Combating complacency in a new era of PHI instability

Peter Kohlhagen, Senior Manager, Policy Development - Health Insurance Summit, Sydney

Good morning everyone, it is a pleasure to be here. Thanks to the organisers for the opportunity to discuss APRA’s views of the private health insurance industry.

This industry is under some duress at present, and it is in all our interests – insurers, the policyholders they serve, APRA and the broader system – that it is able to respond to those challenges.

I spoke at this event last year, and my key theme was resilience. In particular, APRA’s work with insurers on our Prudential Policy Roadmap. The Roadmap is all about building resilience to current and emerging risks. In February this year, APRA Member Geoff Summerhayes built on that theme in a speech to a Members Health Directors’ forum. Geoff’s speech also focused on sustainability, as a key motivation for our work on resilience.

Today, I will build on the importance of resilience in the face of sustainability challenges. I will update you on our work on the Roadmap, including exploring APRA’s initial thinking on reviewing the capital standards.

But before that, I will sound a cautionary note on the risk of complacency. As I noted last year, complacency is the enemy of resilience. APRA continues to see warning signs of complacency in the private health insurance industry.

A cautionary note on complacency

Former Intel CEO Andy Grove once noted that, “Success breeds complacency. Complacency breeds failure. Only the paranoid survive”. These sentiments warm my heart as a prudential regulator – paranoia might be a step too far but we like to see a healthy awareness of what can go wrong.

The private health insurance industry is emerging from a long period of relative stability. Challenges that once appeared to be some distance away are now upon us. We observe that some insurers have been slow to react to this changing reality. It can be comforting to assume that the future will look like the recent past. But that kind of thinking can be fertile ground for complacency. It can leave insurers exposed when the environment changes.

Insurers need to challenge their assumptions about what can go wrong in their operating environment. The final report of APRA’s Prudential Inquiry into the Commonwealth Bank of Australia put it well – cultivate a sense of ‘chronic unease’ about the risks and threats facing your institution.

Stress testing to build resilience and avoid complacency

One antidote to complacency is a robust program of stress testing. Institutions and regulators across the financial services industry use stress testing to understand financial resilience and vulnerabilities. It complements regulatory capital requirements by providing a different lens through which to view an institution’s resilience to financial stress. Strong stress testing approaches give us more comfort that an insurer’s capital is sufficient; weak approaches give us pause.

To be effective, stress testing needs to genuinely challenge and stress the insurer. It should include severe but plausible scenarios that thoroughly interrogate the insurer’s fundamental business strategy. Indeed, a reverse stress test or ‘stress-to-fail approach’ can be a powerful technique. We have seen how it can assist boards and management to understand points of weakness and stress in their insurer.

APRA wrote to insurers on stress testing in February this year with a simple request; provide information to help us understand insurers’ current approaches.

While our analysis is not yet complete, we can say that:

- we saw a lack of severity in the stresses applied, and reverse stress testing was not considered;

- instead of genuine, multifactor scenarios, the focus was primarily on sensitivity testing; and

- stress testing was primarily focused on regulatory capital requirements, rather than using both the regulatory capital lens and other complementary approaches.

In short, we see evidence that current stress testing practices fall well short of those in other APRA-regulated industries. We will have more to say as we finalise our analysis, and the information gathered will help us as we integrate private health insurance into APRA’s broader program of industry-wide stress tests. But the direction is clear – we expect to see a material strengthening of stress testing practices over time.

Resilience and the Policy Roadmap

Turning now to the Policy Roadmap, it’s timely to update you on the state of play and the next steps. In light of emerging challenges facing the industry, these measures are more important than ever.

You’ll recall that the Roadmap consists of three phases: risk management, governance and capital. The core of the first phase, risk management, came into effect on the first of April this year. We are also progressing other initiatives from the Roadmap:

- We expect to release final standards on the role of the Appointed Actuary very soon; and

- We are consulting on the first instalment of our broader work on operational risk, with a new standard that addresses the increasingly prominent issue of cyber risk.

We launched consultation on the second phase, governance, in February this year. We proposed to strengthen the rules around governance, fitness and propriety and audit, with effect from 1 July 2019.

