APRA Insight - Issue 1 2017

APRA’s policy outlook for 2017

Given the evolving nature of the financial system, the prudential policy framework needs to be regularly revised to ensure it remains appropriate. APRA therefore has a range of initiatives on its policy agenda in 2017, across banking, insurance and superannuation. These initiatives should help preserve and enhance a strong, efficient and responsive financial industry for the benefit of the Australian community.

Superannuation

The superannuation prudential framework primarily comprises the suite of new or updated prudential standards and guidance that were introduced in 2013. Over time, the framework has become increasingly well embedded within industry practice as trustees have become more familiar with the requirements and how they can be best applied to individual circumstances. APRA does not consider that the framework requires material changes at this time, but it will be subject to periodic review to ensure the standards and guidance are fulfilling their original intent and are keeping pace with strategic and industry developments.

While the overall prudential framework is considered broadly fit-for-purpose, there are areas where it will require adjustment in response to changes in the Government’s policy agenda. In particular, APRA is actively involved in the Government’s proposals to introduce a legislative framework to facilitate post-retirement products, likely to be known as ‘MyRetirement’ products1. Once the Government’s proposals are further developed, APRA will need to consult with the superannuation industry and other stakeholders on consequential changes that may be needed to the prudential and reporting frameworks. This initiative may well require significant changes for both superannuation funds and for members, and will need to be supported by a thorough, forward-looking and transparent policy-making process in which stakeholder engagement will be crucial.

More broadly, APRA is devoting more attention to reviewing how funds assess the overall outcomes they achieve for their members. For example, in this edition of APRA Insight, APRA has outlined its expectations for registrable superannuation entity (RSE) licensees relating to business planning practices and compliance with the legislative ‘scale test’ for MySuper products. This is likely to be an area of increased focus for APRA in 2017 on both the policy and supervisory fronts.

Finally, APRA is currently considering responses to its consultation on draft prudential guidance released in October 2016 relating to fund transfers and wind-ups. APRA’s response to submissions on Prudential Practice Guide SPG 227 Successor Fund Transfers and Wind-ups (SPG 227) and the final SPG 227 are expected to be released by mid-2017. This guidance will clarify expectations for the industry when seeking to make structural changes to their operations, including by merging with other funds.

Insurance

The policy outlook for life and general insurance has not changed materially, with the prudential framework now quite mature. However, in light of recent concerns that have emerged regarding claims outcomes, APRA is taking on a more active role in facilitating informed public discussion about the performance of the life insurance industry. APRA and the Australian Securities and Investments Commission (ASIC) have committed to working together to deliver enhanced public information on life insurance claims outcomes. While this work is still in its early stages, a preliminary data template is expected to be released in the second quarter of 2017. This template will be used for informal industry consultation on a more formal collection, and a ‘best efforts’ round of data reporting by life insurers. The ultimate outcome will be for consistent disclosure of readily available information on claims performance across the industry.

In the private health insurance (PHI) sector, APRA continues to progress initiatives outlined in its PHI policy roadmap released last year2. In the roadmap, APRA said it would take a measured approach to revising the PHI policy framework over time, using as a starting point the prudential framework for the other APRA-regulated industries. As a first step, APRA has proposed introducing a risk management standard for private health insurers. This draft standard is open for consultation until mid-April 2017. Insurers are encouraged to make submissions on this proposal, which APRA intends to finalise later this year.

APRA is also reviewing the role of the Appointed Actuary across the insurance industry, in order to clarify accountabilities and ensure the Appointed Actuary regime is meeting its intended objectives. A discussion paper on the Actuary’s role was released in June 2016, and APRA will issue a response to submissions later in 2017. The response will also outline how APRA proposes to apply the principles underpinning its review for the private health insurance industry.

Banking

For nearly a decade now, international collaboration toward strengthening the post-crisis global banking system has driven a substantial proportion of APRA’s policy agenda for authorised deposit-taking institutions (ADIs). In 2017, this process is expected to reach substantial completion with agreement anticipated later this year on the last major tranche of bank capital reforms to be issued by the Basel Committee on Banking Supervision.

