APRA's Supervision Priorities

Executive summary

To deliver on its mandate as prudential regulator of the financial industry, APRA has identified four strategic focus areas for 2019-2023 aimed at strengthening outcomes for the Australian community. These are:

• maintaining financial system resilience;

• improving outcomes for superannuation members;

• improving cyber-resilience across the financial system; and

• transforming governance, culture, remuneration and accountability (GCRA) across all regulated financial institutions.1

APRA’s supervision function supports APRA’s mandate and the achievement of these objectives by undertaking regular reviews and assessments of regulated financial institutions with the goal of identifying significant risks to those institutions, and the financial system more broadly, in a timely and effective manner, and acting to ensure those risks are well managed and mitigated. To maximise the effectiveness of these supervision activities, and reflecting APRA’s focus on preventative action before risks crystalise into problems, APRA’s supervisory program seeks to be risk-based and forward-looking.

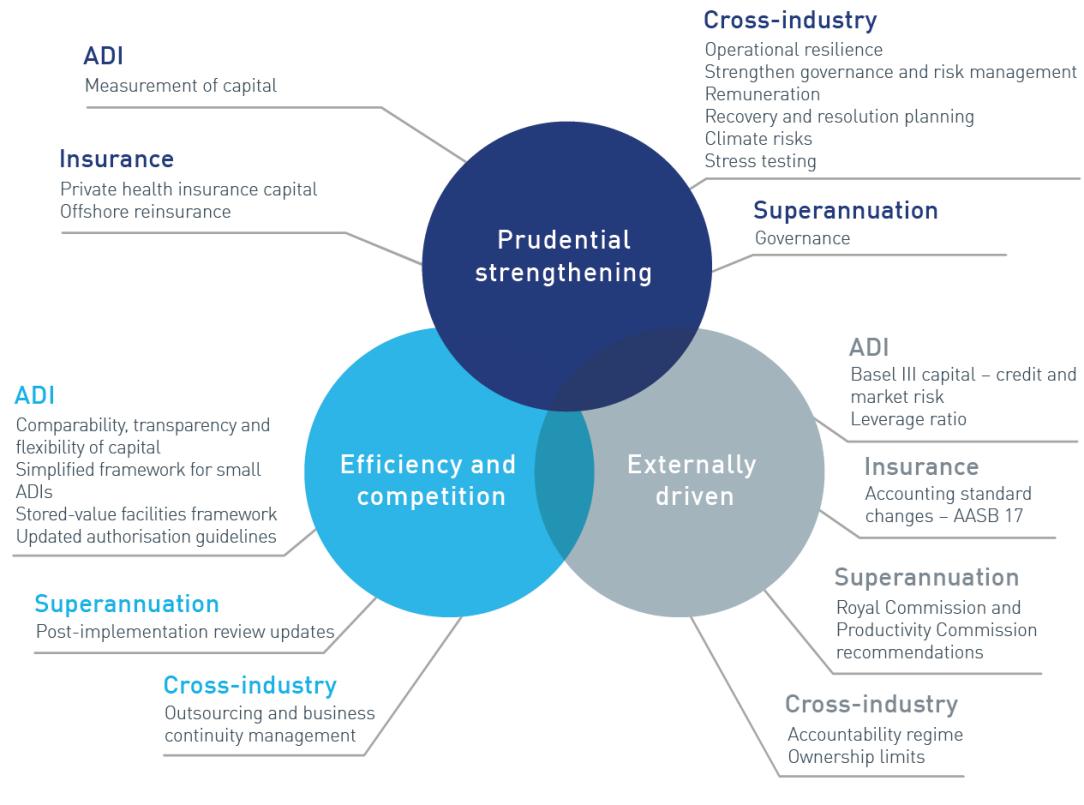

As part of its strategic planning process, APRA undertakes industry risk assessments with a view to identifying those risks and vulnerabilities within the financial sector that will be given heightened attention over the short- to medium-term. This paper provides a 12-18 month forward view on APRA’s planned supervisory activities that will be conducted on a coordinated basis across multiple entities or industries. This paper should be read in conjunction with APRA’s Policy Priorities2, which outlines forthcoming changes to APRA’s prudential framework that support these priorities and the supervision effort.

At their core, all of the activities in this paper are ultimately directed at maintaining financial safety and stability to protect the interests of Australian depositors, insurance policyholders and superannuation members. While the Australian financial system is, on the whole, in a sound financial position, APRA will strive to ensure that the balance sheet strength and very low incidence of disorderly failure among APRA-regulated entities is maintained. This will be supported by increased focus on recovery and resolution planning and stress testing.

