APRA 2019 Year in Review - Safeguarding Australia's financial wellbeing

An introduction from APRA Chair Wayne Byres

Welcome to APRA's first Year in Review.

APRA is the prudential supervisor of the Australian financial services industry. It oversees banks, credit unions, building societies, general insurance and reinsurance companies, life insurers, private health insurers, friendly societies, and a large part of the superannuation industry. APRA currently supervises institutions holding more than $6.5 trillion in assets for Australian depositors, policyholders and superannuation fund members.

APRA’s mandate is to protect the Australian community by establishing and enforcing prudential standards and practices designed to ensure that, under all reasonable circumstances, financial promises made by the institutions APRA supervises are met within a stable, effective and competitive financial system.

Importantly, APRA is a safety regulator, focused wherever possible on preventing harm before it occurs. In this regard, APRA differs from a number of its peers, which are primarily enforcement agencies that seek to enforce the law by taking action after the fact.

Over the past couple of years, the financial services industry has been subject to unprecedented scrutiny over its performance, conduct and treatment of customers. As public interest in the regulation of the financial system has grown, APRA has sought to enhance its own transparency, external communications and collaboration, making improvements in these areas a key strategic priority in APRA’s Corporate Plan.

In that spirit, this new annual publication is designed to highlight the actions and decisions APRA has taken over the past year to fulfil its mandate to protect the financial wellbeing of the Australian community.

With 2020 only just underway, this is an appropriate vantage point to consider the breadth and depth of APRA’s work over the year just gone.

A year of reviews

The past 12 months was a period of significant activity and evolution as APRA responded to a changing and challenging environment and to a number of major reviews. These included the Final Report of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry released in February, and the APRA Capability Review, released in July.

In broad terms, APRA was called upon to continue to build and sustain the underlying strength of the financial system while at the same time intensifying its focus on a broader group of risks, partly to help address an erosion of community trust in the fairness with which customers have been treated. This required more intense scrutiny of the institutions APRA regulates, a broadening of APRA’s risk-based supervision into new areas, better use of data-enabled decision-making, greater preparedness within APRA’s resolution capability, and enhancements to the leadership, people and culture within APRA itself.

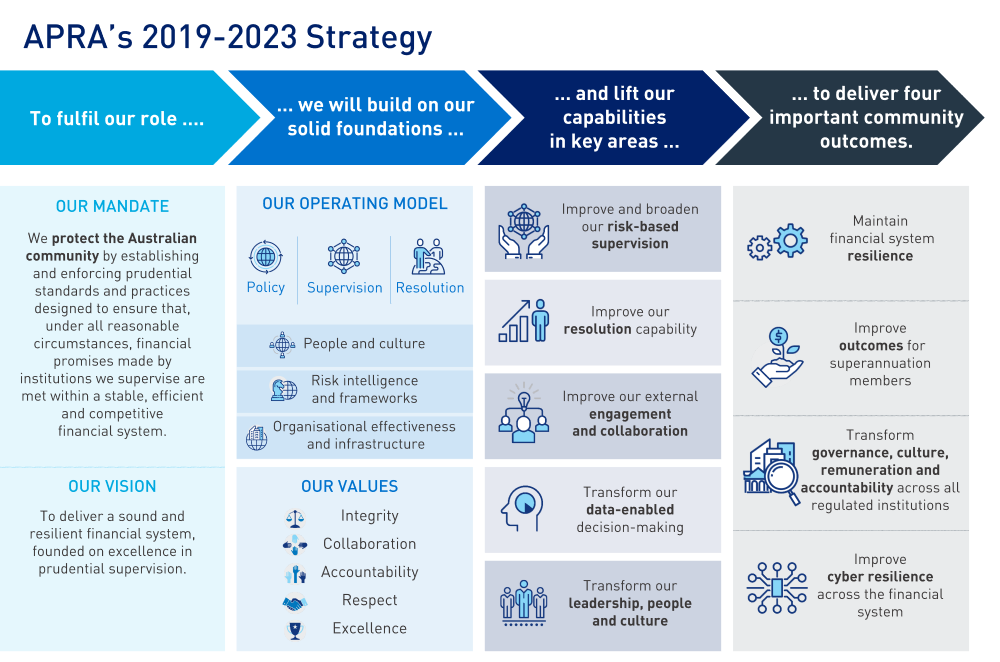

APRA’s roadmap for action is set out in detail in APRA’s four-year Corporate Plan, which was released in August. This plan outlined APRA’s strategic priorities from 2019 to 2023, the areas in which APRA needs to expand and build internal capabilities if it is to remain fit for purpose into the future, and a commitment to greater transparency and accountability. It also included a comprehensive strategic plan designed to focus on four key community outcomes that APRA seeks to deliver for the Australian community.

This Year in Review is one small component of a package of measures designed to enhance community understanding of APRA’s mandate and goals, and explain its activities and progress to all stakeholders.

What's covered in the publication

With a focus on the functioning of Australia’s financial system and the prudential foundations on which it is based, this publication outlines APRA’s perspective on the financial environment and the key issues that have faced the banking, insurance and superannuation sectors in 2019.

It is clear from the range and scale of activities outlined in Year in Review that APRA is pursuing a wider agenda than it has in the past, fortified by a substantial extension in powers and increased funding.

Year in Review also provides financial metrics for the industries APRA regulates, with analysis of industry composition, profitability and financial strength.1

The concluding chapter of this publication looks at developments within APRA throughout 2019, including how it is building its own capabilities. The Year in Review supplements APRA’s Annual Report and Financial Statements which are submitted to the Australian Government after the end of each financial year (to June 30).

Conclusion

During 2019, the Australian community continued to benefit from a safe, sound and stable financial system. APRA’s primary focus remains on delivering this outcome into the future.

One of the findings of APRA’s biennial Stakeholder Survey undertaken in 2019 was that more than 90 per cent of regulated entities and industry experts believe APRA is fulfilling its role to regulate the financial industry and protect the Australian community. This same survey revealed strongly positive assessments of APRA’s increased focus on risk culture, its capacity to identify industry risks, enhance the financial and operational strength of entities, and deliver clear and effective communications. These are obviously pleasing results.

But there is never room for complacency when it comes to prudential supervision of the financial system. 2019 saw a significant recalibration of APRA’s focus and breadth of responsibilities. Yet as busy as 2019 was, there will no doubt be further challenges in store for 2020 for both APRA and the industries it regulates.

On behalf of the APRA Members, I would like to acknowledge the fundamental role of APRA’s employees in helping APRA achieve its mission. They have demonstrated a very high level of commitment, expertise and diligence to serving the Australian community, and we thank them for their contribution to APRA’s successes.

Wayne Byres

APRA Chair

Footnotes

1 Due to the release of this publication so soon after the reporting period to 31 December, these metrics are for the 12 months to June 30, 2019.

Chapter 1 - Financial Sector Resilience

Operating environment

The Australian financial system in 2019 remained stable and broadly in sound health. This was a product of many factors, including supportive economic conditions and policy settings. APRA’s active supervision of the financial services industry also contributed. However, the financial system remains exposed to many vulnerabilities and challenges. Ongoing financial safety and stability therefore cannot be taken for granted.

There were two dominant features of the operating landscape for financial institutions in 2019: low economic growth and the intense focus on governance and culture.

In 2019, historically low interest rates were a central feature of the economic environment in Australia and globally, reflecting subdued economic activity more broadly. Many central banks eased monetary policy in 2019, including the Reserve Bank of Australia (RBA), in response to downside risks and relatively low inflation.

The year saw relatively subdued economic growth in Australia, with the economy growing at 1.7 per cent through the year to September 30.2 Housing credit, the largest component of borrowing by the non-financial sector in Australia also grew at a historically low rate over the past year: annual growth in housing credit over the 12 months to September was 3.1 per cent, marking the lowest growth rate since the beginning of this data series in the 1970s. Also unusually, all of the growth over the past 12 months was in lending to owner-occupiers; lending to investors did not grow over this period. Nevertheless, despite this relatively low growth rate in credit, household debt continued to grow faster than household income.

Business credit growth also slowed over the course of the year. Lending for commercial property, a component of business credit, has also been growing slowly recently.

Very low interest rates, while appropriate for the economy as a whole, added challenges for the financial sector. Coupled with subdued credit growth for banking institutions, profitability, and therefore capital generation – essential for balance sheet growth – faced additional headwinds in 2019, and will likely remain under pressure in 2020.

In such an environment, there is no room for complacency about financial system safety and stability, which is APRA’s primary mandate. While Australia’s financial system is often considered to be one of the most stable and safe in the world, the system has come under increasing pressure in 2019 on a number of fronts, and this will likely intensify into 2020. A program to build, maintain and strengthen financial system resilience (set out further in this chapter) remains a necessary and significant part of APRA’s work as it delivers on its core organisational capabilities of regulation, supervision and enforcement.

The second central feature of 2019 was the intense focus on culture and governance within financial institutions. A number of events – including most notably the evidence presented during the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry – brought issues of governance, culture, remuneration and accountability (GCRA) to the fore, and dominated commentary about the performance of the financial sector.

