A new pathway to internal ratings-based (IRB) accreditation for medium-sized ADIs

Executive summary

The internal ratings-based (IRB) approach is one of two methods APRA permits to calculate authorised deposit-taking institution (ADI) capital requirements for credit risk. The IRB method is an advanced approach that involves more granular and precise risk measurement which helps to align capital more closely with risk. To be accredited for the IRB approach, an ADI must demonstrate sophisticated risk management.

Some medium-sized ADIs are interested in securing accreditation to use the IRB approach given the potential for improved risk management practices to lead to lower capital requirements. The difference in capital outcomes under the two approaches is relatively small and has narrowed significantly due to the introduction of output floors and other adjustments. The Council of Financial Regulators (CFR) and Australian Competition and Consumer Commission (ACCC) review into small and medium-sized bank competition concluded that the current difference between the two approaches is appropriate.1

To make IRB accreditation more attainable for medium-sized ADIs, APRA has reviewed the accreditation process. While APRA has adjusted the IRB accreditation process in the past to make it more accessible, APRA committed to further improve the process as part of the CFR review.2

Through its industry engagement, APRA has identified two potential barriers to achieve accreditation by medium-sized ADIs. First, some stakeholders consider that despite APRA’s previous changes, the process remains too expensive, resource intensive and time consuming. Second, there is a perception of insufficient transparency about how the process operates.

As one part of a series of reforms APRA is undertaking to ‘get the balance right’, this paper outlines proposals to introduce a new streamlined pathway to IRB accreditation. APRA proposes to allow ADIs to:

- select a single portfolio, such as residential mortgages, for the initial phase of IRB accreditation;

- permanently carve-out a larger proportion of exposures from IRB accreditation;

- fully recognise any capital benefit at each stage of a phased accreditation when core requirements are met;

- phase in the additional IRB capital requirement;

- phase in the use of models for interest rate risk; and

- take an extra year to complete the full accreditation process.

In addition to these measures, APRA proposes to make it easier for ADIs to access some of the flexibility available under the current accreditation process. APRA will also improve the transparency of the accreditation process by clarifying the engagement that an applicant can expect from APRA as well as simplify some documentation requirements.

In combination, APRA expects these measures to make IRB accreditation more attainable for some medium-sized ADIs. However, IRB accreditation will still require a meaningful investment of time and resources. APRA does not propose to lower the standards it expects ADIs to achieve. Rather, the proposed new pathway will allow a more incremental approach that can be implemented over a longer period with any capital benefits realised along the way.

Alongside changes to IRB accreditation, APRA is also taking this opportunity to consult on some unrelated minor amendments to the IRB prudential standard and practice guide. These minor changes aim to provide additional clarity to ADIs and address typographical errors. They are not intended to change APRA’s policy position.

APRA invites written submissions in response to this consultation paper by 19 December 2025 and intends to finalise changes in the first half of 2026.

Glossary

| ADI | Authorised deposit-taking institution |

| APG 113 | Prudential Practice Guide APG 113 Capital Adequacy: Internal Ratings-based Approach to Credit Risk |

| APRA | Australian Prudential Regulation Authority |

| APS 112 | Prudential Standard APS 112 Capital Adequacy: Standardised Approach to Credit Risk |

| APS 113 | Prudential Standard APS 113 Capital Adequacy: Internal Ratings-based Approach to Credit Risk |

| APS 117 | Prudential Standard APS 117 Capital Adequacy: Interest Rate Risk in the Banking Book |

| CFR | Council of Financial Regulators |

| CPG 235 | Prudential Practice Guide CPG 235 Managing Data Risk |

| IRB approach | Internal ratings-based approach to credit risk as defined in APS 113 |

| IRB accreditation | The requirements for, and process of, seeking initial approval from APRA to use the IRB approach as set out in APS 113 and APG 113 |

| IRRBB | Interest rate risk in the banking book |

| RWA | Risk-weighted assets |

| Standardised approach | Standardised approach to credit risk as defined in APS 112 |

Chapter 1 – Introduction

APRA’s regulatory capital requirements for ADIs are based on risk-weighted assets (RWA). Risk weights help align capital requirements with risk by reflecting the riskiness of loans and other exposures. This helps to ensure that ADIs hold a level of capital that is commensurate with the risk profile of their business.

