APRA’s expectations of superannuation fund trustees

Helen Rowell, Executive Member - ASFA Unpacks: the future of insurance in superannuation, Sydney

Good morning. It’s a pleasure to be here and participate in today’s seminar. Insurance in superannuation has been a hot topic of conversation over the last year or more and so today’s forum is important and timely.

The revised legislative and prudential requirements governing insurance arrangements in superannuation have been in place for nearly a year now and so it is a good time to take stock of where things are at.

Perhaps more importantly, however, there are a number of market pressures impacting the availability and affordability of group insurance that need to be discussed and addressed. Many funds have been experiencing large increases in premiums and some have been having difficulty in getting insurers to tender for their business. Some insurers and reinsurers have exited the market or reduced their appetite for group life insurance because of poor profit experience in recent years.

So today I would like to talk about APRA’s expectations in relation to insurance in superannuation, and our plans to review industry practice and provide feedback on good practices and where there is room for improvement. I will also touch on the challenges of ensuring the sustainability of insurance through superannuation, for both trustees and insurers, and some thoughts on steps each can take to support sustainability and hence good outcomes for both industries, but importantly also for fund members.

Insurance Management Framework

The requirements for the framework which trustees must have in place for their insurance offerings are set out in the prudential standards and prudential practice guides that came into effect on 1 July 2013. Prudential standard SPS 250 contains the mandatory requirements and prudential practice guide SPG 250 provides supporting guidance.

APRA’s primary focus is on how the trustee manages its insurance arrangements overall. The insurance management framework requirements are intended to assist trustees to do this effectively, by adopting a principles-based approach that addresses all of the key aspects of insurance. The requirements are modelled on APRA’s broader risk management framework requirements and reflect the need for the same sort of management structures and control processes to be in place for insurance as for other key risk areas.

As with all of our prudential standards and guidance, it is not intended that a “one size fits all” approach apply. The insurance management framework needs to take into account the particular features of each trustee’s operations and insurance offerings.

APRA’s insurance prudential standard includes reference to the insurance strategy that is required under the covenants in the SIS Act. However the insurance management framework is much broader than the insurance strategy. It covers all of the policies, procedures and people needed to effectively implement and manage all aspects of insurance, including the benefits and terms offered, the basis of determining the premiums charged to members, how the insurance arrangements are administered, underwriting requirements and how claims are assessed and managed. So, there are roles and responsibilities for trustees, insurers and other parties such as administrators in ensuring that a robust insurance management framework is in place.

There is also a new obligation on trustees to maintain at least 5 years of data relevant to insurance, such as claims experience, membership, sums insured and premiums. Realistically, however, accurate data for a much longer period is desirable to provide the information needed by insurers to appropriately price the insurance cover to be provided and to enable trustees to effectively monitor and manage their insurance arrangements. I will come back to the topic of data integrity a little later as it is a critical piece in addressing the insurance puzzle facing trustees and insurers.

Group Risk Industry

I first want to put some of the discussion about insurance in superannuation, and why changes in approach and thinking are needed, into context.

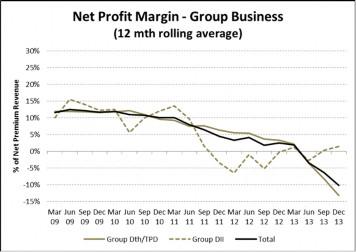

The state of the group risk industry has recently been the subject of much media and industry commentary. It has certainly been a strong focus for APRA in recent years, and has more recently attracted the interest of Government Ministers. This graph helps to show why.

There has been steadily deteriorating profitability for insurers in the group insurance market over the past four years, with some acceleration of this trend in the past year. Some in the super industry might see this as a welcome re-allocation of funds from life insurers to superannuation funds and their members. However this is not a positive trend for life insurers and it raises questions about the sustainability of insurance for superannuation funds and their members.

The trend in insurer net profit margins clearly conveys the impact of the aggressive pricing and inadequate reserving that has occurred, but has been driven by many factors. In part it reflects the costs of the gradual addition of more and more bells and whistles in design and terms and conditions that are now becoming apparent; the loosening of underwriting standards; and poor claims management (reflecting insurer under-resourcing in this area). It is also indicative of the fact that the insurance industry lacks the detailed data that is needed to get really good insights into the root causes of the poor experience – in large part because the superannuation industry is unable to provide it!

