APRA's 2020 Policy Priorities

Executive summary

APRA’s policy function supports APRA’s mandate by establishing minimum prudential expectations for APRA-regulated financial institutions and empowering APRA’s supervisors to achieve desired outcomes. APRA undertakes a program of regular policy review to ensure that the regulatory framework remains fit for purpose. This paper sets out APRA's policy agenda for the next 12 to 18 months, and should be read in conjunction with the accompanying Information Paper on APRA’s Supervision Priorities1, which outlines APRA’s supervisory focus areas for the year ahead.

Consistent with the strategic priorities detailed in APRA’s Corporate Plan, APRA’s key policy priorities relate to maintaining financial system resilience, improving cyber-resilience, improving outcomes for superannuation members and transforming governance, culture, remuneration and accountability across all regulated institutions. A number of the policy initiatives to meet these strategic priorities commenced in 2018 and 2019 and will continue throughout 2020.

One of the most notable areas of reform in APRA's policy work program is strengthening expectations for sound governance, remuneration and accountability within financial institutions. APRA will be strengthening its prudential standards applicable across the financial sector, to reflect the findings of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry (Royal Commission), APRA’s Prudential Inquiry into the Commonwealth Bank of Australia and the APRA Capability Review (Capability Review). This will include findings relating to executive remuneration and non-financial risk management, among other things. APRA will also continue to work with the Treasury and the Australian Securities and Investments Commission to extend the Banking Executive Accountability Regime to the insurance and superannuation industries, as well as introduce a conduct-focused accountability regime.

Building on APRA’s existing work on recovery and resolution planning, and consistent with the Capability Review recommendation, APRA will commence consultation on a new prudential standard. The standard is intended to improve resolution capability, implement reforms from the Financial Sector Legislation Amendment (Crisis Resolution Powers and Other Measures) Act 2018 and set out requirements for the development and execution of recovery and resolution plans. The proposed new standard will apply to authorised deposit-taking institutions (ADIs), general insurers and life insurers.

In the banking sector, APRA will aim to finalise its proposals to implement the Basel III capital reforms and give effect to its expectations for 'unquestionably strong' capital ratios for ADIs, which take effect in 2022. As part of this project, APRA is also considering changes to its overall approach to capital requirements to improve comparability, transparency and flexibility in areas where APRA’s methodology is more conservative than minimum international requirements. APRA will also finalise changes to its capital measurement standard, which includes proposals regarding the capital treatment of a parent ADI’s equity investments in banking and insurance subsidiaries. Other areas of focus include the review of the purchased payment facility regime and the authorisation guidelines for ADIs, including for foreign ADI branches and non-operating holding companies.

The insurance policy agenda includes consultation on capital reforms for private health insurers, which is the final phase of the private health insurance policy roadmap. APRA will continue to work with the insurance industry on understanding the impact, and progressing towards implementation, of AASB 17 Insurance Contracts, as well as considering whether amendments should be made to the Life and General Insurance Capital Framework (LAGIC) in light of current experience since its implementation. APRA is also examining the appropriate prudential treatment of offshore reinsurance in the life insurance industry.

In the superannuation industry, the implementation of enhancements to the superannuation prudential framework as outlined in the post-implementation review and the delivery of quality member outcomes across the industry, supported by the new Prudential Standard SPS 515 Strategic Planning and Member Outcomes, will continue to be important areas of focus over 2020 and into 2021.

In addition, in 2020, APRA will continue to assist Government and industry in implementing the recommendations of the Royal Commission and the recent legislative changes to the provision of insurance in superannuation.

Footnotes:

1 APRA, Supervision Priorities (Information Paper, January 2020) <https://www.apra.gov.au/news-and-publications/apra-policy-and-supervision-priorities>.

Chapter 1 - Introduction

1.1 APRA’s mandate and the policy development process

APRA’s mandate is to protect the Australian community by establishing and enforcing prudential standards and practices designed to ensure that under all reasonable circumstances, financial promises made by the institutions APRA supervises are met within a stable, efficient and competitive financial system. APRA’s policy function supports APRA’s mandate by establishing minimum expectations for financial institutions and empowering APRA’s supervisors to achieve desired outcomes.

The prudential policy framework is comprised of legislation, prudential standards and guidance. The legislative framework is set out primarily in the Banking Act 1959, Insurance Act 1973, Life Insurance Act 1995, Private Health Insurance (Prudential Supervision) Act 2015, Superannuation Industry (Supervision) Act 1993, and the Financial Sector Legislation Amendment (Crisis Resolution Powers and Other Measures) Act 2018. These Acts, together with the Australian Prudential Regulation Authority Act 1998, articulate APRA’s prudential objectives and provide APRA with authority to issue prudential standards and other legislative instruments.