Most ADIs use the standardised approach to calculate capital requirements for credit risk, under which risk weights for different exposures are prescribed by APRA. The standardised approach – which is designed to cater for a wide range of ADIs – combines simplicity and conservatism. APRA’s approach is largely based on the internationally agreed framework developed by the Basel Committee on Banking Supervision, with some modifications for Australian circumstances and risks.

Sophisticated ADIs can seek APRA accreditation to calculate RWAs using their internal risk models. The aim of the IRB approach is to facilitate more granular and accurate risk measurement and thus align capital more closely with risk.3 The IRB approach involves ADIs estimating the loss rate for different exposures based on their own methods and data.

ADIs must be accredited by APRA to use the IRB approach. This is to ensure that their internal risk models are sufficiently robust. APRA expects IRB ADIs to demonstrate an advanced approach to risk and capital management across all of their material risks, and not to be motivated by ‘cherry-picking’ between the IRB and standardised approaches based on the capital outcome. IRB banks are also subject to more stringent regulatory requirements and intensive prudential supervision than ADIs that use the standardised approach.

The IRB approach is currently used by the four major Australian ADIs, Macquarie Bank and ING Bank Australia. Some other medium-sized ADIs are interested in achieving IRB accreditation given the potential for accreditation to support improved risk management practices and lower capital requirements. These ADIs suggest that IRB accreditation would assist them in competing with larger ADIs, especially for residential mortgages.4

The CFR and ACCC review into small and medium-sized bank competition considered the difference in credit risk weights under the two approaches, including APRA’s estimate that it only had a small impact on mortgage pricing.5 The review found that the difference between the two approaches is much smaller in Australia than observed in peer jurisdictions. APRA has carefully calibrated capital requirements to ensure the difference between IRB and standardised risk weights is appropriate. The difference has narrowed as a result of capital floors and other adjustments to the IRB approach.

APRA considers that it is appropriate for there to be a small difference between IRB and standardised risk weights. Lower IRB risk weights help incentivise ADIs to invest in advanced modelling and risk management practices. APRA does not propose to reduce the higher risk management expectations that it places on IRB ADIs. However, it considers there is merit in making its expectations more transparent and introducing further flexibility into the IRB accreditation process.

Through its industry engagement, APRA has identified two potential barriers to IRB accreditation that medium-sized ADIs face:

- First, while APRA has previously modified its IRB accreditation process to make it more accessible, some stakeholders still view achieving IRB accreditation as expensive and resource intensive. Some ADIs reflected that the requirement for the simultaneous upgrade of models, systems and risk management capability has presented a material challenge for them.

- Second, stakeholders have argued that the process for achieving IRB accreditation could be more transparent. Greater clarity about expectations and timelines for each stage of the process could address the perception that the process of IRB accreditation is too long and uncertain.

To help address these issues, this consultation paper proposes a new more flexible pathway to achieve IRB accreditation:

- Allowing a single portfolio as the initial phase: ADIs would be permitted to begin accreditation with a single portfolio of credit exposures, for example residential mortgages. Permitting the selection of a single portfolio in the initial phase of accreditation could make the process less onerous and help ADIs build capacity while giving them additional time to demonstrate maturity in modelling other portfolios.

- Additional permanent carveouts: ADIs will be able to use the standardised approach for more residual exposures e.g. portfolios that are in run-off or are immaterial in size, or where data challenges impede the development of credible models.

- Earlier recognition of any capital benefit: ADIs will be allowed to realise any capital benefits of the IRB approach sooner. Currently, an ADI must wait until almost all the ADI’s exposures are subject to the IRB approach before it can fully recognise any capital benefits from the IRB approach. APRA proposes that ADIs will be allowed to fully recognise lower risk weights at each stage of the process.