Other drivers include changing social attitudes to insurance and increased consumer awareness of the benefits available, which are increasing the propensity to make claims, and to claims for a broader range of causes (for example related to mental health issues).

And of course the impact of the involvement of some segments of the legal fraternity in more proactively assisting fund members to pursue claims cannot be ignored.

So, many superannuation fund members have been getting a great deal in recent years because the insurance premiums they have paid have been less than the cost of providing their insurance cover. But this is clearly not sustainable, and many trustees are finding the insurance premiums for their funds – or for some member segments - rising significantly. While premium increases are a short term solution for insurers to address the financial impact of poor group insurance performance, they are a poor outcome for members. It is therefore important that the more fundamental issues that have been driving the recent trend in insurer performance are addressed.

Sustainability

Some trustees are starting to tackle some of these issues, for example by focusing on the sustainability of the overall insurance arrangements, not just seeking the lowest price that is offered. However, too many funds remain heavily focused on price in selecting their insurer. APRA expects that trustees will consider broader sustainability objectives when tendering for and assessing group insurance arrangements. The range of issues that needs to be considered aligns to a large extent with the drivers of the recent poor experience that I have already touched on - design, underwriting, claims management and so on.

Trustees should be reviewing the insurance benefits offered to ensure they are relevant and appropriate for their fund members. How much cover do different segments of members need and what levels of default cover are appropriate? Obviously the membership profile of the fund will be an important factor to consider and much more rigorous analysis of member demographics and needs should be undertaken as part of insurance benefit design.

Linked to consideration of the appropriate level of insurance is the impact of the cost of insurance on ultimate retirement savings. The SIS covenant is quite clear on this point – insurance should only be offered if it doesn’t inappropriately erode retirement income of beneficiaries. Of course there is considerable room for judgement as to when the insurance cost may be regarded as inappropriate in this context. However I suspect it is a consideration that many trustees have not yet really turned their minds to.

Over a number of years we have seen additional benefits and features added into insurance policies in an effort by insurers to win group business. The amount of insurance offered without the need for medical underwriting has also been increasing steadily. The costs of each marginal change may be small, but over the years they add up, putting additional pressure on claims and premiums. So now is the time for funds – and insurers - to revisit the benefit design of existing insurance coverage, for example by removing features of limited value to members and reviewing automatic acceptance levels, so that trustees better align cover to their members’ needs while also reducing pressure on premiums.

This takes some forward planning, but it needs to be done. We are aware that some group risk tenders are being awarded on current terms with an understanding or quite general agreement to consider benefit redesign later. APRA expects that benefit redesign, and other solutions to address increasing insurance costs, are proactively explored and actioned within appropriate timeframes agreed between the insurer and trustee rather than allowed to drift.

In a positive development, some insurers and trustees are looking at mechanisms to align their interests more closely in relation to group risk scheme performance. This includes premium reviews incorporating assessment of scheme financial performance on a more frequent basis (e.g. annually rather than with 3 or 5 year premium lock-ins). Another mechanism is some form of appropriate experience adjustment mechanism to address the lumpiness of premium adjustments and achieve more balanced outcomes over time and between funds and insurers. APRA has no objection to these types of arrangements provided regulatory requirements are met (for example, ensuring there is no self- insurance).

So, in order to ensure that insurance products are sustainable there needs to be some new thinking – by trustees and insurers. This may involve changes in product design and underwriting processes such as those I have mentioned, with increased consideration of equity issues over time, and for different segments of members. It may also involve more detailed analysis and justification around the concept of “reasonable grounds” for when it may be inappropriate to offer some types of insured benefits to some member segments.

Insurers have raised concerns that the definition of TPD is too broad, leading to considerable uncertainty regarding claims experience which needs to be reflected in pricing. This may be another aspect of design that warrants further consideration and analysis. There is also room to enhance claims assessment and management processes to improve outcomes and provide enhanced certainty for members, funds and insurers. Better communication to, and education of, members about insurance arrangements and processes may also limit the scope for unnecessary involvement of lawyers in the claims process.

The review of insurance arrangements that is required must be a collaborative effort between trustees and insurers. APRA certainly looks at insurance arrangements from both the trustee and group insurer perspective. For example, we are liaising closely with both group insurers and trustees on major group risk scheme tenders and renegotiations to understand how trustee and insurer obligations and needs are being considered and met. This is important to ensure sustainability and stability in the market, which is of benefit to both trustees and insurers.

