Introduction

Chair's foreword

As Australia’s prudential regulator, APRA’s mandate is to provide Australians with a safe and stable financial system. This objective is critical to the Australian community’s financial wellbeing and the long-term growth of the Australian economy.

However, APRA does not pursue a ‘safety at all costs’ agenda. Our prudential framework, by design, is aimed at minimising any undue cost of regulation for industry. Our standards and supervisory practices ensure that financial institutions can fulfil their vital and productive roles in the economy, supporting long-run growth and investment.

This year’s plan has been developed against the backdrop of an increasingly complex and uncertain operating environment. Heightened geopolitical tensions and policy uncertainty in major economies have the potential to create risks to financial stability. In this environment, the importance of a robust prudential framework takes on greater significance. A stable and resilient financial system – one that absorbs shocks and does not amplify them – remains critical to supporting the economy through periods of turbulence.

As a forward-looking regulator, APRA is primarily focused on preventing harm before it occurs. We are working closely with industry to strengthen their resilience to emerging risks, including those that could stem from geopolitical tensions, cyber-attacks, increased reliance on service providers and growing interconnections across the financial sector.

Domestically, we have seen inflation and interest rates decline. This turning point in the financial cycle brings its own risks, as historically house prices rise faster, borrowers take on more leverage and lending standards can slip. This is something that we are carefully monitoring.

Productivity concerns have become more pronounced across the economy. In response, we have increasingly focused on making sure that our framework is not an undue constraint – our goal is to promote safety and stability in the most balanced and efficient way possible. In this plan, we have identified nine initiatives to minimise burden and support productivity, without compromising our safety and stability objectives. We are working closely with the government and other regulators on various initiatives.

At the same time, within APRA, we need to continue to improve our organisational effectiveness. Responding to the complex and fast-changing operating environment requires us to continue investing in ourselves, specifically the capability of our people, our data and technology systems, and our approach to supervision. Our goal is to ensure that APRA remains a dynamic, welcoming, inclusive, and diverse environment that is a great place to work and build a career.

It is through the prism of these current conditions and potential future challenges that APRA has developed its Corporate Plan for 2025-26. This plan confirms APRA’s focus on:

- Delivering our core mandate for safety and stability in the financial system, against the backdrop of an increasingly complex and uncertain operating environment.

- Focusing on “getting the balance right” to ensure our regulation is efficient and proportionate.

- Investing in our future efficiency and effectiveness as a regulator.

As with last year’s plan, it contains both APRA’s strategic objectives over the next four years as well as our more specific policy and supervision priorities for the coming 12 to 18 months.

Finally, we have also enhanced how we will publicly report on our performance going forward. These changes better demonstrate the outcomes APRA expects the community to hold us to account for, including a stronger focus on competition and efficiency considerations.

APRA’s 2025-26 Corporate Plan covers the period from 2025-26 to 2028-29. It has been prepared in accordance with section 35(1)(b) of the Public Governance, Performance and Accountability Act 2013 (PGPA Act).

John Lonsdale

Chair

Introduction

APRA’s 2025-26 Corporate Plan sets out our strategic objectives over the next four years and outlines our planned activities for delivering on those objectives.

APRA’s mandate is to provide Australians with a safe and stable financial system. The economic benefits of this are significant. International confidence in the Australian financial system remains critical to attracting the capital that households and businesses need to grow and invest. A safe and stable system prevents financial vulnerabilities, which can cause significant harm for individuals and the economy, from building.

In delivering on our mandate, we maintain an open and constructive dialogue with industry and peer regulators to ensure our actions are proportionate and risk-based. APRA has a long-established framework designed to minimise unnecessary regulatory burden for industry. This includes making targeted adjustments to existing regulation, where appropriate.

APRA’s 2025-26 Corporate Plan is focused on promoting the safety and stability of the system in a balanced and efficient way. As a forward-looking regulator, APRA continues to prioritise initiatives to maintain resilience as new risks emerge; in the current environment, we are particularly focused on potential risks from geopolitical tensions, cyber-attacks, interconnections, an ageing population, and climate change. At the same time, we are progressing a range of initiatives to minimise regulatory burden for industry and support productivity.

As the environment in which we operate becomes more complex, we must also continue to invest in our own organisational effectiveness. This year’s plan includes initiatives to ensure we remain a modern, agile and future-ready regulator.

APRA’s ability to deliver the 2025-26 Corporate Plan is underpinned by its key strengths: our system-wide perspective on the operating environment; our domestic and international relationships; and our people’s values, expertise, and insights. These strengths enable APRA to identify emerging risks early, assess interconnections across sectors, and determine an appropriate response. APRA retains a strong appetite to increase the intensity of supervision to address inadequate risk management practices and to take formal enforcement action against entities or individuals, where appropriate.

In assessing risks to our prudential objectives, APRA adopts a holistic approach that considers micro and macroprudential risks. We also take into account competition and efficiency considerations to ensure that our regulatory frameworks minimise any undue cost of regulation for industry.

APRA’s assessment of the operating environment takes a through-the-cycle view to protecting the financial interests of Australians. History has shown that poor or insufficient prudential regulation can lead to a build-up of vulnerabilities that can ultimately cause severe harm for individuals and the economy.

Our views on the operating environment are shaped by our supervisory activities, analytics and research, and engagement with domestic and international agencies. The key influences on APRA's 2025-26 Corporate Plan and current priorities are set out below.

External drivers

Global developments

The risk of economic shocks from abroad remains elevated. Heightened geopolitical tensions and policy uncertainty in major economies have the potential to present substantial headwinds to the outlook for growth and stability. In the near term, this unpredictability could lead to market volatility and a potential sharp repricing in assets, with the potential to create strains on liquidity in some markets. The impact of prolonged uncertainty on household spending and business investment decisions could weigh on longer-term growth prospects.

