Delivering member outcomes into the future

The accompanying data file below contains fund-level metrics explored in this paper.

Foreword

Australia’s superannuation system plays a vital role in securing the financial futures of millions of Australians. As the system continues to grow in size, complexity and economic significance, it is more important than ever that trustees face into strategic challenges impacting their ability to deliver for their members into the future.

The environment in which we operate is constantly evolving, and standing still is not an option for any trustee. It is essential that we maintain a strong, safe, and secure system, that delivers for all Australians: a system that continues to invest in capabilities, governance and supporting tools to meet current and emerging challenges, with a laser-like focus on improving member outcomes.

This paper shines a light on challenges facing some trustees in relation to operational efficiency, growth, and competitive positioning. These challenges significantly influence the scope trustees have to maintain and improve outcomes for members over the longer term. When addressing these challenges, trustees must carefully consider the investment required to meet business and risk imperatives, such as improving operational and cyber resilience and lifting support to members approaching retirement, as well as the need to ensure expenditure is in the best financial interests of members. Through this process, it may become clear to some trustees that while they can deliver short-term member outcomes, it is unlikely they will be able to maintain and improve for their members over the longer term. In these circumstances, trustees should actively consider whether members would be better served by another fund or a merger of funds.

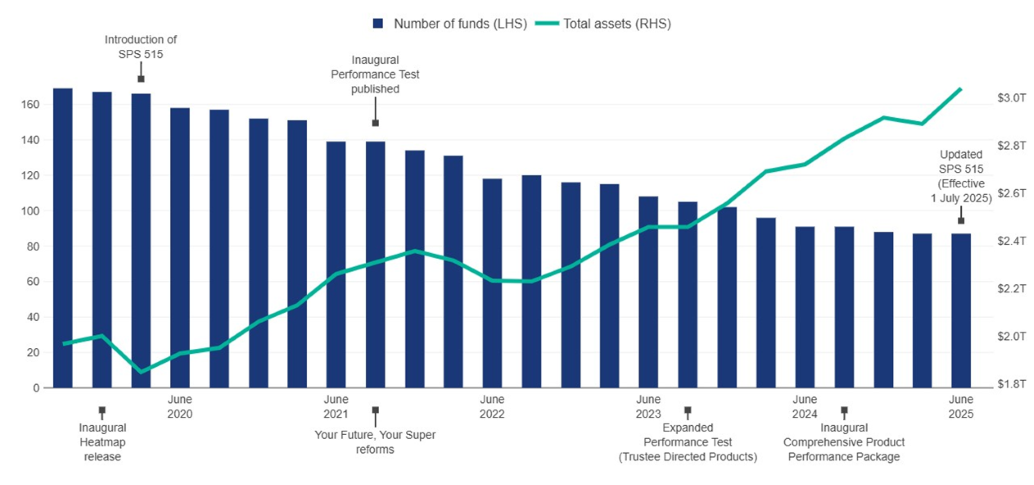

Over the last five years some trustees have embraced these challenges and have fulfilled their responsibility to members by repositioning for the future. During this period, the number of funds has reduced from 158 to 87. Our role as the prudential regulator is not to prescribe the shape or composition of the industry, nor does APRA have a statutory power to require funds to exit the industry. Nonetheless, consistent with APRA’s approach over many years, APRA will continue to engage with individual trustees bilaterally to ensure they are appropriately considering the challenges they are facing in delivering for their members into the future. In this context, this paper:

- highlights some factors that trustees should have regard to when developing credible strategic plans, including under the recently refreshed SPS 515 Strategic Planning and Member Outcomes (SPS 515); and

- provides transparency regarding some of the key considerations APRA takes into account when assessing a trustee’s ability to deliver for their members into the future.

Margaret Cole

Deputy Chair

Australian Prudential Regulation Authority

Executive Summary

Australia’s superannuation system is one of the largest private pension systems in the world, with over $4.3 trillion in total assets which accounts for approximately 160 per cent of GDP. The superannuation industry1 is a leading investor in our local financial markets holding approximately 20 per cent of the Australian Securities Exchange ($670 billion) and invests in Australia’s real economy through investments in Australian property ($140 billion) and infrastructure projects ($120 billion).

The system is constantly evolving with significant changes creating challenges for funds to deliver for their members. In this context, this paper examines certain important current and emerging trends across the superannuation industry and the challenges they present for funds2 in relation to three key categories.

Operational Efficiency

An increasingly complex operating environment, punctuated by a heightened number of cyber-attacks requires continuous investment in systems, capabilities and governance to meet both current and emerging challenges. This investment must be completed efficiently to avoid undue upward pressure on member fees.

