APRA Insight - Issue 2 2018

Thematic reviews point to better super practice

In May this year, APRA released the findings of two thematic reviews into the superannuation industry, conducted over 2016 and 2017. APRA examined RSE licensees’ oversight and management of related party arrangements and, separately, governance practices in respect of board appointments, renewal and performance assessment.

In recent years APRA has, through both supervisory activities and its communications, encouraged RSE licensees to sharpen their focus on enhancing the delivery of outcomes to their members. This work will be supported by enhancements to the prudential framework, to be finalised in the coming months. These enhancements are intended to facilitate RSE licensees embedding rigorous self-assessment of their delivery of sound member outcomes within their broader strategic and business planning processes. The two recent thematic reviews complement this focus on member outcomes, as sound governance practices and management of related party arrangements are key drivers of the outcomes for members that RSE licensees are able to deliver.

Seeking to only meet the minimum requirements of APRA’s prudential framework is unlikely to position RSE licensees to be well-placed to meet the strategic challenges faced by the industry and deliver quality, value-for-money member outcomes. The thematic reviews highlighted variation across the sampled RSE licensees in meeting better practice expectations for board governance and the oversight and management of related party arrangements1.

Observed better practice

Both reviews highlighted examples of better practice, where RSE licensees sought to implement practices and processes that went beyond the minimum prudential requirements, consistent with sustainable and efficient management of their superannuation operations2.

Boards with an appropriate diversity of perspectives and skills are central to decision-making that is undertaken with appropriate review and challenge. In the governance review, APRA noted better practice among boards that took a dynamic and flexible approach to board composition that was consistent with the RSE licensee’s strategic planning processes. These boards sought to ensure that the board as a whole possessed the requisite skills and experience to meet its strategic objectives, rather than solely focusing on individual director skills and experience or having an unduly narrow focus when undertaking fit and proper assessments of directors. While some boards faced challenges in appointing appropriate board members (in some cases due to the limitations imposed by constitutions), APRA also observed instances of collaborative approaches where the RSE licensee was able to work with the nominating body to ensure that nominations for vacant board seats were consistent with the skills and experience needed by the board to effectively execute the board’s strategic and business plan.

Crucial to ensuring that an RSE licensee board demonstrates diversity of opinion and a culture of challenge are its policies on board renewal and tenure. Better practice in this area, across a number of RSE licensees, took the form of staggered board terms and maximum term limits that balanced retaining corporate knowledge and experience with bringing in new perspectives and skills.

APRA found improvements in RSE licensee governance and management of related party service providers since undertaking its conflicts of interest thematic review in 2014. The prevalence of outsourcing in the superannuation industry, and the common use of related parties to provide material services, make the governance of these arrangements crucial to the delivery of appropriate member outcomes.

RSE licensees that undertook comprehensive benchmarking or market testing of related party service arrangements to demonstrate that they continued to be in the best interest of members were demonstrating better practice. Another example of better practice was RSE licensees that sought to ensure that tender processes did not unduly favour the incumbent related party providers through minimising potential barriers to competition in contract and service design.

Opportunities for improvement

The thematic reviews also identified some areas of weakness in practices, including inconsistencies in the approaches taken by some RSE licensees to managing and reporting related party arrangements and in board renewal and performance assessment processes.

In the management of both related party arrangements and board performance assessment, greater use by some RSE licensees of external advisors, or obtaining other forms of independent review and advice on practices, would be beneficial. The related party arrangements thematic review indicated that a number of RSE licensees lacked a rigorous approach for benchmarking particular arrangements and being able to demonstrate that they were in the best interest of members. In a limited number of cases, RSE licensees selected a related party without having documented any comparison of alternatives. For RSE licensees, the use of an external advisor may assist in ensuring there is a credible process for testing whether the pricing and terms provided by the related party service provider are reasonably commensurate with market practices or benchmarks. The use of an external advisor may also assist in addressing gaps in data that may impede comparisons between service providers.

