A more proportionate banking prudential framework

Glossary

Executive summary

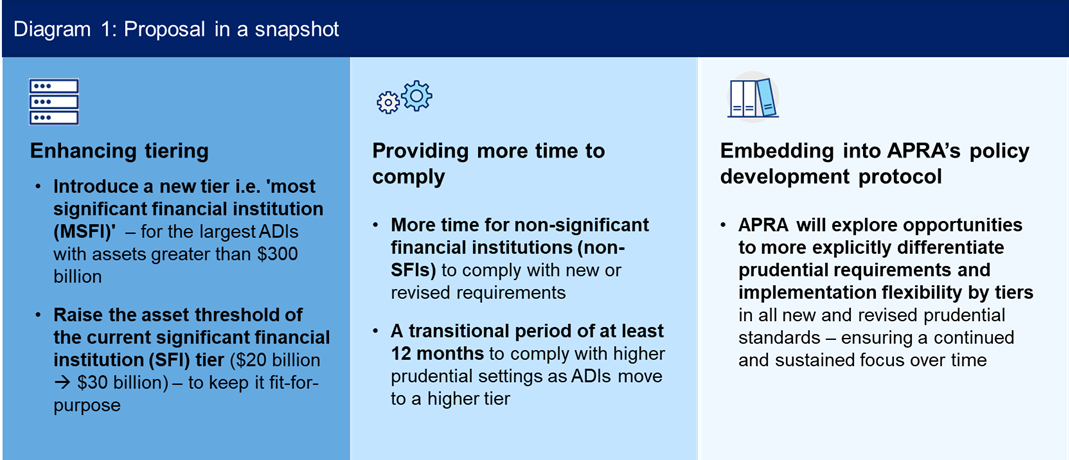

In August 2025, APRA committed to making the banking prudential framework more proportionate, in response to the Council of Financial Regulators’ (CFR) Review into Small and Medium-sized Banks (CFR Review).1 This paper outlines how APRA proposes to better customise its banking prudential requirements based on size, risk profile and complexity of authorised deposit-taking institutions (ADIs).

APRA seeks to:

- Enhance proportionality – a more tiered approach will allow APRA to differentiate prudential requirements with greater clarity – including setting requirements that are not overly complex or burdensome, relative to what is needed to ensure the continued financial safety of smaller ADIs. It would also formalise elements of the existing framework that are already differentiated by more than two tiers and embed the approach more systematically across the framework.

- Support growth, competition, and sustainability – a more differentiated framework should reduce regulatory impost on smaller ADIs, freeing up resources for investment in more productive areas.

- Improve clarity and transparency – APRA is also taking this opportunity to better explain how requirements for ADIs are tailored – both in policy design and implementation.

The proposal builds on existing proportionality in the framework, including the current two-tier approach which designates ADIs as either SFIs or non-SFIs.2 In formulating the proposals, APRA has carefully considered industry feedback received via various channels, including submissions to the CFR Review.

The proposal is one of several APRA commitments to reduce regulatory burden and support productivity. APRA has consulted on several enhancements in the first half of 2025-26. These include simplifying the ADI licensing regime3 designed to reduce the time taken to process new ADI applications by around half, and simplifying and clarifying APRA’s accreditation process for using IRB for regulatory capital purposes.4 APRA is also working closely with Treasury on a possible special regime for the smallest ADIs (a fourth tier), which would further reduce regulatory requirements for this cohort.

Following APRA’s consultation with banks, APRA plans to turn its focus to the insurance and superannuation frameworks, altering where appropriate.

APRA invites written submissions in response to this paper by 27 February 2026. Informed by stakeholder feedback, APRA expects to finalise the proposal in 2026.