- Phasing in the additional IRB capital requirement: APRA is proposing to phase in the additional IRB capital requirement (rather than requiring the full amount to be held on initial accreditation).

- Phased accreditation for interest rate risk: ADIs will be given more time to achieve IRB accreditation in relation to Interest Rate Risk in the Banking Book (IRRBB). This means ADIs could achieve IRB accreditation for credit risk and IRRBB sequentially rather than simultaneously. A RWA amount commensurate with the interest rate risk of the ADI’s portfolio would apply at initial IRB accreditation.

- More time to complete accreditation: APRA would allow ADIs more time to complete a phased IRB accreditation. We will extend the timeframe from 2 years to 3 years.

In addition to these measures, APRA proposes to clarify some existing flexibility available under the current framework. APRA will improve the transparency of the accreditation process by clarifying its expectations at each distinct IRB accreditation stage, including the engagement that an applicant can expect from APRA, as well as simplifying some documentation requirements.

Chapter 2 of this consultation paper sets out in more detail how APRA proposes to increase the flexibility of its IRB accreditation approach for medium-sized ADIs.

Chapter 3 explains how APRA proposes to improve the transparency of the accreditation process, including the expected engagement and timeframes for feedback and decisions.

In combination, APRA considers that these proposals will reduce some barriers to IRB accreditation for medium-sized ADIs while maintaining the ultimate integrity of the IRB approach. The objective of the proposals in this paper is broadly consistent with the UK Prudential Regulation Authority’s (PRA) recent consultation considering options for internal models for medium-sized firms for residential mortgage portfolios. Like APRA, the PRA is retaining necessary high standards for IRB accreditation, including the fundamental expectation that IRB firms demonstrate robust modelling capabilities, high-quality systems, processes and risk management.

For smaller ADIs, these changes are less relevant. The use of the standardised approach to calculating capital requirements is likely to remain more appropriate for smaller ADIs. International experience shows the benefit of IRB accreditation is unlikely to outweigh the costs for smaller ADIs.

Chapter 2 – A new more flexible pathway

This chapter sets out how APRA proposes to create a new more flexible pathway to IRB accreditation, with APRA proposing additional flexibility in several key areas. The chapter also provides greater clarity on the existing flexibility available to IRB applicants in the current framework.

Introducing additional flexibility

Phased modelling of material credit portfolios

Where it is not practical for an ADI to implement the IRB approach across all portfolios at the same time, an ADI may already be permitted to use a ‘phased roll-out’ approach to IRB accreditation (Prudential Standard APS 113 Capital Adequacy: Internal Ratings-based Approach to Credit Risk (APS 113), paragraph 48). However, APRA has not explicitly stated whether selection of a single portfolio in the initial phase is acceptable.

To create a graduated pathway to IRB accreditation, APRA proposes to allow that the initial phase of accreditation may comprise a single credit portfolio, for example residential mortgage portfolios, subject to certain expectations (see draft APS 113, paragraphs 48 - 50). Permitting selection of a single portfolio in the initial phase of accreditation would allow ADIs additional time to demonstrate maturity in modelling other material credit portfolios.

Permanent carve-outs from the IRB approach

While IRB ADIs may already be approved to use the standardised approach on a permanent basis (‘permanent partial use’), this is only allowed in exceptional circumstances, such as where business activities are immaterial in terms of size and perceived risk profile (APS 113, paragraph 51).

To facilitate a quicker pathway to accreditation, APRA proposes to allow ADIs to continue using the standardised approach in a broader range of circumstances (see draft APS 113, paragraph 51). For example, the use of the standardised approach might be appropriate for portfolios that are in run-off or immaterial in size or where data challenges impede the development of credible models.

