Quarterly authorised deposit-taking institution property exposure statistics - September 2025 highlights

Key statistics1

Key residential mortgage lending statistics for ADIs for the quarter were:

ADIs' residential property exposures | Sep 2024 | Sep 2025 | Year-on-year change |

|---|---|---|---|

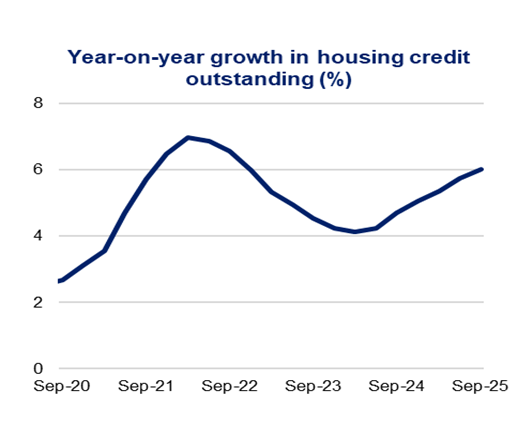

Total credit outstanding ($bn) | 2,288.5 | 2,426.5 | 6.0% |

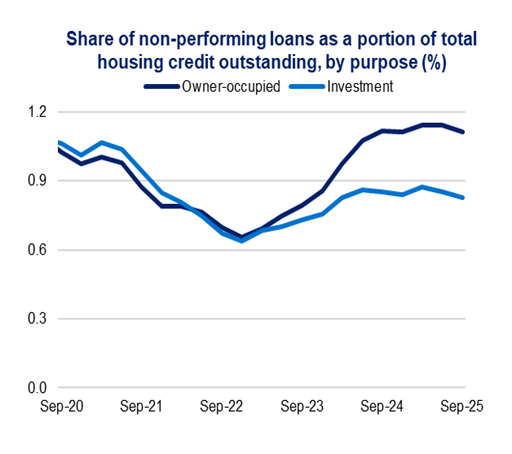

Owner-occupied loans - share | 67.7% | 67.3% | -0.43 points |

Investment loans - share | 30.4% | 30.7% | 0.37 points |

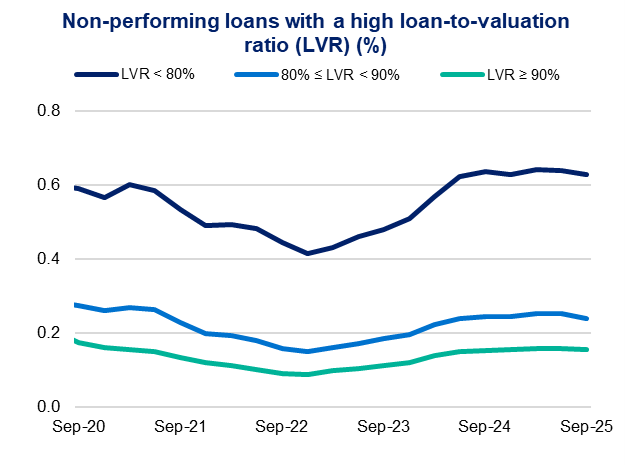

Loans with loan-to-valuation ratio (LVR) ≥ 80 per cent - share | 17.4% | 16.8% | -0.6 points |