APRA endeavours to meet the minimum internationally-agreed prudential requirements where feasible. Given the broad reach and complexity of the latest Basel reforms, APRA will continue to carefully consider which of the specific provisions are appropriate to implement in Australia, and on what timetable. In particular, this will include consideration of the expected forthcoming revisions to the standardised and advanced approaches to credit risk and operational risk capital, interest rate risk in the banking book and market risk capital. Other areas of near-term focus include the leverage ratio requirement and refinements to the content and scope of public disclosures. This will be a multi-year process and likely to involve multiple rounds of consultation, commencing later in 2017 and 2018. As recently announced, consultation and implementation of revised capital requirements for counterparty credit risk will also continue this year.

Closely interrelated to the Basel capital reforms is the Financial System Inquiry’s recommendation that capital requirements should be established such that ADI capital ratios are ‘unquestionably strong’3. APRA expects to publish its view on how ‘unquestionably strong’ can be measured in the coming months.

Within the inevitable changes to the bank capital regime, APRA is also giving consideration to areas where regulatory burden could be reduced. In particular, given the complexity of the forthcoming Basel reforms, there may be efficiencies to be gained through the introduction of a graduated capital adequacy framework for smaller ADIs with very simple business models. This could include, for example, retention of existing requirements rather than imposing the cost of implementing newer approaches that do not materially change capital levels, adopting simpler calculation methodologies in some areas, or even the removal of certain requirements. APRA expects to develop options for consultation later in 2017.

APRA is also working to develop a suitable framework for issuance of Common Equity Tier 1 capital instruments by mutually-owned ADIs, which would meet APRA’s prudential expectations for the highest quality of capital. If viable, this may enable mutual ADIs to raise equity directly and enhance their capital management flexibility, which was also a recommendation of the Senate Economics References Committee’s report Cooperative, mutual and member-owned firms4. This work is expected to progress to formal industry consultation around the middle of 2017.

The limit framework for large exposures and exposures to related entities are also under review. These prudential standards have not been materially updated in over 10 years and, as a result, have not kept pace with prudential practices or internationally-agreed standards. APRA plans to consult on proposed changes to its large exposure rules in the first half of 2017. To maintain an alignment between the limits on large exposure and those to related entities, a consultation on limits for related entities is also expected to occur later in 2017.

Cross industry

In addition to the industry-specific initiatives outlined above, APRA has commenced a project to update existing standards and guidance on outsourcing, business continuity and IT security. The objective of this update is to align the operational risk framework to evolving industry better practice. A cross-industry consultation is expected to commence in late 2017.

1 Refer to https://consult.treasury.gov.au/retirement-income-policy-division/comprehensive-income-products-for-retirement/ for further information about this Government initiative.

2 Refer to ../Pages/insight-issue1-2016.html#private

3 Refer to http://fsi.gov.au/publications/final-report/

4 Refer to: www.aph.gov.au/Parliamentary_Business/Committees/Senate/Economics/Cooperatives/Report

Sound planning essential to member outcomes in superannuation

The need for registrable superannuation entity (RSE) licensees to deliver sound member outcomes has always been core to meeting their member best interest obligations. However APRA-regulated funds are increasingly facing sustainability challenges, for example as a result of an aging membership base and potential reductions in membership and assets as benefit payments increase as members reach preservation age or transfer to other superannuation funds. These challenges, if not well managed, may ultimately impact an RSE licensee’s ability to deliver sound outcomes for its fund members.

There has been increased scrutiny and attention by APRA over the last year or so on how RSE licensees are ensuring adequate focus on the quality and value being delivered for members of the superannuation funds under their oversight. The intensity of this scrutiny is expected to continue for the foreseeable future.