APRA expects that ADIs would continue to have sound reasons for permanent partial use. Ongoing use of the standardised approach should remain limited given the expectation for IRB ADIs to model all material credit portfolios.

Realising potential benefits of accreditation

While APRA currently permits phased implementation of the IRB approach across all material portfolios, a significant portion (at least 50 per cent) of any expected regulatory capital benefit from accreditation would generally become available only after an ADI has completed all phases (Prudential Practice Guide APG 113 Capital Adequacy: Internal Ratings-based Approach to Credit Risk (APG 113), Attachment D, sub-paragraph 6(b)). This guidance aims to incentivise ADIs to fully implement the IRB approach across all material portfolios in a timely manner.

Upon reviewing this guidance, APRA considers that there are sufficient incentives in place to encourage ADIs to complete phased implementation within a reasonable timeframe. Therefore, APRA proposes to revise APG 113 so that any capital benefit of accreditation could be fully realised at each phase of the process (see draft APG 113, paragraph 162).6 This would allow any benefits of IRB accreditation to be realised earlier.

APRA would retain the discretion to impose capital overlays or other approval conditions to address any areas of non-compliance and/or decreased confidence in an ADI’s ability to progress to full implementation.

Additional IRB capital requirement

For IRB applicants seeking phased accreditation, APRA proposes to phase in the additional Common Equity Tier 1 (CET1) capital requirement that applies to IRB ADIs.7 Specifically, the additional IRB capital requirement will not be applied to portfolios that are proposed to transition to IRB as part of a later phase until relevant accreditation has been achieved.

For example, an IRB applicant applies to use the IRB approach in two phases, with residential mortgage exposures in the first phase ($50 risk-weighted assets), corporate exposures in the second phase ($40 risk-weighted assets) and all other exposures permanently on the standardised approach ($10 risk-weighted assets). Based on the additional capital buffer of 125 basis points IRB ADIs are currently required to hold, the additional IRB capital requirement would be 125 bps x ($50 + $10) = $0.75 at the initial phase of accreditation and 125 bps x ($50 + $10 + $40) = $1.25 after full roll-out of the IRB approach.

Interest rate risk in the banking book

Under APS 113 (paragraph 45) and Prudential Standard APS 117 Capital Adequacy: Interest Rate Risk in the Banking Book (APS 117) (paragraph 18), an IRB applicant must also seek approval to use an internal risk measurement model for IRRBB.

To facilitate a more graduated pathway to accreditation and allow ADIs additional time to demonstrate maturity in IRRBB modelling, APRA proposes to provide flexibility on timing by permitting IRB accreditation and IRRBB accreditation to occur in phases where appropriate (subject to certain risk mitigants – see draft APG 113, paragraph 161). That is, the ADI may be approved to use the IRB approach, and eligible to realise the benefits of IRB accreditation, ahead of obtaining IRRBB accreditation. A RWA amount commensurate with the interest rate risk of the ADI’s portfolio will apply at initial IRB accreditation.

Phased implementation criteria

APRA’s current guidance is that phased implementation of the IRB approach across all material portfolios and business units should be completed within a reasonably short timeframe; typically, no more than two years (APG 113, Attachment D, sub-paragraph 6(b)).

To provide additional flexibility, APRA proposes to change its guidance and extend the deadline to three years (see draft APG 113, sub-paragraph 162(a)). APRA also proposes to remove the requirement in current guidance for ADIs to demonstrate, at the time of initial approval, that key APS 113 requirements are met for all other material portfolios in addition to the portfolio(s) in the initial phase (APG 113, Attachment D, sub-paragraph 6(e)).

Clarifying existing flexibility

Threshold for accreditation

APS 113 sets out the requirements that an IRB applicant must satisfy at the time of initial implementation, while APG 113 aims to assist ADIs in complying with these requirements. However, APS 113 and APG 113 do not explicitly state the threshold for IRB accreditation. In practice, APRA does not expect full compliance at the time of initial IRB approval.