In superannuation, improving outcomes for members is a core supervisory priority. Stronger supervisory intervention to resolve or exit underperforming funds, products and options will be a major focus, supported by enhanced breadth, depth and quality of data delivered as part of APRA’s Superannuation Data Transformation. This data will in turn enable improved industry transparency on outcomes and operations, including the expansion and evolution of APRA’s publication of performance assessments, which was launched with the release of the MySuper products Heatmap. Assessing the implementation of the new Prudential Standard SPS 515 Strategic Planning and Member Outcomes, which came into effect in January 2020, will also be important to ensuring trustees are held accountable for meeting members’ best interests.

Improving the ability of regulated entities to deter, detect and defend against cyber incidents is a key supervisory focus area across all regulated sectors. APRA will assess the implementation of Prudential Standard CPS 234Information Security, which came into effect in July 2019, to ensure entities are actively strengthening their cyber resilience. APRA’s own supervisory capabilities in cyber risk will also be strengthened through active collaboration with other agencies, international peers and industry experts.

APRA will be devoting much more of its supervisory resources to issues of GCRA. As outlined in the information paper, Transforming Governance, Culture, Remuneration and Accountability,3 a range of GCRA-related supervisory reviews and ‘deep-dives’ will be conducted over the next 12-18 months. APRA is also investing in new tools to assess and benchmark GCRA practices across entities. APRA’s insights will increasingly be shared with industry and the broader public to reinforce prudential expectations and drive accountability.

Supporting the delivery of these strategic focus areas, APRA is also updating its overall supervision methodology. This includes a new risk-rating tool,4 greater use of thematic reviews, and the increased use of technology and data to generate supervisory insights and guide decision-making.

In addition to the industry-based supervisory priorities outlined in this document, other supervisory activities will be undertaken for individual entities, consistent with their risk profile. Supervisory priorities may also vary as the risk outlook evolves. In all instances, APRA expects entities to be open, cooperative and constructive in addressing prudential risks. Where entities do not meet APRA’s expectations, more forceful supervisory actions will be taken, in line with APRA’s ‘constructively tough’ enforcement appetite.

The annual communication of APRA’s supervision priorities represents a further step in APRA’s ongoing commitment towards greater transparency. This paper is intended to inform industry and the public about APRA’s supervisory work, promote better prudential outcomes and demonstrate greater accountability of APRA’s actions. APRA will report on its progress in addressing its supervision priorities in its annual Year in Review publication.5

Footnotes

1APRA, Corporate Plan 2019-2023 (August 2019) <https://www.apra.gov.au/news-and-publications/apra-releases-2019-2023-corporate-plan>.

2 APRA, APRA’s Policy Priorities (Information Paper, January 2020) <https://www.apra.gov.au /news-and-publications/apra-policy-and-supervision-priorities>.

3APRA, Transforming Governance, Culture, Remuneration and Accountability (Information paper, November 2019). <https://www.apra.gov.au/sites/default/files/Transforming%20governance%2C%20culture%2C%20remuneration%20and%20accountability%20-%20APRA%E2%80%99s%20approach.pdf>.

4APRA, APRA’s new Supervision Risk and Intensity (SRI) model (Insight article, December 2019) <https://www.apra.gov.au/apra’s-new-supervision-risk-and-intensity-sri-model>.

5APRA, APRA 2019 Year in Review (January 2020) <https://www.apra.gov.au/news-and-publications/apra-2019-year-review >.

Chapter 1 - Introduction

1.1 APRA's mandate and role of supervision

APRA’s mandate is to protect the Australian community by establishing and enforcing prudential standards and practices designed to ensure that, under all reasonable circumstances, financial promises made by the institutions APRA supervises are met within a stable, efficient and competitive financial system.

APRA is a supervision-led agency: it seeks to deliver a sound and resilient financial system, founded on excellence in prudential supervision. APRA’s supervision activities are therefore fundamental to APRA’s ability to meet its mandate. Supervision plays a key role in identifying significant risks to entities and the financial system and ensuring these are appropriately addressed in a timely and effectively manner.