Growth

The introduction of account stapling combined with the increasingly competitive environment has meant many funds have experienced challenges in engaging and attracting new members. Approximately half of the funds in the industry are experiencing negative account growth and if this persists over the long term, some of these funds may need to raise member fees to continue to pay for their operating expenses.

Competitive Positioning

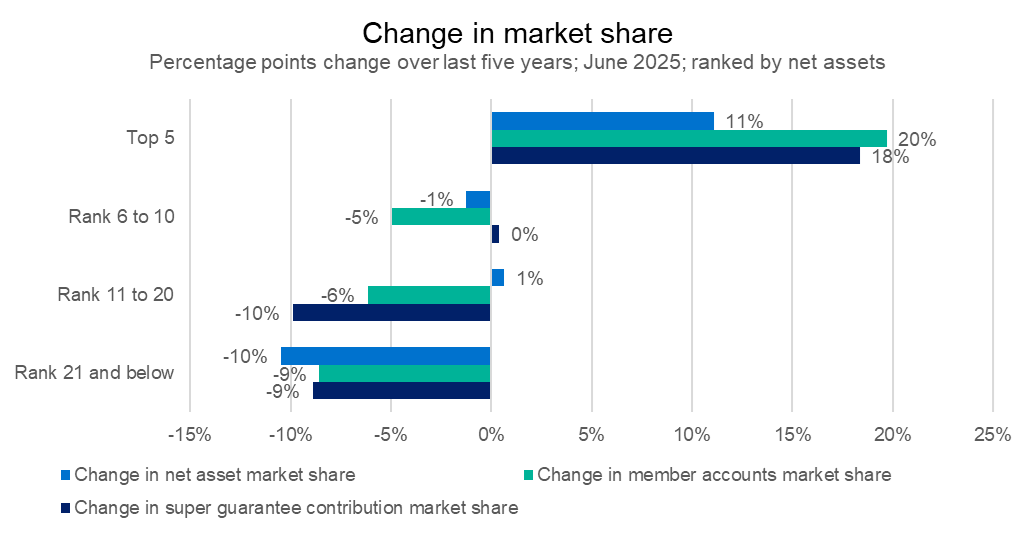

Over the last five years, the market share of the largest 15 funds has increased from 69 per cent to 78 per cent mostly driven by the five largest funds. This has challenged the ability of many funds to grow their membership base and has led to ongoing consolidation activity with the number of funds falling over the last five years.

When facing into these challenges APRA expects trustees to have effective strategic initiatives and business planning processes to ensure they are improving member outcomes over the medium to long term. In relation to trustees facing multiple challenges, it is imperative they look to proactively drive better member outcomes. APRA will continue to maintain a heightened supervisory stance to ensure they are planning and implementing timely and credible actions to improve member outcomes.

Current and emerging trends

The current and emerging trends covered in this paper are explored through three key categories using a range of metrics. These metrics over the 1-, 3- and 5-year time horizons are provided for all funds in the accompanying data file3.

Key categories and metrics

Operational efficiency metric

- Administration and Operating Expense (AOE) ratio – measures administration and operating expenses incurred divided by fund assets.

Growth metrics

- Natural Cash Flow (NCF) ratio – measures underlying organic fund growth divided by fund assets, that is whether member inflows from contributions etc., is greater than member outflows from benefit payments etc. This excludes investment returns, rollovers, insurance flows and successor fund transfers.

- Member accounts growth – measures the growth or decline in member accounts.

Competitive positioning metric

- Net rollover ratio – measures the net value of member assets rolling into and out of the fund divided by fund assets.

Increasing competitive pressures

Total assets held within the superannuation system has grown 51 per cent over the past five years reaching $4.3 trillion as of June 2025. Around $3.0 trillion of this pool of assets are held by APRA-regulated funds representing close to 70 per cent of the system.

The superannuation industry demonstrates a strong financial position at an aggregate level. Alongside growth in assets and member accounts, natural cash flows are positive, investment performance has been strong, and fees and costs charged to members have trended down.

The top five funds by assets are experiencing continued growth, increasing their market share of super guarantee contribution (SGC) flows and member account growth faster than their relative share of net assets. In contrast, funds outside of the ten largest funds have seen their relative share of SGC flows and member accounts decline. While declining market share is not a concern in isolation, it highlights increasing competitive pressure across the industry.

Increasing competitive pressure has resulted in some trustees concluding their members were better served in another fund. These trustees satisfied their fiduciary obligations towards their members by exiting the industry via Successor Fund Transfers (SFTs). In the last five years, over 55 funds have exited the industry via SFTs.