To clarify the flexibility available to IRB applicants in the existing framework, APRA proposes that an ADI may be approved to use the IRB approach for regulatory capital purposes where it is materially compliant with APS 113 (subject to certain requirements – see draft APS 113, paragraph 44).8

To mitigate the risk that gaps to full compliance with APS 113 are not addressed in a timely manner, APRA may impose a capital overlay and/or other approval conditions on the ADI. Additionally, where an ADI has existing remediation plans or enforceable undertakings in place that link to key accreditation requirements, APRA expects that any relevant workstreams should be completed prior to initial IRB approval being given.

Use and experience

To be accredited to use the IRB approach, ADIs must meet the use test in APS 113 (Attachment D, paragraphs 67 - 68). This is intended to ensure that models have not been built purely for regulatory purposes but are an integral component of an ADI’s risk and capital management framework. There is a strong connection between the use test and APRA’s expectations for advanced risk and capital management in relation to credit risk. An IRB applicant must also meet the experience requirement in APS 113 (paragraph 44) and demonstrate they have been using models that are broadly in line with APS 113 requirements for at least three years prior to an IRB approval being given.

To improve transparency, APRA proposes to further clarify expectations in APG 113. In general, APRA takes a pragmatic approach in assessing ADIs against the use and experience requirements, with the overall objective of ensuring that there is meaningful challenge arising from the use of models for internal purposes, thereby supporting the accuracy, robustness and timeliness of the models that are intended to be used for regulatory capital.

Data management

IRB ADIs are expected to have sound data to support the development, validation and use of internal models. APRA’s general expectations for prudent data management are outlined in Prudential Practice Guide CPG 235 Managing Data Risk (CPG 235). However, an ADI’s IRB data management practices need not be consistent with all aspects of CPG 235 at the time of initial approval, provided the ADI has adequate mitigants in place to address data limitations.

To improve transparency, APRA proposes to clarify these expectations in APG 113.

Advanced risk and capital management expectations

The ability to demonstrate advanced risk and capital management is a fundamental expectation of an IRB applicant (APG 113, Attachment D, paragraphs 1 - 2). To provide more clarity and simplify expectations, APRA proposes to amend the guidance on advanced risk and capital management in APG 113 by:

- including a clearer definition of advanced risk and capital management; and

- streamlining the criteria from 14 to 6.

Table 1: Proposed criteria for advanced risk and capital management

| Criteria | Description |

|---|---|

| Governance and oversight | The ADI clearly articulates the roles of the Board and senior management in overseeing advanced risk and capital management. The Board would typically be involved in the decision to implement an advanced approach to risk and capital management for material risks, and how it fits in with the ADI’s strategy, risk appetite and risk management framework. Management would focus more on oversight of effective implementation and use of outputs in understanding the risk profile. |

| Resourcing capability and capacity | The ADI’s risk management function includes sufficient independent specialist risk resources with appropriate technical skills for each material risk. |

| Risk management framework | The ADI’s risk management framework facilitates reasonable and risk-sensitive quantitative estimates of risk including the potential for severe losses. |

| Management awareness | The ADI’s business line management is able to clearly articulate the drivers of its risk profile. |

| Internal capital assessment | Each material risk is considered as a distinct risk class within the ADI’s internal capital adequacy assessment process (ICAAP) with common quantitative elements used as part of both the risk and capital management frameworks. The ADI’s approach to internally estimating required capital includes estimates for all material risks and is capable of attributing capital for those risks to the ADI and any material business lines. |

| Use in risk management | The ADI uses risk measurement inputs and outputs to inform risk management, monitoring and oversight. Some examples include managing risk positions, setting risk limits and delegations, pricing and performance measurement. |

Chapter 3 – A more transparent process

To make IRB accreditation more transparent, this chapter provides further clarity on APRA’s expectations at each distinct IRB accreditation stage. It also clarifies the engagement the ADI can expect throughout the process to facilitate feedback. Further, it reaffirms timelines for decisions as well as simplifies some documentation requirements.

