Industry update: 2025 Pulse Check on retirement income covenant implementation

Download the full report:

About this report

This industry update summarises the responses to a voluntary survey issued to registrable superannuation entity (RSE) licensees by the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC) in June 2025.

The survey formed part of the proposals to improve the retirement phase for Australians, announced by the Government in November 2024.1

The survey asked RSE licensees to comment on their progress in implementing the retirement income covenant and planned improvements since the release of the joint APRA-ASIC industry update, in July 2024 (2024 pulse check).2

The survey also asked RSE licensees to comment on improvements made since the 2024 pulse check, challenges in implementing their strategy, and their planned initiatives across the following three core areas for the effective implementation of the covenant:

- Identify and understand members’ needs in retirement;

- Assist members with information, financial advice and product offerings; and

- Execute and oversee their retirement income strategy (strategy) and assess whether the intended outcomes are being achieved.

Of the 44 RSE licensees that were invited to participate in the voluntary survey, 39 participated, representing around 95% of retirement phase assets in superannuation.3

Executive summary

The retirement income covenant was introduced in 2022 to elevate RSE licensees’ support for Australians approaching or in retirement as a key strategic priority. Yet, three years later, there is a widening gap between RSE licensees that are innovating to meaningfully drive better retirement outcomes and meet their members’ needs, compared to those who are focused on mere compliance with the covenant.

Some RSE licensees have shown leadership by investing significant effort into meeting the needs of members transitioning to and in retirement, with a smaller number innovating and pushing forward best practice. Still, far too many have been content with making incremental improvements. In many cases, we have not observed the level of investment in robust governance, innovative retirement income solutions and tailored support for members that regulators and, more importantly, members should expect.

Unless action is taken, particularly by those falling behind, the quality of support provided to members approaching or in retirement, and the outcomes delivered to members in retirement will be impacted.

RSE licensees should focus on improving retirement outcomes for their members. In doing so, RSE licensees should reflect on the better practices outlined in this report as summarised in the Appendix and consider areas for lifting their approach to meet the needs of the Australian community.

Embracing the covenant

RSE licensees who are more advanced in meeting expectations under the covenant have not only taken action to address gaps in their strategies but are investing in developing retirement solutions that support their members’ diverse needs and preferences.

This report provides an overview of industry progress with reference to: understanding members, tailoring support, governance & oversight and measuring impact. Current baseline and leading industry practices are summarised in the appendix.

Based on responses from this year’s voluntary survey, RSE licensees who have elevated their focus on retirement have invested in:

- Better understanding their members – by analysing existing comprehensive data from a range of internal and external sources.

- Tailoring guidance and support for members – by delivering retirement-focused communications, education, and guidance to assist members navigate the transition to retirement.

- Elevating the strategic focus on retirement – embedding retirement as a central tenet of their overall business strategy, with appropriate governance structures to execute and monitor retirement-focused initiatives.

- Measuring impact and outcomes – with increasing focus on measuring member experience and satisfaction, alongside actual outcomes for members in retirement.

- Tailoring retirement income solutions – providing a range of retirement products, guidance and access to advice and services that collectively accommodate members’ diverse needs and preferences and provide scope for members to tailor their retirement solutions to suit their needs.

Looking ahead

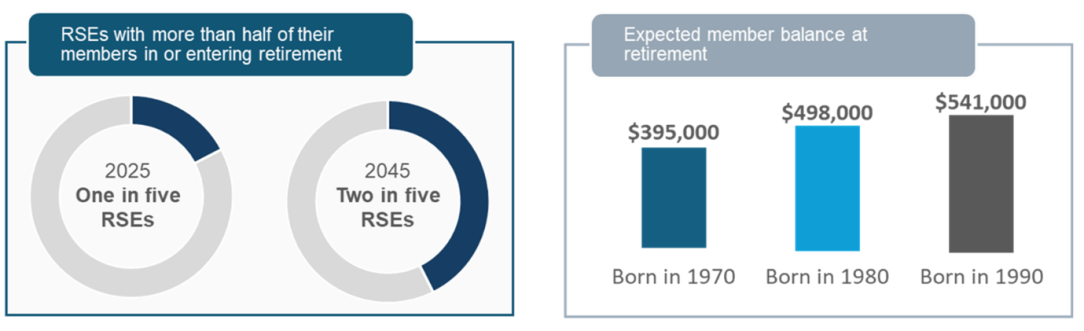

In the coming decade, an estimated 2.5 million Australians are expected to retire4, and most will rely on their superannuation funds to support them as they transition from the accumulation phase to the retirement phase.