Introduction

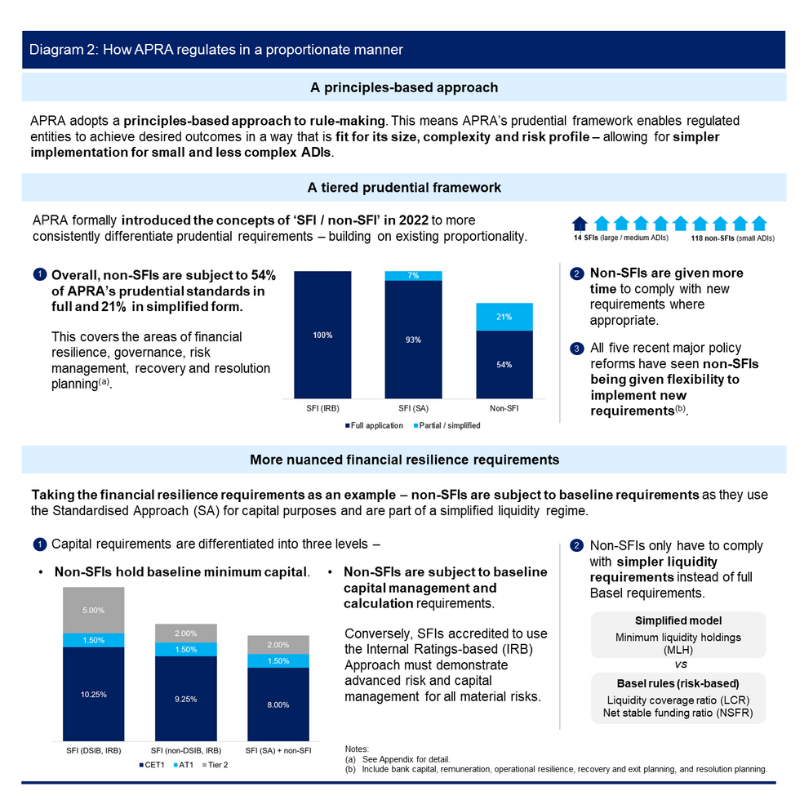

APRA’s banking prudential framework is risk-based and proportionate

APRA’s mandate is to provide Australians with a safe and stable financial system – balancing this with competition and efficiency considerations. To achieve this, APRA has a long-established banking prudential framework, which avoids ‘one-size-fits-all’ so as not to stymie innovation or unduly increase compliance costs, while also recognising the importance of renewing the framework from time to time. Diagram 2 summarises APRA’s existing framework, prior to the proposed enhancements.

APRA’s approach is also aligned with that of the Basel Committee on Banking Supervision (BCBS), with appropriate Australian adjustments. That is, proportionate regulation ensures requirements are commensurate with ADIs’ systemic importance and risk profile and are appropriate for the broader characteristics of the financial system.

APRA is committed to further embedding proportionality

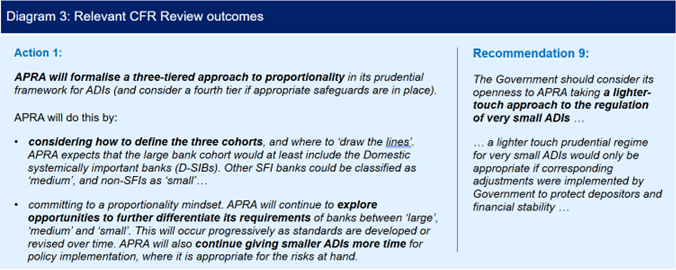

In 2024, the CFR with the ACCC commenced a review to examine the state of the small and medium banking sector, with a focus on competition. The Treasurer released the CFR Review report in August 2025, which made eight recommendations for the Government and sets out nine commitments for action by regulators.5

In response to the CFR Review, APRA:

- has announced that it will formalise a three-tier banking prudential framework – this discussion paper addresses this commitment. This is one of the key initiatives in APRA’s 2025-26 Corporate Plan to minimise regulatory burden without compromising APRA’s financial safety and stability objectives.

- is working with the Government in considering necessary safeguards for a simpler regime for very small ADIs (a fourth tier), including improvements to the Financial Claims Scheme and refinements to liquidity support arrangements.

Diagram 3 summarises the CFR Review outcomes that relate to APRA’s approach to proportionality.

The proposal also supports APRA’s strategic objective of ‘getting the balance right’6 and recent undertakings to the Treasurer7 to promote productivity.

Enhancing tiering

Proposal 1

Enhancing tiering

- Introduce a new tier i.e. MSFI - for the largest ADIs with assets greater than $300 billion

- Raise the asset threshold of the existing SFI tier ($20 billion to $30 billion) to keep it fit-for-purpose

APRA’s current tiered prudential framework

APRA tailors its prudential requirements based on the size, complexity, and risk profile of ADI cohorts (see Diagram 4). APRA formally introduced the two-tier approach to proportionality in 2022, to more explicitly and consistently tailor prudential requirements – designating ADIs as SFIs or non-SFIs. APRA currently designates an ADI as an SFI8 if it:

- has total assets in excess of $20 billion (the ‘quantitative limb’), or

- is determined as such by APRA, having regard to matters such as complexity in its operations or its membership of a group (the ‘qualitative limb’).