Submissions have only recently closed, and so it is too early to confirm our response to any of the matters raised. We will give careful consideration to all the feedback received, including on issues such as tenure of directors and auditor experience requirements. We expect to finalise the new standards and guidance soon. We look forward to continued productive engagement with insurers to support an orderly transition.

With phases 1 and 2 of the Roadmap substantially complete, critical parts of the regulatory architecture have been modernised and made fit for purpose.

APRA’s review of capital standards

Which brings me to phase 3, capital. Capital plays a key role in insurer resilience by providing a financial buffer to protect the insurer in times of stress.

Our Roadmap said that we did not have any significant prudential concerns, or see an urgent need to modify the PHI capital framework. Accordingly, we said that we did not intend to review the capital standards until 2018-2019.

Further, APRA does not think that capital levels in the industry are too high or should be reduced. Adequate capital buffers are crucial to achieving the mandate of the prudential regulator.

Those conclusions remain APRA’s view today, but the time for review of the capital standards is now getting closer. Consistent with my comments on stress testing, more question marks emerge as we delve deeper into current insurer approaches to financial resilience.

There is not yet an urgent need for change, which affords us the benefit of undertaking the review at a measured pace. Health insurers will have plenty of opportunities for dialogue and consultation. Importantly, we want to make sure that any changes happen in an orderly way, with appropriate time provided for transition.

The current capital standards

Before we can decide whether to change the capital standards, we need to assess how insurers are implementing the current standards. On that front, we see a wide range of practices. This is not necessarily wrong, and the standards allow for significant discretion, but it does give us reason to pause. In particular, choices regarding the period of data to use for calibration can have a material impact. APRA observes some insurers using 10 years of data, some using data back to 2003 and some using data since 1990. The last 10 years have been a period of stability compared to the 1990s and early 2000s. Using this data results in less volatility, and as a result generates a significantly lower capital requirement. Choices of methodology also have an impact, and we observe a range of practices there as well.

We will review available information to explore current practice in more detail and engage further as we progress our thinking.

Capital standard principles

Across the other insurance industries, APRA’s approach to capital is underpinned by some key principles. As we review the capital standards, we will considering whether and how these principles are relevant to the PHI industry. No decisions have been made at this point, but we want to be transparent on our thinking where we can.

APRA’s capital framework for other insurers requires each insurer to have available capital that exceeds its required regulatory minimum. That minimum is set to allow it to survive a 1-in-200 level of stress on a gone concern basis.

The regulatory minimum (we call it the Prescribed Capital Requirement, or PCR) is the sum of a standard calculation and a possible additional amount when required by APRA on a case-by-case basis. The PCR considers asset risks, liability risks and the interactions between them. It is designed to require capital against all material risks to the insurer.

The PCR is a statement of APRA’s risk appetite for insurers – APRA’s expectation is that each insurer will always hold sufficient capital to meet its PCR. Failure to do so is a trigger for strong supervisory action.

The framework also requires insurers to calculate their available capital– in our terms, the capital base. The rules for the capital base cover not only its size but also its quality – the aim is to make sure that the capital is able to absorb losses in time of need. That means holding a substantial proportion of equity capital as the highest quality form of capital. Other capital instruments must be readily convertible into equity in times of stress.

Any assets that won’t be there to pay policyholders in times of stress are excluded from the capital base. This includes goodwill, intangibles, deferred acquisition costs and deferred tax assets.

Finally, APRA requires insurers to operate with a prudent buffer of capital, over and above that needed to meet regulatory minimums. The size of the buffer is a matter for insurers, reflecting the board’s risk appetite. Insurers will typically take into account the results of stress testing when setting capital buffers. As an insurer’s capital reduces towards the PCR, our supervisory intensity increases.

Some aspects of the current PHI capital standards are well aligned to these principles. Other aspects reflect different approaches or philosophies. We will work through those differences as we progress our review. It is worth noting though, that on many of these principles, the current PHI standards are less conservative and allow for considerably more discretion than those for other insurers.

Next steps on capital

As our thinking progresses on the review of capital standards, we will release a ‘roadmap for capital’. We found that the approach of outlining a roadmap has worked well so far, and has helped ensure that there is alignment between APRA and insurers.