Although often referred to as ‘non- financial risks’, over recent years large financial institutions have incurred significant costs due to misconduct and operational risk events. The Royal Commission was a major catalyst for the public recognition of these losses: it brought to light a range of misconduct issues, and banks were forced to undertake large customer remediation programs. These not only seek to ensure individual customers are compensated as necessary, but just as importantly also seek to establish frameworks and processes to prevent a recurrence.

As a result of these issues, community trust in the fairness of the financial system has been eroded. Regulators such as APRA need to play a role in restoring that trust, and APRA’s work program in this area is discussed later in this chapter.

Footnote:

2 Source: Australian Bureau of Statistics. Growth calculated in seasonally adjusted chain volume terms.

Royal Commission

In December 2017, the Hon. Kenneth Hayne AC QC was appointed Royal Commissioner into Misconduct in the Banking, Superannuation and Financial Services Industry. The focus of the Royal Commission included:

|

Commissioner Hayne submitted his final report to the Governor-General on 1 February 2019. In that report, he identified a series of failings in the manner in which financial institutions treat their customers. The report identified as contributing factors the connection between conduct and reward, the asymmetry of power and information between financial services entities and their customers, the effect of conflicts between duty and interest, and the need to better hold institutions to account when things go wrong. Although noting that primary responsibility for misconduct lies with entities, the Commissioner also identified areas where the regulation and supervision of financial institutions needed to be strengthened.

The Commissioner made 76 recommendations, 10 of which were within APRA’s direct control. These focused on APRA expanding its work on GCRA, increasing engagement with ASIC, including greater shared responsibility for superannuation regulation, and making some adjustments to its prudential framework.

After the Commissioner’s report was released, APRA set out how it would respond to the 10 recommendations requiring APRA’s direct attention. Three were completed by end-2019: a renewed approach to cooperation between APRA and ASIC was announced, BEAR-style accountability statements for APRA executives were published, and amendments were finalised to prudential requirements in relation to the valuation of collateral, particularly for agricultural loans.

Of the remaining recommendations, six are expected to be completed by end-2020. The report also found that APRA should adopt a stronger stance on enforcement and referred 12 specific cases to APRA for review. These are proceeding apace and where appropriate, the actions will be made public in due course.

The report also found that APRA should adopt a stronger stance on enforcement and referred 12 specific cases to APRA for review. These are proceeding apace and where appropriate, the actions will be made public in due course.

Supervision in action - case study

Following a number of reported breaches of prudential requirements at a particular entity, APRA significantly increased its supervisory intensity. Although the entity was making progress in remediation, APRA supervisors were not satisfied with the speed and comprehensiveness of rectification and had concerns over the effectiveness of oversight and controls. In response, APRA imposed additional licence conditions, issued directions for a tighter remediation timeframe, governance and accountability improvements, and required independent assurance. There have since been significant improvements to governance arrangements, including to the Board, and APRA continues to closely monitor the entity.

APRA and ASIC

ASIC and APRA have committed to strengthen engagement, deepen cooperation and improve information sharing in an updated Memorandum of Understanding (MoU). The MoU facilitates more timely supervision, investigations and enforcement action and deeper cooperation on policy matters and internal capabilities.

ASIC and APRA share an interest in protecting the financial wellbeing of the Australian community and achieving a fair, sound and resilient financial system.

APRA Capability Review

Following the recommendation by the Royal Commission, in March 2019, the Australian Government appointed Graeme Samuel AC, Diane Smith- Gander AO and Grant Spencer to conduct a capability review of APRA. The review was tasked with providing a forward-looking assessment of APRA’s ability to respond to an environment of growing complexity and emerging risks for APRA’s regulated sectors.

The Panel’s final report was submitted to the Government at the end of June and publicly released on 17 July. The report recognised APRA as a high quality prudential supervisor that has successfully delivered on its core mandate – the financial safety of regulated entities and a sound and resilient financial system – over a long period of time.

However, it concluded that APRA also needed to expand its capabilities in a number of areas. These included strengthening its leadership capabilities, culture and organisational structure; increasing resourcing and supervisory focus on GCRA; giving greater prominence to member outcomes in superannuation; and better communicating what it does and how it does it. APRA supported all 19 recommendations that were directed at it; a further five recommendations were directed to Government.

The capability review followed additional external reviews by the International Monetary Fund and the Productivity Commission, as well as APRA’s own internal Enforcement Review (published in April 2019) that identified opportunities to strengthen regulation and supervision practices. Collectively, along with the recommendations from the Royal Commission, these reviews provided approximately 150 recommendations and suggestions for APRA to consider.

The recommendations were important foundations for the formulation of APRA’s 2019-2023 Corporate Plan and underlying operational plans.

APRA's Corporate Plan

APRA’s 2018-2022 Corporate Plan set out an ambitious change agenda, built on a robust strategic development process that undertook a comprehensive assessment of the internal and external environment, as well as international practice.

The past year has only reinforced the need for APRA to go further and faster, supported by stronger resources and capabilities, in a number of strategic priority areas if it is to respond effectively to the changing environment.

As a result, APRA’s Corporate Plan was revised for 2019-2023 to better set out what APRA intends to do and more clearly identify its desired outcomes.

In particular, the 2019-2023 strategy identified four key outcomes that APRA is seeking to deliver for the Australian community:

- maintaining financial system safety and resilience;

- improving outcomes for superannuation members;

- transforming governance, culture, remuneration and accountability within the financial sector; and

- improving cyber resilience across the financial system.

In setting out these objectives, as well as the internal capability improvements needed to deliver on them, APRA will be actively addressing and responding to the recommendations of the Royal Commission and the Capability Review.

APRA intends to regularly report its progress against these objectives over the next few years in various forums.

Explaining APRA's Mandate

To better explain how APRA manages competing objectives, APRA published in November an information paper setting out how it interprets and balances the various components of its mandate.

In the industries it regulates, APRA is not tasked with ensuring nothing can go wrong. To attempt to provide the community with an iron-clad guarantee that nothing can go wrong would require a zero risk financial system. A zero risk system will have zero activity and, in turn, generate zero value. At the other extreme, a financial system without constraints would inevitably lead to significant instability – well beyond the tolerance of the community to bear. The ideal balance for regulators is somewhere in between, balancing the financial safety that is desired for the community with the trade- offs needed to promote competition, innovation and economic growth.

APRA’s mandate under the Australian Prudential Regulation Authority Act 1998 (APRA Act) reflects this, and is therefore quite nuanced. The Act tasks APRA with pursuing its primary safety objective, but also says it should balance that with considerations of efficiency, competition, contestability and competitive neutrality. In other words, the Australian Parliament has not tasked APRA to pursue a ‘safety- at-all-costs’ strategy. Nonetheless, the Parliament also required that, in whatever trade-offs it makes, APRA’s decisions and actions should always be directed towards promoting financial stability. This can be characterised as a ‘stability-at-least-cost’ mandate.

APRA’s objectives are therefore interlinked. Sometimes they are mutually reinforcing; at other times, a balance between competing objectives is needed. APRA also tries to think beyond the particular circumstances of the day so as to maintain a sustainable balance over the longer run. The information paper explains in more detail the issues and questions APRA considers as it seeks to achieve this balance.

One of the most significant areas where APRA has evolved its approach over the past year is in the area of transparency. In line with prudential regulators globally, APRA has historically been relatively guarded as to the information it disclosed. This stemmed partly from legal restrictions on what APRA could say publicly, particularly about individual entities, but also because financial stability is often best served by a prudential regulator that conducts its work out of the spotlight.

"Stability is easy to take for granted, but hugely costly once foregone. In a system notable for its relative stability, it can be easily forgotten that there have been around 150 systemic banking crises around the globe in the past 50 years. The cost of crises is invariably substantial. Stability will always remain APRA’s driving objective: we must stay true to our mandate to deliver a safe and stable financial system for the community.

We are, however, endeavouring to be more structured and systematic about the way we assess all of the components of our mandate – including competition – and be clearer in acknowledging the trade-offs being made. The paper we have released today is part of that process. And the regulatory changes in the pipeline are designed to make sure that competition occurs from a position of financial strength."

-Wayne Byres, speech to COBA 2019, November 2019

Greater transparency

Over the past 12 months, however, APRA has sought to adjust this balance to capture the benefits that can flow from more transparency, while at the same time not jeopardising its ability to fulfil its core role. In a number of areas, especially in relation to matters of enforcement, APRA has substantially increased the amount of information provided to the community on its actions, decisions and assessments. This has been done as a means of informing stakeholders of APRA’s activities, influencing behaviour and driving accountability – both for APRA and the entities it regulates.