Consistent with the performance of its supervisory and resolution functions, when developing policy, APRA is required to balance the objectives of financial safety and efficiency, competition, contestability and competitive neutrality, while promoting financial system stability in Australia2. APRA assesses the appropriate balancing of these objectives and considers the trade-offs that often emerge, primarily through its public consultation process on policy initiatives. This includes consideration of alternative options and the assessment of available data and other evidence on the likely impact of proposed policy changes.

APRA ensures that its policy development process complies with the Office of Best Practice Regulation guidelines with respect to regulatory cost/benefit analysis and Regulation Impact Statements. APRA also consults with other financial regulators such as the Reserve Bank of Australia (RBA) and Australian Securities and Investments Commission (ASIC), and is also engaging more closely with the Australian Competition and Consumer Commission to better assess competition considerations as part of the policy development process.

APRA has a program of regular policy review to ensure that the prudential framework remains fit for purpose. APRA aims to design forward-looking and enduring prudential standards. As a result, material revisions to prudential standards generally occur no more frequently than every five years.

This paper sets out APRA's policy agenda for the next 12 to 18 months.

1.2 Drivers of policy priorities

In 2020, APRA will continue to progress a number of significant policy initiatives that were outlined in the 2018 and 2019 editions of this publication, in addition to commencing several smaller new areas of policy redesign. Consistent with the strategic priorities detailed in APRA’s Corporate Plan, APRA’s key policy priorities relate to maintaining financial system resilience, improving cyber-resilience, improving outcomes for superannuation members and transforming governance, culture, remuneration and accountability across all regulated entities.3 Policy initiatives will continue to have regard to the findings and recommendations of recent significant inquiries and reviews over the course of the past couple of years, including:

- the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry (Royal Commission);4

- the Australian Prudential Regulation Authority Capability Review (Capability Review);5

- the Productivity Commission's Review of Efficiency and Competitiveness of the Australian Superannuation System;6

- APRA's Prudential Inquiry into the Commonwealth Bank of Australia (Prudential Inquiry);7 and

- the International Monetary Fund's Financial Sector Assessment Program review of the Australian regulatory system.8

Policy priorities are also regularly reviewed within an overall framework of emerging risk analysis, strategic priorities for each regulated industry and related supervision activities. Relevant industry trends and issues include:

- the need to improve operational resilience across regulated entities;

- the need for regulated entities to prioritise risk and other data management systems;

- climate change financial risk considerations for regulated entities;

- access and sustainability of insurance; and

- innovation and competition, particularly in retail banking and payments.

