Consultation on financial resources for risk events in superannuation: Operational risk financial requirement

To: All RSE Licensees

Registrable superannuation entities (RSE) licensees need to ensure they have ready access to financial resources to respond to, and rectify, the impacts of operational risks.

On 14 November 2022, APRA published a Discussion Paper on potential changes to operational risk financial requirements, which are set out in Prudential Standard SPS 114 Operational Risk Financial Requirement (SPS 114). The proposed changes aimed to ensure RSE licensees can better access the financial resources held to meet the operational risk financial requirement (ORFR) when needed and maintain an appropriate level of funding.

Response to the Discussion Paper

Responses to APRA’s Discussion Paper were submitted in March 2023. APRA received 12 submissions. Overall, industry generally supported APRA’s aim of enhancing the approach to the ORFR. Key areas of feedback included:

- support for a more flexible, holistic approach with a broader scope of use for the ORFR;

- requests for clear guidance on uses for the ORFR; and

- divergent views on the appropriate method for determining the amount of ORFR.

The range of views on the appropriate method for determining the ORFR target amount, included whether APRA should refine its guideline target amount, develop a new standardised approach or provide more opportunity for RSE licensee discretion to calculate bespoke target amounts. Refer to Attachment A for a summary of the key issues raised in submissions and APRA’s response.

Moving forward to consultation

Given the wide range of feedback and the interaction between this policy area with the development of Prudential Standard CPS 230 Operational Risk Management (CPS 230), APRA has taken time to carefully consider the path forward.

Having considered industry feedback, APRA is proposing a simpler approach that will be easier to implement than the model previously consulted on. APRA will not progress the proposal to introduce separate components to the ORFR. Instead, APRA’s simpler approach is focused on integration with CPS 230 and better enabling use of the ORFR when needed.

Specifically, APRA proposes to amend SPS 114 and the guidance supporting it, Prudential Practice Guide SPG 114 Operational Risk Financial Requirement (SPG 114), to:

- clarify the purpose of the ORFR;

- introduce a clear and direct relationship with CPS 230;

- widen the range of uses for the ORFR; and

- amend the notification requirements to facilitate use of the ORFR.

The proposed changes are expected better to position RSE licensees to use the ORFR actively for its intended purpose: to manage the impact of disruption and smooth operational risk related losses fairly across different cohorts of beneficiaries.

APRA’s view is that, at this time, it is prudent to maintain the existing guideline target amount for the ORFR of 25 basis points of FUM. This standard industry benchmark provides confidence that financial resources would be available to respond to a material operational risk incident if needed, minimising the risk that members are exposed to disruption and unplanned costs.

The proposed changes to SPG 114 recognise that, in exceptional cases, an RSE licensee may seek to adopt a lower target amount. APRA’s expectation is that, in such exceptional cases, the entity would typically be a significant financial institution and would provide a clear, compelling and evidence-based rationale for a different amount.

APRA will monitor industry practice to assess whether there is a need to further evolve the requirements and guidance.

Next steps

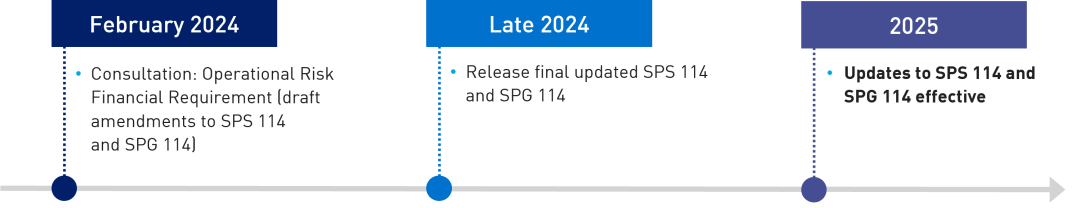

Draft amendments to SPS 114 and SPG 114 are provided. APRA welcomes feedback on draft SPS 114 and SPG 114 between 19 February 2024 and 13 May 2024.

Submissions should be emailed to superannuation.policy@apra.gov.au and addressed to: General Manager, Policy. All information in submissions will be made available to the public on the APRA website unless a respondent expressly requests that all or part of the submission is to remain in confidence (refer to Attachment B).

APRA also requests that all interested stakeholders use this consultation opportunity to provide information on the compliance impact of the proposed changes and any other substantive costs associated with the changes (refer to Attachment C).

APRA would also welcome the opportunity to meet with RSE licensees and other stakeholders during the consultation period.

Subject to the outcomes of consultation, APRA plans to finalise the updates to SPS 114 later this year. The updated SPS 114 would commence in 2025, to align with (or follow) CPS 230.

Yours sincerely,

Margaret Cole

Deputy Chair

Attachment A - Response to submissions

This attachment summarises the key issues raised in submissions, along with APRA’s responses.

1. Baseline+ model

Comments received

Some submissions supported the concept of the Baseline+ model to encourage a wider range of uses for ORFR financial resources, including to support the implementation of a member transfer, recovery or exit plan. Some highlighted the need for a flexible and holistic approach that avoided duplication, and the ability to consider the role of contingent funding.

Other submissions, however, expressed concerns that the baseline component could increase costs and questioned whether this component is necessary given the superannuation industry has limited experience of the impact of disorderly failure on operational losses.

APRA response

APRA remains committed to the objectives of the Baseline+ model to provide enhanced confidence in the financial resilience of the superannuation system and the ability of industry to spread the cost of operational risk incidents fairly across different cohorts of members.

APRA does not, however, intend to proceed with the two-component approach, as outlined in the discussion paper, at this time. The objectives of this approach instead informed the proposed simpler enhancements to SPS 114 and SPG 114 relating to widening the allowable uses of the ORFR and determining the ORFR target amount (refer to relevant sections below).