RSE licensees with robust retirement income strategies and solutions will be in a much stronger position to attract and retain members who are looking for retirement outcomes that better meet their needs.5

APRA and ASIC urge RSE licensees to accelerate their efforts to strengthen their retirement practices and approach. Key areas in need of greater focus, as identified by RSE licensees themselves in their survey responses, include:

- Better use of data to understand members;

- Investing in digital capabilities; and

- Expanding the provision of retirement information and access to advice.

The Government, APRA and ASIC are committed to supporting RSE licensees to deliver better outcomes in retirement for all Australians. Actions include:

- Releasing ASIC’s thematic review into trustee retirement communications in

October 2025;6 - Updating ASIC’s Moneysmart content, tools and consumer calculators with actionable guidance on superannuation and retirement;

- Government finalisation of the proposed Best Practice Principles for Superannuation Retirement Income Solutions;

- Progressing the Government’s proposed Retirement Reporting Framework, including implementation by APRA;

- Expansion of APRA’s Superannuation Comprehensive Product Performance Package to include retirement products; and

- Finalisation by Government of the Delivering Better Financial Outcomes package.

The retirement landscape

Australia’s superannuation system

Australia’s superannuation system is one of the largest private pension systems in the world, with more than $4.3 trillion in assets invested in superannuation at 30 June 2025, accounting for approximately 160% of GDP.7 Over 1.5 million member accounts are in the retirement phase collectively accounting for approximately $575 billion in member assets.8

With 2.5 million Australians expected to retire over the next decade, the retirement phase in Australia's superannuation system presents significant opportunities for growth and innovation. Having benefited from the compulsory superannuation guarantee for a long period of their careers, these members will retire with larger balances9, forming a more significant part of their retirement income.10 These members stand to benefit from access to guidance and information, tailored solutions and access to high-touch support from their superannuation fund.

Figure 1: Proportion of members in or entering retirement over the next 20 years and projected median balance11,12

Regulatory oversight of the retirement income covenant

On 1 July 2022, the retirement income covenant (covenant) under the Supervision Industry (Supervision) Act 1993 (SIS Act) commenced. These reforms were introduced to improve the retirement outcomes of individuals by placing specific obligations on RSE licensees to consider the needs of beneficiaries (i.e. their members) in retirement.

The covenant requires RSE licensees to develop a retirement income strategy for members who are retired or are approaching retirement. The strategy must address how their members will be assisted in achieving and balancing three objectives:

- Maximising their expected retirement income;

- Managing expected risks to the sustainability and stability of their expected retirement income; and

- Having flexible access to expected funds during retirement.