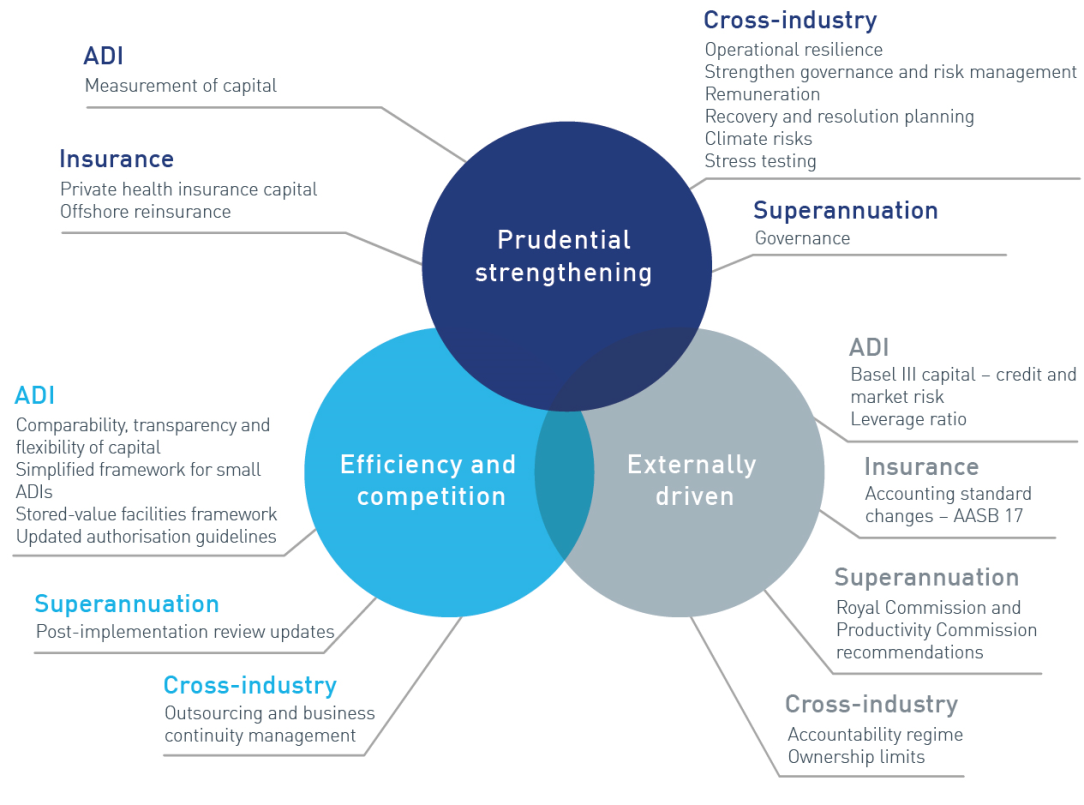

APRA has a broad agenda of policy work underway directed at strengthening financial safety, while also having regard to efficiency and competition considerations. The policy agenda recognises that APRA must respond to an external environment that continues to evolve in line with development in international standards, as well as shifts in Government priorities and community expectations. The diagram below summarises the different streams of policy development according to the key drivers of change.

APRA’s policy priorities for each of its regulated industries are set out in the chapters that follow.

Footnotes:

2 For a fuller explanation of how APRA considers the various components of its mandate, see APRA’s objectives (Information Paper, November 2019) <https://www.apra.gov.au/sites/default/files/Information%20paper%20-%20APRA%27s%20objectives%20FINAL%2011-11.pdf>.

3 APRA, Corporate Plan 2019-2023 (August 2019) <https://www.apra.gov.au/news-and-publications/apra-releases-2019-2023-corporate-plan>.

4 Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, Final Report (2019) <https://www.royalcommission.gov.au/sites/default/files/2019-02/fsrc-volume-1-final-report.pdf>.

5 Australian Treasury, Australian Prudential Regulation Authority Capability Review (June 2019) <https://treasury.gov.au/sites/default/files/2019-07/190715_APRA%20Capability%20Review.pdf>.

6 Productivity Commission, Superannuation: Assessing Efficiency and Competitiveness (21 December 2018) <https://www.pc.gov.au/inquiries/completed/superannuation/assessment/report/superannuation-assessment-overview.pdf>.

7 APRA, Prudential Inquiry into the Commonwealth Bank of Australia (April 2018) <https://www.apra.gov.au/sites/default/files/CBA-Prudential-Inquiry_Final-Report_30042018.pdf>.

8 International Monetary Fund, Financial System Stability Assessment – Australia (February 2019) <https://www.imf.org/~/media/Files/Publications/CR/2019/1AUSEA2019007.ashx>

Chapter 2 - Cross-industry

2.1 Governance, culture, remuneration and accountability

APRA is strengthening the prudential framework in a number of ways to support APRA’s strategic focus on transforming governance, culture, remuneration and accountability across all regulated institutions. Specifically, the core cross-industry standards are being updated to strengthen prudential expectations for governance, remuneration, accountability and non-financial risk management. These reforms will help address deficiencies identified by the Royal Commission, Prudential Inquiry and Capability Review, which highlighted a number of failings related to board governance and oversight, the lack of clear accountability, and incentive structures that encouraged poor conduct or lack of attention to non-financial risks.

2.1.1 Governance and risk management

APRA is reviewing its governance and risk management standards to ensure that these remain fit for purpose. Areas for review will include the clarity of board and senior management roles and expectations, the effectiveness of board obligations in relation to risk culture, the relative emphasis on financial and non-financial risks, and the clear need to strengthen the requirements in relation to compliance and audit functions. As part of this work, APRA also intends to consult with industry on how best to embed risk governance self-assessments in the prudential framework.

APRA intends to consult on revised versions of Prudential Standard CPS 510 Governance and Prudential Standard CPS 220 Risk Management in the second half of 2020. The relevant superannuation standards, Prudential Standard SPS 510 Governance and Prudential Standard SPS 220 Risk Management, will also be reviewed as outlined in chapter 5.

2.1.2 Remuneration

APRA is strengthening its current principles-based prudential requirements for remuneration to provide clearer and more readily enforceable expectations for remuneration arrangements, particularly for senior executives. This will be achieved by implementing more prescriptive remuneration requirements that better align with international practices and also address the recommendations of the Royal Commission.9 The key changes proposed in the draft Prudential Standard CPS 511 Remuneration (CPS 511) include, strengthening the role of the board, requiring specific consideration of non-financial risk when determining variable remuneration, and ensuring that robust consequence management mechanisms are available to align risk with variable remuneration (e.g. malus and clawback).10

After considering the feedback from consultation conducted to date, APRA expects to release a response paper on CPS 511 in the first half of 2020. Consultation on associated reporting and disclosure requirements and prudential guidance will commence shortly thereafter.