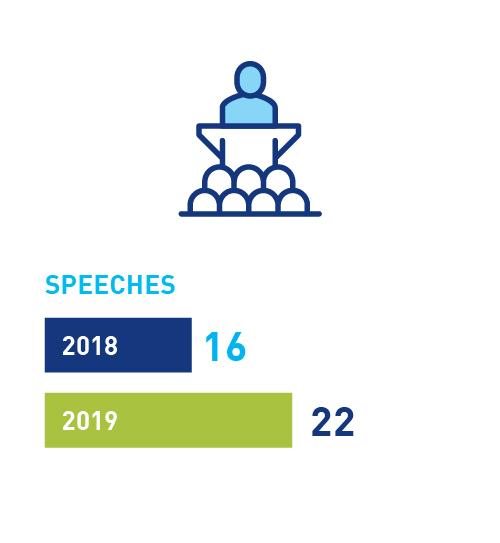

In addition, APRA has made a conscious effort to communicate more often, and in clearer, simpler and more accessible language. APRA has stepped up the number of speaking engagements it undertakes and media briefings it conducts, and has more actively utilised webinars and other means to reach a broader range of stakeholders.

"Greater transparency, conducted carefully and strategically, can enhance financial stability. APRA’s direction will no doubt create some discomfort for some of the entities we regulate. But by informing, influencing and driving accountability, APRA will harness transparency as a tool to promote better practice and deter poor conduct in the entities we regulate. Importantly, opening up on APRA’s actions and decisions will help to restore public confidence that Australia’s banks, insurers and superannuation trustees are being held to account for their performance and the outcomes they deliver."

- John Lonsdale, speech to Finsia's 'The Regulators', November 2019.

|  |  |

Building resilience: cross-industry initiatives

Chapter two of this publication details the activities and initiatives undertaken by APRA in 2019 on an industry-by- industry basis. However, that tells only part of the story, as significantly more of APRA’s supervisory and policy activities are cross-industry in nature, reflecting a wider range of emerging and accelerating risks that have relevance across the entire financial sector.

Some of the key cross-industry issues that APRA tackled in 2019 are set out in the remainder of this chapter.

Information technology (IT) and cyber risk

IT and cyber risk is an area of heightened risk across all industries. As financial institutions seek to harness the benefits of modern technology to deliver products and services to customers in a more efficient manner, so too do they become increasingly exposed to technological failures and cyberattacks. At the same time, the nature of cyberattacks against Australia’s financial institutions is growing in frequency and sophistication.

APRA sharpened its focus on improving cyber resilience across the financial system in 2019, making it one of its core strategic priorities. This was designed to establish a multi-streamed strategy to improve cyber resilience, including the need to increasingly consider the implications of new business models, management and transformation of legacy IT landscapes, greater reliance on third-party providers and technology - enabled competition.

A major milestone in 2019 was the implementation of a critical new cross- industry prudential standard governing information security. Prudential Standard CPS 234 Information Security (CPS 234) came into force on 1 July, with the intent of shoring up the capacity of all APRA- regulated entities to deter, detect and defend against cyberattacks.

Among other things, CPS 234 requires regulated entities to notify APRA promptly once they become aware of any material information security incidents or material information security control weaknesses. It also requires regulated entities to assess and gain assurance regarding the information security capabilities of any third parties they use for information management.

Reporting under CPS 234 has already given APRA additional insights into the scale and nature of the threats its regulated entities are encountering. In the first four months since taking effect, APRA received 36 incident notifications. Many of those were data breaches involving the disclosure of personal information as a result of simple human error. Others, more ominously, involved a compromise of staff or customer credentials resulting in the unauthorised manipulation of records, website defacement and fraud.

APRA used the results to identify areas of common weakness where more work needs to be done by industry to address these vulnerabilities. Additionally, APRA continued to bolster its capacity to assess and assist financial institutions to improve cyber resilience, and strengthened its alliances with peer regulators and other government agencies. This included executing a work plan of the Council of Financial Regulators’ Cyber Security Working Group, and engaging with the government as it consulted on the development of the next national cyber security strategy.

Speaking at a cyber security forum in November, APRA Member Geoff Summerhayes emphasised APRA’s increased attention on the cyber resilience of Australia’s financial institutions.

"APRA’s role in this process is to ensure regulated institutions are resilient to cyber-attacks through prevention, detection and response capabilities. We’ll be increasingly challenging entities in this area by utilising data driven insights to prioritise and tailor our supervisory activities. In the longer term, we’ll use this information to inform baseline metrics against which APRA-regulated institutions will be benchmarked and held to account for maintaining their cyber defences."

- Geoff Summerhayes, speech to CYBSA, November 2019.

Governance, culture, remuneration and accountability (GCRA)

Although often thought of as ‘non- financial’ in nature, weaknesses and shortcomings in governance, culture, remuneration and accountability can result in major financial consequences, and erode trust in supervised entities. In particular, poor governance, remuneration structures and accountability mechanisms, leading to and reinforcing a poor risk culture, can undermine the prudential soundness of an entity and the outcomes for its customers. These issues are of primary interest to a prudential supervisor such as APRA.

In response, APRA prioritised the strategic initiative outlined in its 2019- 2023 Corporate Plan to transform GCRA across all regulated financial institutions.

In November, APRA published a detailed plan to significantly scale up its efforts to lift GCRA practices across the industries it regulates. This includes lifting standards of board and senior executive governance, reinforcing the importance of ‘tone from the top’ to articulate and foster the desired risk culture, strengthening alignment of remuneration with performance and risk outcomes, and enhancing accountability by extending the executive accountability regime across all APRA regulated industries.

At its core, APRA’s intensified approach to GCRA aims to strengthen the resilience of financial institutions, including addressing, and ideally preventing, issues such as poor risk governance, misaligned incentives and misconduct that have undermined public confidence in the financial sector over recent years.

The key attributes of APRA’s new approach to GCRA are:

|

The new approach builds on a program of work that APRA commenced in 2015, including APRA’s thematic reviews of risk culture and remuneration, the Prudential Inquiry into the Commonwealth Bank of Australia, and the results of the subsequent risk governance self-assessments by a range of large financial institutions.

A major program of work for APRA in 2019 was the extension of the Banking Executive Accountability Regime (BEAR) from the four major banks (who became subject to the regime in 2018) to nearly 150 small-to-medium-sized authorised deposit-taking institutions (ADIs), effective from 1 July 2019. The BEAR places stringent accountability obligations on all ADIs, credit unions, building societies and small-to-medium sized banks, and required all ADIs to lodge the requisite accountability statements and maps with APRA in time for the commencement of the new requirements. All up, almost 1,500 executives are now registered under the BEAR regime.

Furthermore, as part of its response to the Royal Commission, the Government announced that it plans to extend the BEAR obligations across, at a minimum, the insurance and superannuation sectors. APRA has been working closely with Treasury and the Australian Securities and Investments Commission (ASIC) on the development of these proposals.

In 2019, following from the findings of the Royal Commission, APRA intensified its examination of the impact of remuneration practices on promoting effective risk management. Remuneration practices that concentrate on short-term financial performance without regard to the means by which that performance was achieved can lead to poor behaviour, which can in turn present a financial risk to an organisation. These issues are not confined to Australia. Other countries’ experiences during the global financial crisis highlighted the role of poor remuneration practices, leading to (for example) internationally agreed guidelines issued by the Financial Stability Board.

A major initiative in this area was therefore the release of APRA’s proposed new Prudential Standard CPS 511 Remuneration (CPS 511).

The proposed reforms address recommendations 5.1 to 5.3 from the Royal Commission. Under APRA’s proposals, which are still being finalised following extensive public consultation and feedback, boards will be more clearly accountable for making sure the remuneration structures within their entities reward the right behaviours, improve senior executives’ accountability and promote effective management of financial and non-financial risks. In particular, APRA proposed that remuneration has greater regard to non-financial risks, and that variable remuneration for senior executives be subject to longer periods of malus and clawback. Compared to APRA’s current principles-based requirements, the proposed standard is more prescriptive than has previously been applied in Australia, recognising the need to force change in an area that has not been delivering appropriate outcomes.

APRA intends to release its response to its remuneration consultation in the first half of calendar 2020

Risk-governance self-assessments

"Although the self-assessments raised no concerns about financial soundness, they confirmed our observation that industry is grappling to manage non-financial risks, such as culture and accountability.

The self-assessments provided valuable insights into the depth and totality of issues, and how institutions were addressing them. It was also interesting to observe the generally positive assessments boards and senior leadership teams had of their own performance, even when they had identified serious weaknesses in their institutions.

It was not always evident that institutions clearly understood the drivers of their findings. Therefore, there is a risk that any planned action to address weaknesses may not be effective or sustainable."

- John Lonsdale, APRA media release, May 2019.

In May 2019, APRA released a report analysing the self-assessments carried out by 36 of the country’s largest banks, insurers and superannuation licensees in response to the Final Report of the Prudential Inquiry into Commonwealth Bank of Australia (CBA).

APRA wrote to a selection of 36 entities in June 2018, asking them to undertake an assessment as to whether the weaknesses uncovered by the CBA Prudential Inquiry also existed in their own companies. The landmark CBA inquiry had found that continued financial success dulled the bank’s senses, especially with regard to the management of non-financial risks.

APRA Deputy Chair John Lonsdale said it was clear that many of the issues identified within CBA are not unique to that institution.

Consistent findings in the self-assessments included:

- non-financial risk management required improvement;

- accountabilities were not always clear, cascaded and effectively enforced;

- acknowledged weaknesses were well-known and some had been long-standing; and

- risk culture was not well understood, and therefore may not be reinforcing the desired behaviours.