Measuring sustainability

Turning now to sustainability, we see emerging challenges confronting the sustainability of the industry. These challenges reinforce the need for the enhancements in resilience that I have just discussed.

Geoff Summerhayes’ speech in February noted that APRA has examined sustainability in the superannuation space, and we have been analysing whether similar dynamics are at play in the PHI industry. Today I will talk about how we are doing that analysis. Notwithstanding that the work is still being refined, I can share some of the insights so far. What can we learn about the pressures on the sustainability of insurers and their business models? Can we identify early warning signs of emerging sustainability challenges?

Let me be very clear that the challenges we see are not exclusive to large insurers or small insurers, for-profits or mutuals. We see challenges affecting insurers across all sections of the industry. Larger and more sophisticated players may be better resourced to face the challenges, but you will see shortly that there are points of stress across all insurers.

Before we get to the detail, it’s worth clarifying how APRA uses the metrics. Clearly, no one metric or set of metrics can tell the full story on sustainability. But metrics can provide a starting point for a discussion, both within institutions, including at board level, and between the institution and APRA. APRA overlays the quantitative measures with a range of qualitative factors to produce a full picture. We consider the strategy of the institution, the risk appetite of the board, and the institution’s risk management and capital management approaches.

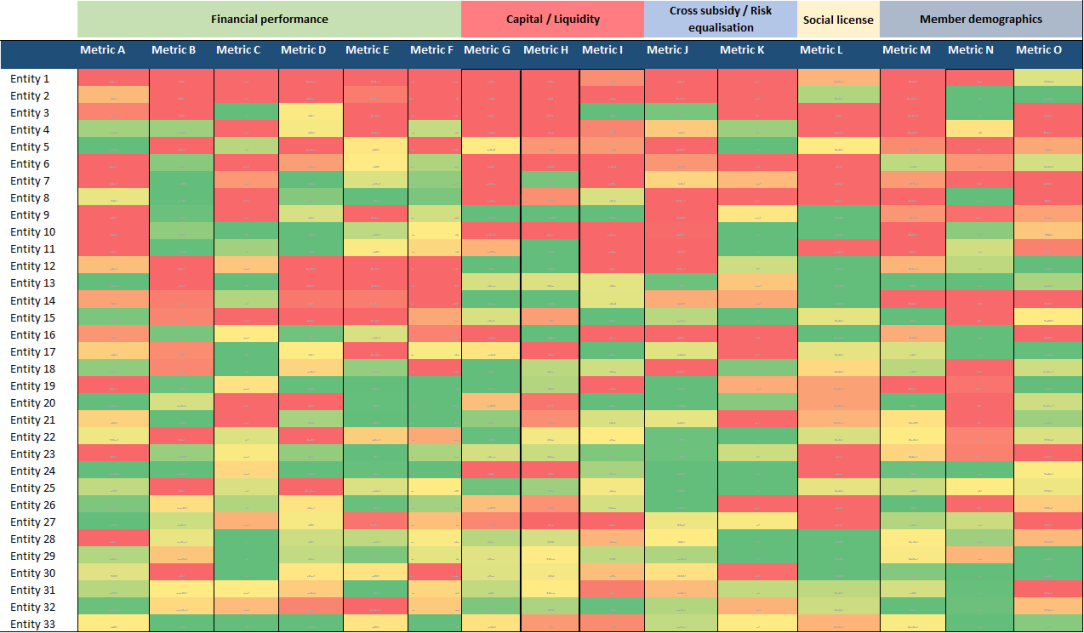

Chart 1: sustainability heatmap

This slide shows a heat map that displays a range of metrics across all insurers. For this purpose, we have masked the identity of the insurers, but you would see them on the left hand side of the table. This is a busy slide, so it’s better to focus on the general approach rather than the detail. The metrics are across the top and include measures related to financial performance, capital and liquidity, cross subsidisation and risk equalisation, social licence (being the unwritten social contract that reflects the trust of the community in an industry), membership demographics and APRA’s own risk ratings of the insurer. We apply a ‘traffic light’ indicator to each metric based on the deviation from the mean.

