ADI centralised publication update and consultation

APRA has previously communicated the intent to produce a centralised publication of key metrics for locally-incorporated authorised deposit-taking institutions (ADIs).1 This publication will improve the transparency of the ADI industry and enable the release of smaller ADIs from disclosure obligations.

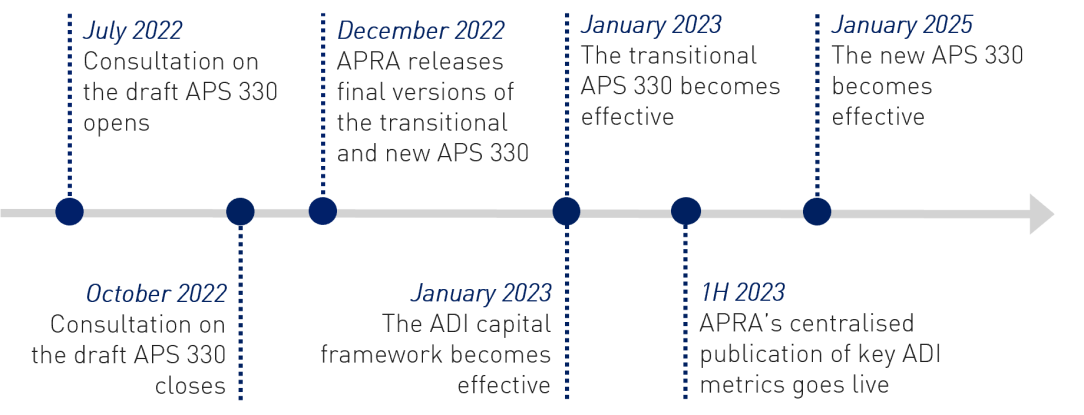

The ADI centralised publication represents the first stage of the development of an ADI entity-level publication of key prudential and financial data implementing Basel’s Pillar 3 requirements, shown in Figure 1.2 This publication will provide market participants access to key data points in a way that is easier to compare and analyse than standalone individual disclosures.

Figure 1. Policy development roadmap for Prudential Standard APS 330 Public Disclosure (APS 330)

Publication details

APRA is now providing further details of the publication including the data elements that will be included and a mock-up of the initial publication. A copy of the mock-up can be found on APRA’s website at: ADI centralised publication update and consultation.

Based on industry feedback, APRA has prioritised the publication of capital, liquidity ratios and risk weighted assets metrics over those proposed in the September 2021 letter.

The first publication will be released in June 2023 for the March quarter 2023 reporting period and will include up to 10 years of historical data.

Consultation on the frequency of publication

In the September 2021 response letter, APRA advised that the publication of metrics was to be initially aligned with an ADI’s current required disclosure frequency, and transition to a quarterly frequency over a two-year period.

Most metrics to be included in the initial publication are already disclosed on a quarterly basis, however, the following four metrics are currently disclosed less frequently:

- Traded market risk under Standard method and Internal model approach

- Net Stable Funding Ratio (NSFR)

- Minimum Liquidity Holding (MLH) ratio

As part of the implementation process, APRA has identified that publishing all the metrics quarterly would simplify the publication and improve ADI comparability because not all disclosure dates are aligned.

APRA is undertaking a short consultation on bringing forward the publication frequency of these four metrics to be on a quarterly basis from the start of the publication. Please provide feedback to dataconsultations@apra.gov.au by 31 January 2023 addressed to the General Manager, Data Analytics and Insights.

APRA intends to expand this publication over coming years and will continue to consult with the ADI industry as it does so.

Yours sincerely,

Brandon Khoo

Executive Director

Cross-Industry Insights and Data Division

Footnotes

1 See letter to the ADI industry in September 2021 and consultation on prudential disclosure requirements communications in July and December 2022.

2 Basel Committee on Banking Supervision’s Pillar 3 disclosure requirements: DIS - Disclosure requirements (bis.org).