Following the receipt of the self- assessments, APRA continued to actively engage with participating institutions. This included conducting more than 60 prudential engagements, monitoring the development and implementation of remediation action plans covering more than 1,200 action items (half of which were scheduled to be completed by the end of 2019) and updating risk assessments where appropriate.

Regulatory capital overlays of $500 million were applied to National Australia Bank, ANZ Banking Group and Westpac Banking Group, and $250 million was applied to Allianz Australia Limited. These remain in place pending successful remediation of the matters identified by each institution. Capital charges for other institutions remain a possibility if remediation plans are delayed or observed to be ineffective.

Supervision in action - case study

Through its engagements with the Board, APRA supervisors formed a view that oversight needed to be strengthened and the focus on compliance significantly improved. APRA also became aware of insurance policies that were issued which then needed to be refunded. APRA required the entity to engage an independent consultant to conduct a review of its compliance function. APRA also required the Board improve its understanding of its obligations, restructure its committees and commit more resources to risk management. Engagements with APRA have subsequently been more open and cooperative, and the entity has strengthened its risk management and governance arrangements.

Climate-related financial risk

Since first publicly flagging the issue in 2017, APRA has progressively sought to ensure that financial institutions are alert to, and actively considering, the implications of a structural shift to a low carbon economy, and the associated climate-related financial risks that could arise depending on how such a shift occurs. APRA’s peer financial regulators, the RBA and ASIC, have similarly warned that the physical and transition risks of climate change are likely to have first order economic effects.

During 2019, APRA announced it would be increasing its scrutiny of banks, insurers and superannuation trustees with respect to their management of the financial risks posed by climate change to their businesses. In his address to the International Insurance Society’s Global Insurance Forum in June, APRA Member Geoff Summerhayes said APRA expects to see continuous improvement in how entities are preparing for the transition to the low-carbon economy. In addition, he urged Australian financial institutions to adopt recommendations from the Financial Stability Board’s Task Force on Climate-related Financial Disclosures (TCFD), which is the closest framework there is to an accepted global standard for identifying, assessing, comparing and disclosing climate risks and opportunities.

Separately, APRA called for substantially greater investment in natural disaster mitigation to keep general insurance available and affordable in northern Australia, where premiums in cyclone and flood-exposed areas have risen sharply over the decade. In a submission to the Australian Competition and Consumer Commission’s Northern Australia Insurance Inquiry Second interim report, APRA outlined its strategic focus on lowering the incidence of underinsurance, given its flow on consequences for social and economic wellbeing, and the broader financial system’s stability.

"Forward thinking companies aren’t waiting to be pushed. By voluntarily committing to initiatives such as the TCFD, these companies are committing to identify, assess, manage and publicly disclose their climate risks. What these companies no doubt understand is that the very act of committing to disclose inevitably prompts them to take practical steps to enhance their business preparedness for the climate- related risks on the horizon."

- Geoff Summerhayes, speech to the International Insurance Society Global Insurance Forum, June 2019.

Supervision in action - case study

Through regular supervision, APRA identified material weaknesses in an entity’s risk management framework. APRA heightened its engagements with the entity, seeking assurance for progress within a specified timeframe, noting that more forceful actions would be taken if the entity did not address APRA’s concerns. APRA heightened its supervision intensity by monitoring the action plan and evaluated the entity’s progress in order to provide feedback.

The entity clearly demonstrated material improvements had been made and APRA continues to proactively engage on this issue.

Enforcement

In April, APRA published details of its new enforcement strategy. The new ‘constructively tough’ approach is designed to better leverage APRA’s enforcement powers to achieve sound prudential outcomes. It was based on the results of an internal review that was commissioned in response to a range of developments, including the creation of the BEAR, evidence presented to the Royal Commission, the Prudential Inquiry into CBA, and proposals to give APRA expanded enforcement powers, particularly in superannuation.

Four principles underpin the new approach:

- Risk based — prioritise cases posing the greatest prudential risk

- Forward looking — seek to prevent harm, mitigate risk and remedy wrong-doing

- Outcomes based — tailor the enforcement type to the desired outcome, recognising that an informal action may deliver a better and faster result

- Deterrence — seek to deter wrongdoing by individuals, regulated entities and the industry more broadly

The new enforcement approach reflects APRA’s preparedness to take stronger action earlier and set public examples. The decision to publicise enforcement actions serves as a general deterrent and allows the public to see how APRA is holding institutions to account when they do the wrong thing.

Since applying the new enforcement approach in April, APRA has increased the capital requirements imposed on banks and an insurer, issued fines for regulatory breaches, increased its supervisory intensity on a number of entities, and imposed directions and controls on some institutions. As examples:

- In May, after a show cause process, APRA issued directions to companies within the IOOF group for failing to comply with licence conditions previously imposed in December 2018, using for the first time the broader directions powers granted under the Superannuation Industry (Supervision) Act 1993 (SIS Act) by parliament in April 2019. APRA had imposed additional conditions on the licences or registration of IOOF-owned subsidiaries, I.O.O.F. Investment Management Limited (IIML), Australian Executor Trustees Limited (AET) and IOOF Ltd (IL) in December 2018, after launching disqualification proceedings against five IOOF directors and executives. These conditions currently remain in place.

- In June, APRA imposed directions and conditions on AMP registrable superannuation entity (RSE) licensees to address concerns regarding compliance with the Superannuation Industry (Supervision) Act 1993 (SIS Act). The action required them to significantly improve their conflicts of

- interest management, governance and risk management, breach remediation processes, risk culture, accountability mechanisms, and also renew and strengthen their boards.

- In July, following a review of funding agreements across the authorised deposit-taking (ADI) industry, APRA required Macquarie Bank, Rabobank Australia and HSBC Bank to strengthen intra-group agreements to restate their past funding and liquidity ratios where these had been reported incorrectly, to provide transparency to investors and the broader community.

- In August, APRA fined Westpac and two of its registered financial corporations a total of $1.5 million for failing to report data on time.

- On 17 December, a formal investigation commenced into possible breaches of the Banking Act 1959 by Westpac, focusing on matters alleged by AUSTRAC in November. This was accompanied by the immediate imposition of a further $500 million increase in Westpac’s capital requirements and the announcement of a new and extensive review program looking at Westpac’s risk governance.

In late 2018, APRA commenced action in the Federal Court in relation to possible breaches of the SIS Act by IOOF and some of its executives. In September 2019, the Federal Court dismissed APRA’s case, which related to the management of conflicts of interest in superannuation, the appropriate use of fund reserves and the need to put members’ interests first. APRA chose not to appeal the decision, but the ruling has prompted APRA to consider possible revision of its prudential standards and/or the need for legislative amendments.

Resolution and recovery

One of APRA’s core functions is to protect the Australian community from financial loss and disruption by planning for and implementing prompt and effective responses to a crisis in the financial system. APRA is not tasked with ensuring a zero-failure regime. However, APRA does seek to identify likely financial failures early enough so that corrective action can be initiated, or an orderly wind down achieved, that minimises risks to the community, beneficiaries, the financial system and public finances. This process is referred to as resolution.

The Financial Sector Legislation Amendment (Crisis Resolution Powers and Other Measures) Act 2018 boosted APRA’s powers in this area, supporting a comprehensive uplift to its resolution capability.

Building on this new legislative foundation, throughout 2019 APRA worked closely with fellow members of the Council of Financial Regulators (Treasury, the RBA and ASIC) and equivalent counterparts in New Zealand to improve the respective agencies’ crisis readiness. This work focused on how to co-ordinate an orderly resolution, and included running crisis simulation exercises.

APRA highlighted its intent to further strengthen its resolution capacity and crisis preparedness in both its response to the Capability Review and in its 2019- 2023 Corporate Plan.

Supervision in action - case study

Through a review of funding arrangements in the banking sector, APRA supervisors identified “non-standard” terms in borrowing agreements between three banks and their related entities. APRA’s assessment was that the funding terms did not meet the requirements of APRA’s

prudential framework and could present a material risk to these banks’ resilience in times of stress. APRA required the banks to strengthen their funding agreements and to publicly restate their past funding and liquidity ratios. APRA supervisors also engaged with overseas regulators to share their findings, and strengthen international supervisory outcomes.

Building Resilience: Internal Initiatives

Supervision Fitness Program

APRA strives to maintain a highly skilled workforce that comprises a strong blend of supervisory and industry expertise. This is essential for a supervision-led regulator such as APRA, which relies heavily on the judgement and experience of its employees to achieve sound prudential outcomes.

APRA currently has just over 200 front line supervisors, across three supervisory divisions, supported by a range of technical specialists in risk and data analytics.

In 2019, APRA embarked on a significant multi-year review of its supervisory philosophy and methodology. The existing supervision methodology is documented in the publicly available Supervision Blueprint, and has served APRA well for a long period, including through the global financial crisis. However, as the financial sector has evolved, new risks and issues have emerged that warrant greater attention alongside the consideration of more traditional financial metrics.

For example, shifts in the risk landscape exposed aspects such as executive behaviour and accountability, risk culture, customer and member outcomes and cyber risk as key drivers of poor performance and reputational damage that could threaten the financial health of an APRA-regulated entity.