We are able to drill down into particular metrics or combinations of metrics to understand some key drivers of sustainability. I’ll show some illustrative examples on the next few slides – exploring some topical questions of growth, profitability and demographics in the context of constrained industry growth.

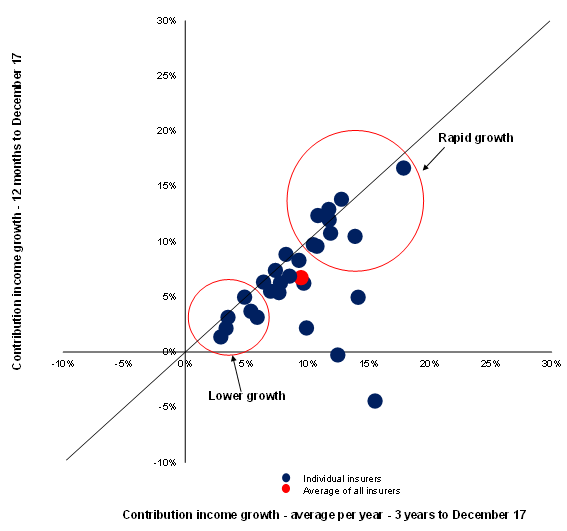

Chart 2: growth rates over 12 months and 3 years

The challenge of affordability is an ongoing issue affecting all insurers and it has implications for participation rates and industry growth. This slide slows 12-month contributions income growth on the vertical axis and three-year average contributions income growth on the horizontal axis. We see a wide dispersion in growth rates – from insurers growing at well above 10 per cent year after year to those growing much more slowly. Rapid rates of growth need to be appropriately managed to ensure sustainability, and have historically been an indicator that an insurer may be under-priced. These matters warrant particularly close monitoring in a time of constrained system growth.

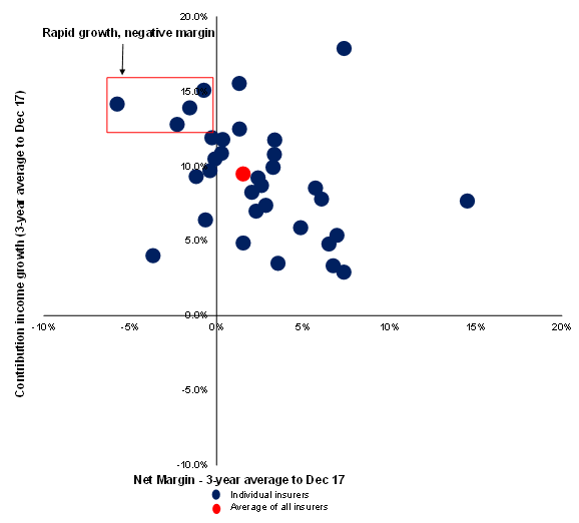

Chart 3: cohort of high growth, negative margin insurers

This chart shows contribution income growth on the vertical axis and net margin on the horizontal. We observe a number of insurers towards the top left of the chart that show a combination of rapid growth and tight margins (or indeed negative margins). In many cases, operating with narrow margins is the result of a commercial decision by the insurer. In other cases, narrow margins may be an unintended outcome of deficiencies in product pricing or design. The past tells us that under-pricing can lead to rapid growth and rapid change in the risk profile of the pool of policyholders. This can lead in turn to sustainability challenges.

Regardless of the cause, APRA will look to understand how the strategy and financial performance sits within the insurers’ pricing philosophy, capital management, risk management and business planning. We will also look to understand any corrective action the insurer intends to take regarding the situation.

Conclusion

In closing, significant progress has been made on the journey towards building resilient insurers. But challenges to the industry and sustainability of business models continue to build. In confronting these risks, insurers are not well served by underestimating the scale of the challenges. APRA is working with industry to implement a prudential framework that supports insurers to build resilience, so that they are sustainable in the long term. However, no amount of policy, process or regulation can succeed without insurers thinking deeply about what could go wrong - and taking action early.

We continue to encourage insurers to step up to the challenge of resisting complacency. To borrow again the words of Mr Grove – to have a healthy dose of “paranoia”.

Thank you and I’m pleased to take your questions.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9.8 trillion in assets for Australian depositors, policyholders and superannuation fund members.