2.1.3 Accountability

The Banking Executive Accountability Regime (BEAR) commenced on 1 July 2018 for the major banks and 1 July 2019 for all other ADIs. Following the Royal Commission, the Government intends to extend the BEAR to the insurance and superannuation sectors, as well as broadening its scope to include a greater focus on conduct matters.11 APRA and ASIC are working closely with the Treasury to support the development of legislative amendments to give effect to an accountability regime for all prudentially regulated industries. APRA’s response to the product responsibility consultation conducted in 2019 will be incorporated in the broader extension of the accountability requirements to all APRA-regulated entities.

Over 2020, APRA also expects to update the existing fit and proper requirements in Prudential Standard CPS 520 Fit and Proper. APRA’s fit and proper standards aim to ensure that responsible persons whose activities may materially affect the business of regulated entities, possess appropriate skills and qualities. Given the significant overlap with the obligations of accountable persons under the BEAR, the updates will address potential inconsistencies and support the alignment with the legislative requirements under the extended accountability regime. APRA expects to consult on draft revised prudential standards in the second half of 2020.

2.2 Financial system resilience

APRA is progressing work on a number of cross-industry prudential standards that are focused on maintaining financial system resilience.

2.2.1 Operational resilience

There is currently no specific detailed coverage of operational risk and other non-financial risks in the prudential framework applicable to all regulated entities. APRA, therefore, intends to set overarching expectations for the management of operational risk and other non-financial risks. The outsourcing and business continuity prudential standards are also due for review and will be updated to ensure alignment across the relevant standards. APRA is also commencing development of a cross-industry standard on data management to improve the quality of risk data aggregation and reporting, as timely and accurate data is critical to identifying and managing emerging risks.

APRA expects to consult on standards for the management of operational and other non-financial risks and compliance, and revised Prudential Standard CPS 231 Outsourcing and Prudential Standard CPS 232 Business Continuity Management in the second half of 2020. The relevant superannuation standards, Prudential Standard SPS 231 Outsourcing and Prudential Standard SPS 232 Business Continuity Management, will also be reviewed as part of this process.

2.2.2 Resolution framework

APRA’s resolution function involves planning for and managing crisis events which may result in financial loss, distress or instability within the Australian financial system. As part of strengthening its crisis preparedness and resolution capabilities, APRA is developing a new prudential standard for recovery and resolution planning which will implement reforms from the Financial Sector Legislation Amendment (Crisis Resolution Powers and Other Measures) Act 2018 (Crisis Management Act). The standard is expected to set out requirements for the development and execution of recovery and resolution plans. The standard will apply to ADIs, general insurers and life insurers.

APRA expects to consult on a draft standard in the first half of 2020, with a view to finalising the standard around the end of 2020.

2.2.3 Other cross-industry initiatives

Climate change financial risk

In 2019, APRA published an information paper that detailed the results of its first climate change financial risk survey of regulated entities.12 The paper also included a stocktake of actions and initiatives underway in Australia and internationally in response to growing awareness of the physical, transition and liability risks of climate change. To encourage regulated entities to better prepare for climate risks and clarify regulatory expectations, APRA intends to publish a prudential practice guide. This guidance will assist entities in developing frameworks for the assessment and monitoring of climate-related risks, including aspects of governance, strategy, risk management, metrics and disclosure. Consultation is expected to commence in mid-2020.

Stress testing

APRA has increased the intensity and supervisory focus of its stress testing program. To promote industry better practice and consistency, APRA intends to publish a stress testing prudential practice guide. APRA expects to consult on the prudential practice guide in the second half of 2020.

Ownership limits

APRA published new financial sector shareholdings rules in 2019, following legislative change to the Financial Sector (Shareholdings) Act 1998 (FSSA) that raised the minimum shareholding in ADIs, general insurers and life insurers requiring approval from 15 per cent to 20 per cent and also introduced a new streamlined ‘fit and proper’ test. APRA intends to publish additional guidelines in the second half of 2020, which will assist shareholders in making an application under the FSSA.

Footnotes:

9 Recommendation 5.1 – Supervision of remuneration – principles, standards and guidance; Recommendation 5.2 – Supervision of remuneration – aims; and Recommendation 5.3 – Revised prudential standards and guidance.

10 APRA, Strengthening prudential requirements for remuneration (Discussion Paper, July 2019) <https://www.apra.gov.au/sites/default/files/discussion_paper_strengthening_prudential_requirements_for_remuneration_july_2019_v1.pdf>.

11 Recommendation 6.6 – Joint administration of the BEAR; and Recommendation 6.8 – Extending the BEAR.

12 APRA, Climate change: Awareness to action (Information Paper, March 2019) <https://www.apra.gov.au/sites/default/files/climate_change_awareness_to_action_march_2019.pdf>.