APRA has observed through its supervision activities that RSE licensees with sound business and strategic planning processes are better positioned to drive quality, value for money outcomes for their fund members. Strategic and business planning practices in the superannuation industry should be of a similar standard to those adopted by APRA-regulated entities in other financial services sectors, however there is room for improvement in this important area.

MySuper scale test only a starting point

Since 2013 RSE licensees have been required to determine each year whether their MySuper product has access to sufficient scale, with respect to both assets and number of members. This requirement seeks to ensure that members of a particular MySuper product are not disadvantaged in comparison to members of other MySuper products.1

However, scale alone is not the only factor that should be considered in assessing the quality and value of MySuper products – larger RSE licensees with significant MySuper members or assets may ‘underperform’ relative to other MySuper products. The scale test requirements should therefore be viewed as a starting point when assessing outcomes for members; a robust assessment across a wider range of factors is needed to be able to be satisfied that the product is of appropriate quality, and providing good value for members. Any assessment of value for members needs to look at both qualitative and quantitative aspects – taking a broader view that encompasses not just investment performance and fees or costs, but also the nature and quality of the benefits and services being provided and the adequacy of the RSE licensee’s governance and risk management frameworks and practices.

Business and strategic planning

Over the past year, APRA reviewed a cross-section of RSE licensees to assess their approaches to strategic and business planning and how they were undertaking the legislated scale test. This group included RSE licensees of registrable superannuation entities which, over recent years, had demonstrated net member benefit outflow ratios consistently greater than 100 per cent. A declining membership base, negative cash flows or a combination of the two, is likely to negatively impact member outcomes over time, for example, due to operating costs potentially leading to higher fees being charged to remaining members.

In general, RSE licensees with poor business planning practices failed to consider the longer-term implications of key factors such as the net member benefit outflow ratio or declining membership. APRA also observed that a number of RSE licensees failed to adequately identify and/or address challenges that would likely impact their ability to attract and retain members or drive strong member outcomes. Common features of weak business planning were:

- strategic objectives or goals that were broad, with no timeframes, allocated resources/budget and not linked to clearly stated business initiatives;

- limited or no measurable indicators or metrics, and associated tolerances or triggers, to enable performance to be tracked against objectives or the outcomes of initiatives to be appropriately assessed;

- indicators or metrics that were not consistent with the current position of the RSE, for example a rapidly declining membership base; and

- failure to develop contingency plans or alternative future actions that would be taken in the event that adequate progress against key objectives or metrics was not achieved.

APRA considers that the detailed contents of a RSE licensee’s business plan are best determined by the board. However, stronger practices adopted by RSE licensees observed by APRA suggest that a quality business plan would encompass a thorough consideration of the resources necessary to achieve its strategic objectives, a reflection of the material risks associated with the strategic objectives and measurable indicators to monitor performance on at least a quarterly basis. RSE licensees must also consider a broad range of indicators when undertaking their business planning. While RSE licensees need to develop measures relevant to their own funds and/or strategy, some possible indicators include but are not limited to:

- financial performance indicators, for example:

- target investment performance, including net returns relative to appropriate benchmarks over the medium and long term;

- target net asset growth;

- target cost or expense base, including average operating costs per member and average operating costs per active member;

- target fee levels;

- target liquidity measurements, including net outflow ratio; and

- target average insurance product premiums and claim payment ratios.

- membership indicators, for example:

- measures of member switching, and the reasons for switching;

- target levels of active and inactive members;

- target levels for default employers;

- understanding membership demographics, including, at a minimum, data on age, gender, retirement preferences; and

- targets for member engagement through various channels, including utilisation by members of different communication channels.

- business initiative indicators, for example:

- outcomes of initiatives such as new/enhanced services or changes in benefits/product design and associated member take-up or other targets.

- outsourcing arrangement indicators, for example:

- target performance by service providers;

- target budget for outsourcing arrangements;

- analysis on the availability of alternative service providers in the event of a price increase or service disruption; and

- analysis on the ability or potential ability of the RSE licensee to in-house functions currently undertaken by third parties.