IRB accreditation process

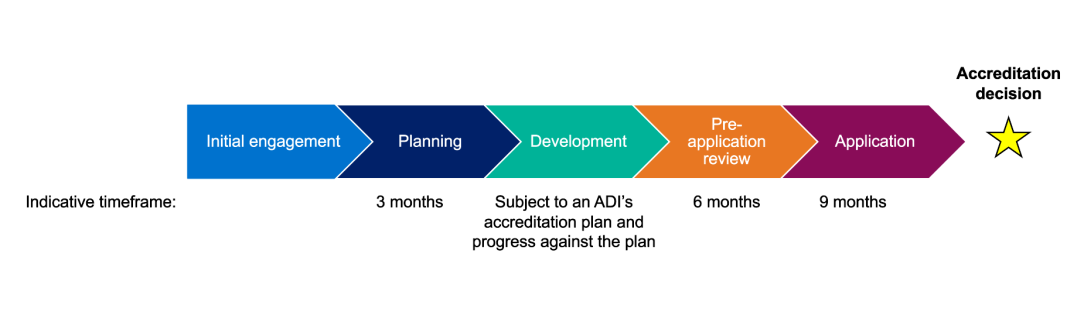

The IRB accreditation process is the end-to-end process from when an ADI indicates its intention to apply for IRB approval to APRA’s accreditation decision. The proposed accreditation process comprises five distinct stages (initial engagement, planning, development, pre-application review and application), with defined engagement points at each stage.

Initial engagement

The initial engagement stage allows early engagement between APRA and prospective IRB applicants. In considering whether to pursue accreditation, an ADI is encouraged to approach APRA at an early stage to discuss its thinking and ensure that it has the appropriate information to support its decision.

APRA proposes to clarify that key considerations for an ADI at this stage are:

- the extent to which the ADI has, or plans to implement, an advanced approach to risk and capital management for its material risks;

- the availability and quality of data and supporting infrastructure for modelling purposes; and

- the technical capability of the ADI’s resources.

Based on initial engagement with an ADI, APRA would endeavour to provide feedback on whether IRB accreditation may be suitable and achievable for the ADI.

Planning

During the planning stage, an ADI would have made the decision to seek IRB approval and commenced the development of a high-level plan for IRB accreditation.

APRA proposes to clarify that development of the accreditation plan is expected to involve an assessment of the ADI’s current state of preparedness for IRB accreditation, identifying key actions needed to achieve the target state and ultimately demonstrate IRB readiness, and setting high-level timeframes for completing those actions. As inputs to the plan, the ADI is also encouraged to consider:

- the scope of a potential IRB application and what portfolios would remain on the standardised approach on a permanent basis (permanent partial use);

- whether a phased implementation approach (i.e. phased IRB roll-out or phased implementation of the IRB approach and an advanced approach for IRRBB) would be pursued. Where the ADI elects to seek a phased approach, consideration would be given to the number of phases, the portfolios and/or risks in the scope of each phase, and the timeframes for each phase; and

- what specific IRB approaches would be implemented.9

As part of this stage, the ADI is also expected to confirm that it is committed to making the necessary investment in achieving accreditation and there is appropriate support from the ADI’s Board and senior management.

Based on a review of the ADI’s assessment of its current state and the high-level accreditation plan, APRA would aim to provide timely feedback on the suitability and feasibility of the ADI’s proposed pathway to accreditation, including the scope of a potential IRB application, phased implementation approach (where applicable) and target accreditation start date. An indicative timeframe for the planning stage is three months.

Development

In the development stage, the ADI would have commenced the development of internal models and frameworks to meet key APS 113 requirements in line with its accreditation plan.

APRA proposes to clarify that, during this stage, we are open to providing feedback to the ADI on key model development decisions (for example, high-level methodology, definitions and data treatments) and sharing key accreditation learnings. APRA, in consultation with the ADI, may also commence regular engagement during this stage. Once regular engagement commences, the ADI would generally be expected to start paying a levy that is imposed on IRB applicants to recover the costs incurred by APRA during the accreditation process.