Chapter 3 - Banking

In addition to the strengthening of cross-industry standards as outlined in chapter 2, APRA’s policy agenda for the banking industry is largely focused on maintaining financial system resilience, reflective of both domestic considerations as well as developments in international standards.

3.1 Unquestionably strong capital and the Basel III reforms

A key policy priority in the banking sector is the ongoing review of capital requirements to implement APRA’s targets for ‘unquestionably strong’ capital ratios and the revisions to the Basel Committee on Banking Supervision’s capital framework, known as Basel III.13 This is a large and complex project with a number of different components, including:

- credit risk capital requirements;

- operational risk capital requirements;

- market risk and interest rate risk in the banking book requirements;

- the introduction of a capital floor for banks using more advanced modelling approaches;

- a minimum leverage ratio requirement; and

- a simplified framework for small, less complex ADIs.

As part of this project, APRA is also considering changes to its overall approach to capital requirements to improve comparability, transparency and flexibility in areas where APRA’s methodology is more conservative than minimum international requirements.14 While this will not affect the overall amount of capital required to be held by ADIs, it is likely to include changes to the presentation and calculation of capital requirements under a number of prudential standards.

APRA expects to consult further on changes to the credit risk standards, as well as its preferred option for implementing the transparency, comparability and flexibility requirements (including the capital floor), in the first half of 2020. A further round of consultation on the draft standards is also planned for later in 2020. Additional quantitative impact studies will also be conducted as part of these consultations, to enable APRA to appropriately assess the impact and better calibrate proposed changes. APRA will be seeking to finalise the standards around the end of 2020, with the revised standards likely to take effect from the beginning of 2022, consistent with international timelines.

APRA is currently reviewing submissions on its interest rate risk in the banking book proposals and is aiming to finalise requirements in the second half of 2020.15 APRA also plans to commence formal consultation on the broader reforms to the market risk framework, known as the fundamental review of the trading book. APRA expects to consult on proposed changes to the market risk prudential standard in the first half of 2020 with the revised standard expected to take effect from 1 January 2023, taking into account internationally agreed timelines.

Amendments to the calculation of the leverage ratio are currently being consulted on, with the standard likely to be finalised with the changes to credit risk requirements at the end of 2020 or early 2021, for commencement in 2022.16

APRA will also be updating its public disclosure standard and reporting standards, as well as making a number of consequential amendments to other prudential standards, to reflect the reforms to the capital standards. Consultation on these changes is expected to commence in the second half of 2020.

3.2 Measurement of capital

APRA is currently considering updates to its criteria for measuring an ADI’s regulatory capital.17 These updates incorporate further technical information to assist ADIs in issuing capital instruments, as well as recent changes to international standards and guidance on capital adequacy measures. APRA is also reviewing the capital treatment of a parent ADI’s equity investments in banking and insurance subsidiaries, to ensure that sufficient capital is held by the parent ADI for the protection of depositors in Australia.

APRA intends to finalise the changes to Prudential Standard APS 111 Capital Adequacy: Measurement of Capital in early 2020, with the revised standard to take effect from 1 January 2021.

3.3 Stored-value facilities framework

In 2018, the Council of Financial Regulators (CFR) established a working group to review the broad regulatory framework for retail payments and Stored Value Facilities (SVFs), including Purchased Payment Facilities (PPFs), which currently involves oversight from the RBA, ASIC and APRA. This review was established to respond to recommendations from the Financial System Inquiry and the Productivity Commission Inquiry into competition in financial services to update and simplify retail payments regulation.18 Consultation was undertaken in late 2018 and the CFR has submitted a proposal to Government for an updated and simplified framework. Supporting this, APRA is reviewing its approach to regulating PPFs to ensure it is proportionate to the risks, and appropriate in the context of the CFR’s proposed framework and recommendations arising from the review process. APRA will consult on a revised prudential standard in the second half of 2020.

3.4 ADI and NOHC authorisation guidelines

APRA is currently reviewing its authorisation guidelines for ADIs, including for foreign ADI branches and non-operating holding companies (NOHCs). APRA intends to publish revised ADI authorisation guidelines in the first half of 2020, and revised NOHC authorisation guidelines in the second half of 2020.

Footnotes:

13 APRA, Revisions to the Capital Framework for ADIs (Discussion Paper, February 2018); APRA, Revisions to the Capital Framework for ADIs (Response Paper, June 2019) <https://www.apra.gov.au/consultations-on-revisions-to-capital-framework-for-authorised-deposit-taking-institutions>.

14 APRA, Improving the transparency, comparability and flexibility of the ADI capital framework (Discussion Paper, August 2018). <https://www.apra.gov.au/sites/default/files/improving_the_transparency_comparability_and_flexibility_of_the_adi_capital_framework_0_0.pdf>.