As a mid-sized economy dependent on overseas markets for capital and investment, Australia's financial system is deeply interconnected with the international economy. A resilient financial system – one that can absorb shocks and does not amplify them – remains critical to supporting the economy through potential shocks from overseas.

Domestic developments

While the global outlook presents downside risks, growth in the Australian economy is generally expected to pick up slightly over the next year. Recent interest rate cuts are expected to support spending by households and businesses. Market participants generally expect some further easing of interest rates in the period ahead.

Further declines in interest rates could create a build-up of risks in banks’ housing lending portfolios. Historically these trends have led to higher credit growth and leverage, higher house prices and often more risky lending, such as high debt-to-income and investor lending. This is something that both APRA and the Council of Financial Regulators (CFR) are carefully monitoring.

Regulatory developments

Overseas regulators are subject to increasing scrutiny. Some regulators have recently announced areas where they are paring back requirements to reduce burden. For the most part, these relate to more onerous prudential requirements that were not introduced by APRA in the first place. For example, UK announcements on regulation relating to ring fencing, small bank capital standards, resolution planning, remuneration and accountability standards would bring UK prudential standards back closer into line with APRA’s existing framework. The same applies to recent US announcements regarding leverage requirements.

In Australia, productivity is also a significant focus for government. In July 2025, APRA and many other regulators received a letter from the Treasurer and Minister for Finance seeking specific, measurable actions to reduce compliance costs. Importantly, we were asked to do this without compromising safety and stability objectives. The nine initiatives outlined in APRA’s response are set out in the Strategic objective: Getting the balance right. APRA looks forward to continuing to work with government in support of productivity.

The Australian Government also continues to progress reforms to payments regulation. These reforms would give APRA an expanded role in regulating certain payment service providers, recognising that those participants provide similar functionality to bank deposits. APRA is working closely with other regulators on the design of new legislation.

Social developments

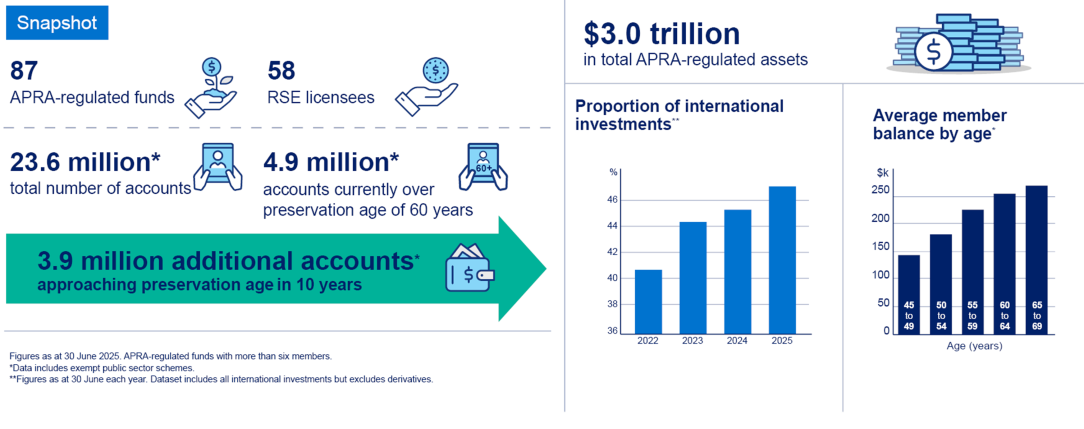

Australia’s population is ageing, a consequence of increased life expectancy and declining birth rates. This demographic shift has implications for the financial system, including how members engage with the superannuation and health insurance industries. Almost 5 million superannuation accounts are currently above the preservation age of 60, with another 3.9 million expected over the next decade.

Technological developments

Most customer engagement with the financial sector is now through digital channels. While digitalisation offers the potential for substantial efficiency gains in the financial system, it can also increase complexity and interdependence in supporting systems. As a result, operational systems in financial institutions are increasingly vulnerable to technology outages and malicious cyber-attacks. The risk environment for cyber-attacks could worsen further in the context of escalating geopolitical tensions.

Environmental developments

Climate events continue to increase in frequency and severity, with implications for long-term financial stability. These trends continue to impact the affordability and accessibility of insurance. Recent surveys indicate that 4 per cent of Australian households have identified living in uninsured properties and 7 per cent in underinsured properties. 1 Property insurance is essential for managing households’ risk and is a precondition for obtaining a mortgage from a bank. Declining insurance coverage among borrowers could expose banks to greater losses from climate risk.

Industry snapshot

Banking

The banking industry faces a range of challenges over the coming years. APRA will be closely monitoring the impact from declining interest rates on banks’ housing lending practices, given a historical tendency for this to coincide with higher risk lending. Banks will need to adjust to material and on-going market-driven challenges, including the impact of digitisation, changing customer preferences and the growing complexity of risks they need to manage – in particular, heightened geopolitical and cyber risks.

APRA, alongside the other CFR members and the Australian Competition and Consumer Commission (ACCC), recently conducted a review of small and medium-sized banks, focusing on competition. 2 The review found that, while small and medium-sized banks had gained market share since the global financial crisis, they face growing challenges to their future competitiveness. These challenges are primarily market driven. As noted above, banks of all sizes face a more difficult operating environment – these challenges are often more pronounced for small and medium-sized banks given the nature of their business models and higher cost structures.

The review concluded that the regulatory regime governing small and medium-sized banks was broadly fit for purpose and also identified several areas where regulations could be changed to contribute to the ability of these banks to compete. The actions APRA is taking to support small and medium-sized banks are set out in the Strategic objective: Getting the balance right.