Within the SFI cohort, APRA also designates the four majors as DSIBs, reflective of their larger systemic impact on the domestic financial system and economy.

Enhancing the tiering approach

APRA’s proposal for enhanced tiering focuses on the quantitative limb, and is informed by the following principles:

- calibrate to size and complexity – The tiering approach should appropriately reflect ADIs’ size and complexity. These are proxies for the potential impact which entity failure, imprudent behaviour or operational disruptions could have on financial stability, economic activity, and the welfare of the Australian community.

- minimise disruption – APRA’s aim is to minimise disruption for ADIs where changes are made, to ensure regulatory burden is reduced or at least not increased.

- consistent with other frameworks – APRA has reviewed the tiering approach against the BCBS' high-level considerations on proportionality9 and other jurisdictions to align to best practice. In addition, APRA has compared the resulting policy tiering against its Supervisory Risk and Intensity (SRI) tiering outcome to ensure alignment where appropriate.10

Diagram 5 summarises the proposed changes to tiering and its impact on the classification of ADIs.

Introducing a new tier – ‘most significant financial institutions’

APRA proposes to set the new third tier – the ‘most significant financial institutions’ or ‘MSFIs’ – with an asset threshold of $300 billion. This new tier would capture the largest and most significant ADIs.

APRA considers this calibration appropriate, as:

- it aligns with the commitment to the CFR Review that the new tier would separate the largest ADIs from other SFIs and would at least include the four DSIBs.

- the top tier would capture the largest ADIs, which are already subject to the highest prudential and supervisory settings – formalising the existing requirements.

- a $300 billion asset threshold maps roughly to 5 per cent of system assets – a reasonable marker of the most material significance. It also leaves considerable headroom for existing SFIs to grow before crossing the threshold.

- the proposed tiering approach formalises aspects of APRA’s existing framework which already differentiate beyond two levels (particularly in capital requirements) and embeds this structure more formally into policy design across the framework.

Within the top tier, APRA would continue to designate the four majors as DSIBs.

Raising the existing SFI threshold

In shifting from a two-tier to a three-tier framework, APRA has reassessed the calibration of the existing SFI tier. APRA proposes to lift the asset threshold of the SFI tier from $20 billion to $30 billion, based on the following:

- the existing threshold is no longer fit-for-purpose given inflation has eroded the real value of the threshold since the SFI concept was introduced, and

- the banking system has grown by around 7 per cent over the same period.

A higher threshold is therefore considered appropriate. The proposed $30 billion threshold also aligns with approximately 0.5 per cent of system assets.

The proposal would result in several current SFIs falling below the new threshold. APRA will assess these ADIs on a case-by-case basis, considering factors other than size (such as complexity and group structure), to determine whether they should retain SFI status.

Consultation question:

Are the proposed asset thresholds for MSFI and SFI appropriate? If not, where should they be and why?

Providing more time

Proposal 2

Providing more time

- More time for non-SFIs to comply with new or revised requirements

- A transitional period of at least 12 months as ADIs move to a higher tier

APRA already provides more time for non-SFIs, on an ad-hoc basis

In recent years, APRA has sought to provide additional time for non-SFIs to comply with new prudential standards where possible. This includes the staggered implementation of Prudential Standard CPS 511 Remuneration and an additional year to comply with certain requirements of Prudential Standard CPS 230 Operational Risk Management. However, it has not been the default expectation.

Today, there is no transitional period for ADIs crossing the SFI threshold. APRA requires ADIs to be compliant with SFI requirements once they become an SFI. To achieve this, they must monitor their asset growth and commence preparations for the higher prudential requirements in anticipation of crossing the threshold. APRA acknowledges this may be challenging, especially for those who cross over due to merger arrangements instead of organic growth.

