Improving the licensing framework for authorised deposit-taking institutions

Executive summary

As Australia’s prudential regulator, APRA has responsibility for licensing new entrants in the banking, insurance and superannuation industries. When licensing new entrants, APRA seeks to strike the right balance between supporting new entry and competition while upholding robust regulatory standards that safeguard financial safety and stability.

As part of its standard practice of reviewing practices and policies, APRA has reviewed the licensing framework for authorised deposit-taking institutions (ADIs) to ensure it remains fit for purpose and reflects lessons learned both domestically and internationally.1 This discussion paper outlines proposals aimed at improving the licensing process by making it clearer, quicker and more supportive of new entrants to the banking sector. These proposals seek to reduce the time and cost associated with obtaining a banking licence.

The current licensing framework for ADIs was introduced in 2018 with the aim of better supporting new entrants, including by introducing the Restricted ADI (RADI) pathway.2 Since then, APRA has licensed 17 new banks, with around half of these being domestic start-ups. These new entrants have experienced mixed outcomes, with success ultimately determined by the viability of their business model and ability to raise capital.

APRA’s assessment is that the current licensing framework has been effective in supporting new entry to the banking sector while also holding new entrants to suitably robust standards of risk management. However, reflecting on the experiences of recent new entrants and benchmarking against international better practice, APRA has identified opportunities to improve the framework. These relate to improving the efficiency of the licensing process by providing greater clarity around licensing expectations and timeframes.

In response to these opportunities, APRA is proposing:

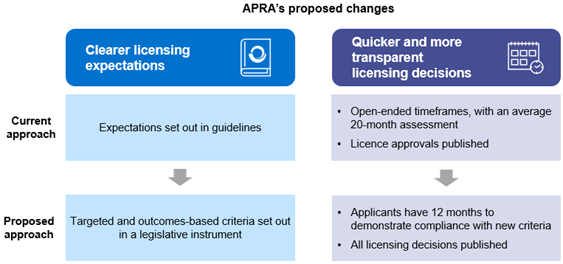

- Clearer licensing expectations. APRA is proposing to replace existing licensing expectations set out in guidelines with a more explicit and targeted set of formal licensing criteria. These criteria would codify APRA’s existing expectations and provide applicants with greater clarity on the requirements for a banking licence.

- Quicker and more transparent licensing decisions. To streamline the licensing process, APRA is proposing that applicants would have 12 months from submitting their application to demonstrate they meet the new licensing criteria. Once the 12 months have concluded, APRA would target a licensing decision within three months. To enhance transparency, APRA is also proposing to make all licensing decisions public, including instances where a licence application is refused.

These proposals align with the objectives of the Council of Financial Regulators’ (CFR) and the Australian Competition and Consumer Commission’s (ACCC) recent review into small and medium-sized banks, and APRA’s broader efforts to better support competition and efficiency in the banking sector.3

As part of its review, APRA also considered the pathways to obtaining a banking licence, particularly the experiences of new entrants that have pursued the RADI pathway. While the pathway initially helped attract more new entrants to the banking sector, there has been limited take-up in recent years. Applicants have also found the pathway challenging, with the phased approach to developing a bank resulting in considerable capital being expended and challenges in operationalising the business. APRA is therefore seeking stakeholder views on the RADI pathway and whether to discontinue this pathway for future new entrants.

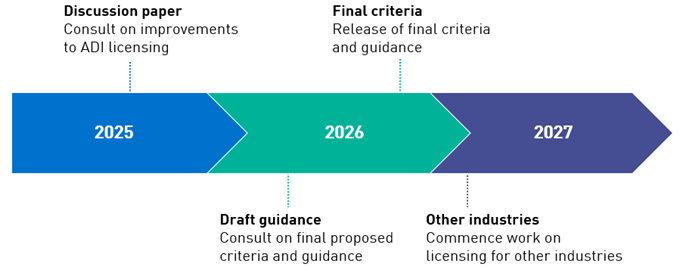

This discussion paper is the first step in improving the licensing framework for banks. In responding to this discussion paper, stakeholders are invited to provide feedback on further opportunities to improve the licensing process, including where APRA’s licensing requirements could be more proportionate. Following input from stakeholders, APRA plans to consult on final proposed criteria and supporting guidance that would assist applicants in meeting APRA’s licensing criteria.

APRA invites written submissions in response to this discussion paper by 31 October 2025.