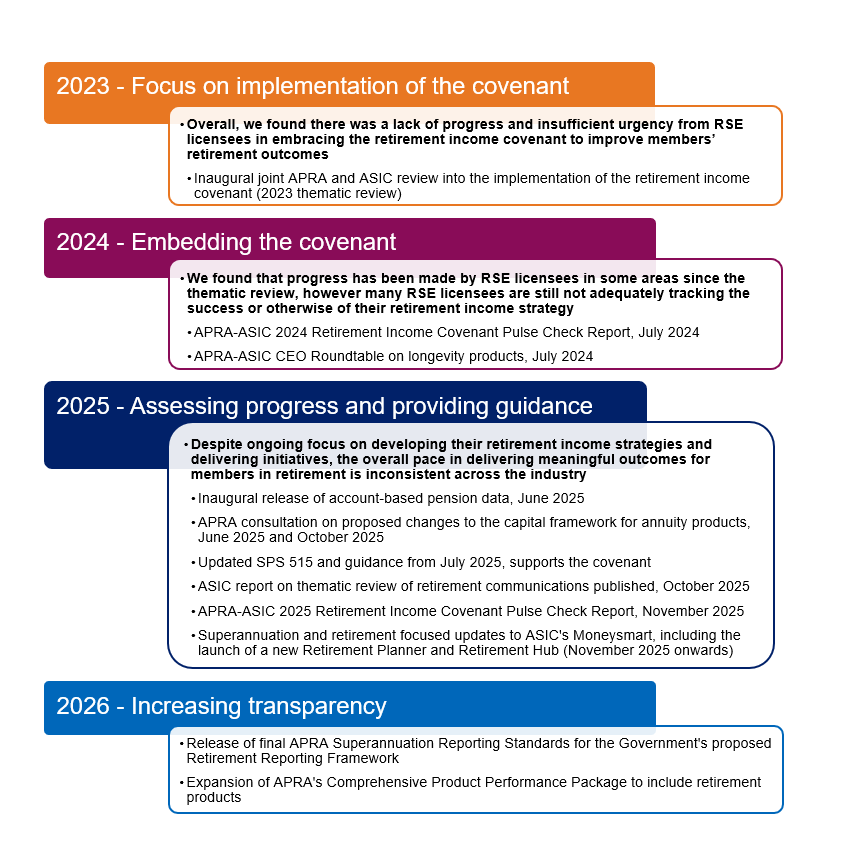

Since its introduction, ASIC and APRA have reviewed how RSE licensees have responded to the covenant. Where possible, we have shared examples of better practice and areas of focus, with the aim of uplifting industry practice.

With foundational elements generally in place across all RSE licensees, APRA and ASIC are now starting to shift their focus on reviewing the effectiveness of RSE licensees’ retirement income strategies and delivery of improved outcomes for members in retirement.

Over time, ASIC and APRA expect that initiatives delivered under an RSE licensee’s retirement income strategy will lead to measurable changes and improvements to member behaviour and retirement outcomes.

Figure 2: Regulatory initiatives since introduction of the Retirement Income Covenant

ASIC and APRA observations

Understanding members

Key points

Most RSE licensees have invested significant effort in understanding their members’ needs, by improving data capabilities and identifying and addressing data gaps called out in the 2023 thematic review and 2024 pulse check.

Most RSE licensees identified a need to further refine their retirement income strategy and cohorts, to better reflect their member base and support development of more fit-for-purpose retirement income solutions.13

Understanding members’ needs in retirement is a key first step to tailoring support to meet the diverse needs of members and deliver better outcomes in retirement.

We asked RSE licensees how well they understand their members’ needs and preferences, whether they segment their membership into cohorts, and what progress has been made on these items since the 2024 pulse check. We also asked RSE licensees to describe planned future enhancements.

Many RSE licensees continued to highlight the impact of data limitations such as the lack of visibility regarding members broader financial and personal circumstances. However, nearly all RSE licensees indicated they have taken steps to strengthen their understanding of member needs, with 97% reporting improvements since the 2024 pulse check. However, only 15% rated their understanding of members higher than ‘good’. This indicates that most RSE licensees believe that more can be done to better understand their members.

Gathering data to better understand members

RSE licensees increasingly recognise the importance of using data to gain deeper insights into their members’ needs and preferences, and as a key enabler for delivering more relevant and tailored interactions.

Key data sources used by RSE licensees are set out in Table 1. RSE licensees frequently cited data collection (77%) and member engagement (74%) as actions they had undertaken to strengthen their understanding of member needs since the 2024 pulse check.

| Category | Approach |

|---|---|

| External data |

|

| Member engagement |

|

| Supplementary research |

|

Using data to generate meaningful insights and improve interactions

Survey responses indicate that most RSE licensees have acted on their commitments made in the 2024 pulse check, with many undertaking actions to address data gaps, integrate existing data and increase in-house capability. Table 2 outlines how some RSE licensees have analysed existing data to better understand their members and obtain meaningful insights.

| Category | Approach |

|---|---|

| Usage of demographic and behavioural data |

|

| Engagement analytics |

|

| Predictive modelling |

|

RSE licensees have indicated that these approaches have helped provide deeper insights about their members and influenced the way they provided member support.

Using data to support cohorting practices

More than three quarters of RSE licensees (77%) segment their members into cohorts, with many using these cohorts to support the provision of, and promotion of tailored retirement solutions. Among the remaining 23% of RSE licensees who do not use cohorts to offer tailored retirement solutions, responses described that efforts have been focused on supporting members to take an active approach to managing their retirement (e.g. through the use of drawdown strategies, education or digital tools) or through engaging a financial adviser.

Most RSE licensees who segment their members into cohorts have three or more cohorts. Typically, most RSE licensees have used member age and account balance as a starting point to define their cohorts. Other factors considered by some RSE licensees when defining cohorts include:

- Employment status;

- Life stage (e.g. pre-retiree, early retirement);

- Inferred Age Pension eligibility; and

- Members’ level of engagement with and preparedness for the transition to retirement.