The development stage is expected to be the longest stage of the accreditation process and is highly dependent on the ADI’s accreditation plan and its progress against that plan.

Pre-application review

APRA proposes to clarify that, prior to the submission of an application to use the IRB approach, we would undertake a pre-application review of an ADI’s internal models and other key accreditation components such as use and experience. The purpose of the pre-application review would be to support the ADI’s readiness for an IRB application and identify any material issues that may need to be addressed prior to an IRB approval being given.

APRA also proposes to clarify that a pre-application review of an ADI’s internal models would generally only occur when the final models proposed for regulatory capital purposes have been developed, fully documented and validated. The final models need not be implemented at this stage. The pre-application review of models would focus primarily on model design.10 APRA would be willing to undertake staggered reviews of models to provide more timely feedback to the ADI.

The timeframe for the pre-application review stage is dependent on the number and complexity of an ADI’s internal models and whether staggered reviews are undertaken but is generally expected to take no more than six months.

Following the pre-application review stage, and prior to submitting an accreditation application, an ADI may need to undertake further work on the models or other key accreditation components to address any material issues raised by APRA. The ADI would also ensure robust implementation of the final models.

Application

The application stage would commence once an ADI submits its application for IRB approval to APRA. The documentation needed for an IRB application is set out in APG 113. To simplify the accreditation process, APRA proposes to streamline this documentation.

During the application stage, an IRB applicant is expected to ensure that:

- it has implemented a validation and control framework consisting of policies, procedures and human capital and encompassing both quantitative and qualitative aspects of the internal models and ratings;

- at least two quarters of parallel run have been completed;

- at least one cycle of annual validation and governance processes have been applied to the final models proposed for regulatory capital purposes; and

- use and experience requirements are met.

APRA proposes to clarify that an ADI may utilise part of the application stage to meet these expectations; however, all aspects would need to be completed at least three months from the target accreditation start date.

In assessing an ADI’s accreditation application, APRA would undertake a range of onsite and offsite reviews of the ADI. APRA is committed to continuing regular engagement with the ADI during the assessment process and providing timely feedback on the application. APRA would also provide an opportunity for the ADI to respond to any material issues raised.

APRA also proposes to reaffirm our commitment to providing an accreditation decision within nine months of an ADI submitting a complete application to APRA. For clarity, APRA’s decision timeframe commences from when a complete application is received, regardless of whether an incomplete application has previously been provided. APRA would aim to provide early feedback on the completeness of the ADI’s application to facilitate a timely accreditation decision.

Where an ADI’s accreditation application is likely to be successful, APRA would consider the need for any capital overlays and/or other conditions on the ADI’s IRB approval. These aspects would be discussed with the ADI during the application stage and are expected to be addressed in a timely manner post accreditation.

Chapter 4 – Consultation and next steps

APRA invites written submissions on the proposals set out in this consultation paper. Written submissions should be sent to policydevelopment@apra.gov.au by 19 December 2025 and addressed to:

General Manager, Policy

Policy and Advice Division

Australian Prudential Regulation Authority

APRA plans to finalise amendments to the IRB prudential standard and practice guide in the first half of 2026.

Important disclosure notice – publication of submissions

All information in submissions will be made available to the public on the APRA website, unless a respondent expressly requests that all or part of their submission is to remain in confidence. Automatically generated confidentiality statements in emails do not suffice for this purpose. Respondents who would like part of their submission to remain in confidence should provide this information marked as confidential in a separate attachment.

Submissions may be the subject of a request for access made under the Freedom of Information Act 1982 (FOIA). APRA will determine such requests, if any, in accordance with the provisions of the FOIA. Information in the submissions about any APRA-regulated entity that is not in the public domain and that is identified as confidential will be protected by section 56 of the Australian Prudential Regulation Authority Act 1998 and will therefore be exempt from production under the FOIA.