APRA’s supervision philosophy is underpinned by three core attributes: risk-based, forward-looking and outcomes-focused. In meeting APRA’s mandate, APRA applies a risk-based approach by directing supervision resources towards areas that pose the greatest risk; focuses on being forward-looking through anticipating the impact of current and emerging risks; and holds entities and individuals to account for delivering desired, clear and timely outcomes. This relies on supervisory judgement and expertise, which is informed by evidence and analysis.

The supervision philosophy is embedded through a supervisory cycle. The key stages of the supervisory cycle are:

• proactive and accurate risk identification across a broad risk spectrum, including risks that change or emerge over time;

• dynamic assessment of identified risks and their impact on an entity’s financial health; and

• prompt response to address and resolve issues, ramping-up supervision intensity where entities fail to address them effectively.

Chapter 2 - Cross-industry

The Australian financial system remains stable and is well placed to support the needs of the Australian community. However, there are ongoing vulnerabilities and challenges. Community trust in the fairness of the financial system has been eroded and cyber security risks are continuing to grow in scale and sophistication. Continued financial safety and stability cannot be taken for granted.

This chapter outlines APRA’s planned supervisory activities for cross-industry risks. These activities cover three of APRA’s four core strategic priorities: maintaining financial system resilience; improving cyber resilience; and transforming governance culture, remuneration and accountability.

2.1 Maintaining financial system resilience

2.1.1 Monitoring and responding to economic and market conditions

Critical to the health of any financial system is supportive economic and financial market conditions. Internationally, growth and economic activity has been subdued in many parts of the world, reflecting amongst other things geopolitical tensions, uncertainties over trade policy, Brexit and slower growth in China and India, although the outlook in some of these areas improved at the end of 2019. The Australian financial system has a number of interconnections to the global financial system, so shocks elsewhere in the world have the potential to flow into the domestic system through a number of channels.

Domestically, growth has continued at a moderate pace in recent times. This reflects a range of factors, including continued low wage growth, restrained consumer and business confidence, a slowdown in housing construction, and somewhat weaker business investment. Interest rates, as in many parts of the world, are at historically low levels, which is making debt serviceability easier but generating a run-up in asset prices.

APRA will continue to underpin its supervision of individual entities with an assessment of overall economic and market conditions. Broadly speaking, Australian financial institutions have ready access to capital and liquidity in current market conditions, but low interest rates, combined with limited growth, are creating a profitability challenge for many. APRA’s supervision will therefore be looking for signs that these pressures are inducing entities to increase their risk-taking as a means of sustaining their desired returns.

2.1.2 Improving recovery and resolution capability

APRA continues to focus on strengthening entities’ own crisis preparedness. Effective recovery plans are critical to ensuring entities are prepared for periods of financial stress and can recover from financial losses without the need for public sector support. APRA’s work on recovery planning in recent years has primarily focused on the larger authorised deposit-taking institutions (ADIs) and insurers. However, over the medium term, APRA’s objective is for all regulated entities to have credible recovery plans in place. APRA will be engaging with all entities on recovery planning requirements as the new prudential framework is developed. This is outlined in the accompanying Policy Priorities information paper.

APRA is also strengthening its own internal capabilities to deal with possible entity failures. APRA’s objective is to ensure that, in the event of failure, entities can be resolved in an orderly fashion to protect the interests of beneficiaries and minimise disruption to the financial system. For example, APRA is working with the Council of Financial Regulators and the Trans-Tasman Council of Banking Supervision to develop and operationalise standard resolution strategies for the larger ADIs. As the prudential framework is developed, APRA’s focus will shift towards developing more tailored resolution strategies for individual entities.

This year, APRA will undertake further work to assess the operability of the Financial Claims Scheme (FCS) at selected entities. APRA is responsible for administering the FCS, a scheme that protects depositors of ADIs and policyholders of general insurers in the event an entity fails. The objective of APRA’s work is to ensure that depositors covered by the FCS can be provided with prompt access to their deposits in the event of entity failure.

2.1.3 Uplifting stress testing capability

Stress tests are particularly important for the Australian financial system, given the lack of significant prolonged economic stress since the early 1990s. APRA regularly conducts stress tests across the banking and insurance sectors to assess their resilience to severe but plausible adverse scenarios. These tests help to improve both APRA and the industry’s understanding of the impact of future potential risks, allowing appropriate safeguards to be put in place.

From 2020, APRA will transition to more frequent, annual industry stress testing for large ADIs (previously, a comprehensive industry stress test had been conducted on a three-yearly cycle, with additional, less intensive testing conducted in the intermediate years). APRA also plans to test resilience to broader stress scenarios, including the impacts from operational and climate change financial risks.