As a result, APRA fast-tracked the revision of the supervision framework, which now represents one of APRA’s most critical internal capability uplifts. The initiative is captured in the 2019- 2023 Corporate Plan as “Improve and broaden risk-based supervision” but is known colloquially within APRA as the ‘Supervision Fitness Program’. It is intended to achieve “a strengthened, contemporary supervision model that is fit for purpose and for the future, and better able to respond to a changing environment.”

Intended to replace the existing Supervision Blueprint, the current program took an in-depth look at supervision approaches in peer regulators in other jurisdictions, leveraging best practice and expertise to develop a new supervision model that will be gradually introduced later this year.

The Supervision Fitness Program has also included a redesign of the supervision training program, to bolster supervisors’ skills development. A new Supervision Training Academy is being developed with a curriculum that emphasises supervision as a professional capability and is in-line with international best practice. The Training Academy will provide training programs for all APRA supervisors, with intensive on-boarding training for new supervisors already underway.

PAIRS and SOARS overhaul

Key staples in APRA’s supervision armoury have been the PAIRS and SOARS risk assessment and supervisory response models. As an important component of the Supervision Fitness Program, both are undergoing a major rework to deal with legacy issues and align with the changed environment.

A revised risk assessment model is in pilot testing and is targeted for rollout by July 2020. The new Supervision Risk and Intensity model (SRI) distinguishes risk classes across different industries, allows for the addition of new risks and facilitates a different level of assessment between small, large and systemically important institutions. The SRI also elevates GCRA, internal audit, cyber risk and member/ customer outcomes in prominence. Backed by a framework that matches the risk rating with a level of supervisory intensity, the SRI will result in a change to the PAIRS and SOARS settings for most entities. In some cases, it will mean a stronger supervisory effort is applied; in others, less so.

APRA is evolving how it conducts supervision and the Supervision Fitness Program is a major foundation for APRA’s future approach. The resultant changes, both to supervision and APRA’s overall regulatory approach as outlined throughout this document, are designed to manifest in a stronger supervisory fabric over time, enabling APRA to achieve its vision and mandate, and deliver a more resilient financial system that benefits all Australians.

Supervision in action - case study

Through its supervision, APRA became aware of material weaknesses in an entity’s IT infrastructure. APRA was concerned the Board and management could not effectively manage this risk and took action. APRA required the entity to gain independent assurance on the adequacy of its controls and the materiality of the risk. APRA also required the Board and management to form a remediation plan for addressing weaknesses in a timely manner. APRA is closely monitoring progress against the remediation plan, holding the entity to account on its key deliverables.

Data Transformation Program

Data supports much of APRA’s work, such as informing policy development and tracking the soundness of financial institutions. Data analysis serves as an early warning system, allowing APRA to identify prudential risks and intervene early to prevent harm or, where appropriate, manage the orderly exit of a failing institution.

APRA also plays an important role in providing data to various government agencies, including Treasury, the RBA, ABS and ASIC.

Throughout 2019, APRA liaised with industry in preparation for the replacement of its data collection system, commonly known as Direct to APRA or D2A. Since its release in 2001, D2A has become increasingly challenging to maintain. It also lacks the functionality to support modern reporting requirements, leading APRA in 2017 to announce plans to seek a new, modern and efficient system capable of meeting APRA’s data collection, analysis and reporting needs into the future.

In March 2019, APRA announced the selection of a joint venture to deliver the new data collection solution, partnering with Vizor Software and Dimension Data.

Once fully implemented, the new solution, APRA Connect, will provide a secure, web-based system for drawing data from approximately 4,500 companies across Australia. It will give APRA accurate, timely and sufficiently granular data to meet information requirements into the future and ensure APRA keeps pace with advances in data, analytics and technology.

Among other things, APRA Connect will support a major expansion of data collection from the superannuation industry, helping to drive better industry practice and better member outcomes by making it easier to compare fund, product performance and investment options. Collection of more detailed information also will enhance APRA’s visibility of key risk areas in banking and insurance, further supporting supervisory activities.

APRA Connect is one component of a broader data modernisation project encompassing processes and infrastructure for storing, analysing and delivering data at APRA.

Work has been continuing throughout 2019 to transition the business systems and processes from the old data warehouse to APRA’s new Enterprise Data Warehouse (EDW), which was rolled out in late 2018. The development of the EDW provides a consolidated single source of truth for all of APRA’s collected data. It will also be the platform to store data collected through the new APRA Connect system. In 2019, APRA has focused on consolidating reporting tools, decommissioning legacy systems and addressing other critical dependencies in preparation for the go-live of APRA Connect.

Additionally, in 2019 APRA integrated the findings from its data innovation lab, a specialist internal team exploring advanced new techniques and tools for data visualisation and data analytics into the business and applied the learnings to build capability and sophistication into APRA’s data modelling and analysis.

With the recent refresh of APRA’s public website, APRA expects to be able to display more dynamic and visual data sets as 2020 progresses.

Supervision in action - case study

APRA supervisors identified an underperforming superannuation trustee that was delivering poor outcomes for its members, which was reflected in low returns and high fees. The trustee board was resistant acknowledging that members might be better served in another fund and was reluctant to consider exiting the industry. APRA required the fund to have its performance externally assessed against its peers and heightened its engagements with the trustee. The trustee board has subsequently undertaken a successor fund transfer to another fund.

Chapter 2 - Sector Developments

Authorised Deposit-taking Institutions (ADIs)

Introduction

The ADI sector remained financially sound and resilient throughout 2019, notwithstanding the on-going challenges associated with reputational damage from cases of misconduct. At the end of 2019, ADIs were well capitalised, had adequate liquidity and funding, and were profitable. Overall asset quality remained strong compared to both historical averages and experience internationally.

Notwithstanding this robust starting position, the banking sector remains exposed to a number of headwinds and vulnerabilities. These include high and rising household debt, on- going reliance on foreign wholesale funding, historically low interest rates, and relatively low rates of economic growth. In addition, operational risks for ADIs were heightened, with evidence of underinvestment in compliance, IT systems and data management.

In response, APRA remained alert to the potential for increasing financial and non- financial risks, and regularly consulted with peer regulators, industry and the Council of Financial Regulators on its observations, prudential actions and changes to prudential policy.

The industry landscape

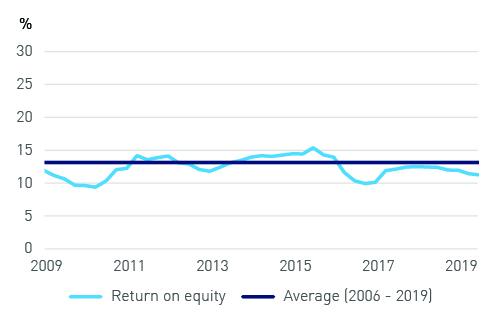

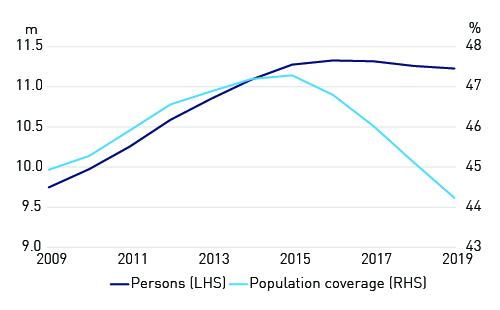

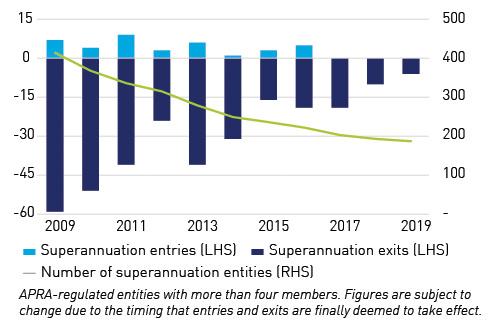

There were 148 ADIs operating in Australia as at 30 June 2019. This was up from 145 a year earlier and represented the first net increase in sector participants in almost a decade-and-a- half (Figure 1a).

The year saw the return or new entry of four foreign banks and the licensing of three locally-incorporated entrants, more than offsetting the loss of two ADIs through market consolidation in the mutual sector and the exit of one foreign bank. The 148 ADIs comprised 93 banks, 47 credit unions and building societies, seven other ADIs, and one Restricted ADI.

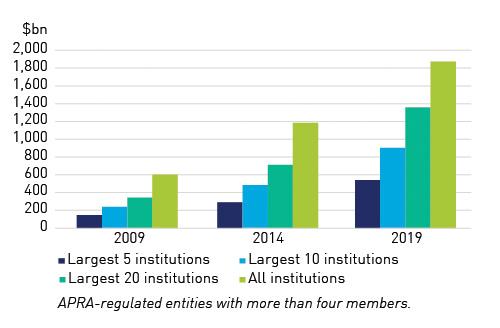

As at 30 June 2019, total ADI industry assets stood at $4.54 trillion, up from $4.32 trillion the year prior. The industry remained concentrated, with the four major banks holding around 75 per cent of industry assets, a marginal reduction in concentration compared to prior years (Figure 1b).