The outcomes from the CFR’s review seek to support small and medium-sized banks in adapting to market-based challenges. The sector’s response to these challenges will ultimately be the main influence on their long-run competitiveness.

Banking snapshot accessible version

Superannuation

The value of assets managed by the superannuation sector has doubled in the past decade to $4.3 trillion in June 2025 – around 160 per cent of GDP. Over two-thirds of those assets are managed by APRA-regulated funds ($3.0 trillion), the largest and most systemically important type of funds.

Australia’s superannuation system is a large and growing component of the financial system – managing the long-term savings of members during their working lives, delivering income for retirees and playing an important role in funding economic activity through its impact on capital allocation.

However, the superannuation industry faces growing challenges over coming years. Similar to the banking industry, risks are becoming more complex – continued strengthening of superannuation funds’ governance and operational risk management practices is therefore an area of ongoing regulatory focus. The growth of the sector has also made it more interconnected with other parts of the financial system, which could introduce potential vulnerabilities.

An ageing population presents new challenges to the superannuation industry as more of its members move to the retirement phase. The Government’s Retirement Income Review found that a high proportion of superannuation benefits remain unspent over the retirement phase, which may lead to a lower living standard in retirement than could otherwise have been achieved. 3 Improving outcomes for members in retirement remains an area of ongoing regulatory focus.

Superannuation snapshot accessible version

Insurance

Australia’s insurance industry is well capitalised and profitable overall but faces heightened challenges. In the general insurance industry, rising premiums in recent years have decreased insurance affordability, including for property insurance. There has been some moderation in the growth of reinsurance costs after increasing significantly over recent years.

The private health and life insurance markets are facing additional challenges. For private health insurers, an ageing population, a relatively small base of younger members and rising health claims costs are weighing on profitability and business models. In the life insurance industry, lapse rates for retail business have continued to outpace new business. The sector is also facing increasing claims in relation to mental health cases.

Internal drivers

Capabilities

In an increasingly complex and rapidly evolving environment, supervision is becoming more challenging. New risks are emerging, and the pace of change is accelerating, which presents new challenges to APRA’s effective oversight of the financial sector. For APRA to maintain a highly performing supervision function, continued investment in training and development is required. This includes investment in learning and development to enhance career pathways, more diverse on-the-job experience, and a stronger facilitation of knowledge transfer.

Technology

Technology has the potential to drive efficiencies for APRA and create new risks. Sustained investment in information technology security is critical to protecting the integrity of financial sector data. APRA is the central data collection agency for the financial sector. We collect information for our own supervisory purposes and share significant amounts of information with other government agencies.

Technology also has the potential to drive significant regulatory efficiencies. An important area of focus is how data is collected, analysed and used. Technology has the potential to strengthen APRA’s supervisory toolkit, through greater efficiency and richer insights.

Culture

APRA’s workforce is changing and needs to keep evolving to maintain a high-performance culture. APRA provides its people with a supportive environment to share and discuss ideas, which reflect a diverse range of insights, experiences, and points of view. APRA’s culture is underpinned by its values, promoting a culture of continuous improvement.

It is important that our workforce reflects the diversity of the community in which we operate. APRA’s Inclusion and Diversity Strategy aims to shape an organisation where everyone feels valued and respected.

Resourcing

APRA is primarily funded through levies on regulated entities. APRA’s 2025–26 Corporate Plan has been developed based on an approved average staffing level of 907 for the financial year and funding allocations outlined in the latest Portfolio Budget Statement.

Sustainability

APRA is adapting its internal sustainability practices to ensure that it is on track to meet the target set by the Australian Government to achieve net zero greenhouse gas emissions from government operations by 2030. To achieve carbon neutrality by 2030, APRA will:

- implement energy-efficient practices across all offices and change to renewable energy sources

- seek to reduce the impact of its business practices on the environment (e.g. travel)

- invest (if appropriate) in emissions offset programs and projects

- disclose progress in the APRA Annual Report.

Footnotes

1 RBA Financial Stability Review, April 2025.

2 Council of Financial Regulators Review into Small and Medium-sized Banks, July 2025.

3 RBA Financial Stability Review, April 2025.

Building on the foundations of last year’s plan, APRA’s 2025–26 Corporate Plan focuses on four strategic objectives. These strategic objectives are shaped by APRA’s statutory responsibilities, the Government’s Statement of Expectations and APRA’s assessment of key risks in the operating environment.

Strategic objectives accessible version

The first three strategic objectives focus on promoting the safety and stability of the financial system in a balanced and efficient way. Under these objectives, APRA has detailed specific policy, supervision and data initiatives planned for the banking, insurance and superannuation industries over the next 12-24 months. Regulated entities should read these industry priorities in conjunction with their entity-specific supervisory programs, which are calibrated to their Tier and Stage.

Under the Government’s Regulatory Initiatives Grid, APRA has consulted with other financial sector agencies on the planned timings of its initiatives with the aim of improving coordination and alignment across regulators.

APRA’s planned industry initiatives have been scoped to address identified risks to safety and stability, while ensuring that APRA’s regulatory settings are efficient and proportionate. Most of the initiatives below are not new, and this plan provides further detail on areas of focus and updates to timeframes.

As always, APRA will remain adaptable to changes in the external environment and will adjust these priorities as needed to ensure the industries it regulates can continue to respond to new and emerging risks.

1. Maintaining financial and operational resilience

Having spent more than a decade building up the strength of the prudential framework, APRA is now in a position to focus on maintaining that strength. Last year, we reduced our policy changes by more than half, having finalised the implementation of government recommendations for large and comprehensive reforms under the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry. 4 This year, we continue to prioritise targeted improvements to our standards, to maintain resilience as the risk outlook evolves.