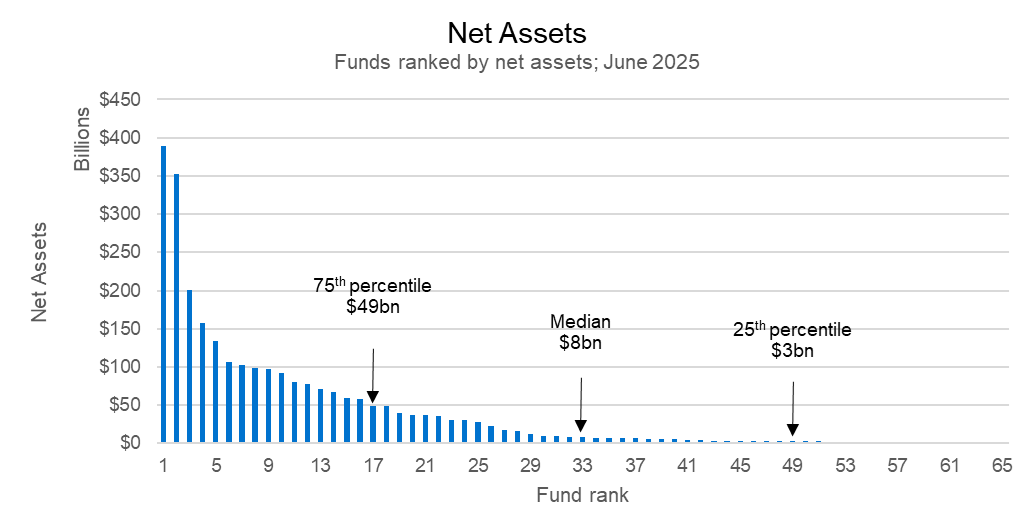

The largest five funds hold $1.2 trillion in net assets and have a combined market share of over 45 per cent. Comparatively, 50 per cent of funds have net assets less than $8 billion which collectively hold approximately 4 per cent of the market share.

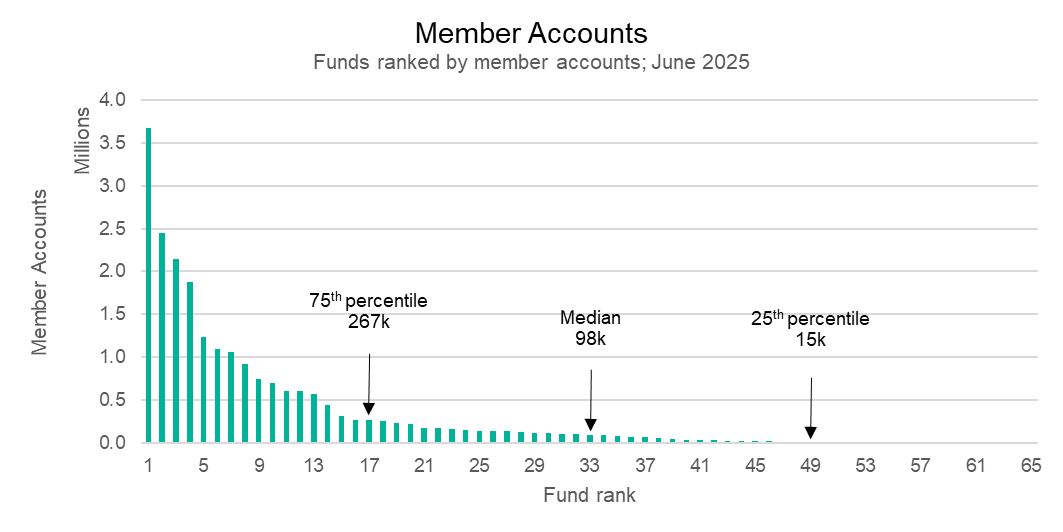

Increasing competitive pressure is also evident when examining the share of member accounts, where the five largest funds have 11.4 million member accounts and have a combined market share of over 50 per cent. Comparatively, 50 per cent of funds have less than 98 thousand members which collectively hold approximately 4 per cent of the market share.

Operational efficiencies

Improving operational efficiency is a crucial element when looking to improve member outcomes including service standards. Poor operational efficiency can lead to higher fees and costs for members. Higher fees and costs reduce net returns, resulting in lower member balances at retirement.