Thematic Reviews

I have mentioned in other fora that APRA will be using thematic reviews over the next 12 to 24 months to get a clear picture of the issues and approaches in particular areas such as insurance. These thematic reviews will focus on key areas covered by the new prudential framework, and assess industry progress on implementation. APRA will provide feedback based on these reviews to individual funds, and to the industry more broadly, on what we see as better practices and areas where improvement is needed. After a period of some forbearance we now expect substantial compliance with the new prudential requirements.

The insurance thematic reviews will be undertaken by APRA’s frontline supervisors as part of planned supervisory activities in 2014, either as a separate targeted meeting or as part of a wider prudential review or consultation.

The objectives of the insurance thematic reviews are to:

- obtain a deeper understanding of the adequacy of trustee’s governance and oversight of the risks associated with making insured benefits available to members;

- obtain information on how trustee’s are responding to the current insurance operating environment and its impact on their insurance arrangements; and

- improve the superannuation industry’s understanding of APRA’s expectations for insurance risk management under SPS 250.

An important aspect of the thematic reviews will be meetings with both the trustee and its group life insurer. On the trustee side the reviews will look at the strategy behind their insurance arrangements; their selection and due diligence process; the monitoring, review and renewal processes in place; key contractual arrangements; and data management, claims management and underwriting. Similar topics will be looked at on the insurer side, with time also devoted to the tender process. We will of course be very mindful of the need for confidentiality of information received from both parties.

We will be seeking to assess trustees’ implementation of their insurance management frameworks. APRA will also focus on how trustees are responding to the flow-on impacts of any recent poor insurance experience that may be impacting their insurance arrangements. We will want to understand the extent to which trustees are considering affordability and sustainability issues, and the depth of analysis being undertaken to ensure that insurance offerings are appropriate for members given the costs involved. And we will also be focussing on data management processes, where our view is that there is considerable room to improve practices.

Data Quality

Data quality is a persistent challenge for many trustees and superannuation funds and has been a key focus area for APRA. Data quality issues are many and varied and (in relation to insurance) can include, for example missing data fields, poor records of benefit changes over time, incomplete or unreconciled premiums, and uncertain run-off periods for claims. Audit testing of some funds has also uncovered problems such as insurance cover being provided outside of age limits, members with cover but no premiums and vice versa, and members in the wrong insurance categories.

In the current market environment, such data failings are making it more difficult for insurers to price their insurance offerings, leading to higher premiums to cover the risks associated with incorrect or incomplete information. Improving data quality should therefore be a very important aim for the superannuation industry.

The new SPS 250 makes it clear that trustees have ultimate responsibility for maintaining data quality and this goes beyond simply requiring a third-party insurer or administrator to hold accurate information. APRA expects trustees to, for example:

- ensure that more than five years of data is held if the typical claims run-off period is longer;

- maintain a history of insurance benefit design; and

- have established processes for accessing data when required, if their records are held by a third party.

For trustees, these new obligations should not be viewed as just another compliance burden. They will not only improve insurance data quality but ultimately drive fairer insurance pricing that is better aligned to their fund membership. Trustees should be establishing regular processes to review insurance data for completeness and, where gaps are identified, make required corrections to member or claims records.

Trustees should have a clear strategy for ensuring the quality of insurance data records. The fund must maintain records sufficiently detailed for the insurer to assess insured benefits and their likely cost. If a trustee is retaining data internally, it should have processes that allow that data to be easily collated and provided to insurers for pricing

purposes. If the trustee is relying on an administrator or insurer for the data, it should have very specific requirements for access to that data and also consider how it will access the data if there is a change of insurer or administrator.

We are aware of, and have been concerned to see, instances where trustees in group insurance tender processes are requesting a waiver of liability from insurers for data errors. When acquiring policies from life insurers, trustees need to be cognizant when negotiating that it is a contract of “utmost good faith”. Significant implications, both financial and to a commercial relationship, can arise from non-disclosure of material factors which impact risk.