Progress since the 2024 pulse check

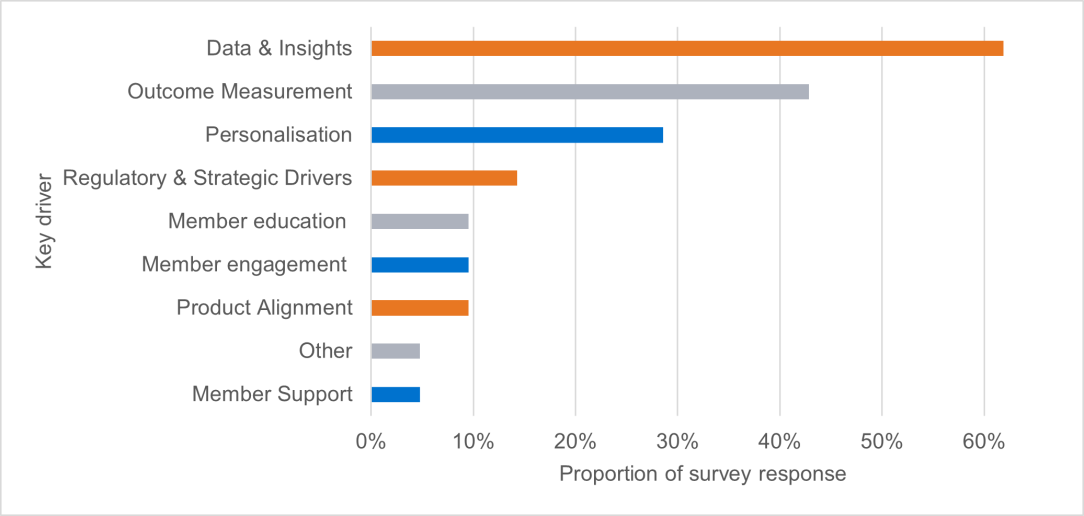

Many RSE licensees have expanded their data analytics and research collection efforts since the 2024 pulse check. These have supported RSE licensees to obtain deeper insights into member behaviours, needs and expectations, and has been a key driver for RSE licensees to update their strategy for determining cohorts (Figure 3).

Figure 3: Drivers for changes to retirement income strategy cohorts since the 2024 pulse check

Additionally, over half of RSE licensees surveyed (54%) have reviewed and updated their cohort approach since the 2024 pulse check.

However, three years on from the introduction of the covenant, overall effectiveness of current cohorting approaches remains an area for improvement:

- Around three-quarters of RSE licensees who used cohorts when offering retirement income solutions rated their current approach as ‘good’ or ‘very good’, indicating good progress, but more to do;

- Survey responses show that while RSE licensees are beginning to measure success against specific cohorts, for example, against the targeted cohorts used for tailored retirement income solutions, only a small amount do so (less than a third, or 28%, measure the success of their retirement initiatives against specific cohorts); and

- Most RSE licensees identified a need to further refine their retirement income strategy, with improved data and insights being the predominant driver.

Addressing member needs

Key points

Most RSE licensees are focusing on improving and expanding services to support members approaching retirement, with some RSE licensees developing support services for specific member cohorts. However, there is still little focus on providing support services to members in later stages of retirement.

RSE licensees continue to refine their current retirement income product offerings and are largely focused on enabling members to tailor retirement income solutions through access to advice, guidance, digital tools and education.

Our survey asked RSE licensees to describe the member support and retirement income products offered to members. We also asked what improvements had been made since the 2024 pulse check. Looking ahead, we also asked RSE licensees to describe the enhancements they had planned, and the gaps they aimed to address.

Tailoring support and retirement income solutions for members

In the 2024 pulse check, more than two-thirds of RSE licensees noted expanding member support was a top priority, with many focused on achieving this through updating or expanding existing offerings on website content and member communication.15

In 2025, survey responses indicated that many RSE licensees viewed member support as a key mechanism enabling members to meet their needs and preferences, through tailoring their retirement income solutions. Most RSE licensees (92%) indicated they have delivered on their intended enhancements to member support since the 2024 pulse check. Some examples include:

- Developing recommended age-based drawdown rates for different cohorts;

- Increased access to general and intra-fund advice options, including providing access to a digital advice platform with information and guidance on retirement specific topics, such as pre-retirement planning and drawdowns;

- Providing members with digital tools that allow members to set retirement goals and drawdown strategies based on spending categories and levels;

- Providing an estimate of the amount that can be drawn from an account-based pension based on a range of factors including projected life expectancy;

- A triage service to connect members to the right support during their first interaction.

However, only 28% of RSE licensees have delivered cohort specific enhancements to member support since the 2024 pulse check, and only 36% had delivered improvements specifically targeted at retired members. Some examples include:

- Publishing a comprehensive retirement guide, which walks members through what their retirement journey may look like;

- Introducing or expanding retirement-focused educational content for members;

- Launching a digital advice pension tool, with an in-built pension eligibility assessment.