APRA is currently undertaking a stress test of the largest ADIs to assess their resilience to a severe economic downturn and significant liquidity stress. Throughout the year, supervisors will be engaging directly with individual ADIs on the results of the stress test. At the conclusion of this exercise, APRA will publish a report on its overall assessment of the banking industry’s financial resilience based on the results of the testing exercise.

APRA is also currently assessing selected general insurers’ internal stress testing capabilities. This assessment focuses on entities’ approach to scenario design, governance and the use of stress testing for capital planning. APRA will engage with the industry during the second half of 2020 on identified areas for improvement. In addition, in response to the recent severe bushfires and other climate-related events, APRA will be undertaking scenario analysis of insurer’s reinsurance programs, to understand the impact of further natural catastrophe events during the current financial year.

2.1.4 Climate change financial risk

APRA continues to increase its scrutiny of how ADIs, insurers and superannuation trustees are managing climate change risks. In 2018, APRA surveyed 38 large entities, across all regulated industries, to understand the range of activities and strategic responses that entities adopted to assess and mitigate climate change risks.6 APRA is reviewing these entities’ progress since the initial survey and forming assessments of the robustness of each of the entities’ management of the risks. Findings from this review will inform the development of a new prudential practice guide, as highlighted in the Policy Priorities paper.

As part of APRA’s actions to both uplift stress testing capability and strengthen the financial sector’s understanding and management of climate change financial risks, a key supervisory initiative for 2020 is to develop a climate change stress test. This stress test will enable a better understanding of the overall financial system’s resilience to climate-related risks. APRA is collaborating with the Reserve Bank of Australia and Australian Securities and Investment Commission on the design of the stress test.

2.2 Improving cyber resilience

APRA is seeking to reduce the impact of cyber incidents on the Australian community and financial system by ensuring that APRA-regulated entities are proactively strengthening their cyber resilience on an ongoing basis.

The introduction of Prudential Standard CPS 234 Information Security on 1 July 2019 provides a stronger platform for APRA’s supervision of cyber risks. This prudential standard aims to strengthen resilience against information security incidents, including cyber-attacks, by requiring entities to maintain an information security capability commensurate with their information security vulnerabilities and threats. APRA’s current supervisory focus is on ensuring effective implementation of the new standard. APRA expects that entities will continue to make necessary and timely improvements to strengthen their cyber resilience.

APRA is also developing a new data collection to gain a broader understanding of entities’ management of Information Technology (IT) risk, including cyber risk. This data collection is intended to inform APRA’s ongoing supervisory activities, by helping to direct supervisory resources to areas of heightened risk. APRA is currently trialling the IT risk data collection at selected insurers and large ADIs, and intends to extend the data collection to all industries in due course.

2.3 Transforming governance, culture, remuneration and accountability

APRA is intensifying its focus on GCRA to enhance the resilience of regulated entities. Despite often being described as ‘non-financial’ in nature, a failure to identify and mitigate weaknesses in GCRA issues can undermine the financial and operational resilience of a regulated entity. In November 2019, APRA communicated its strategy for transforming GCRA across all industries. There are three key elements to this strategy:

• strengthening the prudential framework;

• sharpening APRA’s supervisory focus; and

• sharing APRA’s insights.

Set out below are the key supervisory activities to be undertaken over the next 12-18 months that will sharpen and intensify APRA’s supervisory efforts. APRA’s plans for strengthening the GCRA prudential framework are outlined in the accompanying Policy Priorities information paper.

2.3.1 Governance

In 2018, APRA required 36 of the largest ADIs, insurers and superannuation licensees to conduct a self-assessment against the findings of the CBA Prudential Inquiry.7 APRA imposed higher capital requirements on a number of entities, reflecting the significance of weaknesses identified. All entities were required to develop a remediation plan to strengthen governance practices.

Ensuring that entities appropriately address the weaknesses identified in the self-assessments remains a core supervisory focus area. A series of targeted engagements will occur during 2020 to assess entities progress against their remediation plans. More forceful supervisory actions will be considered where sufficient progress has not been made.

APRA has also recently commenced a review to assess the effectiveness of governance arrangements across a subset of regulated entities. Under a phased approach, APRA will seek to identify drivers of effective governance practices by reviewing: the value of insights gained from reviews required under Prudential Standard CPS 220 Risk management (CPS 220); the robustness of processes supporting the CPS 220 risk management declaration; the role and effectiveness of board committees; and processes undertaken to assess board effectiveness.

