund members.