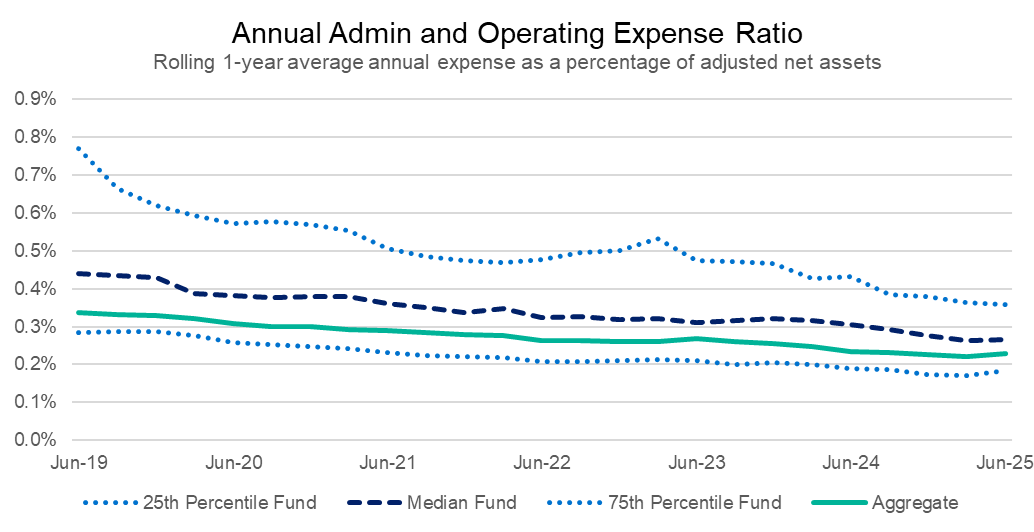

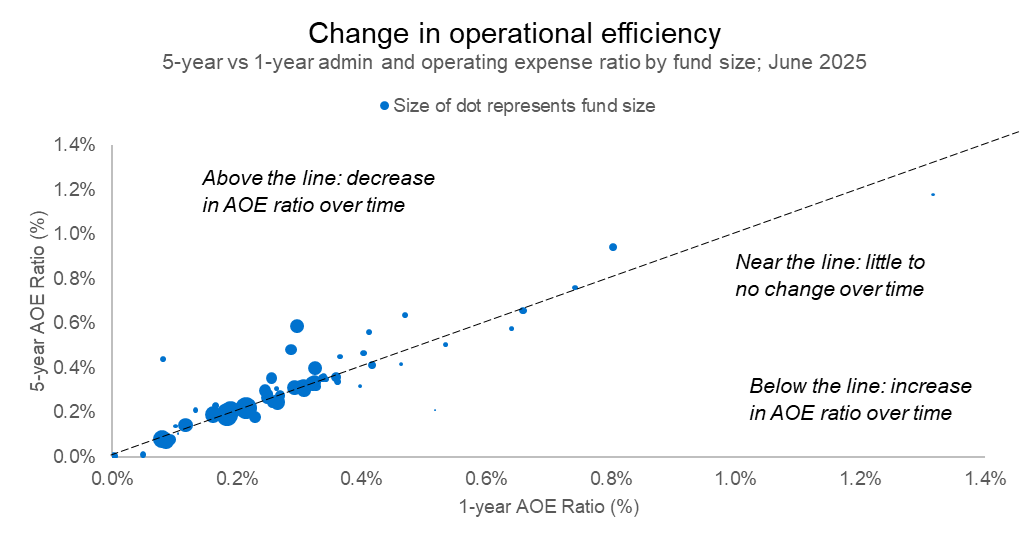

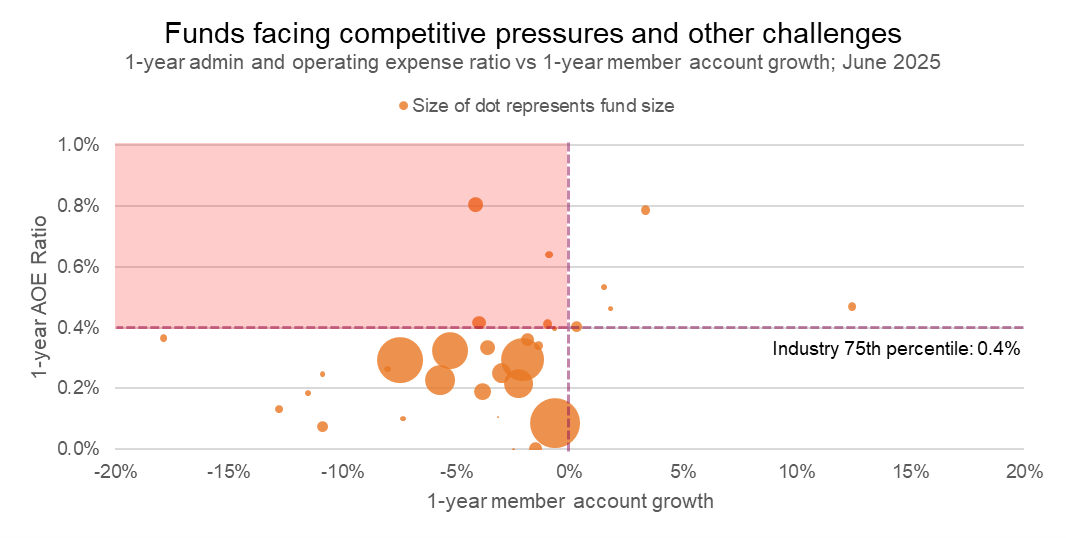

Over the past five years, the administration and operating expense (AOE) ratio has been declining for most funds. While this is the case, there is considerable variation across the industry with AOE ratios remaining high in relative terms for approximately a quarter of funds.

Over the last five years, many funds have improved their operational efficiency, but there remain several funds with limited or no improvement in their AOE ratio. Funds with persistently high AOE ratios over both 1- and 5-year periods may be facing structural or resourcing challenges in improving operational efficiency.

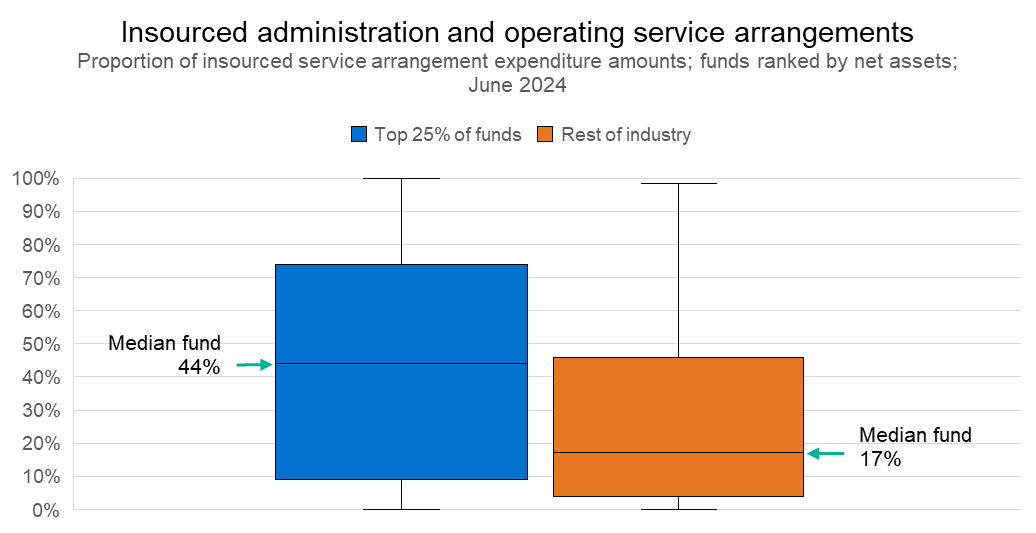

Trend in administration internalisation

In recent years there has been a trend, particularly for larger funds, to internalise parts of their administration operations with the intended aim of improving operational efficiency through technological transformations. Figure 7 shows that based on latest available annual data, larger funds tend to have a greater degree of internalisation for administration and operating service arrangements.

Growth landscape

The introduction of account 'stapling' in 2021 has changed the dynamics of member acquisition and retention. To reduce the creation of multiple superannuation accounts, individuals starting a new job have their existing account automatically carried over unless they actively choose a different fund. Consequently, many funds face challenges in engaging and attracting new members. If this persists over the long term, some funds with a declining membership base may have to cover a greater proportion of the operating expenses via higher member fees.

