Information paper - Combining MySuper product performance histories – APRA’s approach - August 2023

Chapter 1 - Introduction

The Superannuation Industry (Supervision) Regulations 1994 (‘the Regulations’) outline the methodology for the performance test. The performance test applied to MySuper products from 1 July 2021 and applies to trustee-directed products (‘TDPs’) from 1 July 2023.

The performance test is a two-part test and involves assessing:

(i) investment performance relative to a benchmark portfolio created using the product’s strategic asset allocation; and

(ii) administration fees charged in the last financial year relative to the median fee charged for the category of product.

If the product underperforms the combined test by more than 0.50%, the product is deemed to have failed the performance test. Where a product fails the performance test in two consecutive years, the registrable superannuation entity (RSE) licensee will be prohibited from accepting new beneficiaries into that product.

This paper outlines the approach APRA takes when combining the performance histories of two or more MySuper products in certain scenarios in administering the performance test. It also explains APRA’s approach to providing investment performance data to the Australian Tax Office (ATO) for inclusion in the YourSuper comparison tool.

Chapter 2 - Combining the performance histories of MySuper products

APRA has the power to combine the performance history of two or more products so the assessment of a product’s performance uses a continuous performance history under a range of scenarios, where it is appropriate to do so.1

Performance may need to be combined to facilitate the administration of the performance test for MySuper products where there are across-product and within-product changes.

Combining performance allows the performance test to ensure continuous history, rather than performance history resetting as a result of certain product changes or a closure of a product.

2.1 Across-product changes

An across-product change is where a product has ceased, and members have been transferred into a new product under a new MySuper authorisation. The Regulations allow APRA to combine performance for across-product changes.

When combining performance, APRA will apply the following principles to ensure similar scenarios are treated consistently.

Principles for combining the performance of multiple MySuper products

- Avoiding product ‘phoenixing’: Combining performance allows APRA to address circumstances where RSE licensees intentionally close a product and open a new, but similar product, to avoid being assessed in the performance test. APRA will consider whether new MySuper products should be granted authorisation in such circumstances.

- Identifying a predecessor product to create a combined product: Using the actual return history of products to combine performance where possible, avoiding using amalgamated data or creating blended returns using data from multiple products. Where two or more products are combined into a new product, a predecessor product should be identified using the following criteria:

- Continuity of control – for example, where products under RSE licensees within the same corporate group are consolidated, APRA will consider identifying the predecessor product as the one with the same RSE licensee or management as the successor product;

- Continuity of product design – for example, where two products are consolidated, APRA will consider identifying the predecessor product as the one with materially similar product design (such as the investment strategy) as the successor product;

- Members impacted – for example, where two products are consolidated, APRA will consider identifying the predecessor product as the one with the majority of members.

- Continuity of control – for example, where products under RSE licensees within the same corporate group are consolidated, APRA will consider identifying the predecessor product as the one with the same RSE licensee or management as the successor product;

- Continuation of return history achieved by the MySuper product: Combining performance should not allow the performance of a continuing product to be replaced with the performance of another product in the product range. For example, where an RSE licensee replaces the investment strategy of a MySuper product with the investment strategy of another product / investment option in the product range, the investment performance of the MySuper product will not be replaced by the performance of the other product / investment option in the range.

- Performance of continuing MySuper products should be maintained: When a MySuper product continues (and there is no product reauthorisation) as a result of a merger or successor fund transfer (SFT), the historical performance of the continuing product should be assessed, unless exceptional circumstances exist.

Potential scenarios where APRA will consider issuing a determination to combine the performance of multiple MySuper products

Scenario | Approach |

|---|---|

A merger or SFT, with one existing MySuper product continuing | No APRA determination required to maintain history of the continuing product |

A merger or SFT, with members transferred into a newly authorised MySuper product | APRA determination required to combine performance history of the products |

Change in RSE licensee or RSE where continuity of control has been established | APRA determination required to combine performance history of the products |

Product consolidation with one product continuing and others ceasing | No APRA determination required to maintain history of the continuing product |

Product consolidation with no continuing products and new product created | APRA determination required to combine the new product performance with the performance of the predecessor product with the most members. |

Where APRA grants a new MySuper product authorisation under the material goodwill provision | APRA determination required to combine the new MySuper product performance with the predecessor product performance |

2.2 Within-product changes

A within-product change is a change to the structure or nature of a product (for example, changes from a single strategy to a lifecycle product) that continues under an existing MySuper authorisation.

Subregulations 9AB.12(4A) and 9AB.14(9A) of the Regulations permit APRA to make a legislative instrument to modify the performance test formulae where there is a within-product change. In August 2023, APRA made Superannuation technical determination: Actual and benchmark return formulae modifications (the Technical Determination) to modify the actual return formula in subregulation 9AB.12(2) and the benchmark return formula in subregulation 9AB.14(2) for lifecycle MySuper products. This ensures that any changes to the product are reflected in the performance history used in the performance test.2

Example: Combining performance histories for a MySuper product with a within-product change from a single strategy to lifecycle product (“change of lifestage”)