Industry profitability remained healthy but was dampened by a number of factors, including:

- subdued credit growth;

- customer remediation costs flowing from the Royal Commission; and

- narrowing net interest margins, reflecting historically low and declining interest rates.

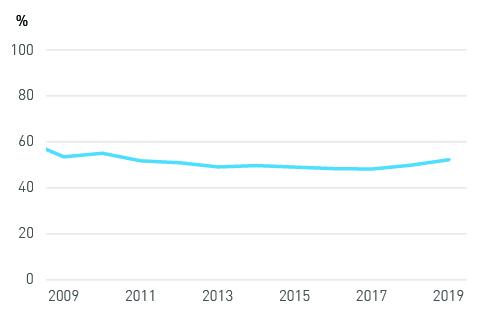

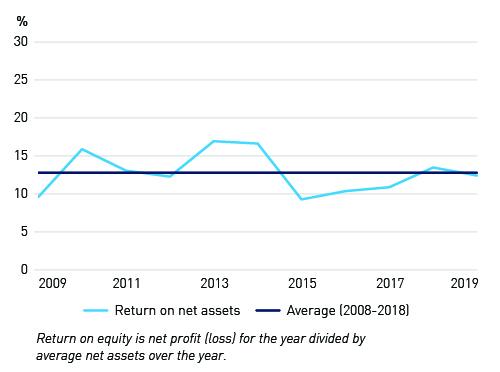

As a result industry return-on-equity (RoE) reduced to 11.5 per cent (Figure 1c), a fall of 50 basis points from 2018 and well below the long-term average RoE of 13.2 per cent since 2006. The industry cost-to-income ratio continued to increase, reaching to 52 per cent in the year to June 2019 from 49 per cent in the year prior (Figure 1d).

Industry asset quality remained strong although there was a slight increase in non-performing loans, up 6 basis points to 0.90 per cent of gross loans and advances at 30 June 2019 (Figure 1e). A stable economic environment, underpinned by low interest rates and low unemployment levels, have helped maintain low levels of asset impairment and credit losses.

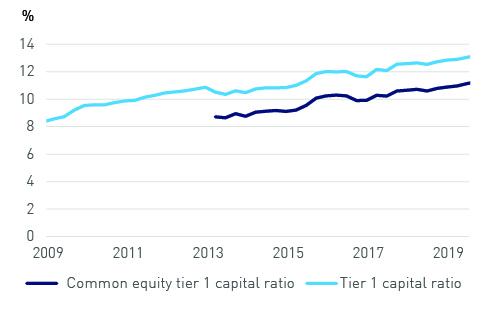

The ADI industry was well capitalised, and at 30 June 2019 the weighted average CET1 ratio for the industry stood at 11.1 per cent — an increase of 55 basis points over the prior year. The weighted average industry Tier 1 capital ratio rose 51 basis points over the year to 13 per cent (Figure 1f).

Figure 1a - Number of ADI entries and exits

| Figure 1b- Assets of larges ADIs |

Figure 1c - ADI return on equity

| Figure 1d - ADI cost-to-income ratio

|

Figure 1e - ADI non-performing loans to gross loans and advances

| Figure 1f - ADI capital ratios

|

Key issues and activities in 2019

Capital framework

To ensure the ongoing resilience of ADIs, APRA continued to progress the major overhaul of the capital adequacy framework designed to implement the internationally agreed Basel III reforms as well as the ‘unquestionably strong’ capital targets recommended by the 2014 Financial System Inquiry (FSI). During 2019, APRA finalised the new operational risk capital framework, and continued to consult with industry on other revisions to the capital framework, particularly in relation to risk weights. APRA’s latest proposals detailed a simplified capital framework for small, less complex ADIs, while ensuring that measures reinforced the safety and stability of the ADI sector by better aligning capital requirements with underlying risk.

While this work will continue in 2020, it is important to note that ADI capital ratios by and large already meet APRA’s ‘unquestionably strong’ benchmark set in 2017. As a result, finalisation of the capital framework is not expected to further increase capital requirements in the system overall.

During 2019, APRA also implemented new requirements that will increase the loss-absorbing capacity available to support the orderly resolution of the largest Australian ADIs, in response to another FSI recommendation. Australia’s major banks are required to increase their total capital by a further three percentage points of risk-weighted assets by 2024. Coupled with the ‘unquestionably strong’ capital targets, this represents an important step towards ensuring sufficient resources are in place to facilitate resolution in the unlikely event of a failure. Over the long term, APRA will explore feasible alternative methods for raising an additional one to two percentage points of loss-absorbing capacity.

In October 2019, APRA additionally completed a review of the appropriate capital treatment for investments in subsidiaries. APRA’s new requirements adopted a more risk-based approach, by increasing the amount of equity required to support investments in large subsidiaries and reducing that for small subsidiaries. In adopting this approach, APRA sought to balance the benefits of diversification that come from owning subsidiaries with potential concentration risk associated with large single investments.

APRA also consulted further on changes to the leverage ratio requirement for ADIs. The proposed amendments incorporate recent technical changes to the Basel Committee on Banking Supervision’s leverage ratio standard, but are not expected to have a material impact on the reported leverage ratios of Australian banks.

Residential mortgage lending

In an environment of moderating higher risk mortgage lending and improved bank origination practices and lending standards, APRA announced in 2018 the removal of the temporary supervisory benchmark measures on investor and interest-only residential mortgage lending. The benchmarks were part of a range of actions over recent years designed to reinforce sound lending practices. Removal of these temporary measures was conditional on APRA receiving specific assurances from boards that lending policies and practices would meet APRA expectations.

In January 2019, APRA released an assessment of its residential mortgage lending measures, which found that the measures were successful in strengthening lending standards and reducing a build-up in systemic risk in mortgage lending. In particular, APRA found that the growth in total credit for housing was stable, notwithstanding that within that, the rate of growth of lending to investors fell considerably, and the proportion of loans written on an interest only basis roughly halved.

APRA also amended its guidance on residential mortgage lending in mid-2019 to remove the existing minimum interest rate floor of at least seven per cent used by ADIs in serviceability assessments. With interest rates at historically low levels and differential pricing existing for loans with different characteristics, the merit of a single interest rate floor had reduced. ADIs are now able to set and review their own minimum interest rate floor, but are still expected to apply an interest rate buffer of at least 2.5 per cent over the loan’s interest rate. These changes, which were likely to increase the maximum borrowing capacity for a given borrower, did not signify any change to APRA’s expectations on the maintenance of sound lending standards more broadly.

In 2018, APRA completed a comprehensive review of residential mortgage risk management at the major banks, the aim of which was to assess the overall effectiveness of the end-to- end risk management framework for residential mortgage lending. During 2019, APRA assessed the remediation plans prepared by the banks, which outlined the actions they would take to address any identified issues, and continued to track progress of each of the actions.

Restricted ADI licensing framework

APRA’s restricted ADI licensing framework, introduced in 2018, facilitated a number of new ADI entrants into the market in 2019. The framework is designed to make it easier for aspiring ADIs to enter the market, without lowering entry standards overall. Risks relating to new ventures are inherently higher, with APRA needing to apply additional resourcing to the licensing and supervision of these entities, especially while the business models are being tested.

In September, Xinja Bank Limited became the second entity to migrate from a restricted licence to a full unrestricted ADI licence in 2019, following the route taken by volt bank Limited.

Exposures to related entities

APRA finalised a strengthened Prudential Standard APS 222 Associations with Related Entities (APS 222) aimed at combatting contagion risk within banking groups. The changes will reduce the risk of problems in one part of a corporate group having a detrimental impact on an ADI, by:

- broadening the definition of related entities to include board directors and substantial shareholders;

- revising limits on ADI exposure to related entities;

- applying minimum requirements for ADIs to assess contagion risk; and

- removing the eligibility of ADIs’ overseas subsidiaries to be captured within APRA’s Extended Licensed Entity framework.

APS 222 will come into effect 1 January 2021, and will ensure ADIs are better able to monitor, manage and control contagion risk within their organisations.

Credit risk management framework

APRA finalised an updated Prudential Standard APS 220 Credit Risk Management (APS 220) in December 2019. This responds to a significant evolution in credit risk practices since the standard was last substantially updated in 2006. The changes, which cover credit standards and the ongoing monitoring and management of ADI credit portfolios, are aimed at reflecting contemporary credit risk management processes and the introduction of a new accounting standard.

The new standard also addresses specific recommendations of the Royal Commission in relation to the valuation of collateral, particularly in relation to agricultural loans.

Westpac

On 17 December, APRA announced an investigation into possible breaches of the Banking Act 1959 by Westpac Banking Corporation (Westpac).

APRA’s investigation will focus on the conduct that led to money laundering- related matters that are the subject of Court action by AUSTRAC, as well as the bank’s actions to rectify and remediate the issues after they were identified. The investigation will examine whether Westpac, its directors and/or its senior managers breached the Banking Act – including the Banking Executive Accountability Regime (BEAR) – or contravened APRA’s prudential standards.