2.3.2 Culture

APRA’s supervisory agenda involves a much sharper focus on entities’ risk culture. APRA is building its supervisory capability and designing new tools to better assess entities’ attitudes to risk management and benchmark risk culture across industry sectors and cohorts of entities. This will help direct APRA’s supervisory attention towards entities where risks are greatest or insufficient progress is being made.

APRA will also be conducting deeper reviews of risk culture practices. Initially, these ‘deep dive’ risk culture reviews will be set at three per year from 2020 onwards. These reviews will involve a high degree of supervisory intensity, including interviews with directors, executives and staff as well as focus groups involving non-managerial staff.

2.3.3 Remuneration

APRA is strengthening its prudential framework for remuneration and expects to finalise Prudential Standard CPS 511 Remuneration in 2020. Once the final standard is released, APRA will commence an assessment of entities’ implementation plans to gauge emerging market practice and will communicate the findings to industry to reinforce APRA’s expectations for implementation. A series of ‘deep dive’ reviews will also be conducted once the final standard is implemented that will focus on the design, implementation and outcomes of remuneration frameworks.

2.3.4 Accountability

As noted in the accompanying Policy Priorities paper, APRA is working closely with the Treasury and the Australian Securities and Investments Commission (ASIC) to extend the banking accountability regime to the insurance and superannuation sectors. Treasury released its proposal paper outlining the Government’s proposed approach to the Financial Accountability Regime on 22 January 2020.8 Once the proposed new legislation is finalised, APRA will start engaging with entities on planning for implementation of this regime.

In the banking industry, APRA is currently assessing how effectively the Banking Executive Accountability Regime (BEAR) has been embedded by the major banks. APRA will make its key findings from this review public by mid-2020, to help make clearer APRA’s expectations for better accountability practices across all industries.

Footnotes

6APRA, Climate change: Awareness to action (Information Paper, March 2019) <https://www.apra.gov.au/sites/default/files/climate_change_awareness_to_action_march_2019.pdf>.

7APRA, Prudential Inquiry into the Commonwealth Bank of Australia (April 2018) <https://www.apra.gov.au/sites/default/files/CBA-Prudential-Inquiry_Final-Report_30042018.pdf>.

8Treasury, Implementing Royal Commission Recommendations 3.9, 4.12, 6.6, 6.7 and 6.8 Financial Accountability Regime (Proposal Paper, January 2020)

<https://treasury.gov.au/consultation/AAc2020-24974>.

Chapter 3 - Banking

The banking industry is currently well capitalised, highly rated and maintains a stable funding and liquidity position. Asset quality remains broadly strong, reflecting supportive economic conditions. However, ensuring that ADIs maintain their financial resilience and enhance their crisis readiness is a priority in APRA’s supervision, to provide the foundations for the industry to be able to weather a range of potential scenarios and conditions.

APRA also continues to closely monitor dynamics in the housing market, given the implications for banks’ credit risk profiles and the broader financial cycle. In recent years, bank lending standards – particularly in relation to residential mortgages – have been a key area of supervisory attention. Given improvements in this area, lending standards will receive relatively less attention in the period ahead, with the focus shifting to strengthening end to end risk management.

This section sets out the specific supervision activities for the banking industry in the year ahead. These activities reinforce the cross-industry initiatives outlined above, to maintain financial resilience, transform GCRA and improve cyber resilience in the banking sector.

3.1 Maintaining financial resilience and crisis

The banking industry has strengthened its financial resilience in recent years to meet the unquestionably strong benchmark levels of capital, and APRA will continue to review risk management to ensure this is underpinned by strong and effective frameworks, controls, systems and practices. APRA’s review programme in the year ahead will encompass liquidity risk, credit risk modelling and data management, as well as monitoring improvements in business and residential mortgage lending.

APRA is also increasing its supervisory scrutiny of ADIs’ crisis readiness. Along with the cross-industry work on recovery and resolution planning set out in chapter 2, APRA will commission an in-depth targeted review of processes for managing problem loans and collateral. The targeted review will examine whether credit systems and processes would be effective in managing the potential risks from less benign economic conditions. The review will focus on the largest ADIs and is expected to be undertaken in the second half of 2020.