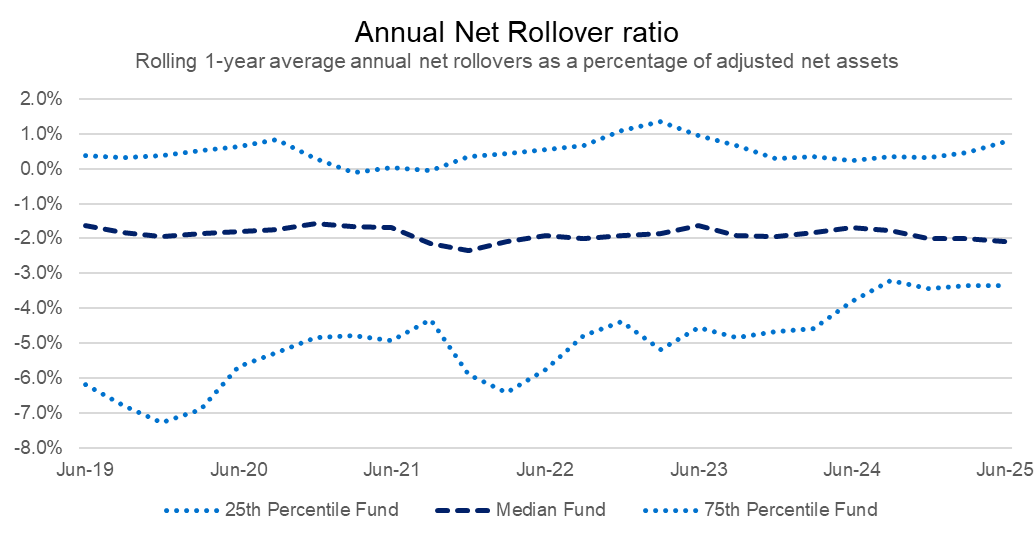

Around 70 per cent of funds have negative net rollover ratios i.e. losing more in assets when members transfer to other funds than they gain from new members transferring in. Key drivers of this include the role of advisors, funds’ membership offerings and brand recognition.

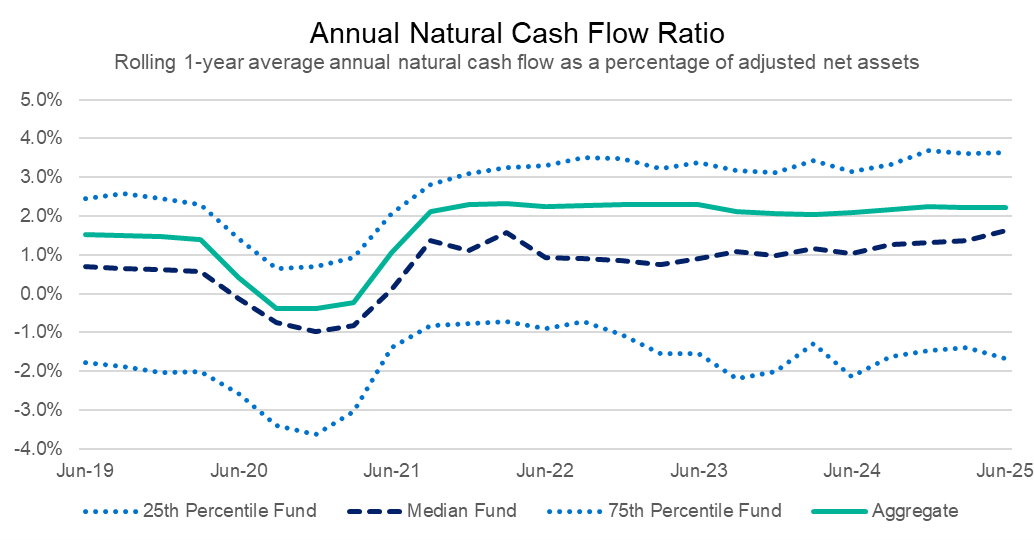

The industry in aggregate has had strong positive natural cash flows (NCFs) supported by the compulsory nature of employer superannuation contributions, rules for preserving superannuation benefits, and a membership base that is disengaged and predominantly aged below preservation age.

Approximately two-thirds of funds have experienced positive NCFs over the past year, indicating that contributions exceed benefit outflows, of which more than half have experienced a declining trend in their 1-year NCF ratios over the last three years.