Chapter 1: APRA’s current licensing framework

APRA’s current approach to licensing

APRA is responsible for authorising entities to conduct banking business in Australia. Banking business consists of both taking deposits and making advances of money.4 Entities licensed by APRA to conduct banking business are referred to as authorised deposit-taking institutions (ADIs). APRA’s approach to licensing seeks to strike the right balance between supporting new entry and competition in the banking sector while upholding robust regulatory standards that safeguard financial system stability and protect the interests of depositors.

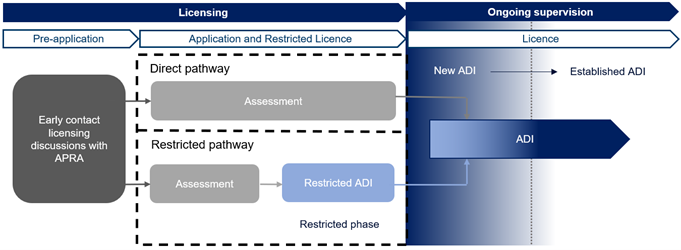

The current licensing framework was introduced in 2018. It provides entities with two pathways to become an ADI: the direct pathway for applicants with sufficient resources and capabilities to establish an ADI, and the Restricted ADI (RADI) pathway for applicants to progressively develop the resources and capabilities to become an ADI. An overview of APRA’s current licensing process is provided below.

ADI licensing process

Since 2018, APRA has issued 17 new ADI licences, with around half of these granted to domestic start-ups. Over the same period, APRA has granted seven RADI licences, with five of those entities transitioning to ADI licences.5 Of the 17 new ADIs, six have voluntarily exited the industry, including two entities that used the RADI pathway. The success of new entrants has ultimately been determined by the viability of their business model and their ability to raise capital.

Review of the licensing framework

As part of its standard practice of reviewing practices and policies, APRA has reviewed the licensing framework to ensure it remains fit for purpose. Since its introduction, many applicants have engaged with the framework, providing important lessons and feedback on how it could be improved. Throughout this time, the external environment, APRA’s prudential framework and international approaches to licensing have also evolved.

APRA’s overall assessment is that the current licensing framework has been effective in supporting new entry to the banking sector while ensuring that new entrants meet suitably robust standards of risk management that maintain financial safety and stability. Through its review, APRA has identified two key areas where the framework could be improved, which are set out below.

1. Clarity and efficiency of the licensing process

Since 2018, ADI licensing assessments have taken an average of 20 months, with some taking over three years to complete. While recognising the impact of COVID, this is longer compared to international better practice, which is typically closer to 12 months. Lengthy licensing assessments have resulted in significant resources being expended by both applicants and APRA.

In many cases, licensing assessments have been prolonged due to initial applications not aligning with APRA’s expectations for a banking licence. This has led to APRA working iteratively with prospective new entrants over extended timeframes to improve their practices and capabilities.

APRA has identified opportunities to provide further clarity around licensing expectations and timeframes, with the aim of better preparing applicants for the licensing process and making the overall process more efficient:

- Licensing expectations: APRA’s current licensing expectations are set out in broad guidelines across multiple documents.6 While this approach provides a comprehensive overview of licensing expectations, it can make it difficult for applicants to identify the core requirements to be granted a banking licence.

- Timeframes for licensing decisions: Under the current licensing framework, it can be difficult for applicants to estimate the total time required for a licensing decision. While APRA commits to making a licensing decision within three months of determining an application as ‘substantially complete’,7 there is no defined timeframe for reaching that point.8

2. Pathways to a banking licence

The RADI pathway was introduced to provide a phased and easier entry into the banking sector. The pathway enables new entrants to conduct limited banking activity while being subject to concessional prudential requirements, allowing them to progressively develop the resources and capabilities needed to become an ADI. A key objective of the pathway was to assist applicants in attracting investment through staged licensing milestones.

While the RADI pathway initially helped attract more new entrants into the banking sector, there has been limited take-up of the pathway in recent years, with the last application received over four years ago. The pathway has also been challenging for applicants. Raising capital has proven difficult, even after reaching milestones such as the granting of a RADI licence or launching products. Furthermore, the phased approach to developing a bank has resulted in considerable capital being expended and challenges in operationalising the business.

Taken together, these observations suggest that the RADI pathway has not achieved its intended purpose of providing a simpler and effective pathway to obtaining a banking licence.

Chapter 2: Improving the licensing framework

This chapter sets out proposals to improve the licensing framework for banks. The proposals seek to address the opportunities identified in APRA’s review of the existing licensing framework. The changes aim to improve the clarity and efficiency of the licensing process and better support new entrants.

Proposals

Proposal 1 – Clearer licensing expectations

APRA proposes introducing new formal licensing criteria.9 The new criteria would codify APRA’s existing licensing expectations and more clearly set out the requirements that applicants must meet to be granted a banking licence.