In some parts of the industry, including smaller ADIs, profitability remains under pressure from slower credit growth, low interest rates and strong competitive pressures. APRA will continue to assess the long-term risk outlooks to banks’ business models throughout 2020. The outcomes of these assessments will inform APRA’s supervisory strategies for individual entities; those with the weakest outlooks will be prioritised for more intensive scrutiny and contingency planning.

3.2 Transforming GCRA

As noted in chapter 2, APRA has an extensive program of supervisory work in relation to GCRA. As banks make progress in their remediation plans to address weaknesses identified in their risk governance self-assessments conducted in the second half of 2018, supervisors will be scrutinising the impact and effectiveness of these actions to assess whether they are delivering the intended improvement in oversight and controls. More forceful supervisory actions will be considered where sufficient progress has not been made.

As noted above, APRA is conducting an assessment of how the BEAR regime has been implemented by the major banks, and how effectively it has been used to enhance accountabilities and consequence management internally. A ‘deep dive’ review of the major banks’ compliance functions is also being undertaken.

3.3 Cyber resilience and technology risks

In addition to cross-industry initiatives on cyber resilience, APRA will be prioritising the review of IT risk management at large ADIs in 2020 and deepening its understanding of data capabilities. This will be conducted through a range of offsite and onsite supervisory activities.

Data management capabilities are a critical input into the setting and monitoring of risk appetites for banks, and the use of more advanced analytics are increasingly used to drive risk decisions. APRA completed an assessment of risk data aggregation capabilities and internal risk reporting practices in 2018 for the largest ADIs, using the Basel Committee on Banking Supervision’s (BCBS) Principles for effective risk data aggregation and reporting as a benchmark.9 As a result of this assessment, APRA required these ADIs to initiate a comprehensive program to address shortcomings in data management. Throughout 2020, APRA will be assessing entities actions in addressing weaknesses to ensure that improvements have been made.

Footnotes

9BCBS, Principles for effective risk data aggregation and risk reporting (Paper, January 2013) <https://www.bis.org/publ/bcbs239.pdf>

Chapter 4 - Insurance

In addition to cross-industry initiatives outlined in Chapter 2, supervisory activities to maintain financial system resilience of the insurance sector are set out below.

4.1 General insurance

The general insurance industry continues to maintain stable profitability and capital coverage. However, it is currently dealing with the impact of the devastating bushfires that have impacted many communities across Australia. In addition, a high reliance on overseas reinsurance and issues with affordability and availability of certain classes, such as professional indemnity (PI) or directors and officers (D&O) insurance, represent heightened areas of supervisory focus.

4.1.1 Overseas reinsurance

During the past year, APRA has given greater attention to managing the risks associated with the insurance industry’s high reliance on overseas reinsurance. Unlike many other major jurisdictions, the Australian general insurance industry is completely reliant on overseas reinsurance, with all reinsurers being part of overseas reinsurance groups.

As a result, APRA will be looking to increase its supervisory engagements with the parent entities of overseas reinsurance groups and the home regulators of material international reinsurers. This will enable a better understanding of the reliance of Australian entities on the overseas parent group, provide better visibility of the capacity of those groups to continue to support the Australian market, and improve APRA’s understanding of the strength of the overseas regulatory regimes. Supervisors will also direct more time and resources to analysing overseas reinsurance group reporting and recovery planning.

4.1.2 Professional indemnity and directors and officers insurance

Insurers with material PI or D&O insurance will be subject to heightened supervision. In recent years, high profile failures in the building industry, growing incidence of shareholder class actions and instances of poor financial advice have contributed to growing concerns about the availability of affordable and unrestricted cover in these lines of business. APRA supervisors will be engaging with insurers to understand how they are responding to the industry risks that are affecting the availability and affordability of these products.

4.2 Life insurance and friendly societies

The life insurance industry faces long-standing challenges created by legacy products with unsustainable features. Instances of poor product design and unsustainable product offerings are threatening affordability. In addition, pricing and design of insurance offerings available through superannuation have faced scrutiny and will need to be addressed by industry following the recent Treasury Laws Amendment (Protecting Your Superannuation Package) Act 2019 (the PYSP) reforms.

4.2.1 Sustainable risk products

The life insurance industry will remain subject to heightened supervisory intervention, reflecting concerns about the sustainability of certain products, particularly individual disability income insurance (IDII). In December 2019, APRA announced a series of measures, including higher capital requirements, that will require life insurers and friendly societies to address flaws in product design and pricing that are contributing to unsustainable practices.10 APRA will also introduce a new more granular IDII data collection to help monitor and assess life companies’ progress in meeting APRA’s expectations.