15 APRA, Interest rate risk in the banking book for ADIs (Response Paper, September 2019) <https://www.apra.gov.au/sites/default/files/response_to_submissions_-_interest_rate_risk_in_the_banking_book_for_authorised_deposit-taking_insitutions_september_2019.pdf>.

16 APRA, ‘Response to submissions – the leverage ratio’ (Letter, November 2019) <https://www.apra.gov.au/leverage-ratio-requirement-for-authorised-deposit-taking-institutions>.

17 APRA, Revisions to APS 111 Capital Adequacy: Measurement of Capital (Discussion Paper, October 2019) <https://www.apra.gov.au/discussion-paper-revisions-to-aps-111-capital-adequacy-measurement-of-capital>.

18 Financial System Inquiry, Final Report (November 2014) Recommendation 16 <https://treasury.gov.au/sites/default/files/2019-03/p2014-FSI-01Final-Report.pdf>; Productivity Commission, Competition in the Australian Financial System – Final Report (August 2018) Recommendation 17.5 <https://www.pc.gov.au/inquiries/completed/financial-system/report>.

Chapter 4 - Insurance

In addition to the strengthening of cross-industry standards as outlined in chapter 2, APRA’s policy agenda for the insurance sector continues to be focused on maintaining financial sector resilience, adapting to the changing environment, and ensuring the prudential framework remains fit for purpose to handle emerging risks.

4.1 Review of the PHI capital framework

During 2019, APRA continued work on the third and final phase of the private health insurance (PHI) roadmap, which was initially released in 2016.19 In December 2019, APRA released a discussion paper on the proposed structure for the future PHI capital framework, aimed at improving the sensitivity of prudential capital requirements to the risks private health insurers face, and improving the comparability of performance between insurers.20 APRA's key proposals for the future PHI capital framework include:

- alignment to the Life and General Insurance Capital (LAGIC) framework, unless characteristics of the industry warrant a different approach;

- applying the capital framework to the insurer’s entire business, rather than just the health benefits fund; and

- integrating changes stemming from the Australian Accounting Standard Board’s new standard AASB 17 Insurance Contracts (AASB 17).

The objective of APRA’s review is to ensure that private health insurers have an appropriate level of financial resilience for the protection of policyholders, even in the event of unexpected stress or losses.

The current consultation on the PHI capital framework will close on 27 March 2020. APRA expects to consult on draft prudential standards in the second half of 2020.

4.2 AASB 17 Insurance Contracts and LAGIC refinements

A key priority for APRA is ensuring that the capital framework for the insurance sector continues to be fit for purpose. APRA’s capital framework for insurers is based on an accounting treatment that will be revised with the introduction of AASB 17. In September 2019, APRA released for consultation a directions paper for the integration of AASB 17 into the capital and reporting framework for insurers.21 AASB 17 is a significant change for insurers and APRA is actively engaging with all insurers to better understand their implementation readiness.

APRA will continue to develop its position on the integration of AASB 17 into its capital and reporting standards in more detail over the coming year and expects to release a discussion paper in the first half of 2020. Given the important interactions, APRA will also use this opportunity to consult on refinements to the LAGIC framework, which was last substantively reviewed in the lead up to 1 January 2013.

APRA is currently considering stakeholder feedback on implementation timeframes, taking into account the International Accounting Standards Board’s proposed effective date for the new standard.

4.3 Offshore reinsurers

In the life insurance sector, APRA has commenced consultation on the treatment of exposures of life insurers to non-APRA authorised reinsurers. In March 2019, APRA wrote to all life insurers setting out its preferred position on offshore reinsurers, and providing a high-level outline of options for revising Prudential Standard LPS 117 Capital adequacy: Asset concentration risk charge (LPS 117).22

This review is being undertaken in the context of APRA’s observation of an increase in the use of offshore reinsurers with the aim of ensuring APRA remains able to effectively supervise the industry. The March 2019 letter sought feedback from stakeholders on APRA’s prudential concerns, and views on a set of policy responses. APRA intends to consult on the draft revised LPS 117 in the first half of 2020.

Footnotes:

19 APRA, ‘Private health insurance: prudential policy outlook’ (Letter, August 2016) <https://www.apra.gov.au/sites/default/files/160728%2520LTI%2520PHI%2520roadmap%2520-%25201%25200.pdf>.

20 APRA, Private health insurance capital standards review (Discussion Paper, December 2019) <https://www.apra.gov.au/discussion-paper-private-health-insurance-capital-standards-review>.

21 APRA, ‘Information request and consultation on directions for integration of AASB 17 into the capital and reporting framework for insurers’ (Letter, September 2019) <https://www.apra.gov.au/sites/default/files/letter_-_information_request_and_consultation_on_directions_for_integration_of_aasb_17_insurance_contracts_into_the_capital_and_reporting_framework_for_insurers.pdf>.