Maintaining resilience requires a strong day-to-day supervisory focus, both at the individual entity and industry-wide levels. At an individual entity level, APRA’s supervisory programs continue to reflect the particular risks that entities are exposed to, with a focus on intervening early to resolve issues. Outlined below are APRA’s policy, supervisory and data priorities at an industry-wide level, for maintaining financial and operational resilience.

Financial Resilience

| Activity | BNK | SUP | INS |

|---|---|---|---|---|

| Policy |

| ✓ | - | - |

| Supervision |

| ✓ | ✓ | ✓ |

| ✓ | - | - | |

| Data |

| ✓ | - | - |

Policy priorities

APRA’s policy priorities are directed at targeted changes to reinforce banks’ financial resilience:

- Bank capital instruments: Following extensive consultation last year, APRA plans to finalise proposed revisions to its capital standards in the first half of 2025-26. These changes will remove Additional Tier 1 capital from the banking prudential framework to ensure that capital instruments can fulfill their intended role in absorbing losses during periods of stress. The updated capital framework will take effect from 1 January 2027.

- Bank liquidity framework: In the second half of 2025-26, APRA plans to commence engagement with industry on potential revisions to the bank liquidity framework. This initiative aims to modernise the framework in response to evolving risks. APRA will also seek to incorporate relevant findings from the CFR review into small and medium-sized banks.

Supervisory priorities

A significant component of APRA’s day-to-day supervision is focused on assessing potential risks to financial resilience. APRA’s regular supervisory activities include frequent monitoring of financial viability and capital adequacy, with a focus on banks’ internal capital models and heightened supervisory attention on areas of concern in liquidity, credit, investment, and insurance risk. At an industry-wide level, a key supervisory priority is strengthening crisis preparedness:

- Recovery and exit planning: APRA will maintain close oversight of industry’s implementation of Prudential Standard CPS 190 Recovery and Exit Planning. This standard requires all regulated entities to prepare for stress events that could threaten their viability. APRA will assess how banks and insurers have addressed APRA’s feedback from last year’s supervisory reviews, which identified several areas for improvement. Superannuation trustees will be required to formally submit their recovery and exit plans to APRA for the first time this year. APRA will review these plans and provide feedback, where appropriate.

- Resolution planning: As Australia’s resolution authority, APRA plays a critical role in preparing for the potential failure of regulated entities to minimise losses to beneficiaries and limit disruption to the broader financial system. Over the coming year, APRA will continue working with 14 entities to develop and refine bespoke resolution plans. The introduction of Prudential Standard CPS 900 Resolution Planning in 2024 formalised obligations for larger and more complex entities to support APRA in this process, where requested.

- Crisis simulations: APRA will collaborate with the other CFR members - the Australian Securities and Investments Commission (ASIC), the Australian Treasury and the Reserve Bank of Australia (RBA) - to conduct a crisis simulation exercise to test agency communication responses to a hypothetical bank failure.

Data priorities

Reporting standards: To reflect proposed changes to Additional Tier 1 capital in the broader banking prudential framework, APRA will make corresponding updates to its reporting standards. In the first half of 2025-26, APRA plans to finalise revisions to Reporting Standards: ARS 110.0 Capital Adequacy; ARS 221.0 Large Exposures; and ARS 222.0 Exposures to Related Entities.

Operational resilience

Activity | BNK | SUP | INS | |

|---|---|---|---|---|

| Policy | Refresh Governance standards | ✓ | ✓ | ✓ |

| Supervision | Assess entity implementation of APRA’s new operational resilience standard | ✓ | ✓ | ✓ |

Policy priorities

APRA’s policy priorities are focused on strengthening governance practices across all its regulated industries:

Governance: In the second half of 2025-26, APRA plans to consult on draft standards and guidance to update core governance requirements. These changes aim to address persistent poor practices and establish clear expectations for all regulated entities – almost 80 per cent of entities currently under heightened supervision by APRA exhibit underlying governance issues. To inform these revisions, APRA is continuing to engage extensively with stakeholders to gather diverse perspectives.

Supervisory priorities

APRA’s supervisory priorities are focused on strengthening all regulated entities’ resilience to operational risks:

Operational resilience: On 1 July 2025, Prudential Standard CPS 230 Operational Resilience (CPS 230) came into effect, introducing enhanced requirements for operational risk management across all regulated entities. Given the growing reliance on third parties, rapid technological advancements and geopolitical uncertainty, effective implementation of CPS 230 is critical to maintaining financial safety and stability. Over 2025-26, APRA will engage with entities to ensure they are meeting their new obligations. APRA’s supervision program will initially focus on the largest entities (significant financial institutions), including through targeted prudential reviews of some entities.

2. Responding to significant and emerging risks

As a forward-looking and proactive regulator, much of APRA’s impact is achieved through working cooperatively with entities to identify and rectify problems before they cause harm.

In the current environment, we are particularly focused on potential risks from geopolitical tensions, cyber-attacks, interconnections, an ageing population and climate change. We are also closely monitoring potential vulnerabilities that could emerge in banks’ housing lending portfolios as interest rates decline.

System-wide risk

Activity | BNK | SUP | INS | |

|---|---|---|---|---|

| Supervision | System stress test | ✓ | ✓ | - |

| Geopolitical risk workplan | ✓ | ✓ | ✓ | |

| Macroprudential policy | ✓ | - | - |

Supervisory priorities

- System stress test: In the second half of 2025-26, APRA will publish the results of its inaugural system stress test, designed to evaluate risks to financial stability arising from interconnectedness in the financial system. The test scenario assesses the impact and potential feedback loops between the banking and superannuation sectors from a significant financial market disruption alongside a major operational risk event. APRA will collaborate with industry and regulatory peers to address any vulnerabilities identified through this exercise.