We also expect trustees to have a good understanding of the performance of their insurance portfolios. In monitoring the performance of their insurance arrangements, many trustees will look at measures such as response times to members’ queries and times for completion of claims. While these service levels are important for members, APRA believes that there is scope for trustees to look at other, more qualitative measures, of group risk scheme performance and also profitability by segment. For example, trustees should review acceptance of underwritten risks and acceptance of claims to ensure that these are aligned with the terms of cover provided to members. Reviewing profitability will assist in understanding any potential impacts on insurance premiums when it comes time to re-rate portfolios. It may also identify areas where there is a need to adjust the insurance offering to members, for example if particular types of cover are becoming too costly for a fund’s membership profile.

Trustees should test insurance processes regularly. This might include periodically testing insurance premium calculations against administration systems, the application of underwriting rules by administrators, and looking at the alignment of claims management processes to product design. Process errors that go unidentified for long periods are very expensive to investigate and rectify; identifying issues early can significantly reduce the cost to members.

Insurer selection

The prudential standard requires that trustees undertake a due diligence review of the selected insurer and be able to demonstrate to APRA the appropriateness of the selection process and due diligence review and how it is applied. The due diligence process when selecting an insurer should focus on all aspects of the insurance arrangements. This would include operational impacts, such as whether the fund and insurer processes in a range of areas align adequately and hence support effective communication, reporting and administration, as well as the outcomes for members in terms of benefits, costs and service.

One particular area on which APRA is urging funds to focus in their due diligence is the claims philosophy of the insurer. It should be clearly articulated, be meaningful (rather than a motherhood statement) and be aligned with the expectations of the trustee. The claims philosophy is a reflection of the insurer’s ability and willingness to assess and pay legitimate claims expeditiously. It can be considered based on measurable factors, such as the history of claim rejection rates, or claim decisions being overturned by the Superannuation Complaints Tribunal, and other factors such as the reasonableness of claims assessment requirements and whether the insurer has very high expectations for data management processes. There should be close alignment between the trustee and the insurer on these important issues.

Outsourcing/insourcing

There needs to be clarity of roles and responsibilities for all parties involved in insurance arrangements whether aspects are insourced or outsourced. However this is particularly important when a trustee decides to outsource some of its insurance functions.

Conflicts of interest can arise where the trustee appears to be acting on behalf of both the beneficiary and the insurer, particularly with insourced arrangements. It is therefore important to ensure that there are appropriate processes to manage these potential conflicts.

Whether aspects of insurance arrangements are insourced or outsourced, trustees need to be satisfied that there are sufficient experienced and skilled staff to ensure effective underwriting and claims management. It is also important to ensure that there are appropriate delegated authority procedures in place. Where claims assessment and management is out-sourced by an insurer to a trustee, or an administrator acting for a trustee, it is important that the insurer retains ultimate control of claims decisions. We have been uncomfortable with arrangements where administrators are being given significant claims decision authority, the relevant staff may not be adequately trained to take on these roles, and the insurer does not have a role to play in ensuring quality, or an appropriate review role.

Administrators typically play an important role in relation to insurance and will be key partners with many trustees in ensuring effective management of insurance arrangements. Administrators will often be involved, for example, in maintaining necessary data and records to determine eligibility for, and discontinuance of, insured benefits; ensure any medical assessment requirements are met; and determine sums insured and claim eligibility.

The data integrity processes of administrators are therefore critical given their key role in capturing relevant member data. The processes and controls that administrators have in place to maintain data quality therefore need to be a key focus area for trustees.

Given their significance to the fund and members, the typical insurance administration support provided to trustees would almost certainly be regarded as material outsourcing arrangements. As such, trustees have significant obligations under SPS 231 to assess and monitor how well an administrator is able to deliver, and whether or not they do actually deliver, the relevant services. APRA expects that, where a group risk scheme has been retendered or renewed since 1 July 2013, an assessment under SPS 231 will have been conducted, documented and approved as per the trustee’s governance processes. Trustees can expect APRA supervisors to enquire about these assessments.

Conclusion

Insurance in superannuation is an area that is being closely monitored by APRA. We are concerned about recent trends in insurer profitability and the flow on effects for funds and members. We are working with both the superannuation industry and insurers to ensure that both are focused on achieving sustainable outcomes. This needs to be a collaborative effort, and involve new thinking and approaches on both sides. How you tackle these issues will be critically important for your fund members so I’d encourage you all to take an interest and think about what you can do to make a difference in this important area.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9 trillion in assets for Australian depositors, policyholders and superannuation fund members.