Only a few RSE licensees confirmed using cohort specific communications or nudges to help members tailor currently available retirement income solutions (13%), or when describing the drawdown strategies available as part of the existing product suite (10%). Further, 1 in 5 RSE licensees (21%) do not provide members with information, guidance and access to advice relating to drawdown strategies beyond the legislated minimum drawdown rate.

Recent research by ASIC’s Moneysmart suggests only one-third of Australians on the cusp of retirement are confident that they will be financially comfortable once they leave the workforce. Additionally, members entering retirement in the future will typically hold larger balances, require more tailored solutions, and expect high-touch support.

The use of cohorts to enhance the development and delivery of member support can help to boost member confidence and ultimately support better retirement outcomes for members. We encourage RSE licensees to focus their attention on providing meaningful and timely communications and support services to members that can meet their needs.16

In doing so, RSE licensees may wish to consider the Government’s proposed Best Practice Principles for Superannuation Retirement Income Solutions, and how their existing member support services can be better tailored to the diverse needs and preferences of their membership base.

Planned enhancements to member support

Most RSE licensees (95%) are planning further enhancements over the next year to support members, in particular, for those transitioning to retirement. This includes:

- Upgrades to existing member support (e.g. new webinars, improved calculator capabilities, expansion of advice topics, additional website content);

- Introducing tailored communication campaigns and targeted member journeys;

- Introducing new forms of support including targeted calls to action for members;

- Improvements to milestone-based communications (e.g. age or life event); and

- Implementing initiatives to support members through new and revised guidance materials.

Comparatively, there is less support being provided to members already in retirement, though some RSE licensees are planning further enhancements over the next year to support members who are already retired. Some examples include:

- New communication campaigns focused on support during retirement;

- Offering a digital will service to members;

- Referrals to third-parties who provide retirement-focused services to assist in estate planning, aged care, and aged pension access.

Planned enhancements to product offerings

There is a clear intention by RSE licensees to improve their current retirement income solutions and product offerings, with over half (54%) describing planned enhancements to their existing product offerings to be delivered by 30 June 2026. Some of the product enhancements outlined by RSE licensees in the survey include:

- Changes to product features, such as the introduction of real-time benefit payments or fixed drawdown periods; and

- Pricing and value enhancements, such as fee reductions, retirement bonuses, or increasing payments for lifetime pensions.

Additionally, 36% of RSE licensees described intentions to conduct a review of longevity products or introduce a new product to address longevity risk by 30 June 2026.

Governance and Oversight

Key points

Governance and oversight have strengthened, but many RSE licensees are still grappling with how to gauge effectiveness of their retirement income strategies. There is less focus from RSE licensees on taking steps to regularly measure the retirement outcomes delivered to members, or impact on member experience and satisfaction.

A strong governance framework to oversee the implementation of initiatives within the RSE licensee’s strategy is critical to support the delivery of better retirement outcomes for members.

The survey questions sought to understand the roles and responsibilities of the board and senior management within these structures.

Strategic focus on retirement

Governance and executive oversight of the retirement income strategy was highlighted as an area for improvement in the 2024 pulse check and remains a key focus for RSE licensees.

Most RSE licensees indicated they had made changes to governance and oversight since the publication of the 2024 pulse check. These include:

- Hiring and appointing senior management dedicated to overseeing the strategy;

- The majority of RSE licensees responding that they have reviewed their strategy; and

- For more than half of RSE licensees, making changes to, or planning to make changes to their strategy where they felt it wasn’t meeting intended outcomes.

RSE licensees have also strengthened oversight of their strategy. Alongside enhancements to ‘member engagement’ and ‘advice accessibility’, a majority of RSE licensees (62%) indicated uplifts were made to strategy governance and oversight through the introduction of quantitative and qualitative metrics and performance scorecards that are specific and measurable.

Performance metrics and scorecards are the most widely used measures outlined by RSE licensees to assess the effectiveness of their strategy. However, we observed limited use of metrics measuring the retirement outcomes delivered to members, overall member experience, or satisfaction in retirement.

The initiatives adopted among RSE licensees to help members balance the covenant objectives differ significantly. This diversity of approach highlights the evolving nature of how RSE licensees have interpreted and implemented their obligations under the covenant.

Notwithstanding the variation of approach, successful implementation of a retirement income strategy requires the RSE licensee to ensure it effectively achieves its intended outcomes and remains appropriate over time. Where the retirement income strategy is not delivering on its intended outcomes, RSE licensees should consider whether actions need to be taken, or whether it may be more appropriate to guide members towards other retirement income solutions that better suit their needs and preferences.