APRA will continue to monitor industry practice as it evolves.

2. Allowable uses

Comments received

Submissions generally supported the expansion of allowable uses of ORFR financial resources, subject to the provision of clear supporting guidance.

Industry expressed support for RSE licensees use of the ORFR to pay for operational risk incidents and to activate recovery, exit and resolution plans. The proposed use of ORFR financial resources to receive a transfer of members, however, received more mixed feedback as this is considered more of a strategic spend than a response to an operational risk incident. Submissions cautioned against expanding the usage for expenditure that would otherwise be funded by general operating expenses.

APRA response

APRA proposes to expand the uses of the ORFR to a wider range of circumstances related to managing the financial impact of operational risks that relate to an RSE.

The proposed amendments to SPS 114 introduce a direct relationship with CPS 230. It is also proposed that the supporting guidance explains how the ORFR may be used for an extended range of cases, which include both making good losses that have arisen and addressing matters that could cause members to sustain a loss.

Accordingly, the guidance covers remediation activities, costs associated with operational risk prevention, managing disruption, executing business continuity plans and supporting an orderly exit from a service provider agreement in response to an operational risk incident. The proposed enhanced guidance also proposes examples of where it would generally not be appropriate to use the ORFR, including business as usual costs including evolving frameworks, paying insurance premiums and the payment of financial penalties incurred by the RSE licensee.

With the removal of the proposed baseline component approach, APRA has not explicitly extended the uses to cover member transfer plans, or recovery, exit and resolution plans.

The expanded uses seek to better enable RSE licensees to effectively utilise the ORFR to smooth losses from operational risk incidents. The changes aim to strengthen confidence in the superannuation system by allowing funds to be available when needed to better protect members from both the disruption and cost of an operational risk event.

3. Determining the ORFR target amount

Comments received

APRA received mixed feedback on how to calculate the ORFR target amount. Some RSE licensees sought greater flexibility to calculate a risk-based amount to reflect their circumstances, with no prescribed minimum for either component. Others were concerned that calculating an individual amount would involve significant expertise, effort and costs, and that inconsistent approaches could be used to gain a competitive advantage.

Submissions continued to raise concerns that APRA’s guideline ORFR target amount (25 basis points of FUM) is leading to excessive amounts, which may not be aligned to the financial interests of beneficiaries. Submissions did not, however, suggest an alternative guideline amount.

Industry also noted that the proposed basic calculation – linked to the number of members in an RSE licensee’s business operations – had similar challenges to APRA’s FUM-based guideline. This basic calculation could also be viewed as a de-facto minimum and would not have regard to different operating models and financial support that may be available.

APRA response

APRA recognises that there is appetite within parts of industry for a more sophisticated approach, where RSE licensees with the necessary expertise and resources could calculate an evidence-based target amount. In other APRA-regulated industries the development of internal models for operational risk has faced several challenges.

There remains, however, the need for an approach that supports consistency and provides an industry standard benchmark. APRA proposes to maintain the current guideline rather than moving to a different, more complex methodology.

APRA recognises that some RSE licensees, typically significant financial institutions, may seek to develop the capability to calculate a bespoke ORFR target amount that is better suited to their risk profile and circumstances. Draft SPG 114 includes additional guidance to outline APRA’s expectations for such cases, and draft SPS 114 requires engagement with APRA prior to any adjustments.

4. Notification requirements

Comments received

Submissions welcomed APRA’s proposal to remove the notification requirements in existing SPS 114, on the basis that they acted as an administrative burden which dissuaded RSE licensees from using the ORFR.

APRA response

APRA proposes to remove the broad notification requirements in draft SPS 114, with only the specific requirement to notify APRA where an RSE licensee seeks materially to amend its ORFR target amount to be retained.

APRA will retain oversight of operational risk incidents through notification requirements within CPS 230 and also Prudential Standard CPS 234 Information Security. APRA will also gain insights on ORFR amounts and usage across the industry through data collections.

Attachment B - Important disclosure – Publication of submissions

All information in submissions will be made available to the public on the APRA website unless a respondent expressly requests that all or part of the submission is to remain in confidence. Automatically generated confidentiality statements in emails do not suffice for this purpose. Respondents who would like part of their submission to remain in confidence should provide this information marked as confidential in a separate attachment.

Submissions may be the subject of a request for access made under the Freedom of Information Act 1982 (FOIA). APRA will determine such requests, if any, in accordance with the provisions of the FOIA. Information in the submission about any APRA-regulated entity that is not in the public domain and that is identified as confidential will be protected by section 56 of the Australian Prudential Regulation Authority Act 1998 and will therefore be exempt from production under the FOIA.

Attachment C - Request for cost-benefit analysis information

APRA requests that all interested stakeholders use this consultation opportunity to provide information on the compliance impact of the proposed changes and any other substantive costs associated with the changes. Compliance costs are defined as direct costs to businesses of performing activities associated with complying with government regulation. Specifically, information is sought on any increases or decreases to compliance costs incurred by businesses as a result of APRA’s proposals.

Consistent with the Government’s approach, APRA will use the Commonwealth Regulatory Burden Measure framework to assess compliance costs. Guidance in relation to the framework is available at https://oia.pmc.gov.au/.

Respondents are requested to use this framework to estimate costs to ensure the data supplied to APRA can be aggregated and used in an industry-wide assessment. When submitting their costs assessment to APRA, respondents are asked to include any assumptions made and, where relevant, any limitations inherent in their assessment.

Feedback should address the additional costs incurred as a result of complying with APRA’s requirements, not activities that entities would undertake regardless of regulatory requirements in their ordinary course of business.