- Geopolitical risk: APRA is working closely with the banking industry and regulatory peers to enhance the financial system’s preparedness for a geopolitical risk event. A dedicated geopolitical risk workplan has been developed, initially focusing on targeted engagements with banks throughout 2025-26 – this will be followed by further work across other industries. APRA’s workplan aims to identify gaps in preparedness and strengthen resilience across a range of scenarios. This initiative forms a key part of the CFR’s broader workplan, announced in December 2024.

- Macroprudential policy: Under Prudential Standard APS 220 Credit Risk Management, banks are required to be pre-positioned to implement a range of credit-based macroprudential measures, if needed, to address risks to financial stability. Given the potential for risks in housing lending to build as interest rates decline, APRA will be engaging with banks on implementation aspects of different macroprudential tools during the first half of 2025-26.

Cyber resilience

Activity | BNK | SUP | INS | |

|---|---|---|---|---|

| Supervision | Strengthen regulated entities' cyber resilience | ✓ | ✓ | ✓ |

| Enhancing government and industry response to cyber incidents | ✓ | ✓ | ✓ | |

| Address systemic cyber vulnerabilities | ✓ | ✓ | ✓ | |

| Assess potential risks associated with the use of artificial intelligence (AI) | ✓ | ✓ | ✓ |

Supervisory priorities

- Strengthening regulated entities' cyber resilience: In 2025–26, APRA will prioritise targeted supervisory engagements to assess entities progress in uplifting cyber resilience. These engagements will focus on evaluating specific cyber control areas and identifying potential single points of failure within entity systems, processes and dependencies. Initial efforts will concentrate on superannuation trustees, insurers and smaller banks. In the superannuation sector, a key focus will be assessing funds’ responses to APRA’s concerns outlined in its June 2025 letter on Information Security Obligations and Critical Authentication Controls. 5

- Enhance government and industry response to cyber incidents: Effective cyber incident response requires strong coordination between industry and government. A key priority for APRA is working with regulatory peers to strengthen incident response protocols, including improvements to information-sharing arrangements. This will be supported by the design and execution of simulation exercises to test whole-of-government responses to cyber events. APRA will continue its collaboration with the CFR Cyber and Operational Resilience Working Group to advance system-wide resilience.

- Address systemic cyber vulnerabilities: APRA will work with entities to develop a system-wide view of entities’ reliance on third party service providers. With increasing reliance on third parties for critical functions, including technology, there is the potential for disruptions outside the financial sector to present risks to financial stability. All entities will be required to submit a register of their material service providers by 1 October 2025.

- Assess emerging risks associated with the use of AI: In the first half of 2025-26, APRA will undertake targeted supervisory engagements with a group of larger entities to understand better emerging practices and potential risks associated with AI. These engagements will assess the appropriateness of risk management and oversight practices to support responsible adoption of AI across the financial system.

Improved outcomes for superannuation members

Activity | BNK | SUP | INS | |

|---|---|---|---|---|

| Supervision |

| - | ✓ | - |

| Data |

| - | ✓ | - |

Supervisory priorities

- Retirement income covenant pulse check report: In the first half of 2025-26, APRA and ASIC will jointly release a pulse check report evaluating industry progress in implementing the retirement income covenant. Previous reviews identified significant variability in how the covenant was adopted, with some entities demonstrating a lack of urgency in embracing its intent. This pulse check will assess industry’s progress in implementing their retirement income strategies, aimed at supporting improved outcomes for members in retirement.

- Intensified supervision of expenditure: Fund-level expenditure will remain a key focus to ensure superannuation trustees act in the best financial interests of their members. Over the next 12 months, APRA will undertake targeted assessments of expenditure data, and where deficiencies are identified, trustees will be required to make improvements.

- Targeted review of platform products: APRA is currently undertaking a review to assess the quality and soundness of trustees’ governance and oversight of investments offered via platforms. The review focuses on key areas including due diligence, onboarding, monitoring, and removal of investment options, as well as strategic planning and practices to promote member outcomes. APRA will assess current practices against relevant prudential standards. APRA’s findings will be shared with the superannuation industry, highlighting areas where enhancements are expected.

Data priorities

- Retirement reporting framework: APRA is working with Treasury to design a new reporting framework on retirement outcomes, which would commence in 2027. This initiative will enable monitoring of the outcomes delivered to members in retirement in a consistent and transparent way.

- 2026 Comprehensive Product Performance Package (CPPP): Following the release of retirement reporting data in mid-2025, APRA will integrate this data into the CPPP from the second half of 2025-26. This will provide a more comprehensive view of product performance across the superannuation sector.

Climate risk

Activity | BNK | SUP | INS | |

|---|---|---|---|---|

| Supervision | Insurance Climate Vulnerability Assessment | - | - | ✓ |

Supervisory priorities

Climate Vulnerability Assessment: In the second half of 2025-26, APRA plans to release the results of its Climate Vulnerability Assessment for the general insurance sector. This assessment has involved Australia’s five largest general insurers and has included detailed analysis of granular, modelled premium data. The findings will provide governments, insurers, policyholders, and the broader community with a clearer understanding of how general insurance affordability may evolve over the medium term in response to the physical and transition risks associated with climate change.

3. Getting the balance right

Under APRA’s mandate, we must balance our financial safety and stability objectives with competition and efficiency considerations. We take this obligation seriously. APRA has a long-established framework to minimise any undue cost of regulation for industry. By design, our prudential standards avoid overly prescriptive requirements which would otherwise stymie innovation and increase compliance costs. We are risk-based and proportionate.

