Guidance on remuneration

APRA has today released final guidance to assist entities in implementing the new Prudential Standard CPS 511 Remuneration (CPS 511). The Prudential Practice Guide CPG 511 Remuneration (CPG 511) sets out guidance and examples of better practice to assist entities in meeting their requirements under CPS 511.

In particular, CPG 511 provides entities with examples for:

- strengthening incentives for individuals to prudently manage risks they are responsible for;

- applying consequences for poor risk outcomes; and

- improving oversight, transparency and accountability on remuneration.

Consultation process

In April 2021, APRA released a draft CPG 511 for consultation. In total, APRA received 23 submissions, including from regulated entities, industry associations, consultants and governance bodies. Non-confidential submissions have been published on APRA’s website.

Submissions largely focused on clarifying expectations in the guidance and sought further examples of better practice, particularly for applying material weight to non-financial measures in variable remuneration and meeting minimum deferral requirements.

In response, APRA has:

- updated guidance to align with the final CPS 511 requirements released in August 2021, in particular with amendments on third-party service providers, and risk and conduct adjustments;

- aligned guidance with the Government’s proposed Financial Accountability Regime (FAR), including for deferral and vesting requirements; and

- provided additional examples of better practice, such as for applying material weight to non-financial measures.

As part of this consultation, some respondents suggested that buyouts should be carved out from APRA’s requirements for deferring variable remuneration. Buyouts represent a particular form of variable remuneration, under which a new employer reimburses an individual for some or all of the variable remuneration they would forgo on leaving their existing employer.

Under CPS 511, all forms of variable remuneration are subject to deferral requirements. APRA does not consider it appropriate to introduce a specific carve out for buyouts, since this would result in misalignment between CPS 511 and the current draft FAR regime. It would also introduce complexity, with risks to enforceability and transparency.

Some respondents also sought clarification regarding implementation timeframes. APRA-regulated entities will be required to comply with the new CPS 511 requirements from 1 January 2023, under a staged implementation approach:

- ADI SFIs from 1 January 2023;

- Insurance and RSE licensee SFIs from 1 July 2023; and

- Non-SFIs (across all APRA-regulated industries) from 1 January 2024.

However, under APRA’s approach to implementation, CPS 511 requirements would not apply to a person’s variable remuneration if the opportunity to earn the variable remuneration arose before the relevant commencement dates of the Prudential Standard. In practice, for example, this would mean that an ADI SFI with a 30 June financial year-end must have incorporated CPS 511 requirements into the variable remuneration arrangements of all staff from 1 July 2023 onwards. APRA considers it appropriate to provide the same flexibility to APRA-regulated entities for new employees, who might join after the commencement date of the Prudential Standard but ahead of the entity’s new financial year.

Next steps

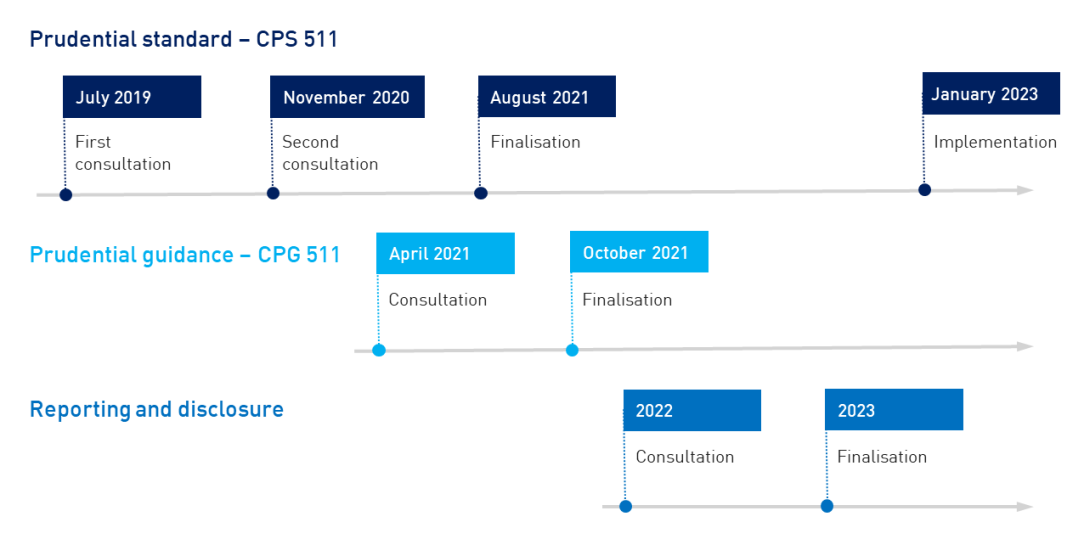

To summarise, next steps are:

- Implementation: with the finalisation of CPG 511, APRA expects that all entities will have a strong focus on the implementation of CPS 511. As noted in APRA’s August 2021 Response Paper – Strengthening prudential requirements for remuneration, APRA will be increasing its supervisory oversight of remuneration practices ahead of the implementation of CPS 511. The new standard CPS 511 comes into effect on 1 January 2023 for the largest and most complex ADIs, and on a staggered basis for other entities.1

- Reporting and disclosure: in 2022, APRA is planning to release for consultation new reporting and disclosure requirements for remuneration. APRA plans to finalise these requirements in 2023.

Remuneration reform - Timeline

An accessible version of this timeline is available here.

If you have any questions regarding the implementation of CPS 511, please contact your Supervisor.

Yours sincerely,

John Lonsdale

Deputy Chair

Footnotes

1 In the period ahead, APRA intends to repeal the remuneration components of Prudential Standards CPS 510 Governance (CPS 510) and SPS 510 Governance (SPS 510), and Prudential Practice Guide PPG 511 Remuneration (PPG 511). This will ensure there is no unnecessary duplication with the new CPS 511. Further detail will be provided to industry ahead of CPS 511 coming into force.