The governance review revealed reasonably widespread use of independent experts and consultants to support RSE licensee board committees. Independent experts and consultants were either appointed as formal committee members, or attended committee meetings to provide input into decisions as non-voting advisors. In some situations, the appointment of independent experts to board committees may indicate a skills deficiency on the board itself. In its letter to industry, APRA therefore recommended that RSE licensees consider whether such a skills deficiency on the board would be more appropriately addressed through the appointment of a director with the requisite skills and experience. Additionally, the governance review indicated an opportunity for more RSE licensees to make effective use of independent experts and review processes in assessing board performance.

APRA also found in both reviews some weaknesses around maintaining and using key internal policies to drive better practices. In the governance thematic review, APRA observed in a number of cases a lack of clear criteria in fit and proper policies in respect of the skill levels needed on board committees. While documentation often indicated the key skills that were desirable for committee members to possess, it was rare for an RSE licensee to identify minimum collective skill requirements for each committee. Additionally, while RSE licensees had in place board renewal policies, they commonly had exception provisions that appeared to enable the composition of the board to be maintained or individual directors’ tenure to be extended. For example, APRA noted an exception provision that allowed extended tenure for special circumstances that were not specified in the policy and did not limit the extension to only one additional term.

APRA also identified weaknesses in how conflicts resulting from related party arrangements were reflected in RSE licensees’ conflicts management frameworks. For example, there were instances where directors or responsible officers of an RSE licensee also held responsible officer roles or had relationships, either directly or through family relationships, with service providers, and the conflicts were not appropriately reflected in the conflicts management framework. Better practice was for an RSE licensee to have policies in place to ensure that, where a director has a conflict, they are excluded from governance of related party arrangements.

Conclusion

APRA expects that the findings of the reviews will prompt RSE licensees to carefully consider how both their board governance processes and management of related party arrangements might be improved. Ensuring that the composition and skills mix of the board are closely aligned to the strategic direction of the RSE licensee will assist them to meet current and future challenges. Furthermore, embedding rigorous market testing and benchmarking practices for related party arrangements will ensure RSE licensees are well placed to meet the best interests of their members. Implementing such better practices and the others detailed in the reviews should assist RSE licensees to deliver quality, value-for-money outcomes for their members into the future.

The detailed findings and recommendations from the two reviews are available in separate letters to industry on APRA’s website.

1 Both thematic reviews sampled a cross section fund type, size and ownership structure with the findings and best practice recommendations relevant to all RSE licensees.

2 The central prudential standards relevant to the thematic reviews: Prudential Standard SPS 510 Governance, Prudential Standard SPS 231 Outsourcing and Prudential Standard SPS 521 Conflicts of Interest.

Restricted area: APRA's new ADI licencing route

Before they can commence business, all authorised deposit-taking institutions (ADIs), as well as all insurers and most superannuation trustees, require authorisation from APRA. This is done through a licensing process in which applicants provide a range of information to demonstrate to APRA they meet the standards needed to safely and responsibly safeguard the financial interests of their depositors, policyholders and members. A robust licensing process is a critical component of the prudential framework: it ensures the public can maintain a high degree of confidence that APRA-regulated institutions are prudentially sound and well-managed, thereby bolstering the stability of the financial system.

While the requirements to achieve an ADI licence need to be sufficiently challenging to ensure prudential safety, APRA is required to take into account a range of considerations, including contestability, under its mandate. From this perspective, APRA considers that the entry of more high quality entrants into the banking sector could improve outcomes for the community through the benefits of increased competition and innovation. In order to facilitate this, APRA recently introduced a new Restricted ADI licensing route, designed to allow potential ADIs to commence operations at an earlier stage than would otherwise be the case. APRA has already received strong interest in restricted banking licences from a range of possible applicants and recently authorised the first bank through the new route. Importantly, however, the limitations imposed on Restricted ADI licensees ensure the public can retain confidence that the safety of deposits with all ADIs is adequately safeguarded.