Measuring impact

Key points

Member engagement has increased but consistent behavioural change has not been observed, particularly around drawdown strategies.

The ultimate objective of the covenant is to support tangible improvements to retirement outcomes for members. Measuring and monitoring retirement outcomes is important for assessing the appropriateness of the retirement income strategy and to ensure its ongoing effectiveness.17

Our survey asked RSE licensees to outline the methods and metrics used to assess the performance of their retirement income strategy. We also asked RSE licensees to outline any observed changes in member experience, member behaviour and retirement confidence since the implementation of their retirement income strategy.

Some RSE licensees have evolved their metrics to measure the effectiveness of specific initiatives and inform their overall strategy. However:

- A little over one in five (21%) of RSE licensees indicated they did not have targets or measures in place to assess how effectively they are assisting members in balancing the covenant objectives;

- Most RSE licensees are focusing on the performance and take up of products and services, and do not assess the impact on member sentiments and outcomes; and

- A smaller number of RSE licensees described using outcomes focused measures, with a minority describing retirement adequacy thresholds (15%), retirement confidence (13%), and readiness indices (10%) as some of the outcomes measured.

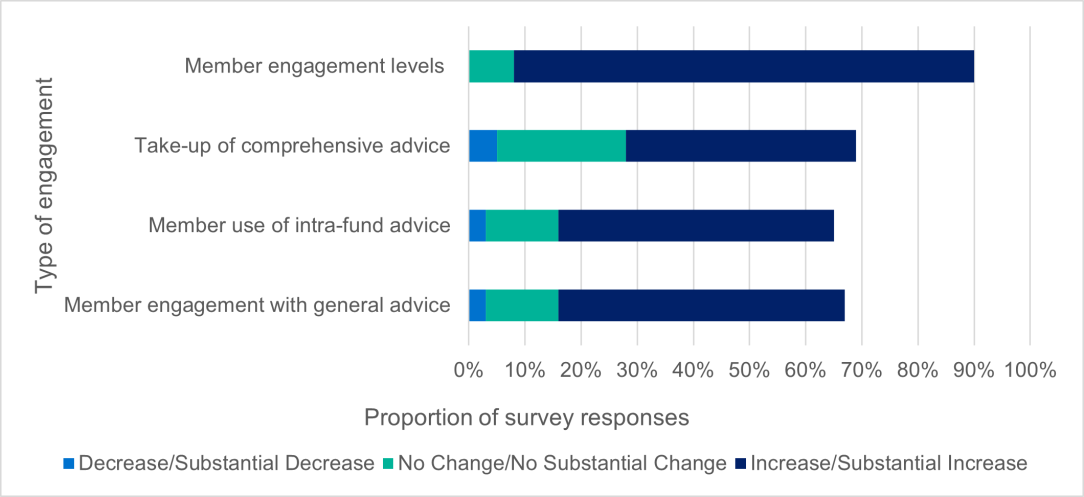

Generally, RSE licensees reported that they have observed member engagement had ‘increased’ or ‘substantially increased’ since the covenant came into effect.

Figure 4: Changes to member engagement since implementation of the covenant

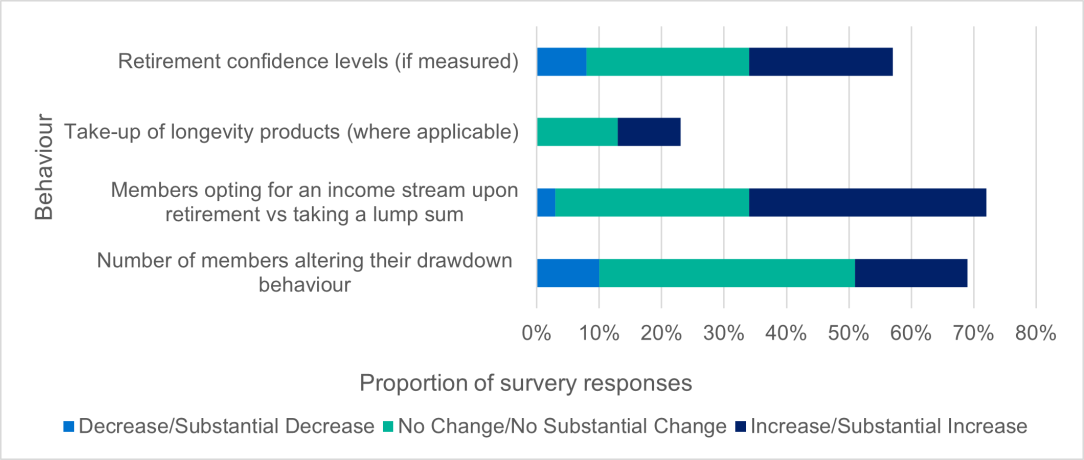

Figure 5: Reported changes to confidence and behaviour since implementation of the covenant

While survey responses are encouraging, this data is largely based on qualitative observations by RSE licensees, often relative to a low starting point. The proposed Retirement Reporting Framework is aimed at providing an objective approach to track changes in member behaviour and decisions in retirement.