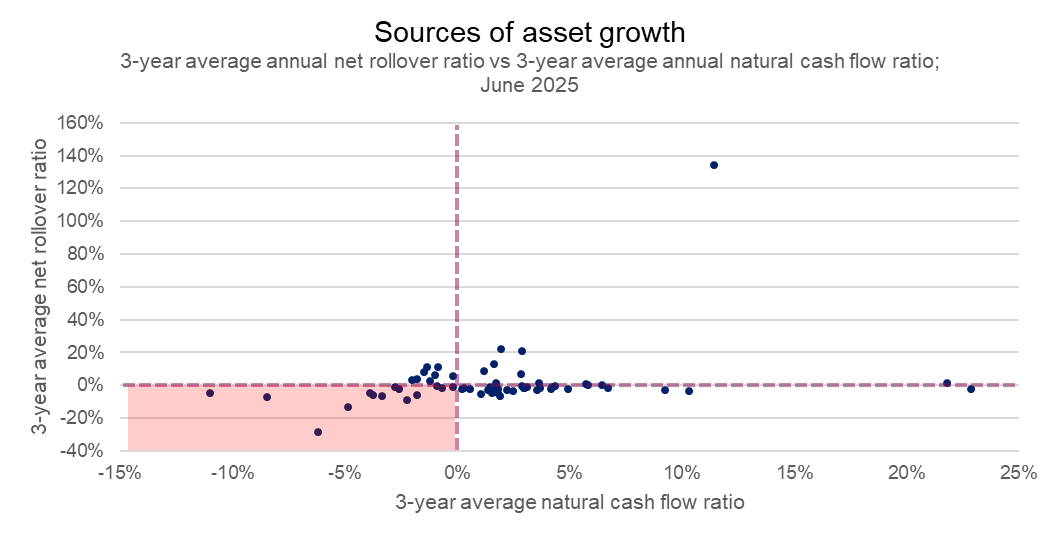

Funds have two main sources of organic asset growth outside of investment returns: net rollovers and NCFs. Figure 10 shows the distribution of these sources across funds, with only 17 per cent of funds experiencing positive 3-year net rollover ratios and 3-year NCF ratios (see top-right quadrant of Figure 10).

Approximately one-third of funds have negative 3-year NCF ratios, indicating that benefit outflows exceed contribution inflows (see left half of Figure 10). This is not necessarily a concern as some funds may have strategic objectives to service a larger proportion of retirees compared to workers and a number of these funds have grown by gaining new members and receiving more money through rollovers (see top-left quadrant of Figure 10).

On the other hand, funds in the bottom-left quadrant of Figure 10 show limited growth from rollovers and NCFs. These funds may rely more on investment returns to grow. While investment returns can support growth, heavy reliance on them can lead to instability in fee revenue. This is particularly relevant for funds that charge fees based only on a percentage of member balances, without a fixed-dollar fee. In such cases, market volatility can reduce fee revenue even as operating costs remain steady or increase, placing upward pressure on member fees.

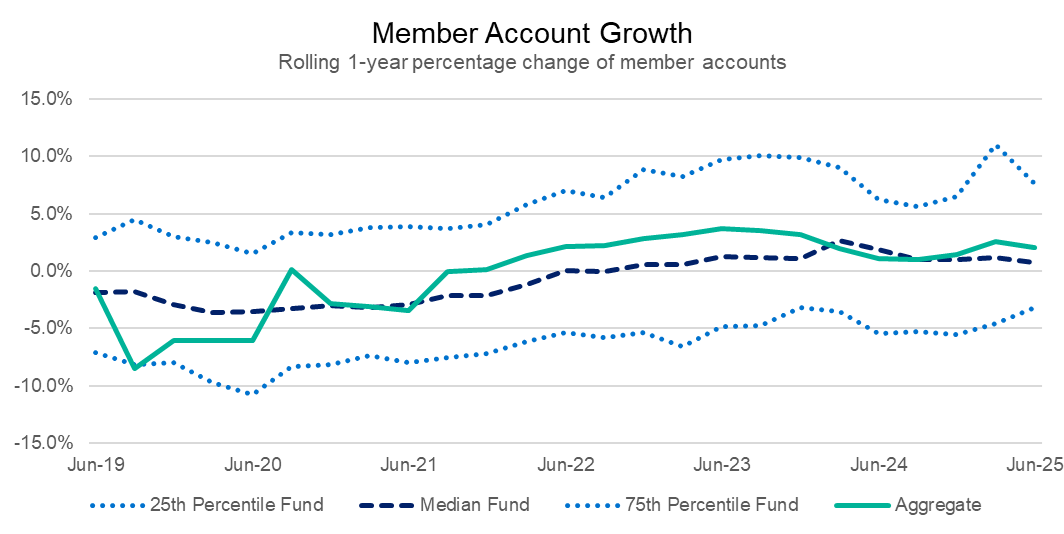

The number of members in a fund influences the amount of fees collected and consequently the resources available for business operations and improvements. Over the last three years the number of member accounts in the industry has increased which has been supported by many factors such as growth in employment and the removal of the $450 superannuation guarantee threshold.

Growing funds have been able to spread their fixed costs over a larger membership base, reducing the fees and costs charged to each member. Some of these growing funds have achieved membership growth through strategic initiatives such as SFTs and merger activity.