Banking licence routes

Obtaining a banking licence is a significant undertaking, requiring substantial time and resources to demonstrate the necessary capabilities and frameworks to run a sound and safe bank. This required standard is – deliberately – set high in order to provide the necessary level of prudential safety. However, it is important that the licensing process itself does not act as an undue barrier to entry, particularly for applicants with limited initial resources to devote to the process.

To address this, APRA now provides companies seeking an ADI licence with the choice of two distinct routes: the established “direct route” and the new restricted route. APRA will provide the same level of guidance and engagement irrespective of licensing route, however different routes will suit different applicants.

The direct route allows entities to actively conduct banking business from the time they are authorised, but requires significant resources and capabilities upfront to demonstrate the applicant can fully meet the required prudential obligations. This route is best suited to applicants with the necessary resources and capabilities to launch their intended banking business from the granting of the licence.

Under the direct route, APRA offers support throughout the process; for example applicants can discuss providing their application documents in stages, with each stage providing a comprehensive set of material on a particular application area, such as business plans and financials, followed by the more detailed material on risk management areas.

The restricted route helps applicants build their resources and capabilities as they progress towards a full licence, but does not allow them to actively conduct banking business with the general public. This type of licence is aimed at applicants that do not have the resources or capabilities to immediately pursue an unrestricted licence through the direct route and that would benefit from an intermediate licensing step that allows limited banking business, such as testing deposit products with a small group of staff and associates.

The Restricted ADI licence is granted for a maximum of two years, after which the company must either transition to an unrestricted banking licence by demonstrating that it fully meets the prudential framework, or exit the industry.

APRA has sought to ensure the new approach does not create material competitive advantages for new entrants; ultimately all applicants will need to meet the same requirements to actively conduct business with the general public.

A full ADI licence can also be granted with conditions in certain circumstances, such as restrictions on retail deposit-taking for foreign branches. APRA may also set conditions where an applicant is planning to operate in a limited market or provide a narrow set of products. This can make the application process simpler, with the applicant only needing to be assessed against its intended business model. Conditions are not, however, intended to introduce an alternative phased licensing approach where conditions are progressively removed on a regular basis. This is to ensure all ADIs meet the same requirements for their intended business on the granting of the licence, providing confidence in the soundness of ADIs and creating a level playing field. While Restricted ADIs meet a lower standard to facilitate entry into the banking system, they are not able to actively conduct business with the general public and have to provide clear disclosures to any customers until they obtain an unrestricted/full licence.

Restricted ADI benefits

On 7 May 2018, APRA granted its first Restricted ADI licence to a new digital bank start-up1. Further licences are likely to be issued over the coming year given the high level of interest in the new category. Since the announcement of the new licensing route last August, APRA has fielded enquiries from more than 30 potential applicants interested in acquiring an ADI licence. The interested parties have comprised locally incorporated start-ups, existing financial businesses wanting to expand into banking, and foreign banks wanting to establish branches in Australia. These potential applicants are a mixture of those pursuing an ADI licence through the restricted and direct routes, depending upon their individual circumstances.

For applicants taking the restricted route, the successful granting of a Restricted ADI licence is an important milestone, providing benefits in a number of areas, including:

- Investors – achieving the Restricted ADI licence provides tangible evidence to the investor community that the applicant is progressing towards an unrestricted licence, potentially helping the applicant raise the equity needed for its planned banking business;

- Recruitment – the Restricted ADI licence increases certainty around the applicant’s progress, potentially helping it recruit high quality staff to build its operations;

- Customers – the Restricted ADI licence allows the applicant to use the word “bank” and may help it establish its brand and customer base ahea of the full launch of its banking business;

- Advisors and vendors – the Restricted ADI licence potentially gives advisors and vendors greater confidence in the applicant, helping to establish partnerships.