APRA expects processes to be in place that include triggers or tolerances linked to the strategic and business plan that would prompt review and action. These would be based on leading indicators that enable action to be taken to strategically address concerns about the sustainability of the fund. It would also be prudent for an RSE licensee to consider undertaking scenario analysis for certain metrics, and their implications.

In some cases, this action might lead the RSE licensee to decide to merge with another fund, or wind-up. For those RSE licensees that decide to transfer their members to another fund, APRA has outlined its expectations in draft Prudential Practice Guide SPG 227 Successor Fund Transfers and wind-ups (SPG 227). APRA expects to issue a final version of SPG 227 in the coming months.

Over 2017, APRA will continue its supervisory focus on strategic and business planning, and how RSE licensees are addressing the need to deliver quality, value for money member outcomes into the future. RSE licensees that are unable to demonstrate sound practices, and an ability to deliver appropriate member outcomes on a sustainable basis, will be subject to heightened APRA supervisory attention. This is likely to include requirements to develop and implement plans to quickly address areas of underperformance, or a plan to merge or wind-up underperforming funds in order to ensure that the best interests of members are adequately protected.

1 MySuper products were introduced as part of the Stronger Super reforms of the previous Government and replaced existing default products. They are required to have the characteristics set out in section 29TC of the Superannuation Industry (Supervision) Act 1993.

Climate change and prudential risks

In recent times, climate change has attracted greater attention from financial regulators globally. The potential systemic and prudential impacts of climate change is increasingly recognised as a challenge that the financial sector needs to grapple with. APRA’s stance on climate change related (CCR) risks is outlined in this article, together with its expectations for regulated entities in addressing these risks.

Setting the scene

In the past, CCR risks were often considered a future or a non-financial issue. That perception has shifted more recently, with a growing acceptance that CCR risks are distinctly ‘financial’ in nature and more immediate. At the same time, advancements in science and technology have improved the way in which the impacts and risks of climate change can be measured and helped develop a clearer picture on the implications for countries, regions, cities and companies.

In APRA’s view, three key recent developments have been important for APRA-regulated financial institutions, and financial markets more broadly:

- The Paris Agreement - the Paris Agreement entered into force globally last November, and provides an important signal about the direction of policy and the adjustments that companies, markets and economies will need to make. Australia is a signatory to this Agreement.

- FSB Taskforce on Climate-related Financial Disclosures - in December 2016, the Financial Stability Board’s 'Taskforce on Climate-related Financial Disclosures', chaired by Michael Bloomberg, released its draft report. Although sponsored by the FSB, this taskforce was led by the private sector, with its members including asset managers, auditors, ratings agencies, banks, manufacturers and miners. The report provides a framework for companies to disclose climate-related financial information and help investors make more informed decisions. In releasing the report, Mr Bloomberg stated “without effective disclosure of these risks the financial impacts of climate change may not be correctly priced and when the costs eventually become clear there is a risk of a rapid repricing of assets that could destabilise markets”.

- Legal opinion on directors’ duties - in October last year, respected barrister Noel Hutley SC opined that company directors who fail to properly consider and disclose foreseeable climate-related risks to their business could be held personally liable for breaching their statutory duty of due care and diligence under the Corporations Act.

Climate change related risks

Developments such as these have prompted financial regulators to intensify their considerations of CCR risks. In September 2015, for example, the UK Prudential Regulation Authority (PRA) published a report1 on the impact of climate change on the UK insurance sector, with Bank of England Governor Mark Carney emphasising the need to bring forward actions on climate change in the wake of the Paris Agreement. APRA too has increased its attention, and a recent speech by APRA Executive Board Member Geoff Summerhayes set out APRA’s views on the challenges and prudential risks associated with climate change at the Insurance Council of Australia’s annual forum2.