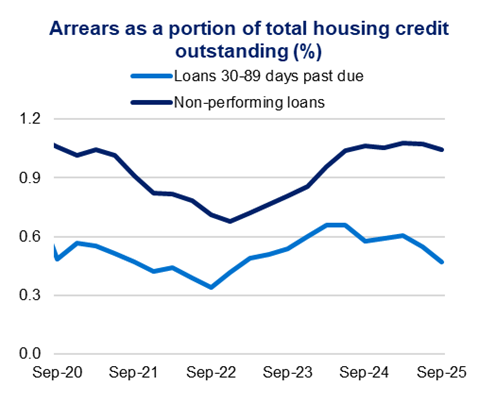

Loans 30-89 days past due - share | 0.58% | 0.47% | -0.11 points |

Non-performing loans | 0.96% | 1.04% | 0.08 points |

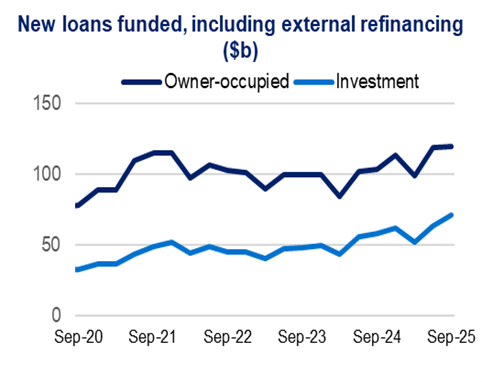

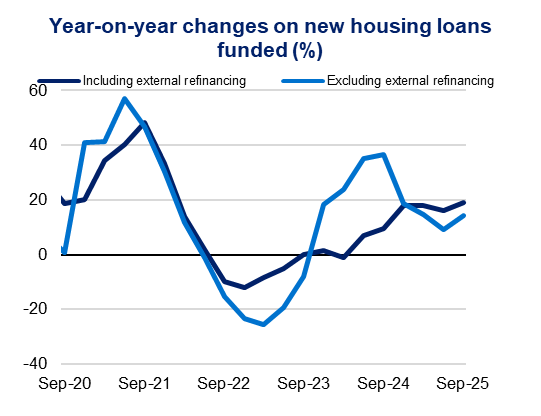

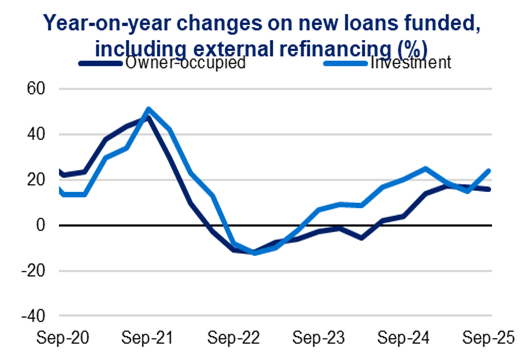

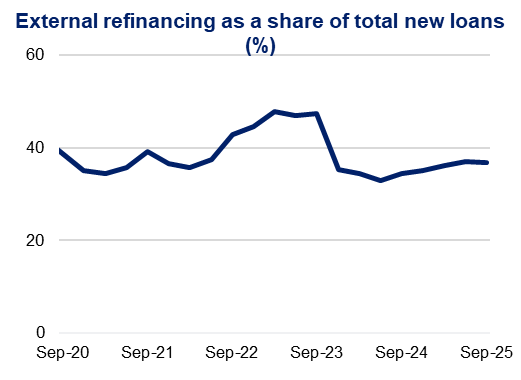

ADIs’ new loans funded during the quarter | Sep 2024 | Sep 2025 | Year-on-year change |

|---|---|---|---|

New loans funded ($bn) | 165.0 | 196.3 | 18.9% |

New owner-occupied loans funded - share | 62.8% | 61.1% | -1.65 points |

New investment loans funded - share | 35.1% | 36.5% | 1.47 points |

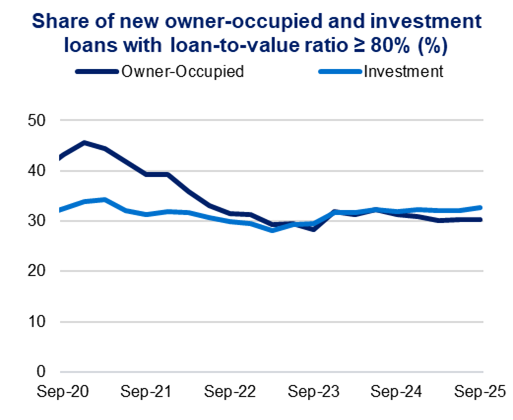

New loans with LVR ≥ 80 per cent funded - share | 31.1% | 30.8% | -0.25 points |

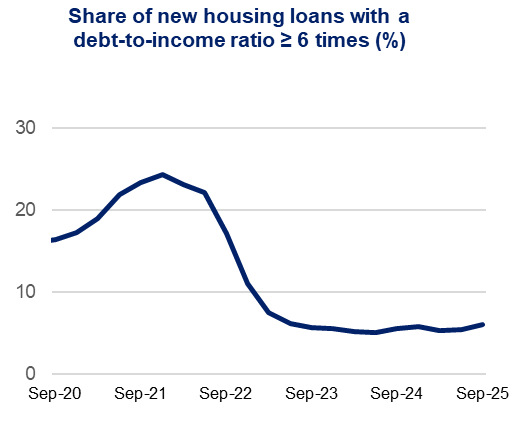

New loans with debt-to-income (DTI) ratio ≥ 6x funded - share | 5.6% | 6.1% | 0.5 points |

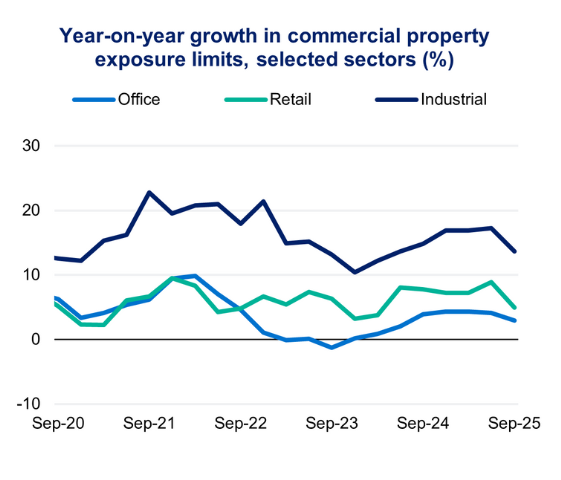

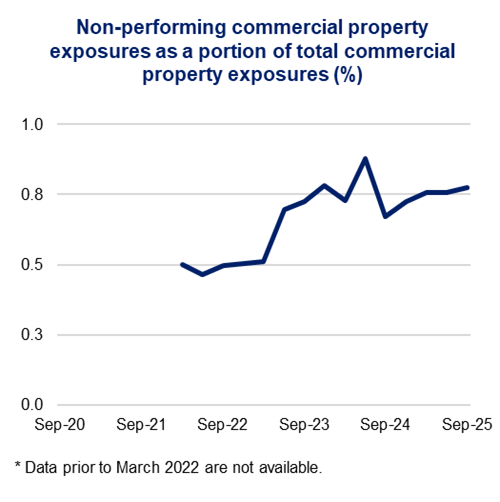

Key commercial property statistics for ADIs for the quarter were:

ADIs' commercial property exposures | Sep 2024 | Sep 2025 | Year-on-year change |

|---|---|---|---|

Commercial property exposure limits ($bn) | 467.5 | 510.3 | 9.2% |

Commercial property exposures ($bn) | 434.6 | 471.8 | 8.6% |

Residential mortgages: new lending

Residential mortgages: outstanding credit

Commercial real estate

Footnote

1 Excludes ADIs that are not banks, building societies or credit unions. See ‘Explanatory Notes’ of the Quarterly authorised deposit-taking institution property exposures statistics (excel file) for details of share calculations.