Conclusion

The bar to obtaining a banking licence is intentionally set high, requiring significant time, resources and capabilities to achieve. This provides the general public with confidence that ADIs have the necessary risk management and controls to ensure that customers’ deposits are safe under all reasonable circumstances.

The restricted licensing route can be a helpful step towards achieving an unrestricted banking licence and being able to actively compete in the banking sector by offering products and services to the general public. APRA believes that the granting of a Restricted ADI licence can deliver benefits that assist new banks in developing the resources and capabilities needed for a full banking licence. Consequently, applicants that might otherwise not be able to meet the high bar for a banking licence can eventually enter the market, allowing the community to gain from enhanced competition and innovation.

APRA has seen significant interest in banking licences from a range of applicants and expects to grant more banking licences over the next year, including more restricted licences. While APRA can never predict which businesses will ultimately be successful in acquiring customers and establishing themselves as sustainable, unrestricted ADI licensees, the new licensing process aims to successfully balance the need to ensure banks are well-run and their customers’ deposits are safe with the need to ensure the licensing process does not unnecessarily impede competition.

1 https://www.apra.gov.au/media-centre/media-releases/apra-authorises-restricted-adi

Seeking sustainability: challenges facing individual disability income insurance

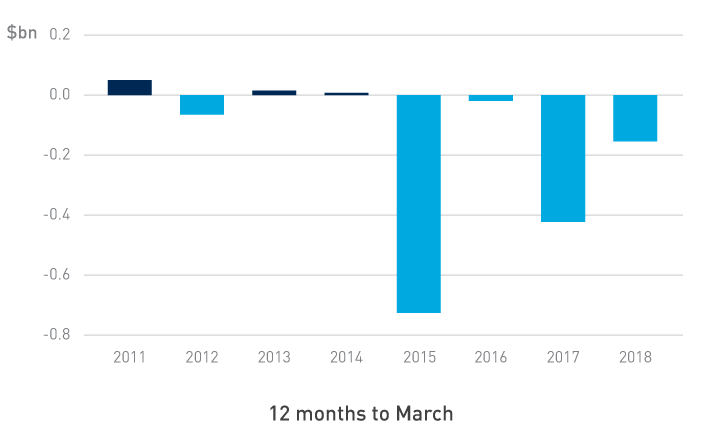

Disability income insurance (DII), also known as income protection insurance, is a protective cover that provides replacement income to policyholders when they are unable to work due to illness or injury. DII offered to individuals outside of superannuation (individual DII) has been an area of heightened focus for APRA over the last 12 months due to its ongoing poor performance and adverse experience (see Figure 1).

Figure 1: Individual DII Net profit after tax

Notwithstanding the somewhat improved performance since 2015, APRA remains concerned about the commercial sustainability of this product in its current form. To better understand the situation, APRA has embarked on a thematic review of insurers involved with individual DII, which is being conducted in two phases.

Phase One of the thematic review focused on APRA-regulated life reinsurers, and comprised a roundtable discussion in August 2017 followed by on-site meetings with those reinsurers. These interactions were useful in helping APRA further understand the challenges facing individual DII, its current management and controls, and the impediments to improving the product’s sustainability. Having recently communicated to reinsurers the key observations and insights gathered during this phase of work, including areas for consideration, APRA has now commenced the second phase of this thematic review with insurers.

Key observations from Phase One

Product strategy

Reinsurers in the Australian market are all part of global reinsurance groups that have a degree of influence over the strategic direction of the Australian entities. Although there are many similarities between the individual DII strategies of the reinsurers, there are notable differences, which seem to be influenced by, among other factors, the reinsurers’ mix of legacy business and new business.