22 APRA, ‘Offshore reinsurers and the review of LPS 117 Capital Adequacy – Asset Concentration Risk Charge’ (Letter, March 2019) <https://www.apra.gov.au/sites/default/files/letter_offshore_reinsurers_and_the_review_of_prudential_standard_lps_117_capital_adequacy_asset_concentration_risk_charge_v1.pdf>.

Chapter 5 - Superannuation

APRA’s policy agenda for the superannuation sector continues to be dynamic, with the sector facing a significant volume of change. APRA is focused on maintaining both the resilience and sustainability of the superannuation sector, and the delivery of improved outcomes for superannuation members, consistent with APRA’s strategic focus area.

Over 2019, a number of very significant policy and legislative reforms were commenced or completed which, in total, provide a strong foundation for regulation of the industry over the next decade. These include:

- stronger tools to enforce compliance with the law, as well as new powers for APRA to approve transfers of business;

- measures aimed specifically at improving overall performance, in particular,

- a new legislative requirement for trustees to conduct an annual assessment of outcomes being delivered to their members, aligned with APRA’s new Prudential Standard SPS 515 Strategic Planning and Member Outcomes;

- enhanced data that will be published to support industry transparency as part of APRA’s Superannuation Data Transformation, which launched in November 2019; and

- publishing performance assessments of various dimensions of the industry, which commenced with the public release of the MySuper product heatmap in December 2019;

- legislative changes designed by Government to reduce duplicate accounts and potentially unnecessary insurance; and

- following the Royal Commission, formal mechanisms to build a much closer collaborative relationship between APRA and ASIC to support effective and efficient regulation of the superannuation industry.

These changes influence, to a large degree, APRA’s areas of focus in superannuation over the next one to two years.

5.1 Enhancing the prudential framework

In 2019 APRA released its report on a post-implementation review of the superannuation prudential framework.23 The review found that the prudential framework had materially lifted industry practices in key areas such as governance, risk management and outsourcing. However, it also highlighted the need to strengthen prudential requirements in several areas, including board appointment processes, management of conflicts of interest and life insurance in superannuation. The review foreshadowed APRA’s intention to progress enhancements to the prudential framework to reflect changes that had taken place since the introduction of the framework in 2013. In late 2019, APRA released a revised version of its superannuation insurance prudential standard, Prudential Standard SPS 250 Insurance in Superannuation (SPS 250), as its initial step in progressing the enhancements, and also in response to recommendations of the Royal Commission.24

APRA will be progressing the full suite of enhancements outlined in its post-implementation review over the remainder of 2020 and into 2021, including the release of a discussion paper covering the governance related prudential standards, in the first half of 2020.25 Enhancements to the risk management, outsourcing and business continuity management prudential standards will then follow in mid to late 2020.

In addition, APRA will be updating its guidance on the sole purpose test in 2020.26

5.2 Royal Commission recommendations

As noted above and in line with APRA’s response to the Royal Commission,27 APRA released a revised SPS 250, containing amendments to implement Recommendations 4.14 and 4.15.28 This standard will be finalised in mid-2020.

In addition to progressing these revised changes, over 2020 APRA will continue to support Government in the implementation of the Royal Commission recommendations, including the recommendations to: expand ASIC’s role in superannuation; prohibit certain dual regulated entity structures (which present unmanageable conflicts of interest); prohibit and limit the deduction of advice fees from superannuation accounts; and establish a compensation scheme of last resort. APRA will also look to provide guidance to the industry to set out its expectations regarding associated legislative changes, as required.

5.3 Protecting Your Superannuation Package reforms

Over the course of 2019, APRA played a critical role in facilitating compliance with the new reforms contained in the Protecting Your Superannuation Package and Putting Members’ Interests First Acts. In particular, APRA proactively engaged with stakeholders across the financial services industry, and provided guidance through the release of Frequently Asked Questions. Over 2020, APRA will continue to work with Government and industry to ensure that the policy intent of the insurance reforms is achieved, including through the issuance of further guidance as needed.

Footnotes:

23 APRA, Review of APRA’s 2013 superannuation prudential framework (Information Paper, April 2019) <https://www.apra.gov.au/sites/default/files/information_paper_review_of_apras_2013_superannuation_prudential_framework.pdf>.

24 APRA, ‘Proposed revisions to Prudential Standard SPS 250 Insurance in Superannuation’ (Letter, November 2019) <https://www.apra.gov.au/proposed-revisions-to-prudential-standard-sps-250-insurance-superannuation>.

25 Prudential Standard SPS 511 Governance, SPS 520 Fit and Proper, SPS 521 Conflicts of Interest, SPS 530 Investment Governance and their associated guidance material.