Given the magnitude and nature of the issues alleged by AUSTRAC, APRA is aiming to ensure that any deficiencies in Westpac’s risk management framework are identified and addressed and that Westpac and those responsible are held accountable as appropriate.

In addition, APRA announced it would:

- impose an immediate increase in Westpac’s capital requirements of $500 million, to reflect the heightened operational risk profile of the bank. This brings the total operational risk capital add-ons that Westpac is required to hold to $1 billion, following the increase announced by APRA in July 2019; and

- initiate an extensive review program focused on Westpac’s risk governance, including risk management, accountability, remuneration and culture. An element of the review will be an examination of the steps Westpac has been taking to strengthen risk governance in recent years, including through its self- assessment.

General Insurance

Introduction

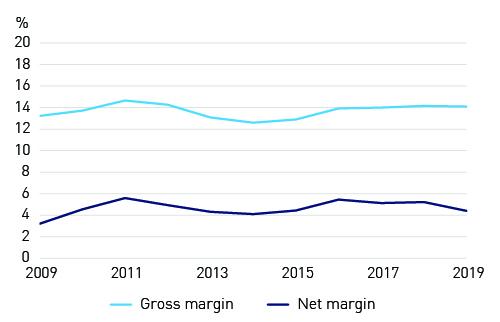

Overall conditions in the general insurance sector were stable throughout 2019. The industry maintained its strong capital position, with sound profitability levels despite major storm and bushfire events, while overall risks to the industry were generally well managed and within expectations. Premium increases during 2019 partially offset rising claims costs, while the low interest rate environment eroded insurers’ interest income on investments.

A number of insurers increased their reinsurance limits to reflect exposures to catastrophe events and also a rise in modelled earthquake risk in New Zealand.

Although the general insurance industry enjoyed a relatively sound level of resilience, outdated business models could expose the industry to viability issues into the future. Longer term, ensuring that general insurance remains accessible and affordable to all Australians, especially those living in areas prone to natural hazards, may pose a challenge without a greater national investment in mitigation and disaster preparedness.

The industry landscape

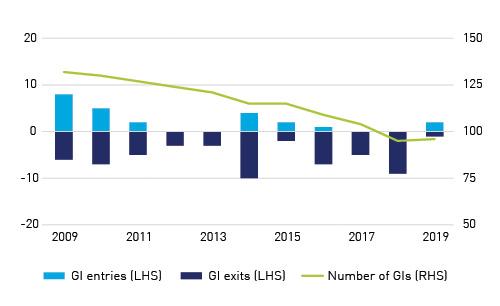

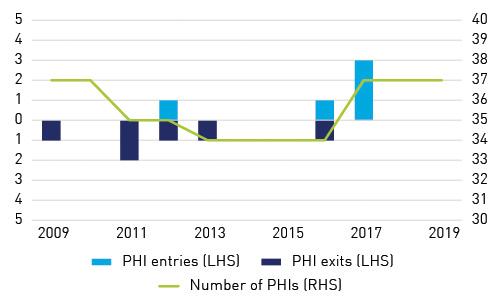

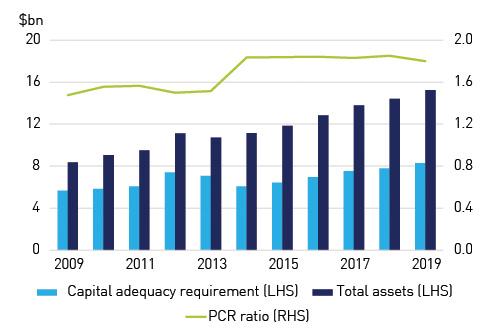

At 30 June 2019, 96 APRA-authorised general insurers operated in Australia, comprising 73 direct insurers, 9 reinsurers and 14 run-off insurers. The number and composition of general insurers was relatively unchanged from the previous year (Figure 2a).

Industry concentration has increased over time, with the top five general insurers now accounting for 55 per cent of total industry assets. This represents a significant increase from 39 per cent 10 years ago (Figure 2b). Over the 12 months to June, an increased use of proportional reinsurance by direct insurers increased reinsurers’ share of industry net earned premium to 8 per cent (6 per cent at June 2018).

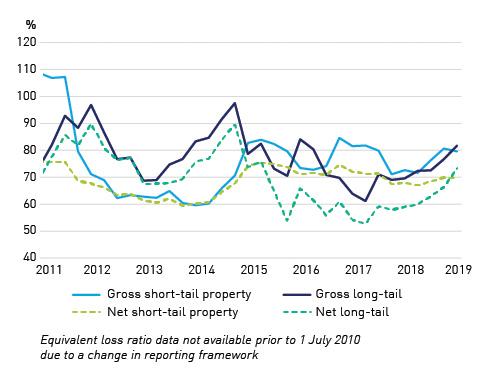

The industry achieved a 12 per cent return on net assets, which was broadly in line with the 10-year average (Figure 2c). The slightly lower return on net assets compared to the prior year was primarily due to higher claims costs from natural catastrophe events, including the Sydney hailstorm in December 2018 and the Townsville floods in early 2019. These events led to higher net loss ratios for short-tail property classes of business, in particular for householders, and Fire and Industrial Special Risks classes of business (Figure 2d). This impact was partly offset by premium rate increases across these classes of business.

The net loss ratio for long-tail classes of business increased significantly over the year. This was due in part to an increase in the valuation of long-tail claims reserves driven by falling bond yields. Other strengthening of claims reserves were also observed, most notably in the employers’ liability and public and product liability classes of business. A sustained low wage inflation environment meant that releases of claims reserves continued in the compulsory third party (CTP) motor vehicle class of business; however, these were smaller than in recent years. The 2017 New South Wales CTP scheme reforms are expected to result in a further reduction in reserve releases and CTP underwriting profits in coming years.

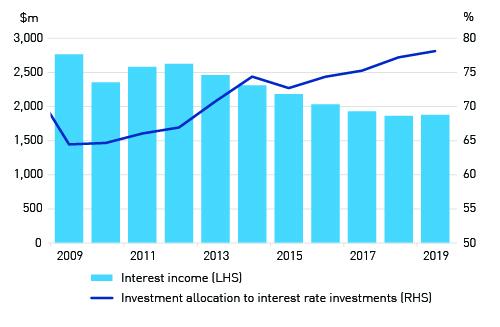

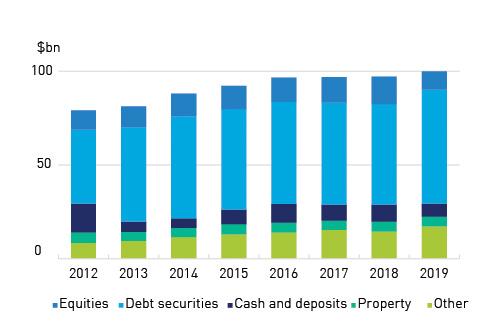

General insurers’ investment portfolios remained heavily weighted to interest bearing investments (Figure 2e). Low interest rates eroded insurers’ interest income on these investments; as a result, there was a gradual shift in the allocation of interest bearing investments to lower grade investments as insurers looked for higher returns. As at 30 June, however, low yields had not caused an industry- level reweighting toward riskier assets, such as equities and property.

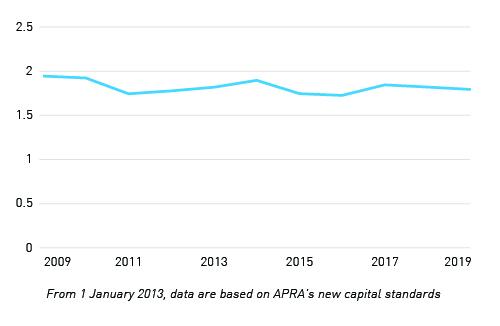

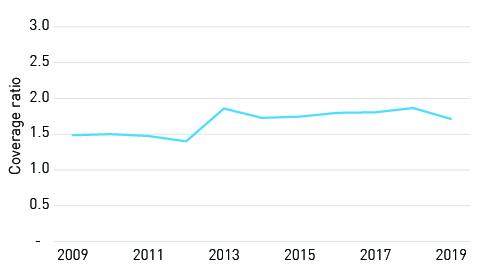

The industry continued to report a stable capital position, with a coverage ratio of 1.79 times the minimum requirement at 30 June 2019 (Figure 2f). The quality of capital held by insurers remained strong, with CET1 capital making up 93 per cent of non-branch insurer eligible capital (91 per cent at June 2018).

Figure 2a - Number of general insurance entries and exits

| Figure 2b - Assets of largest general insurance institutions |

Figure 2c - General insurers' return on net assets

| Figure 2d - General insurers' loss ratios

|

Figure 2e - Investment performance

| Figure 2f - General insurers' capital coverage ratio

|

Key issues and activities in 2019

Natural disasters

Globally, 2018 was the fourth most costly year on record for natural catastrophes for the insurance industry.3

Many of these catastrophes were climate-related. A greater frequency of lower-severity perils, including floods, hailstorms and bushfires, combined with growing populations, rapid urbanisation and concentration of infrastructure and assets in vulnerable locations, have increased the general insurance industry’s exposure to natural peril losses.