The higher capital requirements will remain in place until individual insurers can demonstrate they have taken adequate and timely steps to address APRA’s concerns. Throughout 2020, APRA supervisors will be assessing entities’ progress in better managing these risks. In instances where individual insurers fail to meet APRA’s expectations, APRA will consider more forceful supervisory actions, such as issuing directions or making changes to licence conditions. In 2020, APRA will consider lessons learnt from the work in IDII and turn its attention to other higher risk product types, such as Total and Permanent Disability Insurance.

4.2.2 Friendly societies

In the first half of 2020, APRA will release a roadmap for its approach to supervising the friendly society industry. This roadmap will outline APRA’s supervisory response to industry resilience and sustainability risks. Friendly societies should expect heightened supervisory intensity in areas of financial resilience, risk governance, board tenure, profitability and capital.

4.3 Private health insurance

The industry is supported by a sound capital position. However, continued sustainability is challenged in many instances by declining profitability and membership, associated with affordability pressures.

In June 2019, APRA set out its expectations of private health insurers (PHIs) for improving their resilience to ongoing sustainability challenges.11 APRA required PHIs to develop robust, actionable strategies to address sustainability risks, as well as recovery plans that outline how they will respond if their strategy is not successful or other material risks threaten their solvency. As noted in the accompanying Policy Priorities information paper, APRA is also strengthening the capital framework for PHIs.

During 2020, APRA will devote its supervisory resources to assessing the industry's progress in addressing these concerns. PHI's that continue to take a passive approach to these risks can expect a more forceful supervisory response from APRA.

Footnotes

10APRA, Sustainability measures for individual disability income (Letter, December 2019) <https://www.apra.gov.au/sustainability-measures-for-individual-disability-income-insurance>.

11APRA, Financial sustainability challenges in private health insurance (Letter, June 2019) <https://www.apra.gov.au/sites/default/files/letter_financial_sustainability_challenges_in_private_health_insurance_june_2019.pdf>.

Chapter 5 - Superannuation

5.1 Improving outcomes for superannuation members

Improving outcomes for superannuation members is one of APRA’s core strategic focus areas. APRA’s objective is to actively drive a superannuation trustee culture of continuous improvement in delivering quality outcomes to superannuation members and address underperformance in the superannuation industry.

APRA’s overall strategy for improving outcomes for superannuation members is centred around four key initiatives:

• strengthening prudential frameworks;

• intensifying supervisory approach;

• enhancing superannuation data and insights; and

• improving industry transparency.

In the past 12 months, there have been a number of significant policy and legislative reforms which have strengthened APRA’s prudential framework. These reforms provide APRA with a stronger foundation for supervising the superannuation industry. They are outlined in the accompanying Policy Priorities information paper.

Underpinned by a recently strengthened prudential framework, APRA’s supervisory focus is on driving long-term and sustained improvement in industry practices and the outcomes delivered for members. APRA’s key supervisory initiatives are outlined below.

5.1.1 Intensifying APRA's supervisory approach

APRA is significantly increasing its supervisory focus on holding trustees to account for improving outcomes for members. A key component of this work will be ensuring that trustees effectively implement the new Prudential Standard SPS 515 Strategic Planning and Members Outcomes (SPS 515). Under SPS 515, trustees are required to annually assess performance across their business operations and consider their ability to deliver quality outcomes to members on an ongoing basis. APRA’s supervisory emphasis will be on ensuring that trustees address any areas of underperformance identified. Where needed, APRA will use its new direction powers to compel trustees to take appropriate action.

APRA continues to focus on strengthening its engagement and coordination with ASIC. A current joint area of supervisory focus is trustees’ oversight of fees and other charges being deducted from members' superannuation accounts for payment to third parties such as financial advisers. During 2019, APRA and ASIC required all trustees to review the robustness of their existing governance and assurance arrangements for fees charged to members’ superannuation accounts.12 APRA and ASIC are engaging with individual trustees on the outcomes of their reviews, ensuring that trustees have credible plans for addressing identified weaknesses in a timely manner. Industry-level findings will be made public in the first half of 2020.

Conflicts of interest is another key area of supervisory focus. APRA has commenced an in-depth review of selected large trustees’ management of outsourcing providers, focusing on related party arrangements and managing conflicts of interest. APRA will make its industry-level findings public in early 2021, outlining good practice and areas where APRA expects all trustees to strengthen practices.