Our framework is also subject to regular review. Most recently, the CFR and ACCC assessed Australia’s regulatory framework for small and medium-sized banks, finding that frameworks were broadly fit for purpose and also highlighting some areas for improvement. Later this year, APRA’s framework will again be subject to an independent review by the International Monetary Fund under its Financial Sector Assessment Program. 6

As productivity concerns have become more pronounced economy-wide, we have increased our focus on competition and efficiency considerations. In recent years we have progressed a more targeted policy agenda, worked more collaboratively with industry on policy reforms, strengthened our coordination with other agencies, and ceased certain data collections.

This year – under this new objective – we are progressing nine actions to further minimise burden on industry. Some of these are actions that APRA committed to as part of the CFR review into small and medium-sized banks. Others are broader initiatives, which impact additional industries.

In terms of impact, many of our actions are incremental – they build on existing proportionality in the framework. In aggregate, APRA estimates that its actions will moderately reduce the burden for the financial sector and, at the margin, help to free up capital for other productive purposes.

In addition to the actions outlined below, APRA is also making changes to strengthen competition and efficiency considerations in our internal decision making and culture. This work is more forward looking – it aims to ensure we continue to strike the right balance over the longer-term. We are introducing new public performance measures to strengthen our public accountability (see Performance Measures).

Activity | BNK | SUP | INS | |

|---|---|---|---|---|

| Policy | Introducing further proportionality | ✓ | ✓ | ✓ |

| Simplifying the bank licensing framework | ✓ | - | - | |

| Promoting access to internal capital modelling | ✓ | - | - | |

| Promoting access to cost-effective reinsurance | - | - | ✓ | |

| Reducing capital requirements for annuities | - | - | ✓ | |

| Removing unnecessary or duplicative rules | ✓ | ✓ | ✓ | |

| Coordinating with peer agencies on payments reform | ✓ | - | - | |

| Supervision | Providing greater clarity of supervisory expectations relating to bank capital adjustments | ✓ | - | - |

| Data | Strengthening data sharing with other agencies | ✓ | ✓ | ✓ |

Policy priorities

- Introducing further proportionality: In the first half of 2025-26, APRA will consult on a proposal to formalise a third tier into our proportionality framework for banks. APRA’s existing policy framework is based on a two-tier system that differentiates prudential requirements between significant financial institutions (SFIs) and non-SFIs. A third tier will allow APRA to introduce more nuance into its prudential requirements of banks, reflecting different business models. Following APRA’s consultation with banks, APRA plans to turn its focus to the insurance and superannuation frameworks.

- Simplifying the bank licensing regime: In July 2025, APRA commenced consultation on proposed changes to its bank licensing regime. While APRA cannot control the flow of new applicants, it is important that our processes are as efficient as possible to give new entrants the best possible chance of success. Our goal is to reduce the time taken to process new bank license applications by around half, through providing greater clarity on APRA’s expectations and introducing greater formality within the framework.

- Promoting access to internal capital modelling: In the first half of 2025-26, APRA will consult on changes that aim to simplify and clarify our accreditation process that allows banks to use internal modelling for regulatory capital purposes. The use of internal models can result in moderately lower capital requirements, where banks can demonstrate sophisticated risk management. APRA’s proposed changes aim to improve transparency and implementation flexibility.

- Promoting access to cost-effective reinsurance: APRA is currently consulting with general insurers on ways to maintain access to affordable and appropriate reinsurance in the face of rising global costs. APRA will release further details on its proposals in the first half of 2025-26.

- Reducing capital requirements for annuities: APRA is currently consulting on a proposal to reduce prudential capital requirements for life insurers offering annuity products. APRA’s aim is to moderately lower the cost to life insurers of providing annuity products, helping to attract participants and support growth in the market. APRA plans to finalise its proposed changes in the second half of 2025-26.

- Removing unnecessary or duplicative rules: As part of APRA’s consultation on governance standards (see Strategic objective: Maintaining financial and operational resilience), APRA is exploring with industry opportunities to remove outdated or duplicative requirements. A key focus is addressing overlaps between reporting obligations under APRA’s fit and proper requirements and statutory obligations under the Financial Accountability Regime.

- Coordinating with peer agencies on payments reform: APRA will continue to work closely with government on proposed reforms to the regulation of Stored Value Facilities (SVF). These reforms aim to simplify the existing regulatory framework, to better support innovation and competition. Under the new regime, APRA plans for its prudential requirements of SVFs to be more streamlined than for banks, consistent with relative risks. 7 Following the establishment of the legislative framework for SVFs, APRA intends to consult on new prudential standards. The timing of consultation on draft legislation will be determined by the government.

Supervision priorities

Providing greater clarity of APRA’s supervisory expectations relating to capital adjustments: Throughout 2025-26, APRA will begin implementing changes to how it communicates with banks regarding adjustments to minimum capital requirements. These changes will provide banks with greater clarity on the reasons for the adjustment and the outcomes needed to address APRA’s concerns. APRA’s goal is that banks will be better able to take action to have capital adjustments lowered or removed. This work will complement broader initiatives to provide greater transparency of supervisory expectations across all industries, including communications on supervisory engagements.

Data priorities

Strengthening data sharing with other agencies: APRA will continue to explore opportunities to share data with other regulators, helping to reduce duplicative requests on entities.

4. Improving our organisational effectiveness

Data, technology and security: Informing risk-based decision-making

As the primary data collection authority for Australia’s financial system, APRA’s data collection responsibilities have expanded significantly in recent years. This growth reflects both emerging risks to the financial system, and new government policy initiatives, such as the superannuation performance test.

Like many public and private sector organisations, APRA has also intensified its focus on strengthening the resilience of its technology and data infrastructure in response to the increasing frequency and sophistication of cyber threats.

Unlocking the value of AI for APRA’s organisational effectiveness will be a key priority. APRA is well positioned to utilise AI to strengthen its regulatory and oversight capabilities, optimise existing resources and support innovation. APRA’s approach will build on existing foundations in a balanced way.