The proposed criteria are set out in Chapter 3. The criteria are targeted and outcomes-based. In simple terms, these proposed criteria would mean that an applicant would be granted a banking licence where it:

- is structured and operates in a manner that enables supervision by APRA

- has sufficient financial and non-financial resources to prudently conduct banking business

- has suitable skills and experience to prudently conduct banking business

- has a risk management framework to prudently conduct banking business

- can credibly demonstrate how it would respond to a stress that threatens its viability.

The new criteria are intended to give applicants greater certainty on APRA’s licensing expectations and decision-making process. This would in turn provide applicants greater confidence that they have adequately prepared for the licensing process before submitting an application to APRA.

Proposal 2 – Quicker and more transparent licensing decisions

APRA proposes introducing a 12-month timeframe for applicants to demonstrate that they meet the new licensing criteria. Once the 12 months have concluded, APRA would target a licensing decision within three months.10 The timeframe would not preclude APRA from making a licensing decision sooner than 12 months, where an applicant has met the criteria.

The 12-month timeframe would provide applicants with greater certainty over licensing timelines and facilitate a quicker overall licensing process. As a result, new entrants may allocate their resources more efficiently and set business plans with greater certainty. Investors would also have greater confidence that planned milestones for a prospective new entrant will be met.

For APRA, the new criteria and timeframe would enable more timely licensing decisions, including where applicants do not meet the requirements for a banking licence. APRA would expect applicants to be adequately prepared to meet the criteria before submitting an application. Applications would be refused if they do not meet APRA’s criteria within 12 months.

To enhance transparency, APRA also proposes making all licensing decisions public, including instances where a licence application is refused. APRA would not publish instances where an applicant voluntarily withdraws its licence application, prior to a formal decision being made.

Future of the RADI pathway

As outlined in Chapter 1, while the RADI pathway initially helped attract more new entrants to the banking sector, there has been limited take-up of the pathway in recent years. Furthermore, applicants have found the pathway challenging, with the phased approach to developing a bank resulting in considerable capital being expended and challenges in operationalising the business. In this context, APRA is seeking stakeholder views on the RADI pathway and whether to discontinue this pathway for future new entrants.

Chapter 3: Licensing criteria

This chapter sets out APRA’s proposed criteria for assessing future licence applications. The criteria codify APRA’s existing licensing expectations in one place.

The criteria comprise both broad outcomes and prescriptive requirements. APRA considers these to be essential for new entrants conducting banking business in a prudent manner. At a minimum, applicants would be expected to evidence the outcomes by meeting the prescriptive requirements.

APRA will provide further guidance on how applicants can demonstrate compliance with the criteria.11 Compliance would be assessed in various ways, including through documentation reviews, meetings between APRA and the applicant’s board and key staff, and on-site visits.

The proposed criteria set out below would apply to an applicant seeking to establish a locally-incorporated ADI. These criteria will also apply to foreign banks seeking to establish a branch in Australia, with some variations. For example, governance requirements would apply to senior officers outside of Australia rather than a board, and criteria related to operational readiness for the Financial Claims Scheme would not apply. APRA plans to clarify these differences in a future iteration of the draft criteria released for consultation.

Proposed criteria for locally-incorporated ADIs

To be granted an ADI licence, an applicant must demonstrate within 12 months that it:

- is structured and operates in a manner that enables supervision by APRA. At a minimum, this would include:

- dealing with APRA in an open, constructive and cooperative manner

- providing complete and accurate information to APRA within specified timeframes

- evidencing that owners will meet requirements under the Financial Sector (Shareholdings) Act 1998 at the point of licensing

- a group legal structure that does not hinder APRA’s ability to exercise its powers and functions.

- has sufficient financial and non-financial resources to prudently conduct banking business. At a minimum, this would include:

- capital and liquidity positions that meet minimum requirements12

- credible plans that demonstrate how capital and liquidity positions will be sufficient to execute the business plan while remaining above minimum requirements 13 in the 24 months following the grant of a licence, including under stress scenarios

- generating revenue and operationally ready to accept deposits

- IT systems that are fit for purpose and have been tested and independently validated.

- has suitable skills and experience to prudently conduct banking business. At a minimum, this would include:

- responsible persons that are fit and proper, with accountabilities clearly defined

- a board of at least five directors, with the majority being independent and ordinarily resident in Australia 14

- a board with the necessary skills and experience, individually and collectively, to prudently oversee operations

- staff that have the necessary skills and experience to fulfil their responsibilities and deliver the business plan.

