Quarterly authorised deposit-taking institution performance statistics - September 2025 highlights

Key Statistics1

| September 2024 | September 2025 | Year-on-year change |

|---|---|---|---|

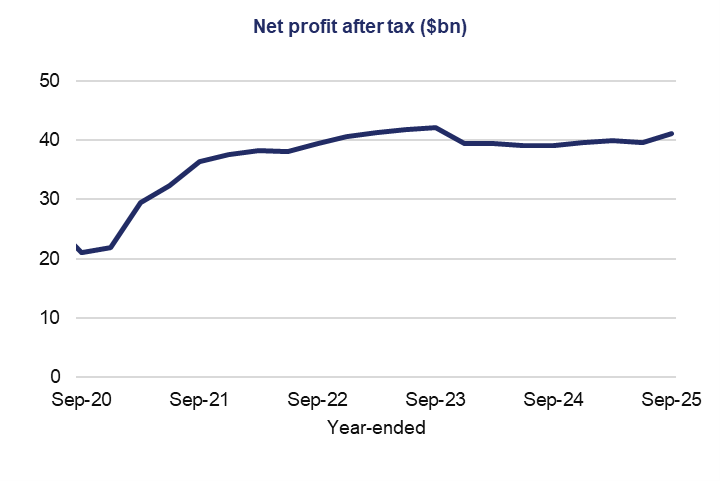

Net profit after tax (year-end) ($bn) | 39.1 | 41.1 | 5.1% |

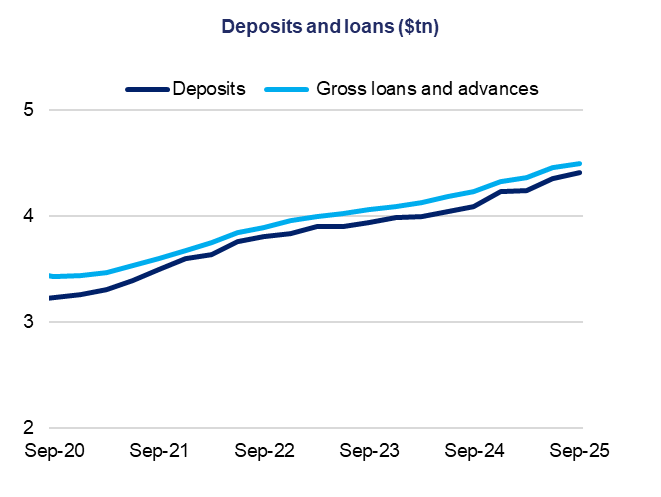

Total assets ($bn) | 6,319.9 | 6,681.7 | 5.7% |

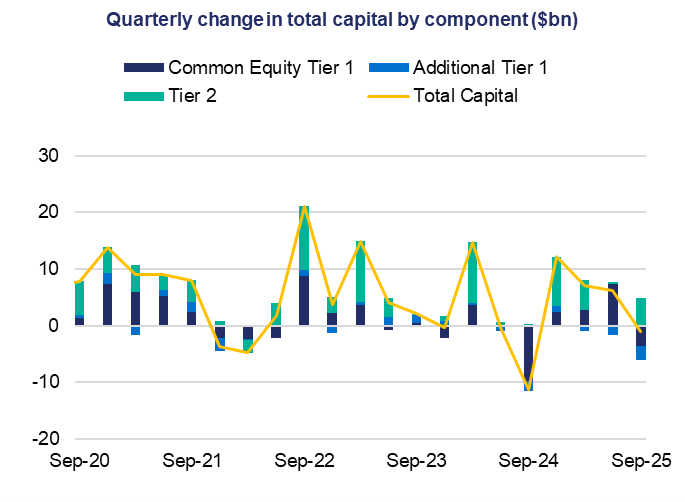

Total capital base ($bn) | 437.5 | 461.8 | 5.6% |

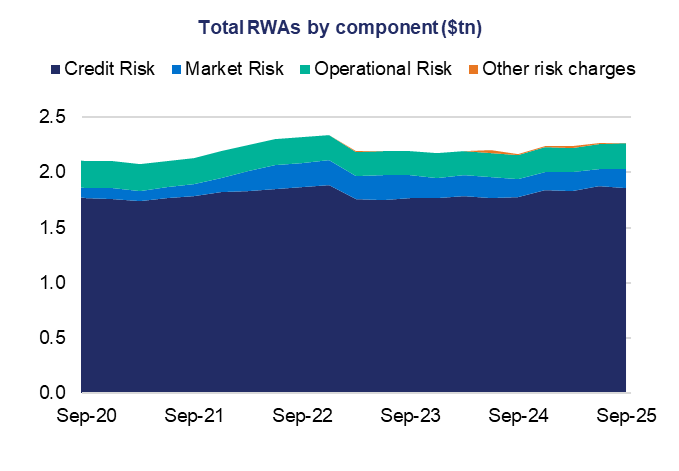

Total risk-weighted assets ($bn) | 2,163.0 | 2,268.5 | 4.9% |

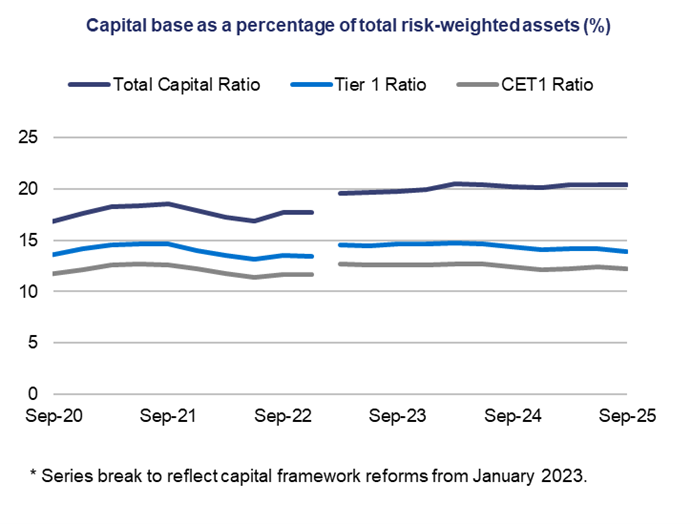