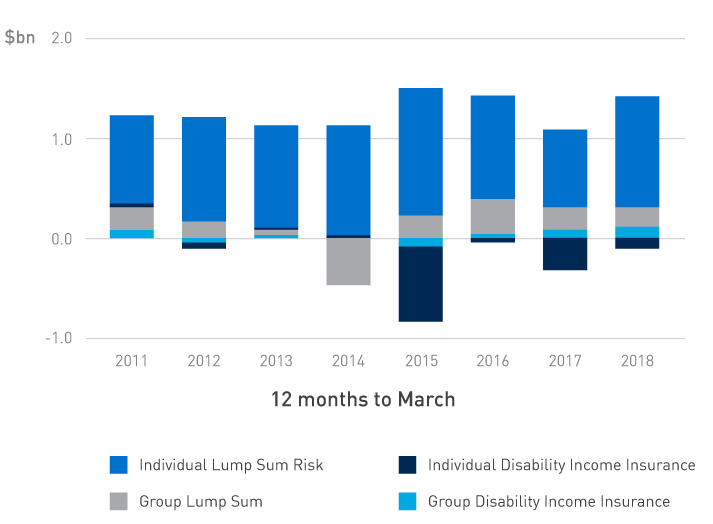

Cross-subsidisation remains an inherent feature across portfolios of life reinsurers and their cedants (i.e. primary writers). In particular, individual DII is often seen as a ‘loss leader’ which is subsidised by other lines of business, such as lump sum death and total permanent disability insurance. The consistent and relative profitability of lump sum products over the years (see Figure 2) seems to have facilitated this view of, and approach to, individual DII. The reinsurers have indicated they would like to reduce cross-subsidies as much as possible, and it appears this issue is now being given greater consideration by the boards and management of reinsurers.

Figure 2: Net profit after tax (risk products)

Many of the reinsurers, who mostly retrocede the risk to their parent or another entity within their global group, noted that individual DII remains an attractive proposition for their retrocessionaire1. Reasons for this included the potential to take advantage of possible differences in regulations with respect to the treatment of deferred acquisition costs across multiple jurisdictions, and diversification benefits for the retrocessionaire’s portfolio.

Pricing and benefit design

A number of the reinsurers told APRA they believed the current individual DII products were substantially under-priced relative to the benefits they offered. Most reinsurers believed that a more sustainable individual DII product should include considerable product simplification, tighter definitions to more closely specify claims eligibility and benefits that promote return to work, and appropriate pricing. While many reinsurers do have an interest in developing a more sustainable individual DII product, they cited the influence of rating houses’ preferences for products with additional ‘bells and whistles’ in recommendations to independent financial advisors as an impediment to product simplification.

The most challenging individual DII portfolios appeared to be those with older reinsurance arrangements, which are mostly closed to new business. These older arrangements were originally priced during a different phase of the insurance cycle, when some reinsurers were looking to grow market share in what appeared, at that time, to be a more benign claims environment. Consequently, pricing was aggressive and benefits continued to be added to the products with a view to gaining market share.

