Interim Policy and Supervision Priorities update

To: All APRA-regulated entities

APRA publishes its supervision and policy priorities annually to outline upcoming areas of focus and assist entities in their planning. Doing so also supports APRA’s commitment to transparency and accountability.

This letter provides an interim update on APRA’s supervision and policy priorities for the first six months of the year, to bridge to the 2024-25 Corporate Plan, which is due by the end of August.

For the first time, APRA is integrating its supervision and policy priorities and providing greater detail as to which groups of entities any particular initiative will apply to. By doing so, APRA intends to provide entities with a better sense of what to expect over the next six months.

In determining its agenda, APRA carefully considers proportionality to minimise excessive regulatory impact where possible, in line with the Government’s latest Statement of Expectations1. In developing the prudential framework, APRA will ensure that standards and guidance are proportionate, with simpler requirements (where appropriate) for smaller entities that are not significant financial institutions (non-SFIs).

The next six months

APRA’s continued focus is on protecting the safety and resilience of regulated entities, promoting confidence and stability in the financial system, and supporting the community to achieve good financial outcomes.

Events over the past year have reinforced the importance of strong prudential supervision and regulation. The banking turmoil in early 2023 was a reminder of how quickly stress can emerge and how robustly entities and authorities need to be positioned, to be able to respond appropriately. In addition, the financial system has faced geopolitical risk, rising interest rates and high inflation, the growing threat of cyber-attacks, and increased frequency of natural disasters.

APRA reprioritised its supervision and policy agendas last year to respond to the risks that emerged and progressed a range of important policy reforms. For the period ahead, APRA plans to continue this program with a focus on:

- operational and cyber resilience for all regulated entities, reflecting the growing reliance on digital technologies by entities and the community;

- embedding lessons from last year’s global banking turmoil through targeted changes to the prudential framework for authorised deposit-taking institutions;

- lifting superannuation trustees’ practices on retirement incomes, implementing recommendations from the Financial Regulator Assessment Authority (FRAA) review, enhancing transparency and aligning APRA’s heatmaps with the performance test; and

- across insurance, continuing to balance financial sustainability with the need to enhance affordability and availability.

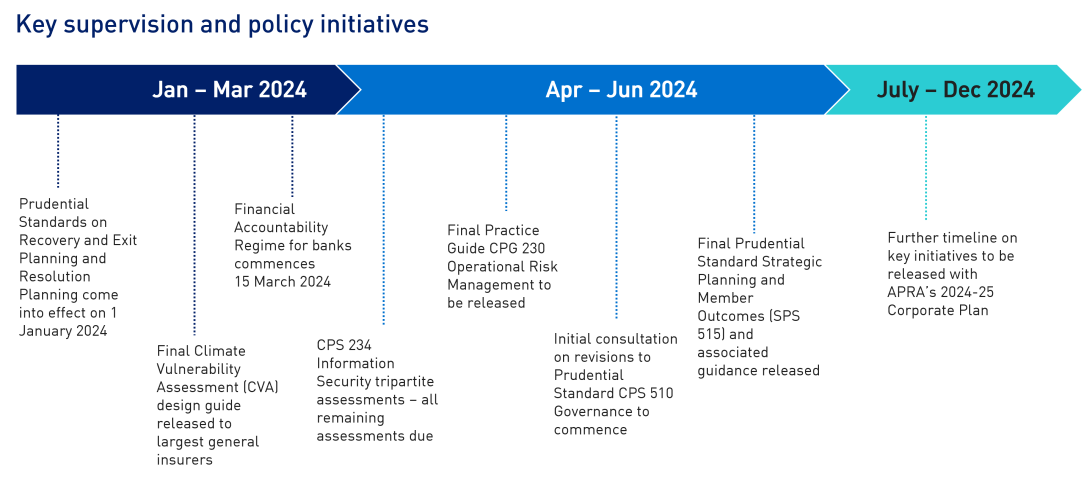

A high-level timeline of key initiatives over the next six months is presented in the graphic on the next page. A detailed table outlining the planned supervision and policy activities is also provided in the Attachment to this letter. Relevant information on APRA’s data roadmap can be found in this recent update.

Entities should read these industry-level priorities in conjunction with their entity specific supervisory programs, which are calibrated to their tier and stage. The majority of the industry-level priorities below are not new, but this update outlines key areas of focus, timeframes and next steps. Although this update covers the next six months, many initiatives will continue beyond this period.

APRA will remain adaptable to changes in the external environment and will adjust these priorities as needed, to ensure the industries it regulates can continue to respond to new and emerging risks.