Recognising the broader scope of APRA’s role and the evolving operating environment, the Australian Government committed $73.2 million in additional funding through the FY2024-25 Federal Budget to enhance APRA’s data capabilities.

This funding will support five key initiatives aimed at strengthening APRA’s technology and data infrastructure. These investments also aim to equip APRA’s people with the data and insights needed to drive continued excellence in supervision.

- Implementing a secure cloud-based platform: By December 2025, APRA will launch a new cloud-based platform to support both current and future data collections. This platform will significantly enhance data analytics capabilities, delivering deeper and more timely insights. It will also improve data accessibility for supervisors, enabling more timely decision-making.

- Finalising the transition to APRA Connect: By December 2027, APRA plans to fully transition all data collections to APRA Connect and retire its legacy systems. The current platform requires substantial manual effort and validation, and this shift is expected to significantly reduce the compliance burden on industry. APRA estimates long-term savings for industry at approximately $6 million annually.

- Strengthening data governance and data management: APRA has established a Data Council of senior executives to oversee APRA’s data priorities. A key area of focus is identifying data collections that could be retired or streamlined to reduce burden on industry.

- Enhancing cyber security and privacy controls: APRA is strengthening its cyber security and privacy practices in alignment with key government frameworks and the Privacy Act. Ongoing improvements to existing controls are focused on safeguarding sensitive information and systems. Priority areas include the Australian Signals Directorate’s ‘Essential Eight’, the Protective Security Policy Framework, and the Australian Privacy Principles.

- Upgrading supervision management systems: To support integrated analytics, streamlined reporting and improved efficiency, APRA is implementing an enhanced supervision management system. The new platform is scheduled to go live in November 2025.

APRA’s people: Building capability in an inclusive and agile organisation

APRA relies on the expertise and judgement of its people to achieve its objectives. APRA has a highly engaged workforce, with a strong commitment to purpose. To maintain a highly engaged, capable and adaptive workforce, APRA will continue to:

- Invest in leadership skills and capabilities: APRA is empowering its people to grow as confident leaders while deepening their expertise in supervision, risk, data and policy. The investment reflects our commitment to building a future-ready organisation with leadership behaviours reinforced through training, leadership role modelling and clear performance expectations.

- Foster an inclusive culture: APRA will continue to enhance our position as a leading, inclusive employer. We will consult with staff in updating our Inclusion and Diversity strategy, building on our successes, and embracing future ways of working.

- Sharpen our approach to remuneration: We are reviewing the framework and increasing transparency of our approach to remuneration, whilst strengthening alignment of capability needs and individual performance.

Supervision excellence

In a rapidly complex and dynamic operating environment, APRA must continue to evolve and strengthen its supervisory capability. The ability to respond swiftly and effectively to emerging risks depends on having skilled supervisors with deep expertise. To support this, APRA will continue to invest in its people and tools through the following initiatives:

- Building capability: to enhance supervisory and industry expertise, APRA will establish a supervisory development centre. Building on existing training programs, this will deliver immersive, scenario-based training designed to empower supervisors with the skills and confidence to navigate complex challenges. The focus will be on strengthening core supervision capabilities and fostering continuous professional growth.

- Smartening our supervision tools: APRA is strengthening its data analytics and data science capabilities, enabled by an enhanced technology toolkit. These changes will equip supervisors with real-time information and insights across entities, industries and geographies.

- Sharpening frameworks and methodology: APRA will continue to review and refine its supervision framework to ensure our methodologies remain fit for purpose and aligned with the evolving risk landscape.

Footnotes

4 In 2024/25, APRA conducted seven policy and reporting consultations. This compares to 20 in 2023/24, a reduction of 65 per cent.

5Information Security Obligations and Critical Authentication Controls

6 These reviews focus on assessing the resilience of the financial sector, the quality of the regulatory and supervisory framework, and the capacity to manage and resolve financial crises.

7 APRA would be responsible for regulating large SVF providers and issuers of Payment Stablecoins. Payment stablecoins are digital assets linked to the value of a fiat currency that could be widely used to make payments. For the proposed legislation, they are also referred to as tokenised SVFs.

A robust performance measurement framework is essential for APRA to remain a high-performing regulator and to demonstrate to stakeholders that its regulatory functions are effective and resources are well-managed. Over the past year, APRA has undertaken a comprehensive review of its performance measures to ensure its reporting framework aligns with best practice under the PGPA Act.

APRA’s revised performance measures are more outcomes focused. This will enable APRA to better communicate the impact of its achievements for the community. A key change to the framework has been a stronger emphasis on competition and efficiency considerations to better demonstrate how APRA is minimising any undue cost of regulation for industry. APRA’s performance measures will continue to be refined over the coming years.

Objective 1. Financial safety and stability

| Outcome | Performance measure | Target |

|---|---|---|

| APRA-regulated entities are financially resilient | Reported prudential capital ratios for banks and insurers | Low incidence of banks and insurers falling below minimum requirements |

| Standard & Poor’s risk rating for the Australian banking system | Low risk rating for the Australian banking industry institutional framework | |

| APRA-regulated entities are operationally resilient | Qualitative assessment of operational disruptions at APRA-regulated entities | Low incidence of operational disruptions that materially affect beneficiaries |

| Superannuation funds are managing funds in members’ best financial interests | Number of superannuation members exposed to unsustainable funds | Reduction during the reporting period or zero |

| Number of superannuation members in MySuper or Choice products that fail the Performance Test | Reduction during the reporting period or zero | |

| APRA supervisors are holding regulated entities to account for addressing material prudential risks | APRA-regulated entities are subject to formal APRA remediation for longer than 12 months 8 | Low incidence of regulated entities over the reporting period |