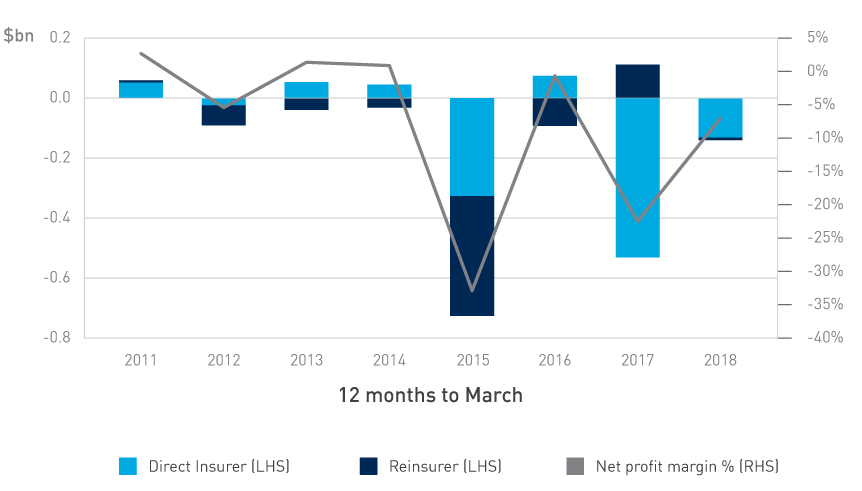

Figure 3: Cedant and Reinsurer Individual DII Net profit after tax

It was also uncommon for these older treaties to include repricing rights for the reinsurer. With the cedants more exposed to lapsation risk2 and the reinsurers to claims risk, the outcome was a misalignment of interests, resulting in a situation where poor experience was more likely to be felt by the reinsurers than their cedants. Historical distribution of profits between the cedants and their reinsurers reflects this (see Figure 3), albeit the reinsurers appear to have largely stemmed their share of losses in the past two years, potentially through actions such as incorporating repricing rights in the newer treaties and recapturing loss-making businesses where possible.

Claims management

The majority of reinsurers felt that claims management had a significant impact on the claims experience of individual DII, although most were also of the opinion that it was not the main reason for the poor experience.

Appropriate claims management resourcing, in terms of both staffing levels and claims management expertise, is widely acknowledged across the life insurance industry as being a necessity. Some primary writers still appear to be reporting difficulties in acquiring and retaining adequate claims management staff. Unavailability of experienced claims resources in the market in general, and more experienced claims resources being diverted to claims improvement projects, appear to have led to this situation, which has been exacerbated by difficulties in retaining staff in businesses that have been recently sold or are for sale. Generally, reinsurers were more likely to have issues with their cedants’ claims management standards for closed business or where the structure of the reinsurance treaty created a misalignment of interests.

Continued improvements are occurring in new business and claims systems, although the implementation of some new systems has been problematic. Reinsurers and primary writers appear to have recognised the need for greater data analytical capability and, while this is improving, there is more work to be done in this space. In the meantime, claims reporting remains an area for further development and improvement.

Approach to Phase Two

The knowledge obtained from Phase One of this thematic review, together with reinsurers’ responses to APRA’s feedback, will be used to inform Phase Two. The focus of Phase Two will be on primary writers driving the positive changes needed to mitigate the risk of deterioration in the performance of DII, and enhancing its sustainability to ensure that insurers remain willing to offer this product – and the financial protection it offers – to the community. For this purpose, APRA will pursue close engagement with a select group of primary individual DII writers, and the core activity will be a targeted review of their individual DII portfolios in the second half of 2018.

We will, however, continue our engagement with reinsurers to monitor their progress with regard to the areas APRA has raised for consideration. If, after a reasonable period, and as the Phase Two work progresses, APRA believes progress is inadequate, we will increase our supervisory intensity. Ultimately, we may consider more significant supervisory responses such as potential Pillar 2 capital requirements.

Conclusion

Although the opinions of reinsurers participating in the thematic review varied, they raised several concerns during Phase One of the review, including:

- sustainability issues with the current benefit design and pricing structures;

- barriers to releasing a more sustainable individual DII product;

- a possible lack of alignment between the interests of primary writers and reinsurers, particularly in relation to older legacy portfolios; and

- potential room for improvement in primary writers’ oversight of, reporting on, and resourcing for, claims management activities.

These factors need to be addressed to help insurers develop a sustainable product that continues to provide appropriate protection to policyholders. A product that is beneficial for policyholders, insurers and reinsurers will avoid market disruption caused by significant pricing increases or reductions in cover by insurers and reinsurers.

The situation that prevails within the individual DII market has many parallels with what occurred in the group insurance market some years ago, and feedback from the industry indicates a high level of awareness of the issues impacting this product. APRA expects the whole industry to continue addressing the challenges facing individual DII, and put this product on a strong and sustainable footing after a prolonged period of underperformance.

1 A reinsurer who insures another reinsurer.

2 Lapsation risk is the risk of policyholders cancelling or declining to renew their policies.