Yours sincerely,

John Lonsdale

Chair

Attachment: Detailed Supervision and Policy Priorities

Cross industry initiatives

Objectives | Policy priorities – next six months | Supervision priorities – next six months | |

Cyber resilience | All regulated entities must ensure they take steps to be resilient against the growing threat of cyber-attacks. | APRA will maintain its heightened supervisory focus on cyber resilience, ensuring that all entities meet the standards expected of them under Prudential Standard CPS 234 Information Security (CPS 234). | |

Operational resilience | Disruptions to financial services can cause major impacts to the community. Entities must understand and manage their operational risks and be able to maintain their critical operations for beneficiaries and customers through business disruptions.

| Prudential Standard CPS 230 Operational risk management (CPS 230) will come into effect from 1 July 2025. APRA plans to finalise the associated prudential practice guide (CPG 230) in the first half of 2024, to support entities in transitioning to the new requirements. CPG 230 will include guidance to support implementation for smaller, less complex entities. | APRA will host information roundtables to brief and prepare entities for the incoming CPS 230 requirements.

|

Climate risk | APRA remains focused on ensuring its regulated entities are well positioned to manage the financial risks associated with climate change, and that they understand, monitor, and mitigate these risks appropriately.

| APRA is reviewing the effectiveness of Prudential Practice Guide CPG 229 Climate Change Financial Risks (CPG 229), with a focus on key issues such as embedding climate risk considerations clearly in risk management frameworks. APRA will engage with industry as part of this review but does not plan to commence formal consultation on any changes in the first half of 2024. | APRA will ask entities to respond voluntarily to the next Climate Risk Self-Assessment survey in 2024. This will provide entities with insights on their alignment to the principles in CPG 229 as well as allow for valuable industry-level insights into the ongoing maturity of climate risk management.

|

Financial Accountability Regime (FAR) | The FAR will come into effect from March 2024 for banks and from March 2025 for the insurance and superannuation industries and will strengthen accountability in all regulated entities. APRA and ASIC will support the financial services industry to ensure the effective implementation of the FAR. | APRA and ASIC will release further information including the Regulator rules and Transitional rules to help banks prepare for the commencement of the FAR in 2024. For the insurance and superannuation industries, APRA and ASIC will release an information package in early 2024 and host a series of webinars to support the insurance and superannuation entities prepare for the FAR commencement. | |

Governance, Culture, Remuneration and Accountability (GCRA) | All regulated entities must ensure they take steps to lift standards of governance, culture, remuneration, and accountability, given the critical importance of governance in underpinning risk management and resilience. | APRA is conducting a broad review of governance requirements, including those set out in Prudential Standard CPS 510 Governance, Prudential Standard CPS 520 Fit and Proper and other relevant standards.

| GCRA components will be heightened in supervisory engagements, including for entities that are implementing material risk transformation projects.

|

Recovery and Resolution | Entities need to be prepared to manage periods of severe financial stress and rebuild their financial resilience if needed.

| Prudential Standard CPS 190 Recovery and Exit Planning and Prudential Standard CPS 900 Resolution Planning came into effect on 1 January 2024 for banks and insurers and will take effect from 1 January 2025 for superannuation licensees. | Some banks and insurers may need to refine their approach to recovery and exit planning. APRA will engage with superannuation licensees to drive an uplift in industry approaches to meeting the expectations in the new standards.

|

Banking initiatives

APRA priority | Objectives | Policy priorities – next six months | Supervision priorities – next six months |

Interest rate risk in the banking book (IRRBB) | Interest rate risk is a material risk for banks. The collapse of banks overseas in 2023 highlighted the importance of managing IRRBB.

| APRA plans to finalise Prudential Standard APS 117 Capital Adequacy: Interest Rate Risk in the Banking Book (APS 117) in the second quarter of 2024. The revised APS 117 will come into effect from 1 October 2025. This will help to improve board reporting and increase awareness of risks banks carry in their banking book.

| All entities can expect continued focus on IRRBB from their banking supervisors. IRB entities that have submitted models for approval can expect ongoing engagement as models are reviewed and approved. |

Regulatory capital | Additional Tier 1 capital (AT1) is a hybrid layer of capital designed to stabilise banks in stress and support resolution, if needed, to avoid a disorderly collapse. APRA is reviewing the effectiveness of AT1 capital to ensure it operates as intended to absorb losses during a crisis.

| Following the discussion paper in 2023 on improving the effectiveness of AT1, APRA intends to undertake a formal consultation on proposals in the first half of 2024.