Total capital ratio | 20.2% | 20.4% | 0.1 points |

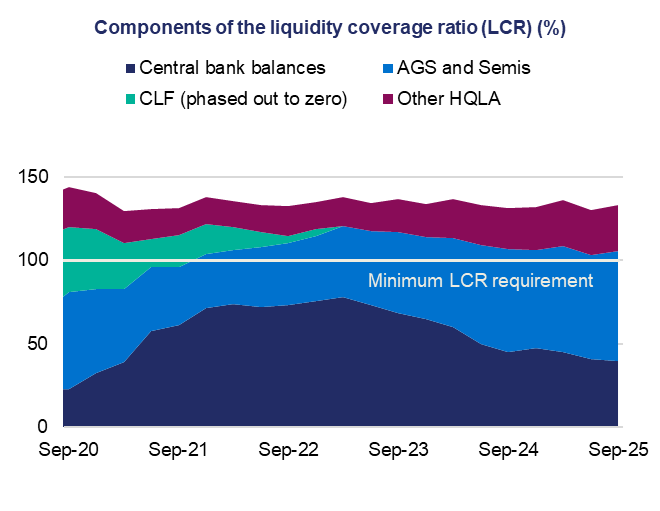

Liquidity coverage ratio | 131.2% | 133.3% | 2.1 points |

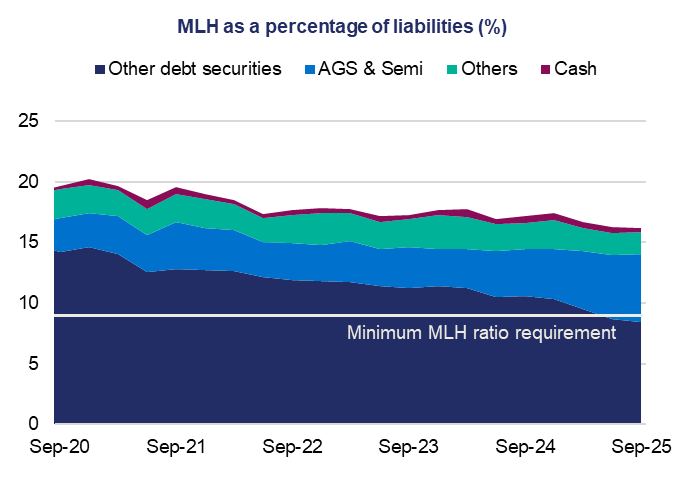

Minimum liquidity holdings ratio | 17.1% | 16.2% | -0.9 points |

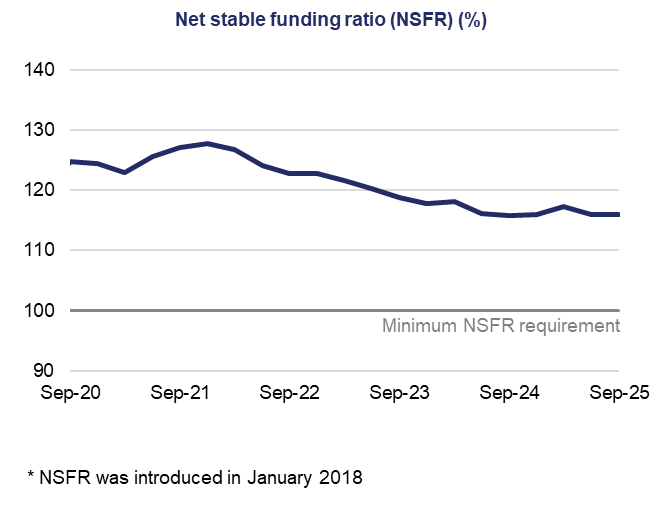

Net stable funding ratio | 115.7% | 115.9% | 0.2 points |

Financial performance

Asset quality

Capital adequacy

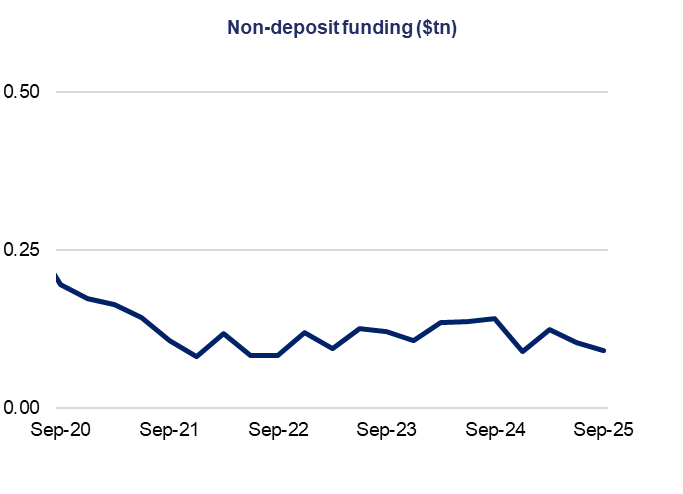

Liquidity

Financial position

Footnotes

1 Excludes ADIs that are not banks, building societies or credit unions, such as payment providers. The year-on-year change are calculated using the underlying unrounded values.