26 APRA. ‘Putting Members First: Expectations and Areas of Focus for the Year Ahead’ (Letter, March 2019) <https://www.apra.gov.au/sites/default/files/letter_putting_members_first_expectations_and_areas_of_focus_for_the_year_ahead.pdf>.

27 APRA, ‘APRA’s response to Royal Commission recommendations’ <https://www.apra.gov.au/apras-response-to-royal-commission-recommendations>.

28 Recommendation 4.14 - Additional scrutiny for related party engagements; and Recommendation 4.15 - Status attribution to be fair and reasonable.

Attachment A: Final standards

APRA finalised a number of prudential standards and other policy initiatives in 2019. These are reflected in the table below, along with their commencement dates.

| Industry | Prudential Standard | Commencement date |

|---|---|---|

| Cross-industry | FSSA Rules | 22 August 2019 |

| CPG 234 Information Security | 1 July 2019 | |

| Banking | APS 115 Capital Adequacy: Standardised Measurement Approach to Operational Risk | 1 January 2021 (AMA banks) 1 January 2022 (All other ADIs) |

| APS 220 Credit Risk Management | 1 January 2021 | |

| APS 222 Related Party Exposures | 1 January 2021 | |

| Loss-absorbing capacity | 1 January 2024 | |

| Superannuation | SPS 515 Strategic Planning and Member Outcomes | 1 January 2020 |

| SPG 516 Business Performance Review | 1 January 2020 |

Attachment B: Timelines

Cross-industry

| 2019 | 1H 2020 | 2H 2020 | 1H 2021 | Expected effective date |

|---|---|---|---|---|---|

Remuneration (CPS 511) | Consult | Finalise |

|

| July 2021 |

Governance (CPS 510) |

|

| Consult |

| 2022 |

Risk management (CPS 220), operational & non-financial risks |

|

| Consult |

| 2022 |

| Fit and proper (CPS 520) | Consult | 2022 | |||

| Outsourcing/Service Provision (CPS 231) | Consult | 2021/22 | |||

| Business Continuity (CPS 232) | Consult | 2021/22 | |||

| Data management standard | Consult | 2021/22 | |||

| Recovery and resolution planning prudential standard | Consult | Finalise | 2022 | ||

| Climate change financial risk PPG | Consult | Finalise | |||

| Stress testing PPG | Consult | Finalise | |||

| FSSA Guidelines | Finalise |

Banking

| 2019 | 1H 2020 | 2H 2020 | 1H 2021 | Expected effective date | |

|---|---|---|---|---|---|

| Standardised Approach to Credit Risk (APS 112) | Consult | Consult | Finalise | 2022 | |

| Internal Ratings-based Approach to Credit Risk (APS 113) | Consult | Finalise | 2022 | ||

| Fundamental Review of the Trading Book (APS 116) | Consult | Consult | 2023 | ||

| Interest Rate Risk in the Banking Book (APS 117) | Consult | Finalise | 2022 | ||

| Overall approach to capital requirements (APS 110)* | Consult | Finalise | 2022 | ||

| Measurement of capital (APS 111) | Consult | Finalise | 2021 | ||

| Public disclosures (APS 330) | Consult | Finalise | 2022 | ||

| Stored-value facilities | Consult | Finalise | 2022 | ||

| ADI and NOHC authorisation guidelines | Finalise | Finalise | Finalise | Finalise |

* This includes elements of the simplified framework for small ADIs.

Insurance

| 2019 | 1H 2020 | 2H 2020 | 1H 2021 | Expected effective date | |

|---|---|---|---|---|---|

| PHI Capital framework | Consult | Consult | Consult | Consult | 2023 |

| AASB 17 and LAGIC refinements | Consult | Consult | 2023 | ||

| Offshore reinsurers and Asset Concentration Risk Charge (LPS 117) | Consult | Consult | Finalise | 2021/22 |

Superannuation

| 2019 | 1H 2020 | 2H 2020 | 1H 2021 | Expected effective date | |

|---|---|---|---|---|---|

| Insurance in Superannuation (SPS 250) | Consult | Finalise | 2021 | ||

| Governance (SPS 510) | 2021/22 | ||||

| Fit and Proper (SPS 520) | 2021/22 | ||||

| Conflicts of Interests (SPS 521) | 2021/22 | ||||

| Investment Governance (SPS 530) | 2021/22 | ||||

| Sole Purpose Test Guidance | Consult | Finalise | |||

| Risk Management (SPS 220) | Consult | 2021/22 | |||

| Outsourcing (SPS 231) | Consult | 2021/22 | |||

| Business Continuity Management (SPS 232) | Consult | 2021/22 |

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9 trillion in assets for Australian depositors, policyholders and superannuation fund members.