Building on APRA’s cross-industry GCRA initiatives, supervisors are also focusing on particular issues in the superannuation industry. APRA is continuing to lift the bar for trustee boards by seeking to limit actual and perceived barriers to achieving the optimal mix of skills and experience needed to fulfil trustee obligations. This will include a review of the effectiveness of board appointment processes and the appropriateness of tenure policies.

5.1.2 Enhancing superannuation data and insights

APRA is significantly enhancing its superannuation data collection to strengthen its supervision of the industry. APRA’s Superannuation Data Transformation (SDT) program is a multi-year program of work that seeks to expand, deepen and refine the data collected from the superannuation industry.13 In developing the revised data collections, and in conducting deep dive reviews and other thematic supervision work, APRA will be issuing periodic data collection requests of trustees.

5.1.3 Improving industry transparency

Strengthening transparency is a key initiative for APRA to hold trustees to account for the outcomes they deliver to members. The release of the MySuper product Heatmap is one major step in this process by providing credible, clear and comparable information for all MySuper products.14 APRA expects this will lead to improved outcomes for members by better enabling stakeholders to hold trustees accountable for the outcomes they deliver, particularly where underperformance is identified. As the SDT progresses, APRA plans to further enhance transparency by providing additional public information on trustee operations and the outcomes they deliver.

Footnotes

12APRA and ASIC, Oversight of fees charged to members’ superannuation accounts (Letter, April 2019) <https://www.apra.gov.au/sites/default/files/apra_asic_letter_oversight_of_fees_charged_to_members_superannuation_accounts.pdf>.

13APRA, Superannuation Data Transformation Phase 1 (Discussion Paper, November 2019) <https://www.apra.gov.au/discussion-paper-superannuation-data-transformation-phase-1>.

14APRA, Heatmap – MySuper products (Information Paper, November 2019) <https://www.apra.gov.au/sites/default/files/Information%20paper%20-%20Heatmap%20-%20MySuper%20products.pdf>.

Attachment A: Timelines

Key supervisory and timelines are summarised in the tables below.

Maintaining financial system resilience

| Strategic focus area | Supervisory activity | Entities included | Expected commencement |

|---|---|---|---|

| Cross-industry | Recovery planning review | Large ADIs and insurers | Underway |

| Climate change progress review | 38 large entities | Underway | |

| Climate change stress test | To be determined | 2021 | |

| Banking | Resolution strategy development | Large ADIs | Underway |

| ADI stress test | Large ADIs | Underway | |

| Data aggregation capabilities review | Large ADIs | Underway | |

| FCS review | Selected ADIs | 2020 1H | |

| Problem loan management review | Large ADIs | 2020 2H | |

| Insurance | General insurance stress test capabilities review | Selected general insurers | Underway |

| Overseas reinsurance | Foreign general insurance reinsurers | Underway | |

| PI and D&O review | General insurers | Underway | |

| IDII intervention | Life insurers | Underway | |

| Resilience planning | PHIs | Underway |

Improving cyber resilience

| Strategic focus area | Supervisory activity | Entities included | Expected commencement |

|---|---|---|---|

| Cross-industry | Implementation of CPS 234 | All regulated entities | Underway |

| IT Risk data collection | Selected insurers and ADIs | Underway |

Transforming governance, culture, remuneration and accountability

| Strategic focus area | Supervisory activity | Entities included | Expected commencement |

|---|---|---|---|

| Cross-industry | Self-assessment follow up | 36 large entities | Underway |

| Governance review | Selected entities | Underway | |

| BEAR reviews | Major ADIs | Underway | |

| Compliance review | Major ADIs | Underway | |

| Deep dive risk culture reviews | 3 entities per year | Underway | |

| Assessment of CPS 511 implementation plans | To be determined | 2020 2H | |

| Deep dive remuneration reviews | To be determined | 2021 |

Improving outcomes for superannuation members

| Strategic focus area | Supervisory activity | Entities included | Expected commencement |

|---|---|---|---|

| Superannuation | SPS 515 implementation | All trustees | Underway |

| Fees and charges review | All trustees | Underway | |

| Outsourcing review | Selected large trustees | Underway | |

| Superannuation Data Transformation project | All trustees | Underway | |

| Addressing areas of underperformance | All trustees | Ongoing |