When considering success metrics and measures, we encourage RSE licensees to consider how outcomes are being measured and whether metrics are using appropriate inputs.

Challenges to covenant implementation

As part of this survey, RSE licensees were invited to outline key challenges they have encountered in implementing their strategy under the covenant. Key challenges highlighted are summarised in Table 3.

| Category | Description |

|---|---|

| Data | Insufficient member data to develop a holistic representation of member circumstances, especially non-financial data such as partnership status, home ownership status etc, limiting ability to segment at a more granular level, or develop specific and personalised retirement income solutions. |

| Advice | Ongoing uncertainty with advice-related regulatory reforms (such as Delivering Better Financial Outcomes reform package), limits to accessibility, and cost of financial advice, especially for members with lower balances. |

| Product | Challenges in developing and launching retirement products due to market immaturity or low demand. |

| Engagement | Low member engagement and financial literacy, making communication and education difficult. |

| Regulatory clarity | Uncertainty relating to regulator expectations. |

| Cohort | Difficulty in identifying and segmenting member cohorts for tailored strategies (such as drawdown strategies). |

| Privacy | Privacy concerns and regulatory constraints in collecting and using member data. |

| Metrics | Challenges in defining and tracking meaningful success metrics for the retirement income strategy. |

Appendix – Examples of current industry practice

Understanding members

| Category | Baseline practice | Better practice |

|---|---|---|

| Knowing your members | RSE licensee primarily relies on basic internally available information. RSE licensee may also obtain further information through an annual member survey. | RSE licensee engages with numerous internal and external sources (including using financial and non-financial data) to obtain a deep understanding of their members over time, including in post-retirement, to provide appropriate and tailored support. This includes efforts to understand members’ diverse attitudes and behaviours that drive their decision making. |

| Tailored experiences | Communication practices are generic and reliant on direct engagement from members to obtain access to further support. | RSE licensee uses member segmentation approaches to provide members with relevant and tailored communications, services, and products. |

| Cohorting practices | RSE licensee has a retirement income strategy which makes minimal effort to distinguish between the diverse needs within the membership base, instead relying on the member to make active decisions on their retirement. | RSE licensee uses knowledge of their members to embed and refine a robust cohorting approach into their retirement income strategy and regularly review their approach to ensure it remains fit-for-purpose. Where an RSE licensee deems it appropriate to have a single cohort for the purposes of their strategy, other mechanisms are in place to support the diverse needs of their membership, such as member segments or profiles, allowing for targeted communications and support. |

Addressing member needs

| Category | Baseline practice | Better practice |

|---|---|---|

| Member guidance and support throughout retirement | RSE licensee offers self-service resources such as fact sheets, webinars, calculators etc. for members to access appropriate information, including information on retirement support services such as age pension access, estate planning and aged care. Information on how to access further guidance and advice is provided to members. | RSE licensee provides prompts or nudges to members on next best actions, conversations or activities to members based on operational, transactional or behavioural data to direct members to relevant topics or suggest actions. RSE licensee provides members with referrals to third-parties who provide retirement-focused services to assist in estate planning, aged care, age pension access etc. |

| Guidance on drawdown strategies | RSE licensee offers educational resources explaining the concept of drawdown strategies. | RSE licensee provides case studies of drawdown strategies based on persons with similar characteristics to their membership base. RSE licensee offers information on age-based drawdown strategies for specific cohorts, and the option for members to adopt a similar approach. RSE licensee provides a product default which provides drawdown paths above the minimum drawdown rate at earlier stages. |

| Tools and calculators | RSE licensee provides access to general superannuation and retirement projection tools (such as balance projection tools). | RSE licensee provides access to additional tools which consider existing member information (e.g. balance, investment strategy, contributions etc) to provide a detailed retirement income estimate. |

| Product offering | RSE licensee offers a standard retirement product for all members, such as an account-based pension. | RSE licensee offers or provides access to products and/or product features for members, appropriate to the breadth of needs across their membership, such as longevity investment options, and/or transition-to-retirement or longevity products. RSE licensee has proactive support services to assist members in choosing a product or product mix, that suit their needs and preferences. RSE licensee provides case studies based on persons with similar characteristics to their membership base to demonstrate to how different product mixes may meet member needs and preferences. |