Embedding flexibility to make implementation easier

More time for non-SFIs to comply with new or revised requirements

APRA proposes to continue to provide more time for non-SFIs to implement new or revised requirements as appropriate. Amongst others, this would not only allow more preparation time but the opportunity to learn from the experience of larger ADIs.

The exact period would depend on, amongst others, the type and complexity of the requirements and the materiality of the risk the requirements are seeking to address.

A transitional period of at least 12 months as ADIs move to a higher tier

APRA also proposes to introduce a transitional period of at least 12 months to support ADIs who cross the SFI and MSFI thresholds – with APRA discretion to allow more time on a case-by-case basis.

As an example, APRA may consider that a longer transitional period is appropriate in cases where a merger presents operational challenges, to allow for smooth execution. In some circumstances, more time may only be required for a particular standard, especially one involving a significant uplift in an ADI’s capability.

Consultation question:

Are there any other ways APRA can support effective policy implementation or transition across tiers?

Embedding into APRA’s policy development protocol

Proposal 3

Embedding into APRA's policy development protocol

- APRA will explore opportunities to more explicitly differentiate prudential requirements by tiers.

APRA proposes to update its policy development protocol to ensure that every time a new standard is created, or an existing standard is revised, APRA will look for opportunities to more explicitly differentiate prudential requirements across the three tiers.

This will support continued and sustained focus over time, ensuring prudential requirements and implementation arrangements for each tier is commensurate with an ADI’s risk and complexity.

Consultation and next steps

APRA invites written submissions on the proposal set out in this discussion paper, including the specific consultation questions. Written submissions should be sent to PolicyDevelopment@apra.gov.au by 27 February 2026 and addressed to:

General Manager, Policy

Policy and Advice Division

Australian Prudential Regulation Authority

APRA plans to finalise the changes proposed in this paper by the end of 2026.

Important disclosure notice – publication of submissions

All information in submissions will be made available to the public on the APRA website, unless a respondent expressly requests that all or part of their submission is to remain in confidence. Automatically generated confidentiality statements in emails do not suffice for this purpose.

Respondents who would like part of their submission to remain in confidence should provide this information marked as confidential in a separate attachment.

Submissions may be the subject of a request for access made under the Freedom of Information Act 1982 (FOIA). APRA will determine such requests, if any, in accordance with the provisions of the FOIA. Information in the submissions about any APRA-regulated entity that is not in the public domain and that is identified as confidential will be protected by section 56 of the Australian Prudential Regulation Authority Act 1998 and will therefore be exempt from production under the FOIA.

Appendix: APRA’s three-tiered banking prudential framework

With the revised tiering approach, APRA is taking the opportunity to illustrate how we tailor prudential requirements for different ADI cohorts (Table 1). This provides a more holistic view of the prudential framework and better support ADIs in their transition to a higher tier.

Tier | Policy design | Implementation | |||

|---|---|---|---|---|---|

| - | Financial risk | Non-financial risk | Recovery and resolution | - | |

Capital | Liquidity | ||||

MSFI Full-scope, most stringent requirements |

|

|

| ||

SFIFull-scope, stringent requirements | |||||

Non-SFIPartial, baseline requirements |

|

|

|

|

|

Footnotes

2APRA determines an ADI as an SFI based on total assets ($20 billion) and other factors such as complexity or group structure.

3Improving the licensing-framework-for-ADIs

4APRA proposes more accessible pathway to IRB accreditation for banks

5Review into Small and Medium-sized Banks - Consultation – Council of Financial Regulators

6APRA publishes 2025-26 Corporate Plan

7APRA releases letters sent to Treasurer and Finance-Minister

8 Does not apply to foreign ADIs.

9 BCBS' High-level Considerations on Proportionality notes that authorities should consider these for proportionality purposes – number of tiers, metrics for tiering, thresholds, and transition between tiers.

10Supervision Risk and Intensity Model Guide, 6 October 2020.

11 Additional capital requirement where also a DSIB.

12 APRA does not currently subject all SFIs to LCR and NSFR requirements. Moving forward, APRA considers it prudent to anchor LCR and NSFR compliance into the SFI tier to better align with the funding and liquidity risks of the cohort and formalise the existing expectation. We will consult with industry as part of the review of the bank liquidity framework.

13 Refer to footnote 12.

14 If an ‘internal-ratings based’ ADI.

15 Simplified reporting if a ‘standardised approach’ ADI.