In March 2019, APRA published an Information Paper, Climate Change: Awareness to Action, providing a stocktake of climate change activity domestically and internationally as well as thematic insights from APRA’s climate change survey. Throughout 2019, APRA supervisors undertook further reviews of the 38 entities that participated in the survey, assessing their responses to climate change financial risks. The results of this analysis will be concluded in 2020.

In September 2019, APRA also called for a substantially greater investment in natural disaster mitigation in northern Australia. Premiums in cyclone and flood-exposed parts of the country’s north have risen sharply over the past decade in comparison to the rest of Australia. In a submission to the ACCC, APRA noted that about 97 per cent of disaster funding goes towards clean-up and recovery, rather than prevention and mitigation. APRA argued that increased investment in mitigation would save money in the long-term by reducing physical loss and economic disruption.

The twin issues of underinsurance and insurance affordability are matters of special interest to APRA given the risk that parts of the community may find it increasingly difficult to obtain affordable, appropriate or adequate insurance cover. This has flow-on consequences for the economy as a whole, undermining the ability of property owners and business owners to recover from natural disasters, with associated negative social and financial implications.

Extreme weather events also highlight the important role of global reinsurance in spreading the financial burden beyond our shores. Australia’s general insurers are reliant on global reinsurance groups, with all 10 APRA-authorised reinsurers foreign-owned.

In light of this dependence on global reinsurers, APRA developed a specific reinsurance supervision strategy and framework to better understand the regulatory regime in the home country of each reinsurer’s parent entity. Among other things, APRA is giving greater consideration to the regulatory regimes in each reinsurer’s home country and the setting of appropriate capital requirements, as well as building stronger relationships with home country regulators.

Preparing for AASB 17

Preparations for a new accounting standard represented a substantial program of work in 2019 as APRA and insurers (general, life and private health) assessed the implications for capital levels and the reporting of premiums, profits and policy liabilities.

The Australian Accounting Standards Board’s (AASB’s) new standard, AASB 17 Insurance Contracts (AASB 17), once implemented, is intended to make it easier to compare the risk profile, profitability and financial position of insurance companies and firms in other economic sectors. Nevertheless, it is expected to impose major changes on the industry.

APRA’s primary objective is to ensure insurers and APRA’s prudential standards are appropriately prepared for AASB 17’s implementation. In September, APRA gave life, general and private health insurers indicative prudential directions on the new standard and its integration, and invited feedback. Consultations with industry have looked at the appropriate prudential and regulatory changes that should be adopted to integrate AASB 17 into APRA’s prudential framework. APRA also continued to monitor international developments around amendments proposed by the International Accounting Standards Board (IASB).

As AASB 17 will modify a number of accounting concepts that underpin APRA’s prudential framework and introduce some new concepts, APRA is considering how to integrate these changes. Although there is some uncertainty regarding the final form of the accounting standard, insurers have been encouraged to familiarise themselves with a June 2019 IASB exposure draft to help with their preparations.

Emerging risks

A significant increase in the number of class actions against financial institutions in recent years has resulted in rising claims costs for providers of both directors’ and officers’ liability insurance and professional indemnity insurance.

As sustained losses prompted some insurers to cease providing this class of insurance, APRA has taken steps to monitor the impact on insurance companies and their clients, including by using the National Claims and Policies Database to track this issue and monitor risk.

Another emerging risk relates to rapid technological advances, which are supporting new-generation, tailored and on-demand coverage. APRA is exploring the potential impact of these developments on traditional business models.

In the context of APRA’s role to ensure a stable, efficient and competitive insurance market, it is necessary to consider how general insurers may adjust their underwriting assumptions, risk assessments and use of data to respond to changing market dynamics and products. APRA continues to monitor the new technology developments in general insurance in the context of the impact to their business model and financial safety.

Footnotes:

3 https://www.swissre.com/institute/research/sigma-research/sigma-2019-02.html

Life insurance

Introduction

Australia’s life insurance sector faced deteriorating conditions over 2019. Industry risks and challenges hampered profitability, putting the viability of some products in severe doubt.

For a fifth straight year, the performance of individual disability income insurance (DII) worsened, taking losses over that time to more than $3 billion. The profitability of individual lump sum insurance and group DII also deteriorated, due in part to poor product design and aggressive selling methods, as highlighted by the Royal Commission.

Some long-standing issues in this industry remain unresolved, including how to deal with legacy products. These products have become increasingly complex and expensive to administer over time, resulting in poor consumer outcomes and increased operational risk for insurers. Another issue is the mis-selling of life insurance products to consumers through direct marketing channels, and poor claims management processes.

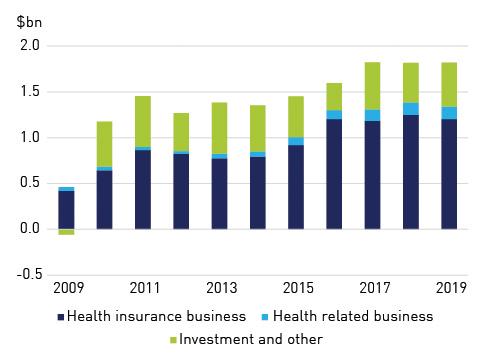

Despite these challenges, areas of significant underperformance and a continuing low interest rate environment, life insurers remained financially resilient in 2019. For APRA, risk product sustainability, risk governance and strengthened data intelligence were priority areas of strategic importance during the year.

The industry landscape

At 30 June 2019, 29 APRA-authorised life insurers were operating in Australia, with no new life insurance licences granted and no licences revoked during the year.4 Furthermore, approximately 800,000 Australians hold accounts with friendly societies. These entities share a common heritage as mutual associations designed to represent groups of individuals with a common financial or social purpose.

As at 30 June 2019, there were 12 friendly societies operating in Australia, including six demutualised entities, holding combined assets of approximately $7.5 billion. Overall, friendly societies are profitable, with capital coverage ratios well above minimum requirements.

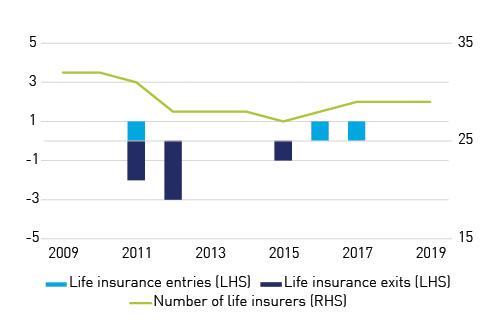

The life insurance industry picture has been stable for several years (Figure 3a), despite significant change in the industry’s ownership. The 29 life insurers comprised seven large diversified insurers, four insurance risk specialists, 11 small or niche market players, and seven reinsurers that support the local risk market.

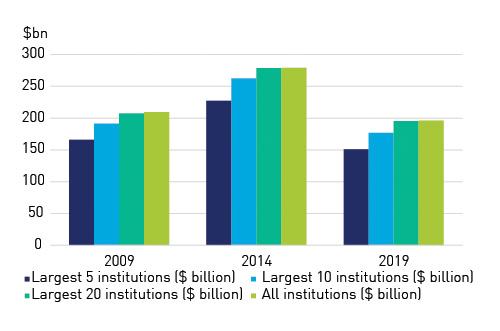

The life insurance industry remained highly concentrated, with the top five life insurers accounting for 77 per cent of total industry assets (Figure 3b), down from 81 per cent in the previous year. Ownership changes during the past 12 months built on substantial changes in recent years. Large foreign insurers, particularly from Asia and Europe, have acquired, or are seeking approval to acquire, significant shareholdings in several large diversified insurers and niche market businesses. As a result, the industry is now majority foreign-owned.

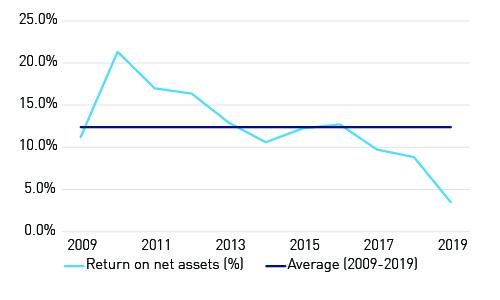

The industry experienced a marked decline in its return on net assets, earning 3.5 per cent in the year to 30 June 2019 compared with 8 per cent in the prior period. This accelerated a long-term declining trend and was significantly below the 10-year average of 12 per cent (Figure 3c). The main driver of the reduction in the return on net assets since 2015/16 has been significant declines in total profits across both investment-linked and non-investment-linked products, with the prolonged period of low interest rates further contributing to the decline.

Risk products in particular have seen a substantial decline in profitability in recent years. The net profit margin for 2018/19 was -3 per cent, well below the longer-term average of around 6 per cent. This result was driven largely by continued substantial losses in individual DII and a further decline in the profitability of individual lump sum insurance (Figure 3d). Premium rates for individual DII rose in response to substantial losses incurred in the last four years. Despite this, the combined effects of persistent adverse claims experience and the need to strengthen reserves contributed to the poor result. The profitability of individual lump sum business continued to weaken in 2018/19, continuing a deteriorating trend that commenced in 2016/17. The profitability of group lump sum insurance and group DII also declined during 2018/19.