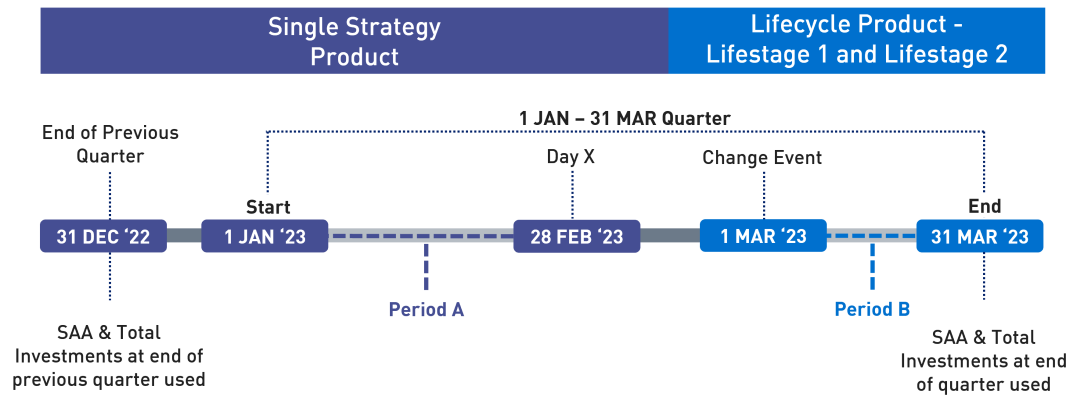

Product A is a single strategy MySuper product that changes to a lifecycle MySuper product with two lifestages (“Lifestage 1” and “Lifestage 2”) effective from 1 March 2023 – this is referred to as a change of lifestage.

As Product A changed its strategy during a quarter, APRA assesses performance for the March 2023 quarter over two discrete “partial quarter” periods:

- Period A: 1 January 2023 to 28 February 2023 ("Day X" in the Technical Determination); and

- Period B: 1 March 2023 ("change event" in the Technical Determination) to 31 March 2023.

The Technical Determination modifies the actual return and benchmark return formulae specified in the Regulations to enable partial quarter returns to be calculated for Period A and Period B. These modified formulae are used to calculate the performance measure over the product’s lookback period. Refer to the illustrative timeline below.

Period A - Partial Quarter Calculation Before Change in Strategy (1 January – 28 February 2023)

Strategic Asset Allocation (SAA) data for benchmark return: Product A is assessed as a product with one single lifestage ("Single Strategy"), using its strategic asset allocation (SAA) from 31 December 2022 (the end of the previous quarter).

Total Investments data for determining lifestage weights in actual return and benchmark return: Calculated with reference to the value of assets in each lifestage at 31 December 2022 (the end of the previous quarter).

Period B - Partial Quarter Calculation After Change in Strategy (1 March – 31 March 2023)

SAA data for benchmark return: Product A is assessed as a lifecycle product with two lifestages, "Lifestage 1" and "Lifestage 2". The SAA data reported to APRA at 31 March 2023, the first SAA applicable to the two lifestages, is used to create the benchmark return.

The Technical Determination modifies the formula specified in the Regulations to reflect the SAA as at the end of the current quarter (SAAa,j,t) instead of the SAA at the end of the previous quarter (SAAa,j,t-1).

Total Investments data for determining lifestage weights in actual return and benchmark return: The Technical Determination states that the product level actual return and benchmark return for each lifestage are weighted using the amount of investments in Lifestage 1 and Lifestage 2 at the end of the current quarter (i.e. 31 March 2023) for the partial quarter after the change in strategy, instead of at the end of the previous quarter.

Footnotes

1 See regulation 9AB.7(4) of the Regulations.

2 Superannuation Technical Determination No. 1 of 2023 - Actual and benchmark return formulae modifications.

Chapter 3 - Investment performance in YourSuper comparison tool

The comparison tool displays the net return achieved by MySuper products over multiple time horizons.

APRA’s approach for combining performance for display in the comparison tool aims to apply the same principles for combining investment performance of products in the performance test, i.e.

- focusing on continuity of control;

- using actual returns delivered by the MySuper product; and

- focusing on the returns that the majority of members achieved while avoiding using amalgamated data from multiple products.

The comparison tool displays investment performance at the investment option level for each individual lifestage while the performance test is applied at the MySuper product level. The methodology for combining performance in the comparison tool is therefore different to the methodology applied in the performance test.

The below tables outline the scenarios where APRA has combined performance for the purposes of the comparison tool and the approach taken.

Within product changes | |

Type of change | Present investment performance: |

Single strategy to a lifecycle strategy | For each lifestage by: Combining the net returns of the new lifestages from the effective date of strategy change with the net returns of the predecessor single strategy |

Lifecycle strategy to a single strategy | For the single strategy by: Combining the net returns of the single strategy from the effective date of strategy change with that of the predecessor lifestage with the greatest number of members |

Where the investment strategy of a MySuper product has been replaced with the investment strategy of another investment option in the RSE’s product offering (e.g. an RSE’s MySuper product changes from the Balanced option to the Growth option) | Reported to APRA which consists of: Net returns generated by the current investment strategy from the effective date of strategy change, and the net returns generated by the predecessor strategy before that date |

Change in lifestages in a lifecycle product (where a single predecessor lifestage can be identified for each new lifestage) | For each lifestage by: Combining the net return of the new lifestages from the effective date of strategy change with the net returns of the relevant predecessor lifestage |

Change in lifestages in a lifecycle product (where there are multiple predecessor stages for each new lifestage) | For each lifestage by: Combining the net return of the new lifestages from the effective date of strategy change with the net return of the relevant predecessor lifestage with the most members |

Across product changes | |

Type of change | Present investment performance: |

A merger or SFT, with one existing MySuper product continuing | By maintaining performance history of the continuing product |

A merger or SFT, with members transferred into a newly authorised MySuper product | By combining performance histories of the products |

Change in RSE licensee or change in RSE | By combining performance histories of the products |

Product consolidation with one product continuing and others ceasing | By maintaining performance history of the continuing product |

Product consolidation with no continuing products and new product created | By combining the performance history of the predecessor product with the most members with the new product |

Where APRA grants a new MySuper product authorisation under the material goodwill provision | By combining performance history of the predecessor product with the new product |