Governance and oversight

| Category | Baseline practice | Better practice |

|---|---|---|

| Board and Senior Executive structure | Strategy and business performance review are formally approved and periodically reviewed. | RSE licensee has embedded retirement as a central tenet of the trustee strategy. Senior executives and aligned functional teams are focused on retirement initiatives. RSE licensee considers the benefit of adopting retirement-specific governance committees to oversee specific functions. Roles between the board and senior management are clearly defined and set out accountabilities for certain actions, outcomes or initiatives. |

Measuring impact

| Category | Baseline practice | Better practice |

|---|---|---|

| Member engagement and outcomes | Use of basic member outcomes measures, such as net promoter score (NPS) survey results, or annual member surveys. | A range of insightful measures are implemented, including behavioural and attitudinal analysis to determine the impact of the retirement income strategy. Outcome focused metrics and measures (such as retirement adequacy thresholds, retirement confidence and retirement readiness indices) are used to track the impact of the retirement income strategy on member outcomes. |

| Measuring effectiveness | Basic trustee and member activity measures are adopted for inclusion in the business performance review, such as fund growth or product-specific measures such as fees, investment performance. | Broader range of activity metrics are captured. Data gaps are identified to review how measures and targets can be improved or refined over time. |

Glossary

| Corporations Act | Corporations Act 2001, including regulations made for the purposes of that Act |

|---|---|

| covenant | The retirement income covenant under s52(8A) and 52(8B) of the Superannuation Industry (Supervision) Act 1993 |

| retirement phase | Generally, ‘retirement phase’ refers to the period between the start of retirement or when an individual begins to draw down on their superannuation as an income stream (or lump sum), and the end of their life. |

| retirement income solutions | The combination of products, information, guidance and access to advice provided to members to assist them to balance the RIC objectives set out in s52AA(2) of the Superannuation Industry (Supervision) Act 1993 |

| s52 (for example) | A section of the SIS Act (in this example numbered 52) |

| SIS Act | Superannuation Industry (Supervision) Act 1993 |

| SPS 515 | Prudential Standard 515 Strategic Planning and Member Outcomes |

| strategy | Retirement income strategy required under s52AA of the Superannuation Industry (Supervision) Act 1993 |

| we | The Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC) |

Footnotes

1Treasury, Government response: Improving the retirement phase of superannuation, 20 November 2024, p. 2.

2Industry update - Pulse check on retirement income covenant implementation, 2 July 2024.

3APRA-regulated retirement phase member assets from APRA’s June 2025 Quarterly Superannuation Product Statistics (QSPS).

4Treasurer, The Hon Dr Jim Chalmers MP, ‘Improving the retirement phase of superannuation’, media release 20 November 2024

5The great retirement race, speech by ASIC Commissioner, Simone Constant, Conexus Retirement Leaders Summit, Canberra, 13 August 2025.

6REP 818 From superficial to super engaged: Better practices for trustee retirement communications (REP 818)

7RBA, Financial Stability Review – October 2025, 2 October 2025, p. 3.

8Based on APRA’s Quarterly Superannuation Industry Publication (QSIP), including Defined Benefit retirement.

9Treasury, Superannuation in retirement, 4 December 2023, p. 6.

10Treasury, Guidance on best practice principles for superannuation retirement income solutions, 7 August 2025, p. 2.

11Based on APRA’s Quarterly Fund-Level Statistics, June 2025 and APRA workings.

12Based on ‘Accumulation of superannuation across a lifetime’, Australian Treasury Note, November 2019 and APRA workings.

13Retirement income solutions are the combination of products, information, guidance and access to advice provided to members.

14The Household, Income and Labour Dynamics in Australia (HILDA) Survey is a household-based panel study that collects information about economic and personal wellbeing, labour market dynamics and family life; (HILDA Survey).

15Industry update - Pulse check on retirement income covenant implementation, 2 July 2024, p. 6.

16For more information on product promotion in retirement communications, see Report 818 From superficial to super engaged: Better practices for trustee retirement communications (REP 818).

17APRA Prudential Standard SPS 515 Strategic Planning and Member Outcomes at paragraphs 25 and 26 require RSE licensees to annually assess whether they are achieving the outcomes it seeks for beneficiaries (SPS 515).