- has a risk management framework to prudently conduct banking business. At a minimum, this would include:

- having appropriate and adequate policies and procedures in place for all material risks

- having controls in place for key operational risks, including risks related to critical operations and the use of material service providers.

- can credibly demonstrate how it would respond to a stress that threatens its viability. At a minimum, this would include:

- at least one credible option for an orderly and solvent exit from banking business

- recovery options that would be relevant and plausible during stress

- being operationally ready for the activation of the Financial Claims Scheme.

Chapter 4: Next steps and providing feedback

Project timeline

In the three months following release of this discussion paper, APRA is seeking feedback from interested stakeholders. APRA is particularly interested in feedback on the potential benefits and costs of its proposals for future applicants. Subject to consultation feedback, next steps for this work are set out below. Once amendments to the ADI licensing framework are finalised, APRA then intends to consider the licensing process for other industries.

Request for submissions

APRA invites written submissions in response to this discussion paper. Submissions are welcome to address any aspect of this discussion paper. Stakeholders are also invited to provide views on the questions set out below. They should be sent to licensing@apra.gov.au by 31 October 2025 and addressed to:

Senior Manager

Licensing

Policy and Advice Division

Australian Prudential Regulation Authority

Important disclosure information

All information in submissions will be made available to the public on the APRA website unless a respondent expressly requests that all or part of the submission is to remain in confidence. Automatically generated confidentiality statements in emails do not suffice for this purpose.

Respondents who would like part of their submission to remain in confidence should provide this information marked as confidential in a separate attachment.

Submissions may be the subject of a request for access made under the Freedom of Information Act 1982 (FOIA). APRA will determine such requests, if any, in accordance with the provisions of the FOIA. Information in the submission about any APRA-regulated entity that is not in the public domain and that is identified as confidential will be protected by section 56 of the Australian Prudential Regulation Authority Act 1998 and will therefore be exempt from production under the FOIA.

Discussion paper questions

Current licensing framework | Are there further opportunities to improve the licensing process? |

|---|---|

Impact | Will the proposals achieve the intended outcomes? What is the anticipated impact of the proposed changes (benefits and costs)? |

Criteria | Are the criteria appropriate for new entrants? Where could APRA’s licensing requirements be more proportionate? What additional guidance is needed to assist applicants in meeting the criteria? |

Timeframe | Is a 12-month timeframe for meeting the criteria appropriate? |

RADI pathway | Are there specific views on the RADI pathway and whether to discontinue this pathway for future new entrants? |

Footnotes

1 For the purposes of this discussion paper, ‘ADI’ refers to a body corporate that holds an ADI licence and is not a purchased payment facility provider (PPF). ‘ADI’ and ‘bank’ are used interchangeably throughout the paper.

2 Subsequent updates were made in 2021. These updates introduced a stronger focus on product launch for Restricted ADIs and on contingency planning for all new entrants.

3 Further information on the review can be found at Small and medium-sized banks review.

4 See section 5 of the Banking Act 1959 (Banking Act) for the full definition.

5 These entities form part of the 17 ADI licences granted since 2018.

6 These guidelines are available at Licensing guidelines for authorised deposit-taking institutions.

7 Under APRA’s Service Charter, APRA has committed to making a licensing decision within three months of receiving a substantially complete application, for more than 75% of applications.

8 Substantially complete is defined as the point at which APRA forms the view that ‘an applicant has demonstrated that it has sufficient financial and non-financial resources and has submitted all expected supporting material, which is of sufficient quality and detail to allow APRA to complete its assessment.’ The existing licensing guidelines note that the application process from submission of formal application until substantially complete may take 12-18 months, depending on the readiness of the applicant and complexity of the business.

9 Under subsection 9(2A) of the Banking Act, APRA has the power to set, by legislative instrument, criteria for the granting of an authority to carry on banking business in Australia.

10 APRA would fulfil this in line with the Service Charter commitment set out in footnote 7.

11 This guidance will replace the existing guidelines on APRA’s website. It will also clarify how the proposed new criteria and 12-month assessment timeframe will impact the licensing process.

12 As per current minimum initial requirements set out in Information paper: ADI new entrants - a pathway to sustainability.

13 As per current minimum ongoing requirements set out in Information paper: ADI new entrants - a pathway to sustainability.

14 This requirement would vary slightly for foreign banks seeking to establish locally-incorporated subsidiaries in Australia, in line with the existing requirements in Prudential Standard CPS 510 Governance. For example, these applicants would only be required to have at least two of the directors be ordinarily resident in Australia, at least one of whom must also be independent. These variations will be reflected in a future iteration of the draft criteria released for consultation.