However, approximately 45 per cent of funds have experienced a decline in member accounts over the last year. These funds face increasing costs per member as members exit through rollovers or take their entire balance as a lump sum payment upon reaching preservation age.

Expectations

APRA’s SPS 515 obligations are designed to ensure trustees have robust business operations to ensure their strategies and decisions deliver better quality outcomes for members. This involves regularly reviewing and refining strategic initiatives and business plans to ensure they remain effective and aligned with evolving member needs.

It is imperative that trustees continue to focus on fund performance, operational efficiency and improving services to members, while also investing in good risk management.

When looking to grow their fund, trustees should approach growth opportunities through sound decision-making processes aligned with their strategic objectives. This includes establishing regular, evidence-based monitoring and reporting processes to evaluate whether growth initiatives are delivering tangible benefits for their members.

Finally, it is important for trustees, when reflecting on the challenges they face, to consider questions such as:

- What is the medium- and long-term outlook for the fund in delivering quality member outcomes, including with reference to competitive positioning, growth and operational efficiency?

- What level of investment is required to maintain and uplift systems and capabilities, while also improving the offering for members to ensure quality member outcomes?

- Are credible business plans in place to achieve the fund’s strategic objectives for the benefit of members, and are those objectives being met over time? If not, how are members’ interests being served in the medium- and longer- term, relative to the potential options of being served by another fund or a merger of funds?

Funds facing multiple challenges

Some trustees are facing one of the challenges outlined above relating to operational efficiency, growth, and competitive positioning. A smaller group of trustees are facing multiple of these challenges at the same time. For these trustees in particular, APRA will continue to maintain a heightened supervisory stance and proactively engage to ensure member outcomes are at the forefront of their decision making.

Funds with weaker operational efficiency, despite recent growth (Figure 12, top-right quadrant)

These funds have weaker operational efficiency and generally have had no meaningful improvement over the 1-, 3- and 5-year time horizons. These funds may also be facing additional pressure with the need to appropriately invest to meet current and emerging risks.

In general, these funds have higher member fees relative to their peers which is likely to be impacting the competitiveness of its member offering. This lack of competitiveness will impact member retention and their ability to attract new members which will lead to a slowdown in growth.

APRA expects these trustees to consider whether their strategic plans are likely to deliver persistent growth and lead to an improvement in operational efficiency. It is paramount that their strategic plans articulate clear and achievable actions that will result in improved member outcomes over the medium to long term.

Funds with a weaker growth outlook (Figure 12, top-left and bottom-left quadrants)

These funds have experienced declining growth and are generally not positioned to increase their membership base. If this trend persists, the resulting decline in membership may lead to higher fees and detrimental retirement outcomes for remaining members, as fixed fund expenses are spread over a smaller membership base.

Efforts by trustees to improve growth and retention, such as enhancing their member offering, can place additional strain on their operational efficiency. This is also relevant for consolidation activities which are complex and can take several years to harmonise products and fully integrate systems and/or business processes. Growth initiatives, depending on the fund’s structure and strategic approach, place upward pressure on fees (reserves) or require additional support from related entities.

APRA expects trustees should consider whether the expenditure associated with growth initiatives will deliver meaningful growth and translate into improved member outcomes.

Funds with weaker operational efficiency and a weaker growth outlook (Figure 12, top-left quadrant)

These funds face an especially challenging outlook. They have weaker operational efficiency, have been experiencing a declining membership base, and often do not appear to be in a position to improve their outlook. These funds tend to have higher fees relative to peers, which can affect their competitiveness and member retention. On this basis, the ability of these trustees to improve member outcomes over the medium to long term is a particular focus of APRA.

The ability of trustees to make meaningful change without adversely impacting members in the short to medium term may be hindered by the way these challenges interact in practice. For example, the cost of undertaking an initiative to improve organic growth may be borne by current members in the short term and place further strain on operational efficiency, especially with a declining membership base.

APRA expects these trustees to develop credible strategic plans that provide clear evidence of their ability to improve member outcomes over the medium to long term. APRA further expects these trustees to demonstrate progress against such plans. Where trustees are unable to develop or execute on credible strategic plans, trustees should consider, in line with SPS 515, whether their members are likely to be better served in another fund given the challenges they face.

Footnotes

1Entities with more than six members.

2This paper will focus on APRA-regulated funds with more than six members as at June 2025. The population aligns with APRA’s quarterly fund level statistics excluding entities that are either defined benefit only or insurance only which have unique characteristics compared to the rest of the industry.

3Looking forward, APRA will adjust existing performance reporting in the APRA Annual Report to align with these metrics.