APRA’s initial focus on CCR risks was mostly in terms of an insurers’ exposure to losses from increasingly frequent and severe natural disasters, or ‘physical risks’. However, this has now expanded to recognise there can also be potential flow-on or secondary impacts associated with climate change. These include the exposure of banks’ and insurers’ balance sheets to, for example, real estate impacted by climate change, and to re-pricing (or even ‘stranding’) of carbon-intensive assets in their loan books. Asset owners and investment managers are also exposed, which is important for the superannuation sector. These CCR risks are so-called ‘transition risks’ — those stemming from changes in policy, law, markets, technology and prices as part of the agreed transition to a low-carbon economy.

The transition risks that stem from existing and anticipated policy and regulatory changes are not averted or minimised if these policy changes are delayed or do not eventuate as anticipated. The latter scenario may well make risks greater and more abrupt, either due to the need for sharper, more significant policy changes and market adjustments at a later stage, or from greater severity and frequency of the physical impacts of climate change.

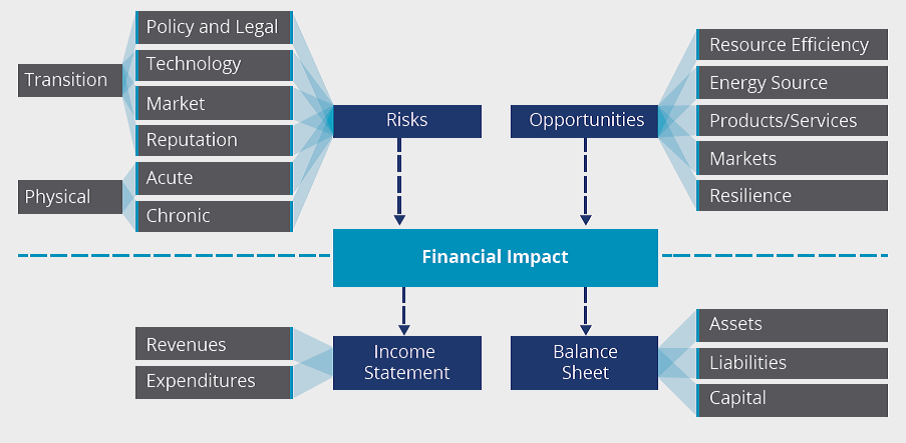

Figure 1 shows the range of climate related risks and their potential financial impact on profitability, assets and liabilities. It also depicts some of the associated opportunities and emphasises the need for regulated entities to consider climate change as part of their forward-looking risk analysis. Better disclosure standards, such as those promoted by the FSB’s Taskforce, allow investors and markets to have more information on climate exposure and risk management and to respond accordingly. The possibility of legal liability heightens risks for companies that aren’t responding — one of the many ways, including damage to valuation and reputation, that failure to explicitly address issue could manifest.

Figure 1 - Climate-related risks, opportunities and financial impact

Source: Recommendations of the Task Force on Climate-related Financial Disclosures Report, December 2016, Task Force on Climate-related Financial Disclosures

Scenario analysis

One implication of considering climate change as a potential financial risk relates to scenario analysis and stress testing. Financial entities should consider their need to be able to model the potential impact of CCR risks under different scenarios and over different time horizons, beyond mere documentation of static metrics.

Over the past decade, APRA has placed greater emphasis on stress and scenario testing for organisational and system resilience in the face of adverse shocks. In due course, just as APRA would expect to see more sophisticated scenario-based analysis of climate risks in individual entities, these risks could also be looked at as part of APRA’s system-wide stress testing.

Conclusion

APRA regulated entities have many risks and regulatory issues to manage. CCR risks pose additional challenges for entities’ capabilities and skills, given their somewhat more uncertain nature. But it is incumbent on both APRA and its regulated entities to consider CCR risks, and put in place actions to mitigate those that could have a significant financial impact if left unaddressed.

1 The impact of climate change on the UK insurance sector – A Climate Change Adaptation Report by the Prudential Regulation Authority, September 2015

2 Australia’s new horizon: climate change challenges and prudential risks” Speech by Geoff Summerhayes, APRA Member for Insurance, ICA Annual Forum 17 February 2017