Attachment A – Summary of proposed changes

| Category | Existing | Proposed | Available Risk Mitigants | Expected Benefit |

|---|---|---|---|---|

| Phased modelling of material credit portfolios | No explicit guidance on whether selection of a single portfolio in the initial phase of accreditation is acceptable | Permit the initial phase of accreditation to comprise a single portfolio where appropriate for the size, business mix and complexity of the ADI |

|

|

| Permanent carveouts from the IRB approach | Permanent partial use is permitted in exceptional circumstances only | Permit permanent partial use in limited circumstances where appropriate for the size, business mix and complexity of the ADI |

|

|

| Realising the benefits of accreditation | At least 50% of any capital benefit would only become available after completion of all phases | Permit the capital benefit from accreditation to be fully realised at each phase |

|

|

| Additional IRB capital requirement | Applies to all portfolios from the initial phase of accreditation | Would only apply to portfolios proposed to transition to IRB when accreditation is complete | N/A |

|

| IRRBB | IRRBB approval must be sought at the same time as IRB approval | Permit the use of the IRB approach for regulatory capital purposes ahead of IRRBB accreditation where appropriate for the size, business mix and complexity of the ADI |

|

|

| Phased implementation criteria | Phased implementation timeframe of up to two years | Permit a phased implementation timeframe of up to three years |

|

|

| Phased implementation criteria | At the time of initial approval, key APS 113 requirements are expected to be met for all other material credit portfolios in addition to the portfolio(s) in the initial phase | Remove the expectation that, at the time of initial approval, key APS 113 requirements are met for material credit portfolios not in the initial phase |

|

|

| Threshold for accreditation | Threshold for accreditation is not explicitly outlined in APS 113 | Clarify that material compliance with APS 113 may be sufficient to be accredited |

|

|

| Threshold for accreditation | Threshold for accreditation is not explicitly outlined in APG 113 | Clarify that an ADI's practices need not be consistent with all aspects of APG 113 at the time of initial approval | N/A |

|

| Use, experience and data management | High-level guidance in APG 113 | Clarify expectations for use, experience and data management | N/A |

|

| Advanced risk and capital management expectations | Detailed criteria in APG 113 | Simplify and clarify expectations for advanced risk and capital management | N/A |

|

| Accreditation process | High-level description of the accreditation process in APG 113 | Simplify and clarify the end-to-end accreditation process | N/A |

|

Footnotes

1 See section 5.2 Bank capital requirements in Review into Small and Medium-sized Banks - Consultation – Council of Financial Regulators.

2 See Action 2 in section 1.6 under Recommendations and actions targeted at more proportionate regulation in Review into Small and Medium-sized Banks - Consultation – Council of Financial Regulators.

3 See Is the capital benefit of being an advanced modelling bank justified? | APRA and Demystifying credit risk capital requirements for housing loans | APRA.

4Non-confidential submissions to the CFR and ACCC review into small and medium-sized bank competition will be available at https://www.cfr.gov.au.

5APRA estimated the mortgage loan pricing differential to be approximately 5 basis points at that point in time. For further details, see section 5.2 Bank capital requirements in Review into Small and Medium-sized Banks - Consultation – Council of Financial Regulators.

6 APRA proposes to move Attachment D of APG 113 on initial IRB approval to become the new Chapter 9 of draft APG 113 that has been released as part of this consultation package.

7 See sub-paragraph 27(b) of Prudential Standard APS 110 Capital Adequacy.

8APRA also proposes to clarify that an ADI’s practices need not be consistent with all aspects of APG 113 at the time of initial implementation. Not all practices outlined in APG 113 will be relevant for every ADI and some aspects may vary depending on the size, business mix and complexity of the ADI.

9Subject to certain constraints, there are three available IRB approaches for corporate exposures (advanced IRB, foundation IRB and supervisory slotting).

10 Model validation would mainly be assessed during the application phase.