| Stakeholders agree that APRA's supervision enhances the financial and operational strength of regulated entities | 80 per cent or more of survey respondents | |

| The financial system can withstand future stress | Stress test results at an industry level | Stress test results indicate that the industry can withstand a severe, plausible shock without breaching minimum requirements |

| In the event of an entity failure, Australian beneficiaries are protected | Money Protection Ratio (MPR) | Low incidence of loss |

| Performing entity ratio (PER) | Low incidence of failure |

Objective 2. Regulatory balance and transparency

| Outcome | Performance measure | Target |

|---|---|---|

| APRA adequately balances competition and efficiency considerations | Stakeholders agree that APRA effectively pursues financial safety, balanced with considerations of efficiency, competition, contestability and competitive neutrality, and promotes financial stability | 80 per cent or more of survey respondents |

| Qualitative assessment based on trends in banks’ lending | The prudential framework does not unduly restrict banks’ ability to lend to households and businesses | |

| Larger and more complex entities are subject to more stringent prudential requirements | Qualitative assessment based on new material policy consultations | Non-SFIs are subject to simpler requirements or other transitional support, where appropriate |

| Larger and more complex entities are subject to more heightened supervisory demands | Number of formal supervisory engagements for large and complex entities compared to small and less complex | On average, Tier 1 entities are subject to significantly more formal supervisory engagements than Tier 4 entities |

| APRA’s policy changes are subject to external scrutiny | Policy consultations undertaken | All major policy proposals are subject to public review and APRA publicly responds to issues raised by external stakeholders |

Objective 3. Organisational effectiveness

| Outcome | Performance measure | Target |

|---|---|---|

| APRA’s communication is clear | Stakeholders agree that APRA’s prudential standards are effective in communicating APRA’s requirements | 80 per cent or more of survey respondents |

| APRA manages its financial resources efficiently | Budgeted versus actual expenditure | Within budget |

| APRA manages its operations efficiently | Delivery of services are in line with commitments to stakeholders (Service Charter) | 100 per cent |

| APRA connect data submissions complete within 1 hour | 99 per cent or more |

APRA will report on its performance against these measures in the Annual Performance Statement that will be included in its 2025-26 Annual Report.

APRA’s delivery of its 2025-26 Corporate Plan is supported by effective risk management practices. These include robust internal governance and accountability mechanisms, supported by sustained focus on risk awareness to strengthen risk culture across the organisation.

APRA’s system of risk oversight, management and internal controls is aligned with section 16 of the PGPA Act, including the Commonwealth Risk Management Policy.

APRA also comes under the jurisdiction of the National Anti-Corruption Commission, an independent Commonwealth agency responsible for detecting, investigating, and reporting on serious or systemic corrupt conduct in the Commonwealth public sector.

APRA’s Enterprise Risk team oversees the administration of the Enterprise Risk Management Framework while the Internal Audit function provides independent assurance on the effectiveness of internal controls, risk management and governance across the organisation.

Governance

APRA’s risk profile is governed through four key committees:

- Executive Board: comprising APRA Members and chaired by the Accountable Authority (i.e. the Chair), it is responsible for overseeing APRA’s performance against its mandate. This committee is focused on ensuring that a sound framework of internal control, risk management and compliance is established and maintained. It also monitors APRA’s risk profile to ensure that risks are being managed within APRA’s stated risk appetite or actions are being taken to bring risks back within appetite.

- Executive Committee: comprising all APRA Members and the Executive Directors, and chaired by the Accountable Authority. The Executive Committee focuses on strategy, overseeing the execution of the corporate plan and scanning of the external environment.

- Management Committee: comprising APRA’s Executive Directors and chaired by APRA’s Chief of Staff, this committee oversees day-to-day operations. The Management Committee provides an oversight of how APRA’s Enterprise Risk Management Framework is being implemented and embedded across the organisation and is responsible for escalating to the Executive Board significant risk matters for consideration. These include risks outside of appetite.

- Audit and Risk Committee: consisting of three independent members, it provides an independent view to the Accountable Authority on the operation of APRA’s Enterprise Risk Management Framework.

APRA’s Chief Risk Officer provides regular reports to governance committees on key risks along with any material breaches, incidents, and or instances of non-compliance with or material deviation from the Enterprise Risk Management Framework.

Risk management framework

The Enterprise Risk Management Framework enables APRA to identify, assess, manage, and report the key risks relating to the delivery of APRA’s 2025-26 Corporate Plan.

The Enterprise Risk Management Framework is embedded through a range of training and awareness activities to support the role of all APRA staff in managing risks.

In addition to APRA’s centralised Risk Management and Compliance team that administers the Enterprise Risk Management Framework, APRA’s Internal Audit function independently evaluates the effectiveness of internal controls, risk management and governance processes throughout APRA.

Key risks

A description of APRA’s key risks and mitigating actions is outlined below, together with their connection with APRA’s core functions, capabilities, and strategic priorities.

| Key risk focus | Mitigating actions |

|---|---|

| Inability to achieve the Corporate Plan objectives due to insufficient capacity and capability and organisational mechanisms to manage competing priorities. |

|

| Inability to pivot and effectively respond to unexpected operating environment changes and manage the impact of initiative deferrals. |

|

| APRA’s prudential policies and supervision activities are not aligned with APRA’s purpose to protect the financial interests of the Australian community. |

|

| Inadequate operational resilience to effectively secure APRA’s people, data, and third-party services, and ensure the continuity of business operations in a heightened internal and external threat environment. |

|

| APRA’s people (and enabling processes) do not act with integrity or in compliance with APRA’s values and obligations resulting in scenarios such as regulatory capture, which impacts on staff wellbeing and erodes APRA’s reputation. |

|