| |

Liquidity | All banks must maintain strong liquidity positions and be well positioned to manage shocks. | APRA is consulting on targeted changes to strengthen liquidity management practices and crisis preparedness. APRA aims to complete this consultation in the first half of 2024.

| APRA’s focus for Tier 1 entities will be continuing to uplift their liquidity stress testing capabilities following 2023 reviews.

|

Payments | The modernisation of the payments system is an important program of reform that involves a range of CFR agencies. As part of the CFR, APRA will play a key role in implementing these reforms.

| Government plans to finalise its proposed reforms to the payments licensing regime in 2024, following which APRA will consult on prudential requirements.

| |

Crypto assets | Crypto-assets are a new type of potential exposure for banks. In late 2022, the Basel Committee finalised the international standard for the prudential treatment of banks’ exposures to crypto-assets. This will provide the basis for APRA’s prudential requirements for Australian banks. | APRA will consult on the prudential treatment for crypto-assets in 2024, with new requirements expected to come into effect from 2025. APRA released interim expectations on the management of risks associated with crypto-assets in 2022. | |

Stress testing | Stress testing is a critical forward-looking analytical tool that can generate important insights into key risks and vulnerabilities at specific entities and for the system as a whole. | APRA will conduct a banking stress test in mid-2024 with systemically important banks. The scope of entities involved will be determined in early 2024 and entities will be notified.

|

Insurance initiatives

APRA priority | Objectives | Policy priorities – next six months | Supervision priorities – next six months |

General insurance affordability and availability | Affordability and availability pressures are seen in areas affected by natural disasters and in some commercial lines. These pressures can have significant implications for the community and the wider economy.

| APRA will continue to work with stakeholders to deepen the understanding of the drivers of affordability and availability pressures.

| |

Life insurance sustainability | APRA will continue to assess life insurers’ progress in meeting product sustainability expectations and will monitor the market for lead indicators of unsustainable products or practices. This is intended to avoid deteriorating viability of certain products, which may result in adverse consumer impacts or insurers withdrawing products from the market. | Entities can expect APRA to continue to review their progress in meeting APRA’s product sustainability expectations across both individual and group insurance business. | |

Life insurance – retirement | To support the availability of a range of retirement products for Australian retirees, APRA will seek to better understand the challenges for insurers in offering longevity products and will identify learnings from international markets that can be applied to Australia. | APRA will engage with all entities with experience or interest in longevity products in the first half of 2024. This will include an invitation to complete a survey, roundtable discussions and individual meetings with entities. | |

Private health insurance capital reforms | Robust board oversight of capital management is an important component of the new private health insurance capital framework. | All entities are expected to have either an Internal Capital Adequacy Assessment Plan (ICAAP) transition plan or an ICAAP report submitted to APRA in the next six months.

|

Superannuation initiatives

APRA priority | Objectives | Policy priorities – next six months | Supervision priorities – next six months |

Investments | System-wide risks associated with investment market conditions highlight the importance of robust investment governance by registrable superannuation entity (RSE) licensees.

| All RSE licensees can expect APRA to review their self-assessments against requirements in Prudential Standard SPS 530 Investment Governance.

| |

Superannuation transparency | The legislated performance test and APRA’s heatmaps have highlighted underperformance in MySuper and Trustee Directed Products.

| Following consultation in 2023, APRA plans to finalise updates to Prudential Standard SPS 515 Strategic Planning and Member Outcomes (SPS 515) and associated guidance in the first half of 2024. | APRA will maintain a focus on ensuring that trustees responsible for underperforming choice products are taking steps to improve or exit them. |

Retirement outcomes | RSE licensees will need to uplift practices to support better retirement incomes, as more Australians enter the retirement phase. | APRA’s proposed update to SPS 515 includes expectations to support the retirement income covenant. APRA aims to finalise updates to SPS 515 in the first half of 2024. | All RSE licensees can expect APRA to review their self-assessments against the findings outlined in the joint APRA and ASIC Information Report on the implementation of the retirement income covenant, published in July 2023.

|

Financial resilience | APRA aims to ensure trustees are well-placed to manage the impact of operational risks and provide confidence that sufficient financial resources would be available to implement contingency plans if needed. | APRA plans to consult on revisions to Prudential Standard SPS 114 Operational Risk Financial Requirement and associated guidance in 2024. |

Footnote

1 Point 4.3 requests APRA to “minimise the costs and burdens of regulatory requirements for regulated entities, including by applying proportionate requirements, considering different businesses models, and taking a principles-based approach to regulation, ultimately to benefit consumers”.